Horseback Riding School Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Horseback Riding School Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Horseback Riding School Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HORSEBACK RIDING SCHOOL FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year horseback riding school financial model serves as an essential equestrian center revenue projection and financial planning tool for startups and entrepreneurs aiming to impress investors and secure funding. Featuring detailed horseback riding business financial forecasts, expense management, and cash flow analysis models, it enables thorough evaluation of startup costs and operational profitability. With built-in key financial charts, summaries, and funding forecasts, this equestrian school budgeting and forecasting model supports strategic decision-making and growth planning, providing a robust foundation for riding school investment return analysis and long-term financial sustainability.

This ready-made horseback riding school financial model template effectively alleviates common pain points by providing comprehensive budgeting and forecasting tools tailored specifically for equestrian centers, enabling precise revenue projections, cash flow analysis, and expense management. Users benefit from an integrated riding school financial growth strategy model and profitability assessment, simplifying complex horse riding academy expense tracking and horseback riding operation cost analysis. The template’s intuitive design supports detailed horseback riding lessons income projections and stable management financial forecasting, ensuring financial sustainability and clear visibility into riding school investment returns without the burden of ongoing fees, making it an indispensable tool for managing equestrian business profit and loss with confidence and ease.

Description

Launching an equestrian school requires a comprehensive horseback riding school budget planning financial model to ensure profitability and sustainability. Utilizing an equestrian center revenue projection financial model alongside a horseback riding business financial forecast enables owners to analyze income streams from horseback riding lessons and other services, while an equestrian school cash flow analysis financial model tracks liquidity and operational expenses. To maximize efficiency, the horse riding academy expense management financial model helps control costs, and the stable management financial forecasting model provides insight into facility-related expenditures. Incorporating a horseback riding facility profitability model and riding school investment return financial model offers a clear picture of potential gains and long-term viability, supporting data-driven decisions with visual charts in the equestrian business profit and loss model. This integrative financial planning approach empowers owners to develop riding school financial growth strategy models that confidently project cash flow, assess operation cost analysis, and optimize service pricing for sustainable success.

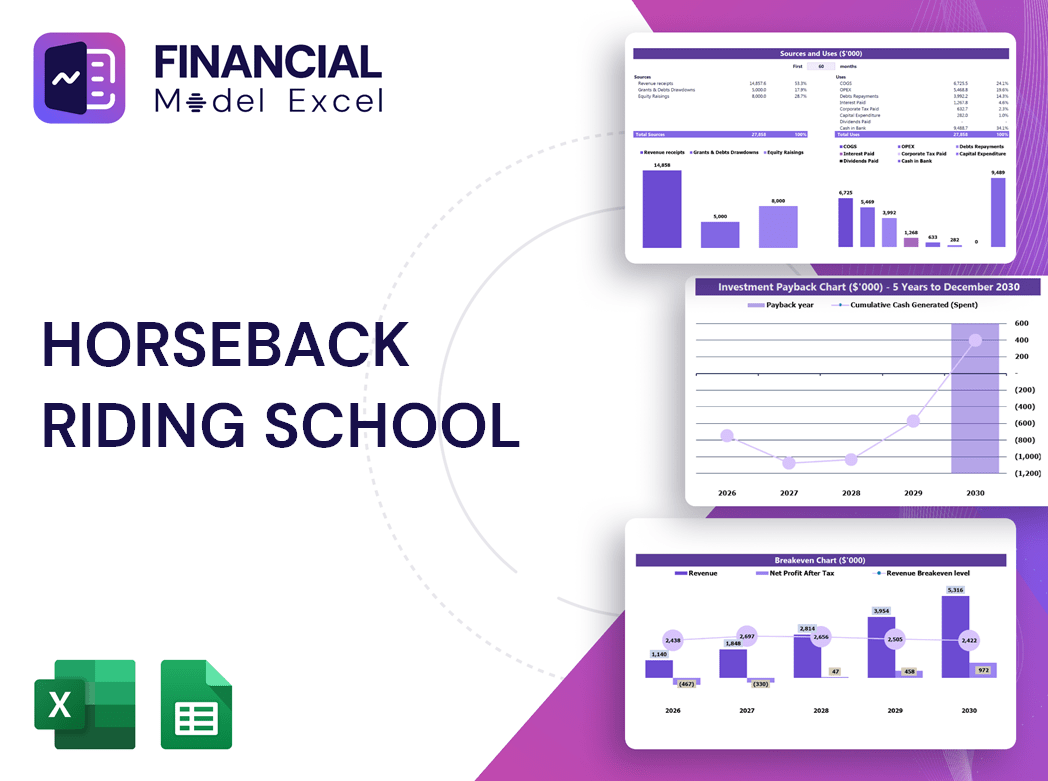

HORSEBACK RIDING SCHOOL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your horseback riding school with our comprehensive financial model, expertly designed for robust budgeting, forecasting, and expansion planning. This versatile horseback riding business financial forecast seamlessly integrates all your assumptions and scenarios, ensuring a resilient equestrian center revenue projection. Tailored for uniqueness, our customizable horseback riding school financial model empowers you to manage expenses, project cash flow, and evaluate profitability with precision. Elevate your equestrian training center’s financial planning and confidently drive sustainable growth with a model built to adapt to your evolving business needs.

Dashboard

Looking for a comprehensive horseback riding business financial forecast in one place? Our all-in-one equestrian center revenue projection financial model features a dynamic dashboard showcasing start-up metrics, annual revenue breakdowns, cash flow analysis, profitability forecasts, and cumulative cash flow—all visualized through intuitive charts and graphs. Perfect for riding school budget planning and financial sustainability, this tool empowers you to manage expenses effectively, analyze operation costs, and strategize for long-term growth with confidence. Streamline your equestrian school startup financial model and make informed decisions with ease.

Business Financial Statements

All three financial statements play a crucial role in evaluating a horseback riding business’s performance from diverse perspectives. The horseback riding business financial forecast, especially the projected income statement, reveals the core revenue and expense drivers shaping profitability. Meanwhile, the equestrian school startup financial model’s balance sheet and cash flow analysis focus on capital management—assets, liabilities, and liquidity—ensuring stability and informed budget planning for sustained growth. Together, these models provide comprehensive insight into riding school financial sustainability and guide strategic decision-making for long-term success.

Sources And Uses Statement

A comprehensive sources and uses template is essential for effective horseback riding school budget planning and expense management. This financial model enables clear tracking of all income streams and allocates funds strategically, supporting robust equestrian center revenue projections and horseback riding operation cost analysis. By integrating this tool within your equestrian training center financial planning model, you ensure accurate cash flow analysis and enhance the riding school’s financial sustainability and profitability. Streamlined tracking drives informed decisions, maximizing investment returns and strengthening your horseback riding business financial forecast.

Break Even Point In Sales Dollars

Calculating the break-even point is crucial in horseback riding business financial forecasting models. It requires a clear analysis of sales and revenue streams within your equestrian center revenue projection financial model. Understanding the distinction between sales, revenue, and profit is essential: revenue reflects total income from horseback riding lessons income projections, while profit accounts for all fixed and variable expenses deducted. Incorporating this into your stable management financial forecasting model ensures accurate horseback riding operation cost analysis, supporting effective equestrian school budget planning and sustainable financial growth strategies.

Top Revenue

Leverage the horseback riding school budget planning financial model to create a detailed demand report under the Top Revenue column. This tool enables precise revenue projections and profitability analysis across scenarios, enhancing your equestrian center revenue projection financial model. Utilize insights from revenue depth and revenue bridge within the financial forecasting template to anticipate demand fluctuations during weekdays and weekends. This strategic forecast supports informed resource allocation, optimizing your riding school financial growth strategy model and ensuring operational efficiency while maximizing profitability and financial sustainability.

Business Top Expenses Spreadsheet

To maximize success and profitability, precise financial management is essential. Our equestrian school startup financial model meticulously categorizes expenses—operational, staffing, maintenance, and marketing—plus an 'other' segment for a comprehensive horseback riding business financial forecast. This equestrian facility budgeting and forecasting model enables thorough horseback riding operation cost analysis, empowering you to control costs effectively. By mastering expense management with this financial planning tool, your riding school can enhance cash flow, improve profitability, and ensure sustainable growth—key factors for achieving strong riding school investment return and long-term financial performance.

HORSEBACK RIDING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The horseback riding school financial model is an essential tool for budgeting, expense management, and accurate financial forecasting. By integrating a 3-way financial approach, it enables precise cash flow analysis, expense tracking, and profitability assessment. This model reveals critical cost-saving opportunities and prioritizes financial resources effectively. For startups and established equestrian centers alike, it forms the backbone of a robust business plan, supporting revenue projections, investment return analysis, and loan applications—ultimately driving informed decisions and sustainable growth within the horseback riding operation.

CAPEX Spending

Capital expenditures (CAPEX) form the foundation of your horseback riding school’s startup budget, driving the company’s growth. By leveraging an equestrian school startup financial model, you can accurately project initial costs and optimize expense management. This comprehensive approach ensures precise cash flow analysis and supports effective financial planning. Business owners rely on such pro forma templates to enhance budgeting accuracy and achieve strong financial performance, ultimately securing sustainable profitability and long-term success in the equestrian industry.

Loan Financing Calculator

Loan repayment schedules are crucial for horseback riding business financial forecasts and equestrian center revenue projection models. They detail principal amounts, terms, maturity periods, and interest rates, directly impacting cash flow analysis financial models. Accurate monitoring ensures the horseback riding facility profitability model reflects true expenses and liabilities, influencing the riding school financial sustainability model and overall financial planning. Integrating loan repayments within the equestrian school cash flow analysis financial model is essential to maintain precise horse riding academy expense management and support informed decisions for stable management financial forecasting and riding school investment return financial models.

HORSEBACK RIDING SCHOOL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross margin percentage (GPM) is a vital metric in horseback riding business financial forecasts, reflecting the gap between sales revenue and related expenses. An improving GPM within your equestrian center revenue projection financial model signals rising sales income alongside effective expense management. This key indicator highlights enhanced profitability and operational efficiency, crucial for sustaining riding school financial growth strategies and ensuring long-term stability in horseback riding facility profitability models. Tracking GPM empowers informed budgeting and cash flow analysis, driving smarter investment and pricing decisions across your equestrian training center financial planning.

Cash Flow Forecast Excel

The horseback riding school budget planning financial model systematically tracks all cash inflows and outflows across operating, investing, and financing activities. This comprehensive equestrian center revenue projection financial model ensures accurate cash flow analysis, aligning ending cash balances with those in the projected balance sheet. By leveraging this horseback riding business financial forecast, stable management financial forecasting model, and horseback riding facility profitability model, riding schools can optimize expense management, enhance financial sustainability, and confidently plan for long-term growth and operational success.

KPI Benchmarks

Benchmarking is essential in horseback riding business financial forecasting models, enabling equestrian centers to evaluate performance against industry standards. By analyzing key metrics like profit margins, cost per unit, and productivity margins, horseback riding schools can enhance budgeting, expense management, and revenue projections. This financial planning model empowers both startups and established riding academies to assess profitability, cash flow, and investment returns, ensuring sustainable growth. Leveraging benchmarking within your equestrian facility budgeting and forecasting model provides a competitive edge for optimizing operational costs and maximizing financial viability.

P&L Statement Excel

The Income Statement, or Profit and Loss template, highlights your horseback riding school’s revenue flow and key expenses within the financial model. It offers a clear view of income, costs, and profitability, crucial for effective budget planning and expense management. This dynamic tool enables stakeholders to analyze cash flow, assess financial sustainability, and project future profitability. Whether for an equestrian center revenue projection or a riding school investment return model, it provides essential insights to optimize financial performance and support informed decision-making for your horseback riding business’s growth and success.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet—also known as the statement of financial position—offers a snapshot of a horseback riding business’s key assets, liabilities, and equity at a specific time. Paired with profit and loss projections, it guides equestrian center financial planning models by highlighting investment needs to sustain operations and profitability. Accurate forecasts of cash, inventory, receivables, and payables are essential in the horseback riding facility profitability model and riding school financial growth strategy, enabling confident decisions on budgeting, expense management, and long-term financial sustainability.

HORSEBACK RIDING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive horseback riding school startup financial model to captivate investors with precise data and insights. The weighted average cost of capital (WACC) demonstrates the minimum expected return on invested funds, assuring stakeholders of sound financial management. Our free cash flow valuation highlights cash available to both shareholders and creditors, while the discounted cash flow analysis accurately values future cash flows in today’s terms. This equestrian center financial planning model empowers you to showcase robust financial viability and maximize your riding school's investment appeal.

Cap Table

A comprehensive horseback riding school budget planning financial model includes a detailed capitalization table, essential for any equestrian business startup. This spreadsheet outlines all ownership shares, investor contributions, and pricing, offering clear visibility into equity distribution and investor stakes. Integrating the cap table within the equestrian facility budgeting and forecasting model ensures transparent ownership percentages and potential dilution. This foundational tool supports precise riding school financial growth strategies and informed decision-making for investors and management alike.

HORSEBACK RIDING SCHOOL STARTUP FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Our horseback riding school financial model ensures precise break-even analysis and maximizes your return on investment potential.

The horseback riding financial model enhances team alignment through clear budget planning and accurate revenue projections.

Gain precise control and maximize profits with the horseback riding school financial planning and forecasting model.

Boost stakeholder confidence with our precise horseback riding school financial model for accurate budget planning and revenue projection.

Optimize asset acquisition confidently with the horseback riding school financial model for precise budget planning and growth.

HORSEBACK RIDING SCHOOL FINANCIAL PROJECTION MODEL TEMPLATE ADVANTAGES

Run different scenarios with our horseback riding school budget planning financial model to optimize profitability and ensure growth.

The horseback riding school budget planning financial model enables dynamic cash flow scenario analysis for smarter, informed decisions.

Optimize profits effortlessly with our horseback riding business financial forecast—updated anytime for precise, strategic planning.

Easily refine your horseback riding school financial model by adjusting inputs for precise, dynamic budget planning and profitability insights.

The horseback riding business financial forecast model ensures precise key metrics analysis for optimized growth and profitability.

Empower your riding school with a dynamic 5-year financial model for precise budgeting, forecasting, and profitability analysis.

Optimize profits effortlessly with our horseback riding business financial forecast—updated anytime for precise, strategic planning.

The horseback riding business financial forecast enables dynamic input adjustments for accurate, ongoing profit and loss projections.

Our horseback riding business financial forecast quickly identifies customer payment issues, ensuring steady cash flow and growth.

The equestrian school cash flow analysis model accelerates identifying unpaid invoices, optimizing timely customer payments efficiently.