Hotel Investment Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Hotel Investment Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Hotel Investment Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HOTEL INVESTMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive hotel investment analysis financial model serves as a robust 5-year financial planning template tailored for startups and existing businesses in the hospitality sector. It integrates critical components such as hotel revenue projection models, hotel cash flow financial models, and hotel profitability financial models to provide accurate hotel financial forecasting. Designed for full customization, this unlocked template enables detailed hotel budget planning and expense forecasting, helping users estimate startup costs and assess hotel investment returns effectively. Whether used for hotel asset management financial models or hotel development financial feasibility studies, this tool offers a holistic approach to optimizing hotel financial performance and making informed investment decisions.

This hotel investment analysis financial model Excel template addresses the common pain points faced by hospitality investors and operators by providing a fully integrated hotel financial forecasting model that consolidates revenue projection, cash flow forecasting, and expense management. It simplifies complex hotel profitability financial models and hotel operations financial models into an easy-to-use format, allowing users to conduct detailed hotel valuation financial modeling, assess hotel investment return models, and perform robust hotel market analysis financial model evaluations with confidence. The dynamic structure ensures that changes in occupancy rates, capital expenditures, or loan underwriting assumptions instantly update the hotel income statement model and balance sheet model, enhancing accuracy and saving valuable time during hotel budget planning and financial feasibility studies. This ready-made tool empowers hotel asset management professionals to optimize cash flow and capex decisions while supporting detailed hotel development financial modeling for strategic growth initiatives.

Description

This comprehensive hotel investment analysis financial model provides a 5-year forecast with fully integrated hotel income statement, balance sheet, and cash flow financial models, tailored to support both startups and established operations. It includes detailed hotel revenue projection models based on industry-specific assumptions, a hotel expense forecasting model, and hotel occupancy rate financial model to optimize budgeting and resource allocation. The model also features hotel valuation financial model components, hotel profitability financial model metrics, and hotel capital expenditure model insights, facilitating robust hotel financial feasibility evaluation and investment return analysis. Designed for operational efficiency, this hotel asset management financial model and hotel market analysis financial model deliver actionable KPIs and dynamic scenario planning to guide strategic decisions and enhance hotel financial performance models across various business cycles.

HOTEL INVESTMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our powerful yet user-friendly hotel investment analysis financial model, designed to simplify your hotel revenue projection and cash flow forecasting. This fully customizable Excel template serves as an indispensable tool for hotel financial feasibility, budget planning, and profitability analysis. Whether you’re experienced or just starting, easily tailor every sheet to fit your unique hotel operations and investment return goals. Elevate your hospitality financial forecasting with a comprehensive model that supports hotel asset management, valuation, and capital expenditure planning—ensuring confident, data-driven decisions for exceptional business growth.

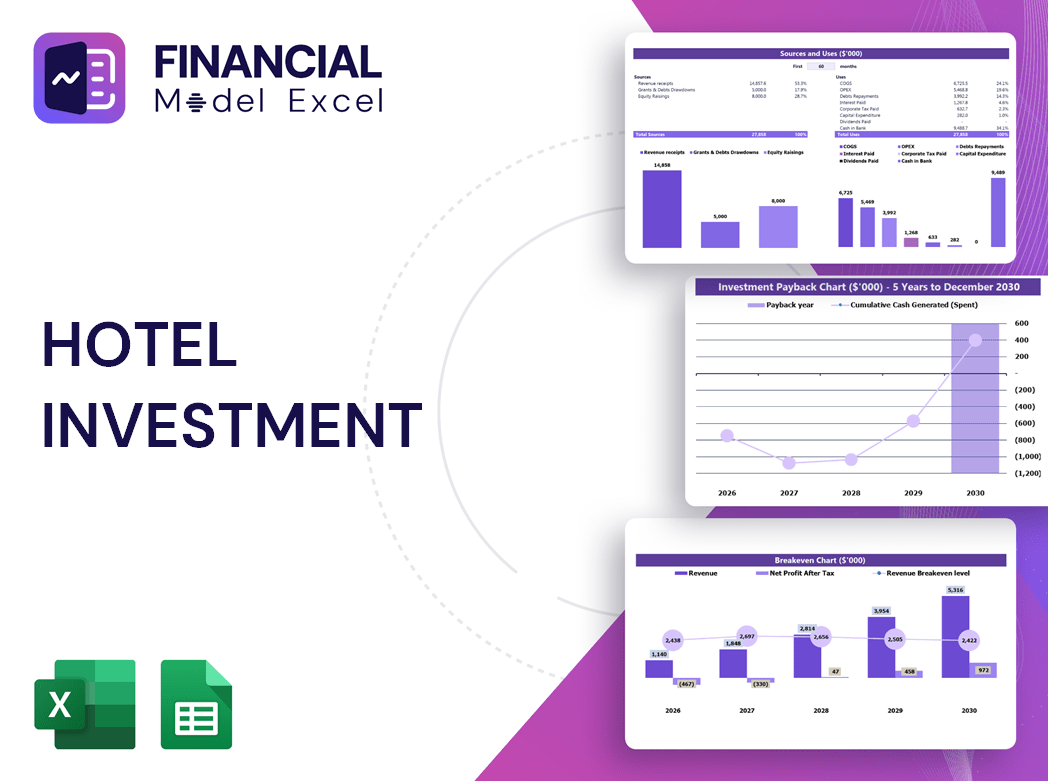

Dashboard

Our 5-year hotel financial forecasting model features an intuitive dashboard showcasing critical metrics across key periods. Visualized through dynamic graphs and charts, it delivers detailed hotel revenue projection, cash flow insights, and highlights from the pro forma income statement. This comprehensive tool streamlines hotel investment analysis and budget planning by organizing data with precision and clarity, empowering you to make confident, data-driven decisions with ease.

Business Financial Statements

Each hotel financial model—whether a hotel income statement model, balance sheet model, or cash flow financial model—offers unique insights into performance. The income statement reveals profitability from core operations, the balance sheet snapshot illustrates asset structure and financial position, and the cash flow model tracks liquidity through operating, investing, and financing activities. Together, these vital components form a comprehensive hotel financial performance model, essential for robust hotel investment analysis and informed decision-making in hospitality financial forecasting and asset management.

Sources And Uses Statement

Our hotel investment analysis financial model includes a comprehensive sources and uses of funds statement, essential for investors and lenders alike. This module clearly details investment size, funding allocation, and planned revenue streams, supporting transparent hotel development financial planning. By integrating with hotel cash flow and profitability financial models, it ensures precise forecasting and balanced financial performance. This clarity aids in loan underwriting and capital expenditure decisions, providing a solid foundation for hotel asset management and budget planning. Streamline your hospitality financial forecasting with our Excel model for accurate, controlled financial insights.

Break Even Point In Sales Dollars

Utilizing a comprehensive hotel financial feasibility model with a 5-year breakeven analysis empowers you and your stakeholders with vital insights. It identifies the minimum revenue required to cover expenses, assessing your hotel’s viability effectively. This clarity supports strategic decisions to enhance profitability by optimizing costs. Additionally, the model’s break-even unit sales projection forecasts when investment returns begin, crucial for managing stakeholder expectations. Leveraging detailed hotel cash flow and revenue projection models ensures informed planning, driving successful hotel investment analysis and sustainable financial performance.

Top Revenue

This comprehensive hotel revenue projection model offers a detailed breakdown of revenue streams by category, enabling precise hotel investment analysis. Utilize this hospitality financial forecasting model to evaluate income generated from each service or product, enhancing hotel profitability financial model accuracy. Designed for seamless integration within your hotel operations financial model, this tool supports informed decision-making and strategic planning. Elevate your hotel financial performance model with granular revenue insights that drive smarter investment return models and optimize overall hotel asset management.

Business Top Expenses Spreadsheet

The Top Expenses tab provides a detailed internal summary report essential for tracking costs by category, streamlining tax preparation, and optimizing budget control. Leveraging this data, you can accurately forecast and refine your hotel investment analysis financial model. By reviewing total expenses over specific periods—monthly, quarterly, or annually—you gain insights into cost variances and operational efficiency. This empowers informed decision-making for hotel budget planning and supports robust hotel financial feasibility and development modeling, ensuring strategic growth and enhanced profitability.

HOTEL INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The hotel investment analysis financial model is an essential tool for accurately forecasting expenditures and identifying necessary financial resources. By utilizing a detailed hotel budget planning model, users gain clear insights into cost-saving opportunities and priority expenses. This comprehensive hotel financial feasibility model not only streamlines budget management but also strengthens your business plan, enhancing investor presentations and loan underwriting processes. With precise hotel cash flow financial modeling, you can confidently project revenue and profitability, ensuring strategic decision-making and successful hotel development.

CAPEX Spending

Capital expenditure (CapEx) is a critical element in any hotel cash flow financial model, essential for accurate 5-year forecasting. It represents funds allocated to acquire, upgrade, and maintain property, plants, and equipment (PPE). A precise capital expenditure forecast enables effective hotel budget planning and depreciation management. Additionally, calculating development costs is vital in hotel development financial models and finance leasing, as it directly impacts asset valuation and long-term profitability. Integrating CapEx within your hotel financial performance model ensures comprehensive insights for investment return analysis and sustainable hotel operations.

Loan Financing Calculator

Our comprehensive hotel loan underwriting model features a built-in loan amortization schedule, accurately calculating both principal and interest payments. This hospitality financial forecasting model streamlines your capital management by incorporating loan amount, interest rate, loan term, and payment frequency. Designed to support precise hotel investment analysis and hotel financial feasibility, it empowers stakeholders to project cash flows and optimize financial performance confidently. Elevate your hotel asset management with this essential tool for clear, actionable loan payment insights.

HOTEL INVESTMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Monitoring sales growth year-to-date is essential in any hotel financial forecasting model, offering clear insight into revenue trends and business expansion. A robust hotel revenue projection model integrates sales growth metrics across daily, weekly, monthly, or yearly periods, enabling precise tracking of performance fluctuations. For hospitality investors, this allows targeted analysis of different sales teams or departments, ensuring strategic alignment and driving profitability. Leveraging such detailed data within your hotel operations financial model empowers smarter decision-making to optimize growth and maximize returns.

Cash Flow Forecast Excel

Effective cash flow management is crucial for any hotel’s financial success. Our hotel cash flow financial model provides a detailed, dynamic analysis of cash inflows and outflows, considering key factors like payable and receivable days, working capital, and long-term debt. This comprehensive template enables precise tracking of net cash flow, opening and closing balances, supporting robust hotel investment analysis and financial forecasting. Ideal for optimizing liquidity and informing strategic decisions, it empowers stakeholders to enhance hotel profitability and secure funding with confidence. Elevate your hospitality financial planning with this indispensable tool.

KPI Benchmarks

This hotel investment analysis financial model includes a dedicated benchmarking module that compares key financial indicators against industry peers. By leveraging this hospitality financial forecasting model, users can evaluate their hotel's operational efficiency, competitiveness, and productivity within the market. This in-depth financial benchmarking study empowers stakeholders to make informed decisions on hotel investment return, profitability, and overall financial performance, ensuring strategic growth and sustainable success in the hospitality sector.

P&L Statement Excel

The hotel investment analysis financial model is an essential tool for accurately forecasting monthly profits and losses. Designed specifically for the hospitality industry, it offers comprehensive insights into hotel revenue projection, cash flow, and profitability. This financial model supports informed decision-making by evaluating key indicators such as occupancy rates, operating expenses, and capital expenditures. Whether used for hotel development, asset management, or investment return analysis, it ensures precise budget planning and financial feasibility assessments—empowering stakeholders to optimize hotel financial performance with confidence and accuracy.

Pro Forma Balance Sheet Template Excel

Our 5-year projected balance sheet model in Excel offers a comprehensive snapshot of your hotel’s assets, liabilities, and equity over time. Designed for seamless integration with hotel financial models—such as hotel investment analysis, financial feasibility, and asset management—it enables clear tracking of financial position monthly, quarterly, or annually. This hotel balance sheet model supports informed decision-making by revealing historical trends and future projections, empowering startups and established businesses alike to evaluate financial performance, optimize capital allocation, and confidently plan for sustainable growth in the hospitality industry.

HOTEL INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive hotel investment analysis financial model features a dedicated valuation tab for precise Discounted Cash Flow (DCF) assessments. It streamlines hotel valuation by integrating key financial metrics—including residual value, replacement costs, market comparables, and recent transaction data—enabling accurate hotel asset management and investment return projections. Ideal for hospitality financial forecasting and hotel financial feasibility evaluations, this model supports strategic decision-making with robust hotel revenue projection and cash flow analysis capabilities.

Cap Table

Our hotel financial forecasting model includes a dynamic pro forma cap table designed to accurately calculate shareholder ownership dilution across up to four funding rounds. Users can seamlessly integrate one or multiple rounds into their hotel investment analysis financial model, enhancing precision in hotel profitability and investment return projections. This feature empowers hotel developers and investors to make informed decisions by aligning equity changes with their comprehensive hotel revenue projection and cash flow financial models.

HOTEL INVESTMENT FINANCIAL MODEL IN EXCEL TEMPLATE ADVANTAGES

Build a comprehensive hotel investment analysis financial model to secure funding with accurate pro forma projections.

Secure smarter loans confidently using the hotel investment financial model for accurate financial projections and risk assessment.

Maximize accuracy and insight by forecasting all three financial statements with the comprehensive hotel investment financial model.

The hospitality financial forecasting model empowers precise customer insights to optimize revenue and enhance strategic decisions.

Maximize returns confidently using our hotel investment analysis financial model with accurate 5-year forecasting capabilities.

HOTEL INVESTMENT FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Identify potential cash shortfalls early with our precise hotel cash flow financial model, ensuring proactive financial management.

The hotel cash flow financial model acts as an early warning system, ensuring proactive and accurate investment decisions.

Optimize profits and forecast growth accurately with our comprehensive hotel investment analysis financial model.

The hotel cash flow financial model reveals optimal growth strategies by analyzing funding impacts and cash balance scenarios effectively.

The hotel investment analysis financial model saves you time by streamlining accurate revenue and profitability projections efficiently.

Streamline your hotel cash flow financial model to focus more on growth, customers, and business development opportunities.

Optimize returns confidently with our hotel investment analysis financial model, empowering precise forecasting and strategic growth decisions.

Accelerate funding by using our hotel financial forecasting model, delivering precise performance metrics for confident investor negotiations.

Optimize funding success with our hotel investment analysis financial model for precise, insightful financial forecasting and planning.

Impress investors confidently with a proven hotel investment analysis financial model delivering accurate, insightful forecasts every time.