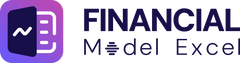

Investment Advisory Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Investment Advisory Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Investment Advisory Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVESTMENT ADVISORY FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year investment advisory financial planning model is essential for businesses of any size and stage of development, providing a comprehensive framework that integrates investment management financial forecasting and a financial advisor revenue model. This easy-to-use model requires minimal financial planning experience and basic Excel skills, yet delivers reliable insights into critical metrics such as investment advisory fee structure model, financial advisor profitability model, and investment advisory cash flow model. Ideal for evaluating an investment advisory firm’s financials and supporting growth strategies, this fully unlocked template allows complete customization, making it a valuable tool to assess business potential and optimize the financial advisory business model before purchase.

This ready-made investment advisory financial planning model in Excel effectively addresses common pain points by providing a comprehensive financial advisor revenue model integrated with an investment advisory fee structure model, allowing users to accurately forecast cash flow and profitability while managing expenses through a built-in financial advisor expense model. It streamlines investment management financial forecasting with adaptable scenario analysis and break-even calculations, supporting investment portfolio financial model adjustments tailored to client investment advisory models. Additionally, the template enhances financial advisor budgeting model capabilities and incorporates financial risk management models, empowering investment advisory firms to optimize growth, client retention, and firm valuation without the complexity of building from scratch.

Description

This comprehensive investment advisory financial planning model offers a robust framework for projecting profit and loss, cash flow, and key performance indicators integral to an investment advisory firm’s financials, enabling strategic decision-making and effective financial risk management. Designed for both startups and established financial advisory businesses, the model integrates a detailed financial advisor revenue model, expense projections, and a client investment advisory model that supports wealth management financial planning and investment portfolio financial modeling. Featuring dynamic dashboards, it facilitates investment management financial forecasting, budgeting, and financial advisor compensation modeling, while the investment advisory fee structure model and client retention modules enhance profitability and growth potential. With customizable components such as break-even sales calculators and a five-year financial projection, this financial advisory business model template streamlines asset management financial modeling and investment advisory firm valuation with ease, making it accessible for users at all levels of financial expertise.

INVESTMENT ADVISORY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our investment advisory financial planning model delivers precise projections to evaluate the future impact of today’s decisions. This comprehensive financial advisory business model generates detailed startup financial statements, including profit and loss forecasts, pro forma balance sheets, and cash flow statements. Leveraging advanced investment portfolio financial modeling, it calculates key startup KPIs based on your assumptions. All critical financial metrics—spanning investment advisory fee structures, risk management models, and cash flow forecasts—are presented in a streamlined, intuitive dashboard, empowering financial advisors to drive growth, optimize profitability, and enhance client retention effectively.

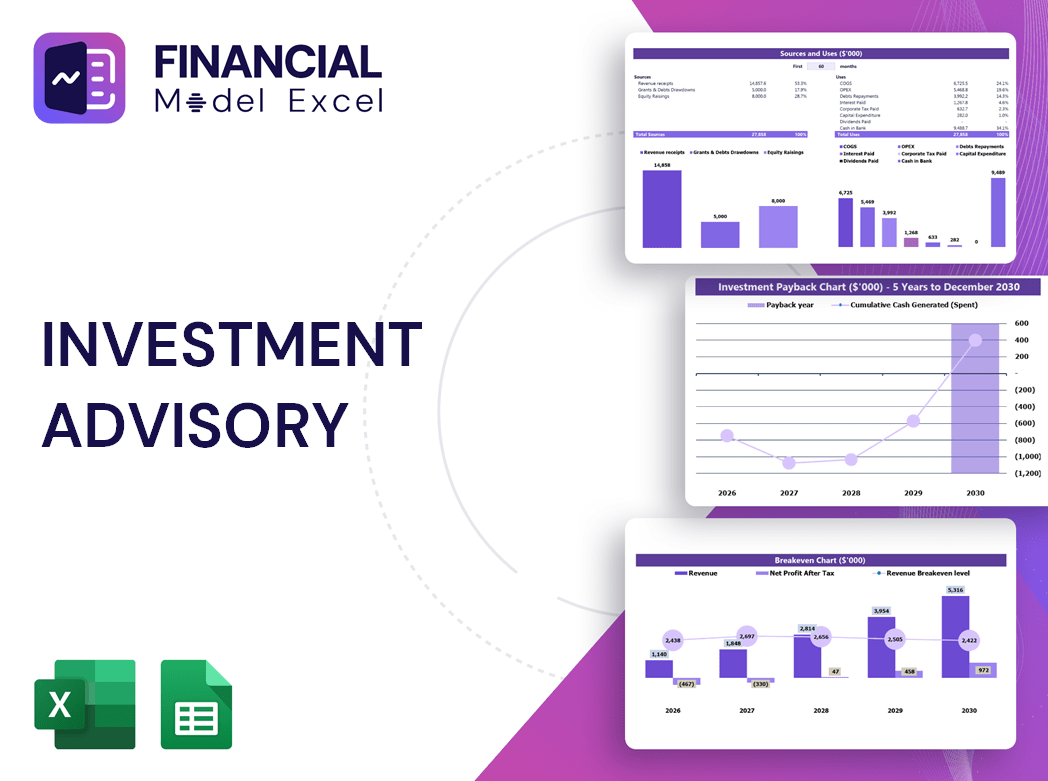

Dashboard

Our investment advisory financial model features a comprehensive, user-friendly dashboard designed to streamline financial advisory business models. It enables financial advisors to quickly analyze investment portfolio financials, forecast cash flow, and evaluate client investment advisory models with precision. This tool enhances wealth management financial planning by offering transparent, actionable insights into key performance indicators, supporting effective financial risk management and boosting advisor profitability. Tailored for fast, reliable decision-making, our dashboard empowers investment management firms to optimize their revenue models, improve client retention, and drive sustainable growth, all within a single, efficient financial planning platform.

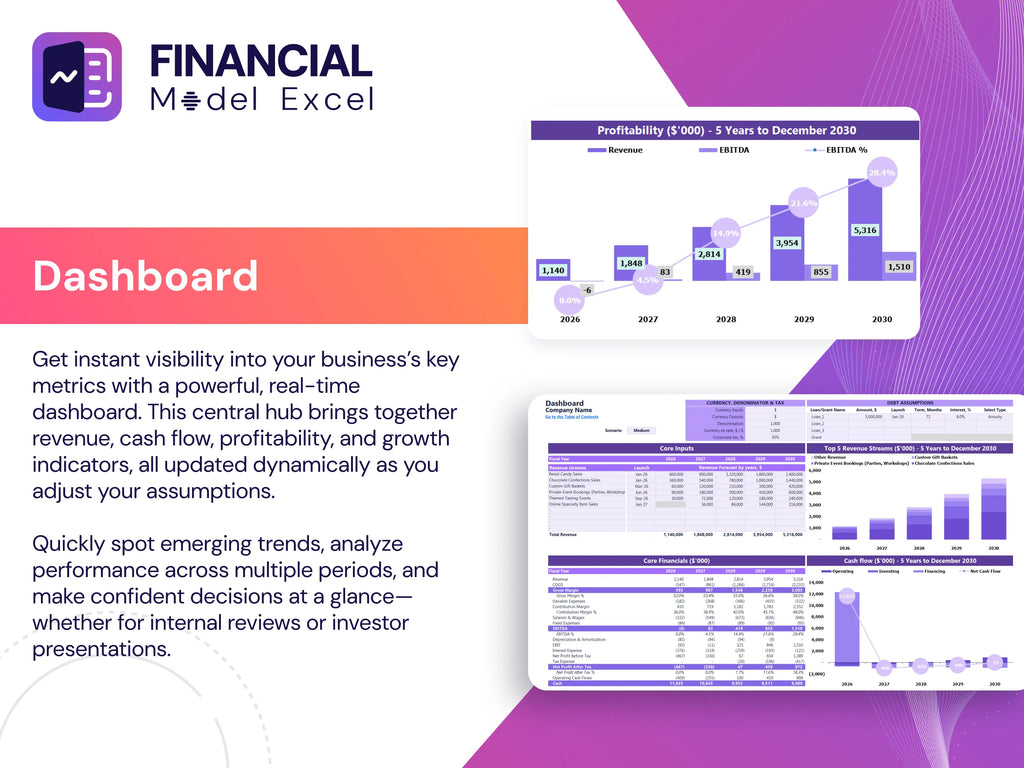

Business Financial Statements

This comprehensive financial projection template offers a robust investment advisory financial planning model, tailored for wealth management and asset management firms. Featuring pre-built sheets for investment advisory firm financials, budgeting, and cash flow models, it enables precise financial forecasting and performance analysis. Easily customizable graphs, charts, and tables translate complex data into compelling visuals, ideal for investor presentations. This tool supports financial advisor profitability models and investment advisory fee structure modeling, empowering firms to drive growth and enhance client retention with clarity and confidence.

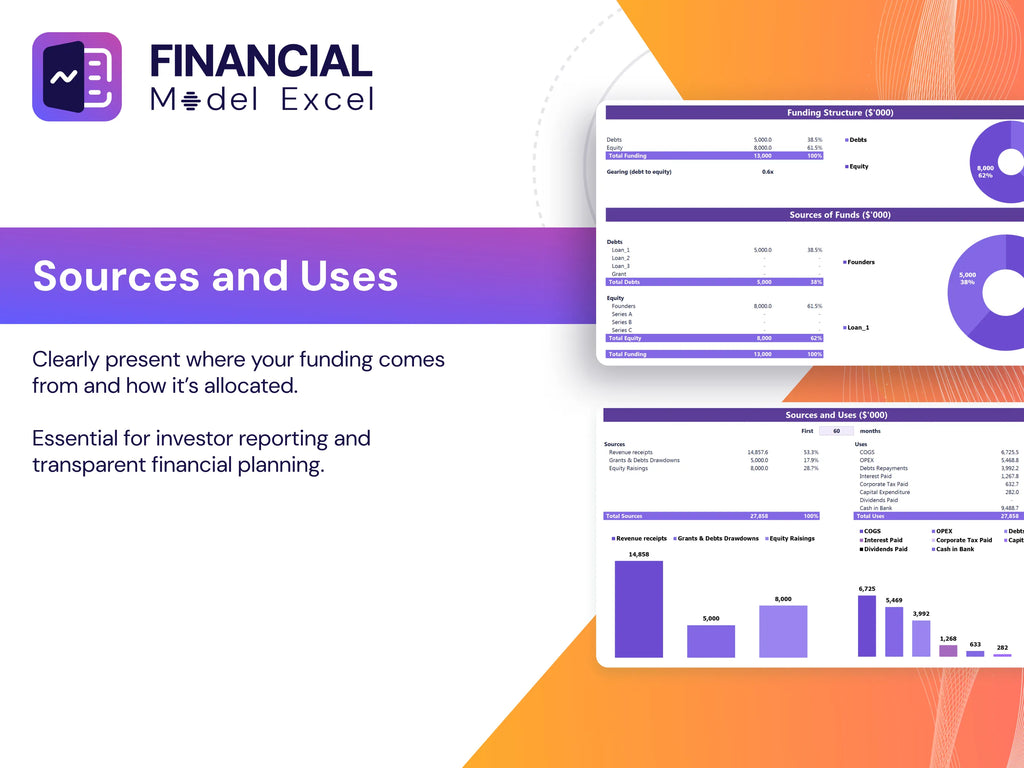

Sources And Uses Statement

The investment advisory cash flow model’s sources and uses statement clearly outlines how a firm plans to allocate capital and secure funding. This financial advisory business model ensures that funding sources balance with planned uses, essential for accurate investment management financial forecasting. A detailed client investment advisory model breaks down funding sources and expenditures line-by-line, aiding wealth management financial planning and financial advisor budgeting. When sources exceed uses, firms can explore growth or distribution; if uses surpass sources, additional equity is needed. This model enhances investment advisory firm financials by supporting profitability and risk management strategies.

Break Even Point In Sales Dollars

The break-even analysis within this investment advisory financial planning model highlights the critical point where your firm’s revenues surpass its expenses, signaling the onset of profitability. Utilizing this financial advisor profitability model empowers asset management and wealth management firms to forecast financial health accurately, optimize budgeting, and refine their investment advisory fee structure model. This strategic insight is essential for sustainable growth and effective financial risk management in your investment advisory business model.

Top Revenue

In the investment advisory financial model, the top line represents a firm’s total revenue, a key metric closely monitored in financial advisory business models. Top-line growth signifies rising revenues, signaling robust investment portfolio financial performance and a healthy asset management financial model. This growth positively influences the investment advisory firm’s financials, driving enhanced profitability and strengthening the investment advisory fee structure model. For financial advisors, tracking top-line trends is essential for accurate investment management financial forecasting, optimizing the financial advisor revenue and compensation models, and supporting sustainable wealth management financial planning strategies.

Business Top Expenses Spreadsheet

To maximize success and drive positive outcomes, vigilant cost management within the financial advisor expense model is essential. Utilizing a detailed investment advisory cash flow model, expenses are categorized and analyzed over specific periods, enabling precise financial forecasting. Effective cost control not only safeguards profitability but also enhances the financial advisor revenue model by optimizing resource allocation. Mastery of financial risk management and budgeting models ensures the firm remains on track to achieve sustained growth and higher client retention, ultimately boosting overall investment advisory firm valuation and long-term wealth management financial planning success.

INVESTMENT ADVISORY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

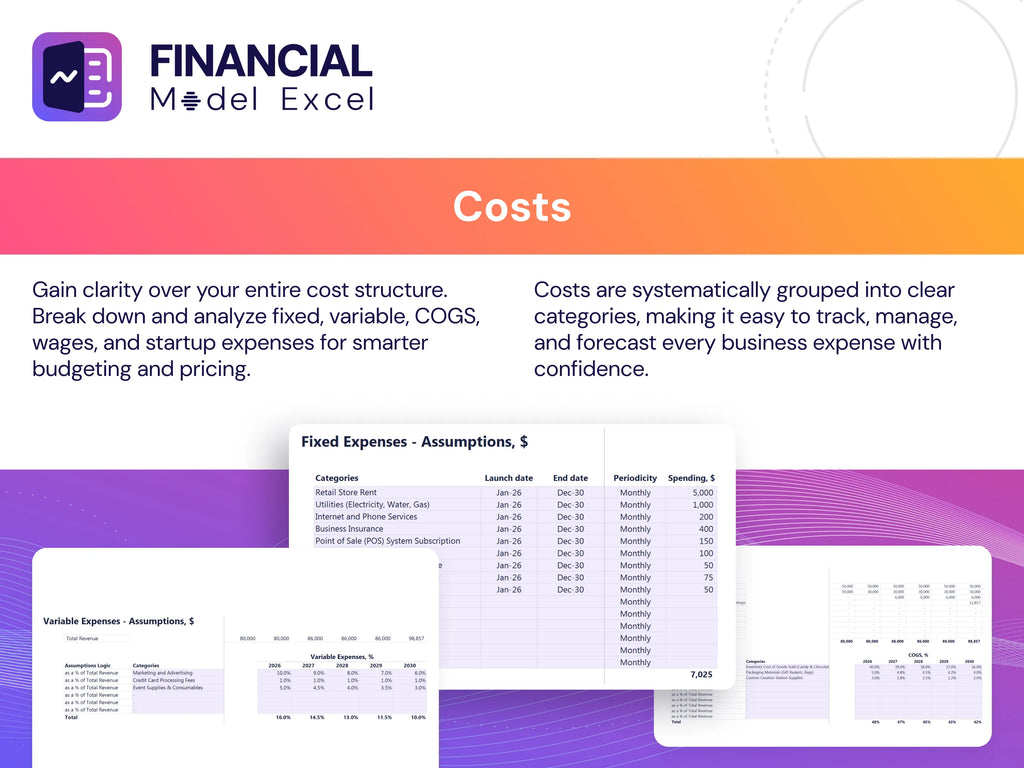

Costs

Our 5-year investment advisory financial forecasting model is an essential tool for any financial advisory business model. It enables precise analysis of costs, risks, and key financial ratios, empowering advisors to optimize their investment portfolio financial model and asset management financial strategy. This comprehensive projection highlights critical areas requiring focus, supports effective financial risk management, and enhances the financial advisor profitability and client retention models. Leverage this invaluable resource to identify challenges early and implement data-driven solutions, driving sustainable growth and maximizing your investment advisory firm’s financial performance and valuation.

CAPEX Spending

Effective financial planning in investment advisory firms hinges on accurate revenue forecasting within the financial advisory business model. A well-structured investment advisory cash flow model captures revenue drivers essential for firm valuation and profitability. Incorporating detailed assumptions in the investment advisory growth model, including client retention and fee structure models, enhances forecasting precision. Investment management financial forecasting, combined with a robust financial advisor budgeting model, ensures sustainable wealth management financial planning. Ultimately, precise revenue projections drive the investment portfolio financial model’s accuracy, underpinning sound financial risk management and maximizing the financial advisor revenue model’s success.

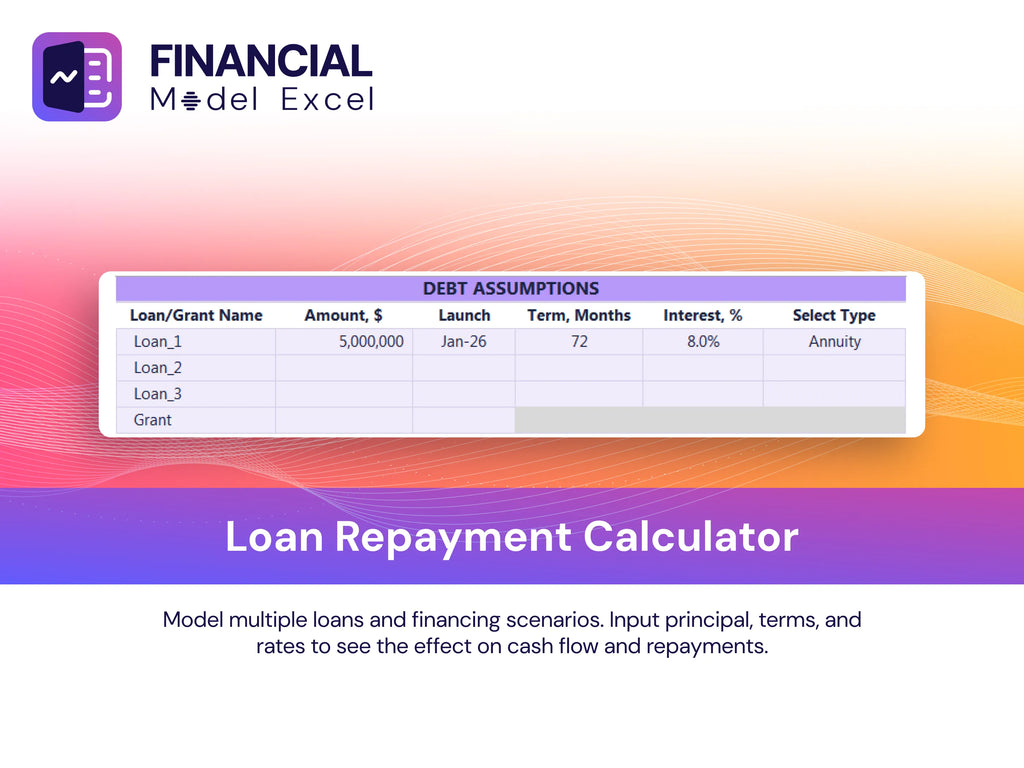

Loan Financing Calculator

Our investment advisory cash flow model integrates seamless loan amortization calculations, clearly distinguishing principal and interest components. This financial advisory business model feature enables precise tracking of repayment amounts, payment frequency, and duration. By embedding advanced formulas, the model supports accurate financial forecasting and budgeting, empowering financial advisors to optimize their financial advisor profitability model and strengthen their investment portfolio financial model. Streamline your asset management financial model with this comprehensive, user-friendly tool designed to enhance your investment advisory firm financials and support strategic wealth management financial planning.

INVESTMENT ADVISORY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

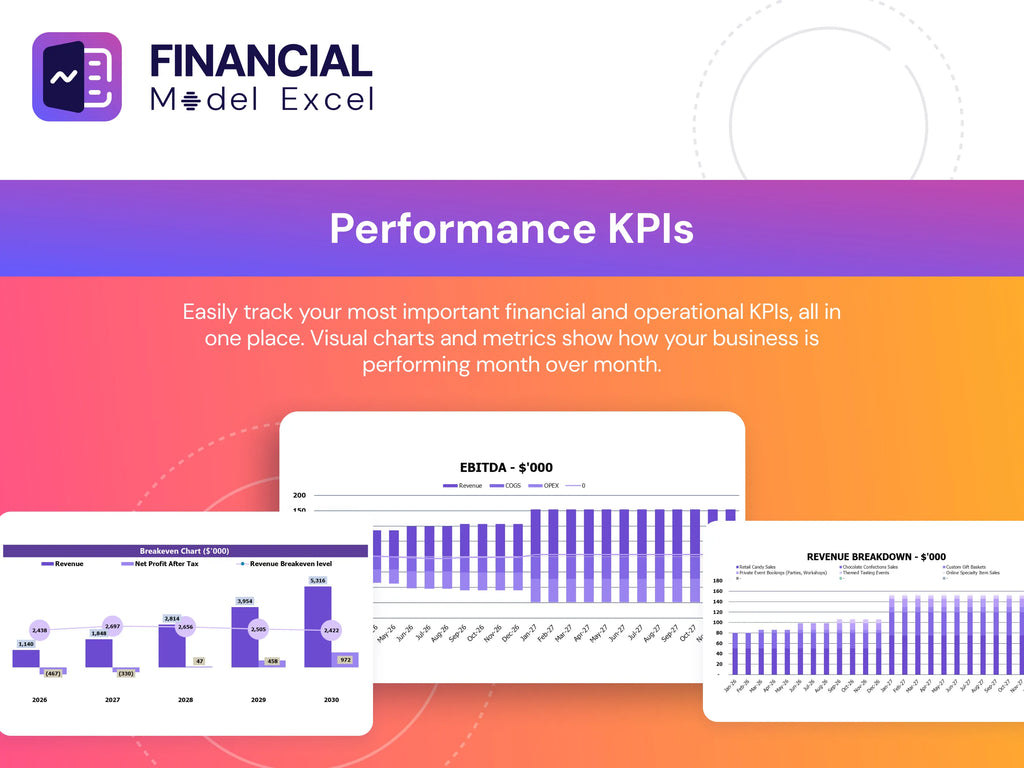

Financial KPIs

The gross profit margin, a key metric in the investment advisory financial model, gauges a firm’s financial health by measuring profit relative to revenue after deducting the cost of sales. An increasing gross margin indicates improved profitability, driven by rising revenues or reduced sales-related expenses. For financial advisors, monitoring this ratio within the financial advisor profitability model or investment advisory cash flow model is crucial for sustainable growth. Consistent margin improvement enhances firm valuation and supports effective financial advisor budgeting and compensation models, ultimately strengthening client retention and investment advisory business model performance.

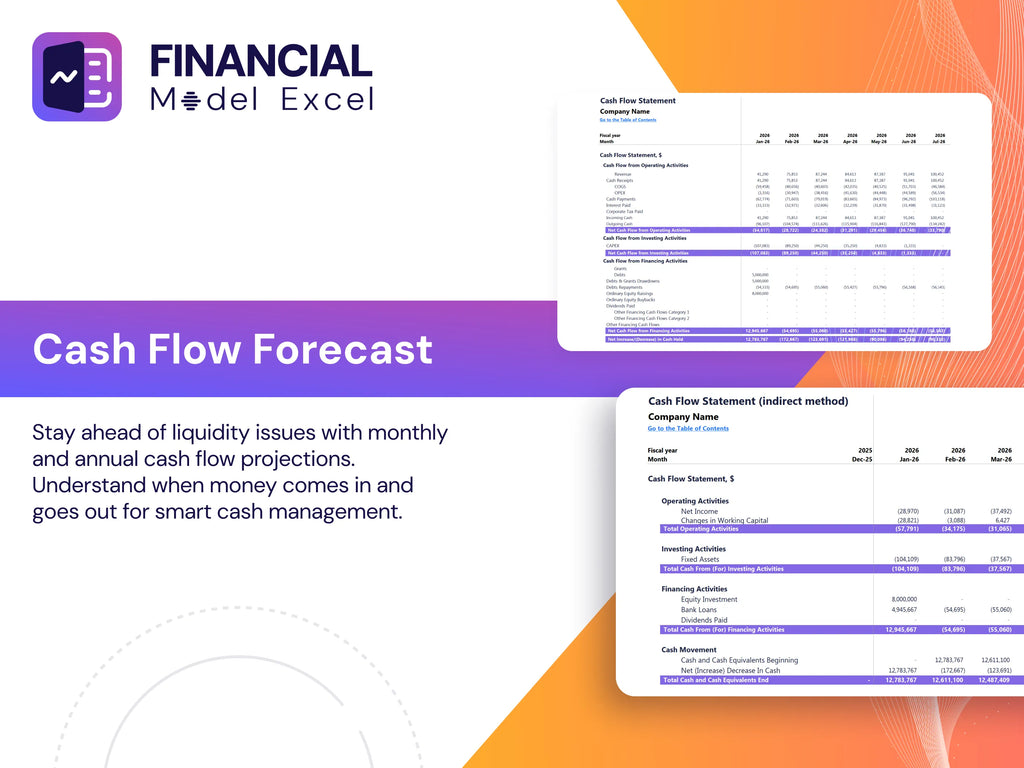

Cash Flow Forecast Excel

Present a clear snapshot of your investment advisory firm financials and key performance metrics with this concise, easy-to-use table. Ideal for integrating into financial advisory business models, client investment advisory models, or wealth management financial planning reports, it highlights essential data such as revenue streams, cash flow models, and profitability. Empower your pitches and reports with a compelling overview that supports investment advisory growth models and enhances client retention strategies, ensuring your financial advisor budgeting and compensation models are transparent and actionable. Elevate your investment portfolio financial model analysis with this streamlined tool.

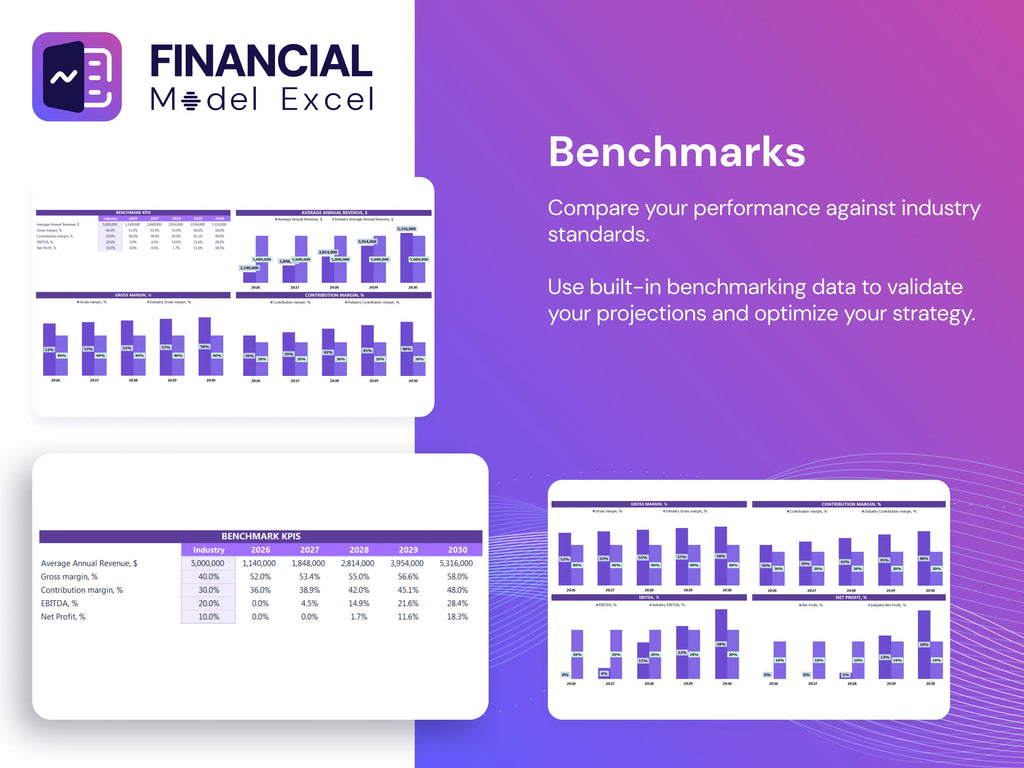

KPI Benchmarks

A robust investment advisory financial model incorporates industry benchmarking through detailed proforma analysis, comparing key financial indicators. This approach enables asset management and wealth management firms to objectively evaluate their investment advisory firm financials, enhancing financial advisor profitability and client investment advisory models. By leveraging investment advisory growth and retention models, firms gain valuable insights into performance, cash flow, and risk management, empowering strategic decisions that drive sustainable success in a competitive market.

P&L Statement Excel

Integrating robust investment management financial forecasting within your investment advisory financial planning model offers clear insights into projected performance. Utilizing proforma income statements and analyzing net income percentages alongside gross profit margins empowers firms to evaluate profitability and growth potential effectively. This comprehensive financial advisor revenue model not only enhances confidence in your financial advisory business model but also strengthens your firm’s overall valuation and strategic positioning. Embrace sophisticated financial models to drive informed decisions and secure long-term success in wealth management and asset management operations.

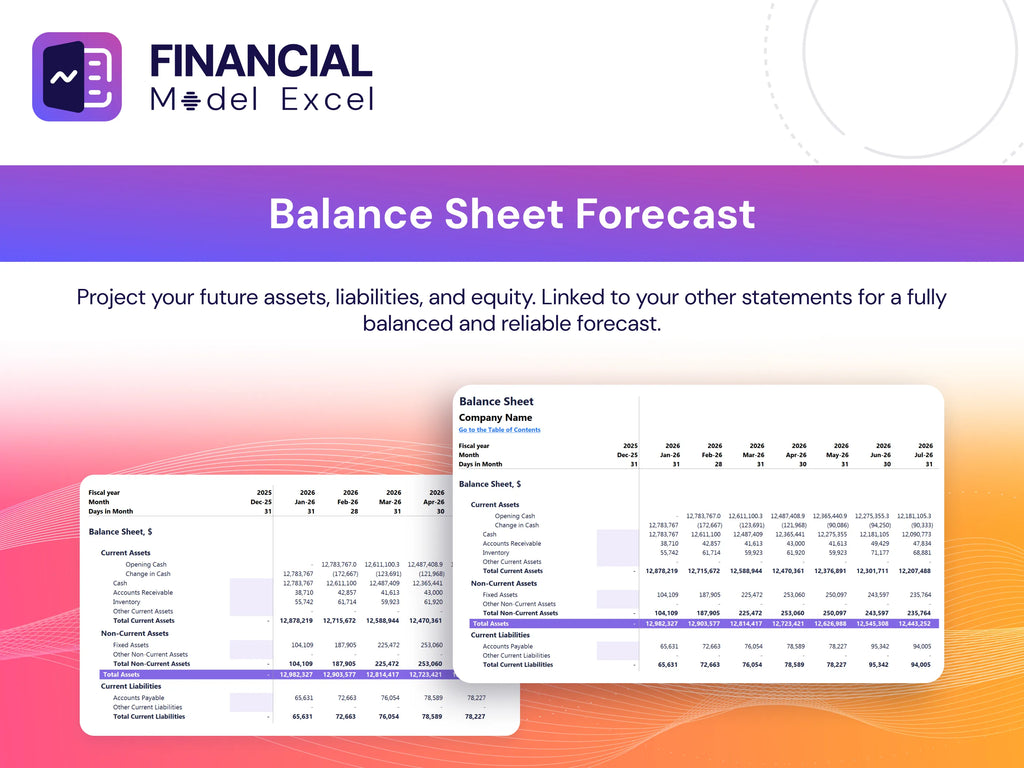

Pro Forma Balance Sheet Template Excel

This investment advisory financial forecasting model empowers you to analyze your current and fixed assets, liabilities, and equity with precision. It facilitates monitoring of accounts receivable, accounts payable, and accrued expenses, providing a comprehensive view of your firm’s financial health. Ideal for optimizing your financial advisory business model, this tool supports effective financial risk management and enhances your investment advisory cash flow model, enabling informed decisions to maximize profitability and client retention within your asset management financial framework.

INVESTMENT ADVISORY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

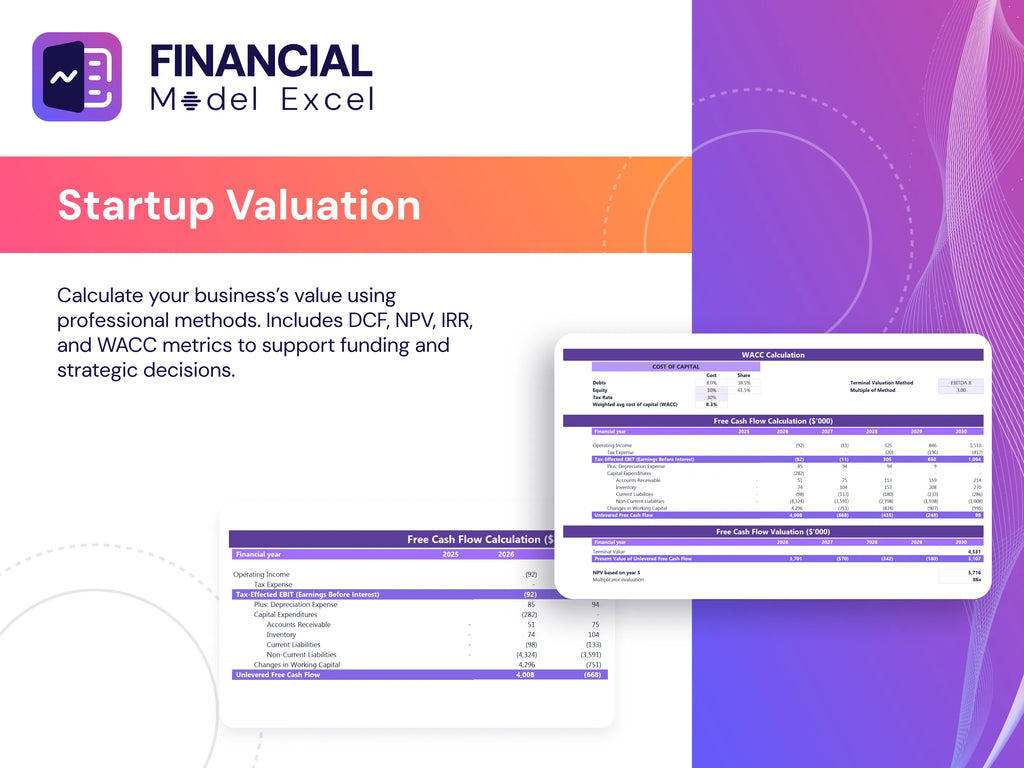

Startup Valuation Model

Net Present Value (NPV) is a critical component of any investment portfolio financial model, representing the discounted value of all future cash flows throughout an investment’s lifespan. Incorporating key elements such as investment required, equity raised, future values, net income, WACC, EBITDA, and growth rate, this financial planning model enables precise investment advisory firm financial forecasting. By integrating these metrics into your financial advisor budgeting model and investment advisory fee structure model, you can enhance profitability and strengthen your wealth management financial planning strategy.

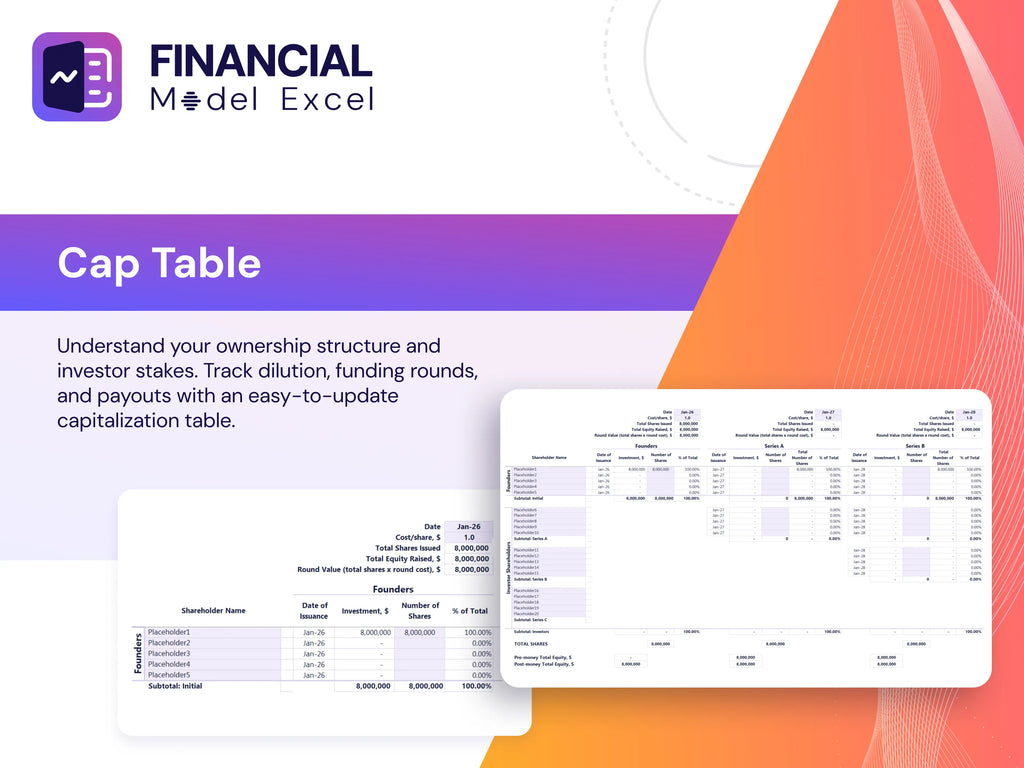

Cap Table

Our startup costs template features a comprehensive capitalization table integrated within the investment advisory financial model. It details four financing rounds, illustrating how newly issued shares affect investment income and ownership percentages. This transparent view of equity distribution and dilution empowers financial advisors to forecast investment advisory firm financials accurately, optimize the financial advisor revenue model, and strategically plan for sustainable growth. By capturing ownership shifts, the model supports informed decision-making critical to enhancing client investment advisory models and strengthening overall financial advisor profitability.

INVESTMENT ADVISORY FINANCIAL MODEL TEMPLATE FOR BUSINESS PLAN ADVANTAGES

Optimize profitability and client retention with a powerful investment advisory financial model designed for seamless growth.

The investment advisory financial model optimizes profitability and drives sustainable growth in your advisory business.

The investment advisory financial forecasting model ensures accurate break-even analysis and maximizes return on investment efficiently.

Maximize growth and forecast profits confidently with our Investment Advisory Financial Model 5-Year Projection Template.

Optimize startup costs effortlessly using the investment advisory financial model, ensuring precise, strategic business planning and growth.

INVESTMENT ADVISORY FINANCIAL MODEL EXCEL TEMPLATE ADVANTAGES

Our investment advisory growth model maximizes profitability by optimizing client retention and financial forecasting—We do the math.

Streamline your financial advisory business model with a ready-to-use, no-programming investment advisory financial forecasting tool.

The investment advisory cash flow model proactively identifies cash gaps and surpluses, ensuring optimal financial stability.

Financial advisor cash flow models enable early deficit detection, optimizing loan access and boosting strategic investment opportunities.

The investment advisory cash flow model optimizes accounts receivable, enhancing financial stability and boosting firm profitability.

The investment advisory cash flow model optimizes revenue by accurately forecasting impacts of late payments on financial stability.

Our investment advisory growth model maximizes profitability by optimizing client retention and financial forecasting—We do the math.

Financial Model Startup streamlines complex financial planning with no formulas, programming, or costly consultants needed—boosting efficiency instantly.

The investment advisory firm financials model provides accurate forecasts, boosting stakeholder confidence and supporting strategic growth decisions.

The investment advisory financial model ensures accurate forecasting, boosting lender confidence and securing timely bank loan approvals.