Investment Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Investment Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Investment Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVESTMENT BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year investment banking financial modeling template in Excel features a fully integrated investment bank financial statement model, including consolidated monthly profit and loss, balance sheet, and investment banking cash flow model components. Designed specifically for financial modeling in investment banking, it provides key financial charts, summaries, and funding forecasts to support business plans and investment bank valuation models. Ideal for startups and established firms alike, this unlocked financial model template allows full customization to assist with investment bank underwriting models, discounted cash flow analyses, and scenario financial models—empowering users to secure funding from banks or investors with confidence.

This investment banking excel financial model template alleviates common pain points by providing a comprehensive, ready-made solution that requires minimal financial modeling expertise, allowing users to quickly develop robust financial projections, including an investment bank valuation model, discounted cash flow model, and merger model. Its automated input-output structure streamlines updates across all reports such as cash flow models, financial statement models, and budgeting models, eliminating manual errors and saving time in financial analysis and risk assessment. With scenario financial models and sensitivity analysis features embedded, this template empowers users to assess various business outcomes and capital structure options, enhancing decision-making and investor communication while ensuring accuracy and flexibility for underwriting and leveraged buyout evaluations.

Description

Our investment banking financial model pro forma projection is expertly crafted to support critical business and financial decision-making through precise reporting and comprehensive analysis. This financial model for investment banks integrates core input tables and dynamic charts, enabling thorough investment banking financial projections up to 60 months. It encompasses key elements such as an investment banking discounted cash flow model, investment bank merger model, and investment banking leveraged buyout model, delivering projected income statements, cash flow models, and balance sheets. Enhanced with scenario financial modeling, sensitivity analysis, and risk assessment capabilities, this excel-based model serves as a robust investment bank valuation model and underwriting framework, while also offering detailed investment banking revenue, capital structure, and budgeting models. Designed to facilitate startup and established investment banks alike, it includes financing options and diagnostic tools for tracking critical metrics and ensuring sustainable growth.

INVESTMENT BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Every organization, regardless of size, requires a robust investment banking financial projection model. A comprehensive financial model for investment banks integrates the cash flow model, pro forma balance sheet, and projected profit and loss statement, forming a holistic 3-way financial model. This investment bank valuation model captures all financial inputs throughout the year, enabling precise financial analysis and strategic planning. Utilizing detailed financial modeling in investment banking ensures accurate forecasting, risk assessment, and informed decision-making, essential for sustainable growth and successful capital structuring within any business plan.

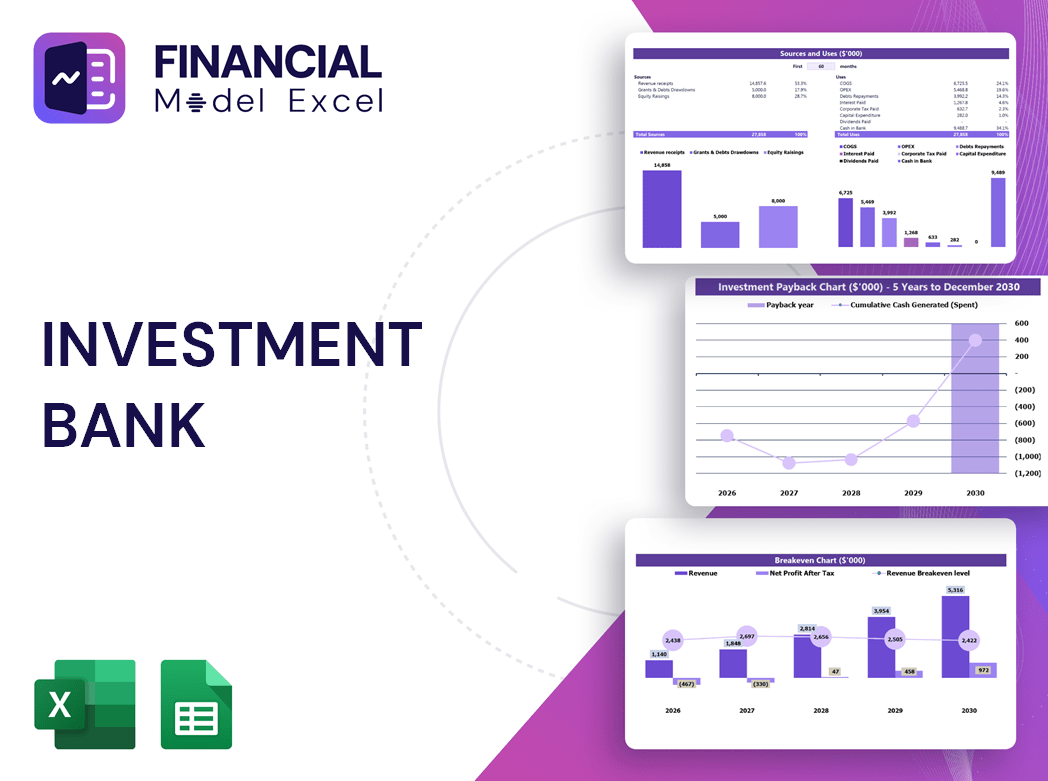

Dashboard

Our investment banking financial model template features a dynamic financial dashboard designed for in-depth financial analysis and planning. Utilizing advanced charts and graphs, it ensures precise and accurate evaluation of a company’s financial statements. Tailored for investment banking needs, this dashboard supports detailed valuation models, cash flow projections, and risk assessments. It empowers stakeholders with critical insights, facilitating robust financial projections and scenario analyses essential for strategic decision-making in investment banking.

Business Financial Statements

Our investment banking financial modeling template offers a dynamic, 5-year projected balance sheet, providing a precise snapshot of assets, liabilities, and equity at each reporting period’s close. Designed specifically for investment banks, this financial model for investment banks automatically generates critical business financial statements, including a pro forma balance sheet in Excel. It empowers users to perform robust financial analysis, streamline budgeting, and enhance forecasting accuracy with built-in templates tailored for valuation, cash flow, and scenario modeling—essential tools for informed decision-making in investment banking.

Sources And Uses Statement

Our investment banking financial modeling templates simplify complex financial planning by clearly outlining the Sources and Uses statement. This essential model demonstrates to stakeholders—lenders and investors alike—the company’s funding needs and planned capital allocation. Whether showcasing alternative funding options like crowdfunding or emphasizing financial stability without additional capital, this financial model for investment banks ensures transparency. It balances all sources with their corresponding uses, supporting effective investment bank valuation models, underwriting models, and risk assessment. Designed for accuracy and clarity, our templates empower startups and established firms to communicate financial strategies confidently.

Break Even Point In Sales Dollars

Our investment banking financial projection model integrates a dynamic break-even chart, pinpointing the exact sales volume needed to cover fixed and variable costs. This critical tool enhances financial modeling in investment banking by enabling precise analysis of profitability thresholds. Built with robust financial model templates for investment banks, it allows you to effortlessly adjust assumptions and instantly evaluate impacts on your investment bank valuation model. Whether refining your investment banking cash flow model or underwriting scenarios, this solution drives smarter decisions, ensuring your business plan aligns with realistic, profit-driven financial forecasts.

Top Revenue

Our startup pro forma template’s Top Revenue tab enables dynamic scenario analysis within an investment banking financial model, helping you evaluate profitability and attractiveness across varying demand levels. With built-in financial modeling in Excel, users can dissect revenue bridges and depth, forecasting fluctuations such as weekday versus weekend demand. This robust investment banking revenue model empowers precise operational planning—optimizing manpower and resource allocation. Designed for agility, it’s an essential tool for strategic decision-making, enhancing your business’s financial projections and ensuring scalable, data-driven growth aligned with investment banking standards.

Business Top Expenses Spreadsheet

The company’s expenses are detailed within the investment banking excel financial model, categorized into four key segments, including an ‘Other’ section for additional inputs. This comprehensive financial modeling in investment banking allows for precise historical data analysis spanning up to five years. Utilizing this financial model template for investment banks enhances accuracy in budgeting, cash flow forecasting, and risk assessment, providing a strong foundation for valuation and scenario analysis.

INVESTMENT BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

This investment banking financial projection model in Excel offers unparalleled ease-of-use, enabling swift and accurate projection of total operating expenses, including R&D and SG&A. Designed specifically as a financial model template for investment banks, it organizes cost details clearly and efficiently. Its automated, end-to-end formulas minimize manual updates, ensuring seamless financial modeling in investment banking. Perfect for building robust investment bank valuation models and cash flow analyses, this template streamlines complex budgeting and underwriting processes with precision and professionalism.

CAPEX Spending

Accurate revenue forecasting is essential in financial modeling for investment banking, as it drives enterprise value over a 5-year projection. Whether using an investment banking financial projection model or an Excel financial model template, precise assumptions on growth rates based on historical data ensure reliable results. Management and financial analysts must focus on detailed scenario financial models to create robust revenue models that underpin budgeting, valuation, and cash flow forecasts. A flawed revenue forecast can compromise the entire investment bank financial analysis model, highlighting the importance of meticulous planning in financial modeling within investment banking.

Loan Financing Calculator

Simplify complex financial projections with our investment banking financial projection model featuring an integrated loan amortization schedule. Effortlessly input loan amount, tenor, and maturity to generate detailed repayment schedules, including principal and interest breakdowns. This comprehensive template serves as your all-in-one solution, providing clear visibility into interest rates, maturity dates, and repayment timelines—ideal for investment banking cash flow models and underwriting processes. Enhance accuracy and efficiency in financial modeling for investment banks with this essential tool.

INVESTMENT BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In investment banking financial modeling, Net Present Value (NPV) is a crucial metric within financial model templates for investment banks. Using discounted cash flow models, NPV calculates the present value of future cash flows, answering: “What is today’s value of $1 received years from now?” In complex investment bank valuation models and cash flow models, the sum of these discounted cash flows across multiple periods determines the NPV. This foundational concept enhances investment bank financial analysis models and guides informed decision-making in merger models, leveraged buyout models, and scenario financial models.

Cash Flow Forecast Excel

The investment banking cash flow model in Excel provides a streamlined approach to financial forecasting and analysis. It enables precise calculation of profits, expenses, debts, and net income, essential for crafting robust financial projections. Utilizing a pro forma cash flow statement template enhances efficiency, making complex financial management straightforward. This budgeting model supports strategic planning to optimize cash flow and drive growth. Trusted by industry professionals, the investment banking financial projection model is a reliable, fast, and effective tool to consolidate finances and elevate your investment bank’s valuation and risk assessment processes.

KPI Benchmarks

A benchmarking study, integral to financial projection models in investment banking, evaluates key performance indicators—such as profit margins, cost efficiency, and productivity—against industry peers. This process, often embedded in investment banking financial modeling templates, enables firms to assess their standing and identify improvement areas. By comparing metrics within the same sector, companies gain strategic insights essential for effective financial analysis and decision-making. Benchmarking is especially valuable for start-ups, providing a clear framework to align with industry best practices through robust financial modeling, including investment banking cash flow and revenue models.

P&L Statement Excel

The Monthly Income Statement sheet within our investment banking financial modeling templates offers detailed, regular reporting essential for precise financial analysis. Featuring comprehensive revenue streams, gross and net earnings linked to revenue analysis, it ensures accuracy in forecasting. Complemented by the Yearly Profit & Loss Excel model, this tool provides in-depth insights into revenue trends, G&A expenses, and key metrics such as margins, ratios, and net profit. Ideal for investment bank valuation models, cash flow projections, and sensitivity analysis, it empowers professionals with robust data to drive informed decision-making and secure financial performance.

Pro Forma Balance Sheet Template Excel

Our investment banking financial modeling template seamlessly integrates cash flow statements, P&L forecasts, and key inputs with monthly and yearly projected balance sheets. Designed specifically for startups, this comprehensive investment banking revenue model delivers an insightful summary of your assets, liabilities, and equity accounts. Leverage this financial model for investment banks to enhance budgeting accuracy, support financial projections, and optimize capital structure decisions with confidence.

INVESTMENT BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive financial modeling template for investment banks streamlines valuation analysis by incorporating an advanced Discounted Cash Flow (DCF) model. Designed for precision, it enables detailed financial projections and thorough assessment of residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for financial modeling in investment banking, this Excel-based tool enhances accuracy and efficiency in investment bank valuation models and scenario financial models, empowering professionals with robust insights for strategic decision-making.

Cap Table

Our investment banking cash flow model seamlessly integrates the equity cap table, linking funding rounds to financial instruments like equity and convertible notes. This financial modeling in investment banking offers a clear view of how company decisions influence share ownership and dilution. Utilizing our financial model template for investment banks, users gain precise insights into capital structure and funding impacts, enhancing investment bank financial analysis models and supporting strategic valuation and projection efforts.

INVESTMENT BANK FINANCIAL PLANNING MODEL ADVANTAGES

Financial modeling in investment banking enhances decision accuracy, minimizing risks when evaluating strategic opportunities.

Empower decisions with investment banking financial models, streamlining analysis for accurate valuation and strategic growth.

Optimize decision-making with tailored investment banking financial models that enhance accuracy and strategic insights.

Efficiently plan costs and optimize operations with a precise investment banking financial model.

Investment banking financial modeling enhances precision and strategic insight, empowering confident, data-driven investment decisions.

INVESTMENT BANK EXCEL FINANCIAL MODEL ADVANTAGES

Leverage our investment banking financial modeling to build compelling plans and secure confident funding approvals.

Impress bankers and investors with a reliable investment banking financial model that delivers precise, actionable insights every time.

Unlock precise investment banking insights and maximize returns with our accurate, customizable financial modeling templates—great value guaranteed.

Leverage our proven investment banking financial projection model for startups—affordable, transparent, and built on years of expertise.

Run different scenarios with investment banking financial models to optimize valuation, risk, and strategic decision-making efficiently.

Investment banking cash flow models enable dynamic scenario analysis, optimizing forecasts and improving strategic financial decisions efficiently.

Unlock precise valuation insights with the investment banking discounted cash flow model, optimizing your financial decisions effortlessly.

Easily refine your investment bank financial model with dynamic input adjustments for precise, real-time financial projections and analysis.

Financial modeling in investment banking enables better decision making through precise valuation and risk assessment insights.

Enhance decision-making confidence with investment banking cash flow models forecasting scenario impacts on your financial operations.