IT Equipment Rental And Leasing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

IT Equipment Rental And Leasing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

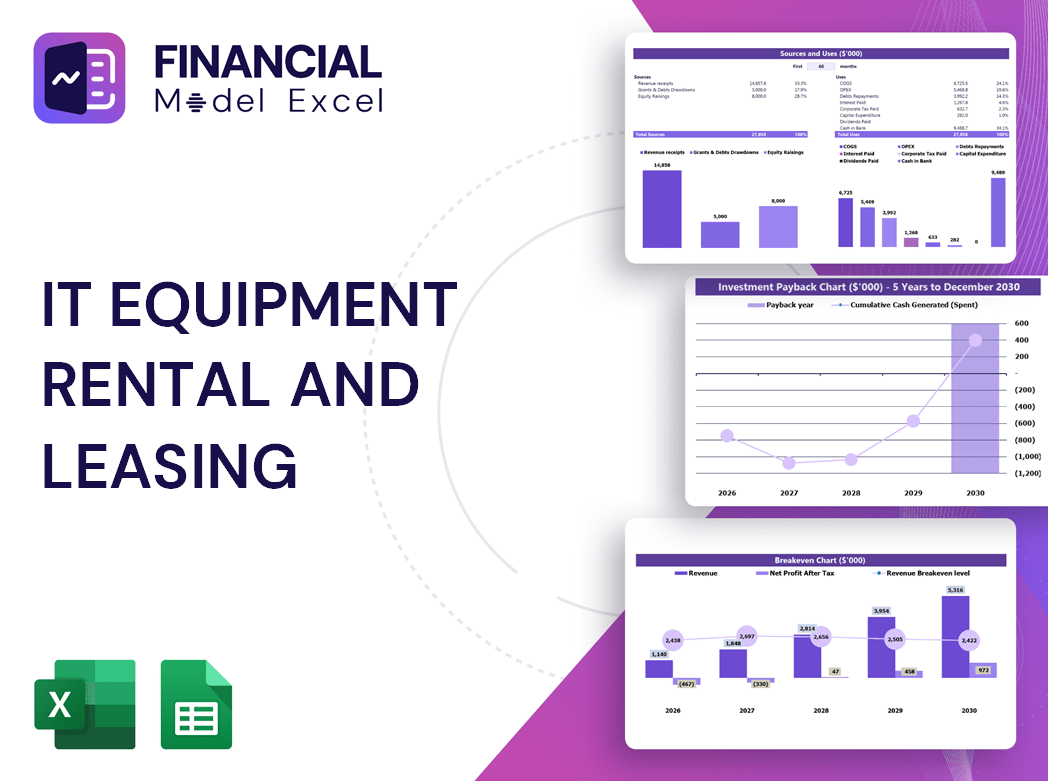

IT Equipment Rental And Leasing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year IT equipment rental and leasing financial model template featuring detailed financial projections, cash flow models, and an interactive financial dashboard with core metrics aligned to GAAP/IFRS standards. This technology equipment lease financial analysis and equipment rental revenue model provides essential tools like an IT asset leasing cost model, rental equipment depreciation schedule, and operating lease financial forecast. Utilize this IT leasing business budget model and financial scenario modeling for equipment rental to accurately forecast financials for IT rentals, analyze equipment rental profitability, and create a robust financial plan for your equipment leasing business—ensuring you are fully prepared to get funded by banks or investors. Fully unlocked and editable for tailored financial modeling for IT equipment leasing startups.

This ready-made it equipment rental financial projection and technology equipment lease financial analysis template addresses common challenges such as accurately forecasting financials for IT rentals, managing leasing payments and financial impact, and ensuring comprehensive equipment rental profitability analysis. The built-in tech equipment rental cash flow model and operating lease financial forecast enable business owners to optimize their capital expenditure model for IT leasing while keeping a detailed rental equipment depreciation schedule for precise asset valuation. By utilizing the IT asset leasing cost model and financial scenario modeling for equipment rental, users can streamline their equipment rental revenue model and make informed decisions through dynamic financial metrics for equipment leasing. This Excel template simplifies the complex process of creating a leasing and rental financial statement model and integrates an IT leasing business budget model to maintain control over expenses and maximize returns, ultimately providing a solid financial plan for equipment leasing business success.

Description

This comprehensive IT equipment rental financial projection template offers a robust framework for financial forecasting for equipment rental businesses, integrating an IT leasing financial model template that captures detailed startup expenses and ongoing operational costs. Designed to support both new and existing ventures, the model facilitates equipment rental profitability analysis by generating a full suite of financial statements, including an equipment leasing income statement model, tech equipment rental cash flow model, and leasing and rental financial statement model, with monthly and annual views up to 60 months. It incorporates capital expenditure modeling for IT leasing, rental equipment depreciation schedules, and leasing payments and financial impact models, enabling precise financial scenario modeling for equipment rental. The tool also features diagnostic tools and financing options analysis such as equity funding scenarios, ensuring thorough financial planning for equipment leasing businesses while tracking essential financial metrics for equipment leasing to inform strategic investment and operational decisions.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive IT equipment rental and leasing financial model offers a complete 3-statement framework, integrating profit and loss templates, 5-year cash flow projections, and pro forma balance sheets. Designed for startups and established businesses, it delivers robust financial forecasting for equipment rental, detailed equipment leasing income statements, and key financial metrics for equipment leasing. Benefit from insightful performance reviews, monthly and annual business summaries, and a streamlined capital expenditure model to drive data-driven decisions and optimize profitability in your IT leasing business.

Dashboard

If you have access to a comprehensive tech equipment rental cash flow model or IT leasing business budget model, sharing it with your stakeholders is essential. Providing transparency through financial forecasting for equipment rental and leveraging a financial plan for equipment leasing business enhances collaboration. This approach not only refines your equipment rental revenue model but also strengthens financial scenario modeling for equipment rental, making your capital expenditure model for IT leasing and operating lease financial forecast more insightful and actionable. Expand your business potential by optimizing leasing payments and financial impact models for greater efficiency and investor confidence.

Business Financial Statements

Our IT equipment rental financial projection template offers an integrated startup financial statement model, including pro forma balance sheet, income statement, and cash flow forecasts automatically generated for five years. This comprehensive IT leasing financial model template features pre-built proformas, detailed financial metrics for equipment leasing, and managerial reports. Users can seamlessly customize reports in GAAP or IFRS formats, enabling precise financial forecasting for equipment rental and leasing businesses. Perfect for equipment rental profitability analysis and financial scenario modeling, this tool streamlines capital expenditure and operating lease financial forecasts to optimize your equipment leasing business budget model.

Sources And Uses Statement

Our startup’s sources and uses of cash statement simplifies financial forecasting for equipment rental businesses. It clearly presents funding needs and strategies to stakeholders, including lenders and investors, enhancing transparency in our IT leasing financial model template. By detailing potential alternative funding sources—such as crowdfunding—this financial plan for equipment leasing businesses builds confidence and flexibility. The statement balances capital inflows with planned uses, ensuring an accurate revenue model and supporting robust financial scenario modeling. This approach streamlines financial metrics for equipment leasing, helping startups manage leasing payments and forecast cash flow with clarity and precision.

Break Even Point In Sales Dollars

This 5-year IT equipment rental financial projection template features built-in breakeven analysis, pinpointing when revenues surpass total costs—marking profit generation. This insight is vital for investors and creditors assessing risks and benefits before business launch. By examining revenue alongside fixed and variable costs within the equipment leasing financial model template, businesses gain clarity on profitability timelines. Incorporating this financial forecasting for equipment rental enhances strategic planning, ensuring informed decisions and robust financial performance in the evolving IT leasing market.

Top Revenue

Our IT equipment rental financial projection template empowers you to analyze demand, run scenario-based profitability assessments, and refine your equipment leasing business budget model. Featuring a comprehensive equipment rental revenue model and tech equipment rental cash flow model, it enables precise financial forecasting for equipment rental across varying timeframes. This financial modeling for IT equipment leasing supports revenue bridge analysis and operational adjustments—helping optimize manpower and resource allocation. Leverage this robust financial plan for equipment leasing business to enhance forecasting financials for IT rentals, ensuring agile, data-driven decisions that maximize profitability and operational efficiency.

Business Top Expenses Spreadsheet

Maximize profitability with our IT leasing financial model template, designed for precise financial forecasting for equipment rental. The top expense tab highlights your four highest costs, aiding strategic cost optimization annually. This feature empowers startups and established businesses alike to monitor IT asset leasing costs effectively, optimize leasing payments, and enhance equipment rental profitability analysis. With clear visibility into expenses, you can develop proactive strategies to improve your operating lease financial forecast and boost overall business performance.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive IT leasing financial model template is essential for accurate financial forecasting and profitability analysis. It enables detailed equipment rental revenue modeling, cost budgeting, and forecasting financials for IT rentals, providing clear insights into leasing payments and financial impact. This technology equipment lease financial analysis highlights operational strengths and identifies weak areas, allowing proactive strategies to enhance performance. Additionally, integrating capital expenditure models and rental equipment depreciation schedules ensures robust financial planning, supporting bank loans and investor confidence through precise equipment rental income statement models and cash flow forecasts.

CAPEX Spending

An accurate capital expenditure (CAPEX) model with automated depreciation schedules is crucial for financial forecasting in IT equipment leasing. Our financial modeling template enables seamless integration of straight-line or double-declining balance depreciation methods, enhancing your equipment rental profitability analysis and cash flow modeling. This feature supports comprehensive financial planning and scenario modeling, ensuring precise financial statements and optimized leasing payments impact. Empower your IT leasing business budget model with robust tools for detailed CAPEX tracking and effective rental equipment depreciation management.

Loan Financing Calculator

Accurately forecasting leasing payments is crucial for IT equipment rental startups to ensure financial stability. Our comprehensive IT leasing financial model template simplifies this process by integrating a detailed loan amortization calculator within the financial projection. This tool enables precise planning of payments, supporting your equipment rental revenue model and financial forecasting for equipment rental. Optimize your capital expenditure model for IT leasing and gain clear insights into the operating lease financial forecast, ensuring informed decisions and enhanced profitability.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) are essential for business owners and investors to gauge the success drivers in IT equipment rental. Our comprehensive 5-year financial forecasting for equipment rental template enables precise tracking of revenue, costs, and profitability. Utilizing this IT leasing financial model template, users can evaluate cost structures, optimize operating lease forecasts, and monitor cash flow with ease. This financial plan for equipment leasing businesses ensures focus on strategic goals while providing insightful financial scenario modeling, empowering informed decisions and sustainable growth in the competitive tech equipment rental market.

Cash Flow Forecast Excel

In any equipment leasing business, a robust financial plan is essential for profitability. Utilizing a comprehensive IT equipment rental financial projection and equipment rental cash flow model provides clear insight into cash inflows and outflows. This enables accurate financial forecasting for equipment rental, highlighting how leasing payments impact overall finances. By leveraging financial modeling for IT equipment leasing and equipment rental profitability analysis, businesses can optimize their operating lease financial forecast and capital expenditure model, ensuring sustainable growth and strong financial metrics for equipment leasing success.

KPI Benchmarks

This IT equipment rental financial projection model includes a dedicated tab for comprehensive financial benchmarking research. It provides in-depth technology equipment lease financial analysis, comparing your company’s key financial metrics against industry peers. This enables precise financial forecasting for equipment rental, helping you evaluate operational efficiency, competitiveness, and profitability. Leverage this financial modeling for IT equipment leasing to gain actionable insights, optimize your equipment rental revenue model, and strengthen your financial plan for equipment leasing business growth.

P&L Statement Excel

A comprehensive financial forecasting for equipment rental, including the projected profit and loss statement, is vital for startups. Utilizing an IT equipment rental financial projection or IT leasing financial model template enables businesses to monitor performance and forecast income and expenses over five years. This financial plan for equipment leasing businesses supports strategic decision-making, helping optimize revenue growth and operational efficiency. Incorporating key financial metrics for equipment leasing ensures accurate scenario modeling, empowering startups to build stronger, data-driven strategies for sustainable profitability and long-term success.

Pro Forma Balance Sheet Template Excel

The balance sheet forecast within an IT equipment rental financial model provides a clear snapshot of key assets—including cash, inventory, fixed assets, and equipment—alongside current and long-term liabilities and equity. This comprehensive financial statement model is essential for accurate financial forecasting for equipment rental businesses. Especially when presenting to lenders or investors, the pro forma balance sheet template demonstrates the business’s financial health, helping to secure financing by detailing asset allocation, capital structure, and leverage. Utilizing this financial modeling tool enhances credibility and supports strategic decision-making in IT leasing and rental operations.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This 5-year tech equipment rental cash flow model integrates a comprehensive financial forecasting for equipment rental, featuring a Discounted Cash Flow (DCF) valuation analysis. It empowers users to evaluate critical financial metrics for equipment leasing, including residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for IT leasing business budget models and equipment rental profitability analysis, this template supports informed financial scenario modeling and strategic decision-making in the leasing and rental financial statement model.

Cap Table

The startup costs template streamlines financial forecasting for equipment rental businesses by accurately estimating key metrics like sales and revenue. Integrated with an equity cap table, it enhances financial modeling for IT equipment leasing, providing a clear, organized framework for analyzing leasing payments and their financial impact. This structured approach supports comprehensive equipment rental profitability analysis and capital expenditure modeling, empowering users to make informed decisions with confidence.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL MODEL ADVANTAGES

Optimize cash flow and identify payment issues easily with our comprehensive equipment rental financial projection model.

The IT equipment rental financial model forecasts cash flow, enabling proactive management of potential cash shortfalls.

Boost profitability and confidence with our comprehensive IT equipment rental and leasing financial model in Excel.

The financial forecasting model ensures precise tracking of spending, optimizing profitability and strategic decision-making for IT equipment leasing.

The IT leasing financial model template accurately forecasts profitability, empowering strategic decisions and optimizing rental equipment revenue.

IT EQUIPMENT RENTAL AND LEASING FINANCIAL PROJECTION ADVANTAGES

Get a robust financial model for IT equipment leasing that enhances forecasting accuracy and drives strategic growth decisions.

This robust IT equipment leasing financial model empowers precise forecasting and tailored financial planning for maximum profitability.

This IT equipment leasing financial model ensures precise forecasting, enhancing investor confidence and maximizing funding opportunities.

Boost investor confidence with our IT equipment leasing financial model delivering clear, actionable forecasting and profitability analysis.

Our IT equipment leasing financial model ensures accurate forecasting, maximizing investor confidence and business profitability.

Streamline profitability with our IT equipment leasing financial model offering comprehensive forecasts and ready-to-use financial statements.

Secure loan approval confidently with our financial model proving your IT equipment leasing business’s repayment capability.

Use the IT equipment rental financial projection to confidently demonstrate loan repayment and boost lender approval chances.

Our IT equipment lease financial model ensures accurate forecasts, building stakeholder trust through clear, reliable financial insights.

A detailed IT leasing financial model fosters investor confidence by delivering clear, monthly cash flow and profitability forecasts.