Lithium Ion Battery Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Lithium Ion Battery Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Lithium Ion Battery Manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

LITHIUM ION BATTERY MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly lithium ion battery manufacturing financial model in Excel, designed for comprehensive financial planning including profit and loss projections, cash flow modeling, and balance sheet preparation on both monthly and annual timelines. This template is ideal for startups or established companies seeking a detailed financial plan for lithium ion battery facilities, encompassing cost analysis, budgeting, capital expenditure modeling, and profitability analysis to support informed decision-making. The unlocked model allows full customization, making it a valuable tool for investment modeling, revenue forecasting, and financial risk analysis within the lithium ion battery production industry. Consider utilizing this pro forma business plan template before purchasing to ensure it fits your lithium ion battery manufacturing financial forecasting needs.

The ready-made lithium ion battery manufacturing financial model Excel template expertly addresses common pain points by offering comprehensive cost analysis and expense modeling features that enable precise budgeting for manufacturing operations, alongside detailed capital expenditure models for plant setup. Its integrated cash flow model and financial plan for lithium ion battery facility allow users to confidently manage ongoing operating costs while projecting revenue forecasts and profitability analysis with clarity. This model's financial dashboard simplifies complex financial statement reviews, supports investment modeling, and provides a robust five-year financial forecast that ensures users can evaluate financial risk and performance with ease, even without advanced financial expertise, ultimately streamlining decision-making and enhancing strategic planning in lithium ion battery production ventures.

Description

This comprehensive financial modeling for lithium ion battery production integrates cost analysis lithium ion battery manufacturing with a detailed lithium ion battery plant financial forecast, enabling stakeholders to develop a robust financial plan for lithium ion battery facility operations. By utilizing budgeting lithium ion battery manufacturing operations alongside an investment model lithium ion battery production, this approach facilitates profitability analysis lithium ion battery manufacturing through dynamic financial statements, including a financial statement lithium ion battery company overview and a cash flow model lithium ion battery manufacturing. Incorporating lithium ion battery production cost model and expense modeling lithium ion battery production components ensures accuracy in revenue forecast lithium ion battery manufacturing, while financial risk analysis lithium ion battery manufacturing and lithium ion battery manufacturing capital expenditure model assessments provide insights essential for sustainable growth. Additionally, leveraging an operating cost model lithium ion battery plant and a financial dashboard lithium ion battery production enhances monitoring and strategic adjustments, all supported by a lithium ion battery manufacturing budget template to streamline financial performance analysis lithium ion battery manufacturing and secure long-term business viability.

LITHIUM ION BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive financial plan for your lithium ion battery manufacturing startup with precision. Our advanced financial modeling tools deliver dynamic financial projections, including pro forma income statements, balance sheets, and cash flow models tailored to lithium ion battery production. Effortlessly perform cost analysis, budgeting, and profitability assessments while monitoring key performance indicators via an intuitive, automatically updating dashboard. This integrated financial model empowers stakeholders with clear visibility into capital expenditures, operating costs, revenue forecasts, and financial risks, enabling confident strategic decisions to drive sustainable growth and maximize returns in the competitive lithium ion battery manufacturing industry.

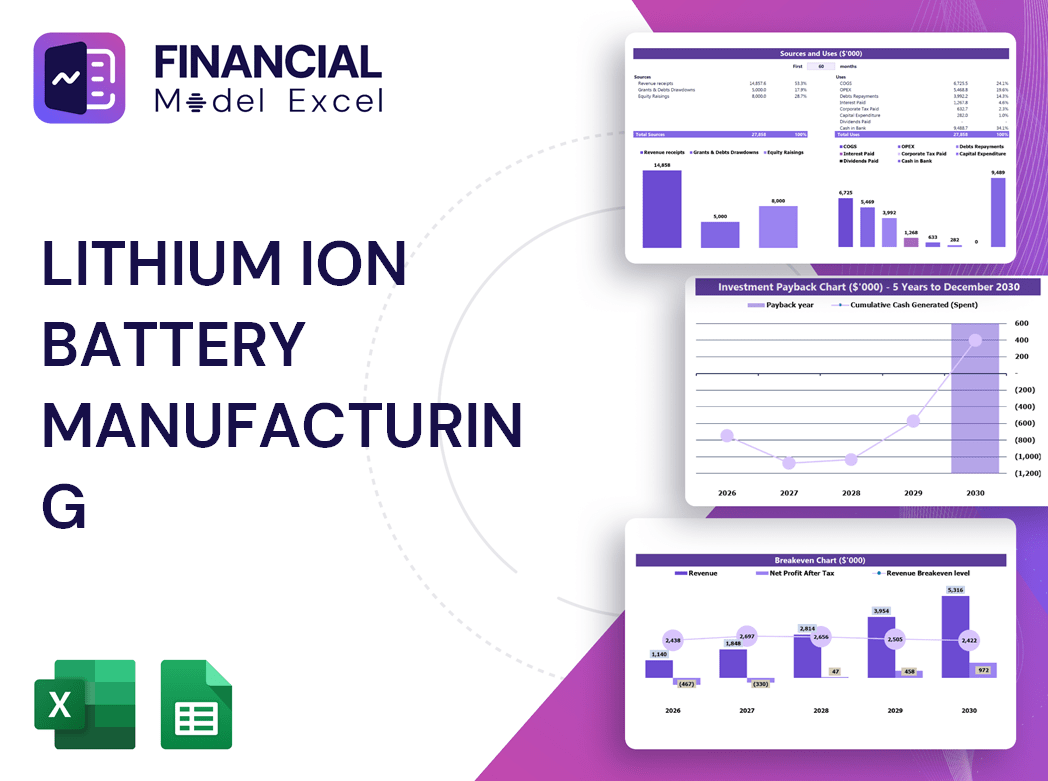

Dashboard

The all-in-one financial dashboard in this 5-year lithium ion battery manufacturing cash flow model consolidates key KPIs and start-up metrics essential for comprehensive financial analysis. It delivers a clear summary of critical insights from the balance sheet forecast, income statement, and cash flow projections. Designed for impactful stakeholder presentations, users can seamlessly visualize financial data through dynamic graphs and charts. This powerful tool supports budgeting, profitability analysis, and financial risk assessment, empowering strategic decisions throughout lithium ion battery production and plant operations.

Business Financial Statements

This comprehensive lithium ion battery manufacturing financial plan features an integrated Excel dashboard, combining monthly profit and loss, pro forma balance sheet, and cash flow models. Designed for precision, it offers a seamless 5-year financial forecast, linking startup financial statements with detailed cost analysis, revenue projections, and expense modeling. Ideal for budgeting lithium ion battery manufacturing operations, this tool empowers profitability analysis and financial risk assessment, supporting strategic decision-making and investment modeling for lithium ion battery production facilities.

Sources And Uses Statement

The sources and uses of funds statement within this 5-year lithium ion battery manufacturing financial projection comprehensively outlines all capital inflows and strategic expenditures. It serves as a vital component of the financial plan for lithium ion battery facilities, enabling precise budgeting and investment modeling. This ensures transparent cash flow management, supports cost analysis, and strengthens profitability analysis, empowering stakeholders to make informed decisions aligned with the company’s financial goals and operational efficiency.

Break Even Point In Sales Dollars

A comprehensive break-even analysis in lithium ion battery manufacturing financial projections distinguishes sales, revenue, and profit clearly. Revenue represents total income from product sales, while profit accounts for revenue minus all fixed and variable expenses. Integrating this into your financial modeling for lithium ion battery production ensures precise budgeting and profitability analysis. This clarity is vital in developing a robust financial plan for lithium ion battery facilities, supporting accurate cost analysis, cash flow modeling, and revenue forecasting that drive informed investment decisions and sustainable growth.

Top Revenue

Enhance your lithium ion battery manufacturing financial projections with our specialized Excel template. It features dedicated tabs for in-depth revenue forecasting, allowing you to analyze income streams by product line or service category with precision. Utilize this tool for comprehensive financial modeling, cost analysis, and profitability insights, empowering strategic budgeting and investment decisions tailored to your lithium ion battery production operations.

Business Top Expenses Spreadsheet

This comprehensive 5-year lithium ion battery manufacturing financial forecast features a detailed Top Expenses tab, categorizing costs into four key segments plus an additional "Other" category for miscellaneous expenditures. Designed to support precise cost analysis and budgeting lithium ion battery manufacturing operations, this template enhances financial modeling accuracy and profitability analysis. Ideal for developing a robust financial plan for lithium ion battery facilities, it empowers stakeholders with clear insights for investment modeling and expense management, driving strategic decision-making and sustainable growth.

LITHIUM ION BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Instantly access a comprehensive financial plan for lithium ion battery manufacturing, designed for efficient budgeting of fixed operating expenses like R&D and SG&A. This automated financial modeling template integrates end-to-end formulas across multiple worksheets, streamlining cost analysis and cash flow forecasting for your lithium ion battery production facility. With organized and straightforward projections, it simplifies your lithium ion battery manufacturing business plan financials, enabling quick revenue forecasts, expense modeling, and profitability analysis without manual updates—empowering confident investment and financial decisions in your lithium ion battery plant operations.

CAPEX Spending

Accurate CAPEX forecasting is vital for strengthening a lithium ion battery manufacturing facility’s financial position. Integrated within the startup budget, it ensures strategic allocation of investments to fully support operational needs. This financial planning drives innovation by funding advanced business management practices and the adoption of cutting-edge technologies, ultimately enhancing profitability and long-term growth.

Loan Financing Calculator

Our financial modeling template for lithium ion battery manufacturing features an integrated loan amortization schedule with advanced formulas. It provides a clear, time-based breakdown of principal and interest repayments—monthly, quarterly, or annually—enabling precise cash flow forecasting and budgeting for lithium ion battery production. This tool supports comprehensive financial planning, enhancing profitability analysis and investment modeling for your lithium ion battery facility.

LITHIUM ION BATTERY MANUFACTURING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The lithium ion battery manufacturing financial model features a detailed revenue forecast dashboard, presenting monthly revenue breakdowns across five key products. This dynamic financial plan for lithium ion battery production allows customization, enabling you to add additional products or adjust the analysis period to fit your budgeting and investment modeling needs. Ideal for profitably analyzing lithium ion battery manufacturing operations, this template supports comprehensive cost analysis and cash flow modeling, empowering precise financial projections and informed decision-making for your lithium ion battery facility.

Cash Flow Forecast Excel

A vital component in lithium ion battery manufacturing financial projections, the cash flow model offers a comprehensive view of cash inflows and outflows, surpassing traditional income statements. This fully integrated financial modeling template provides detailed cash flow statements, customizable monthly or annually, spanning up to five years. Ideal for budgeting lithium ion battery manufacturing operations and conducting financial risk analysis, it empowers precise revenue forecasting and expense modeling, enhancing profitability analysis and financial planning for lithium ion battery production facilities.

KPI Benchmarks

The financial projection model’s benchmark tab critically assesses a lithium ion battery manufacturing company’s performance. Completing this step enables comprehensive competitive analysis, essential for informed financial planning and strategic development, especially for startups. Leveraging profitability analysis and financial modeling for lithium ion battery production empowers manufacturers to optimize cost structures and forecast revenue accurately. Monitoring key financial indicators ensures agile responses to industry trends, enhancing operational efficiency and investment decisions. This approach underpins a robust financial plan for lithium ion battery facilities, driving sustainable growth and competitive advantage in a dynamic market.

P&L Statement Excel

The Profit and Loss Statement offers crucial insights into your lithium ion battery manufacturing business’s core revenue streams and key expenses. This financial statement enables stakeholders to assess profitability, cost structure, and loan repayment capacity. Leveraging financial modeling for lithium ion battery production, including revenue forecasts and cost analysis, enhances accuracy in projecting future profitability. Integrating this with budgeting and cash flow models provides a comprehensive financial plan for your facility, empowering strategic decision-making and optimizing financial performance in the competitive battery manufacturing landscape.

Pro Forma Balance Sheet Template Excel

The projected balance sheet for a lithium ion battery manufacturing startup outlines assets, liabilities, and net worth, divided into equity and borrowed funds. This financial statement reveals liquidity, solvency, and turnover ratios critical for assessing financial health. Complementing this, the pro forma profit and loss statement captures operational performance over time, driving financial forecasting. Integrating financial modeling, cost analysis, and cash flow projections, these tools form the backbone of a robust financial plan and investment model, ensuring informed budgeting and profitability analysis for lithium ion battery production.

LITHIUM ION BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our pre-revenue lithium ion battery manufacturing financial model features dynamic calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC represents the company’s cost of capital from both debt and equity, serving as a critical risk assessment metric for lenders during loan approvals. The DCF analysis accurately values future cash flows, providing essential insights for investment decisions and profitability analysis. This financial toolkit empowers stakeholders to evaluate the lithium ion battery production cost model and craft a robust financial plan for the facility’s long-term success.

Cap Table

The equity cap table is a vital element for any lithium ion battery manufacturing start-up, providing clear insights into share distribution and investor ownership. It details each stakeholder’s equity percentage, supporting accurate financial modeling and investment analysis. Integrating the pro forma cap table with your financial plan for lithium ion battery production enhances transparency, enables precise budgeting of manufacturing operations, and strengthens profitability analysis. This foundational tool is essential for informed decision-making and effective management of capital expenditures in battery plant financial forecasts.

LITHIUM ION BATTERY MANUFACTURING FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

A robust financial model ensures accurate cost analysis and boosts profitability in lithium ion battery manufacturing startups.

Anticipate and bridge cash gaps confidently using our advanced lithium ion battery manufacturing financial model template.

The financial model optimizes lithium ion battery manufacturing by accurately forecasting cash inflows and outflows for better decisions.

Identify potential shortfalls in lithium ion battery manufacturing financial models to proactively safeguard cash balances and ensure stability.

Leverage the lithium-ion battery financial model to accurately forecast startup costs and optimize budgeting for maximum profit.

LITHIUM ION BATTERY MANUFACTURING 5 YEAR PROJECTION TEMPLATE ADVANTAGES

Our financial model ensures accurate lithium-ion battery forecasts, satisfying banks and optimizing manufacturing profitability.

A robust financial model ensures accurate forecasting, satisfying bank requirements and boosting lithium ion battery manufacturing success.

Our financial model simplifies lithium ion battery manufacturing, empowering precise cost analysis and confident investment decisions.

Unlock precise, reliable insights effortlessly with our sophisticated lithium ion battery manufacturing financial model and expert support.

Our financial model accelerates investor confidence with precise cost analysis and accurate lithium ion battery manufacturing forecasts.

Secure investor meetings effortlessly with our Lithium Ion Battery Manufacturing Financial Model’s precise and compelling financial plan.

Our lithium ion battery financial model delivers precise key metrics analysis, empowering strategic and profitable manufacturing decisions.

Unlock precise 5-year lithium ion battery financial models with real-time GAAP/IFRS proformas, improving strategic decisions fast.

Our financial model ensures accurate projections, building stakeholder trust and securing lithium ion battery manufacturing success.

A detailed cash flow model builds stakeholder confidence, enabling clearer financial foresight and easier investment growth.