LNG Liquefied Natural Gas Shipping and Transportation Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

LNG Liquefied Natural Gas Shipping and Transportation Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

LNG Liquefied Natural Gas Shipping and Transportation Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year liquefied natural gas (LNG) shipping financial model offers a detailed cash flow proforma, core metrics, and a financial dashboard in GAAP/IFRS formats, designed for startup evaluation and funding acquisition. It features an integrated LNG shipping cost analysis and a transportation revenue forecast to optimize LNG maritime transport financial projections. The model supports financial modeling for LNG carrier operations, including capital expenditure planning, fuel consumption cost modeling, and vessel maintenance financial planning. Additionally, it incorporates LNG shipping contract revenue modeling and a shipping operations expense forecast, making it an essential tool for assessing profitability, cash flow, and financial risk in LNG import-export and transit time cost impact scenarios. Fully unlocked and editable, this template is ideal for securing funding from banks, angel investors, grants, and venture capital.

This ready-made Excel template addresses critical pain points for LNG shipping professionals by providing a comprehensive liquefied natural gas shipping profitability model that simplifies complex lng shipping cost analysis and transportation logistics cost modeling. It delivers print-ready reports such as a detailed LNG shipping project cash flow model, financial forecast of LNG vessel charter rates, and a complete set of financial ratios, enabling accurate lng maritime transport financial projections and precise evaluation of lng import export shipping financial analysis. By integrating features like lng vessel maintenance financial planning and lng shipping fuel consumption cost model, it facilitates efficient lng shipping operations expense forecasting and lng shipping capital expenditure model insights, ultimately supporting strategic lng shipping fleet expansion financial plans and robust lng shipping financial risk assessments without the need for building models from scratch.

Description

This comprehensive LNG shipping financial model offers a robust framework for liquefied natural gas transportation revenue forecast, integrating detailed projections such as profit and loss statements, balance sheets, and cash flow analyses over a five-year horizon. It encompasses critical components like LNG shipping project cash flow models, capital expenditure plans, and shipping operations expense forecasts, enabling precise financial modeling for LNG carrier operations and supply chain logistics cost modeling. The model further incorporates LNG maritime transport financial projections by factoring in vessel maintenance financial planning, LNG vessel charter rates, transit time cost impact models, and fuel consumption cost estimates, providing a thorough LNG shipping cost analysis and financial risk assessment. By facilitating LNG shipping contract revenue modeling and liquefied natural gas shipping profitability models, the tool supports strategic decision-making by forecasting revenue streams and operational expenses while accounting for demand analysis and fleet expansion financial plans essential for optimizing LNG import export shipping financial performance.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

You don’t need to be a financial expert to create a robust LNG shipping financial model for your start-up. Our comprehensive liquefied natural gas transportation financial projections template equips you with essential tools for accurate LNG shipping cost analysis, revenue forecasting, and cash flow modeling. Designed to support LNG vessel charter rate forecasts, shipping fleet expansion plans, and supply chain cost modeling, this user-friendly financial plan empowers you to optimize profitability and manage operational expenses with confidence.

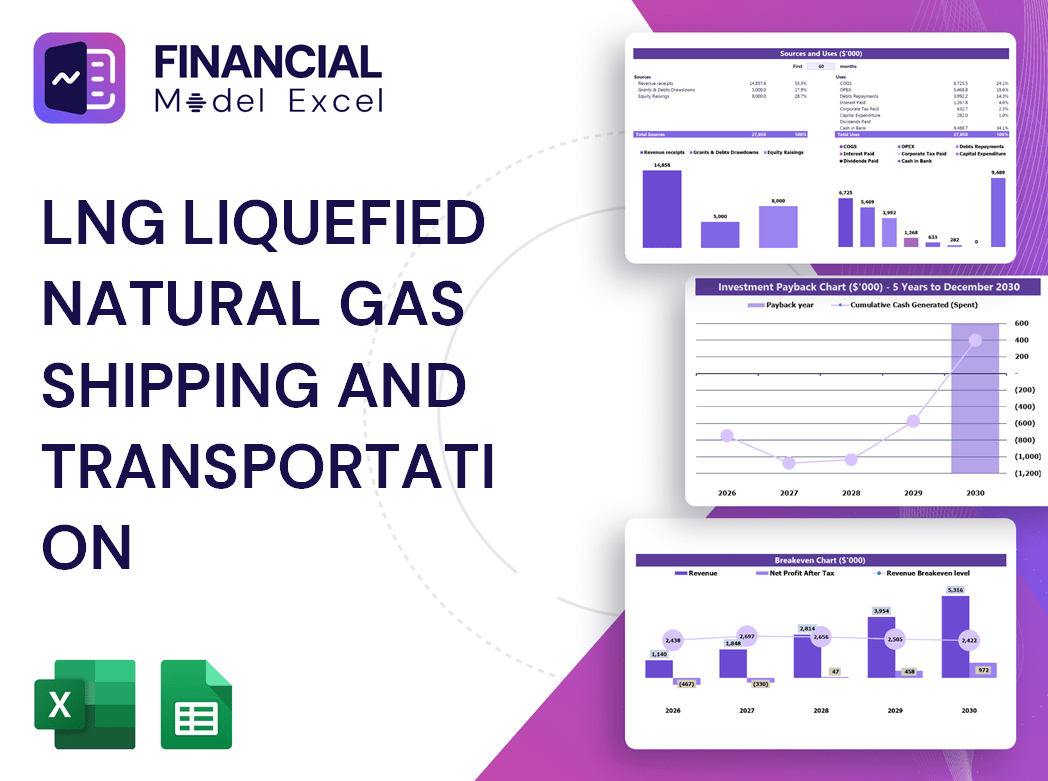

Dashboard

Our advanced financial dashboard, integrated within the LNG shipping cost analysis financial model, offers real-time tracking of key performance indicators (KPIs) critical for liquefied natural gas transportation revenue forecasting and cash flow management. This tool enhances financial planning by providing detailed insights into LNG shipping operations expense forecasts, vessel charter rates, and profitability models. Easily accessible and shareable, the dashboard empowers stakeholders with a clear overview of the LNG shipping fleet expansion financial plan and maritime transport financial projections, ensuring informed decisions to optimize costs and maximize revenues across the LNG supply chain.

Business Financial Statements

Our LNG shipping financial model automates all three annual business financial statements—simply update the Assumptions inputs. This comprehensive tool streamlines liquefied natural gas transportation revenue forecasts, shipping cost analysis, and cash flow projections, enabling precise financial planning for LNG carrier operations. Ideal for LNG shipping fleet expansion financial plans, contract revenue modeling, and capital expenditure assessments, it delivers accurate profitability and risk evaluations with ease. Input your data and let the model generate reliable, detailed financial forecasts tailored to your LNG shipping ventures.

Sources And Uses Statement

Our LNG shipping financial model includes a detailed sources and uses of funds statement, simplifying complex financial planning. This essential tool demonstrates to stakeholders—lenders and investors alike—the company’s funding needs and strategies, highlighting alternative financing options such as crowdfunding or reserve capital for unforeseen events. Balancing sources with planned uses of funds ensures transparency and confidence in the LNG shipping project cash flow model, supporting robust financial forecasting for vessel charter rates, fleet expansion, and shipping operations expense forecasts. This approach strengthens financial risk assessment and underpins reliable LNG maritime transport financial projections.

Break Even Point In Sales Dollars

Our LNG shipping financial model includes a comprehensive break-even analysis template in Excel, empowering companies to pinpoint the price thresholds necessary to cover operational costs. Leveraging this tool, businesses can enhance accuracy in LNG transportation revenue forecasts and optimize profitability. Whether modeling shipping fleet expansion financial plans or conducting detailed cost analysis for liquefied natural gas transport, this template supports data-driven decisions to maximize return on investment and strengthen financial risk assessments in LNG maritime transport operations.

Top Revenue

This LNG shipping financial model features a dedicated tab for comprehensive revenue forecast analysis. It meticulously segments liquefied natural gas transportation revenue streams by service and product, enabling precise financial projection and profitability assessment. Designed for clarity, it supports informed decision-making in LNG maritime transport operations, fleet expansion planning, and shipping contract revenue modeling. Ideal for stakeholders seeking in-depth LNG shipping revenue estimation and cost modeling to optimize the financial outlook of their carrier operations.

Business Top Expenses Spreadsheet

Effective LNG shipping cost analysis and financial modeling are critical to optimizing operations and maximizing profitability. By implementing a comprehensive LNG shipping project cash flow model that categorizes expenses—including startup, operational, and miscellaneous costs—companies can accurately forecast and control expenditures. Rigorous financial forecasting for LNG vessel charter rates and transportation logistics cost modeling ensures precise revenue estimation and expense management. This disciplined approach to cost control and financial risk assessment empowers LNG carriers to enhance profit margins and secure sustained growth in a competitive maritime transport market.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up expenses are essential for sustainable growth in LNG shipping. Our comprehensive LNG shipping cost analysis financial model offers detailed pro forma statements and templates, enabling precise tracking of start-up costs and balanced account management. Designed for LNG carrier operations, the five-year financial plan includes shipping project cash flow models and revenue forecasts, empowering you to effectively manage expenses and optimize profitability. Begin your LNG maritime transport journey with robust financial modeling tailored to vessel charter rates, maintenance, and transportation logistics cost modeling—ensuring your business scales efficiently and sustainably from day one.

CAPEX Spending

Capital expenditure (CAPEX) represents the substantial investments in assets like property, plants, and equipment critical to LNG shipping fleet expansion financial plans. In LNG shipping capital expenditure models, CAPEX forecasts are depreciated over asset lifespans, impacting cash flow and profit-loss projections. Accurate CAPEX planning is vital for LNG shipping project cash flow models and financial forecasting of vessel charter rates. Integrating CAPEX within pro forma balance sheets enhances financial risk assessment and supports optimized financial modeling for LNG carrier operations, ultimately driving stronger liquidity and profitability in liquefied natural gas transportation revenue forecasts.

Loan Financing Calculator

A comprehensive LNG shipping financial model integrates key elements like loan amortization schedules to provide stakeholders a clear view of periodic payments. This includes detailed data on loan amounts, interest rates, maturity terms, payment intervals, and amortization methods such as straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Incorporating these factors enhances accuracy in LNG vessel charter rate forecasts, shipping cost analyses, and overall financial risk assessments—essential for optimizing LNG maritime transport profitability and strategic fleet expansion planning.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In LNG shipping financial modeling, the payback period is a crucial metric that compares customer acquisition costs against generated profits. Calculated by dividing the acquisition cost by the customer’s profit contribution, this ratio provides vital insights for LNG shipping project cash flow models and revenue forecasts. Incorporating payback period analysis enhances LNG supply chain shipping cost models and supports informed decisions in fleet expansion financial plans, vessel charter rate forecasts, and overall LNG transportation logistics cost modeling. This metric underpins effective financial risk assessment and profitability modeling in liquefied natural gas maritime transport operations.

Cash Flow Forecast Excel

Our comprehensive cash flow Excel template empowers users to accurately forecast future liquidity, enabling precise assessment of loan requirements and capital expenditures. This tool is indispensable for startups seeking to optimize liquefied natural gas shipping operations through detailed financial modeling. By integrating LNG shipping cost analysis, revenue forecasting, and expense tracking, the model supports strategic planning and ensures robust financial risk assessment. Effective management of your LNG maritime transport finances starts with complete, precise, and dynamic cash flow projections—driving profitability and sustainable growth in the competitive LNG shipping market.

KPI Benchmarks

A comprehensive LNG shipping cost analysis leverages benchmarking within a robust financial model to evaluate key metrics like profit margins, unit costs, and operational expenses across industry leaders. By comparing these indicators, companies gain actionable insights to optimize their liquefied natural gas transportation revenue forecast and enhance LNG shipping fleet expansion financial plans. This strategic approach enables precise LNG shipping project cash flow modeling and financial risk assessment, empowering stakeholders to identify weaknesses, streamline operations, and drive profitable growth in LNG maritime transport and carrier operations. Benchmarking remains essential for informed, competitive decision-making in the dynamic LNG shipping sector.

P&L Statement Excel

For precise LNG shipping cost analysis and revenue forecasting, an Excel-based financial model is essential. This versatile tool supports monthly and long-term projections—up to five years—enabling accurate cash flow modeling and profit and loss analysis. It facilitates robust LNG shipping fleet expansion financial planning, vessel maintenance budgeting, and contract revenue modeling. By delivering insights into profit margins, balance sheets, and expense forecasts, this model empowers effective management of LNG maritime transport operations and supply chain logistics costs, ensuring informed, data-driven decision-making in the dynamic liquefied natural gas shipping industry.

Pro Forma Balance Sheet Template Excel

The 5-year projected balance sheet in Excel provides a snapshot of a company’s assets and liabilities, essential for LNG shipping financial risk assessment and capital expenditure modeling. Complementing this, the pro forma profit and loss (P&L) statement offers a dynamic view of operational performance, crucial for LNG shipping project cash flow modeling and revenue forecasting. Together, these financial models enable comprehensive analysis of liquidity, solvency, and profitability—key factors in optimizing LNG transportation logistics cost modeling and supporting strategic decisions in fleet expansion and vessel maintenance financial planning.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive LNG shipping financial model integrates advanced methodologies, including discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations, delivering precise liquidity natural gas transportation revenue forecasts. Designed for robust LNG shipping project cash flow modeling, it supports detailed financial analysis of vessel charter rates, operating expenses, and capital expenditures. This model empowers strategic decision-making through accurate LNG maritime transport financial projections, enabling stakeholders to optimize shipping fleet expansion plans and assess financial risks, ensuring profitable and sustainable LNG carrier operations.

Cap Table

The capitalization table details the company’s share capital, crucial for informed decisions on share value and market capitalization. Using our LNG shipping financial model, you can accurately assess the market value of liquefied natural gas transportation investments. Our comprehensive profit and loss projection includes detailed proformas, covering LNG shipping cost analysis, revenue forecasts, cash flow models, and financial risk assessments. Designed for precision, this full version supports thorough financial evaluation of your LNG shipping project. Invest confidently—access the complete LNG shipping financial plan today for robust LNG maritime transport financial projections.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Optimize repayment schedules effortlessly using the LNG shipping financial model for accurate cash flow and cost forecasting.

Optimize asset acquisition confidently using our comprehensive LNG shipping and transportation financial model with pro forma templates.

Optimize cash flow and anticipate gaps confidently with our comprehensive LNG shipping financial model and revenue template.

Optimize profits and minimize risks using our LNG shipping financial model for dynamic, scenario-based revenue forecasting.

Optimize LNG shipping profits and growth with our precise, dynamic financial modeling and revenue forecasting tools.

LNG LIQUEFIED NATURAL GAS SHIPPING AND TRANSPORTATION PRO FORMA FINANCIAL STATEMENTS TEMPLATE EXCEL ADVANTAGES

Optimize funding success with our LNG shipping financial model delivering accurate cost, revenue, and risk insights.

Impress investors confidently with our proven 5-year LNG shipping financial model delivering strategic revenue and cost insights.

Our LNG shipping financial model optimizes cost analysis and revenue forecasting for smarter, more profitable transport decisions.

Easily refine your LNG shipping financial model to optimize costs, forecast revenue, and enhance strategic decision-making continuously.

Our LNG shipping financial model proactively identifies cash shortfalls, ensuring seamless liquidity and strategic decision-making.

The LNG shipping financial model provides early warnings, optimizing cash flow and enhancing profitability with precise forecasts.

Our LNG shipping financial model optimizes costs and forecasts revenue, ensuring profitable, risk-free maritime operations.

Accurate LNG shipping cash flow models enable proactive decisions, ensuring financial health and sustainable fleet expansion.

The LNG shipping financial model optimizes cost analysis and revenue forecasting for strategic, data-driven decision making.

A clear, well-structured LNG shipping financial model enables swift, accurate scenario testing and informed decision-making.