Business To Customer Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Business To Customer Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Business To Customer Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUSINESS TO CUSTOMER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year business to customer financial model template is designed for startups and entrepreneurs seeking effective business to consumer financial planning and fundraising support. It incorporates essential financial KPIs for business to consumer companies, including customer acquisition cost analysis, profit margin analysis b2c model, and customer lifetime value calculation, ensuring robust financial projections for b2c business growth. The template features integrated business to customer revenue model components, b2c sales forecast model, break even analysis for b2c, and cash flow model for customer businesses, providing a clear overview of revenue streams in b2c financial model and b2c expense forecasting. With built-in financial scenario planning b2c and financial statements for b2c companies, this editable model empowers users to leverage startup financial models for b2c to get funded by banks, angels, grants, and VC funds confidently.

This ready-made business to customer financial model template effectively addresses key pain points such as simplifying complex financial projections for B2C business through integrated financial statements for B2C companies, enabling accurate b2c sales forecast model and customer acquisition cost analysis to optimize marketing spend, while offering comprehensive b2c expense forecasting and profit margin analysis B2C model to improve budgeting techniques. It supports break even analysis for B2C scenarios and financial KPIs for business to consumer tracking, facilitating financial scenario planning B2C and pricing strategy financial impact B2C evaluation that ensures sound business to consumer financial planning. By including customer lifetime value calculation and revenue streams in B2C financial model, it helps users understand long-term profitability and market size estimation, while the cash flow model for customer businesses ensures healthy liquidity management, making startup financial models for B2C more accessible and actionable.

Description

Our comprehensive business to customer financial model template integrates essential financial statements for B2C companies, enabling accurate financial projections for B2C business growth and profitability analysis. Featuring detailed customer acquisition cost analysis, customer lifetime value calculation, and pricing strategy financial impact assessments, this model supports effective business to consumer financial planning and budgeting techniques. Incorporating b2c sales forecast models, break-even analysis for B2C, and cash flow models for customer businesses, it facilitates robust financial scenario planning and the evaluation of revenue streams in B2C financial models. With built-in profit margin analysis and financial KPIs tailored for business to consumer markets, this tool is designed to optimize startup financial models for B2C enterprises by providing reliable financial forecasts and market size estimations crucial for informed decision-making.

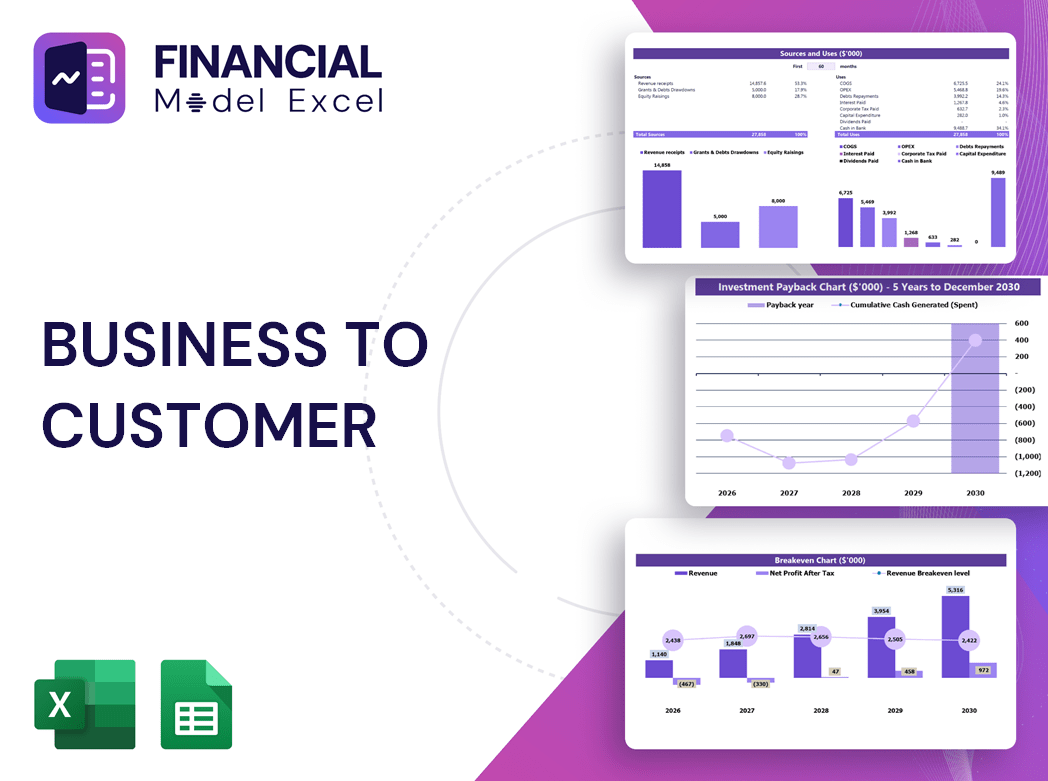

BUSINESS TO CUSTOMER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover a comprehensive and user-friendly business to customer financial model template designed for precise financial projections and strategic planning. This versatile B2C revenue model empowers you to perform detailed customer acquisition cost analysis, profit margin assessments, and break-even analysis with ease. Ideal for financial professionals, our expandable Excel tool supports in-depth financial statements preparation, cash flow modeling, and scenario planning—all tailored to your unique business needs. Elevate your business to consumer financial planning and gain clear insights into pricing strategy impacts, expense forecasting, and revenue streams, ensuring confident, data-driven decisions and sustainable growth.

Dashboard

The all-in-one dashboard in this 5-year financial projection seamlessly integrates essential business to customer financial planning metrics, including balance sheet data, forecasted income statements, and comprehensive cash flow models for customer businesses. It empowers users with clear visualizations—charts and graphs—that enhance financial scenario planning for B2C companies. Designed to support accurate customer acquisition cost analysis, profit margin analysis, and financial KPIs for business to consumer ventures, this tool is ideal for startups and established companies seeking robust b2c financial forecasting methods and insightful revenue streams in b2c financial models.

Business Financial Statements

A business to customer financial model template includes a projected income statement that highlights profitability and revenue streams in a specified period. This essential financial statement complements a pro forma balance sheet and cash flow model for customer businesses. The profit and loss forecast focuses on income, expenses, gains, and losses, providing clarity on financial performance without differentiating cash and non-cash transactions. Utilizing b2c financial forecasting methods and customer acquisition cost analysis, companies can optimize financial planning and enhance profit margin analysis, ensuring accurate financial projections for b2c business growth and sustainability.

Sources And Uses Statement

A well-crafted startup financial model for B2C businesses is essential for effective business to consumer financial planning. Utilizing a detailed sources and uses of cash table ensures precise cash flow management and supports robust financial projections for B2C businesses. This approach not only signals success to investors but also drives strategic growth by integrating customer acquisition cost analysis and pricing strategy financial impact. By leveraging b2c financial forecasting methods and revenue streams in B2C financial models, entrepreneurs gain valuable insights to confidently scale operations and boost profitability in competitive markets.

Break Even Point In Sales Dollars

The Break-Even Analysis tab in this business to consumer financial planning model provides clear insight into when your company will achieve profitability. Using a CVP chart, it highlights the precise point where total revenues surpass expenses, enabling effective profit margin analysis for B2C models. This essential financial KPI supports strategic decision-making by pinpointing your break-even milestone, ensuring accurate financial projections for your B2C business and enhancing your overall financial scenario planning.

Top Revenue

In B2C financial planning, understanding the top line and bottom line is crucial. The top line in your business to customer revenue model represents total sales or gross revenue, signaling growth when increasing. Bottom line growth, reflected in net income, indicates improved profitability after expenses. Utilizing financial KPIs for business to consumer, including profit margin analysis and customer acquisition cost analysis, ensures accurate financial projections for B2C businesses. Incorporating these metrics into your financial statements and b2c sales forecast model drives effective financial scenario planning and informed decision-making, ultimately enhancing your company's market position and long-term success.

Business Top Expenses Spreadsheet

The company's expenses are detailed within the pro forma income statement template Excel, categorized into four key segments, including an 'Other' category for additional data entry. Utilizing a startup financial model template for B2C businesses allows for comprehensive financial projections, offering historical insights up to five years. This approach enhances business to customer financial planning by integrating expense forecasting with profit margin analysis, supporting accurate b2c financial forecasting methods and effective budgeting techniques.

BUSINESS TO CUSTOMER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate startup cost estimation is crucial in any business to customer financial model template, forming the foundation of effective financial projections for B2C businesses. Our comprehensive financial plan integrates customer acquisition cost analysis and b2c expense forecasting to ensure robust budgeting techniques. Designed for precise financial scenario planning, the cost proforma facilitates expense management, helping you anticipate financial losses and optimize profit margin analysis in B2C models. Harness this tailored approach to strengthen your business to consumer financial planning and drive sustainable growth from day one.

CAPEX Spending

Capital expenditures (CAPEX) represent a company’s strategic investment in growth and operational excellence, often including new equipment or advanced management techniques. In business to consumer financial planning, CAPEX supports product line expansion and long-term performance improvement. These investments appear on financial statements for B2C companies as depreciated assets over time, impacting cash flow models and profit margin analysis. Accurate CAPEX forecasting is essential within B2C financial projections and business to customer revenue models to ensure robust startup financial models and effective financial scenario planning.

Loan Financing Calculator

Our comprehensive business to customer financial model template features an integrated loan amortization schedule, providing clear visibility into repayment timelines. This budget planning tool uses advanced algorithms to detail each installment’s breakdown—highlighting principal and interest amounts due monthly, quarterly, or annually. Designed to support accurate financial projections for B2C businesses, it enhances financial scenario planning and cash flow modeling, ensuring precise expense forecasting and effective profit margin analysis for sustainable growth.

BUSINESS TO CUSTOMER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth and net earnings expansion are key metrics within a business to customer financial model template. Tracking these through a forecasted income statement offers essential insights into your B2C business’s development. Utilizing financial projections for B2c business enables precise monitoring of sales and revenue trends, supporting effective financial planning and informed decision-making. This approach integrates seamlessly with customer acquisition cost analysis and profit margin analysis B2C model, empowering you to optimize growth and achieve sustainable profitability.

Cash Flow Forecast Excel

A business-to-customer financial model template includes a detailed cash flow model for customer businesses, illustrating changes in cash balance throughout the period. It highlights critical inflows and outflows, enabling precise financial forecasting for B2C business growth. Incorporating break-even analysis for B2C and profit margin analysis enhances business-to-consumer financial planning, while customer acquisition cost analysis and revenue streams in B2C financial models support strategic decisions. This approach ensures accurate financial projections for B2C businesses, empowering entrepreneurs with actionable insights for sustainable success.

KPI Benchmarks

Our business to customer financial model template includes a powerful benchmarking study tab for comparative analysis. It enables B2C companies to evaluate financial KPIs, analyze profit margins, and assess customer acquisition costs against industry peers. This insightful financial projections tool guides startups in refining their revenue streams and optimizing expense forecasting. By understanding these critical metrics, businesses can make informed decisions to enhance cash flow, improve break-even analysis, and drive sustainable growth. Effective benchmarking is essential for strategic financial planning and elevating your B2C business to the next level of success.

P&L Statement Excel

Utilize a comprehensive business to customer financial model template to accurately forecast revenue, expenses, and profit margins. While the profit and loss projection provides insights into depreciation and overall profitability impacting your yearly balance sheet, the pro forma cash flow model focuses exclusively on tracking cash movement within your B2C business. Combining these financial projections for B2C business enhances your ability to conduct break-even analysis, customer acquisition cost analysis, and informed financial planning, ensuring robust financial scenario planning and strategic growth decisions in your business to consumer revenue model.

Pro Forma Balance Sheet Template Excel

The Monthly and Yearly projected balance sheet template seamlessly integrates with cash flow models, profit and loss forecasts, and other crucial financial inputs. This comprehensive three-statement model offers a clear, bottom-up financial overview of your assets, liabilities, and equity accounts. Ideal for business to consumer financial planning, it supports accurate financial projections for B2C businesses, efficient expense forecasting, and insightful profit margin analysis. Empower your B2C revenue model and strengthen financial KPIs with this all-encompassing tool designed to optimize your financial scenario planning and forecasting methods.

BUSINESS TO CUSTOMER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive business-to-customer financial model template delivers precise financial projections for B2C startups, equipping you with critical insights for investor presentations. Featuring weighted average cost of capital (WACC) analysis, it clearly demonstrates the minimum required return on invested capital. The model includes free cash flow valuation to highlight cash available to both shareholders and creditors, while discounted cash flow analysis accurately assesses the present value of future earnings. Leverage this robust tool for effective financial planning, customer acquisition cost analysis, and profit margin insights to confidently drive your business-to-consumer growth strategy.

Cap Table

Our business to customer financial model template includes a detailed pro forma cap table that transparently summarizes investor information, ownership percentages, and capital contributions. This essential tool supports accurate financial projections for B2C businesses, enhancing financial planning and investor relations. By integrating customer acquisition cost analysis and revenue streams in B2C financial models, companies can optimize their pricing strategy’s financial impact and improve profit margin analysis. The cap table serves as a foundation for robust financial forecasting methods, enabling startups and established businesses to effectively track equity distribution and support strategic growth decisions.

BUSINESS TO CUSTOMER FINANCIAL MODEL TEMPLATE FOR STARTUP ADVANTAGES

Startup financial models for B2C pinpoint strengths and weaknesses, driving smarter business-to-consumer financial planning.

Streamline growth with our business to customer financial model, enhancing accurate forecasting and boosting profitable decision-making.

Unlock growth with our B2C financial model, delivering precise projections and insightful revenue forecasting for smart decisions.

Maximize profits and forecast growth accurately with our comprehensive business to customer financial model template.

The 5-year cash flow model enhances B2C financial planning by pinpointing strengths and revealing growth opportunities.

BUSINESS TO CUSTOMER FINANCIAL MODEL TEMPLATE ADVANTAGES

Our 5-year B2C financial model optimizes revenue streams and enhances accurate financial projections for strategic growth.

Optimize growth with our fully integrated 5-year B2C financial model featuring automatic monthly and annual summary aggregation.

Optimize funding success with our business to customer financial model template, delivering precise projections and strategic insights.

Impress investors with a proven business to customer financial model that drives accurate forecasting and maximizes profitability.

Our B2C financial model proves your ability to repay loans through accurate revenue and cash flow forecasting.

Using a cash flow model for customer businesses boosts lender confidence by clearly demonstrating your repayment plan.

Our B2C financial model streamlines accurate revenue and profit forecasting, empowering smarter business-to-customer decisions.

The 3 Way Financial Model streamlines B2C planning with ready features—no formulas, formatting, coding, or costly consultants needed!

This business to customer financial model template saves you time by streamlining accurate B2C financial projections efficiently.

The business to customer financial model template streamlines forecasting, boosting focus on growth, sales, and customer engagement.