Machine Learning For Financial Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Machine Learning For Financial Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Machine Learning For Financial Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MACHINE LEARNING FOR FINANCIAL SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year financial model template in Excel is designed specifically for machine learning for financial services applications, incorporating advanced financial model development techniques such as predictive modeling in finance and financial data analytics with machine learning. It features prebuilt consolidated pro forma profit and loss, balance sheet, and cash flow projections, along with key financial charts, summaries, metrics, and funding forecasts tailored for AI-driven investment strategies and automated financial forecasting. Ideal for evaluating startup ideas, this template supports financial risk modeling with AI, credit scoring models using machine learning, and portfolio optimization using AI, providing a comprehensive foundation for quantitative finance and machine learning projects. Fully unlocked and editable, it empowers users to customize their financial statement analysis models and leverage big data in financial modeling to enhance decision-making in machine learning financial market analysis.

This ready-made financial model template addresses common pain points such as the complexity and time-consuming nature of financial model development techniques by integrating advanced machine learning algorithms for finance, enabling automated financial forecasting and predictive modeling in finance with ease. It supports financial risk modeling with AI and credit scoring models using machine learning, reducing manual errors and enhancing accuracy, while also facilitating fraud detection in financial services through financial data analytics with machine learning. Designed for flexibility, it allows users to perform portfolio optimization using AI, implement neural networks for financial modeling, and leverage big data in financial modeling, thus providing a scalable and customizable solution ideal for algorithmic trading models, financial time series prediction, and quantitative finance and machine learning projects.

Description

This advanced financial model leverages machine learning algorithms for finance to deliver precise financial projections and facilitate robust financial model development techniques tailored for startups and established businesses. Incorporating predictive modeling in finance and automated financial forecasting, it enables detailed revenue and expense forecasting over a 60-month horizon alongside generating comprehensive financial statements, including profit & loss forecasts, cash flow analysis, and projected balance sheets. Enhanced by financial data analytics with machine learning and big data in financial modeling, the tool supports financial risk modeling with AI, credit scoring models using machine learning, and financial time series prediction, offering dynamic dashboards and feasibility matrices that empower businesses to optimize portfolio management, analyze financial statements, and implement AI-driven investment strategies with clarity and ease.

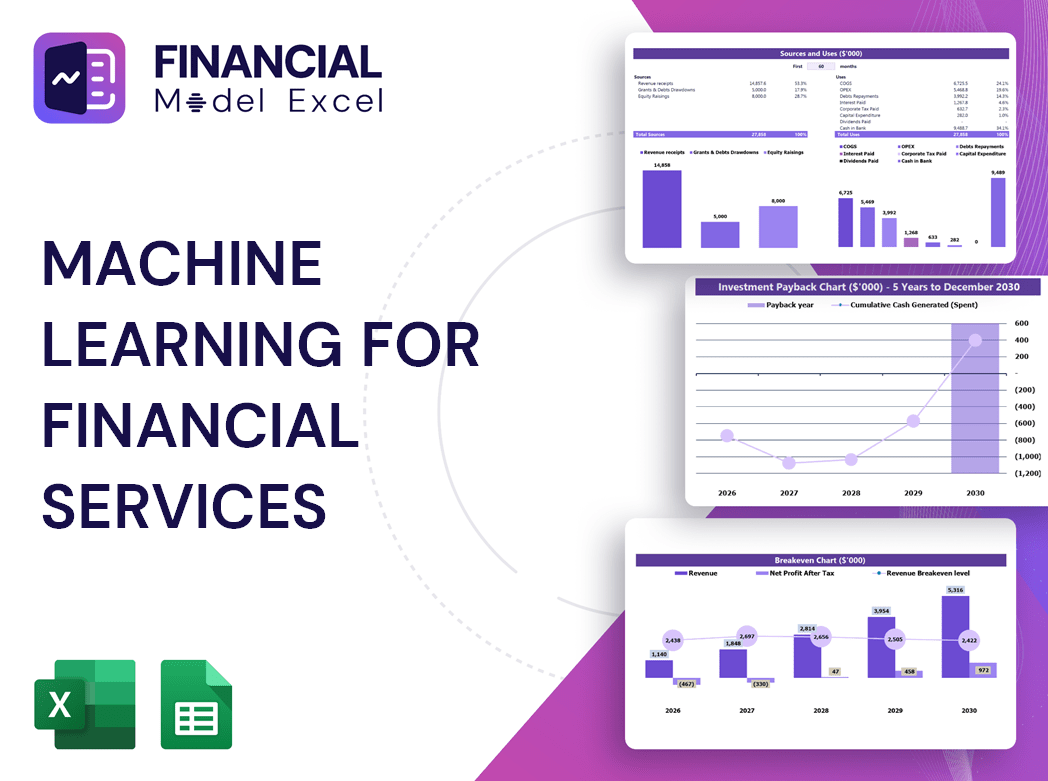

MACHINE LEARNING FOR FINANCIAL SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our fully customizable 5-year financial forecasting template, designed for seamless integration with your business needs. Leveraging advanced financial model development techniques and big data in financial modeling, this Excel-based tool empowers you to perform automated financial forecasting and financial statement analysis with ease. Tailor every aspect to fit your unique requirements, whether for portfolio optimization using AI or credit scoring models using machine learning. With minimal Excel knowledge, transform your financial planning through predictive modeling in finance and machine learning financial market analysis for smarter, data-driven decisions.

Dashboard

Access an intuitive dashboard that offers a comprehensive overview of your company’s financial model, powered by advanced machine learning algorithms for finance. Enhance collaboration by effortlessly sharing predictive modeling insights, financial risk assessments, and automated financial forecasting with stakeholders. Leverage cutting-edge financial data analytics with machine learning to drive informed decisions, optimize portfolios using AI, and implement robust credit scoring models. Streamline financial model development techniques and unlock the full potential of AI-driven investment strategies—all within a user-friendly platform designed for today’s dynamic financial services landscape.

Business Financial Statements

Understanding a company’s financial health requires thorough analysis of its three core statements. The P&L statement offers critical insights into earnings-generating operations, while the pro forma balance sheet and cash flow forecast emphasize asset management and capital structure. Leveraging financial data analytics with machine learning enhances this analysis, enabling more accurate financial model development techniques, predictive modeling in finance, and automated financial forecasting. Integrating AI-driven tools transforms traditional financial statement analysis models, empowering stakeholders with deeper, real-time insights for strategic decision-making and optimized portfolio management.

Sources And Uses Statement

The five-year financial projection template’s Sources and Uses statement clearly outlines capital inflows and their corresponding expenditure. Designed for accuracy and balance, it ensures each source precisely matches its use. This essential tool supports financial model development techniques and financial data analytics with machine learning, facilitating strategic decisions in refinancing, restructuring, recapitalization, and M&A. Incorporating predictive modeling in finance, it enhances transparency and confidence for internal teams and external stakeholders.

Break Even Point In Sales Dollars

This business plan forecast template integrates advanced financial modeling techniques, featuring a comprehensive five-year break-even analysis. It delivers both numeric calculations and dynamic visual charts, supporting predictive modeling in finance and financial data analytics with machine learning. Designed to enhance automated financial forecasting and portfolio optimization using AI, this tool empowers strategic decision-making. Ideal for leveraging machine learning algorithms for finance, it provides crucial insights for financial risk modeling with AI, credit scoring models, and algorithmic trading models—driving accuracy and clarity in your financial planning process.

Top Revenue

Topline (revenue) and bottom line (profit or EBITDA) are critical metrics in financial modeling. Investors and analysts closely analyze these figures using advanced financial model development techniques and predictive modeling in finance to gauge a company’s health. Monitoring topline growth—an increase in gross sales—signals positive momentum, enhancing overall financial performance. Integrating machine learning financial market analysis and financial data analytics with machine learning can further refine revenue forecasts, enabling AI-driven investment strategies and optimized portfolio management for stakeholders seeking data-driven insights.

Business Top Expenses Spreadsheet

Leveraging machine learning for financial data analytics, the Top Expenses tab within the three-statement model template offers a clear breakdown of annual expenses. By categorizing costs—such as customer acquisition and fixed costs—businesses gain actionable insights into their expense drivers. This AI-driven financial model development technique empowers firms to optimize spending, enhance predictive modeling in finance, and refine financial risk modeling with AI for more strategic decision-making.

MACHINE LEARNING FOR FINANCIAL SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Leveraging machine learning for financial services applications, a three-statement financial model template streamlines cost projections and enhances financial foundation insights. By automating data compilation, it accelerates predictive modeling in finance and improves forecasting accuracy. Maintaining organized budgets through automated financial forecasting ensures comprehensive expense tracking, minimizing financial risks. Additionally, this approach supports professional communication with investors and lenders, showcasing robust financial risk modeling with AI. Integrating machine learning algorithms for finance empowers startups to optimize resource allocation and confidently navigate their financial landscape.

CAPEX Spending

The CAPEX investment tool integrates advanced financial model development techniques to accurately capture capital expenditure, credit costs, and startup expenses. Leveraging predictive modeling in finance, it transforms expenditures into strategic investments that drive business growth. Coupled with automated financial forecasting and financial statement analysis models, this approach enhances capital expenditure forecasting precision. Utilizing machine learning algorithms for finance ensures dynamic insights, making the 3-statement model Excel an essential resource for robust CapEx planning and financial risk modeling with AI.

Loan Financing Calculator

Loan amortization in financial modeling mirrors the systematic repayment of debt over multiple reporting periods, utilizing predictive modeling in finance to schedule fixed payments. Typically executed monthly, these payments can also occur quarterly or annually, optimized through machine learning algorithms for finance to enhance accuracy. Integrating financial data analytics with machine learning and financial risk modeling with AI ensures precise forecasting and robust financial plan development techniques, empowering businesses to manage liabilities efficiently while supporting algorithmic trading models and portfolio optimization using AI.

MACHINE LEARNING FOR FINANCIAL SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) remains a key metric for evaluating a company's core operating performance. Integrating machine learning for financial services applications enhances financial model development techniques by improving accuracy in financial statement analysis models and automated financial forecasting. Leveraging predictive modeling in finance and advanced machine learning algorithms for finance allows deeper insights into EBITDA trends, strengthening financial risk modeling with AI and portfolio optimization using AI. This fusion of quantitative finance and machine learning empowers more data-driven decisions, optimizing operational efficiency and investment strategies.

Cash Flow Forecast Excel

Leveraging machine learning for financial services applications, our cash flow forecasting models integrate advanced financial risk modeling with AI to deliver precise, automated financial forecasting. By incorporating predictive modeling in finance and financial data analytics with machine learning, we provide clear insights into costs and profits, enabling accurate calculations and optimized fund allocation. This approach not only simplifies bookkeeping but also enhances portfolio optimization using AI, creating a strong foundation for your startup’s financial growth and strategic decision-making.

KPI Benchmarks

The financial benchmarking tool leverages advanced financial data analytics with machine learning to deliver competitive insights. By comparing your company’s loss metrics against industry peers, it enhances financial model development techniques and predictive modeling in finance. This analysis provides actionable intelligence on key financial and operational metrics, empowering start-ups to optimize performance. Integrating AI-driven financial risk modeling and automated financial forecasting, the toolkit helps identify growth opportunities and refine strategic focus, ensuring your business consistently advances toward greater financial success in today’s dynamic market.

P&L Statement Excel

The Income Statement, or Profit and Loss forecast, reveals the flow of revenue and expenses within machine learning for financial services applications. Utilizing financial model development techniques, this statement tracks profitability from top-line revenue to bottom-line net income. Through automated financial forecasting and financial data analytics with machine learning, stakeholders gain clear insights into expense structures and profit potential. Leveraging AI-driven predictive modeling in finance, the profit and loss template empowers users to project future financial performance accurately, enhancing decision-making for sustainable growth in complex financial environments.

Pro Forma Balance Sheet Template Excel

Our comprehensive pro forma template integrates monthly and yearly balance sheets for five years, seamlessly linked with cash flow analysis, profit and loss statements, and key financial inputs. Leveraging financial model development techniques and machine learning financial market analysis, this solution offers a holistic view of your assets, liabilities, and equity accounts. Empower your financial decision-making with advanced predictive modeling in finance and AI-driven insights for accurate forecasting and portfolio optimization using AI.

MACHINE LEARNING FOR FINANCIAL SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This pre-revenue valuation spreadsheet integrates advanced machine learning for financial services, enabling precise calculation of Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). Leveraging financial model development techniques, WACC assesses capital costs by balancing equity and debt—a crucial metric for banks’ credit risk assessment. Meanwhile, DCF uses predictive modeling in finance to evaluate the present value of future cash flows, empowering investors to make informed decisions. This AI-driven approach enhances financial risk modeling and automated financial forecasting for startups, creditors, and investors seeking data-driven insights.

Cap Table

A cap table is a fundamental tool for startups, detailing securities and investor share distribution. Integrating machine learning algorithms for finance enhances accuracy by factoring in time dynamics and complex variables. Leveraging advanced financial model development techniques, startups can optimize equity management and anticipate dilution impacts. Combining financial data analytics with machine learning ensures precise, real-time updates, enabling smarter decision-making. This approach aligns with predictive modeling in finance and portfolio optimization using AI, empowering companies to maintain transparency and strategic control as they grow.

MACHINE LEARNING FOR FINANCIAL SERVICES STARTUP PRO FORMA TEMPLATE ADVANTAGES

The 3-way financial model empowers precise forecasting, revealing future plan impacts and optimizing decision-making outcomes.

Machine learning for financial services enhances cash flow models by improving accuracy and enabling proactive financial decision-making.

Enhance accuracy and profitability with machine learning financial models for advanced forecasting and risk assessment.

Machine learning for financial services provides precise, real-time insights into cash flow, enhancing financial model accuracy and decision-making.

Reassess assumptions swiftly using machine learning for financial services, enhancing accuracy and confidence in financial model outcomes.

MACHINE LEARNING FOR FINANCIAL SERVICES PROJECTED CASH FLOW STATEMENT TEMPLATE EXCEL ADVANTAGES

AI-driven financial models simplify complex data, enabling accurate, efficient, and predictive decision-making in finance.

Our AI-driven financial model delivers fast, reliable insights with minimal planning and basic Excel skills required.

Achieve precise, scalable financial forecasts with AI-driven predictive modeling, transforming data into confident investment decisions.

This robust machine learning financial model accelerates precise forecasting, enhancing financial strategies and risk assessment efficiency.

AI-driven financial models deliver precise predictions, enhancing risk management and maximizing investment returns efficiently.

Leverage proven machine learning financial models for accurate 5-year forecasts with no hidden fees or recurring costs.

AI-driven financial models enable precise forecasting, empowering strategic planning for sustainable future growth.

AI-driven financial forecasting enhances cash flow projections, empowering precise growth planning and strategic decision-making effortlessly.

AI-driven financial modeling accelerates accuracy, saving time and money while optimizing investment and risk decisions effectively.

Machine learning financial models simplify planning with no coding, formulas, or costly consultants, accelerating your business growth.