Medical Equipment Leasing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Medical Equipment Leasing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Medical Equipment Leasing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MEDICAL EQUIPMENT LEASING FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year medical equipment leasing financial projection model is essential for any business, regardless of size or stage, aiming to streamline its healthcare equipment leasing financial plan. Designed for users with minimal financial planning experience and basic Excel skills, this comprehensive medical device leasing cash flow model enables quick, reliable results. Utilize this fully unlocked medical equipment leasing business model and medical equipment leasing financial statement template to secure funding from banks, angels, grants, and VC funds, while accurately forecasting costs and revenues through integrated medical equipment leasing cost forecasting and rental income projection tools.

This ready-made medical equipment leasing financial projection model addresses critical pain points by offering a comprehensive, fully integrated solution that streamlines the creation of income statements, cash flow budgets, and five-year forecasting within a single Excel template. It eliminates the complexity of managing multiple documents by automatically aggregating annual financial summaries into an intuitive All In One Dashboard, enhancing decision-making for healthcare providers and lessors. The model incorporates specialized tools such as lease amortization schedules, cost forecasting, and depreciation tracking, ensuring accurate reflection of operational and capital expenditures. Additionally, it supports financial analysis through built-in revenue models, lease payment calculators, and profit and loss statements, enabling users to perform investment analysis and valuation effortlessly. By providing clear, customizable templates for hospital equipment leasing budgets and finance options, this financial model mitigates the typical challenges associated with medical equipment rental income projection and lease financing management, saving time while enhancing financial accuracy and strategic planning.

Description

Our medical equipment leasing financial projection model offers a comprehensive healthcare equipment leasing financial plan that includes detailed medical device leasing cash flow models and hospital equipment leasing budget templates, enabling precise medical equipment rental financial analysis and cost forecasting. Designed to streamline financial management, this model incorporates healthcare equipment lease amortization schedules, medical equipment leasing revenue models, and medical equipment lease payment calculators to facilitate informed decision-making. The integrated medical equipment financing and leasing model supports thorough medical equipment leasing investment analysis, valuation models, and financing options, while the inclusion of medical equipment leasing financial statement templates, rental income projections, capital expenditure models, operational cost models, and depreciation schedules ensures robust tracking of profit and loss statements, helping startups and established businesses optimize leasing operations and attract potential investors with reliable, data-driven financial forecasts.

MEDICAL EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This comprehensive medical equipment leasing financial projection model empowers business owners and managers with detailed financial assumptions on expenses and revenues. By integrating these insights, it delivers a clear, complete picture of your healthcare equipment leasing business’s financial health, enabling accurate revenue forecasting, cost management, and investment analysis. Utilize this powerful tool for effective budgeting, cash flow modeling, and strategic planning to maximize profitability and growth.

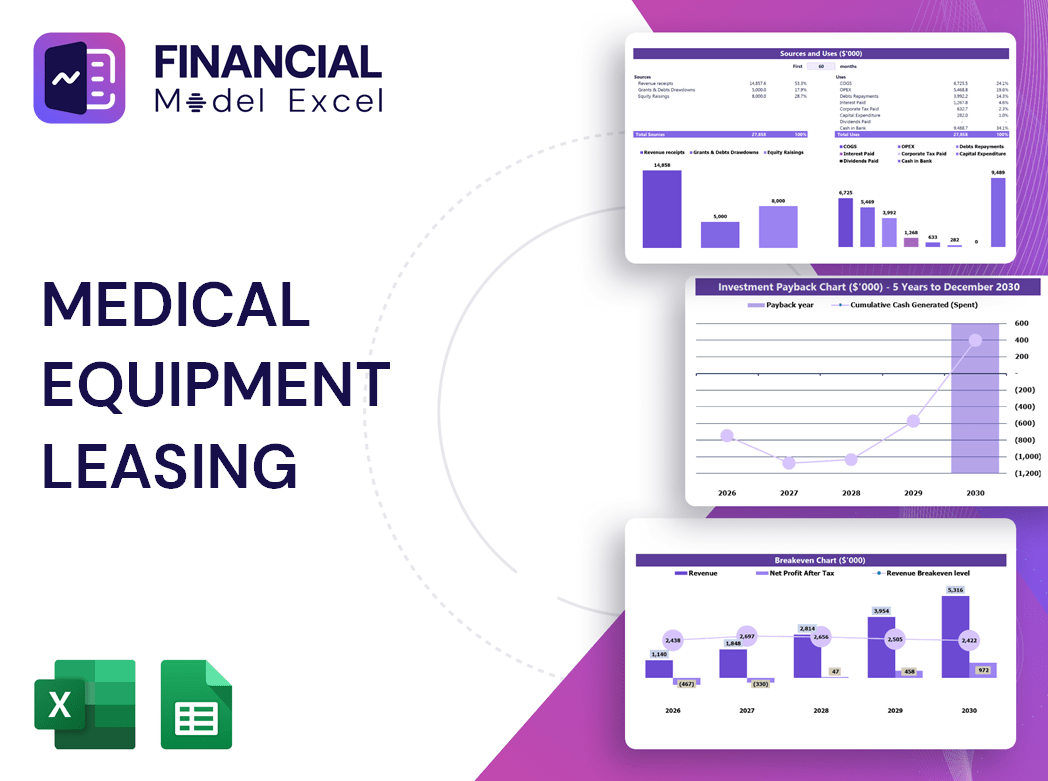

Dashboard

The medical equipment leasing financial projection model features an intuitive dashboard presenting key financial statements at any point—from startup to growth phases. It visually displays critical metrics such as cash flow forecasts, profit and loss projections, and annual revenue breakdowns through dynamic charts and graphs. This comprehensive healthcare equipment leasing financial plan empowers stakeholders with clear insights for effective decision-making and strategic planning.

Business Financial Statements

When developing a medical equipment leasing financial projection model, ensure it includes all critical components for a comprehensive 5-year outlook. An intuitive healthcare equipment leasing financial plan, incorporating elements like lease payment calculations, cost forecasting, and revenue modeling, enhances clarity and usability. Utilizing a well-structured hospital equipment leasing budget template or medical equipment lease profit and loss statement makes your financials more accessible, especially when presented to stakeholders. Prioritizing simplicity without sacrificing detail is key to creating a compelling medical device leasing cash flow model that effectively supports investment analysis and strategic decision-making.

Sources And Uses Statement

The sources and uses of capital statement within this medical equipment leasing financial projection model meticulously outlines all funding origins and expenditure allocations. This essential component provides a clear view of the company’s capital inflows and outflows, supporting informed decision-making and precise cost forecasting. Ideal for startups, it integrates seamlessly with medical equipment leasing business models, ensuring transparency in investment analysis, cash flow management, and budgeting. Harness this financial plan to optimize capital structure and enhance profitability in your healthcare equipment leasing venture.

Break Even Point In Sales Dollars

A break-even analysis in medical equipment leasing requires a clear distinction between sales, revenue, and profit within your financial projection model. Revenue captures total income from leasing healthcare equipment, while profit accounts for all fixed and variable costs subtracted from that revenue. Utilizing a comprehensive medical equipment leasing financial plan ensures accurate cost forecasting and cash flow modeling, empowering stakeholders to make informed decisions and optimize profitability in the medical device leasing business model.

Top Revenue

Accurate revenue modeling is essential for any medical equipment leasing business. Our healthcare equipment leasing financial plan and medical equipment leasing revenue model incorporate detailed assumptions, including historical growth rates, to deliver precise revenue projections. Whether you’re using a medical device leasing cash flow model or a hospital equipment leasing budget template, our financial forecast tools ensure comprehensive analysis. Designed for financial analysts, these templates enable robust forecasting of multiple revenue streams, supporting strategic decision-making. Elevate your medical equipment rental financial analysis with our proforma business plan templates and confidently plan for sustainable growth.

Business Top Expenses Spreadsheet

The Profit & Loss Projection Top Expenses page offers a comprehensive overview of your company’s annual expenditures, categorized into four key groups. This medical equipment leasing financial projection model delivers a detailed cost analysis, including customer acquisition and fixed costs. By leveraging this healthcare equipment leasing financial plan, you gain crucial insights into your expense structure, enabling precise cost forecasting and effective financial management. Stay in control of your cash flow and optimize your medical equipment leasing business model for sustainable growth.

MEDICAL EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our medical equipment leasing financial projection model offers a streamlined approach to forecast costs and revenues over five years. This comprehensive healthcare equipment leasing financial plan enables users to track expenses, analyze cash flow, and manage capital expenditures effectively. Utilizing this medical device leasing cash flow model and budget template helps maintain financial control, reducing risk and supporting sustainable growth. With detailed lease amortization schedules and profit and loss statements, you gain clear insights into your company’s financial health, empowering smarter decisions in medical equipment rental and leasing operations.

CAPEX Spending

Capital expenditure (CapEx) is a crucial metric within any medical equipment leasing financial projection model. It represents funds allocated to acquire, upgrade, and maintain physical assets like property, plants, and equipment (PPE). An effective healthcare equipment leasing financial plan incorporates CapEx budgeting not only to manage asset investments but also to account for depreciation through the medical equipment leasing depreciation schedule. Accurate CapEx forecasting is essential in medical equipment financing and leasing models, ensuring sustained operational efficiency and long-term asset value within hospital equipment leasing budgets and cash flow forecasts.

Loan Financing Calculator

Our medical equipment leasing financial projection model features a comprehensive loan amortization schedule tailored for diverse loan types. This healthcare equipment lease amortization schedule meticulously tracks principal amounts, interest types and rates, loan durations, and repayment timelines. Designed to integrate seamlessly within your medical equipment leasing financial plan, it ensures precise forecasting, cash flow management, and cost control—empowering your startup with clarity and confidence in every financial decision.

MEDICAL EQUIPMENT LEASING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The return on equity (ROE) is a key financial metric calculated using data from the 5-year projected balance sheet and income statement within your medical equipment leasing financial projection model. This metric evaluates the efficiency of equity utilization by measuring the relationship between net earnings and shareholder equity, revealing how effectively invested capital generates profits. Integrating ROE analysis into your medical equipment leasing financial plan or healthcare equipment lease amortization schedule empowers informed decision-making and strategic investment to optimize returns in the competitive medical device leasing market.

Cash Flow Forecast Excel

The medical equipment leasing cash flow model in Excel vividly captures your company’s cash balance fluctuations over a specified period. This dynamic financial tool highlights all critical cash inflows and outflows, empowering healthcare providers to optimize their equipment leasing financial plan. By leveraging this model, hospitals and medical device firms can enhance budgeting accuracy, streamline cost forecasting, and improve investment analysis, ensuring robust financial health and strategic growth in the competitive medical equipment leasing business.

KPI Benchmarks

The medical equipment leasing financial projection model provides crucial benchmarks by analyzing key performance indicators, highlighting averages, and offering comparative insights. This detailed financial analysis—incorporating medical equipment leasing cost forecasting and cash flow models—enables startups and established companies to optimize healthcare equipment leasing financial plans. By accurately tracking metrics through templates like the medical equipment leasing financial statement and budget templates, businesses can strategically manage operations, improve profitability, and make informed decisions. Effective financial control and forecasting within the medical equipment leasing business model empower confident planning and sustainable growth in a competitive market.

P&L Statement Excel

The medical equipment leasing financial projection model offers a comprehensive profit and loss statement template to evaluate revenue, expenses, and profitability over a 5-year period. This detailed financial plan includes monthly and annual income statements, operational cost models, and key metrics like margins, net profit, and cost of services. With integrated graphs, assumptions, and ratios, it provides clear insights into your medical equipment leasing business model’s financial health and income potential, supporting strategic decisions with accurate leasing revenue models and cost forecasting tools.

Pro Forma Balance Sheet Template Excel

Forecasting a startup’s pro forma balance sheet is vital within any medical equipment leasing financial projection model. Integrated with forecasted income statements and cash flow templates, it ensures seamless financial planning. Though less prominent than income statements, balance sheet projections critically support accurate cash flow forecasts, essential for healthcare equipment leasing financial plans. They enable investors to assess the realism of net income forecasts by evaluating profitability ratios like return on equity and invested capital. This comprehensive approach strengthens investment analysis and confidence in the medical equipment leasing business model’s financial viability.

MEDICAL EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This medical equipment leasing financial projection model delivers a comprehensive valuation analysis using Discounted Cash Flow (DCF) methodology. Designed for healthcare equipment leasing financial plans, it calculates key metrics including residual value, replacement costs, and market comparables. The template seamlessly integrates medical equipment leasing revenue models and cost forecasting, empowering users to evaluate investment opportunities with precision. Ideal for preparing medical equipment lease profit and loss statements and capital expenditure models, this tool supports strategic decision-making for sustainable growth in the medical device leasing sector.

Cap Table

Our medical equipment leasing financial projection model integrates a detailed cap table that tracks four financing rounds, clearly illustrating how new investments influence ownership and returns. After each round, the model updates the ownership structure and quantifies dilution effects, providing precise insight into stakeholder positions. This transparent approach supports strategic decision-making in medical equipment leasing business models, ensuring accurate financial analysis and optimized investment outcomes.

MEDICAL EQUIPMENT LEASING PROFIT LOSS PROJECTION ADVANTAGES

The medical equipment leasing financial projection model proactively identifies cash flow gaps, ensuring seamless healthcare operations.

The medical equipment leasing financial model offers precise cost forecasting, enhancing your strategic financial planning and profitability.

Schedule startup loan repayments effortlessly using the medical equipment leasing financial model for accurate financial forecasting.

Establish clear milestones and optimize growth with our free, comprehensive medical equipment leasing financial model template.

The medical equipment leasing financial projection model optimizes budgeting accuracy, driving smarter investment and revenue growth decisions.

MEDICAL EQUIPMENT LEASING FINANCIAL FORECASTING MODEL ADVANTAGES

Optimize expenses and ensure budget compliance with our precise medical equipment leasing financial projection model.

Our medical equipment leasing cash flow model empowers precise forecasting and strategic budgeting for sustainable financial growth.

Our medical equipment leasing financial projection model ensures accurate forecasts, satisfying external stakeholders like banks effortlessly.

The medical equipment leasing financial model ensures precise planning, boosting lender confidence and securing essential bank loans.

Gain confidence in the future with our medical equipment leasing financial projection model for accurate, strategic planning.

Our medical equipment leasing financial model ensures precise cash flow forecasting and strategic planning for sustained growth.

Optimize medical equipment leasing profitability and plan for future growth with our comprehensive financial projection model.

The medical equipment leasing financial projection model empowers precise growth planning and strategic decision-making with effortless accuracy.

Streamline medical equipment leasing with an all-in-one dashboard for clear, intuitive financial projections and cost forecasting.

Easily access all essential medical equipment leasing financial data in one intuitive, comprehensive 5-year projection dashboard.