Membership Based Coworking Space Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Membership Based Coworking Space Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Membership Based Coworking Space Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year pro forma projection offers a comprehensive financial planning tool tailored for membership-based coworking space startups, integrating detailed revenue projections, membership growth rate analysis, and subscription-based coworking financial plans. Designed to impress investors and facilitate capital raising, it incorporates cash flow forecasts, break-even analysis, and operating expense breakdowns within the coworking membership model. The financial model also includes income and profit and loss statements, alongside shared office space financial analysis, to accurately evaluate variable and fixed costs, customer acquisition costs, and membership retention rates. By leveraging key financial KPIs and occupancy rate projections, this robust financial forecasting framework enables early-stage coworking businesses to optimize membership pricing strategies and revenue streams, supporting informed investment analysis and successful business valuation before selling.

This ready-made financial model template addresses key pain points faced by coworking space operators by providing a comprehensive financial planning tool tailored for membership-based coworking spaces. It streamlines the complexities of building accurate revenue projections through customizable membership growth rate assumptions and flexible coworking space membership pricing strategies, enabling precise cash flow forecasts and detailed profit and loss statements. The model incorporates both variable and fixed operating expenses, facilitating thorough operating expense management and break-even analysis, while delivering clear insights into critical financial KPIs such as customer acquisition cost, membership retention rate, and occupancy rate projections. By integrating shared office space financial analysis with investment analysis and subscription-based coworking financial planning, this Excel template empowers users to generate robust income statements, perform financial forecasting for coworking businesses, and monitor membership revenue streams effectively, ultimately reducing the time and expertise needed to perform comprehensive financial planning for flexible workspace ventures.

Description

Our membership based coworking space financial model offers comprehensive revenue projections and integrates a detailed cash flow forecast coworking space structure, enabling precise financial planning for flexible workspace ventures. The model incorporates a break-even analysis coworking space framework along with a profit and loss statement coworking space template, providing a robust subscription based coworking financial plan tailored for both startups and established businesses. Users can evaluate key financial KPIs coworking membership business, including membership growth rate coworking model, membership retention rate coworking model, and customer acquisition cost coworking space, supported by a thorough shared office space financial analysis that addresses variable and fixed costs coworking financial model. This tool also features operating expenses coworking membership model breakdowns, income statement coworking space business projections, and co-working space occupancy rate projections, all designed to facilitate investment analysis coworking space startup and optimize membership revenue streams coworking space for sustainable profitability.

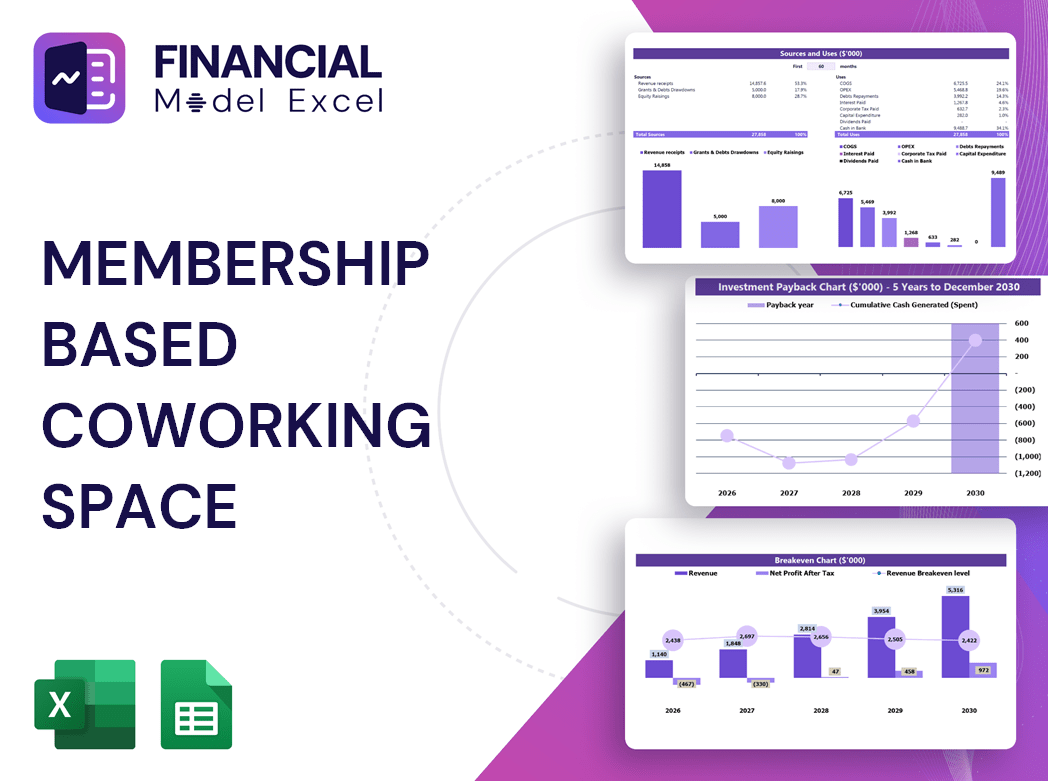

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Investors demand comprehensive financial planning for membership-based coworking spaces. Our 3-way financial model template offers detailed revenue projections, break-even analysis, and cash flow forecasts to validate startup capital needs and ROI. Featuring a robust coworking space membership pricing strategy, operating expense breakdowns, and financial KPIs, this business plan template ensures precise financial forecasting. Optimize your subscription-based coworking financial plan with insights into membership growth rates, retention rates, and customer acquisition costs. Leverage our model to present a compelling profit and loss statement and investment analysis, securing investor confidence and driving your flexible workspace business to success.

Dashboard

Our membership-based coworking space financial model offers a comprehensive dashboard that consolidates income statements, cash flow forecasts, and break-even analyses into a single, easy-to-use view. Designed for financial planning and forecasting, it highlights key metrics like membership growth rate, occupancy projections, and operating expenses. This transparent, subscription-based coworking financial plan empowers management to make informed strategic decisions, optimize membership pricing strategies, and improve retention rates. Delivering accurate data instantly, it builds stakeholder trust through accounting transparency—an essential asset for sustainable revenue growth and investment analysis in flexible workspace businesses.

Business Financial Statements

Our comprehensive financial model for coworking space businesses includes pre-built, consolidated accounting templates—monthly profit and loss statements, 5-year projected balance sheets, and detailed cash flow forecasts in Excel. Designed for membership-based coworking revenue projections, this tool supports integration with QuickBooks, Xero, FreshBooks, and other software, enabling dynamic rolling forecasts. Ideal for financial planning of flexible workspaces, it enhances your break-even analysis, operating expense tracking, and membership growth rate evaluation. Elevate your shared office space financial analysis with accurate income statement projections and actionable financial KPIs to drive sustainable revenue streams and optimize membership retention.

Sources And Uses Statement

The Sources and Uses template in startup financial projections provides a clear breakdown of total funding and its allocation. For coworking space startups, this statement is critical to track investor funds accurately, ensuring transparency and strategic spending. Incorporating this into your financial model for coworking space business supports effective financial planning for flexible workspace, enhances investment analysis, and aligns with key financial KPIs. This clarity drives confidence in your membership-based coworking space revenue projections and aids in optimizing operating expenses within the membership model.

Break Even Point In Sales Dollars

This membership-based coworking space financial model includes a 5-year break-even analysis, identifying when revenue surpasses total fixed and variable costs. This critical insight enables management to set effective membership pricing strategies and project cash flow forecasts accurately. By analyzing operating expenses alongside membership growth rate and retention metrics, the model supports informed financial planning for flexible workspace businesses. Understanding the break-even point guides customer acquisition cost optimization and maximizes profitability, ensuring sustainable membership revenue streams and long-term success in the shared office space market.

Top Revenue

In financial forecasting for coworking businesses, the top line—membership revenue streams—signals overall growth, while the bottom line reflects net profitability after operating expenses coworking membership model. Investors closely analyze the profit and loss statement coworking space to assess membership growth rate coworking model and cash flow forecast coworking space. A strong coworking space membership pricing strategy drives top-line growth, indicating effective operations and healthy financial KPIs coworking membership business. Rigorous break-even analysis coworking space and customer acquisition cost coworking space insights help stakeholders evaluate the business’s financial health and sustainability.

Business Top Expenses Spreadsheet

The Top Revenue tab in the financial model for coworking space business offers a clear, organized overview of each membership revenue stream. It provides a comprehensive annual breakdown, highlighting revenue depth and bridges to support accurate financial forecasting for coworking businesses. This tab is essential for analyzing membership growth rate, cash flow forecasts, and profit and loss statements, enabling informed decisions on coworking space membership pricing strategy and optimizing shared office space financial analysis.

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a critical component of any financial model for coworking space business, accruing before operations begin. Monitoring these early prevents overspending and funding gaps. Our Membership Based Coworking Space Financial Plan offers a detailed proforma for start-up costs, highlighting both funding requirements and expenses. This tool enables precise budgeting, supports accurate cash flow forecasts, and strengthens your financial planning for flexible workspace ventures. Use it to optimize operating expenses and enhance your membership pricing strategy for sustained revenue growth and profitability.

CAPEX Spending

Accurate revenue projections are vital for a membership-based coworking space’s financial model, directly impacting cash flow forecasts and profitability. A well-crafted coworking space membership pricing strategy, combined with precise membership growth rate assumptions, strengthens the financial planning for flexible workspace. Utilizing a detailed financial model for coworking space business — including break-even analysis, variable and fixed costs, and membership retention rates — enables management to optimize revenue streams and improve financial KPIs. Thorough financial forecasting and shared office space financial analysis ensure informed decision-making, driving sustainable growth and maximizing the enterprise’s value.

Loan Financing Calculator

Our comprehensive 3-year financial model for coworking space businesses includes a dynamic loan amortization schedule tailored to various loan types. This tool meticulously tracks key metrics such as principal amount, interest type and rate, loan duration, and repayment schedules. Integrated within a robust financial forecasting framework, it supports detailed cash flow forecasts, break-even analysis, and operating expense management. Ideal for optimizing your coworking space membership pricing strategy and maximizing revenue streams, this model empowers precise financial planning and investment analysis to drive sustainable growth and profitability.

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

For start-ups in the coworking space sector, accurately incorporating Customer Acquisition Cost (CAC) into your 5-year financial forecasting is essential. This key financial KPI reflects the marketing expenses divided by the total number of new members gained annually. Integrating CAC within your subscription-based coworking financial plan enables precise revenue projections and supports a robust membership growth rate. Understanding this metric aids in refining your coworking space membership pricing strategy and optimizing cash flow forecasts, ultimately driving sustainable profitability and informed investment analysis for your flexible workspace business.

Cash Flow Forecast Excel

A pro forma cash flow forecast is an essential tool in financial planning for flexible workspaces. It enables accurate management of operating expenses and revenue streams, ensuring optimal cash flow budgeting. Integrating this with a comprehensive financial model for coworking space business supports precise financial forecasting, enhancing membership growth rate and retention. By aligning subscription-based coworking financial plans with variable and fixed costs, operators can improve profitability and streamline investment analysis. This strategic approach drives sustainable success in the competitive shared office space landscape.

KPI Benchmarks

Our startup financial model template includes a robust financial benchmarking study tab, enabling membership-based coworking spaces to perform comprehensive financial analysis. By comparing key indicators like cash flow forecasts, membership growth rate, and operating expenses against industry peers, businesses can identify strengths and areas for improvement. This comparative approach drives informed decisions on pricing strategy, membership retention, and revenue streams, vital for achieving break-even targets and maximizing profitability. Understanding these financial KPIs empowers coworking operators to refine their subscription-based financial plans and consistently elevate their flexible workspace’s performance toward sustainable growth.

P&L Statement Excel

The pro forma profit and loss statement is a critical financial KPI, revealing your coworking space's monetary performance and profitability. Accurate financial forecasting for coworking businesses hinges on precise income statement projections. However, while essential, the profit and loss statement does not capture assets, liabilities, or actual cash flow. Therefore, a profit and loss forecast without an integrated cash flow forecast coworking space model is incomplete. For a comprehensive financial plan, combine membership-based coworking space revenue projections with cash flow analysis to ensure robust financial insights and strategic decision-making.

Pro Forma Balance Sheet Template Excel

A comprehensive five-year projected balance sheet is vital in any financial model for coworking space businesses. Integrated with pro forma income statements and cash flow forecasts, it ensures balanced financial planning and accurate cash flow projections. This unified approach provides critical insights into membership revenue streams, operating expenses, and occupancy rate projections. Investors rely on these projections to analyze key financial KPIs, including profitability, leverage, and return on investment, making it an indispensable tool for startup investment analysis and strategic growth in subscription-based coworking membership models.

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our financial model for coworking space startups integrates key valuation metrics—including Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF)—to streamline investment analysis. WACC reflects the weighted cost of equity and debt, serving as a risk benchmark banks use for financing decisions. DCF translates future cash flows into present value, enabling precise revenue projections and break-even analysis. This comprehensive approach supports accurate cash flow forecasts, membership revenue stream assessments, and financial KPIs tracking, empowering informed financial planning for flexible workspace ventures.

Cap Table

Our financial forecasting for coworking businesses incorporates a detailed cap table reflecting four financing rounds. This dynamic model illustrates how new investments influence ownership percentages and investment income through dilution effects. By integrating membership growth rate coworking model data and subscription-based coworking financial plans, the pro forma cap table enables precise investment analysis for coworking space startups. This tool supports strategic financial planning, ensuring clarity on variable and fixed costs coworking financial model, while optimizing shareholder value throughout funding phases.

MEMBERSHIP BASED COWORKING SPACE BUSINESS FORECAST TEMPLATE ADVANTAGES

A robust financial model for coworking startups ensures strategic planning, minimizing risks and maximizing membership revenue streams.

Easily run diverse scenarios with our membership-based coworking space financial model for accurate revenue projections.

A robust financial model ensures accurate revenue projections, proving your coworking space’s loan repayment capability confidently.

Leverage our financial model to optimize coworking revenue with flexible 161-currency, five-year projections for global growth.

Our financial model accurately forecasts membership revenues and expenses, empowering strategic growth and optimized profitability for coworking spaces.

MEMBERSHIP BASED COWORKING SPACE FINANCIAL MODEL TEMPLATE STARTUP ADVANTAGES

Our integrated financial model ensures accurate revenue projections and optimal membership pricing to maximize coworking space profitability.

Our financial model delivers clear, investor-ready projections that optimize coworking space revenue and growth strategies efficiently.

Run different scenarios with our financial model to optimize coworking space revenue and maximize profitability effectively.

A dynamic financial model empowers you to optimize coworking cash flow by simulating membership and expense scenarios.

Optimize profitability by identifying cash gaps and surpluses early using a robust financial model for coworking spaces.

A robust financial model enables proactive cash flow forecasting to prevent deficits and optimize coworking space growth opportunities.

Our financial model accurately forecasts coworking space revenue, optimizing membership growth and maximizing profitability with precision.

Our financial model simplifies coworking space planning—no formulas, formatting, or costly consultants needed for accurate forecasts.

Optimize cash flow and manage surplus cash effectively with a comprehensive financial model for coworking space businesses.

A financial model for coworking spaces enables precise cash flow forecasts, guiding strategic reinvestment and debt management decisions.