Metal Mining Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Metal Mining Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Metal Mining Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

METAL MINING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Creates a comprehensive 5-year financial model for mining projects, including detailed metal mining cash flow analysis, projected profit and loss statements, and key mining financial performance metrics in GAAP or IFRS formats. This adaptable metal mining project valuation and financial forecasting tool allows for dynamic financial statement modeling tailored to metal mining operating expense models, ore grade sensitivity analysis, and capital budgeting mining projects. Consider using this metal mining cost estimation model and metal mining capital expenditure model in Excel before buying to perform thorough investment analysis metal mining and financial scenario planning mining, with unlocked templates ready for full customization.

This ready-made metal mining financial model in Excel template effectively addresses common challenges faced by mining project developers and investors by offering a comprehensive financial forecasting tool that integrates metal mining cash flow analysis, cost estimation, and revenue modeling into a single user-friendly platform. It simplifies the complexity of mining company financial modeling by allowing users to perform ore grade sensitivity analysis, assess metal extraction cost modeling, and evaluate capital budgeting mining projects with dynamic input scenarios. The model’s built-in metal mining operating expense and capital expenditure models streamline financial statement modeling for mining, enhancing the accuracy of mining financial performance metrics and profitability analysis. By combining financial scenario planning mining and metal mining risk assessment model features, this template empowers stakeholders to conduct robust investment analysis metal mining and metal mining project valuation without requiring advanced financial expertise.

Description

This comprehensive financial model for mining projects provides robust metal mining financial projections, integrating metal mine revenue modeling with detailed metal mining cash flow analysis for a clear view of profitability. It incorporates a metal mining cost estimation model alongside capital budgeting mining projects to ensure precise allocation of resources and effective metal mining capital expenditure modeling. With features like ore grade sensitivity analysis, metal mining operating expense model, and mining company financial modeling, this tool facilitates thorough metal mining risk assessment models and investment analysis metal mining. The financial statement modeling mining enables five-year monthly and yearly forecasts, including pro forma balance sheets and cash flow projection business plans, supporting financial scenario planning mining and metal mining profitability analysis that drive sound decision-making based on mining financial performance metrics.

METAL MINING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

The metal mining financial model Excel template offers mining company executives a comprehensive tool for financial forecasting in metal mining. By integrating metal mining cost estimation models and metal mine revenue modeling, it unifies key financial assumptions on expenses and revenues. This enables precise capital budgeting for mining projects, enhances metal mining cash flow analysis, and supports financial scenario planning mining operations. Ultimately, it empowers decision-makers with critical mining financial performance metrics and investment analysis for metal mining, driving informed strategies and maximizing project valuation and profitability.

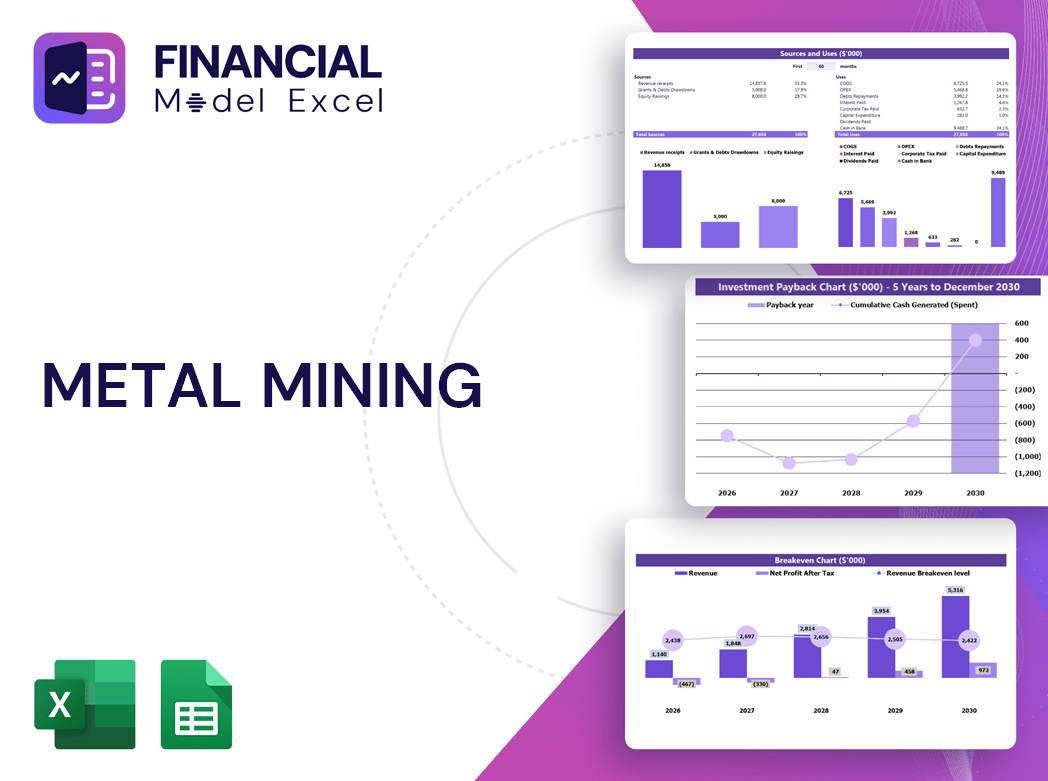

Dashboard

Our 5-year financial model for mining projects offers comprehensive metal mining cash flow analysis and detailed financial forecasting in metal mining. This versatile template simplifies metal mining project valuation by providing monthly or annual financial statement modeling mining reports. Its intuitive dashboard consolidates key mining financial performance metrics and capital budgeting mining projects data into clear visual charts. Ideal for mining company financial modeling, it supports metal mining cost estimation models, metal mine revenue modeling, and ore grade sensitivity analysis—empowering precise financial scenario planning mining and robust metal mining profitability analysis. Elevate your investment analysis metal mining with this all-in-one tool.

Business Financial Statements

This comprehensive metal mining financial projections template streamlines your capital budgeting mining projects by automatically generating all essential annual financial statements. Simply input your data into the assumptions, and the advanced financial model for mining projects delivers precise metal mining cash flow analysis, cost estimation, and revenue modeling. Ideal for mining company financial modeling, it supports robust financial forecasting in metal mining and enables detailed financial scenario planning mining professionals rely on for accurate mining financial performance metrics and project valuation. Elevate your investment analysis metal mining with this dynamic, user-friendly tool designed to optimize profitability analysis and risk assessment.

Sources And Uses Statement

The sources and uses statement in a metal mining financial model outlines capital budgeting mining projects by detailing funding origins and expenditure plans. The 'Sources' section highlights financing streams—such as business loans, investor capital, and share issuance—essential for mining company financial modeling. Meanwhile, the 'Uses' segment demonstrates how funds are allocated toward metal mining capital expenditure models, including land acquisition, equipment purchases, and start-up costs. This financial statement modeling mining component is crucial for metal mining project valuation, enabling accurate financial forecasting and investment analysis in metal mining ventures.

Break Even Point In Sales Dollars

The 5-year breakeven analysis is a vital component of metal mining financial projections, enabling mining companies to evaluate the interplay between fixed and variable costs versus revenue. Utilizing our financial model for mining projects, this tool determines the precise break-even point (BEP)—the moment when investments begin yielding positive returns. Our pro forma projection visually and mathematically illustrates the sales volume needed at specific prices to cover total costs, supporting robust metal mining project valuation, capital budgeting, and profitability analysis for informed decision-making in mining financial modeling.

Top Revenue

In metal mining financial projections, revenue modeling is crucial for accurate financial forecasting and project valuation. As a primary driver of key mining financial performance metrics, revenue forecasts must be grounded in realistic assumptions, including ore grade sensitivity and historical growth trends. Our financial model for mining projects integrates best practices in capital budgeting, cost estimation, and cash flow analysis—empowering mining companies to enhance profitability analysis and risk assessment. Utilizing our proforma template ensures robust financial statement modeling, enabling precise metal mining project valuation and sound investment analysis.

Business Top Expenses Spreadsheet

Effective metal mining financial projections rely on continuous optimization of major expenses. Our five-year financial model for mining projects includes a Top Spending Report that highlights the four largest operating expense categories, consolidating others for clarity. This enables mining companies to perform detailed metal mining cash flow analysis and monitor cost trends annually. Rigorous cost estimation models and capital budgeting mining projects ensure sustained profitability. Whether a start-up or established operation, leveraging financial forecasting in metal mining and expense control is essential to maximize metal mining profitability analysis and drive informed investment decisions.

METAL MINING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive metal mining financial projections template streamlines capital budgeting for mining projects by integrating salary costs for FTEs and PTEs within your team. Designed for precise metal mining cost estimation modeling, the tool ensures all inputs seamlessly flow through the metal mining cash flow analysis and financial statement modeling modules. This dynamic financial model for mining projects enables robust mining company financial modeling, facilitating accurate metal mine revenue modeling and metal mining profitability analysis tailored to your company’s unique data. Elevate your financial forecasting in metal mining with this all-in-one solution for investment analysis and operational efficiency.

CAPEX Spending

Capital budgeting mining projects are vital for accurate metal mining financial projections. A comprehensive metal mining capital expenditure model enables expert assessment of startup costs and investment tracking. Precise metal mining cost estimation models ensure effective financial forecasting in metal mining, supporting robust cash flow analysis. Understanding initial capital expenditures is key to metal mining project valuation and profitability analysis, helping mining companies optimize their financial performance metrics. Careful financial scenario planning mining strengthens decision-making, ensuring sustainable growth and sound financial turnover throughout the mining lifecycle.

Loan Financing Calculator

Effective loan repayment schedules are crucial for startups and growing mining companies, directly impacting financial forecasting in metal mining. These schedules detail principal amounts, terms, maturity, and interest rates, providing clarity for capital budgeting mining projects. As loan repayments influence cash flow, they are integral to metal mining cash flow analysis and financial statement modeling mining activities. Accurate tracking ensures precise metal mining project valuation and supports metal mining profitability analysis through comprehensive financial performance metrics and scenario planning. Monitoring repayments safeguards financial stability and strengthens the foundation for successful investment analysis in metal mining ventures.

METAL MINING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT (Earnings Before Interest and Tax) is a crucial metric in metal mining financial projections, representing operational profitability by subtracting cost of sales and operating expenses from total revenues. Incorporating EBIT into mining company financial modeling enables accurate metal mining cash flow analysis and investment analysis for metal mining projects. This metric supports robust financial forecasting in metal mining and underpins capital budgeting decisions, metal mining project valuation, and profitability analysis. Utilizing EBIT within a comprehensive financial model for mining projects enhances insight into mining financial performance metrics, guiding strategic planning and risk assessment throughout the metal mining lifecycle.

Cash Flow Forecast Excel

A robust financial model for mining projects, featuring comprehensive metal mining cash flow analysis, is essential to demonstrate your company’s ability to generate sufficient cash to service liabilities. Banks and investors require confidence that your integrated three-statement financial modeling for mining—including metal mining operating expense models and capital budgeting mining projects—can reliably support loan repayment. Leveraging detailed metal mining project valuation and financial forecasting in metal mining ensures accurate profitability analysis and risk assessment, making your investment analysis metal mining both transparent and compelling.

KPI Benchmarks

Our financial model for mining projects incorporates a benchmarking template that leverages industry and financial performance metrics. This enables clients to assess their mining company’s financial health, comparing operating efficiency and profitability against top performers in the sector. By utilizing metal mining cash flow analysis and cost estimation models, users can pinpoint key areas for improvement and optimize capital budgeting and revenue modeling strategies. This powerful tool supports mining financial performance metrics and risk assessment models, empowering stakeholders to drive superior outcomes and maximize project valuation and profitability in metal mining operations.

P&L Statement Excel

A robust metal mining financial model is essential for accurately forecasting cash flow, revenue, and operating expenses. Monthly financial statement modeling and ore grade sensitivity analysis enable mining companies to perform detailed financial forecasting and capital budgeting for mining projects. These projections support investment analysis and profitability assessment, helping leaders make informed decisions. By leveraging advanced metal mining project valuation and risk assessment models, businesses can optimize financial performance metrics and develop strategic plans to drive sustainable growth in the competitive mining sector.

Pro Forma Balance Sheet Template Excel

A robust metal mining financial model integrates pro forma balance sheets with monthly profit and loss templates to deliver comprehensive financial forecasting in metal mining. This mining company financial modeling approach provides critical insights into assets, liabilities, and equity over a 5-year horizon. By combining metal mining cash flow analysis with capital budgeting mining projects, stakeholders can accurately assess investment needs and revenue potential. Leveraging metal mining project valuation and ore grade sensitivity analysis ensures precise mining financial performance metrics and supports strategic decision-making for sustainable profitability and risk management.

METAL MINING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our metal mining financial model offers comprehensive financial projections, including pre-money valuation and weighted average cost of capital (WACC), providing clear insights for investors and stakeholders. It features detailed metal mining cash flow analysis with Free Cash Flow (FCF) highlighting available cash post-operations and investments. The Discounted Cash Flow (DCF) method accurately values future cash flows at present value, supporting robust metal mining project valuation and investment analysis. This financial model for mining projects ensures precise capital budgeting, risk assessment, and profitability analysis, empowering mining companies with reliable financial forecasting and scenario planning tools.

Cap Table

The equity cap table is a fundamental tool in mining company financial modeling, capturing detailed data on securities and their distribution among investors. It integrates crucial factors such as time progression and ownership changes to ensure precise financial forecasting in metal mining projects. This dynamic model supports metal mining project valuation, investment analysis, and capital budgeting mining projects by providing clear insights into ownership structure, essential for effective financial scenario planning and mining financial performance metrics.

METAL MINING FINANCIAL MODEL BUSINESS PLAN ADVANTAGES

Boost lender confidence by showcasing timely repayment through our precise metal mining financial projections and cash flow analysis.

Boost decision-making confidence with our precise financial model for mining projects, optimizing profitability and risk management.

Financial models for mining projects enable proactive cash flow analysis, preventing gaps and maximizing metal mining profitability.

Optimize metal mining profitability with a tailored financial model that enhances accurate forecasting and risk assessment.

Reduce risk and boost profits with our precise metal mining financial model pro forma Excel template.

METAL MINING FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Get a robust financial model for mining projects that enhances accuracy, efficiency, and strategic investment decision-making.

This robust metal mining financial model empowers precise forecasting, tailored analysis, and strategic decision-making for optimized profitability.

Our financial model for mining projects enables better decision making through precise metal mining cash flow analysis.

Enhance operational decisions confidently using metal mining cash flow analysis for accurate financial scenario planning in Excel.

Our financial model for mining projects identifies potential cash shortfalls early, ensuring proactive financial management and stability.

The metal mining financial model provides early warnings, enhancing accurate cash flow analysis and proactive project decision-making.

Our financial model for mining projects enables precise investment analysis and confident funding decisions with clear profitability insights.

Impress investors with a robust metal mining financial model that ensures accurate forecasts and maximizes project profitability.

Our financial model for mining projects ensures precise cash flow analysis, boosting investment confidence and profitability forecasting.

Easily adjust inputs anytime to refine your metal mining financial model for precise, dynamic decision-making and strategic planning.