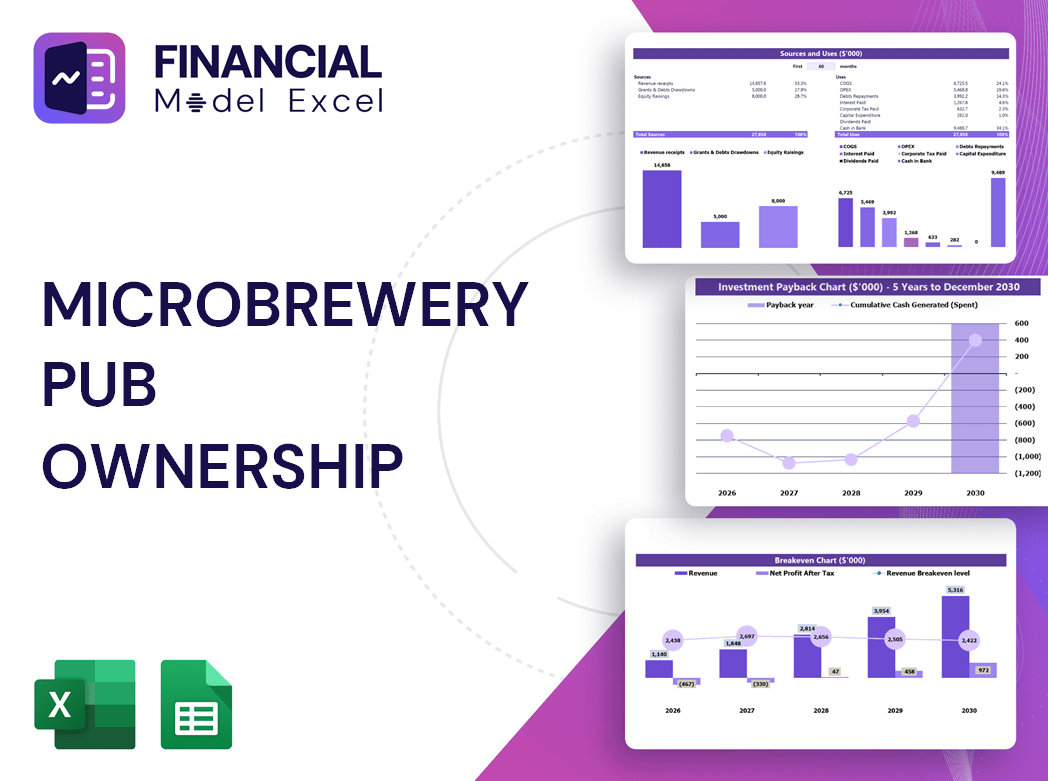

Microbrewery Pub Ownership Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Microbrewery Pub Ownership Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Microbrewery Pub Ownership Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MICROBREWERY PUB OWNERSHIP FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive microbrewery financial projections model offers a detailed brewery business financial plan featuring prebuilt three-statement templates, including a consolidated profit and loss forecast, balance sheet, and microbrewery cash flow model. Designed specifically for microbrewery startup cost analysis and brewpub revenue forecasting, it integrates key craft brewery financial planning metrics, capital expenditure plans, and brewery funding strategy financials to help craft brewers secure funding from banks, angels, grants, and VC funds. The model also includes a brewery operating budget model, microbrewery expense budgeting, and a microbrewery break-even analysis, providing a robust microbrewery owner financial summary and brewpub income statement forecast for effective financial feasibility studies and investment decision-making.

The ready-made microbrewery financial projections model in Excel effectively addresses common pain points by simplifying complex brewery business financial plans into user-friendly templates, offering comprehensive microbrewery startup cost analysis and microbrewery expense budgeting that streamline expense tracking and capital allocation. It integrates brewpub revenue forecasting and a detailed microbrewery cash flow model to help owners anticipate income fluctuations and maintain healthy cash flow, while the brewery profit and loss template and brewpub income statement forecast facilitate clear visibility into operational profitability. Additionally, the inclusion of brewery funding strategy financials, microbrewery break-even analysis, and craft brewery financial planning tools ensures that users can make informed decisions on investment and expansion, reducing uncertainty in brewpub investment financial modeling and craft brewery business valuation models, ultimately enhancing financial feasibility and performance metrics without the need for advanced accounting skills.

Description

This microbrewery financial projections model offers a detailed brewery business financial plan, including a comprehensive microbrewery startup cost analysis and brewpub revenue forecasting to guide your venture toward profitability. Featuring a sophisticated microbrewery cash flow model and brewery profit and loss template, it supports brewpub investment financial modeling and microbrewery expense budgeting for efficient capital allocation. The template incorporates brewery funding strategy financials and microbrewery break-even analysis alongside a craft brewery financial planning framework, including a brewpub sales and cost model and microbrewery capital expenditure plan. With an integrated brewery operating budget model and craft pub financial performance metrics, it delivers a thorough brewery financial feasibility study and microbrewery cost structure breakdown. Additionally, users benefit from a brewpub income statement forecast and craft brewery business valuation model to produce a precise microbrewery owner financial summary for informed decision-making and strategic growth.

MICROBREWERY PUB OWNERSHIP FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our versatile microbrewery financial projections model—a powerful yet easy-to-customize Excel template designed for comprehensive brewery business financial planning. Whether you’re conducting a microbrewery startup cost analysis, brewpub revenue forecasting, or crafting a detailed brewery profit and loss template, this tool adapts to your unique needs. With intuitive features for microbrewery cash flow modeling, expense budgeting, and break-even analysis, it empowers you to optimize your craft brewery’s financial performance and streamline your funding strategy financials. Elevate your brewery business valuation and make informed decisions with a customizable template that grows with your venture.

Dashboard

Our comprehensive brewery business financial plan features an all-in-one dashboard integrating a microbrewery cash flow model, projected balance sheet, and detailed cash flow analysis. This dynamic tool enables monthly and annual breakdowns of key financial statements, empowering users with clear, visual insights through intuitive charts and figures. Designed for craft brewery financial planning, it streamlines expense budgeting, break-even analysis, and profit and loss tracking, providing a robust foundation for informed decision-making and strategic growth.

Business Financial Statements

A comprehensive brewery business financial plan includes a detailed brewpub income statement forecast, microbrewery cash flow model, and pro forma balance sheet. These core financial statements are essential for analyzing operational performance, revenue streams, and capital structure. The microbrewery profit and loss template offers insight into expense budgeting and revenue forecasting, while the financial feasibility study and break-even analysis guide strategic funding decisions. Together, they provide a clear picture of cash flow, assets, and funding strategies, empowering owners with the financial clarity needed for successful brewery startup cost analysis and long-term growth.

Sources And Uses Statement

The Sources and Uses of Funds statement within our microbrewery financial projections model provides a clear overview of total capital raised and its allocation. This essential tool enables startups to meticulously track investor fund utilization, ensuring transparency and accountability. Incorporating this statement into your brewery business financial plan helps optimize expense budgeting and supports effective brewpub investment financial modeling. By precisely outlining funding sources alongside expenditure, you gain invaluable insight for managing your microbrewery startup cost analysis and achieving financial feasibility.

Break Even Point In Sales Dollars

A microbrewery break-even analysis is vital for determining when your brewery business will start generating profit by covering all fixed and variable costs. Fixed expenses, like rent and administrative salaries, remain constant regardless of sales and form your overhead. Variable costs, including inventory, shipping, and production, fluctuate directly with sales volume. Integrating this analysis into your brewery financial projections model or microbrewery cash flow model ensures accurate forecasting, enabling strategic planning within your craft brewery financial planning and brewery operating budget model for sustainable growth and profitability.

Top Revenue

The Top Revenue tab in your microbrewery financial projections model enables detailed demand analysis for products and services, revealing profitability and guiding strategic decisions. Utilizing the five-year brewery business financial plan, you can create a revenue bridge to identify key drivers like sales volume and unit price. This brewpub revenue forecasting helps predict demand fluctuations across periods, optimizing resource allocation for sales teams. Together, these tools support comprehensive microbrewery cash flow modeling and expense budgeting, ensuring informed financial planning and sustainable growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in our five-year microbrewery financial projections model highlights your four highest costs for quick insights. This comprehensive brewery business financial plan delivers an in-depth expense budgeting analysis, covering customer acquisition and fixed costs. Understanding your microbrewery cost structure breakdown empowers you to optimize cash flow, enhance profitability, and align your brewpub investment financial modeling with targeted growth strategies. Effective expense management is key to driving sustained success and maximizing your craft brewery’s financial performance metrics.

MICROBREWERY PUB OWNERSHIP FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our microbrewery financial projections model is an essential tool for precise expense budgeting and startup cost analysis. This comprehensive brewery business financial plan identifies potential challenges in cash flow and profitability early, enabling effective solutions. Leveraging brewpub revenue forecasting and a detailed brewery profit and loss template, it supports robust funding strategy financials and a microbrewery break-even analysis. Accurate expense tracking and capital expenditure planning enhance the brewery’s financial feasibility study, helping secure loans and attract investors. Ultimately, this craft brewery financial planning tool drives informed decisions and sustainable growth.

CAPEX Spending

Accurate revenue forecasting is crucial in a microbrewery financial projections model, as it directly impacts the brewery business financial plan and overall valuation. Utilizing detailed assumptions and historical data, a comprehensive brewpub revenue forecasting approach strengthens the microbrewery startup cost analysis and cash flow model. Management and financial analysts must meticulously model future revenue streams within the brewery profit and loss template to ensure reliable five-year financial projections. This precision supports effective brewery funding strategy financials and enhances craft brewery financial planning for sustainable growth and profitability.

Loan Financing Calculator

Start-ups and growing microbreweries must meticulously manage their loan repayment schedules, detailing each loan's amount, maturity, and terms. Integrating this into a microbrewery cash flow model is essential, as interest expenses directly impact cash flow projections. The closing debt balance should be reflected in the brewery financial plan’s balance sheet forecast. Additionally, principal repayments flow through the cash flow statement, ensuring accurate brewpub revenue forecasting and expense budgeting. This comprehensive approach supports a robust brewery funding strategy financial model and strengthens overall craft brewery financial planning.

MICROBREWERY PUB OWNERSHIP FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a key metric embedded in microbrewery financial projections models, reflecting the current worth of future discounted cash flows. By summing the present values of cash inflows across multiple periods, NPV enables craft brewery financial planning to accurately assess investment potential. This insight empowers microbrewery owners to evaluate the true value today of dollars expected years ahead, ensuring informed decisions within brewery business financial plans, brewpub investment financial modeling, and brewery funding strategy financials.

Cash Flow Forecast Excel

The microbrewery cash flow model is a vital component of your brewery business financial plan, demonstrating your ability to manage cash streams efficiently and cover liabilities. A comprehensive brewpub income statement forecast and brewery operating budget model further validate your financial strategy. Lenders rely on these financial feasibility studies to ensure your microbrewery startup cost analysis supports timely loan repayment. Incorporating detailed microbrewery expense budgeting and break-even analysis strengthens your brewery funding strategy financials, building confidence in your craft brewery financial planning and investment potential.

KPI Benchmarks

Our microbrewery financial projections model includes industry benchmarks that provide valuable insights into your craft brewery’s performance compared to top competitors. This brewery business financial plan helps identify key areas for improvement, guiding strategic decisions to maximize profitability. With our comprehensive brewpub revenue forecasting and microbrewery cash flow model, you can confidently prioritize efforts that yield the best results. Leverage our brewpub investment financial modeling to drive success and ensure your craft brewery thrives in a competitive market.

P&L Statement Excel

An accurate brewery profit and loss template is crucial in any microbrewery financial projections model. Serving as the foundation of your brewpub income statement forecast, it reveals the true bottom line and overall profitability. Even when initial growth looks promising, without detailed microbrewery startup cost analysis and precise expense budgeting, results remain uncertain. Craft brewery financial planning demands thorough documentation—nothing replaces a carefully crafted financial plan to ensure authentic, data-driven decisions and long-term success.

Pro Forma Balance Sheet Template Excel

This comprehensive brewery business financial plan includes monthly and yearly projected balance sheets seamlessly integrated with a microbrewery cash flow model and monthly profit and loss template. It offers detailed microbrewery startup cost analysis, microbrewery expense budgeting, and brewpub sales and cost models to ensure accurate brewpub revenue forecasting. Designed for precise brewery financial feasibility studies and craft brewery financial planning, this model supports informed decision-making with clear insights into brewery operating budgets and microbrewery break-even analysis, empowering entrepreneurs with a complete microbrewery owner financial summary.

MICROBREWERY PUB OWNERSHIP FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Easily perform a Discounted Cash Flow valuation using this comprehensive microbrewery startup cost analysis template. By inputting just a few key rates in the cost of capital section, users can generate a detailed brewery financial projections model and brewery business financial plan. This powerful tool supports microbrewery break-even analysis, cash flow modeling, and capital expenditure planning, enabling informed decisions with a clear microbrewery owner financial summary and brewpub income statement forecast. Maximize investment insights with precise brewpub revenue forecasting and craft brewery financial planning—all within a streamlined valuation report format.

Cap Table

The cap table model is an essential component of a microbrewery financial projections model, providing start-ups and early-stage ventures with a clear breakdown of ownership stakes, investor shares, and dilution over time. Integrating this with your brewery business financial plan enhances transparency and supports informed decision-making. Leveraging tools like microbrewery startup cost analysis and brewpub investment financial modeling ensures a comprehensive view of your craft brewery’s capital structure, enabling strategic funding strategies and long-term growth.

MICROBREWERY PUB OWNERSHIP 5 YEAR FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Accelerate growth confidently with our microbrewery cash flow model, delivering precise 5-year financial projections in Excel.

The microbrewery financial projections model ensures precise budgeting and streamlines spending for maximum profitability.

A microbrewery financial projections model ensures precise, updated plans that satisfy lenders and boost investor confidence.

Develop a winning sales strategy with the microbrewery financial model for precise pub ownership profit forecasting.

The microbrewery financial projections model accurately predicts cash flow shortages and surpluses, ensuring proactive budget management.

MICROBREWERY PUB OWNERSHIP SIMPLE FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

This microbrewery financial projections model offers simple, practical insights to boost profitability and secure strategic funding.

Streamline your microbrewery financial planning with a simple, yet powerful, startup cost analysis and cash flow model template.

Optimize profits with our microbrewery financial projections model, predicting impacts of upcoming market and cost changes.

Microbrewery cash flow models enable precise forecasting and strategic planning for equipment purchases and product launches.

Our microbrewery financial projections model builds stakeholder trust by delivering accurate, insightful, and actionable business forecasts.

A microbrewery cash flow model builds investor confidence by clearly projecting future financial health and funding needs monthly.

Our microbrewery financial projections model empowers precise forecasting, optimizing profitability and securing strategic investments confidently.

A microbrewery cash flow model empowers owners to forecast impacts, minimize risks, and ensure sustainable business growth.

Our microbrewery financial projections model ensures precise budgeting, optimizing profitability with clear, currency-denominated insights.

Our microbrewery financial projections model ensures precise, customizable currency settings for accurate and tailored financial insights.