Microgrid Energy Solutions Provider Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Microgrid Energy Solutions Provider Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Microgrid Energy Solutions Provider Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MICROGRID ENERGY SOLUTIONS PROVIDER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive microgrid energy financial planning model offers a robust framework for renewable microgrid financial analysis and microgrid project financing strategies, delivering a detailed five-year financial projection template including forecasted income statements, financial statements, and key financial ratios in both GAAP and IFRS formats. Designed to support energy microgrid investment models, the tool enables stakeholders to conduct an in-depth microgrid financial feasibility study, incorporating financial modeling for microgrid systems such as microgrid capital expenditure modeling, operational cost models, and microgrid cash flow projection models. By integrating microgrid energy economics models and microgrid revenue forecasting models, users can optimize microgrid energy pricing models, evaluate financial performance model microgrid projects, and perform comprehensive microgrid cost-benefit analysis models, thereby ensuring rigorous financial risk assessment microgrid solutions and enhancing microgrid financial sustainability models for long-term profitability analysis. The unlocked and fully editable Excel template empowers users to evaluate startup ideas and plan startup costs effectively while facilitating microgrid funding and investment models focused on financial metrics for microgrid solutions and microgrid energy cost optimization models.

The microgrid energy financial planning model Excel template effectively addresses key pain points faced by buyers by delivering a comprehensive and adaptable microgrid financial feasibility study tool that streamlines microgrid project financing strategies and financial modeling for microgrid systems. It incorporates an integrated microgrid cash flow projection model and operational cost model microgrid energy framework, enabling users to perform accurate renewable microgrid financial analysis and microgrid cost benefit analysis model with ease. By leveraging the microgrid energy economics model and microgrid revenue forecasting model, users can optimize capital expenditures through microgrid capital expenditure modeling and evaluate financial risk assessment microgrid scenarios, ensuring robust financial sustainability and profitability analysis model outcomes. This turnkey solution empowers stakeholders to confidently manage microgrid energy pricing models, funding and investment models, and financial performance metrics for microgrid projects, saving valuable time while providing clear insights to support investor decision-making and operational efficiency from the outset.

Description

The microgrid financial sustainability model integrates comprehensive financial modeling for microgrid systems, enabling renewable microgrid financial analysis and microgrid project financing strategies tailored for start-ups and SMEs. This microgrid cost benefit analysis model features detailed microgrid capital expenditure modeling and operational cost model microgrid energy components, ensuring precise financial risk assessment microgrid projects and accurate microgrid cash flow projection model outputs. With embedded microgrid revenue forecasting model and microgrid energy pricing model capabilities, it supports robust energy microgrid investment model evaluations, facilitating effective financial performance model microgrid projects, microgrid energy cost optimization model analysis, and strategic microgrid funding and investment model decisions for optimized profitability analysis and long-term financial planning.

MICROGRID ENERGY SOLUTIONS PROVIDER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive microgrid financial modeling framework integrates pro forma income statements, projected balance sheets, and cash flow forecasts, reflecting annual changes crucial for renewable microgrid financial analysis. Leveraging advanced financial metrics for microgrid solutions, this microgrid energy investment model supports robust project financing strategies and enhances financial feasibility studies. Regular updates to the microgrid capital expenditure modeling and operational cost models ensure accurate microgrid revenue forecasting and financial risk assessment, driving sustainable profitability. Organizations relying on these sophisticated Excel-based microgrid financial performance models empower informed decision-making and optimize energy microgrid investment outcomes.

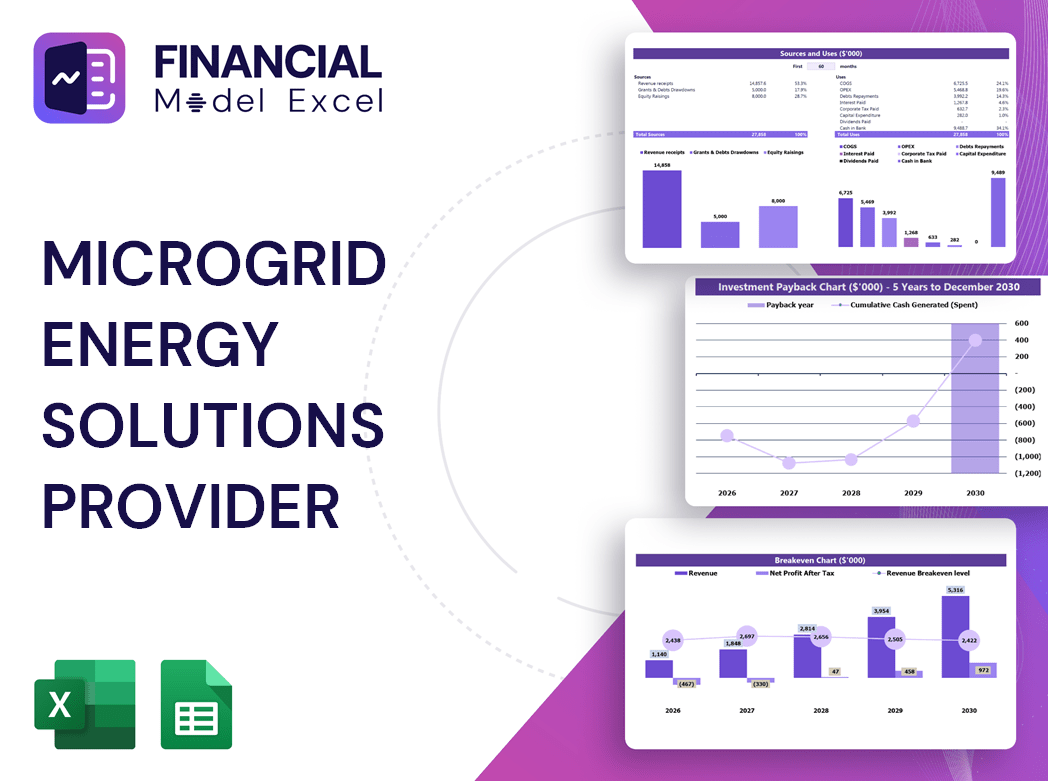

Dashboard

The microgrid financial planning model offers comprehensive insights into your project’s financial feasibility, including cash flow projections, capital expenditure modeling, and revenue forecasting. Featuring detailed microgrid cost-benefit analysis and operational cost modeling, it empowers stakeholders to optimize energy pricing and assess financial risks effectively. Interactive charts and graphs provide clear visualization, ensuring transparent financial performance evaluation for renewable microgrid investments. This strategic tool supports robust microgrid project financing strategies and sustainability assessments, driving informed decision-making and long-term profitability in microgrid energy economics.

Business Financial Statements

Our microgrid financial planning model integrates profit and loss projections, startup financial statements, and balance sheet forecasts to deliver a comprehensive microgrid financial feasibility study. The pro forma profit and loss statement offers detailed insights into operational activities driving revenue, while cash flow projection models and capital expenditure modeling ensure effective asset and funding management. This holistic approach supports renewable microgrid financial analysis and microgrid project financing strategies, enabling stakeholders to optimize financial performance, assess risks, and drive sustainable investment decisions in microgrid energy solutions.

Sources And Uses Statement

This microgrid financial planning model features a comprehensive sources and uses statement, providing clear insight into the project’s funding structure. Users can analyze capital allocation, investment inflows, and operational expenditures to optimize microgrid energy cost and enhance financial sustainability. This robust tool supports microgrid project financing strategies by delivering detailed microgrid cash flow projections and revenue forecasting, empowering stakeholders with accurate microgrid cost-benefit analysis and financial risk assessment for informed decision-making.

Break Even Point In Sales Dollars

Break-even represents the critical point where a company’s revenue precisely covers all fixed and variable costs, resulting in neither profit nor loss. Utilizing a microgrid financial feasibility study and cost-benefit analysis model, businesses can accurately assess this threshold. Effective microgrid cost optimization models and financial risk assessment tools enable informed decision-making, ensuring sustainable operations. Typically, enterprises with lower fixed costs benefit from a reduced break-even revenue, enhancing their microgrid energy investment model’s viability and financial sustainability. This precision supports strategic microgrid project financing strategies to maximize profitability and long-term success.

Top Revenue

When developing a microgrid energy financial planning model, accurate revenue forecasting is paramount. Revenue drives enterprise value and shapes profit-loss projections, making it critical in microgrid financial feasibility studies. Financial analysts must apply robust microgrid revenue forecasting models, incorporating growth assumptions informed by historical data and market trends. Utilizing advanced microgrid cost benefit analysis models and financial performance models ensures optimized energy pricing and investment strategies. Our comprehensive microgrid financial sustainability model empowers stakeholders to devise strategic, data-driven plans for successful project financing and long-term profitability.

Business Top Expenses Spreadsheet

The Top Expenses tab within the 5-year microgrid financial planning model offers a concise overview of your largest cost drivers, highlighting the top four expenses for quick insight. This financial modeling for microgrid systems also delivers detailed cost analysis, including customer acquisition and fixed operational costs. By accurately forecasting expenses using this microgrid cost benefit analysis model, you enhance your microgrid project financing strategies, enabling better financial risk assessment and improved profitability in your microgrid energy investment model. Effective expense management is crucial for maximizing financial sustainability and optimizing energy microgrid investment returns.

MICROGRID ENERGY SOLUTIONS PROVIDER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive microgrid financial planning model must incorporate detailed start-up costs, as these initial expenses occur before key strategic activities and can impact cash flow and funding. Proper management of these costs is essential to avoid cash shortages and ensure project viability. Utilizing a microgrid energy solutions provider financial model with built-in proforma templates for expenses and financing supports accurate expense planning. This approach enhances financial feasibility studies, cash flow projections, and overall financial sustainability, empowering stakeholders with reliable data to optimize investment strategies and drive successful renewable microgrid project implementation.

CAPEX Spending

Capital expenditure (CAPEX) represents significant upfront investments essential for acquiring assets in microgrid projects. Accurately modeling CAPEX within a financial planning model is critical for microgrid financial feasibility studies and cost-benefit analyses. These substantial expenses, typically reflected in projected balance sheets, drive operational enhancements and technology optimization. Incorporating CAPEX in microgrid capital expenditure modeling and cash flow projection models ensures realistic energy microgrid investment strategies and robust microgrid project financing. Effective financial modeling for microgrid systems enables precise revenue forecasting and energy cost optimization, supporting sustainable and profitable microgrid solutions.

Loan Financing Calculator

Our microgrid financial planning model integrates a comprehensive loan amortization schedule, detailing precise repayment timelines. Leveraging pre-built algorithms, the model forecasts installment amounts, breaking down principal and interest payments over monthly, quarterly, or annual periods. This robust approach supports microgrid project financing strategies by enhancing financial risk assessment and enabling accurate cash flow projection models, ensuring optimal financial sustainability and profitability analysis for renewable microgrid investments.

MICROGRID ENERGY SOLUTIONS PROVIDER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) are essential for evaluating a microgrid project's financial health against industry benchmarks. Utilizing a comprehensive microgrid financial planning model enables clear visualization of KPIs through precise figures and intuitive charts. This approach enhances your ability to conduct renewable microgrid financial analysis, optimize energy cost models, and strengthen financial sustainability. By integrating these metrics, stakeholders gain actionable insights to drive microgrid profitability, improve cash flow projections, and refine investment strategies—ultimately ensuring robust financial performance and long-term project success.

Cash Flow Forecast Excel

Effective microgrid project financing strategies hinge on comprehensive financial modeling for microgrid systems. Utilizing a robust microgrid cash flow projection model and microgrid cost benefit analysis model enables precise tracking of operational costs and revenues. This clarity enhances financial risk assessment for microgrid investments, supporting accurate microgrid revenue forecasting and capital expenditure modeling. By leveraging renewable microgrid financial analysis and microgrid financial sustainability models, businesses can optimize energy microgrid investment models, ensuring balanced cash flows and promoting sustainable growth. Such meticulous planning empowers startups to navigate complexities, streamline bookkeeping, and secure favorable funding and investment outcomes.

KPI Benchmarks

This advanced microgrid financial analysis model offers a comprehensive comparative financial review of companies within the renewable microgrid sector. By leveraging financial modeling for microgrid systems, it provides clients with clear insights into each company's financial performance and sustainability. This robust microgrid cost benefit analysis model enables informed decision-making, highlighting key financial metrics and investment viability. Ideal for microgrid project financing strategies and energy microgrid investment models, it delivers a precise financial feasibility study that empowers stakeholders to optimize capital expenditure and forecast revenue effectively.

P&L Statement Excel

A comprehensive microgrid financial feasibility study hinges on precise income statements, serving as the cornerstone for profitability assessment. Employing a robust microgrid cash flow projection model alongside a detailed profit and loss template ensures transparent financial performance. Without accurate financial modeling for microgrid systems, including revenue forecasting and cost benefit analysis models, project viability remains uncertain. Meticulously documented financial metrics for microgrid solutions empower informed decision-making, enabling strategic microgrid project financing strategies and optimizing energy cost structures. Ultimately, reliable financial projections are vital to validate investment potential and drive sustainable success in renewable microgrid ventures.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet template in Excel offers a precise financial snapshot of your microgrid project at a specific point in time. It captures assets, liabilities, and net worth across the forecast horizon, serving as a vital tool within financial modeling for microgrid systems. Integrating this with your microgrid financial feasibility study and investment model enhances your ability to conduct rigorous cost-benefit and profitability analyses, supporting effective project financing strategies and ensuring financial sustainability in renewable microgrid ventures.

MICROGRID ENERGY SOLUTIONS PROVIDER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Confidently present your microgrid project with our comprehensive financial modeling for microgrid systems. This 5-year microgrid financial feasibility study template includes automated valuation tools like WACC calculation, microgrid cash flow projection models, and discounted cash flow analysis. Showcase your renewable microgrid financial analysis with precise financial metrics, highlighting free cash flow available to investors and demonstrating strong microgrid energy economics. Perfect for microgrid project financing strategies, this model ensures clear insights into capital expenditure, operational costs, and revenue forecasting—empowering you to secure funding and drive investment decisions with confidence.

Cap Table

This comprehensive microgrid financial planning model Excel template enables precise cash flow projections and forecasted profit and loss statements. Featuring a detailed capitalization table, it supports robust microgrid capital expenditure modeling and financial feasibility studies. Ideal for renewable microgrid financial analysis, it facilitates critical evaluation of sales, EBITDA, and investor equity through advanced microgrid revenue forecasting and funding strategies. Empower your microgrid project financing with this dynamic tool, designed to optimize microgrid energy economics and ensure sustainable financial performance.

MICROGRID ENERGY SOLUTIONS PROVIDER 5 YEAR FINANCIAL PROJECTION ADVANTAGES

The microgrid financial model optimizes cash flow projections, enhancing investment decisions and ensuring sustainable project profitability.

The microgrid financial model ensures clear investment insights, minimizing risks and maximizing project profitability effectively.

The microgrid financial model accurately estimates future expenses, optimizing investment and ensuring sustainable energy project profitability.

The microgrid financial model delivers clear insights, optimizing investment decisions and enhancing project profitability confidently.

Raise capital efficiently with our microgrid financial model, delivering precise projections for confident energy investment decisions.

MICROGRID ENERGY SOLUTIONS PROVIDER BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Optimize investments and save time with our advanced microgrid financial feasibility model for sustainable energy projects.

Our microgrid financial modeling template enables effortless, accurate planning without complex formulas or costly consultant fees.

Our microgrid financial modeling offers clear, dashboard-driven insights for optimized investment, cost, and revenue forecasting.

Our microgrid financial model dashboard consolidates all key data for instant, seamless investment analysis and decision-making.

Optimize funding success with a microgrid financial feasibility study delivering clear investment and profitability insights.

Impress investors with a proven microgrid financial model ensuring robust profitability, risk assessment, and sustainable energy investment returns.

Optimize cash flow and maximize returns with our advanced financial modeling for sustainable microgrid investment strategies.

The microgrid cash flow projection model empowers managers to optimize surplus cash reinvestment and ensure financial sustainability.

Optimize returns and drive growth with our advanced microgrid financial feasibility study and investment model.

The microgrid cash flow projection model reveals optimal funding strategies to maximize growth and financial sustainability effectively.