Money Transfer Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Money Transfer Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Money Transfer Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MONEY TRANSFER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year international money transfer cash flow model offers a robust financial projection template tailored for startups and entrepreneurs in the remittance service industry. Designed to support fundraising efforts, the model integrates financial forecasting for payment platforms, including key financial metrics, budgeting for money transfer businesses, and expense models for payment transfer services. With a focus on digital money transfer financial planning and peer-to-peer payment financial models, it enables detailed transaction-based financial modeling and revenue forecasts for international payments, empowering businesses to evaluate startup ideas, optimize financial assumptions, and secure funding from banks, angels, grants, and venture capitalists through a scalable, bottom-up money transfer profit and loss model.

This ready-made money transfer financial model Excel template effectively addresses common pain points faced by startups and established businesses in the remittance sector by providing an all-in-one financial forecasting tool that simplifies budgeting for money transfer businesses and streamlines transaction-based financial modeling. It eliminates the complexity of building a cross border payment financial analysis from scratch by offering integrated input tables and charts tailored for digital money transfer financial planning, peer to peer payment financial models, and mobile money transfer revenue models. Users benefit from automated generation of key financial statements—including profit and loss, cash flow, and balance sheet projections—enabling accurate financial valuation of remittance services and clear visibility into financial metrics for remittance companies. The template’s expense model for payment transfer services, combined with scale-up financial model features and customizable financial assumptions for money transfer firms, empowers entrepreneurs and investors to confidently forecast revenue for international payments and manage cash flows over a 60-month horizon with ease, ultimately facilitating better decision-making and investor communication without requiring advanced financial modeling expertise.

Description

The money transfer business model financial template offers comprehensive financial modeling for money transfer services, integrating detailed cross border payment financial analysis and international money transfer cash flow models to support strategic decision-making. This digital money transfer financial planning tool includes a 5-year remittance service financial projections and a peer to peer payment financial model that accurately forecasts revenue streams and budgets for operational expenses, ensuring precise financial forecasting for payment platforms. Equipped with a money transfer startup financial template, it covers transaction based financial modeling and expense models for payment transfer services, delivering key financial metrics for remittance companies such as cash burn analysis, debt service coverage ratios, and profit and loss models. The scale-up financial model for money transfer is designed to optimize money transfer profit and loss statements, validate financial assumptions for money transfer firms, and facilitate financial valuation of remittance services through robust payment processing financial statement models, making it an essential tool for forecasting revenue and managing investments in mobile money transfer revenue models.

MONEY TRANSFER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Investors demand a robust money transfer financial model to ensure success. Our comprehensive financial modeling for money transfer services provides a clear blueprint, detailing capital requirements and projecting investor returns. With precise financial forecasting for payment platforms, including cross-border payment financial analysis and mobile money transfer revenue models, our template enables confident decision-making. Leverage our remittance service financial projections and transaction-based financial modeling to validate your startup’s profitability and growth potential. Secure investor trust with a professional, data-driven money transfer business model that highlights key financial metrics and a scalable expense model for payment transfer services.

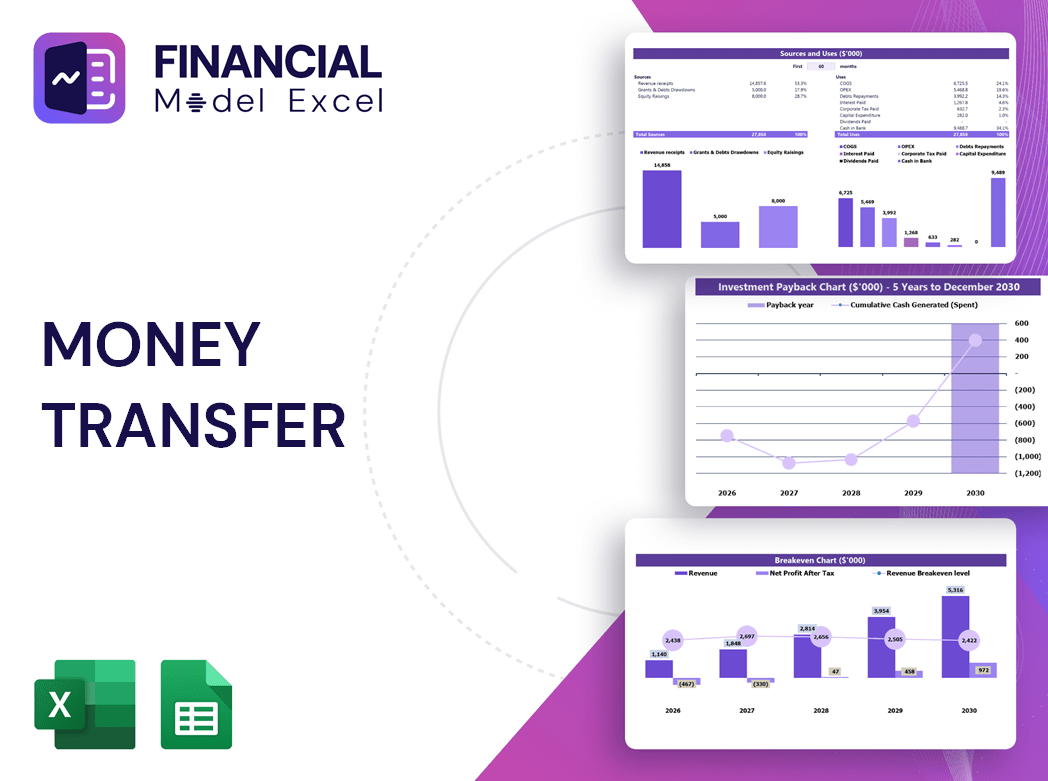

Dashboard

Our money transfer financial model offers a comprehensive dashboard designed for seamless financial forecasting and analysis. Tailored for remittance and cross-border payment services, it consolidates key financial metrics, cash flow models, and profit and loss projections into one intuitive view. This empowers professionals to make informed strategic decisions, optimize budgeting, and enhance revenue forecasts. By providing accurate, transparent financial data instantly, it builds trust with stakeholders and drives growth within the digital money transfer and payment processing sectors. Gain financial clarity and confidently scale your money transfer business with this essential financial modeling tool.

Business Financial Statements

Our money transfer business model template offers a comprehensive financial forecasting tool tailored for payment platforms. Featuring a 5-year integrated financial model—including projected balance sheets, profit and loss statements, and cash flow projections—this Excel-based template streamlines financial planning for remittance services. With built-in financial assumptions and key metrics, it supports digital and international money transfer cash flow models. Users can effortlessly generate GAAP or IFRS-compliant reports, empowering startups and scale-ups to confidently analyze revenue forecasts, expense models, and transaction-based financial metrics for optimal decision-making and growth.

Sources And Uses Statement

Our money transfer business financial model offers a comprehensive sources and uses of funds statement, essential for precise financial forecasting and cash flow management. Designed for remittance services and cross-border payment platforms, this template delivers key financial metrics, including profit and loss projections and expense modeling. It equips startups and established firms alike with clear insights into funding requirements and allocation, enhancing investor confidence. User-friendly and efficient, this tool enables robust financial planning, helping businesses optimize operations and scale successfully within the competitive international money transfer market.

Break Even Point In Sales Dollars

This comprehensive financial forecasting model for money transfer businesses calculates the break-even point in sales dollars over a five-year horizon. It delivers detailed break-even analysis through both numeric data and clear graphical representations, enabling informed decision-making. Ideal for digital money transfer financial planning and transaction-based financial modeling, this tool supports budgeting, revenue forecasting for international payments, and expense modeling for payment transfer services. Empower your remittance service financial projections with precise break-even insights that drive strategic growth and profitability.

Top Revenue

In building a money transfer business model, revenue forecasting is critical to accurate financial modeling for money transfer services. Effective financial planning hinges on reliable revenue forecasts that incorporate growth rate assumptions grounded in historical data. Our three-statement financial model template integrates comprehensive elements of digital money transfer financial planning, enabling precise revenue forecasts for international payments. This approach supports robust financial valuation of remittance services, ensuring your payment platform’s profit and loss model reflects realistic income streams and drives strategic growth decisions.

Business Top Expenses Spreadsheet

The money transfer startup financial template organizes expenses into four categories, including a flexible “Other” section for additional data input. This comprehensive financial model supports detailed financial forecasting for payment platforms over a five-year horizon. Designed to enhance digital money transfer financial planning, it enables precise budgeting and expense modeling for remittance services. By leveraging this Excel-based tool, businesses can refine their cross-border payment financial analysis and optimize their international money transfer cash flow model, ensuring robust financial metrics and accurate revenue forecasts for scalable growth.

MONEY TRANSFER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

To succeed in the money transfer business, precise financial modeling and planning are crucial. Our money transfer financial model offers robust pro-forma templates designed for startups, enabling clear tracking of funding versus expenditures. By focusing on start-up costs and ongoing budgeting, this model supports accurate financial forecasting and cash flow management. Utilize our three-way financial model tailored for international payments and remittance services to optimize expense control and avoid financial pitfalls, ensuring sustainable growth and profitability in your money transfer venture.

CAPEX Spending

Capital expenditures (CAPEX) form a critical part of the startup budget, driving the growth of money transfer businesses. Utilizing a comprehensive 3-year financial projection template enables precise capital expenditure forecasting, essential for effective financial planning and cash flow management. In financial modeling for money transfer services, such detailed forecasting supports budgeting, revenue forecasting for international payments, and expense modeling—empowering remittance companies to optimize their financial performance and scale-up confidently. This approach ensures robust financial assumptions and insightful metrics, making it an indispensable tool for money transfer startups aiming for sustainable success.

Loan Financing Calculator

Our comprehensive financial model for money transfer businesses features an integrated loan amortization schedule, designed with advanced algorithms to detail each installment’s breakdown of principal and interest. This essential component supports accurate financial forecasting for payment platforms and enhances budgeting for money transfer businesses. By incorporating this amortization plan, firms gain clear visibility into repayment timelines, ensuring robust cash flow management and informed financial planning for scale-up and international money transfer operations.

MONEY TRANSFER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Streamline your money transfer startup’s financial planning with this comprehensive Excel template. Designed for financial modeling of money transfer services, it tracks key metrics like EBITDA, cash flows, and cash balance, providing clear visibility into operational performance and liquidity. Ideal for budgeting, revenue forecasting, and transaction-based financial modeling over 24 months to 5 years. Empower your cross-border payment financial analysis and scale-up financial model with accurate, easy-to-use tools tailored for remittance services and digital payment platforms. Make data-driven decisions with confidence and optimize your money transfer profit and loss model effectively.

Cash Flow Forecast Excel

A robust international money transfer cash flow model is essential for effective financial planning. It enables precise allocation of funds, ensuring timely payment of salaries and efficient management of operational expenses. Incorporating this within your financial modeling for money transfer services enhances budgeting accuracy and supports sustainable business growth. Leveraging transaction-based financial modeling and financial forecasting for payment platforms ensures your remittance service financial projections remain realistic and actionable, driving profitability and scalability in a competitive market.

KPI Benchmarks

The 5-year financial model includes a benchmark tab that calculates essential key indicators to validate your money transfer business model. These metrics are compared with industry peers to provide a clear cross-border payment financial analysis and assess performance effectively. This comparative approach is crucial for remittance services and money transfer startups, enabling accurate financial forecasting and strategic planning. By leveraging these benchmarked financial assumptions and metrics, companies can optimize decision-making, streamline budgeting, and enhance their digital money transfer financial planning for sustained growth and profitability.

P&L Statement Excel

Monthly financial forecasting for money transfer businesses is essential for maximizing profits by closely monitoring revenues and expenses. Utilizing a profit and loss financial model tailored for remittance services enables startups to gain clear insights into cash flow, costs, and profitability. This transaction-based financial modeling, supported by comprehensive financial assumptions and projections, empowers entrepreneurs to plan strategically and scale operations. Leveraging an international money transfer cash flow model or a payment processing financial statement model ensures effective budgeting and performance assessment, ultimately driving sustainable growth in the competitive cross-border payment landscape.

Pro Forma Balance Sheet Template Excel

A projected balance sheet is a crucial component of any money transfer business model, intricately linked with profit and loss forecasts and cash flow models. In financial modeling for money transfer services, especially startups, the balance sheet provides key insights into financial health and supports accurate cash flow projections. A detailed 5-year forecast enables investors to assess profitability through metrics like return on equity and return on invested capital. Incorporating this into remittance service financial projections ensures realistic financial assumptions and strengthens overall digital money transfer financial planning and valuation efforts.

MONEY TRANSFER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This financial projection Excel template includes a comprehensive valuation report feature, enabling users to conduct Discounted Cash Flow (DCF) analysis effortlessly. By inputting key rates in the Cost of Capital, money transfer businesses can accurately assess their financial valuation. Ideal for financial modeling of money transfer services, this tool supports detailed cash flow modeling, revenue forecasting for international payments, and robust financial planning. Perfect for startups and established remittance firms alike, it streamlines budgeting, expense modeling, and profit and loss projections, empowering smarter financial decisions in payment processing and cross-border payment financial analysis.

Cap Table

The equity cap table is essential for accurately assessing shareholder ownership dilution within your money transfer business model. Our comprehensive financial template features up to four funding rounds, allowing you to incorporate one or multiple rounds into your financial forecasting for payment platforms. This flexible structure supports precise financial modeling for money transfer services, enabling robust planning and informed decision-making throughout your startup’s growth and scale-up phases.

MONEY TRANSFER FINANCIAL FORECAST TEMPLATE ADVANTAGES

Effortlessly plot startup loan repayments using our money transfer financial model for precise financial projections in Excel.

Effortlessly optimize growth and profitability using a comprehensive money transfer financial model for precise cash flow forecasting.

Unlock strategic growth with a money transfer financial model that drives precise forecasting and maximizes revenue opportunities.

Empower your startup with a money transfer financial model that drives accurate forecasting and strategic growth decisions.

The financial model empowers proactive problem-solving by forecasting challenges early in your money transfer business operations.

MONEY TRANSFER BUSINESS PLAN EXCEL TEMPLATE ADVANTAGES

Unlock growth potential with a dynamic financial model tailored for scalable, profitable money transfer businesses and startups.

Financial modeling reveals optimal growth strategies by projecting cash flow impacts of funding and operational scenarios.

Our financial model for money transfer services saves you time by streamlining accurate forecasting and budgeting processes.

The money transfer financial model streamlines budgeting, boosting focus on growth and customer engagement effortlessly.

Identify potential cash shortfalls early with our precise financial model, ensuring smooth operations and informed decision-making.

The financial model acts as an early warning system, ensuring precise cash flow forecasting for money transfer startups.

Optimize growth and profitability with precise financial modeling for international money transfer services and key metrics analysis.

Accelerate growth with our 5-year money transfer financial model delivering dynamic forecasts and GAAP/IFRS-compliant proformas instantly.

Optimize your money transfer business with precise financial modeling for accurate forecasting and scalable growth strategies.

Maximize funding success with a precise 5-year money transfer financial model, showcasing clear projections and investor confidence.