Mortgage Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Mortgage Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Mortgage Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MORTGAGE BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly mortgage bank valuation model designed for comprehensive financial modeling for mortgage banks, including detailed mortgage bank revenue forecast, mortgage banking cash flow model, and loan portfolio financial projection. This all-in-one mortgage bank financial projection tool facilitates mortgage bank profitability analysis, interest rate impact modeling, and mortgage bank expense forecasting, ideal for both startup and established mortgage banking businesses. The model also incorporates mortgage underwriting financial model components, mortgage servicing financial model features, and mortgage bank balance sheet forecast, allowing for in-depth mortgage bank risk assessment model and scenario analysis mortgage bank to support strategic decision-making. Unlocked for full customization, this mortgage bank financial model excel pro forma template is essential before purchasing a mortgage bank financial model business.

The ready-made mortgage bank financial model Excel template effectively alleviates common pain points by offering comprehensive financial modeling for mortgage banks, including detailed mortgage bank revenue forecast and mortgage banking cash flow model features that ensure accurate loan portfolio financial projections and mortgage bank profitability analysis. It integrates critical tools such as interest rate impact model mortgage and mortgage bank risk assessment model to anticipate market fluctuations and credit risks, while its financial statement modeling mortgage and mortgage bank balance sheet forecast streamline complex data into actionable insights. Additionally, the template addresses operational challenges through mortgage bank expense forecasting, debt structuring model mortgage, and mortgage servicing financial model, enabling users to manage capital requirements mortgage bank and conduct scenario analysis mortgage bank with ease. This cohesive financial plan also incorporates mortgage loan amortization model and mortgage underwriting financial model components, providing a robust investment banking model mortgage framework that simplifies mortgage bank cost analysis model and loan origination financial model for faster, more reliable decision-making.

Description

This comprehensive mortgage bank valuation model incorporates financial modeling for mortgage banks with detailed loan portfolio financial projections and mortgage bank revenue forecasts, enabling precise mortgage bank profitability analysis. It integrates mortgage banking cash flow models alongside mortgage loan amortization and debt structuring models to assess capital requirements and expense forecasting accurately. The model also includes scenario analysis mortgage bank tools and mortgage bank risk assessment models, allowing users to evaluate the interest rate impact model mortgage and perform mortgage underwriting financial model assessments. Additionally, it features mortgage servicing financial models and mortgage bank balance sheet forecasts, streamlining mortgage bank cost analysis modeling and loan origination financial model processes for a thorough investment banking model mortgage approach.

MORTGAGE BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a robust mortgage bank valuation model with our comprehensive financial modeling solutions. Whether you need mortgage bank revenue forecasts, loan portfolio financial projections, or mortgage banking cash flow models, our tools provide precise insights. Navigate mortgage bank profitability analysis, interest rate impact models, and risk assessment frameworks effortlessly. Streamline your mortgage underwriting financial models and debt structuring strategies while optimizing capital requirements and expense forecasting. Empower your mortgage bank’s financial statement modeling, balance sheet forecasts, and scenario analyses with our expert-designed templates—perfect for driving informed decisions and sustainable growth.

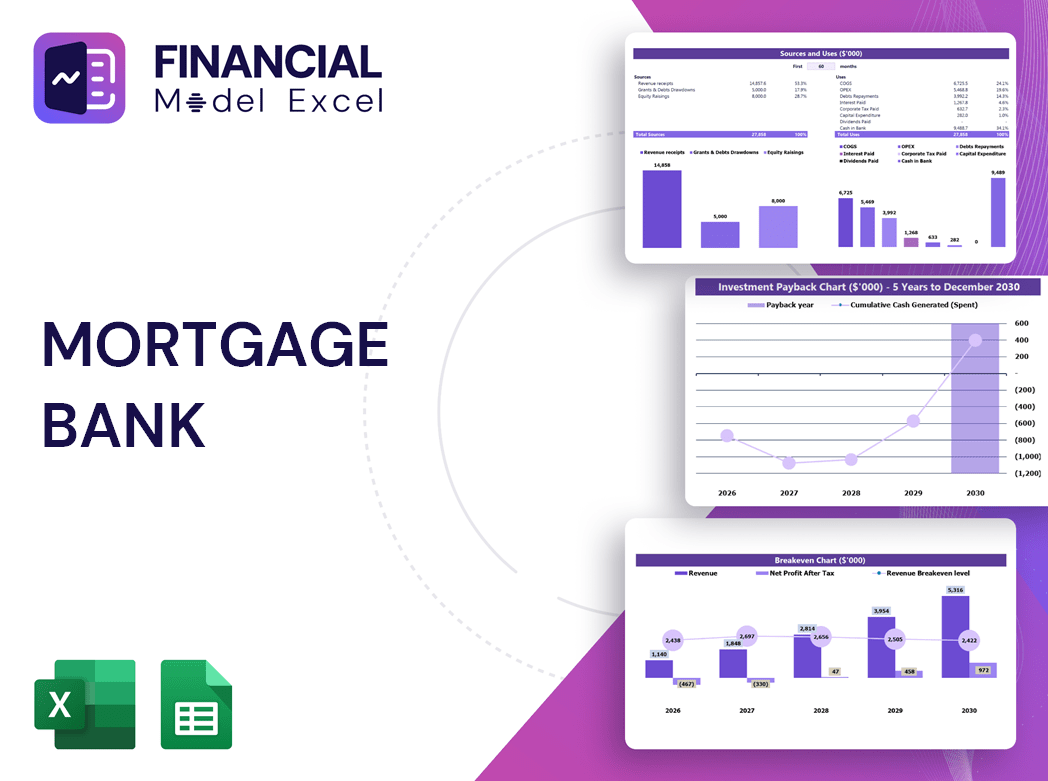

Dashboard

By integrating detailed data into our mortgage bank valuation model, you’ll quickly develop a robust pro forma financial statements template. Leveraging built-in scenario analysis and mortgage bank revenue forecast tools, you can strategically optimize your loan portfolio financial projections and mortgage bank profitability analysis. The intuitive dashboard features dynamic charts and graphs, enhancing mortgage banking cash flow model insights and expense forecasting. Harness this comprehensive financial modeling for mortgage banks to elevate your business plan, attract investors, and confidently navigate interest rate impact models and capital requirements with precision.

Business Financial Statements

This comprehensive mortgage bank valuation model integrates detailed financial statement modeling, combining projected profit and loss, balance sheet forecasts, and mortgage banking cash flow analysis. Designed for startups, it seamlessly links financial data inputs across spreadsheets, supporting robust mortgage bank revenue forecasting and profitability analysis. Utilize this model for precise loan portfolio financial projections, mortgage bank expense forecasting, and capital requirements assessments, ensuring effective scenario analysis and risk management within your mortgage banking operations.

Sources And Uses Statement

The sources and uses of cash statement within a mortgage bank financial modeling framework offers a clear view of cash inflows and outflows, highlighting key financial sources and expenditures. Essential for mortgage bank revenue forecasting and loan portfolio financial projections, this statement is critical for start-ups to ensure effective capital management. Integrating it with mortgage bank cash flow models and expense forecasting enhances accuracy in profitability analysis and risk assessment, enabling informed decision-making and robust financial planning in dynamic interest rate environments.

Break Even Point In Sales Dollars

This mortgage bank financial model features a comprehensive five-year break-even analysis, presented through detailed numeric calculations and an intuitive chart. Designed for in-depth mortgage bank profitability analysis, it integrates seamlessly with mortgage bank revenue forecast and expense forecasting modules. Ideal for scenario analysis and risk assessment, this model empowers strategic decision-making in loan portfolio financial projection, debt structuring, and capital requirements planning—ensuring a robust foundation for sustained growth and financial stability.

Top Revenue

In mortgage banking, mastering financial modeling for mortgage banks—such as mortgage bank valuation models and revenue forecasts—is essential. Topline growth, reflected in mortgage bank balance sheet forecasts and loan portfolio financial projections, drives enhanced profitability and sustained cash flow. Stakeholders rely on comprehensive mortgage bank profitability analysis and mortgage banking cash flow models to track quarterly and annual trends. Effective use of mortgage bank expense forecasting and interest rate impact models ensures proactive management of financial performance, reinforcing the company’s robust bottom line and positioning it for long-term success.

Business Top Expenses Spreadsheet

The Top Expenses tab in our mortgage bank financial modeling tool offers a streamlined approach to expense analysis. Expenses are categorized into four key segments plus a customizable 'Other' category, enabling precise tracking aligned with your mortgage bank’s unique cost structure. This feature enhances mortgage bank expense forecasting and supports comprehensive mortgage bank profitability analysis, ensuring you maintain clear visibility on all financial outflows within your loan portfolio financial projection. Perfect for optimizing your mortgage bank balance sheet forecast and driving smarter financial decisions.

MORTGAGE BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs accrue before operations launch, making early monitoring vital to prevent overspending or underfunding. Our mortgage bank financial modeling tool features a dedicated proforma for start-up costs, integrating funding and expenses seamlessly. This enables precise expense tracking and effective cost budgeting within your mortgage bank revenue forecast and loan portfolio financial projection. Stay ahead with comprehensive mortgage bank cost analysis and ensure a solid financial foundation from day one.

CAPEX Spending

In mortgage banking, integrating CapEx into a 5-year mortgage bank cash flow model is critical for startups and growth-oriented firms investing in PP&E, new technologies, or product lines. These capital expenditures significantly influence the mortgage bank revenue forecast and loan portfolio financial projections. Accurate inclusion of CapEx within the mortgage bank balance sheet forecast ensures robust financial modeling for mortgage banks. While CapEx impacts the projected balance sheet, its effect on immediate cash flow is often minimal. This nuanced approach supports comprehensive mortgage bank profitability analysis and informed capital requirements planning.

Loan Financing Calculator

Start-ups and growing companies often rely on loans to scale, making a robust mortgage bank valuation model essential. Integrating a mortgage loan amortization model within financial modeling for mortgage banks ensures accurate tracking of repayment schedules, interest impact, and debt structuring. This 5-year loan portfolio financial projection seamlessly feeds into mortgage banking cash flow models, balance sheet forecasts, and profitability analysis, enabling precise mortgage bank revenue forecasts and risk assessment. By aligning repayment data with expense forecasting and capital requirements models, businesses gain clear insights into financial health, empowering strategic decisions that drive sustainable growth and optimize mortgage bank performance.

MORTGAGE BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The mortgage bank valuation model features a detailed proforma chart outlining monthly revenue across five core products by default. Built for flexibility, this financial modeling for mortgage banks allows you to customize product offerings and adjust analysis periods to suit your loan portfolio financial projection needs. Ideal for mortgage bank revenue forecast and expense forecasting, it supports comprehensive mortgage bank profitability analysis and scenario analysis, empowering strategic decision-making with precision and clarity.

Cash Flow Forecast Excel

A robust mortgage banking cash flow model is essential for accurately forecasting financial activities, especially regarding loan portfolios and capital raising. Integrating mortgage bank revenue forecasts and expense forecasting ensures comprehensive financial planning. Utilizing scenario analysis and mortgage bank risk assessment models further enhances decision-making, helping you optimize profitability and meet capital requirements. By leveraging advanced financial modeling for mortgage banks, you can secure a clear path to sustainable growth and success.

KPI Benchmarks

The mortgage bank valuation model’s benchmark tab is essential for analyzing financial performance across similar institutions. By averaging key metrics, it enables comprehensive mortgage bank profitability analysis and mortgage bank revenue forecasts. This insight is crucial for startups, providing clarity on financial capabilities and guiding mortgage bank expense forecasting, capital requirements, and loan portfolio financial projections. Utilizing these benchmarks supports robust financial modeling for mortgage banks, aiding in strategic planning, risk assessment, and scenario analysis to drive sustainable growth and informed decision-making from day one.

P&L Statement Excel

Our mortgage bank valuation model streamlines complex financial modeling for mortgage banks, simplifying revenue forecasts, cash flow analysis, and profitability assessments. Equipped with built-in formulas, it delivers precise mortgage bank balance sheet forecasts, loan portfolio financial projections, and interest rate impact models. This comprehensive tool enhances mortgage bank risk assessment, cost analysis, and capital requirement planning, empowering you to identify weak spots and optimize profitability with clear reports and charts. Transform your mortgage banking decisions with an intuitive, scenario-driven financial statement modeling solution tailored for success.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet is a critical component of your mortgage bank valuation model, detailing key assets—including loan security, buildings, and equipment—alongside liabilities and capital at a specific date. Investors and banks expect a comprehensive 5-year mortgage bank balance sheet forecast, typically in Excel, highlighting loan portfolio financial projections. This essential financial statement supports mortgage bank profitability analysis and risk assessment models, ensuring clear visibility into your institution’s financial health and capital requirements over time.

MORTGAGE BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our mortgage bank valuation model integrates advanced financial modeling techniques, including discounted cash flow (DCF) and weighted average cost of capital (WACC), to deliver precise revenue forecasts and profitability analysis. This comprehensive approach enhances mortgage bank cash flow modeling and balance sheet forecasting, empowering lenders to evaluate loan portfolio performance and assess risk effectively. Designed for accurate mortgage banking expense forecasting and capital requirements planning, our model supports insightful scenario analysis, ensuring informed decision-making and optimized financial outcomes in a dynamic interest rate environment.

Cap Table

A comprehensive mortgage bank valuation model integrates financial modeling for mortgage banks to deliver precise mortgage bank revenue forecasts and loan portfolio financial projections. By incorporating mortgage banking cash flow models, interest rate impact analysis, and mortgage bank risk assessment models, institutions can optimize profitability and manage capital requirements effectively. Advanced scenario analysis and mortgage bank expense forecasting further enhance decision-making, supporting robust mortgage bank balance sheet forecasts and debt structuring strategies. This holistic approach drives accurate mortgage bank profitability analysis, ensuring confident, data-driven growth in a dynamic lending environment.

MORTGAGE BANK 5 YEAR FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

The mortgage bank revenue forecast model enables precise cash flow predictions, optimizing financial strategy and profitability.

Enhance mortgage bank profitability analysis with a dynamic three-statement financial model supporting 161 currencies for global precision.

Optimize profitability and manage risks effectively with a comprehensive mortgage bank financial modeling solution.

Create flexible 5-year financial models in Excel to enhance mortgage bank profitability analysis and risk assessment accuracy.

The mortgage bank financial model enables precise tracking of spending to optimize profitability and ensure financial accuracy.

MORTGAGE BANK FINANCIAL EXCEL TEMPLATE ADVANTAGES

Optimize mortgage bank profitability with our easy-to-follow financial modeling for accurate revenue forecasts and risk assessments.

Optimize decision-making with a clear, color-coded mortgage bank financial model featuring detailed, transparent projections and analyses.

Our mortgage bank valuation model delivers precise financial projections, maximizing profitability and minimizing risk effectively.

Optimize decision-making with a mortgage bank revenue forecast delivering precise projections tailored to your currency and scale.

Optimize funding success with a precise mortgage bank valuation model delivering clear revenue forecasts and risk assessments.

Impress investors with a strategic mortgage bank financial model that ensures accurate forecasts and maximizes profitability.

Optimize decisions with our mortgage bank valuation model, accurately predicting the influence of upcoming market changes.

Financial modeling for mortgage banks enables precise scenario analysis to optimize cash flow and maximize profitability forecasts.

Our mortgage bank valuation model saves you time by delivering precise financial projections and profitability insights effortlessly.

Financial modeling for mortgage banks accelerates decision-making, boosting profitability and optimizing risk management efficiently.