Office Acquisition Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Office Acquisition Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Office Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

OFFICE ACQUISITION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year office acquisition financial modeling plan is designed for startups and entrepreneurs aiming to impress investors and secure funding. It features key financial charts, summaries, and detailed office acquisition financial projections to support informed decision-making before purchasing. The integrated office acquisition valuation model, cash flow model, and scenario analysis provide robust insights, while the office acquisition budgeting model and expense modeling ensure accurate cost control. Fully editable and tailored for effective office acquisition investment modeling, this tool streamlines due diligence and deal structuring for successful office acquisitions.

The office acquisition financial modeling template effectively alleviates common pain points by providing a comprehensive and customizable framework that integrates detailed office acquisition financial analysis, valuation, and cash flow projections, allowing users to confidently assess investment viability and optimize deal structuring. This ready-made excel model streamlines budgeting, expense modeling, and return on investment calculations, enabling precise office acquisition forecasting and scenario analysis with dynamic assumptions that adjust financial projections in real time. By incorporating robust due diligence and profitability models, the template reduces manual errors and accelerates decision-making processes, offering clear visibility into asset valuation and financing options while supporting thorough office acquisition merger financial modeling and overall financial planning needs in a user-friendly format.

Description

The office acquisition financial modeling template is expertly designed to support startups and established companies with a comprehensive office acquisition pro forma model that integrates multiple revenue streams and expense categories, allowing detailed office acquisition cash flow modeling and office acquisition expense modeling. This dynamic office acquisition financial analysis tool offers robust scenario analysis and forecasting capabilities, enabling users to make informed decisions on office acquisition deal structuring, budgeting, and financing while providing accurate office acquisition return on investment modeling, asset valuation, and profitability projections for long-term adaptability and strategic planning.

OFFICE ACQUISITION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

We developed a fully modular office acquisition financial modeling template that integrates core components: acquisition valuation, cash flow, budgeting, and deal structuring models. Featuring dynamic forecasting, scenario analysis, and investment projections, this Excel tool allows seamless customization of inputs and assumptions. Its transparent structure supports extending financial projections and integrating specialized due diligence or profitability models. All cells and formulas remain unlocked, empowering you to tailor every aspect of the office acquisition financial plan to your strategic needs.

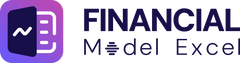

Dashboard

Our office acquisition financial modeling dashboard streamlines complex analysis by automatically generating key financial projections, including revenue forecasts, cash flow, and profitability metrics. This dynamic tool transforms data into clear charts and graphs, enhancing communication with stakeholders. Integrating the office acquisition pro forma model and cash flow model, it supports precise expense modeling and asset valuation, enabling informed decision-making throughout due diligence, deal structuring, and investment planning. Elevate your financial planning with this comprehensive office acquisition financial analysis resource for confident, data-driven insights.

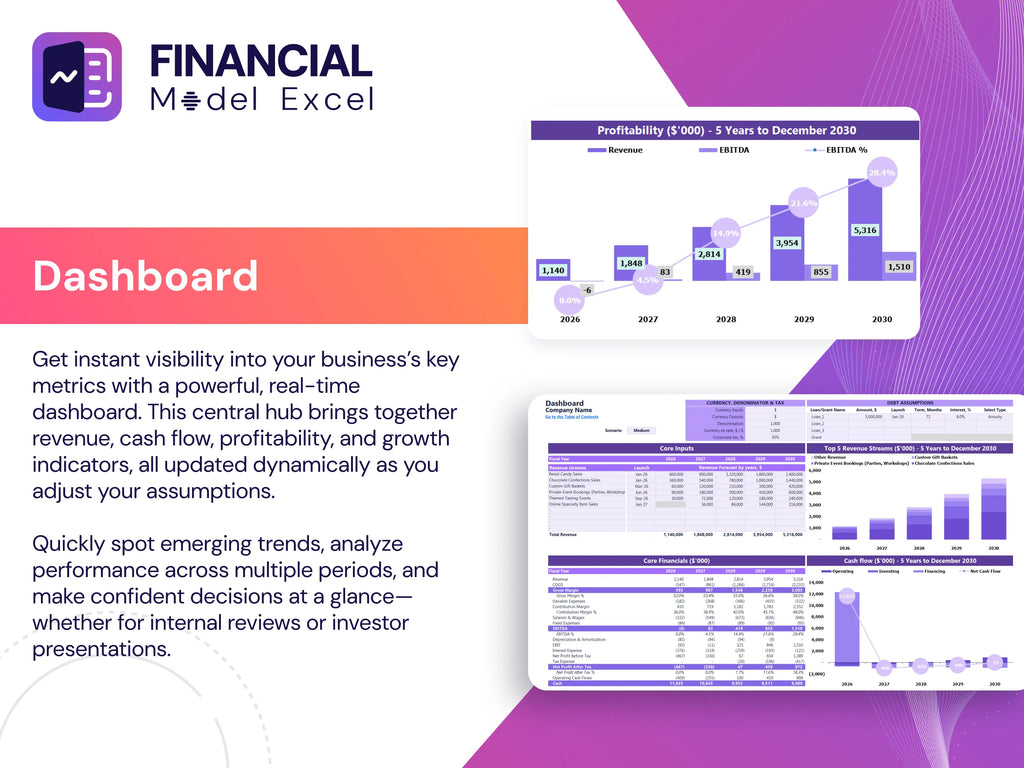

Business Financial Statements

Our office acquisition financial modeling tool seamlessly generates essential annual financial statements, fully integrated with your core assumptions. By simply updating inputs, the model dynamically adjusts to provide accurate financial projections, enhancing your due diligence and investment analysis. This comprehensive office acquisition pro forma model ensures precise budgeting, cash flow forecasting, and return on investment evaluation—empowering informed decision-making throughout your acquisition process.

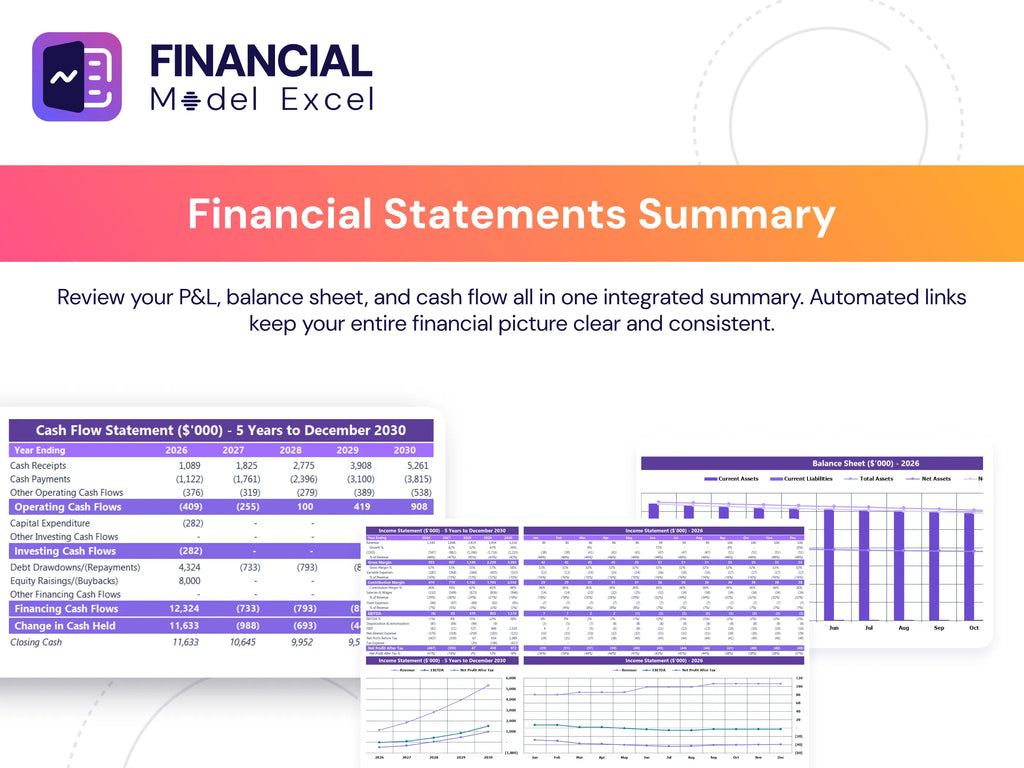

Sources And Uses Statement

The Sources and Uses of Cash tab within the office acquisition financial projections model offers a clear overview of total funding and its structure, alongside detailed expense modeling. This essential tool enables precise tracking of investor fund allocation, ensuring transparency and strategic financial planning. Crucial for successful deal structuring and due diligence, it empowers stakeholders to monitor spending, optimize budgeting, and forecast cash flow effectively—driving informed decisions throughout the office acquisition process.

Break Even Point In Sales Dollars

Our office acquisition financial modeling tools provide comprehensive break-even analysis, integrating fixed and variable costs with revenue projections. Utilizing a sophisticated office acquisition cash flow and budgeting model, we graphically and mathematically determine the break-even sales volume needed to cover total expenses. This empowers investors with precise insights on when an acquisition will achieve positive returns, supporting informed decision-making through our office acquisition return on investment model and financial projections. Trust our office acquisition investment and scenario analysis models to optimize deal structuring and enhance profitability.

Top Revenue

The Top Revenue tab in the office acquisition financial modeling template offers a detailed breakdown of your company’s revenue by product, enhancing clarity for stakeholders. Complementing this, the five-year office acquisition financial projections deliver an annual revenue analysis, highlighting total revenue streams alongside comprehensive revenue bridges. Together, these models empower precise office acquisition financial planning and forecasting, facilitating informed decision-making and optimized investment strategies.

Business Top Expenses Spreadsheet

The top expenses tab within the office acquisition financial modeling template offers a comprehensive overview of all costs, highlighting the four largest expenses for quick insights. This detailed office acquisition financial projections and expense modeling feature breaks down costs such as customer acquisition and fixed expenses. By clearly identifying and analyzing your spending through the office acquisition budgeting and cost analysis model, you empower strategic financial planning and enhance overall profitability. Efficient expense management is key to maximizing your office acquisition return on investment model and ensuring long-term financial success.

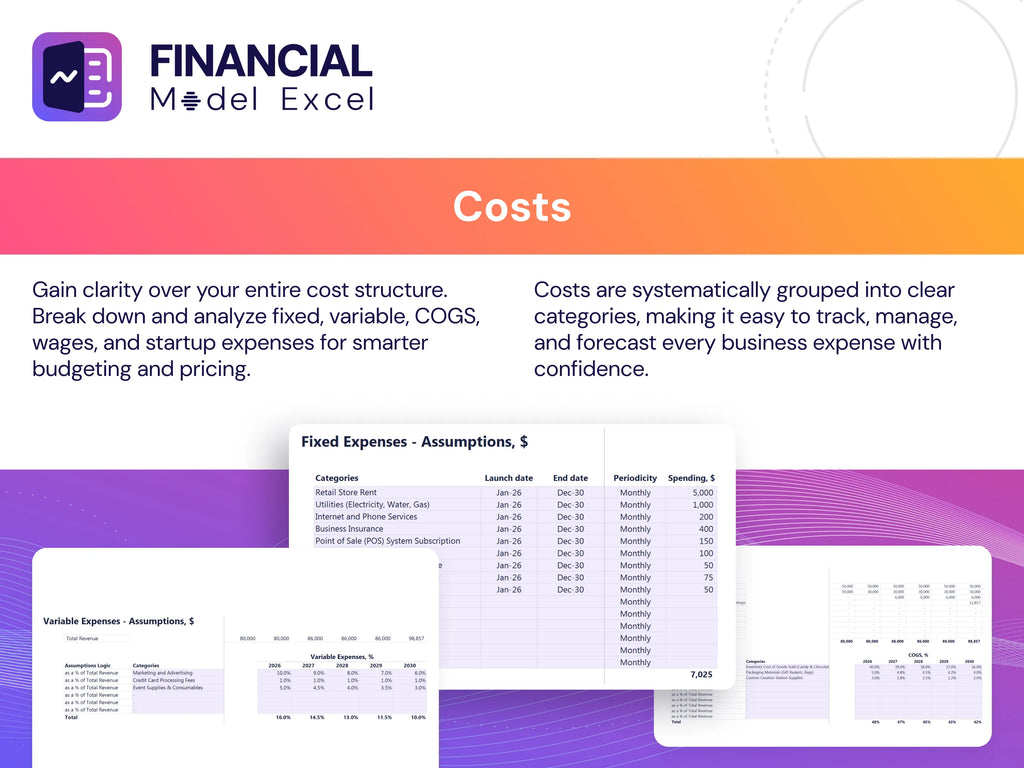

OFFICE ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effortlessly monitor all full-time and part-time employee salary costs with our streamlined office acquisition budgeting model. Designed for both individual and group financial planning, it seamlessly integrates with your office acquisition financial projections. Our interconnected office acquisition financial modeling ensures automatic data flow throughout your entire pro forma model, eliminating manual updates. Save time on data entry and focus on optimizing your office acquisition investment model and deal structuring. Experience precise expense modeling and robust scenario analysis that empowers smarter office acquisition financial analysis and enhances overall profitability forecasting.

CAPEX Spending

The office acquisition financial projections provide a comprehensive framework for evaluating capital expenditures related to asset acquisition, ensuring significant future value. Utilizing advanced office acquisition cash flow models and cost analysis models, professionals can accurately forecast long-term growth and development prospects. These tools enable precise capital cost analysis and support effective office acquisition budgeting and financial planning. Distinguishing capital expenditures from depreciation and standard financial reports is crucial for insightful office acquisition financial analysis and informed decision-making during due diligence and deal structuring processes.

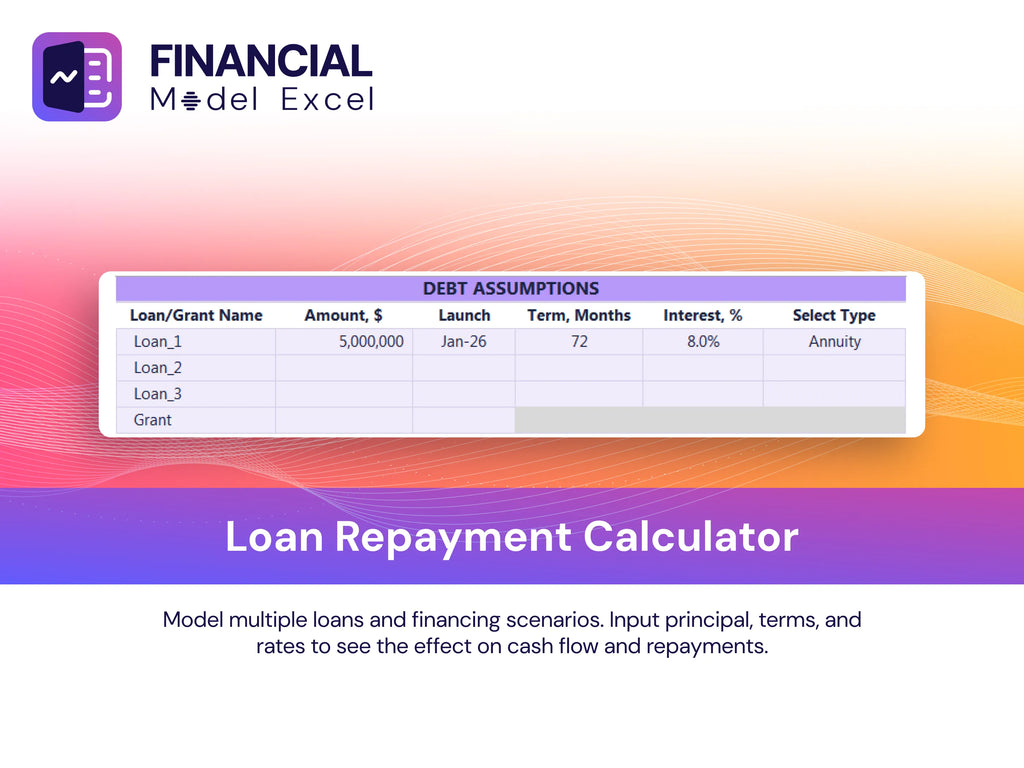

Loan Financing Calculator

Effective loan repayment schedules are crucial for startups and growing companies, as they detail principal amounts, terms, maturity, and interest rates. These schedules directly impact cash flow analysis and play a vital role in office acquisition financial modeling. Monitoring repayments enhances accuracy in cash flow forecasting models and reflects on the balance sheet, informing office acquisition budgeting and expense modeling. Integrating loan schedules within office acquisition financial projections ensures comprehensive financial planning, supporting informed investment decisions and optimizing return on investment models for sustained growth.

OFFICE ACQUISITION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

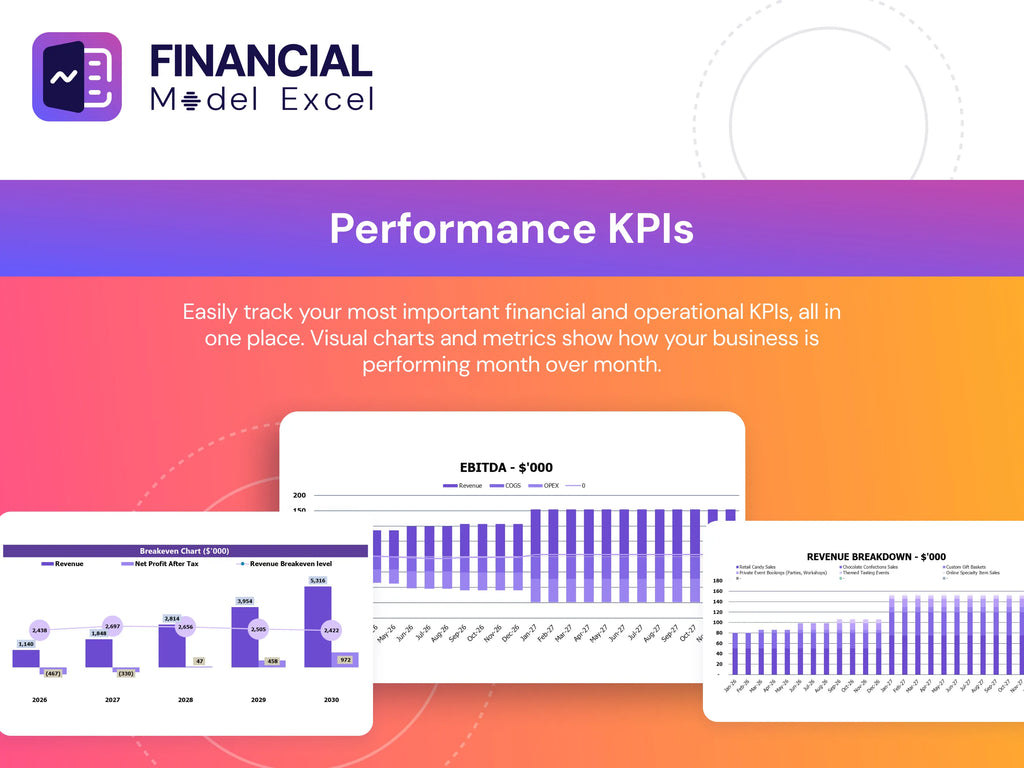

Financial KPIs

A gross profit margin, derived from office acquisition financial modeling, is a key indicator of profitability. It measures efficiency by dividing gross profit by net sales within your office acquisition financial projections. Utilizing office acquisition profitability and cash flow models ensures accurate assessment, empowering informed decision-making. This metric is essential in office acquisition valuation models and scenario analysis to optimize investment strategies and enhance returns.

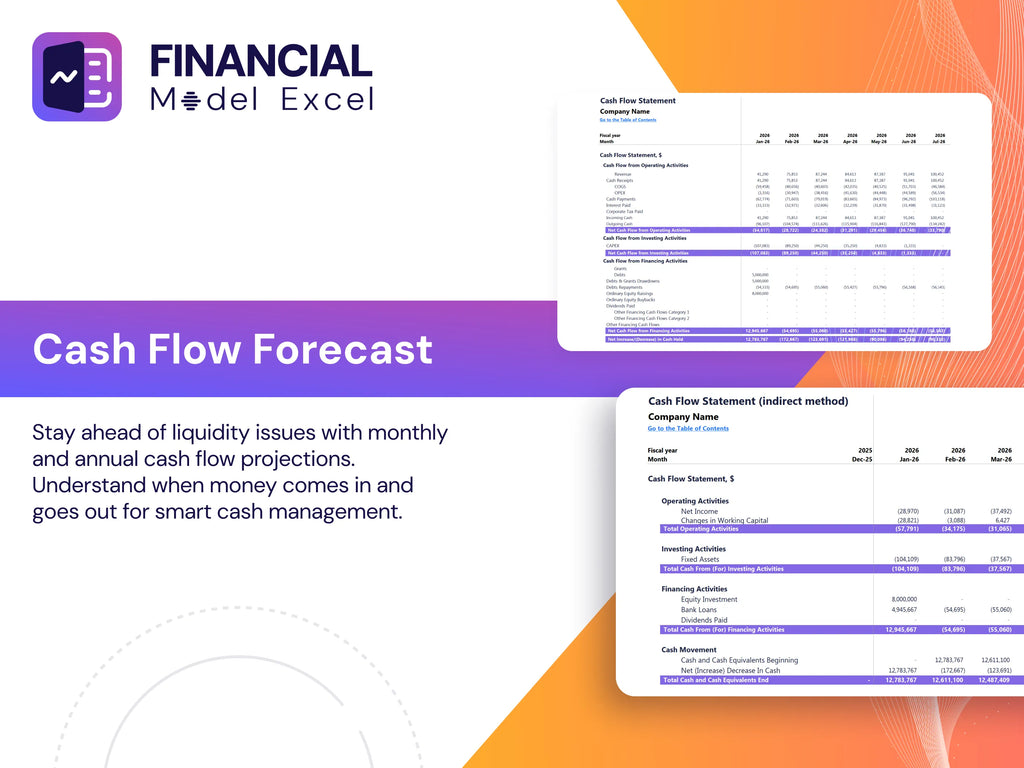

Cash Flow Forecast Excel

The office acquisition cash flow model offers precise tracking of cash inflows and outflows, critical for understanding liquidity beyond standard profit and loss projections. Unlike P&L templates that include non-cash expenses, this fully integrated financial model excels in cash flow forecasting, providing detailed monthly and annual projections for up to five years. Designed for comprehensive office acquisition financial analysis, it supports budgeting, investment valuation, and scenario analysis—empowering decision-makers with accurate financial planning and robust return on investment insights throughout the acquisition process.

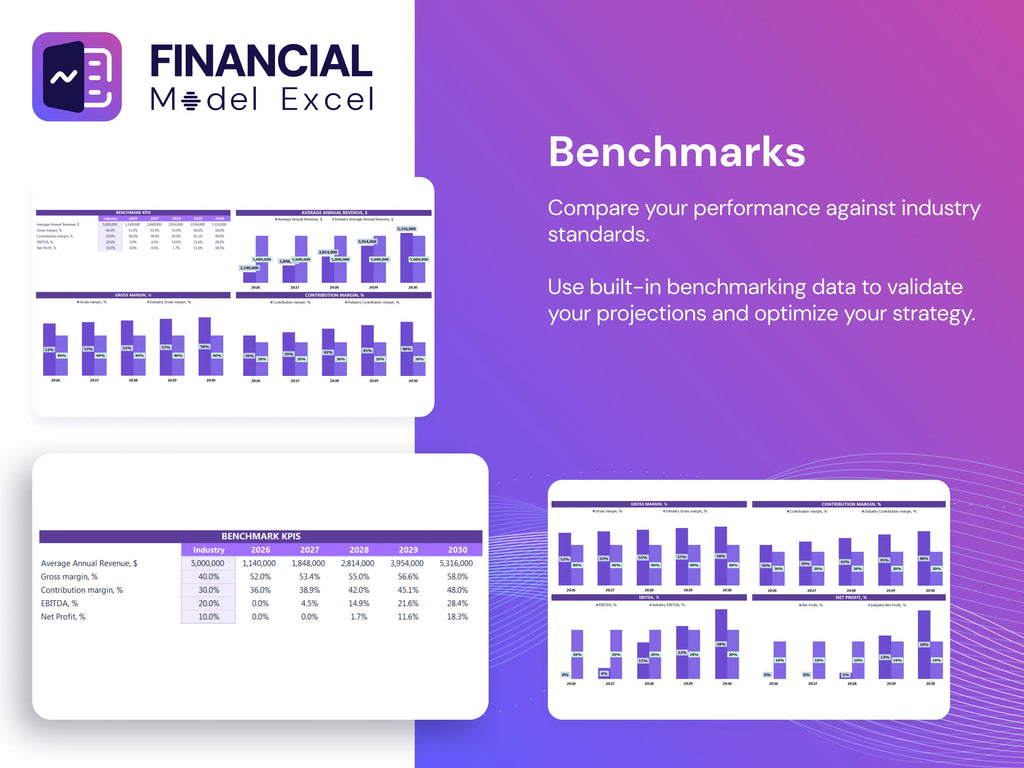

KPI Benchmarks

Leverage our office acquisition financial modeling tool featuring a dedicated benchmarking tab to conduct precise financial and operational comparisons. By analyzing key indicators from comparable industry players, users can evaluate their company's competitiveness, productivity, and profitability. This office acquisition benchmarking model empowers informed decision-making by highlighting strengths and identifying improvement areas within the same market, enhancing strategic planning and investment confidence.

P&L Statement Excel

The office acquisition pro forma profit and loss model is crucial for accurately capturing financial performance and monetory outcomes. However, relying solely on a P&L statement overlooks key components like assets, liabilities, and cash flow dynamics. Integrating an office acquisition cash flow model alongside the P&L ensures comprehensive financial projections. This holistic approach enhances the accuracy of office acquisition financial analysis, valuation, and return on investment modeling, enabling informed decision-making and robust deal structuring for successful office acquisitions.

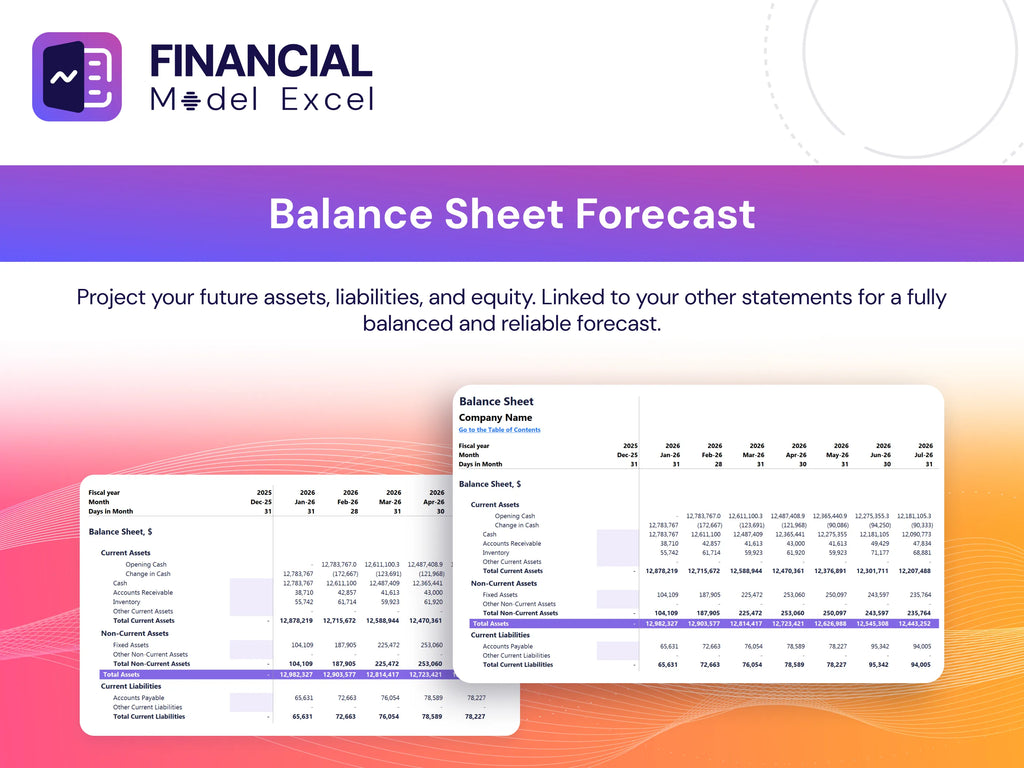

Pro Forma Balance Sheet Template Excel

An effective office acquisition financial modeling tool is essential for comprehensive business planning. This model provides detailed insights into current and long-term assets, liabilities, and shareholders’ equity, enabling precise office acquisition financial analysis. Utilizing an office acquisition pro forma model enhances accuracy in forecasting cash flows, budgeting, and investment returns. Incorporating this data is crucial for due diligence, scenario analysis, and valuation, ensuring informed decision-making and optimized deal structuring. A robust office acquisition financial planning model empowers stakeholders to assess profitability and financing strategies with confidence, driving successful investment outcomes.

OFFICE ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

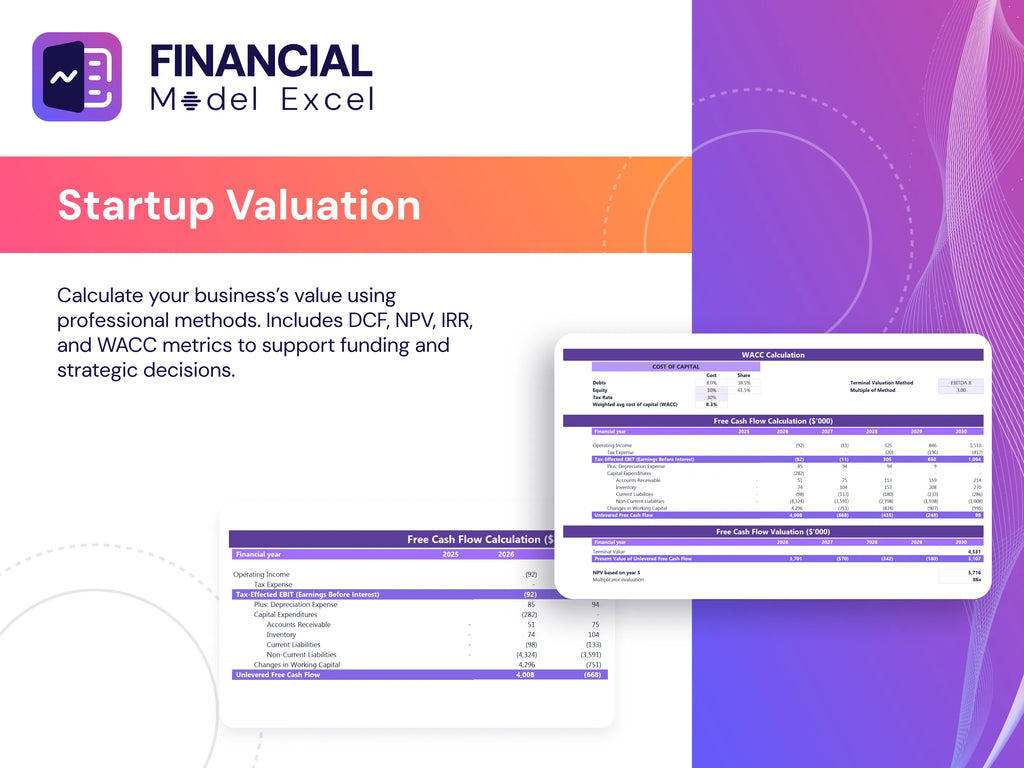

Startup Valuation Model

Utilize our comprehensive office acquisition valuation model, integrated with advanced cash flow and financial projections, to provide investors with precise data and insights. Incorporating weighted average cost of capital (WACC), this office acquisition financial modeling tool evaluates costs from equity, preferred stock, and debt sources. Coupled with a robust discounted cash flow (DCF) approach, it accurately estimates investment value based on expected future cash flows. This professional office acquisition financial analysis ensures effective deal structuring, budgeting, and scenario planning for confident, data-driven investment decisions.

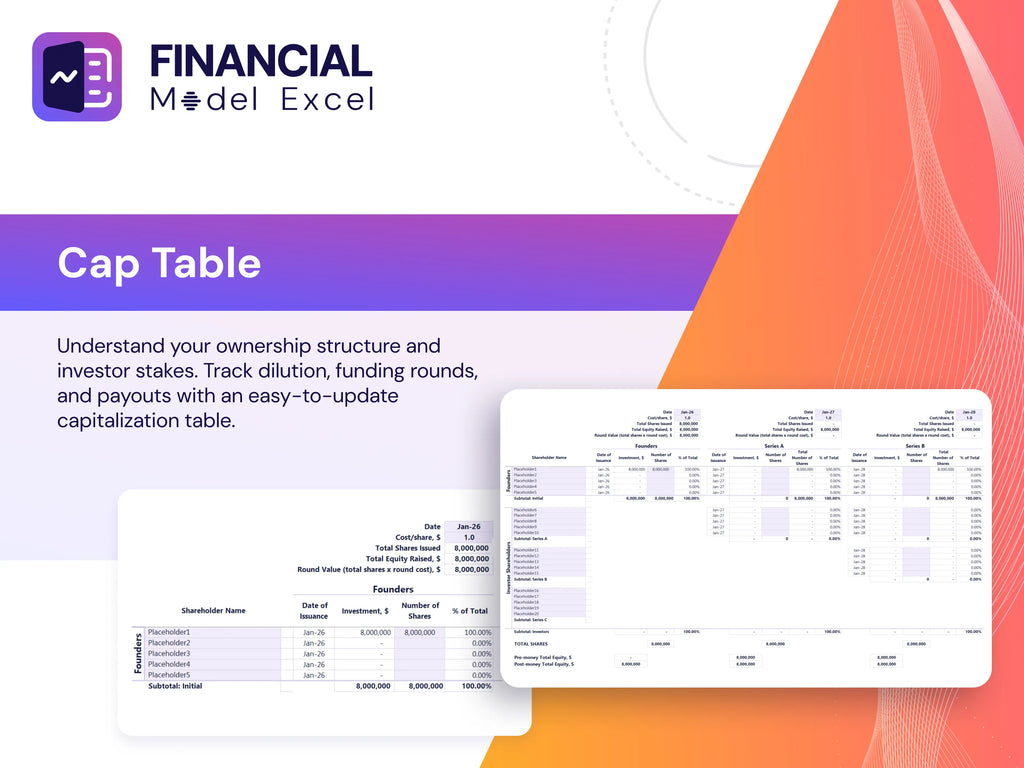

Cap Table

A comprehensive office acquisition financial model, including cap table analysis, is essential for understanding ownership structure and investor shares. This unified approach offers crucial insights into the company’s material potential, supporting effective office acquisition financial planning, valuation, and investment decisions. Leveraging detailed office acquisition pro forma and cash flow models ensures transparent financial projections and maximizes return on investment, empowering stakeholders with a holistic view of all financial components critical to successful office acquisition deal structuring and due diligence.

OFFICE ACQUISITION 5 YEAR FORECAST TEMPLATE ADVANTAGES

Office acquisition financial modeling enhances precise cash flow forecasting, optimizing investment decisions and maximizing returns efficiently.

Easily forecast cash flow and maximize returns using our comprehensive office acquisition financial modeling and projection tools.

Our office acquisition financial modeling enhances accuracy, streamlines budgeting, and optimizes investment decision-making for maximum returns.

The office acquisition financial modeling empowers precise expense and income comparisons, enhancing strategic investment decisions confidently.

Office acquisition financial projections enable proactive expense management, maximizing profitability and informed decision-making.

OFFICE ACQUISITION FINANCIAL PROJECTION MODEL EXCEL ADVANTAGES

Streamline decision-making and save time and money with our precise office acquisition financial modeling solutions.

Office acquisition financial modeling streamlines planning with no complex formulas, enabling focused, efficient business growth.

Our office acquisition forecasting model ensures precise financial projections, satisfying external stakeholders like banks with reliable forecasts.

The office acquisition financial model ensures accurate forecasts, satisfying lenders and optimizing investment decisions confidently.

Streamline your pitch with a precise office acquisition financial modeling tool that enhances accuracy and drives investor confidence.

Impress investors with a strategic office acquisition financial model that delivers accurate, insightful forecasts and maximizes investment returns.

Office acquisition financial modeling uncovers payment issues early, enhancing cash flow accuracy and investment confidence.

Office acquisition cash flow model accelerates debt collection by identifying unpaid invoices for timely financial action.

Run different scenarios with our office acquisition financial model to optimize investment decisions and maximize returns.

The office acquisition cash flow model enables dynamic scenario analysis for precise forecasting and informed financial decision-making.