Peer To Peer Lending Platform Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Peer To Peer Lending Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Peer To Peer Lending Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PEER TO PEER LENDING PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

The peer to peer lending platform financial model serves as a comprehensive 5-year financial planning template tailored for startups and established small businesses within the peer to peer lending sector. This robust financial model for peer to peer lending startups integrates crucial elements such as cash flow projections, cost structure analysis, and income statement modeling to provide an in-depth peer to peer lending platform profitability analysis. Designed to assist in peer to peer lending platform investment analysis and funding requirement modeling, it enables users to generate accurate financial forecasting and break-even analysis, supporting informed decision-making and facilitating successful funding rounds from banks, angel investors, grants, and venture capitalists. The unlocked, fully editable template ensures adaptability and precision for effective peer to peer lending platform business valuation and risk assessment financial modeling.

The ready-made financial model for peer to peer lending platforms addresses critical pain points by providing an all-in-one solution that integrates peer to peer lending platform revenue model, cost structure, and break-even analysis, enabling startups to quickly draft accurate financial plan and funding requirement models without extensive accounting expertise. It simplifies complex peer to peer lending platform profitability analysis and investment analysis through automated cash flow projections and loan default modeling, ensuring reliable risk assessment and scenario analysis to anticipate market fluctuations. With built-in peer to peer lending platform income statement model, balance sheet projections, and cash flow model, users benefit from streamlined financial forecasting and budget planning, ultimately enhancing business valuation and facilitating strategic decision-making with actionable peer to peer lending platform financial metrics.

Description

This comprehensive financial model template for peer to peer lending platforms offers detailed five-year cash flow projections, income statement models, and balance sheet forecasts, empowering entrepreneurs to conduct in-depth profitability analysis and business valuation with ease. Designed for both operational management and investors, it incorporates essential peer to peer lending platform financial forecasting tools such as loan default modeling, risk assessment financial models, and break even analysis, while also facilitating budget planning and investment analysis. Users can leverage this dynamic model to generate key financial metrics including FCF, IRR, and NPV, alongside scenario analysis and funding requirement models, ensuring accurate peer to peer lending platform platform revenue model documentation and streamlined peer to peer lending platform platform cost structure management for optimal financial decision-making.

PEER TO PEER LENDING PLATFORM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover a robust financial model template for peer to peer lending platforms, designed to support startups through scalable growth and detailed scenario analysis. Our comprehensive 3-way financial model integrates key elements like cash flow projections, income statements, and cost structure, ensuring accurate profitability analysis and risk assessment. Tailored for flexibility, it empowers users to customize assumptions and align budgeting, break-even, and valuation metrics with their unique business needs. Rely on this powerful tool for precise financial forecasting and investment analysis, driving confident decision-making and sustainable platform success.

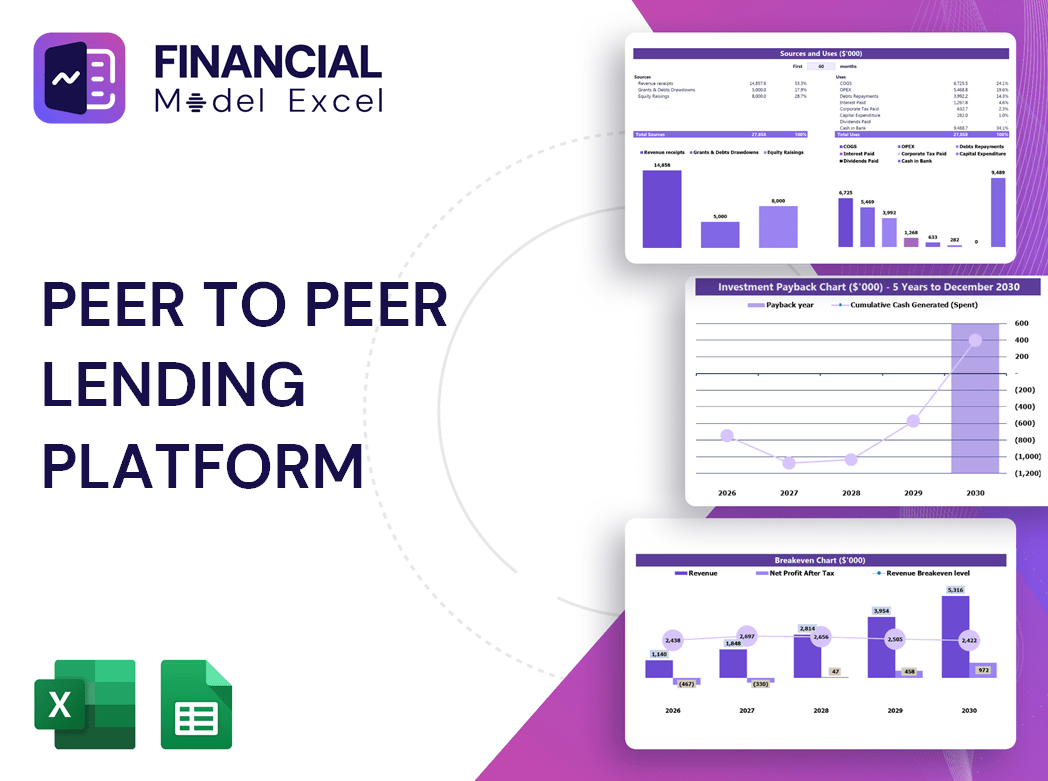

Dashboard

Our peer to peer lending platform financial model template offers a dynamic financial dashboard designed for robust financial planning and profitability analysis. It provides clear charts and visualizations from comprehensive 5-year cash flow projections, income statement models, and balance sheet forecasts. This powerful tool enhances peer to peer lending platform business valuation and investment analysis by delivering precise financial metrics and scenario analysis. Stakeholders gain actionable insights to support budget planning, risk assessment, and break-even analysis, enabling informed decision-making and strategic growth for your P2P lending startup.

Business Financial Statements

A comprehensive financial model for peer to peer lending startups integrates monthly profit and loss statements, pro forma balance sheets, and cash flow projections to deliver in-depth performance analysis. The income statement model details operating activities driving revenue, while balance sheet projections and cash flow models clarify asset management and funding structures. This financial forecasting approach supports effective budget planning, risk assessment, and investment analysis, ensuring optimized peer to peer lending platform profitability and sustainable growth.

Sources And Uses Statement

This professional financial model template for peer to peer lending platforms effectively calculates sources and uses of funds, providing clear insights into cash flow projections and fund distribution. It supports comprehensive peer to peer lending platform financial forecasting and budgeting, enabling accurate break-even analysis and investment evaluation. Designed to enhance peer to peer lending startup profitability analysis, this model ensures thorough risk assessment and scenario analysis, empowering strategic decision-making and optimizing platform cost structure management for sustained revenue growth and business valuation accuracy.

Break Even Point In Sales Dollars

Break-even analysis is crucial for peer to peer lending platforms, marking the point where total revenue equals total costs, resulting in zero profit or loss. Utilizing a break-even graph in Excel enhances financial forecasting by visually illustrating the relationship between fixed costs, variable costs, and revenue. Platforms with lower fixed costs typically achieve break-even sooner, improving profitability outlook. Integrating break-even analysis within a comprehensive financial model for peer to peer lending startups aids in budget planning, cash flow projections, and risk assessment, ensuring informed investment analysis and strategic decision-making.

Top Revenue

Creating a robust financial model for peer to peer lending startups demands precise revenue forecasting, as revenue underpins key financial metrics and overall business valuation. A well-designed peer to peer lending platform revenue model incorporates growth assumptions grounded in historical data, ensuring accurate cash flow projections and profitability analysis. Our financial plan template offers best-practice components—from cost structure and break-even analysis to scenario modeling—empowering analysts to conduct comprehensive investment analysis and financial forecasting for sustainable platform success.

Business Top Expenses Spreadsheet

For peer to peer lending startups, effective cost management is key to profitability. Our five-year financial model template includes a Top Expense Report, highlighting the four largest cost categories alongside an aggregated 'Other' section. This tool empowers users to monitor, analyze, and optimize their peer to peer lending platform cost structure, enhancing cash flow projections and supporting informed budget planning. By identifying expense trends year-over-year, startups can improve their peer to peer lending platform profitability analysis and financial forecasting, ultimately driving sustainable growth and stronger business valuation.

PEER TO PEER LENDING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately managing start-up costs is vital for peer to peer lending platforms. Our comprehensive financial model template integrates the platform revenue model and cost structure, enabling precise tracking of expenses and investments. Utilizing the peer to peer lending platform income statement model and cash flow projections, users can perform profitability analysis and financial forecasting with ease. This dynamic proforma empowers startups to optimize budget planning, anticipate funding requirements, and mitigate risks, ensuring sustainable growth and informed decision-making. Stay in control of your financial future with a tailored financial plan designed specifically for peer to peer lending startups.

CAPEX Spending

For peer to peer lending startups, capital expenditures are essential for steady growth and profitability. A robust financial model for peer to peer lending platforms integrates these capex expenses into the platform’s cost structure and cash flow projections. By leveraging a comprehensive peer to peer lending platform financial forecasting approach, including balance sheet projections and income statement modeling, startups can accurately conduct capital budgeting analysis. This ensures well-planned investment strategies that drive scalable growth while maintaining stable cash flow models and supporting effective budget planning to enhance overall platform profitability.

Loan Financing Calculator

Our comprehensive financial model template for peer to peer lending platforms integrates a dynamic loan amortization schedule, precisely calculating principal and interest payments. This tool streamlines your peer to peer lending platform revenue model by factoring in loan amount, interest rates, term length, and payment frequency. Enhanced with cash flow projections and income statement modeling, it supports detailed profitability analysis and financial forecasting, empowering startups to perform robust break-even and risk assessment analyses. This holistic approach fuels informed investment analysis and optimal budget planning, driving sustainable growth and maximizing platform financial metrics.

PEER TO PEER LENDING PLATFORM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Internal Rate of Return (IRR) is a critical financial metric in peer to peer lending platform investment analysis. It represents the discount rate that equates the net present value of cash flow projections to zero, indicating the expected profitability of a project or investment. In financial models for peer to peer lending startups, IRR helps investors evaluate potential returns, guiding funding requirement models and overall platform business valuation. Accurately incorporating IRR into financial forecasting and profitability analysis ensures informed decision-making and strategic growth planning.

Cash Flow Forecast Excel

Present a clear, concise financial overview highlighting your peer to peer lending platform’s key metrics and annual performance. Our financial model template for peer to peer lending startups offers detailed cash flow projections, income statement models, and cost structure insights—ideal for pitch decks, investment analysis, and business valuation. Streamline your budget planning and break even analysis with confidence, using data-driven financial forecasting and risk assessment models designed specifically for peer to peer lending platforms. This comprehensive snapshot ensures compelling, professional reporting that drives informed decision-making and supports sustainable growth.

KPI Benchmarks

Our business plan Excel template includes a comprehensive benchmarking feature that leverages industry and financial benchmarks to evaluate your peer to peer lending platform’s performance. This powerful tool enables detailed profitability analysis, risk assessment, and financial forecasting, helping you identify key areas for improvement. Use it to compare your cost structure, cash flow projections, and revenue model against top competitors, ensuring strategic decisions that drive optimal outcomes and sustainable growth within the peer to peer lending sector.

P&L Statement Excel

Utilizing a pro forma income statement model is essential for peer to peer lending platform financial forecasting. Unlike cash flow models that track actual cash movements, the pro forma profit and loss projects non-cash items such as depreciation, ensuring accurate expense allocation over multiple years. This approach supports comprehensive peer to peer lending platform revenue model analysis and enhances financial plan development, enabling startups to optimize profitability, conduct break-even and scenario analyses, and execute precise peer to peer lending platform business valuation. Incorporating such financial models strengthens budget planning and investment analysis for sustainable growth.

Pro Forma Balance Sheet Template Excel

Accurate balance sheet projections are vital in any peer to peer lending platform financial model, seamlessly integrating with income statements and cash flow forecasts. While less visible than profit and loss statements, the projected balance sheet template plays a crucial role in cash flow modeling and profitability analysis. It enables investors to assess key financial metrics like return on equity and return on invested capital, enhancing investment analysis. For startups, this comprehensive financial forecasting ensures realistic net income projections and supports robust budget planning, risk assessment, and overall platform business valuation.

PEER TO PEER LENDING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our peer to peer lending platform financial model template integrates two robust valuation methodologies: discounted cash flow (DCF) and weighted average cost of capital (WACC). This dual approach delivers comprehensive financial forecasting, enabling precise business valuation and investment analysis. By combining these techniques, startups gain clear insights into revenue models, cash flow projections, and profitability analysis, supporting informed decision-making and strategic planning.

Cap Table

The capitalization table is a vital element of any startup, providing clear insights into equity distribution and investor ownership. In peer to peer lending platforms, an accurate pro forma cap table supports informed financial forecasting and investment analysis. It details each investor’s ownership percentage, enabling precise peer to peer lending platform business valuation and funding requirement modeling. Integrating the cap table with financial models enhances budget planning, profitability analysis, and risk assessment, ensuring strategic decision-making grounded in transparent equity and cost structure data.

PEER TO PEER LENDING PLATFORM FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Optimize your startup’s loan repayments using a peer-to-peer lending platform financial model for precise forecasting and growth.

Gain full control and forecast success with a peer to peer lending platform three-way financial model.

Spot issues in customer payments early using our financial model template to enhance peer-to-peer lending platform profitability.

A financial model for peer to peer lending startups enhances profitability analysis and sharpens strategic financial forecasting.

Financial models empower peer to peer lending platforms to optimize profitability through precise financial forecasting and risk assessment.

PEER TO PEER LENDING PLATFORM BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

This financial model simplifies peer to peer lending profitability analysis, boosting clear, actionable insights for smart decisions.

This sophisticated yet user-friendly financial model delivers reliable peer-to-peer lending insights with minimal Excel expertise required.

Optimize peer-to-peer lending success by using financial models for accurate cash flow projections and budget planning.

A cash flow model for peer to peer lending platforms enables precise forecasting to optimize budgeting and future profitability.

Our financial model for peer to peer lending platforms simplifies profitability analysis, ensuring accurate forecasts and smarter investment decisions.

Unlock effortless profitability with our comprehensive peer-to-peer lending financial model—no formulas, coding, or consultants needed!

Get a robust financial model for peer-to-peer lending that enhances profitability analysis and drives confident investment decisions.

This powerful financial model enables precise peer to peer lending platform forecasting, boosting profitability and strategic decision-making.

Our financial model empowers peer-to-peer lending startups with accurate profitability analysis and dynamic cash flow projections.

A financial model for peer-to-peer lending startups streamlines accurate projections, enhancing investor confidence and strategic planning.