Personal Finance Coaching Platform Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Personal Finance Coaching Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Personal Finance Coaching Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive 5-year personal finance coaching platform business plan featuring a dynamic financial model for the app, including detailed financial projections and a revenue model for personal finance coaching. This startup financial model incorporates a break-even analysis coaching platform, cost structure personal finance platform breakdown, and cash flow model personal finance app to support robust financial scenario planning. It offers a profit and loss statement finance coaching, financial KPIs personal finance coaching, and a subscription model personal finance coaching as part of its monetization strategy coaching platform. Additionally, the model facilitates budget planning personal finance platform, pricing strategy personal finance platform, user growth financial projections platform, and investment analysis personal finance tool to align funding requirements coaching platform with targeted financial forecasts for coaching services. All financial statements and dashboards are customizable and compliant with GAAP or IFRS standards, enabling startups to evaluate ideas, plan pre-launch expenses, and secure funding from banks, angels, grants, and VC funds efficiently.

This ready-made financial model template effectively addresses common pain points faced by personal finance coaching platform entrepreneurs by providing a comprehensive financial forecast for coaching services, including a detailed revenue model personal finance coaching and cost structure personal finance platform analysis. It streamlines the budgeting process with built-in budget planning personal finance platform tools and supports critical decision-making through a financial dashboard personal finance app featuring key financial KPI personal finance coaching metrics. The inclusion of break-even analysis coaching platform functionality and cash flow model personal finance app projections simplify complex financial scenario planning personal finance, while the startup financial model coaching business foundation aids in accurately defining funding requirements coaching platform and performing investment analysis personal finance tool with confidence. Additionally, the pricing strategy personal finance platform and subscription model personal finance coaching elements facilitate the creation of a robust monetization strategy coaching platform, ensuring users can optimize profit and loss statement finance coaching outcomes while projecting user growth financial projections platform for scalable success.

Description

Our personal finance coaching platform business plan features a robust financial model tailored to deliver detailed financial projections for coaching platforms, including a comprehensive profit and loss statement, cash flow model, and balance sheet forecasts over a 5-year period. The revenue model for the personal finance coaching platform emphasizes a subscription-based monetization strategy supported by scalable user growth financial projections and a clear pricing strategy. This model incorporates a transparent cost structure personal finance platform analysis alongside break-even analysis coaching platform tools, allowing for efficient budget planning and funding requirements assessment. Key financial KPIs for personal finance coaching are tracked automatically through an intuitive financial dashboard personal finance app, facilitating ongoing financial scenario planning and investment analysis personal finance tool evaluations. Designed for ease of use, this startup financial model coaching business template empowers users with minimal financial expertise to make informed decisions and optimize profitability through dynamic and easy-to-manage forecasting tools.

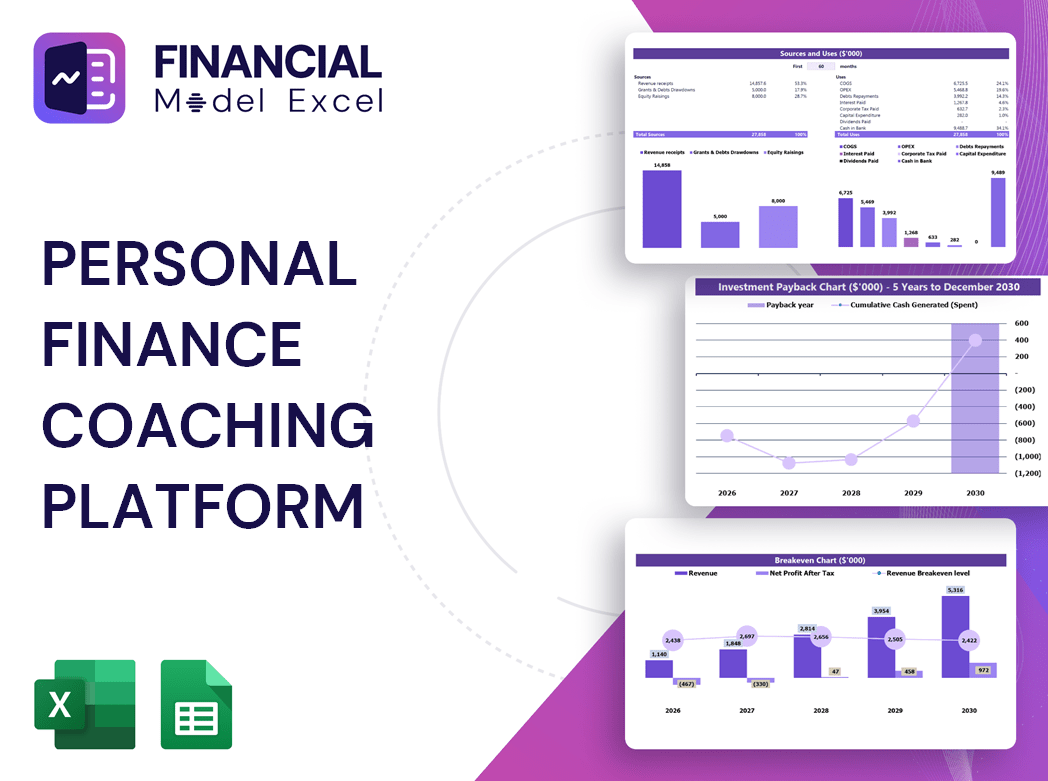

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our Personal Finance Coaching Platform Financial Model offers comprehensive financial projections essential for startups and established businesses. Featuring detailed proformas for income statements, cash flow, and balance sheets, it provides clear month-to-month and year-over-year summaries. This dynamic financial dashboard supports budgeting, revenue modeling, and break-even analysis, empowering you to optimize your subscription and monetization strategies. Tailored for personal finance coaching businesses, it delivers actionable insights through financial KPIs, scenario planning, and funding requirement assessments—ensuring your platform’s growth and profitability are consistently on track.

Dashboard

Our all-in-one financial dashboard empowers personal finance coaching platforms with a comprehensive view of key metrics, including budget planning, cash flow models, and financial forecasts. Seamlessly integrated with startup financial models and projected balance sheets, it offers customizable reporting—monthly or annual, numerical or visual. This streamlined solution supports revenue model analysis, pricing strategies, and break-even assessments to drive informed decisions and fuel user growth. Experience maximum efficiency and clarity with a single, dynamic dashboard tailored for personal finance coaching businesses.

Business Financial Statements

This comprehensive business plan financial model for a personal finance coaching platform integrates key financial statements—including a projected profit and loss statement, balance sheet, and cash flow forecasting model. Designed for startup financial scenario planning, this Excel template links all essential financial data seamlessly, enabling accurate financial projections for coaching platforms. It supports critical analyses such as break-even, investment assessment, and budgeting, empowering founders to optimize their revenue model, pricing strategy, and funding requirements with confidence. Perfect for developing a robust monetization strategy and monitoring financial KPIs in the personal finance app space.

Sources And Uses Statement

The sources and uses of cash statement provides a clear overview of capital inflows and expenditures, ensuring total sources align with total uses. This essential financial report supports effective budget planning for personal finance platforms and informs investment analysis for coaching services. It is a vital tool in developing robust financial projections and conducting break-even analysis, especially during recapitalization, restructuring, or M&A activities. Integrating this with your financial model for a personal finance app enhances transparency, driving informed decision-making and optimizing the revenue model for personal finance coaching businesses.

Break Even Point In Sales Dollars

A break-even analysis is essential in a financial model for personal finance coaching platforms, pinpointing when revenue surpasses total costs. By examining the cost structure—distinguishing fixed costs like rent and salaries from variable costs tied to user growth or service delivery—you can forecast profitability accurately. This analysis supports your revenue model and pricing strategy, guiding budget planning and cash flow management. Integrating break-even insights into your startup financial model or financial projections for coaching platforms helps optimize monetization strategies and informs funding requirements, ensuring sustainable growth and sound investment analysis.

Top Revenue

In a startup financial model coaching business, the top line represents gross sales or revenue—key in evaluating your revenue model personal finance coaching platform. Investors focus on top-line growth as a strong indicator of market traction and user growth financial projections platform. Conversely, the bottom line shows net earnings after costs, reflecting the cost structure personal finance platform and profitability. Monitoring these financial KPIs on your financial dashboard personal finance app is essential for break-even analysis coaching platform and informed financial scenario planning personal finance. Understanding these metrics drives smarter investment analysis personal finance tool and sustainable monetization strategy coaching platform decisions.

Business Top Expenses Spreadsheet

In the Top Expenses section of our financial projections for coaching platform, expenses are categorized into four key areas for clear analysis. Additionally, an 'Other' category allows users to input customized expenses tailored to their unique business needs. This flexible cost structure personal finance platform ensures comprehensive budget planning and enhances the accuracy of your financial forecast for coaching service.

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are critical in any financial model for personal finance coaching platforms. These initial expenses, incurred before operations begin, must be carefully monitored and regularly evaluated to prevent underfunding and financial setbacks. Incorporating a detailed financial forecast for coaching services—such as budgeting, cash flow models, and break-even analysis—enables precise expense tracking. Utilizing a comprehensive financial dashboard or pro forma within your business plan ensures accurate projections of spending and funding levels, empowering proactive decision-making and strengthening your monetization strategy for sustainable growth.

CAPEX Spending

Detailed CAPEX planning with automated depreciation calculation is vital for any personal finance coaching platform business plan. Our financial model for personal finance apps enables users to apply straight-line or double-declining balance depreciation methods, enhancing accuracy in startup financial projections. This robust approach supports precise profit and loss statements, cash flow models, and break-even analysis, empowering informed investment analysis and effective budget planning for your coaching platform’s financial forecast and growth strategy.

Loan Financing Calculator

Simplify your startup financial model for coaching businesses with our comprehensive loan amortization schedule. Input total loan amount, tenor, and maturity to instantly calculate regular repayments, detailing principal and interest breakdowns. This clear financial dashboard provides all essential data—interest rates, repayment timelines, and maturity dates—empowering precise financial forecasting and cash flow management for your personal finance coaching platform. Streamline your investment analysis and budget planning with this all-in-one tool designed to enhance your financial projections and funding strategy.

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive financial model for your personal finance coaching platform offers a detailed breakdown of revenue streams through an intuitive Pro-forma chart. This bottom-up financial forecast highlights monthly income from five distinct revenue sources, adaptable to fit your unique monetization strategy. Easily customize or expand revenue streams and adjust the financial analysis period to align with your startup’s growth projections and pricing strategy. Empower your business plan with dynamic financial scenario planning and gain clear insights into your platform’s cash flow, funding requirements, and profitability potential.

Cash Flow Forecast Excel

A monthly cash flow model in Excel is essential for any personal finance coaching platform business plan. This pro forma cash flow statement integrates operating, investing, and financing activities, providing a clear financial forecast for coaching services. It ensures accurate reconciliation of projected balance sheets and aligns seamlessly with your startup financial model. Precise cash flow budgeting is critical for effective financial scenario planning, break-even analysis, and funding requirements assessment. Leveraging this financial dashboard enhances your subscription model personal finance coaching's revenue and cost structure, driving informed decision-making through robust financial KPIs and investment analysis.

KPI Benchmarks

Our comprehensive three-way financial model, integrated with a benchmarking template, empowers clients to compare their coaching platform’s performance against industry and financial benchmarks. This financial dashboard for personal finance apps highlights top-performing companies within the sector, enabling targeted financial scenario planning. Use these insights to refine your revenue model, optimize cost structure, and enhance your pricing strategy. By pinpointing key areas for improvement, you can drive sustainable growth and achieve the strongest financial projections for your personal finance coaching business.

P&L Statement Excel

Achieving profitability is the cornerstone of any successful business, clearly reflected in a comprehensive profit and loss statement. However, constructing an accurate P&L statement can be complex and time-consuming. To simplify this, we’ve developed a forecasted income statement template tailored for personal finance coaching platforms. This tool streamlines intricate calculations, delivering precise financial projections and revenue forecasts with ease. Empower your financial planning with our solution—optimizing your financial model, enhancing your revenue model, and supporting strategic decisions with clarity and confidence.

Pro Forma Balance Sheet Template Excel

Our 5-year pro forma balance sheet for personal finance coaching startups offers a clear snapshot of assets, liabilities, and shareholders’ equity at a specific point in time. Integrated within our financial model for personal finance apps, it empowers users to accurately assess the company’s financial position. This essential tool supports effective financial scenario planning, aiding in revenue model optimization, cost structure analysis, and funding requirement evaluations, ultimately driving strategic decision-making for sustainable growth and profitability.

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The valuation report template within this comprehensive three-statement financial model empowers users to conduct a precise discounted cash flow (DCF) valuation. By inputting key metrics such as the cost of capital rates, users can generate accurate financial projections for their personal finance coaching platform. This tool supports critical investment analysis and financial scenario planning, providing a robust foundation for strategic decision-making and effective budget planning. Ideal for developing a startup financial model or refining a subscription model, it ensures clarity in revenue models and enhances forecasting accuracy for sustainable growth.

Cap Table

The cap table is a fundamental element in any startup’s financial model, detailing the ownership distribution of securities among investors. It dynamically accounts for time-based changes and critical variables, ensuring precise equity tracking. This tool is essential for investment analysis, funding requirements, and financial scenario planning within a personal finance coaching platform or app, supporting informed decision-making and strategic growth.

PERSONAL FINANCE COACHING PLATFORM FINANCIAL PROJECTION MODEL TEMPLATE ADVANTAGES

Run two valuation methods with the financial model to accurately forecast growth and optimize your personal finance coaching platform.

Easily run diverse scenarios with our financial model, optimizing projections for your personal finance coaching platform’s success.

Our financial model enables precise cash flow and revenue forecasting, optimizing profitability for your personal finance coaching platform.

A robust financial model for personal finance apps ensures accurate projections to optimize growth and maximize profitability.

A robust financial model for startups minimizes risk by accurately identifying and pursuing the most profitable opportunities.

PERSONAL FINANCE COACHING PLATFORM FINANCIAL MODEL TEMPLATE FOR BUSINESS PLAN ADVANTAGES

Unlock accurate financial projections to confidently predict the influence of upcoming changes and drive coaching platform growth.

Our financial model enables precise cash flow forecasts and scenario planning to optimize investment and operational decisions.

The financial model for personal finance apps simplifies budget planning, ensuring accurate forecasts and profitable coaching platform growth.

Easily master financial projections with our sophisticated coaching platform model, delivering accurate cash flow insights and expert support.

Our financial model for personal finance apps ensures accurate projections, optimizing revenue and guiding strategic business decisions — we do the math.

Streamline your financial projections with our model—no formulas, formatting, or consultants needed, focusing solely on planning.

Our financial model ensures accurate projections, guiding strategic growth and maximizing profitability for your personal finance coaching platform.

Our detailed financial model ensures clear, transparent planning with color-coded, multi-tab templates for precise coaching platform insights.

Our financial model delivers accurate forecasts, empowering stakeholders with clear insights for confident investment decisions.

A robust financial model ensures clear projections, boosting lender confidence and securing essential bank loan approvals.