Property Investment Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Property Investment Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Property Investment Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PROPERTY INVESTMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year real estate investment valuation model is an essential property investment analysis template designed for startups and entrepreneurs aiming to impress investors and secure funding. Featuring comprehensive real estate cash flow projection tools, rental income financial projection, and property investment IRR calculation, it provides key financial charts, summaries, and funding forecasts tailored to the real estate asset management model. Ideal for evaluating a real estate portfolio financial modeling business before sale, this fully unlocked real estate financial modeling tool enables in-depth property acquisition financial analysis, property development financial forecasting, and real estate investment return calculation, ensuring robust rental property financial planning and property investment profitability analysis.

This ready-made real estate financial modeling tool in Excel addresses common pain points by offering a fully integrated and dynamic property investment analysis template that simplifies complex real estate investment valuation models and property development financial forecasts. Users can effortlessly perform real estate cash flow projections, rental income financial projections, and comprehensive commercial property financial modeling, ensuring precise rental property financial planning and property acquisition financial analysis. The model also features property investment IRR calculation and real estate investment return calculation functions, enabling accurate property investment profitability analysis and risk assessment. By linking all financial statements and assumptions, it enhances real estate project cost estimation, real estate financing scenario modeling, and real estate asset management model capabilities—offering a seamless real estate portfolio financial modeling experience that allows investors to understand how adjustments in inputs impact overall outcomes and make data-driven decisions backed by dependable property investment budgeting tools.

Description

Our property investment financial model template offers an all-encompassing solution for real estate financial modeling tools, featuring a 5-year forecast that integrates real estate cash flow projection, rental property financial planning, and property acquisition financial analysis. Designed to streamline real estate investment return calculation and property investment budgeting tools, this template automatically generates comprehensive reports including projected balance sheets, P&L forecasts, and cash flow statements, while also providing valuation charts, break-even analysis, and key performance indicators essential for property development financial forecast and real estate portfolio financial modeling. With dynamic input management and automatic updates linked to forecast data, this residential property financial model serves as an intuitive property investment analysis template suited for users seeking to perform property investment profitability analysis, real estate market financial simulation, and property investment IRR calculation without requiring advanced financial expertise.

PROPERTY INVESTMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive property development financial forecast integrates the income statement, cash flow projection, and balance sheet into one cohesive real estate financial modeling tool. Typically updated monthly, this robust real estate investment valuation model captures all operational changes throughout the year. Regardless of portfolio size, every investor benefits from preparing a detailed 5-year rental property financial planning template annually. This ensures accurate real estate investment return calculation, effective property acquisition financial analysis, and strategic property investment budgeting, empowering smarter decisions across residential, commercial, and mixed-use real estate projects.

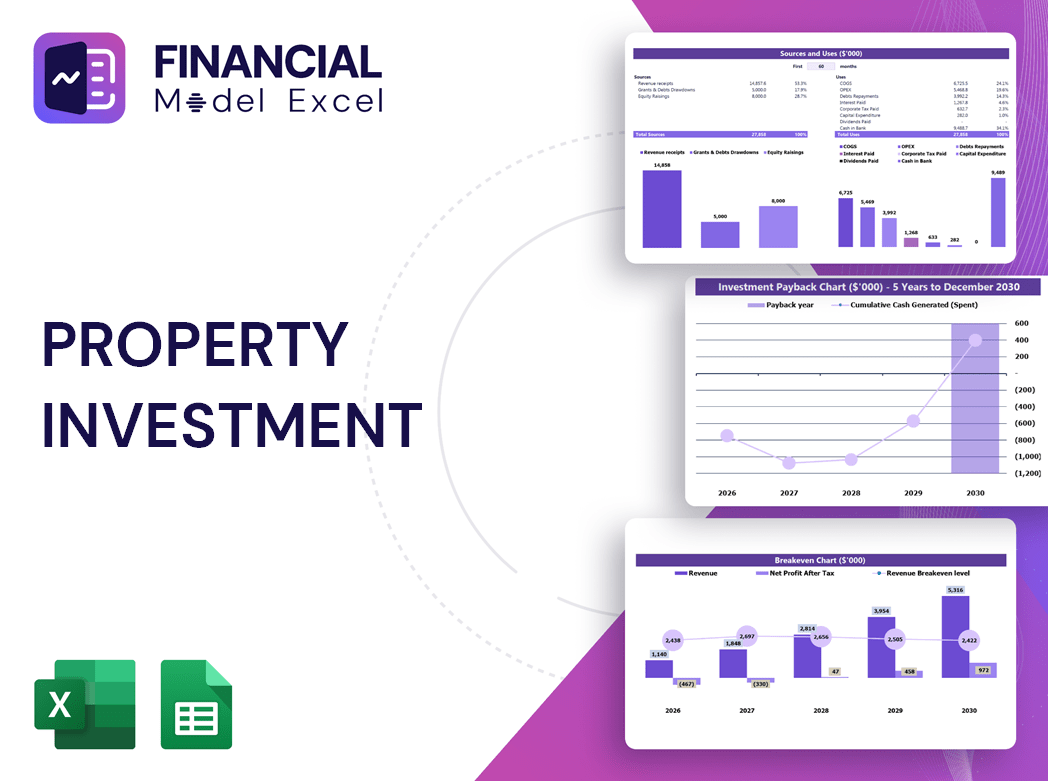

Dashboard

The Dashboard tab showcases your real estate financial modeling tools through dynamic graphs, ratios, and charts. It delivers clear visual insights into property investment analysis, cash flow projections, and investment return calculations, empowering you to perform comprehensive rental property financial planning and portfolio financial modeling. This intuitive interface streamlines real estate asset management and investment valuation, making property acquisition financial analysis and development forecasting seamless. Elevate your decision-making with ready-to-analyze financial indicators designed for precise property investment profitability and risk assessment.

Business Financial Statements

Our 5-year real estate financial modeling tools offer comprehensive projections, including income statements, balance sheets, and cash flow forecasts. Designed for property investment analysis, these templates support monthly or annual reporting and seamless integration with QuickBooks, Xero, FreshBooks, and other accounting software. Ideal for rental property financial planning, commercial property financial models, and real estate portfolio financial modeling, our solution simplifies property acquisition financial analysis and real estate investment return calculation, empowering you to make informed decisions with precision and confidence.

Sources And Uses Statement

A comprehensive financial model template with a sources and uses Excel framework delivers clear insights into your real estate investment’s income streams and expense allocations. Utilizing advanced real estate financial modeling tools, you can enhance your property investment analysis, streamline real estate cash flow projections, and accurately forecast property development costs. Whether for rental property financial planning or commercial property financial modeling, these templates support precise real estate investment valuation models and property acquisition financial analysis—empowering you to optimize profitability and make data-driven decisions with confidence.

Break Even Point In Sales Dollars

This 3-year financial projection template integrates real estate financial modeling tools to pinpoint the break-even unit sales—when revenue surpasses total costs. Essential for rental property financial planning and property investment profitability analysis, it clarifies the relationship between fixed and variable costs versus revenue. Utilizing this model, management can accurately forecast the sales volume and pricing needed to cover expenses and begin generating profit. Ideal for commercial property financial models and property acquisition financial analysis, this tool ensures informed decision-making to drive sustainable growth and maximize return on investment in real estate projects.

Top Revenue

The Top Revenue tab in this startup financial model template enables precise demand forecasting by product or service, essential for real estate investment analysis. It simulates profitability scenarios, enhancing your property investment budgeting tools and rental income financial projection accuracy. Analyze revenue bridges and depth, while forecasting demand fluctuations, such as weekdays versus weekends, to optimize resource allocation—be it manpower or inventory. This dynamic approach supports robust real estate cash flow projection and property acquisition financial analysis, empowering informed decisions in rental property financial planning and real estate portfolio financial modeling.

Business Top Expenses Spreadsheet

The Top Revenue tab in our real estate financial modeling tools expertly organizes and presents detailed financial data for each property or service offering. Gain a clear, summarized annual breakdown of your revenue streams, including revenue depth and revenue bridge, enhancing your rental property financial planning and investment valuation model. This feature supports accurate real estate cash flow projection and property investment profitability analysis, empowering informed decisions and strategic growth in your real estate portfolio financial modeling.

PROPERTY INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive property investment financial model streamlines startup cost analysis and expense tracking, essential for effective rental property financial planning. Using this real estate investment valuation model, investors gain clear insights into cash flow projections, property acquisition financial analysis, and investment return calculations. This tool empowers users to create accurate financial forecasts and risk assessments, ensuring strong financial control and profitability. Whether for residential or commercial properties, our model simplifies real estate portfolio financial modeling, helping you manage costs, optimize investments, and secure your company’s long-term financial health with confidence.

CAPEX Spending

CAPEX plays a vital role in real estate cash flow projections and rental property financial planning. Utilizing property investment budgeting tools and financial modeling templates allows experts to accurately set startup budgets and track investments. Precise estimation of initial expenditures is essential for effective real estate investment return calculation and enhancing financial turnover. A strategic approach to property acquisition financial analysis ensures optimized capital allocation, supporting robust property development financial forecasts. Careful management of CAPEX within a comprehensive real estate portfolio financial modeling framework is key to sustainable growth and profitability.

Loan Financing Calculator

Our comprehensive property investment analysis template features an integrated loan amortization schedule, precisely calculating principal and interest payments. This real estate financial modeling tool streamlines your rental property financial planning by factoring in loan amount, interest rate, loan term, and payment frequency. Optimize your property acquisition financial analysis and enhance your real estate investment return calculation with accurate, dynamic projections—empowering you to make informed investment decisions with confidence.

PROPERTY INVESTMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a key real estate investment return calculation that measures how efficiently assets generate earnings. Utilizing data from a projected balance sheet template and forecast income statement, ROA provides clear insights into profitability. Incorporating this metric within your real estate financial modeling tools enhances property investment analysis, helping investors optimize asset utilization and improve rental property financial planning. Accurately assessing ROA supports smarter decision-making across residential property financial models, commercial property financial models, and comprehensive real estate portfolio financial modeling.

Cash Flow Forecast Excel

A comprehensive real estate cash flow projection excel spreadsheet is essential for detailed business planning. It empowers qualified management with accurate forecasting of financial transactions, enhancing property investment analysis and rental income financial projections. Utilizing advanced real estate financial modeling tools, this approach supports precise real estate investment return calculations and property development financial forecasts. Whether for residential property financial modeling or commercial property financial models, integrating these insights ensures robust property acquisition financial analysis and effective real estate asset management models. Optimize your property investment budgeting tools and elevate your investment decisions with expert financial planning.

KPI Benchmarks

The financial plan benchmark tab integrates real estate financial modeling tools to evaluate a company's performance effectively. Completing this benchmark enables insightful competitive analysis, crucial for refining property investment budgeting tools and enhancing real estate asset management models. These indicators drive strategic rental property financial planning and support real estate investment return calculation. Monitoring leading indicators ensures agile adaptation to market shifts, empowering startups and established firms alike with precise property development financial forecasts and robust property investment risk assessment—key for sustainable growth and maximizing investment profitability.

P&L Statement Excel

Stay ahead in property investment with advanced real estate financial modeling tools. Utilize a comprehensive property investment analysis template to generate accurate real estate cash flow projections and rental income financial projections. These real estate investment valuation models and property acquisition financial analyses enable precise forecasting of income, expenses, and profitability. Whether managing commercial property financial models or residential property financial models, leveraging real estate portfolio financial modeling and property investment budgeting tools ensures effective financial planning and risk assessment. Streamline your real estate asset management and maximize returns with reliable real estate project cost estimation and investment IRR calculation models.

Pro Forma Balance Sheet Template Excel

Integrating real estate financial modeling tools, such as a projected balance sheet with a profit and loss statement template, provides a comprehensive view of the investment required to achieve projected sales and profits. This approach enhances property investment analysis by accurately forecasting cash flow projections and investment return calculations. Utilizing these models is essential for effective rental property financial planning and property development financial forecasts, ensuring clear visibility into a company’s future financial health and enabling informed decision-making for real estate asset management and investment profitability analysis.

PROPERTY INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive real estate investment valuation model and property investment analysis template to deliver clear insights to your investors. With built-in real estate cash flow projection and discounted cash flow calculations, you can accurately showcase future cash flows. Our model incorporates weighted average cost of capital (WACC) to demonstrate your project's minimum required returns, ensuring transparency for stakeholders. Designed for rental property financial planning and commercial property financial models, this tool empowers precise property investment IRR calculation and real estate portfolio financial modeling, driving confident, data-backed decisions for successful property acquisition and development.

Cap Table

A comprehensive real estate financial modeling tool, like a pro forma cap table, offers critical insights into company capital and ownership structure. It details shares, options, and their sources, enabling precise real estate investment return calculation and property acquisition financial analysis. This powerful model helps investors assess ownership percentages, track capital contributions, and supports accurate property investment budgeting tools. By integrating these elements, it enhances rental property financial planning and real estate asset management, driving informed decisions across property development financial forecasts and portfolio financial modeling.

PROPERTY INVESTMENT BUDGET FINANCIAL MODEL ADVANTAGES

Maximize returns and minimize risks with our advanced property investment financial model and projection template in Excel.

Optimize cash flow timing and maximize profits using our 5-year real estate financial modeling tools for precise projections.

Boost funding success with a comprehensive property investment financial model for accurate planning and confident pitching.

Real estate financial modeling tools streamline investment analysis, maximizing accuracy and boosting confident property investment decisions.

Maximize loan success with our property investment financial model delivering precise, reliable financial projections and risk assessment.

PROPERTY INVESTMENT FINANCIAL PLAN FOR BUSINESS PLAN ADVANTAGES

Optimize cash flow and enhance investment decisions with our robust real estate financial modeling tools for superior profitability.

Real estate cash flow projection models identify late payments, enabling precise forecasting to optimize rental income and financial planning.

Real estate financial modeling tools empower investors to optimize returns through precise investment analysis and cash flow projections.

Optimize investment decisions with our real estate financial modeling tools, featuring comprehensive income and cash flow projection templates.

Unlock precise rental property financial planning with our simple, incredibly practical real estate cash flow projection tool.

Easily create accurate real estate financial modeling tools with minimal Excel skills, plus expert support and helpful tutorials.

Enhance stakeholder trust with our real estate investment valuation model for accurate, insightful financial decision-making.

Real estate cash flow projection tools build investor confidence by clearly forecasting future financial performance and ensuring informed decisions.

Get a robust real estate financial model that streamlines property investment analysis and maximizes profitability with ease.

This adaptable financial model empowers precise, customizable property investment projections for confident, detailed business planning and analysis.