Real Estate Brokerage Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Brokerage Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Brokerage Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE BROKERAGE FINANCIAL MODEL FOR STARTUP INFO

Highlights

The real estate brokerage financial model business forecast template, ideal for startups or established firms, is essential for creating accurate financial planning for real estate brokerage operations. This comprehensive tool aids in developing cash flow models for real estate brokerage, performing break-even analysis, and constructing detailed profit and loss forecasts. It enables users to design effective brokerage commission structure financial models, conduct expense analysis, and produce financial forecasts for real estate brokerage business growth. By utilizing a real estate brokerage budget template and incorporating scenario analysis for real estate brokerage financials, companies can enhance their business plan financials and investment models, facilitating funding from banks, angels, grants, and VC funds with confidence. The fully unlocked and editable spreadsheet streamlines financial metrics for real estate brokerage, supporting precise financial planning and successful capital acquisition.

This ready-made real estate brokerage financial model Excel template effectively alleviates common pain points by offering a comprehensive and easy-to-use financial planning tool that requires no advanced technical skills, enabling brokerage owners to confidently manage their budget, forecast profit and loss, and conduct break-even analysis with precision. Its integrated cash flow model for real estate brokerage and detailed expense analysis streamline financial planning, while the inclusion of a brokerage commission structure financial model and scenario analysis for real estate brokerage financials empowers users to simulate various growth and investment outcomes. With built-in financial metrics, valuation models, and income statement templates, this model transforms complex financial data into clear, actionable insights—allowing for better decision-making, investor presentations, and strategic planning to secure sustainable profitability and scalable growth.

Description

This comprehensive real estate brokerage financial projections model integrates a robust revenue model, expense analysis, and budget template to deliver accurate profit and loss forecasts and cash flow statements, enabling effective financial planning for real estate brokerage operations. Designed with a focus on startup financial plans and ongoing financial forecast for real estate brokerage business growth, this template incorporates a detailed brokerage commission structure financial model, break-even analysis, and scenario analysis to address various business contingencies. It features key financial metrics for real estate brokerage, including debt service coverage ratio, investment modeling, and valuation calculations linked to equity funding and bank loans, providing a clear financing model for real estate brokerage ventures. Tailored for small and medium enterprises, this adaptable real estate brokerage income statement template supports diagnostic tools and cash burn analysis, ensuring owners and investors have insightful real-time data to optimize cash flow management and strategically drive long-term profitability and sustainability.

REAL ESTATE BROKERAGE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Every real estate brokerage, whether startup or established, requires a comprehensive financial planning model. A robust real estate brokerage financial projections template consolidates key elements—cash flow models, profit and loss forecasts, and balance sheets—into one cohesive tool. This real estate brokerage revenue model offers detailed, holistic insights, enabling accurate scenario analysis and growth modeling. By integrating expense analysis and brokerage commission structure financial models, firms can optimize budgeting and investment strategies. A well-constructed financial forecast for real estate brokerage businesses drives informed decision-making and sustainable growth throughout the fiscal year.

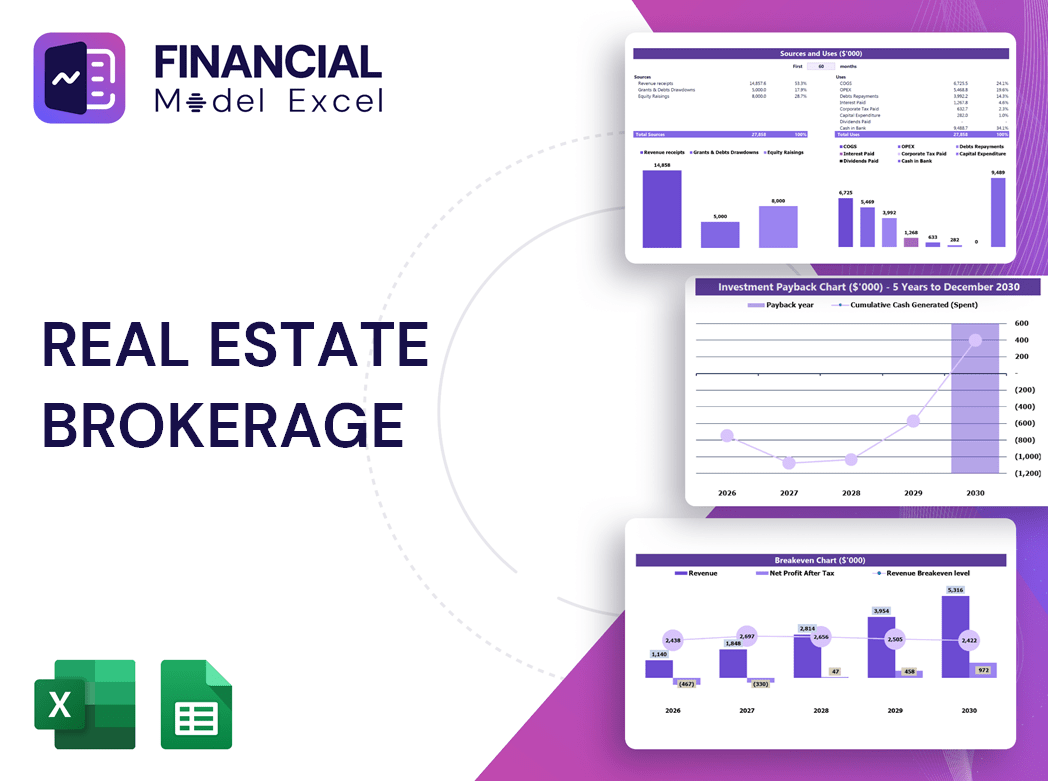

Dashboard

The Dashboard tab in our real estate brokerage financial projections template delivers a comprehensive snapshot through dynamic graphs, charts, key financial ratios, and concise summaries. Designed for seamless integration, it’s ideal for enhancing pitch decks and presentations. This tool empowers financial planning for real estate brokerage firms by visualizing revenue models, expense analysis, and cash flow statements—all essential for strategic decision-making and investor communications. Elevate your brokerage’s financial storytelling with actionable insights at a glance.

Business Financial Statements

Our expertly crafted 3-statement financial model for real estate brokerage seamlessly integrates pro forma balance sheets, profit and loss forecasts, and startup cash flow statements into a comprehensive financial summary. Designed for ease, this model requires no advanced Excel skills—our pre-built formulas deliver precise financial projections ideal for your pitch deck. Whether for financial planning, revenue modeling, or break-even analysis, this tool simplifies complex real estate brokerage financials, empowering confident decision-making and compelling investor presentations.

Sources And Uses Statement

The sources and uses table within a real estate brokerage financial projections model outlines how capital is raised and allocated across business needs. This essential tool highlights primary funding sources and planned expenditures, providing clear insight into the brokerage’s financing model. For startups, it ensures strategic financial planning and transparency, supporting informed decision-making and stakeholder confidence. Incorporating this table into your real estate brokerage business plan financials strengthens your overall financial forecast and enhances your brokerage’s investment appeal.

Break Even Point In Sales Dollars

A break-even analysis for real estate brokerage involves evaluating revenue streams and sales performance within your financial planning framework. It’s crucial to distinguish between sales, revenue, and profit when developing your brokerage commission structure financial model. Revenue represents total income from property sales, while profit reflects revenue minus all fixed and variable expenses. Integrating these insights into your real estate brokerage budget template ensures accurate profit and loss forecasts, enabling strategic decision-making for sustainable growth and optimized cash flow management.

Top Revenue

The Top Revenue tab in our real estate brokerage financial projections model provides a clear, organized overview of your revenue streams by product or service. It delivers an annual summary featuring detailed revenue depth and a comprehensive revenue bridge, empowering precise financial planning for your brokerage. This insightful revenue model supports strategic decision-making, enhances your brokerage’s financial forecast, and guides growth modeling for sustainable success.

Business Top Expenses Spreadsheet

Understanding the sources of your expenses is crucial for effective financial planning for real estate brokerage. The Top Expenses section in the real estate brokerage budget template categorizes annual costs into key groups such as customer acquisition and fixed expenses. This expense analysis empowers brokerages to pinpoint the primary drivers behind their spending, enabling informed decisions to optimize cash flow and enhance profitability. Utilizing this detailed breakdown supports accurate financial projections and strengthens your brokerage’s overall financial forecast.

REAL ESTATE BROKERAGE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The real estate brokerage financial projections template offers a comprehensive cash flow model and expense analysis to streamline financial planning for real estate brokerage firms. This robust financial forecast enables precise budgeting, break-even analysis, and profit and loss forecasting, ensuring a clear understanding of costs and revenue streams. Ideal for startups and established brokerages alike, it supports investment modeling and financing strategies while enhancing communication with investors. With a structured real estate brokerage revenue model and income statement template, companies can confidently manage financial metrics and growth modeling to secure funding and drive sustainable success.

CAPEX Spending

Capital expenditure (CAPEX) represents significant startup costs in real estate brokerage financial projections, covering property, equipment, and facilities. This essential financial metric is integrated within the real estate brokerage income statement template and cash flow model for real estate brokerage, reflecting asset depreciation over time. Accurate CAPEX forecasting is vital for financial planning for real estate brokerage, impacting the profit and loss forecast and balance sheet projections. Strategic CAPEX management supports sustainable growth modeling and enhances overall brokerage valuation, making it a cornerstone of the real estate brokerage startup financial plan and ongoing expense analysis.

Loan Financing Calculator

The loan amortization schedule within this comprehensive real estate brokerage financial projections template provides a clear repayment plan. It details each periodic payment, breaking down principal and interest components throughout the loan term. This schedule supports precise financial planning for real estate brokerage operations, ensuring accurate cash flow modeling and expense analysis until full loan repayment. Integrating this into your brokerage’s financial forecast enhances budgeting accuracy and strengthens your investment model, ultimately contributing to a robust profit and loss forecast and informed business decisions.

REAL ESTATE BROKERAGE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical financial metric in real estate brokerage financial projections and income statement templates. It quantifies profitability by comparing net investment gains against total investment costs. Utilizing ROI within your real estate brokerage revenue model and cash flow statement enables precise financial planning, ensuring informed decisions on brokerage commission structures and expense analysis. Accurately forecasting ROI supports robust scenario analysis and growth modeling, essential for optimizing your brokerage’s break-even analysis and overall valuation model. Integrating ROI into your startup financial plan enhances investment strategy and financial forecast accuracy, driving sustainable brokerage success.

Cash Flow Forecast Excel

In real estate brokerage financial planning, a robust cash flow model is essential. This cash flow forecast reveals actual liquidity, highlighting accumulated funds versus shortfalls, guiding funding strategies. Utilizing a comprehensive cash flow statement within your brokerage business plan financials empowers informed decision-making, ensures accurate profit and loss forecasts, and supports precise break-even analysis. Integrating this with your brokerage commission structure financial model and expense analysis optimizes financial performance and growth modeling, ultimately enhancing your real estate brokerage valuation model and investment planning.

KPI Benchmarks

Leverage this comprehensive real estate brokerage financial model Excel spreadsheet, featuring a dedicated benchmarking tab. By comparing key financial metrics and operating indicators against industry peers, users can evaluate their brokerage’s profitability, efficiency, and competitive positioning. This targeted benchmarking empowers informed financial planning for real estate brokerage firms, enhancing revenue models, expense analysis, and growth strategies. Optimize your brokerage’s financial forecast, commission structure, and cash flow management by gaining actionable insights through scenario analysis and industry comparisons—all within one dynamic financial tool.

P&L Statement Excel

The profit and loss forecast for real estate brokerage in Excel enables dynamic modeling of revenues and expenses, offering a forward-looking financial perspective. Unlike the cash flow model for real estate brokerage, which tracks actual cash movements historically, this template includes non-cash items like depreciation. Such financial metrics provide a comprehensive income statement template, essential for accurate financial planning for real estate brokerage. By integrating these elements, brokers gain deeper insights into profitability beyond cash flow, supporting informed decision-making and effective budget management within their real estate brokerage business plan financials.

Pro Forma Balance Sheet Template Excel

Combining the pro forma balance sheet template with the profit and loss forecast provides vital insights into the investment required to sustain projected sales and profits in your real estate brokerage financial plan. This integration is essential for accurate financial planning, enabling a comprehensive view of cash flow, expenses, and revenue models. A well-structured balance sheet forecast is crucial for assessing your brokerage’s future financial health, supporting robust scenario analysis, and guiding strategic growth decisions within your real estate brokerage business plan financials.

REAL ESTATE BROKERAGE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive 3-statement financial model for real estate brokerage integrates a robust valuation model, enabling in-depth Discounted Cash Flow (DCF) analysis. It empowers users to evaluate critical financial metrics, including residual value, replacement cost, market comparables, and recent transaction comparables. Designed to streamline financial planning for real estate brokerage firms, this tool enhances accuracy in profit and loss forecast, cash flow modeling, and scenario analysis—providing a solid foundation for strategic decision-making and growth modeling. Ideal for startups and established brokerages aiming to optimize their revenue model and investment strategy.

Cap Table

A Pro Forma Cap Table is an essential tool for real estate brokerage financial planning, offering clear insights into how stock issuance affects the company’s financial health. By systematically inputting and analyzing data, it supports accurate financial projections, enhances brokerage valuation models, and informs key decisions related to commission structures and expense analysis. This structured approach empowers brokers to develop robust cash flow models, conduct break-even analyses, and optimize their revenue model for sustainable growth.

REAL ESTATE BROKERAGE STARTUP FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Build a real estate brokerage financial model to secure funding with accurate projections and comprehensive financial planning.

Optimize cash flow and growth confidently with a comprehensive financial forecast for real estate brokerage business.

A real estate brokerage financial model clearly identifies strengths and weaknesses, enhancing strategic financial planning and growth.

Optimize startup loan repayments effortlessly using our real estate brokerage financial model for precise, strategic planning.

Optimize profits and manage risks with our real estate brokerage financial forecast for effective business growth.

REAL ESTATE BROKERAGE BUSINESS FINANCIAL MODEL TEMPLATE ADVANTAGES

Streamline decision-making with a convenient all-in-one dashboard for real estate brokerage financial modeling and growth analysis.

Our comprehensive real estate brokerage financial model ensures accurate forecasts, clear KPIs, and insightful monthly performance reviews.

Our financial model ensures confident growth with precise cash flow and revenue projections for real estate brokerages.

Our financial model empowers precise planning, risk management, and five-year cash flow forecasting for real estate brokerages.

Our real estate brokerage financial model saves you time by streamlining forecasting, budgeting, and expense analysis efficiently.

Our real estate brokerage cash flow model saves time, letting you focus more on growth, clients, and business success.

Our simple-to-use real estate brokerage financial model streamlines revenue forecasting and accelerates strategic growth planning.

Unlock rapid, reliable real estate brokerage financial projections with our easy, expert-friendly business plan and modeling template.

Our five-year real estate brokerage financial model ensures accurate growth forecasting and strategic, data-driven decision-making.

Unlock growth with a 5-year real estate brokerage financial model offering automated monthly and annual insights.