Real Estate Investment Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Investment Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Investment Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE INVESTMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

The real estate investment financial model template serves as an essential tool for startups and established companies looking to secure funding or analyze their projects comprehensively. This versatile commercial real estate financial model enables users to create accurate cash flow projections, develop detailed budgets, and enhance their business plans with a reliable real estate financial projection model. Featuring an unlocked, fully editable format, it supports a wide range of applications, including real estate development financial models, rental property financial models, and multifamily real estate financial models, allowing investors and developers to evaluate startup ideas, plan costs, and confidently assess real estate investment returns and feasibility.

This comprehensive real estate investment financial model template in Excel is designed to alleviate common pain points by providing a fully integrated, customizable, and scalable solution that streamlines the complexities of commercial and residential real estate financial modeling. Whether managing multifamily real estate, rental properties, or development projects, users benefit from an intuitive interface that captures critical inputs such as acquisition costs, funding requirements, growth rates, and cash flow projections, eliminating the need for expensive financial analysts. Its dynamic real estate cash flow model and real estate valuation model automatically update all relevant statements, enabling rapid scenario analysis and investment risk assessment while supporting real estate project feasibility, budgeting, and investment return calculations. This makes it an invaluable tool for investors looking to efficiently build a real estate investment portfolio and perform detailed real estate proforma financial models with confidence and ease.

Description

This real estate investment financial model template is a comprehensive tool designed for detailed real estate development financial analysis, offering a robust real estate cash flow model integrated with a 5-year monthly and annual real estate financial projection model, including P&L, balance sheet, and cash flow statements. Ideal for both startups and established ventures, this commercial real estate financial model consolidates discounted cash flow valuation techniques to accurately estimate business profitability and liquidity, while also calculating key financial performance ratios and KPIs essential for investor and bank presentations. Tailored for diverse applications such as rental property financial modeling, multifamily real estate financial planning, and real estate acquisition financial assessments, this bottom-up real estate proforma financial model streamlines complex calculations, enabling efficient management of real estate investment portfolios and supporting strategic decision-making with precise real estate investment return and risk models.

REAL ESTATE INVESTMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our versatile real estate investment financial model template, designed for seamless analysis across development, acquisition, and cash flow scenarios. This commercial real estate financial model features editable pro forma sheets, operating cost breakdowns, and customizable growth forecasts. Fully unlocked and flexible, it accommodates multifamily, residential, and rental property financial models with ease. Whether you need detailed financial projections, valuation models, or investment return analysis, this Excel-based tool streamlines budgeting and reporting, empowering informed decision-making for your real estate projects. Elevate your financial planning with a comprehensive, user-friendly real estate financial projection model tailored to your portfolio’s needs.

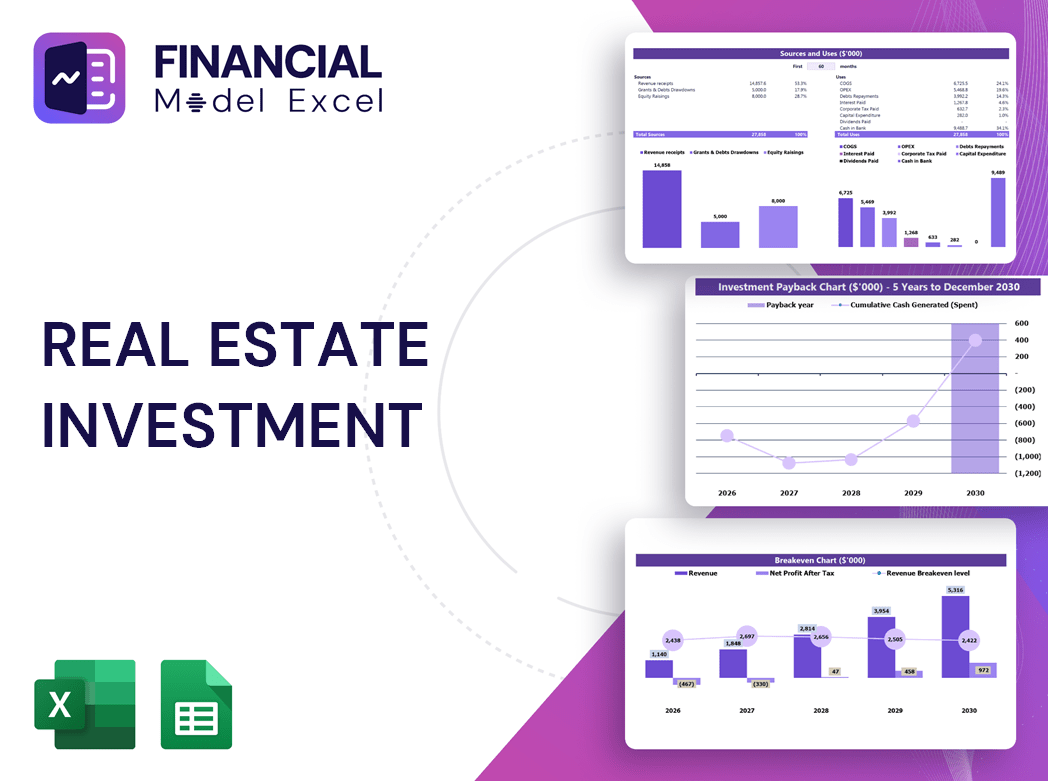

Dashboard

The Dashboard tab in this real estate financial model template delivers a clear snapshot of your investment’s performance through dynamic graphs, charts, key ratios, and concise financial summaries. Designed for seamless integration, all visuals and data are ready to be copied directly into your pitch deck, enhancing your real estate investment analysis with professionalism and precision. Whether you’re using a commercial real estate financial model, rental property financial model, or a real estate development financial model, this dashboard simplifies decision-making and elevates your presentations.

Business Financial Statements

Our comprehensive real estate proforma financial model template delivers an integrated analysis by consolidating data from multiple spreadsheets. It includes a 5-year projected balance sheet, monthly profit and loss statements, and cash flow forecasts—all optimized for real estate investment analysis. Designed by industry experts, this real estate financial projection model streamlines your pitch deck preparation with clear, professional reports, enhancing your commercial or residential real estate development evaluations and funding presentations. Elevate your investment strategy with our dynamic, Excel-based real estate investment financial model template.

Sources And Uses Statement

Our real estate financial projection model simplifies financial planning by clearly outlining sources and uses of funds. It demonstrates to stakeholders, including lenders and investors, the required financing and planned funding strategies. Whether securing additional capital or showcasing alternative options like crowdfunding, this model highlights flexibility in real estate investment budgeting. Balancing the total sources with uses ensures transparency and accuracy, making it an essential tool in real estate investment analysis models for both startups and established companies.

Break Even Point In Sales Dollars

Our real estate financial projection model integrates a dynamic break-even analysis to pinpoint when your investment starts generating positive returns. Utilizing a comprehensive real estate investment financial model template, it graphically and mathematically evaluates the balance between fixed and variable costs versus revenue. This powerful tool, ideal for commercial real estate financial models or rental property financial models, calculates the precise sales or rental volume needed at a given price to cover total costs. Enhance your real estate investment analysis model with our clear, data-driven break-even insights for confident, profitable decision-making.

Top Revenue

The Top Revenue tab in this real estate proforma financial model offers a clear, detailed view of each revenue stream within your portfolio. Leveraging this real estate financial projection model, you gain an annual breakdown of revenues, highlighting key metrics such as revenue depth and revenue bridge. This insight empowers informed decision-making for your real estate investment analysis model, ensuring accurate forecasting and strategic growth across your projects.

Business Top Expenses Spreadsheet

In the Top Expenses tab, generate a detailed cost summary—essential for accurate record-keeping and tax compliance. This data empowers you to build a robust real estate investment financial model template, enabling precise forecasting and historical analysis. Compare actual versus planned expenses to identify variances and optimize your commercial real estate financial model or rental property financial model. With organized expense insights, confidently develop future scenarios, enhance your real estate project financial model, and strategically plan for growth and scalability.

REAL ESTATE INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Instantly streamline your real estate investment analysis with this expertly designed financial model template. Whether you’re managing a commercial real estate financial model, rental property financial model, or a comprehensive real estate proforma financial model, this tool offers seamless, automated 3-year financial projections. Built with robust, end-to-end formulas across multiple worksheets, it ensures accurate forecasting of fixed operating expenses and cash flows without manual updates. Perfect for real estate development financial models, acquisition models, and investment portfolio models, this template simplifies complex data, empowering you to make informed, strategic decisions with ease and confidence.

CAPEX Spending

This real estate funding financial model automates the calculation of capital requirements by analyzing cash flow and integrating additional funding sources. Ideal for developers and investors, this template streamlines real estate investment budgeting and financial feasibility, ensuring accurate forecasts for commercial, residential, or multifamily projects. Enhance your real estate investment analysis model with precise funding insights to optimize your financial projections and maximize investment returns.

Loan Financing Calculator

Our real estate financial projection model features a built-in loan amortization schedule, detailing periodic payments and principal reduction over the loan term. Designed for real estate investment analysis, this tool helps stakeholders visualize payment breakdowns, interest, and remaining balances clearly. Whether managing commercial real estate financial models or rental property financial models, this amortization calculator ensures precise budgeting and strategic loan repayment planning, enhancing your real estate investment return model’s accuracy and financial feasibility.

REAL ESTATE INVESTMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The real estate financial projection model incorporates gross profit margin, a vital metric measuring profitability by dividing gross profit by net sales. Utilizing this key indicator within commercial real estate financial models or residential real estate financial models ensures accurate investment analysis. Whether you're working on a real estate development financial model or a rental property financial model, understanding gross profit margin enhances your real estate investment return model and financial feasibility assessments for informed decision-making.

Cash Flow Forecast Excel

A real estate cash flow model precisely illustrates the fluctuations in cash throughout a project timeline, highlighting key financial inflows and outflows. Utilizing a comprehensive real estate financial projection model allows investors and developers to anticipate liquidity changes, optimize budgeting, and enhance investment decision-making. Whether applied in a commercial real estate financial model or a rental property financial model, it provides critical insights to ensure sustainable financial management from project inception to completion.

KPI Benchmarks

A real estate proforma financial model leverages industry benchmarks to deliver insightful performance analysis. By comparing key financial indicators within your sector, this model offers an objective evaluation of your project’s health—whether it’s a multifamily real estate financial model or a commercial real estate financial model. Utilizing such targeted benchmarking in your real estate investment analysis model empowers you to make informed decisions, optimize cash flow, and enhance overall project feasibility. Unlock valuable insights to elevate your real estate investment portfolio and drive sustainable growth with a robust financial projection model.

P&L Statement Excel

To ensure profitability, a real estate investment financial model must include a detailed P&L statement in Excel, accurately projecting revenues against expenses. Whether using a real estate development financial model or a rental property financial model, this analysis is essential for startups to assess business viability. Our comprehensive real estate proforma financial model consolidates monthly profit and loss data into an annual report, providing clear insights into after-tax balances and net profits. This empowers investors and developers with precise financial feasibility and investment return evaluations critical for informed decision-making.

Pro Forma Balance Sheet Template Excel

Utilize our real estate financial projection model with a 5-year projected balance sheet template in Excel to gain clear insights into your assets, liabilities, and equity. This comprehensive real estate proforma financial model empowers investors and developers to accurately evaluate their organization’s financial position and investment viability. Whether you're utilizing a commercial real estate financial model or a rental property financial model, our tool ensures precise real estate investment analysis, helping you make informed decisions and optimize your portfolio’s performance over time.

REAL ESTATE INVESTMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive real estate financial projection model equips you with essential data for investor confidence. Featuring a sophisticated real estate investment analysis model, it includes weighted average cost of capital (WACC) to demonstrate minimum required returns, a real estate cash flow model detailing free cash flow available to stakeholders, and a discounted cash flow valuation to accurately assess the present value of future cash flows. Perfect for commercial, residential, or multifamily real estate development, this real estate investment excel model ensures robust financial feasibility and investment return clarity.

Cap Table

A comprehensive real estate investment financial model template provides detailed insights into ownership structures and asset allocations, similar to a cap table for startups. It tracks equity distribution across common and preferred shares, warrants, and options within a project’s financial feasibility model. Regular updates to this real estate proforma financial model ensure accurate real estate investment analysis, empowering developers and investors to make informed decisions, optimize rental property cash flows, and maximize returns. Staying current with ownership and investment data is essential for driving profitable commercial, multifamily, or residential real estate projects.

REAL ESTATE INVESTMENT FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Empower your team with a real estate investment financial model that drives accurate projections and strategic decision-making.

Establish clear milestones and maximize returns with a comprehensive real estate investment financial model 5-year projection plan.

Start a new business confidently with our real estate investment financial model, ensuring accurate revenue and risk analysis.

Achieve precise forecasts and maximize returns with our comprehensive real estate investment financial model template.

Optimize your real estate investment with our comprehensive financial model template for accurate 5-year projections and budgeting.

REAL ESTATE INVESTMENT 3 STATEMENT FINANCIAL MODEL TEMPLATE ADVANTAGES

Simplify decisions with our real estate financial model, delivering precise projections for confident investment and maximum returns.

Unlock accurate, comprehensive real estate investment insights effortlessly with our user-friendly yet sophisticated financial model template.

Identify cash gaps and surpluses early with our real estate cash flow model for proactive financial planning.

The real estate cash flow model forecasts deficits or surpluses, enabling proactive financial decisions to maximize growth.

Optimize investments confidently with our real estate financial projection model, designed to secure funding and maximize returns.

Impress investors with a strategic real estate investment financial model that ensures precise analysis and maximizes ROI confidently.

Optimize returns and avoid cash flow shortfalls with our comprehensive real estate investment financial model template.

The real estate cash flow model accurately forecasts and visualizes trends, preventing costly cash flow shortfalls and improving planning.

Optimize decisions with our 5-year real estate investment financial model template for accurate forecasting and risk analysis.

Optimize profits with our fully integrated 5-year real estate investment financial model featuring automatic annual summary aggregation.