Real Estate Investment Platform Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Investment Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Investment Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE INVESTMENT PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

The real estate investment platform financial model, featuring a comprehensive 3-statement financial model template for startups or established companies, is an essential tool for raising capital from investors or bankers by facilitating detailed financial analysis and funding requirement calculations. This model supports the creation of accurate cash flow projections, income projection models for real estate platforms, and robust financial plans, allowing businesses to develop precise budgets and enhance their business plans. Additionally, the unlocked and fully editable financial modeling tools offer invaluable capabilities such as real estate platform valuation models, investment return analysis, scenario analysis, and capital budgeting models, helping stakeholders estimate startup costs, forecast expenses, and generate profit forecasts, all aligned with real estate financial modeling best practices.

This comprehensive real estate investment platform financial model template addresses common pain points by offering an intuitive financial plan for real estate investment platforms that integrates real estate platform expense forecasting models and revenue projections, ensuring accurate income projection models for real estate platforms. Its built-in real estate investment platform scenario analysis and capital budgeting model allow users to simulate various market conditions and investment strategies, reducing uncertainty and improving decision-making. The inclusion of a real estate platform investment risk model alongside a real estate ROI financial model offers actionable profit forecasts and investment return analysis to optimize portfolio performance. Additionally, the ready-made real estate financial modeling best practices embedded in the template streamline budgeting and provide a dynamic real estate investment platform financial dashboard, enabling startups and investors to efficiently monitor financial health, cash flow forecasts, and valuation metrics without the need for extensive manual financial modeling tools for real estate investments.

Description

This real estate investment platform financial model provides a comprehensive financial plan for real estate investment platforms, integrating financial modeling best practices to deliver detailed cash flow models, income projection models, and expense forecasting templates tailored for startup to established ventures. It features a dynamic five-year projection plan, including monthly and yearly financial statements such as profit and loss, balance sheets, and cash flow spreadsheets, enabling accurate real estate platform valuation models, ROI financial models, and profit forecasts. By employing a bottom-up approach, the model accounts for OPEX, capital expenditures, and pricing assumptions to generate reliable real estate platform revenue projections, capital budgeting insights, scenario and risk analysis, and performance KPIs, all presented through an intuitive financial dashboard designed to streamline financial analysis and optimize real estate platform investment return analysis.

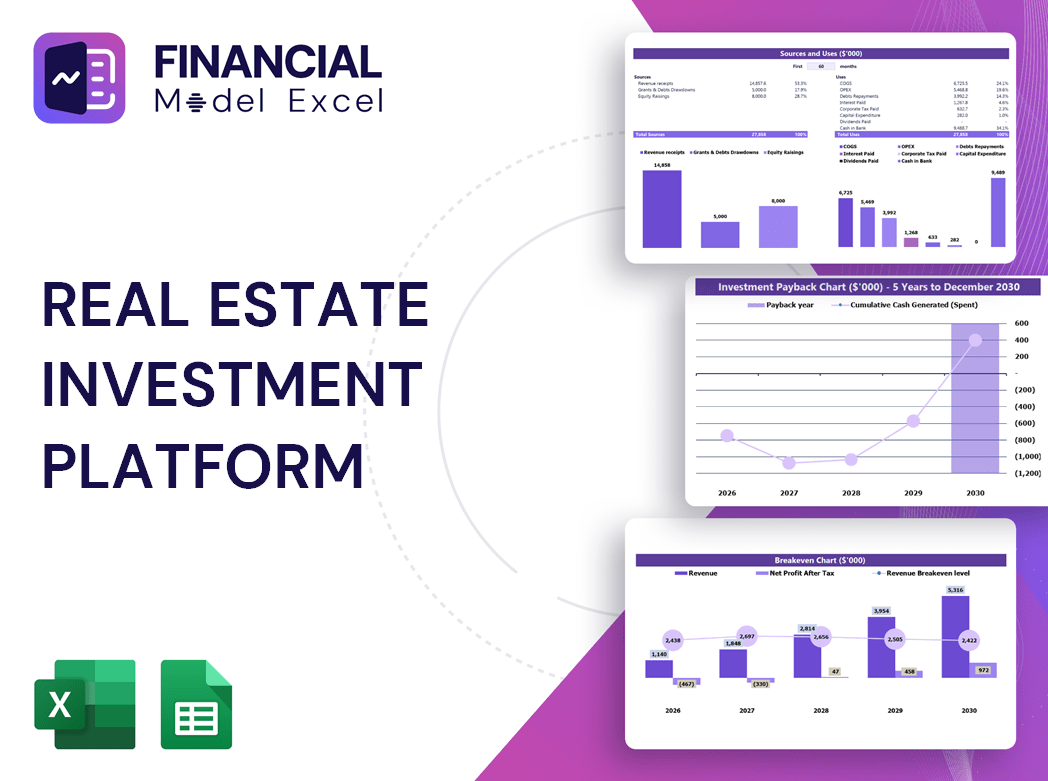

REAL ESTATE INVESTMENT PLATFORM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover a powerful yet user-friendly real estate investment platform financial model template, designed to streamline your financial planning. This comprehensive tool includes income projection, cash flow modeling, and ROI analysis, empowering you to create accurate profit forecasts and scenario analyses with ease. Whether you are a seasoned financial analyst or new to real estate modeling, customize every aspect to fit your unique business needs. Leverage best practices in real estate financial modeling to optimize budgeting, valuation, and risk assessment for your platform’s success. Elevate your investment strategy with our versatile and fully extensible Excel solution.

Dashboard

Our real estate investment platform financial dashboard consolidates data from all proforma statements and models, offering seamless financial analysis. Customize KPIs effortlessly, while the dashboard automatically pulls and calculates key metrics from your financial reports for any period—monthly or yearly. Ideal for real estate investment platform cash flow models and profit forecasts, it streamlines income projection, budgeting, and scenario analysis. Stay agile with a dynamic tool that adapts to your needs, ensuring real-time insights for robust capital budgeting and ROI forecasting aligned with best practices in real estate financial modeling.

Business Financial Statements

All three accounting statements are essential for comprehensive real estate investment platform financial analysis. The profit and loss projection model offers critical insights into core operating activities driving earnings. Meanwhile, the projected balance sheet and cash flow model emphasize capital management, focusing on asset allocation and financial structure. Leveraging these real estate financial modeling best practices enhances accuracy in income projection, cash flow modeling, and investment return analysis, empowering informed decision-making for robust real estate platform valuation and profit forecasting.

Sources And Uses Statement

A comprehensive sources and uses statement schedule is essential for real estate investment platforms to transparently trace capital inflows and their allocation. Integrating this within a robust real estate investment platform financial analysis or financial modeling framework enhances accuracy in cash flow models, budgeting templates, and profit forecasts. This clarity supports effective income projection models, capital budgeting, and investment return analysis, ensuring stakeholders have a clear view of fund utilization aligned with strategic objectives and risk management best practices.

Break Even Point In Sales Dollars

This 5-year real estate investment platform financial projection template offers a comprehensive break-even analysis, calculating the critical revenue threshold in both numeric and visual chart formats. Designed with best practices in real estate financial modeling, it supports cash flow modeling, profit forecasting, and investment return analysis. Ideal for scenario analysis and budgeting, this tool empowers investors to make informed decisions by visualizing when their platform will achieve profitability, enhancing financial planning and capital budgeting strategies for optimal real estate ROI.

Top Revenue

In real estate investment platforms, accurate revenue projection models are vital to robust financial analysis and valuation. Revenue drives key metrics and underpins financial modeling for real estate investment platforms, including cash flow, ROI, and profit forecasts. Incorporating growth rate assumptions grounded in historical data enhances model reliability. Our financial plan templates embed real estate financial modeling best practices, offering comprehensive budgeting, scenario analysis, and capital budgeting tools. These enable precise investment return analysis and risk assessment, empowering analysts to deliver insightful, data-driven forecasts that optimize platform financial performance and long-term value.

Business Top Expenses Spreadsheet

Effortlessly analyze your expenses using the Top Expenses section of our real estate investment platform financial plan. Structured into four core categories plus an flexible ‘Other’ bucket, this design ensures comprehensive tracking tailored to your unique needs. Whether for financial modeling, expense forecasting, or budgeting, our detailed expense report empowers precise cash flow management and supports robust income projection models, aligning perfectly with real estate platform financial modeling best practices to optimize investment return analysis.

REAL ESTATE INVESTMENT PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a critical component in any real estate investment platform financial plan. These expenses arise before operations begin and require continuous monitoring through a comprehensive budgeting template to prevent underfunding and financial setbacks. Utilizing a detailed start-up costs proforma within your real estate financial modeling tools ensures accurate cash flow modeling and expense forecasting. This proactive approach enhances income projection models and supports robust scenario analysis, ultimately driving informed investment return analysis and maximizing ROI. Consistent oversight of initial expenditures is key to sustaining financial feasibility and achieving long-term profitability in real estate investment platforms.

CAPEX Spending

Capital expenditure (CapEx) is a crucial component of any real estate investment platform financial plan. Accurate CapEx modeling enables investors to track investments in fixed assets, manage depreciation, and accommodate additions or disposals of property, plant, and equipment (PPE). Incorporating CapEx within a real estate platform budgeting template or cash flow model ensures comprehensive forecasting, including assets acquired through financial leasing. Utilizing best practices in financial modeling for real estate investment platforms enhances investment return analysis and supports robust profit forecasts, ultimately optimizing capital budgeting and long-term valuation models.

Loan Financing Calculator

A comprehensive real estate investment platform financial modeling tool includes a detailed loan amortization schedule, vital for accurate cash flow and profit forecasting. This schedule outlines key data—loan amount, interest rate, maturity term, payment frequency—and incorporates diverse amortization methods such as straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Integrating these elements enhances scenario analysis, capital budgeting models, and ROI projections, empowering stakeholders with precise income projection and risk assessment for informed investment decisions.

REAL ESTATE INVESTMENT PLATFORM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

A comprehensive real estate investment platform financial model delivers a dynamic financial forecast template featuring both company and sector-specific KPIs. Key metrics such as profitability, cash flow, and liquidity enable precise income projection and real estate platform valuation. These insights align with real estate financial modeling best practices, empowering investors with a clear financial plan for real estate investment platforms. This robust financial analysis supports confident investment decisions through accurate profit forecasts and scenario analysis, ensuring a thorough understanding of the platform’s financial health and investment return potential.

Cash Flow Forecast Excel

A comprehensive real estate investment platform cash flow model offers an in-depth analysis of all cash inflows and outflows within a specified period. This financial modeling tool enhances accuracy in income projection, expense forecasting, and profit forecasting—empowering investors with clear visibility into their platform’s financial health. Utilizing best practices in real estate financial modeling, it supports robust scenario analysis and capital budgeting, ensuring strategic decision-making based on detailed cash flow insights and investment return analysis.

KPI Benchmarks

Our Excel model features a uniquely designed benchmarking template tailored for real estate investment platforms. By integrating industry and financial benchmarks, it delivers critical insights into company performance and highlights top performers within the sector. This tool guides stakeholders in pinpointing key areas for improvement, enhancing financial planning, cash flow modeling, and ROI analysis. Employing this benchmarking study template ensures data-driven decisions that drive optimal results, strengthen your investment platform valuation model, and align with real estate financial modeling best practices. Elevate your strategic focus and maximize your platform’s profitability with this essential resource.

P&L Statement Excel

Elevate your real estate investment platform with our precise monthly profit and loss statement template. Designed for accuracy, it delivers detailed financial analysis and reliable profit forecasts crucial for strategic decision-making. This income projection model enables seamless creation of annual and gross profit reports, supporting comprehensive financial planning. Incorporate best practices in real estate financial modeling to enhance your platform’s cash flow modeling, profit forecasting, and investment return analysis. Trust this essential tool to optimize budgeting, scenario analysis, and revenue projection, empowering your investment strategy with clarity and confidence.

Pro Forma Balance Sheet Template Excel

A comprehensive projected balance sheet template in Excel is essential for real estate investment platforms, detailing current and long-term assets, liabilities, and equity over a 5-year horizon. Integrating this with financial modeling tools for real estate investments enhances accuracy in real estate platform valuation models and financial plan development. This foundation supports effective cash flow models, income projection models, and investment return analyses, empowering data-driven decision-making and adherence to real estate financial modeling best practices for optimal ROI and profit forecasting.

REAL ESTATE INVESTMENT PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive real estate investment platform valuation model, featuring an integrated 3-way financial model to provide investors with critical insights. The weighted average cost of capital (WACC) clearly communicates the minimum required return on invested capital, while the free cash flow valuation highlights available cash for all stakeholders. Our discounted cash flow analysis accurately reflects the present value of future cash flows, ensuring precise real estate ROI financial modeling. Equip your platform with this robust financial plan, combining best practices in scenario analysis and cash flow modeling to drive confident investment decisions.

Cap Table

Our real estate investment platform financial modeling template features a dynamic pro forma cap table designed to accurately track shareholder ownership dilution across up to four funding rounds. Users can seamlessly customize projections by applying any combination of these rounds to reflect their investment scenarios. This powerful tool integrates effortlessly with your real estate platform valuation model and financial plan, enabling precise income projection, cash flow analysis, and profit forecasting. Empower your investment strategy with robust financial modeling best practices and scenario analysis for confident decision-making.

REAL ESTATE INVESTMENT PLATFORM PROJECTED INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Enhance decision-making with a real estate investment platform financial model for accurate startup cost forecasting.

Financial modeling tools for real estate platforms predict cash flow, optimizing investment decisions and maximizing ROI effectively.

Optimize decisions and maximize returns with a real estate investment platform financial model designed for precise management.

A real estate investment platform financial model ensures precise budgeting, maximizing ROI through accurate cash flow and risk analysis.

Set new goals confidently with a real estate investment platform financial model for accurate forecasting and strategic planning.

REAL ESTATE INVESTMENT PLATFORM SIMPLE FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

Optimize returns with our real estate investment platform financial model, driving precise forecasting and strategic growth decisions.

Financial modeling tools empower real estate platforms to forecast cash flow, evaluate funding options, and optimize growth strategies.

Unlock precise key metrics analysis with our advanced real estate investment platform financial modeling tools.

Quickly generate accurate 5-year real estate investment platform financial models with comprehensive forecasts and GAAP/IFRS compliance.

Our real estate investment platform financial model saves you time by streamlining accurate cash flow and profit forecasts.

Real estate investment platform financial models streamline projections, empowering smarter decisions and maximizing investment returns efficiently.

Simple-to-use real estate financial modeling tools offer accurate investment return analysis for confident platform decisions.

Experience quick, reliable insights with our sophisticated real estate investment platform financial model—no advanced Excel skills needed.

Streamline real estate investment decisions with our easy-to-follow financial modeling tools for accurate profit forecasting.

Clear, color-coded real estate financial model enhances transparency, streamlines analysis, and optimizes investment decision-making.