Real Estate Investment Trust REIT Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Investment Trust REIT Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Investment Trust REIT Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly real estate financial modeling template designed as a comprehensive REIT valuation financial model, incorporating a detailed REIT cash flow projections model, operating income financial model, and dividend distribution model with monthly and annual timelines. Ideal for startups or existing real estate investment trusts, this all-in-one real estate investment trust pro forma model supports accurate real estate asset financial modeling and real estate portfolio financial forecasting. Utilize this robust REIT financial statement modeling tool, optimized for capital expenditure modeling and debt and equity financing models, to secure funding from banks, angels, grants, and VC funds. Fully unlocked and customizable to fit advanced real estate trust financial planning tools and real estate financial modeling best practices.

This ready-made real estate investment trust financial analysis model effectively addresses common pain points such as complex reit valuation financial modeling, fragmented cash flow projections, and the challenge of integrating operating income with debt and equity financing structures. Equipped with comprehensive real estate financial modeling templates, it streamlines reit dividend distribution model calculations and enhances accuracy in real estate asset financial modeling. The template simplifies intricate processes like real estate portfolio financial forecasting, reit financial statement modeling, and capital expenditure modeling, while incorporating industry best practices for real estate financial modeling. Additionally, it offers robust reit sensitivity analysis financial models and reit market analysis financial models, ensuring users can confidently perform thorough risk assessments and maintain precise reit financial metrics calculation, empowering investors to optimize their real estate trust financial planning tools efficiently.

Description

This real estate investment trust financial analysis model offers a comprehensive 5-year forecast integrating detailed real estate trust financial statement modeling, including profit and loss, pro forma balance sheets, and cash flow projections. Equipped with robust real estate financial modeling templates, the model supports reit valuation financial model capabilities by calculating key financial metrics such as Internal Rate of Return (IRR), Discounted Cash Flow (DCF), and free cash flows, while also enabling thorough reit dividend distribution modeling and reit capital expenditure modeling. By incorporating reit debt and equity financing model features alongside real estate portfolio financial forecasting tools, users can precisely estimate initial capital investments, working capital needs, and monthly sales and expenses. Additionally, this real estate investment trust pro forma model includes reit sensitivity analysis financial model functions and real estate trust investment risk model assessments to evaluate risk and optimize financial returns, delivering best practices in real estate financial modeling for strategic financial planning and decision-making.

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking a sophisticated yet intuitive real estate investment trust financial analysis model? Our versatile REIT valuation financial model offers user-friendly real estate financial modeling templates, designed for seamless customization and expansion. Ideal for detailed cash flow projections, dividend distribution modeling, and debt and equity financing scenarios, this comprehensive tool supports precise real estate portfolio financial forecasting and performance assessment. Built on real estate financial modeling best practices, it empowers informed decision-making with accurate financial metrics calculation and sensitivity analysis. Elevate your real estate trust financial planning with our dynamic, professional-grade modeling solution—effortlessly adaptable to your unique investment strategies.

Dashboard

Our comprehensive real estate financial modeling templates streamline REIT cash flow projections and financial statement modeling, delivering clear monthly or annual reports. With an intuitive dashboard, key metrics from your REIT valuation financial model and operating income forecasts are centralized and visually presented for quick insights. Designed with real estate investment trust pro forma models and best practices in mind, this tool empowers precise revenue modeling, dividend distribution, and portfolio financial forecasting, enhancing your REIT financial planning and market analysis capabilities. Elevate your real estate investment trust financial analysis model with accuracy and clarity.

Business Financial Statements

Our comprehensive real estate investment trust financial analysis model features an integrated Excel-based structure encompassing key startup templates—including balance sheet forecasts, pro forma income statements, and REIT cash flow projections models. Designed for seamless five-year financial forecasting, this REIT valuation financial model offers pre-built pro formas, detailed financial and managerial reports, and essential financial metrics calculations. Users can effortlessly customize outputs in GAAP or IFRS formats, ensuring flexible and professional real estate portfolio financial forecasting aligned with industry best practices. Elevate your REIT financial planning with our robust and user-friendly real estate financial modeling templates.

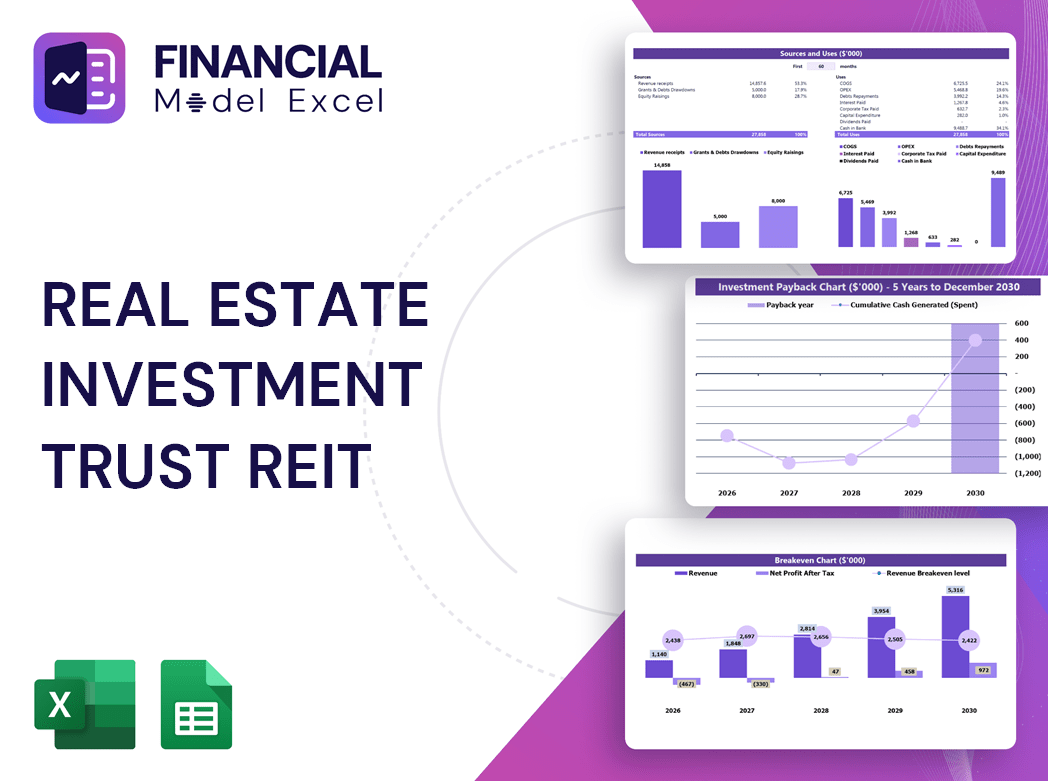

Sources And Uses Statement

To enhance professionalism and streamline fund management, our real estate financial modeling templates feature a dedicated Sources and Uses of Funds tab. This component clearly delineates the origins of capital—crucial for REIT valuation financial models—and maps them to their intended applications. Integrating this tab into your real estate investment trust financial analysis model ensures transparent tracking of funding sources alongside corresponding expenditures, aligning with real estate portfolio financial forecasting best practices and supporting accurate reit cash flow projections models.

Break Even Point In Sales Dollars

Understanding break-even revenue is crucial in real estate investment trust financial analysis models. It pinpoints the exact sales level where total contribution covers fixed costs, resulting in zero profit or loss. This insight aids REIT financial statement modeling and cash flow projections by highlighting profitability thresholds. Utilizing this approach within real estate financial modeling templates leverages marginal costing principles, adapting to varying output levels. Integrating break-even analysis enhances REIT valuation financial models, supporting accurate revenue forecasting and strategic decision-making for optimal investment performance.

Top Revenue

Accurate revenue forecasting is crucial in real estate investment trust financial analysis models, as revenues drive overall enterprise value. Utilizing real estate investment trust pro forma models and financial planning tools, management can create precise reit cash flow projections and revenue models. Incorporating detailed assumptions and historical data within real estate financial modeling templates ensures reliable 5-year financial forecasts. Adopting best practices in reit valuation financial models and sensitivity analysis enhances strategy, enabling informed decision-making and sustainable growth in real estate portfolio financial forecasting.

Business Top Expenses Spreadsheet

In the Top Expenses section of our real estate investment trust pro forma model, core costs are clearly categorized into four key areas. The “Other” category offers flexibility to include any additional expenditures vital for your REIT’s operations. Leverage our comprehensive real estate financial modeling templates, including startup financial model Excel tools, to accurately track your REIT’s financial performance, cash flow projections, and dividend distribution model over a five-year horizon—ensuring robust financial planning and informed decision-making.

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a crucial component of any real estate investment trust financial analysis model. Accumulating prior to operations, early tracking prevents underfunding and overspending. Our start-up cost pro forma, integrated within the REIT valuation financial model, captures both funds and expenses, enabling precise real estate financial modeling. Use this template to monitor spending, enhance budgeting accuracy, and align with real estate financial modeling best practices—ensuring your real estate trust financial planning tools support sound investment decisions from the outset.

CAPEX Spending

Initial CAPEX represents a company’s strategic investment in assets such as equipment, vehicles, or office infrastructure, crucial for growth and operations. Development costs typically support launching new products or expanding existing lines. In REIT financial modeling, CAPEX isn’t directly expensed in profit and loss projections. Instead, it’s capitalized on the balance sheet within real estate investment trust pro forma models and gradually expensed over time as depreciation. Utilizing real estate financial modeling best practices ensures accurate reflection of these costs in cash flow projections and dividend distribution models, supporting robust REIT valuation and market analysis financial models.

Loan Financing Calculator

Accurately forecasting loan payments is critical for REIT financial planning, especially for start-ups navigating debt and equity financing models. Our comprehensive Excel-based real estate investment trust financial analysis model features an integrated loan amortization schedule and calculator, streamlining cash flow projections and ensuring precise debt management. This tool empowers users to efficiently plan and track mortgage obligations, enhancing real estate portfolio financial forecasting and supporting informed decision-making aligned with real estate financial modeling best practices.

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Gross profit margin, a key metric in real estate investment trust financial analysis models, measures profitability by comparing revenue minus cost of sales to total revenue. Increasing gross margins in a REIT operating income financial model signify improved efficiency—either through reduced sale-related expenses or higher revenue generation. Tracking this ratio within real estate portfolio financial forecasting and REIT performance models provides critical insights into financial health and operational success, driving informed investment and dividend distribution strategies.

Cash Flow Forecast Excel

The REIT cash flow projections model offers a comprehensive analysis of cash inflows and outflows, delivering clearer insights than traditional income statements. This fully integrated real estate financial modeling template enables detailed forecasting of cash flow statements monthly for 12 months or annually up to 5 years. Ideal for real estate investment trust financial analysis, it supports effective financial planning and performance evaluation, ensuring accurate REIT valuation and informed decision-making aligned with best practices in real estate financial modeling.

KPI Benchmarks

The real estate investment trust financial analysis model’s benchmark tab calculates key business and financial metrics, comparing them to industry averages. This relative valuation approach is crucial for effective REIT valuation and performance modeling. For start-ups, leveraging real estate financial modeling templates and industry benchmarks enables strategic insights, guiding improvements in cash flow projections, dividend distribution, and debt-equity financing models. Incorporating these best practices enhances real estate portfolio financial forecasting and risk assessment, driving stronger financial outcomes and informed decision-making within the competitive REIT landscape.

P&L Statement Excel

The Monthly Proforma Income Statement and Yearly Profit & Loss Forecast templates are essential real estate financial modeling tools for startups and REITs. They provide detailed revenue streams, gross and net earnings, and link to comprehensive REIT financial statement modeling. With embedded real estate investment trust financial analysis models and real estate portfolio financial forecasting, these templates enable precise profit tracking and expense management. Features include assumptions, key financial metrics calculations, margins, and cash flow projections, helping owners make informed decisions and optimize profitability through best practices in real estate financial modeling.

Pro Forma Balance Sheet Template Excel

Forecasting a 5-year pro forma balance sheet is crucial in any real estate investment trust financial analysis model. Integrated with the profit and loss statement and cash flow projections, it ensures seamless financial statement modeling. While investors focus on income statements, accurate balance sheet forecasts enhance reit cash flow projections models and support critical reit financial metrics calculations like return on equity and invested capital. This comprehensive real estate financial modeling approach aids in validating net income assumptions and strengthens investment risk assessment, making it an essential component of effective real estate asset financial modeling and reit valuation financial models.

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Utilize this comprehensive REIT valuation financial model template to perform a Discounted Cash Flow analysis effortlessly. By inputting key rates in the Cost of Capital section, users can generate detailed real estate investment trust revenue models and accurate cash flow projections. Designed with real estate financial modeling best practices, this bottom-up approach streamlines REIT financial statement modeling and enhances sensitivity analysis capabilities for precise performance forecasting and risk assessment. Ideal for professionals seeking reliable real estate asset financial modeling and strategic portfolio financial forecasting tools.

Cap Table

Our comprehensive real estate financial modeling templates include a robust REIT valuation financial model that details ownership structure, akin to a startup cap table. This model outlines share distribution, investor contributions, and precise ownership percentages. Integrated with REIT cash flow projections and dividend distribution modules, it empowers investors to analyze financial metrics, forecast portfolio performance, and assess investment risk confidently. Experience best practices in real estate asset financial modeling combined with in-depth debt and equity financing insights, ensuring accurate and actionable real estate investment trust pro forma analysis and strategic financial planning.

REAL ESTATE INVESTMENT TRUST REIT FINANCIAL FORECAST TEMPLATE EXCEL ADVANTAGES

Demonstrate timely repayment confidence to lenders using our precise real estate investment trust pro forma financial model.

The real estate investment trust pro forma model ensures precise tracking of spending, enhancing financial control and decision-making.

Attract investors effortlessly using the REIT financial analysis model for precise, insightful real estate investment trust forecasts.

The REIT financial model ensures accurate forecasts, minimizing misunderstandings and optimizing real estate investment decisions.

The REIT financial model ensures accurate, up-to-date five-year projections, boosting credibility with banks and investors.

REAL ESTATE INVESTMENT TRUST REIT BUDGET FINANCIAL MODEL ADVANTAGES

Our REIT financial analysis model empowers startups to optimize investment strategies with precise, real-time cash flow projections.

The REIT financial model delivers clear, concise summaries that enhance your pitch deck’s impact and investor confidence.

The REIT financial analysis model saves you time by streamlining accurate real estate investment trust valuation and forecasting.

The REIT cash flow projections model streamlines analysis, freeing time to focus on growth and strategic business development.

Our REIT financial analysis model accurately proves your ability to repay loans with precise cash flow projections.

Using a REIT cash flow projections model clearly demonstrates loan repayment ability, boosting lender confidence and approval chances.

Unlock precise REIT valuation and risk insights with our advanced financial analysis and modeling tools—because we do the math.

Streamline REIT valuation with our Excel model—no formulas, formatting, or costly consultants required!

Our REIT valuation financial model delivers precise key metrics analysis for confident, data-driven real estate investment decisions.

Streamline REIT performance with an accurate 5-year financial model, integrating GAAP/IFRS statements and key ratios instantly.