Remittance Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Remittance Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Remittance Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REMITTANCE SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

The remittance services financial model template offers a comprehensive 5-year financial planning framework tailored for both startups and established businesses in the remittance sector, enabling detailed financial projections for remittance services. This robust tool supports in-depth remittance business financial planning by incorporating key financial assumptions, revenue forecasting, and break-even analysis, while also facilitating discounted cash flow remittance services evaluation. Designed with best practices in remittance service financial modeling, it includes scenario and sensitivity analysis features to assess financial risks and optimize the cost structure model, making it ideal for investment analysis and long-term financial planning within the remittance service industry.

The ready-made financial model template for remittance services effectively alleviates common pain points by providing a comprehensive structure for remittance business financial planning and financial projections. It automates revenue forecasting and cash flow modeling while incorporating financial assumptions specific to the remittance industry, allowing users to perform detailed investment analysis and profitability modeling with ease. Its built-in scenario and sensitivity analysis features enable robust financial risk assessment, while the break-even analysis and cost structure models ensure clear visibility into cost drivers and operational efficiency. Designed following remittance service financial modeling best practices, this template streamlines budgeting and long-term financial planning, producing GAAP/IFRS-compliant financial statements that support strategic decision-making and improve confidence in financial outcomes.

Description

This comprehensive financial model template for remittance services offers detailed financial projections for remittance services, integrating remittance business financial planning with robust financial assumptions for remittance business. It includes a cash flow model for remittance services, remittance service revenue forecasting, and a profitability model remittance services to support long-term financial planning remittance, budget management, and break-even analysis remittance business. The model features remittance financial statement modeling with scenario analysis remittance financial model, sensitivity analysis remittance business model, and investment analysis remittance service components, ensuring thorough financial risk assessment remittance services and adherence to remittance service financial modeling best practices for accurate and insightful decision-making.

REMITTANCE SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Whether launching a remittance startup or growing an existing service, our comprehensive financial model template for remittance services provides all essential reports. Access detailed financial projections, including income and expenditure templates, cash flow models, and balance sheet forecasts. Our solution supports five-year revenue forecasting, budgeting, and profitability analysis, with monthly and yearly financial summaries. Built with best practices in remittance service financial modeling, it enables scenario and sensitivity analysis, break-even evaluation, and risk assessment to optimize your remittance business financial planning and investment decisions.

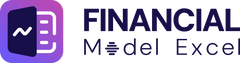

Dashboard

A robust financial model template for remittance services offers a dynamic dashboard to streamline financial projections and cash flow analysis. It enables detailed remittance business financial planning, including revenue forecasting, cost structure modeling, and profitability assessments. By integrating scenario and sensitivity analysis, it supports investment analysis and financial risk assessment, ensuring informed decision-making. These models provide timely, accurate financial statements and budgeting insights, fostering transparency and building stakeholder trust. Leveraging best practices in remittance service financial modeling empowers startups to optimize financial management and enhance long-term strategic growth.

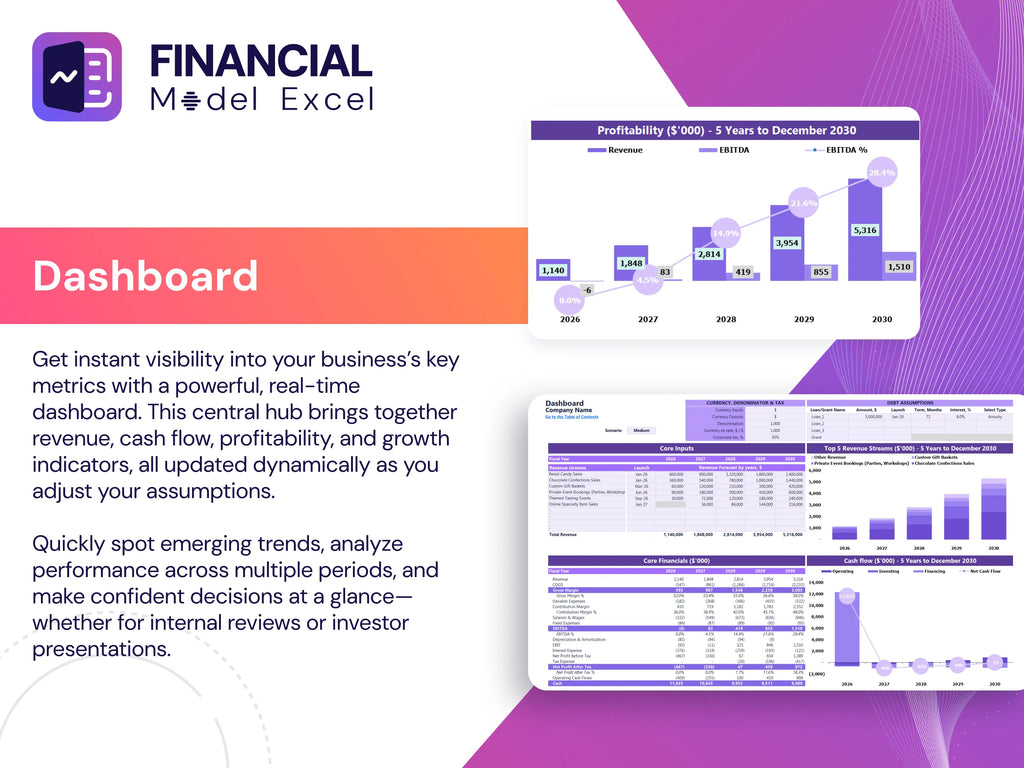

Business Financial Statements

Our comprehensive financial model template for remittance services features pre-built pro forma income statements, projected balance sheets, and cash flow models—designed for 5-year financial projections. Presented in both monthly and annual formats, this template supports remittance business financial planning with robust revenue forecasting and cash flow analysis. Easily integrate existing financial statements from QuickBooks, Xero, or FreshBooks to enhance budgeting models and enable dynamic rolling forecasts. Ideal for investment analysis, break-even analysis, and sensitivity scenario planning, it empowers precise financial risk assessment and long-term financial planning tailored to remittance service profitability and growth.

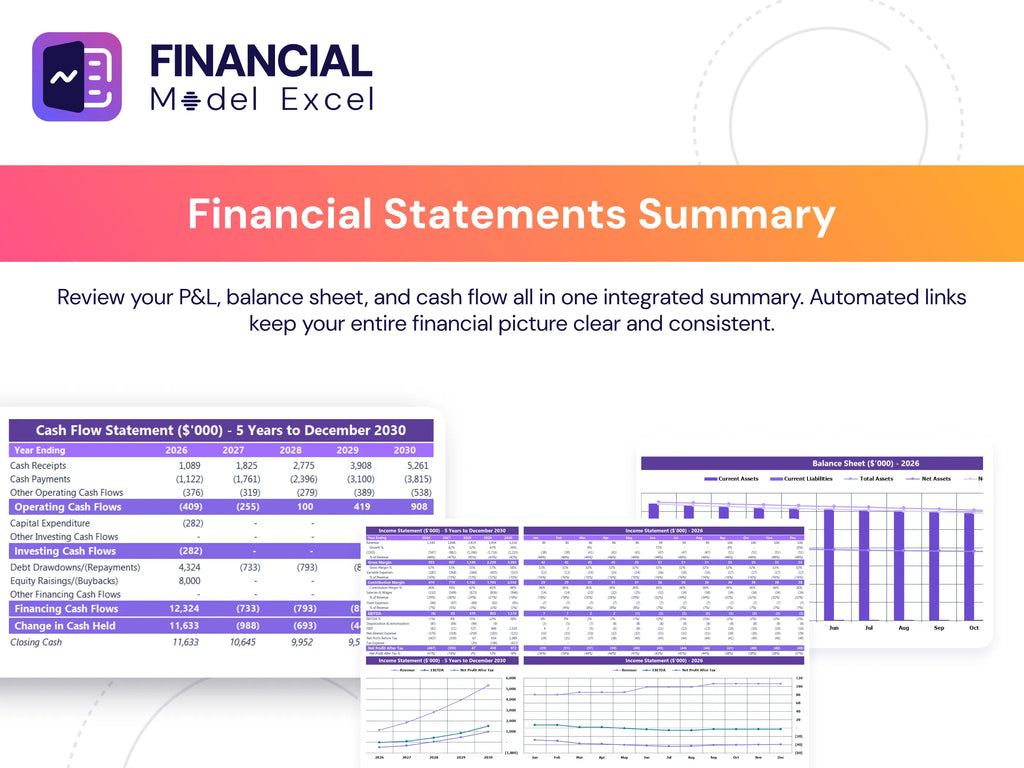

Sources And Uses Statement

The sources and uses template is a vital component of a comprehensive financial model template for remittance services. It enables precise tracking and regulation of income streams and expense allocations, supporting robust financial projections and cash flow models. Integrating this tool into your remittance business financial planning facilitates accurate revenue forecasting, cost structure analysis, and break-even assessment. Employing best practices in remittance service financial modeling ensures informed investment analysis and strengthens long-term financial planning, ultimately enhancing profitability and mitigating financial risks.

Break Even Point In Sales Dollars

A break-even analysis is essential in remittance business financial planning, identifying the sales volume needed to cover fixed and variable costs. This financial model template for remittance services enables accurate revenue forecasting and profitability modeling, helping businesses determine the timeline to recoup investments. By leveraging scenario and sensitivity analysis, management can optimize pricing strategies and cost structures, enhancing long-term financial planning. Utilizing this cash flow model for remittance services supports informed decision-making, ensuring sustainable growth while aligning with best practices in remittance service financial modeling and investment analysis.

Top Revenue

In remittance services financial modeling, understanding top-line and bottom-line metrics is crucial. The top line represents total revenue, reflecting remittance service revenue forecasting and growth potential. Bottom line indicates net income, highlighting profitability after costs—key for break-even analysis and cash flow modeling. Investors rely on these financial projections for remittance services to assess long-term financial planning and investment analysis. Incorporating financial assumptions, sensitivity analysis, and scenario planning ensures robust remittance business financial planning and strengthens the overall financial model template for remittance services.

Business Top Expenses Spreadsheet

Effective remittance business financial planning requires continuous cost optimization. Our startup financial model template features a top expense report that highlights the four largest cost categories, consolidating others for streamlined monitoring. This enables users to track expense trends annually, supporting accurate budgeting and cash flow modeling. Regular expense analysis is crucial for maintaining profitability and making informed financial projections for remittance services. By leveraging financial metrics and scenario analysis, startups and established companies can optimize their cost structure, enhance profitability models, and implement robust financial risk assessment for sustainable growth.

REMITTANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

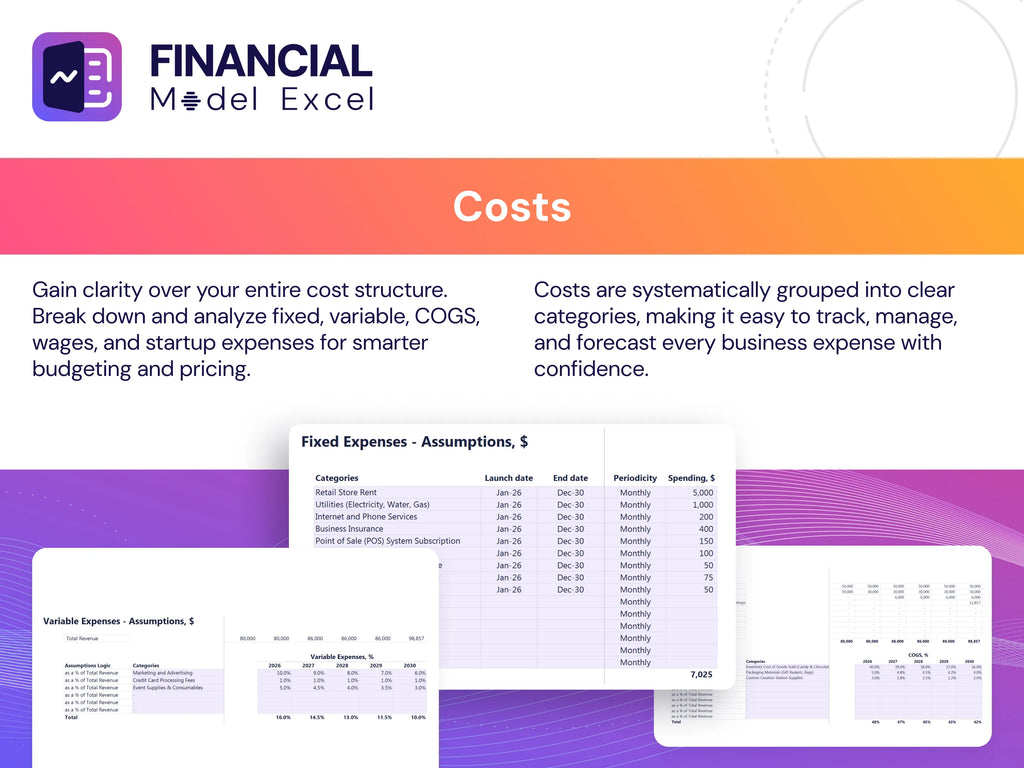

Costs

A comprehensive financial model template for remittance services is essential for effective business planning. It enables precise cost management, cash flow modeling, and profitability analysis. Incorporating financial projections and scenario analysis, this tool supports revenue forecasting, break-even analysis, and investment evaluation. By leveraging best practices in remittance service financial modeling, businesses can ensure accurate financial assumptions and risk assessments. This robust, flexible model facilitates strategic decision-making and provides clear insights for internal management and external stakeholders, including investors and creditors.

CAPEX Spending

Capital expenditures (CAPEX) are essential for the rapid growth and innovation of remittance services. Investing in new technologies and optimized service offerings drives competitive advantage and scalability. CAPEX forms a significant component of the remittance business cost structure model, directly impacting financial projections and cash flow models. Effective remittance financial modeling best practices incorporate CAPEX to ensure accurate budgeting, profitability analysis, and long-term financial planning. By integrating CAPEX into scenario analysis and sensitivity assessments, companies maintain financial balance and control, enabling strategic investment decisions and sustainable growth within a competitive market.

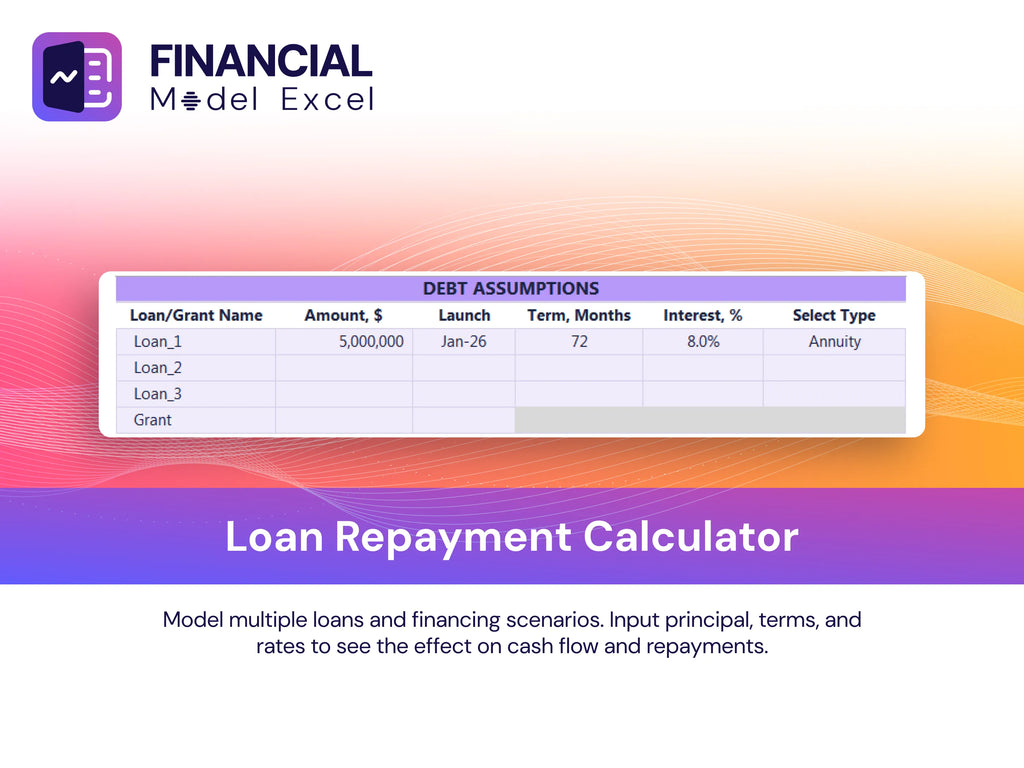

Loan Financing Calculator

Loan repayment schedules are crucial for startups and growing businesses, detailing principal amounts, terms, maturity, and interest rates. As a key element of cash flow modeling for remittance services, these schedules directly impact cash flow projections and the balance sheet. Monitoring repayments ensures accurate financial projections and enhances profitability models within remittance business financial planning. Integrating loan repayment data into monthly cash flow statements supports robust financial risk assessment and investment analysis, empowering companies to maintain healthy financial metrics and optimize long-term financial planning for sustained growth.

REMITTANCE SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

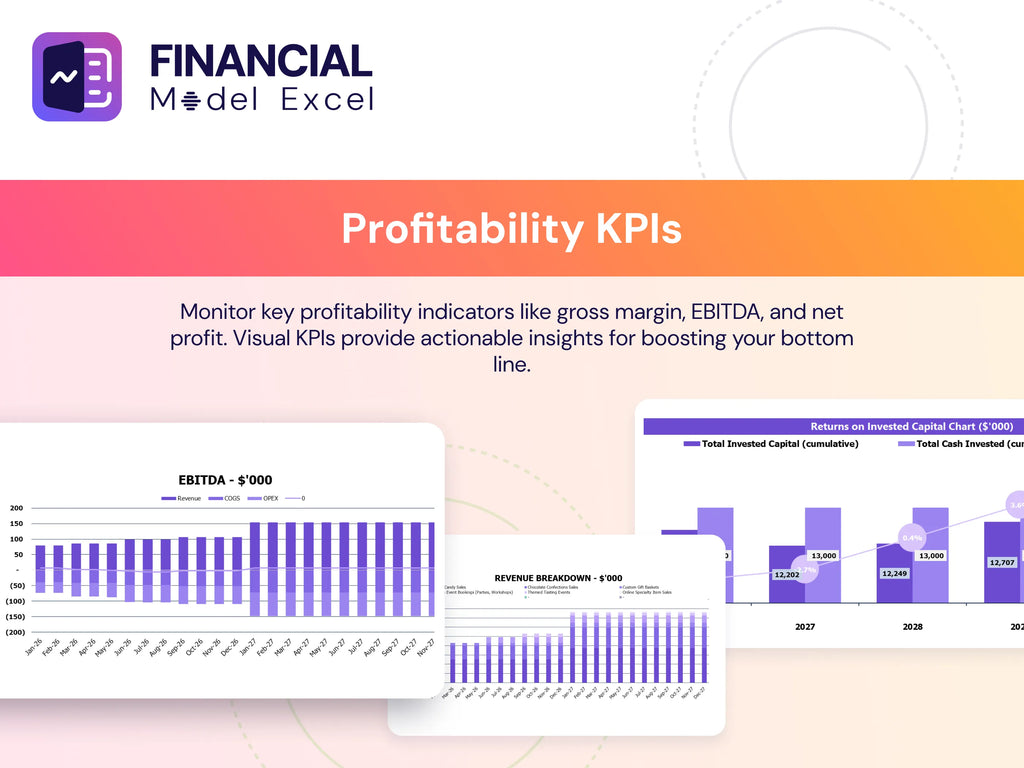

Financial KPIs

Customer acquisition cost is a vital financial metric within a remittance service’s financial model template. It represents the total marketing expenses divided by the number of new customers acquired annually. Accurately incorporating this metric in your remittance business financial planning enables effective revenue forecasting, budgeting, and profitability analysis. Including customer acquisition cost in your financial projections for remittance services supports robust scenario and sensitivity analysis—ensuring informed decision-making and optimized cash flow management for sustainable growth.

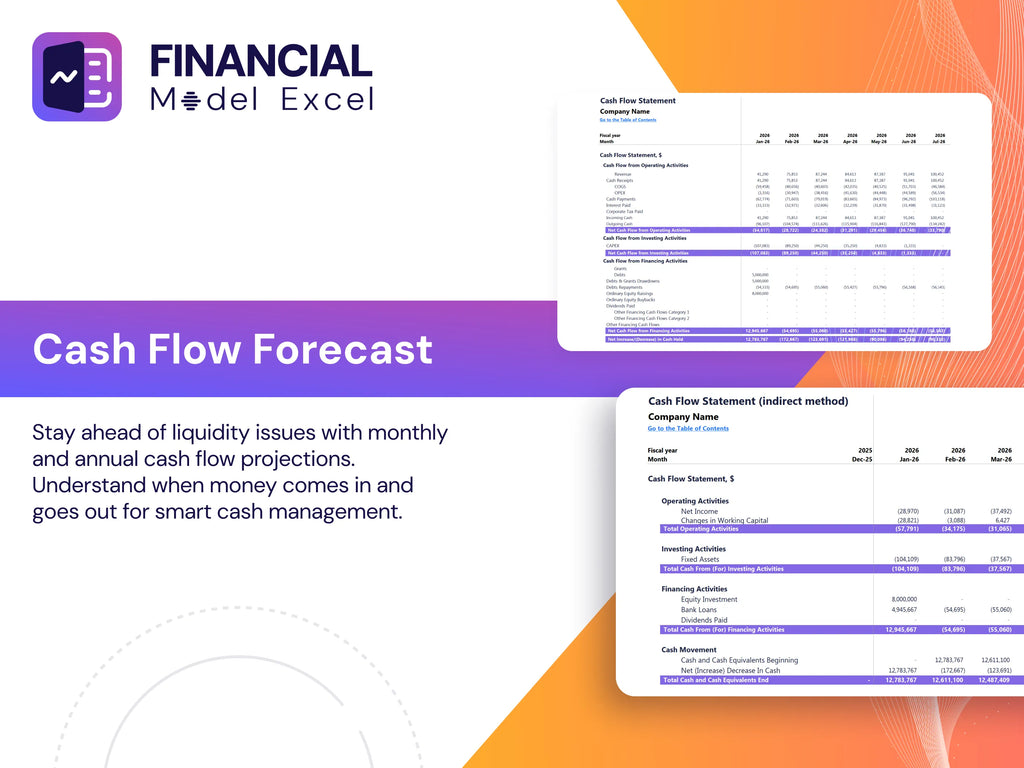

Cash Flow Forecast Excel

A robust cash flow model for remittance services captures the fluctuations in cash balance throughout a given period, highlighting critical inflows and outflows. This essential financial tool supports accurate revenue forecasting, enhances financial projections, and underpins effective financial planning. By integrating key financial assumptions and employing remittance financial statement modeling, businesses can optimize cash management, identify profitability drivers, and conduct thorough investment analysis. Implementing best practices in remittance service financial modeling ensures informed decision-making and sustainable growth.

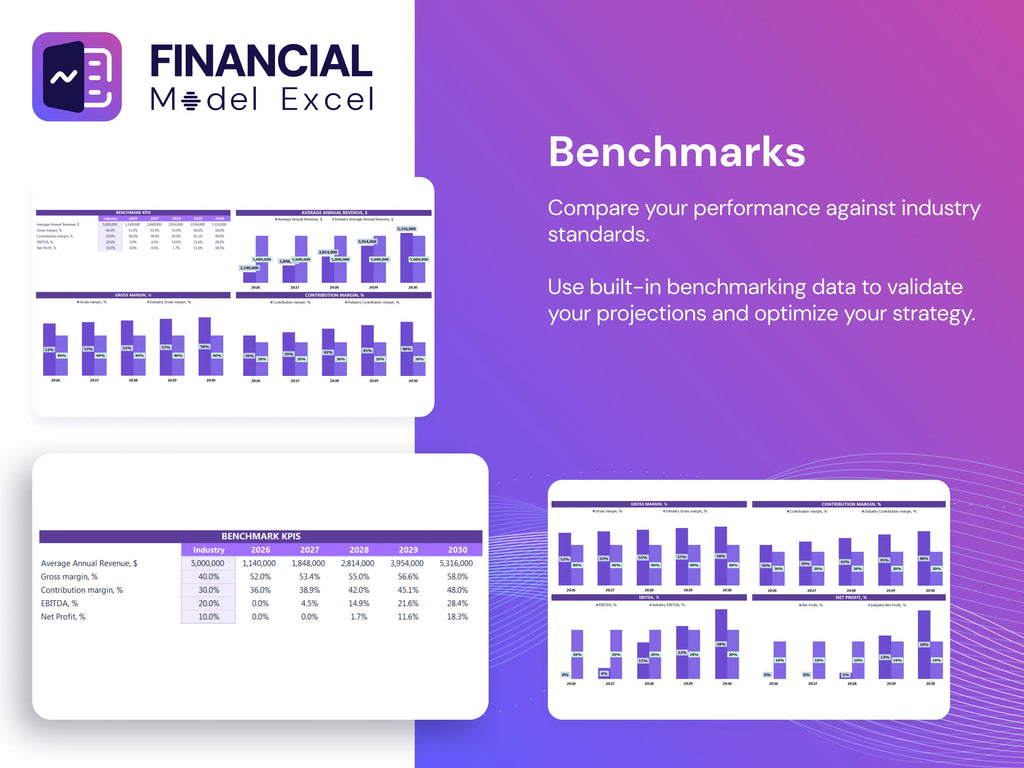

KPI Benchmarks

Our financial model template for remittance services includes a robust benchmarking study feature, enabling comprehensive financial projections and scenario analysis. By comparing key financial metrics and profitability models against industry standards, companies gain valuable insights into their remittance business financial planning. This tool highlights areas for improvement in revenue forecasting and cost structure models, empowering users to perform effective sensitivity and break-even analyses. Regular benchmarking enhances investment analysis and long-term financial planning, driving smarter decisions and stronger cash flow management for sustained success in the remittance sector.

P&L Statement Excel

Making informed decisions for your remittance business requires robust financial projections and insightful analysis. Utilizing our advanced financial model template for remittance services, you can conduct comprehensive revenue forecasting, cash flow modeling, and break-even analysis. This 5-year financial projection tool incorporates key financial assumptions and scenario analysis to identify profitability drivers and potential risks. With best practices in remittance service financial modeling, you gain clarity on cost structures, investment analysis, and long-term financial planning—empowering you to optimize performance and confidently navigate your business’s future.

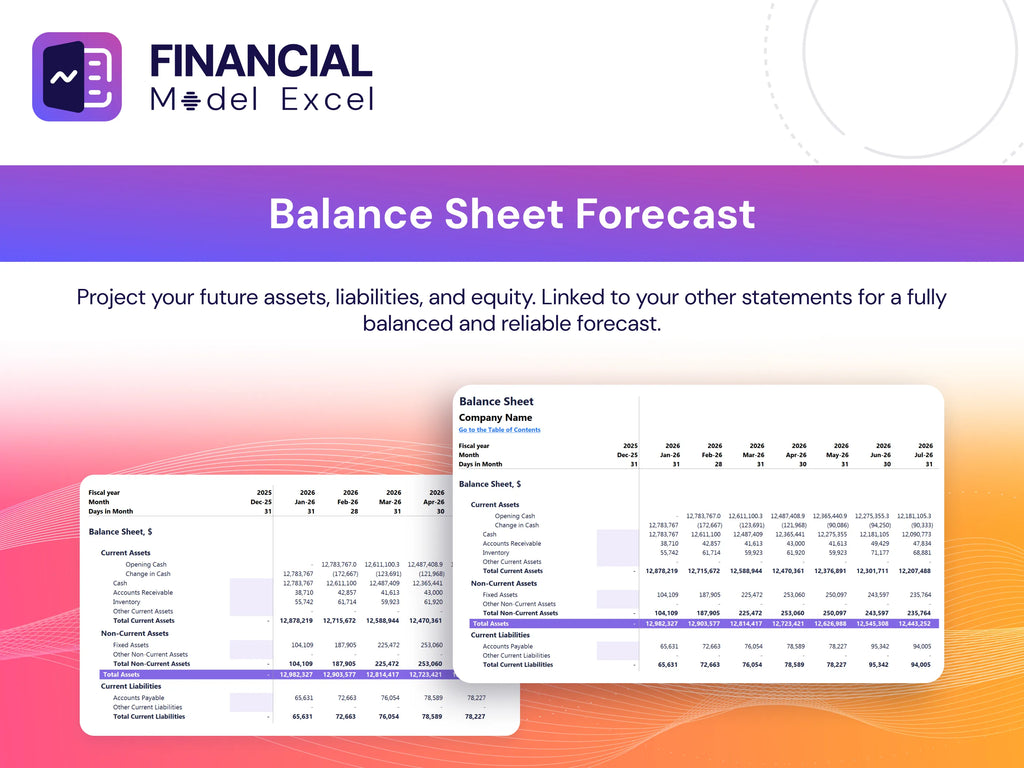

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet for a remittance startup is a vital component of financial model analysis. This template captures current and long-term assets, liabilities, and equity, providing essential data for remittance service financial projections. By incorporating this balance sheet, businesses can enhance budgeting models, conduct break-even and sensitivity analyses, and improve investment analysis. It lays the foundation for robust cash flow modeling and profitability assessments, supporting long-term financial planning and risk evaluation within the remittance business.

REMITTANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

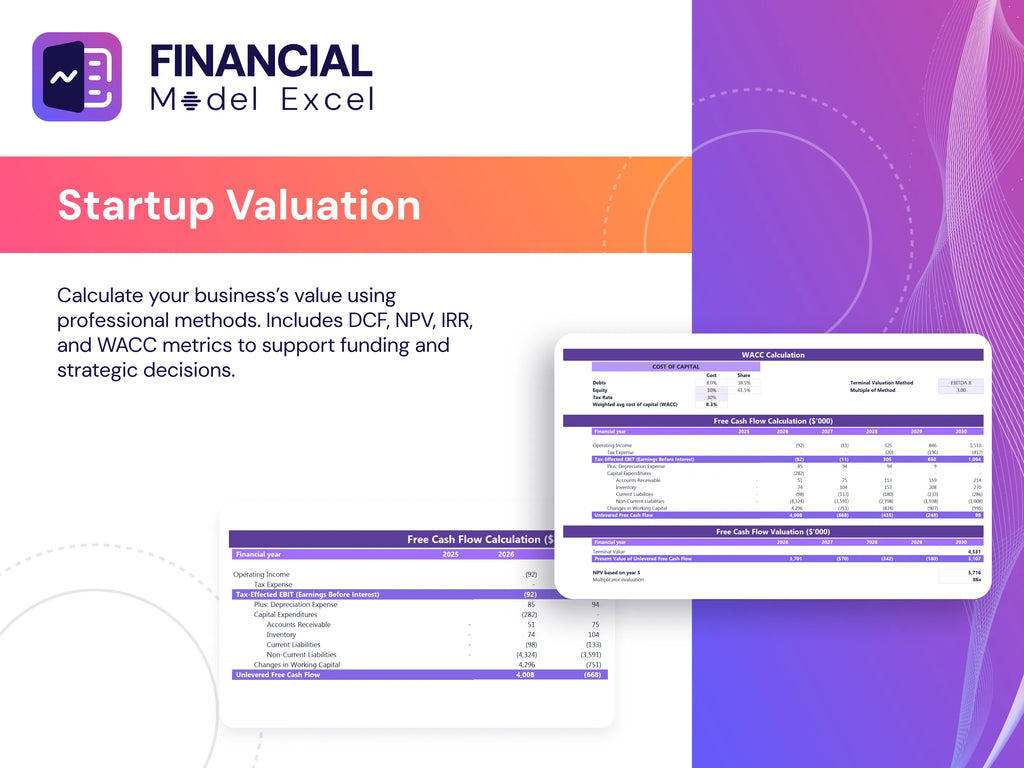

Startup Valuation Model

This remittance services financial model template offers comprehensive 3-year financial projections, integrating two robust valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). Designed for precise investment analysis and revenue forecasting, it empowers remittance business financial planning with accurate profitability modeling and cash flow forecasting. Leveraging these financial assumptions and scenario analysis tools ensures informed decision-making and strategic growth in remittance service financial statement modeling.

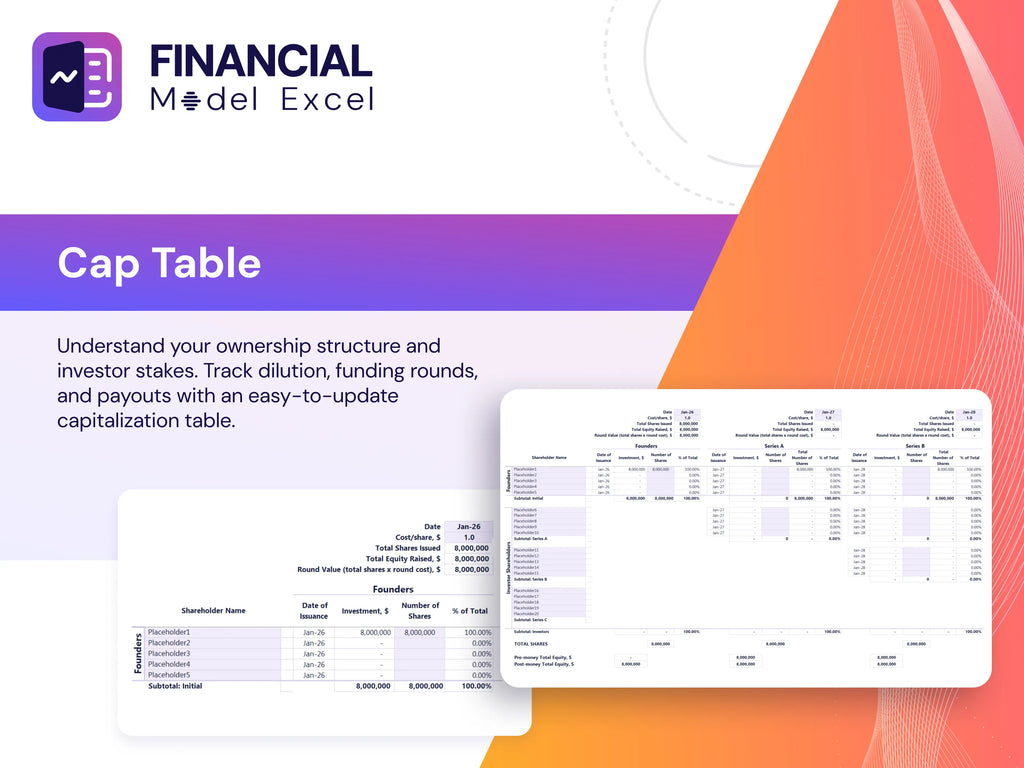

Cap Table

A well-structured capitalization table is an essential component in remittance business financial planning, enabling precise ownership dilution calculations across multiple funding rounds. Integrating this cap table within a financial model template for remittance services enhances accuracy in revenue forecasting, break-even analysis, and investment analysis. By aligning these metrics with remittance service financial modeling best practices, businesses can conduct robust scenario and sensitivity analyses, strengthen cash flow models, and optimize long-term financial projections. This holistic approach supports sound decision-making and drives sustainable profitability in the dynamic remittance services sector.

REMITTANCE SERVICES 5 YEAR CASH FLOW PROJECTION TEMPLATE ADVANTAGES

Financial model analysis empowers remittance services with precise financial projections and competitive advantage insights.

Proven financial models for remittance services enable precise forecasting, optimizing profitability and strategic business growth.

Accurate financial modeling empowers remittance services to forecast expenses precisely, optimizing budgeting and boosting profitability.

Optimize decision-making and profitability with a robust financial model tailored for remittance services management.

The financial model enables precise remittance service revenue forecasting and strategic financial planning for sustained profitability.

REMITTANCE SERVICES FINANCIAL MODEL TEMPLATE FOR STARTUP ADVANTAGES

Integrated financial model ensures accurate remittance projections, optimizing investment decisions and maximizing profitability for investors.

Our remittance financial model ensures accurate projections and investor-ready insights for confident financial planning and growth.

Financial model templates for remittance services enable better decision making through accurate revenue forecasting and risk assessment.

Enhance decision-making with a cash flow model for remittance services, forecasting impacts confidently and accurately.

Leverage our financial model template for remittance services to optimize planning, forecasting, and secure investor funding confidently.

Impress investors with a proven remittance services financial model offering accurate revenue forecasting and robust profitability analysis.

Get a scalable financial model for remittance services that ensures precise revenue forecasting and optimal profitability planning.

This robust remittance financial model empowers precise forecasting, strategic planning, and tailored analysis for optimal business growth.

Our simple-to-use financial model streamlines remittance service planning with accurate revenue forecasting and risk assessment.

Our financial model delivers quick, reliable remittance service projections requiring minimal experience and basic Excel skills.