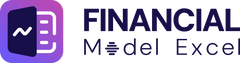

Robo Advisor Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Robo Advisor Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Robo Advisor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ROBO ADVISOR FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year robo advisor financial planning model template in Excel includes prebuilt consolidated profit and loss forecasts, balance sheets, and cash flow models, specifically designed for the fintech robo advisor model business. Featuring key financial charts, summaries, metrics, and funding forecasts, it enables thorough evaluation of automated investment financial models and robo advisor revenue models. Fully unlocked and editable, it supports in-depth analysis of robo advisor portfolio models, automated financial advisory models, and robo advisor risk assessment models, making it an essential tool for assessing investment management automation models and AI-driven robo advisor performance models before selling or scaling the business.

The fintech robo advisor model template addresses critical pain points by offering a comprehensive automated financial advisory model that streamlines investment management automation, cash flow monitoring, and expense tracking, ensuring users maintain precise control over key performance indicators. Its integrated robo advisor asset allocation model, alongside the robo advisor risk assessment model, enables dynamic portfolio optimization and risk mitigation driven by predictive analytics financial model and machine learning financial model capabilities. The template’s flexible robo advisor fee structure model combined with its robo advisor client acquisition model supports scalable growth strategies, while the built-in DCF valuation and robo advisor performance model provide real-time insights into business valuation and profitability, all within an easily customizable Excel framework that requires minimal technical expertise.

Description

The robo advisor financial planning model integrates an advanced automated investment financial model and a robo advisor portfolio model designed to optimize asset allocation and risk assessment using machine learning financial models and predictive analytics financial models. This fintech robo advisor model supports detailed 5-year monthly and yearly projections, including profit and loss statements, balance sheet forecasts, and cash flow proformas, while incorporating a discounted cash flow valuation approach to evaluate free cash flows accurately. Equipped with a robo advisor fee structure model and a client acquisition model, it facilitates strategic decision-making by calculating key financial performance ratios and KPIs essential for assessing business profitability and liquidity. The digital wealth management model is fully customizable through an accessible Excel template, enabling users to update inputs seamlessly, which automatically adjusts all relevant metrics and financial reports such as startup costs, break-even analysis, and cash flow forecasts, empowering startups or existing robo advisor services to plan and scale their algorithmic trading financial model effectively.

ROBO ADVISOR FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive fintech robo advisor financial planning model with our professional business projection template. Effortlessly analyze your start-up’s future financial impact using automated investment financial models, including pro forma income statements, 5-year projected balance sheets, and cash flow projections—all updated automatically in Excel. Leverage integrated robo advisor performance and risk assessment models to inform strategic decisions. Key start-up KPIs feed directly into a sleek dashboard, enabling data-driven growth powered by machine learning financial models and predictive analytics. Elevate your investment management automation model and maximize success with precision insights right at your fingertips.

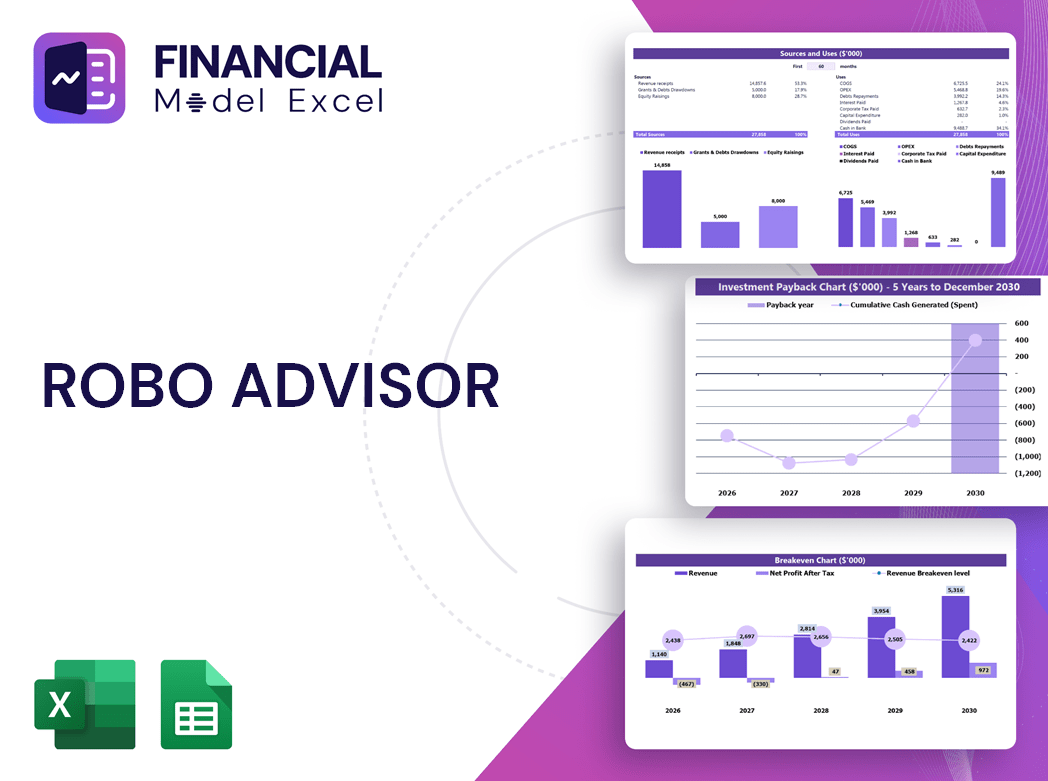

Dashboard

This financial projections dashboard integrates key indicators from your startup’s financial statements across selected periods. Featuring a comprehensive robo advisor revenue model and automated investment financial model, it delivers clear annual revenue breakdowns, cash flow forecasting, and predictive analytics—all presented in Excel format. Ideal for fintech robo advisor models, this tool streamlines investment management automation and risk assessment, empowering informed decision-making. Use it to evaluate overall financial health and support strategic planning, ensuring your digital wealth management model drives sustainable growth and operational excellence.

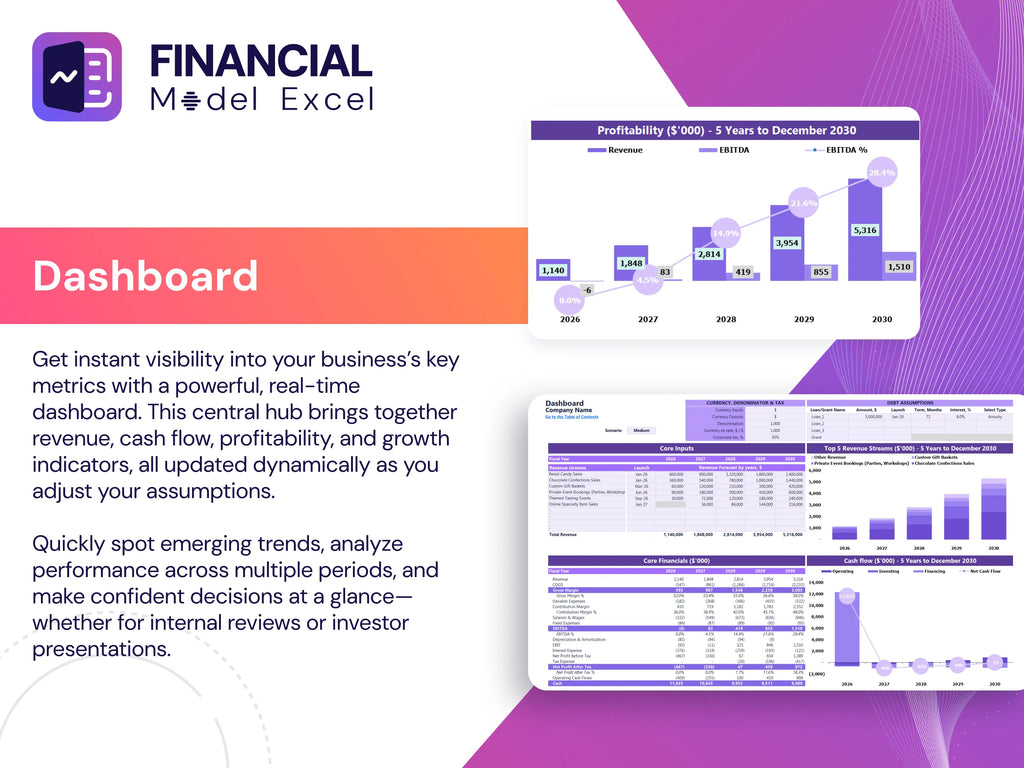

Business Financial Statements

This startup financial projection template integrates a comprehensive automated investment financial model, featuring pre-built pro forma income statements, projected balance sheets, and cash flow forecasting tools. Designed for flexibility, it supports monthly or annual views and seamlessly links with leading accounting platforms like QuickBooks, Xero, and FreshBooks. By leveraging a fintech robo advisor model, users benefit from streamlined investment management automation, enhanced by predictive analytics financial models to optimize decision-making and elevate financial planning accuracy.

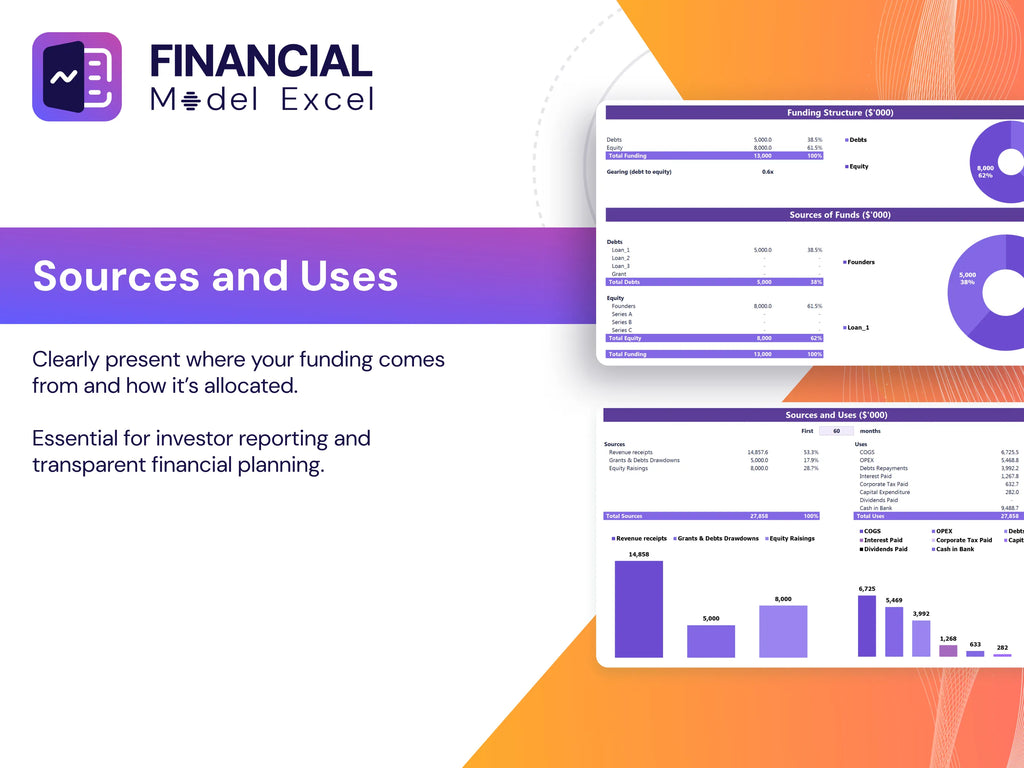

Sources And Uses Statement

The fintech robo advisor financial model clearly outlines sources and uses of capital, ensuring balanced funding allocation for seamless project financing. This automated investment financial model highlights line-by-line funding sources and planned uses, aligning with strategic business goals. If sources exceed uses, excess capital can drive growth or optimize cash flow. Conversely, if uses surpass sources, additional equity is necessary. Integrating predictive analytics and robo advisor cash flow models enhances precision, making it an essential tool for effective financial planning and investment management automation.

Break Even Point In Sales Dollars

The break-even graph for your robo advisor financial planning model highlights the revenue threshold where total costs—fixed and variable—are covered, and profit begins. This automated financial advisory model uses predictive analytics to pinpoint the minimum sales volume needed to achieve zero profit, guiding strategic decisions. By integrating a robo advisor revenue model with break-even analysis, investors can confidently assess the sales required to recoup investments and forecast profitability timeframes. Harnessing this digital wealth management model enhances clarity and precision in financial planning and investment management automation.

Top Revenue

This comprehensive 3-statement financial model features a dedicated revenue tab designed for in-depth analysis of company earnings. Leveraging this template, you can systematically evaluate revenue streams across each product or service category. Integrating advanced robo advisor revenue model principles, it enhances your ability to forecast and optimize financial performance, supporting strategic decision-making in automated investment and digital wealth management frameworks.

Business Top Expenses Spreadsheet

Leveraging a robo advisor financial planning model empowers businesses to gain clear insights into expense origins and optimize cash flow. The Top Expenses report, integrated within the automated investment financial model, categorizes costs—including customer acquisition and fixed expenses—enabling precise expense structure analysis. This fintech robo advisor model enhances financial oversight, helping companies strategically allocate resources and improve profitability through data-driven decision-making.

ROBO ADVISOR FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

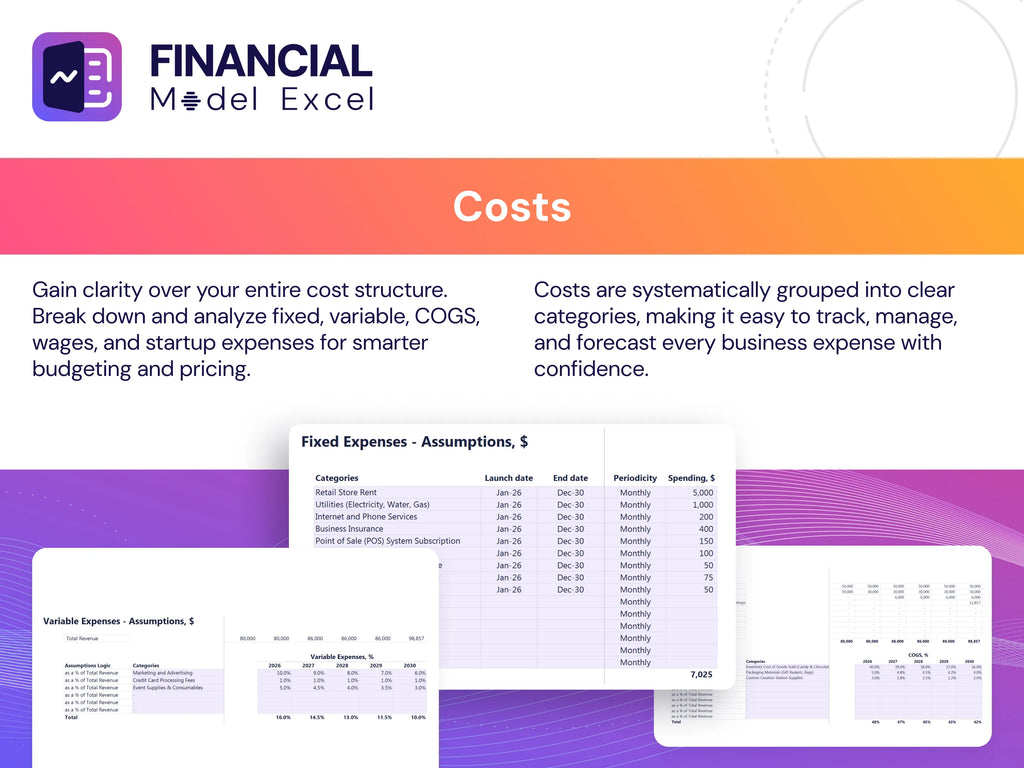

Costs

A robo advisor financial planning model is an essential fintech tool that estimates costs, forecasts risks, and projects key financial ratios. By leveraging algorithmic trading and automated investment strategy models, it highlights critical areas needing attention to mitigate losses and enhance performance. Additionally, a well-structured robo advisor revenue model plays a pivotal role in securing investor funding by transparently forecasting expenses and demonstrating growth potential through predictive analytics and machine learning financial models. This automation-driven approach revolutionizes investment management, delivering precise digital wealth management and robust portfolio optimization.

CAPEX Spending

In advanced robo advisor financial models, specialized algorithms accurately forecast CAPEX schedules, optimizing capital expenditure planning. These automated investment financial models integrate predictive analytics and machine learning to precisely calculate CAPEX spending, expenses, and their impact on profit and loss statements. By leveraging a fintech robo advisor model, businesses enhance financial planning efficiency, driving informed asset allocation and investment management automation. This robust approach ensures dynamic, data-driven insights that support strategic growth and sustainable profitability.

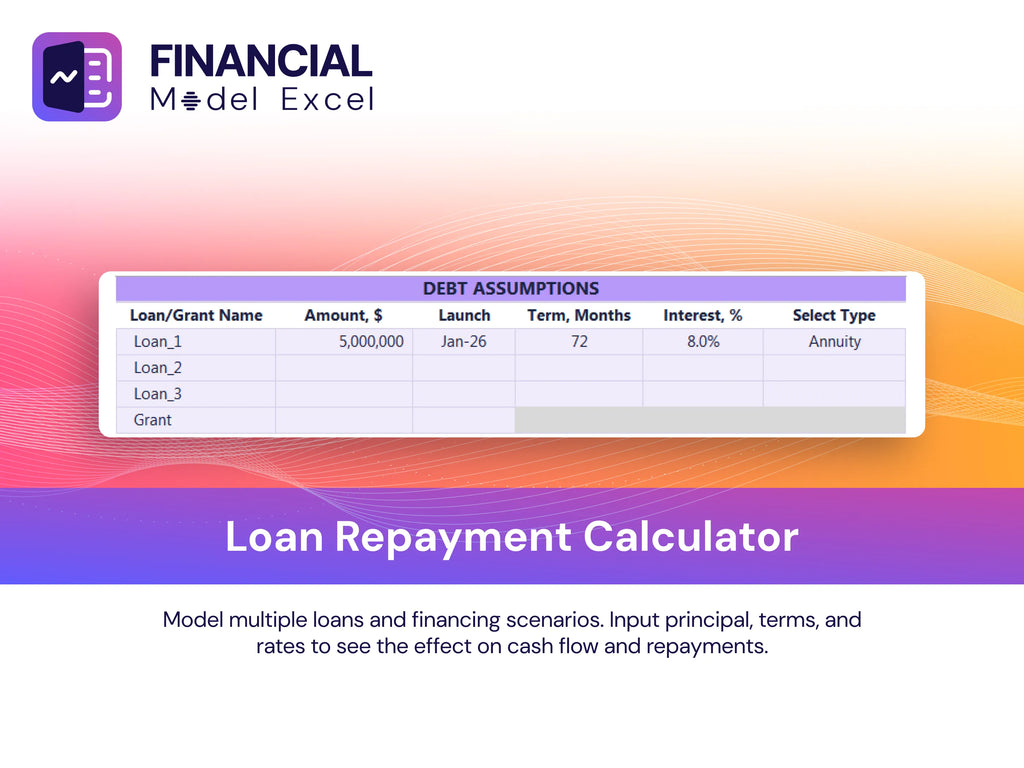

Loan Financing Calculator

Start-ups and growing businesses can streamline loan repayment management using an automated investment financial model integrated with a robo advisor cash flow model. This approach provides a detailed loan breakdown—amounts, maturity terms, and interest—while seamlessly incorporating interest expenses and principal repayments into cash flow projections. Leveraging a robo advisor portfolio model enhances accuracy in forecasting, ensuring precise debt schedules align with pro forma balance sheets. By adopting an intelligent, fintech robo advisor model, companies optimize financial planning, improve investment management automation, and maintain robust control over debt servicing within dynamic cash flow analysis frameworks.

ROBO ADVISOR FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

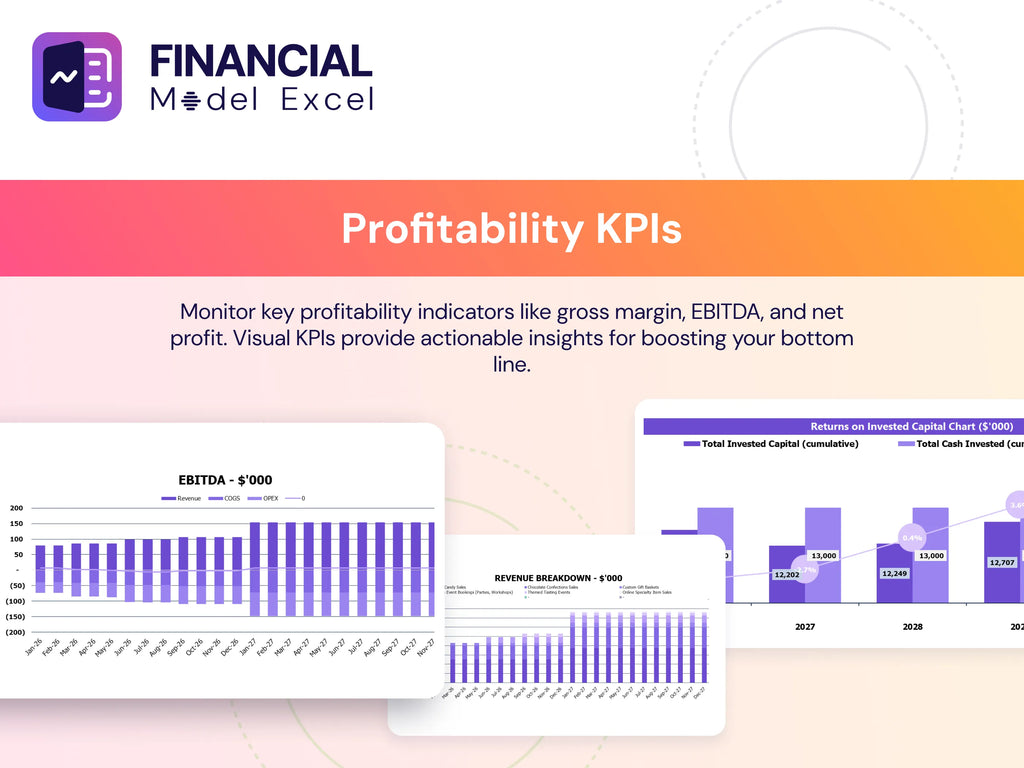

Financial KPIs

The fintech robo advisor financial planning model for startups emphasizes key metrics like earnings growth and net income expansion. Early-stage growth is critical, and leveraging an automated investment financial model ensures strategic progress. Utilizing a profit and loss statement template in Excel offers clear visibility into sales and revenue trends, enabling precise monitoring of the robo advisor’s performance model. This approach supports data-driven decisions, driving sustainable growth and positioning the company for long-term success in the competitive digital wealth management landscape.

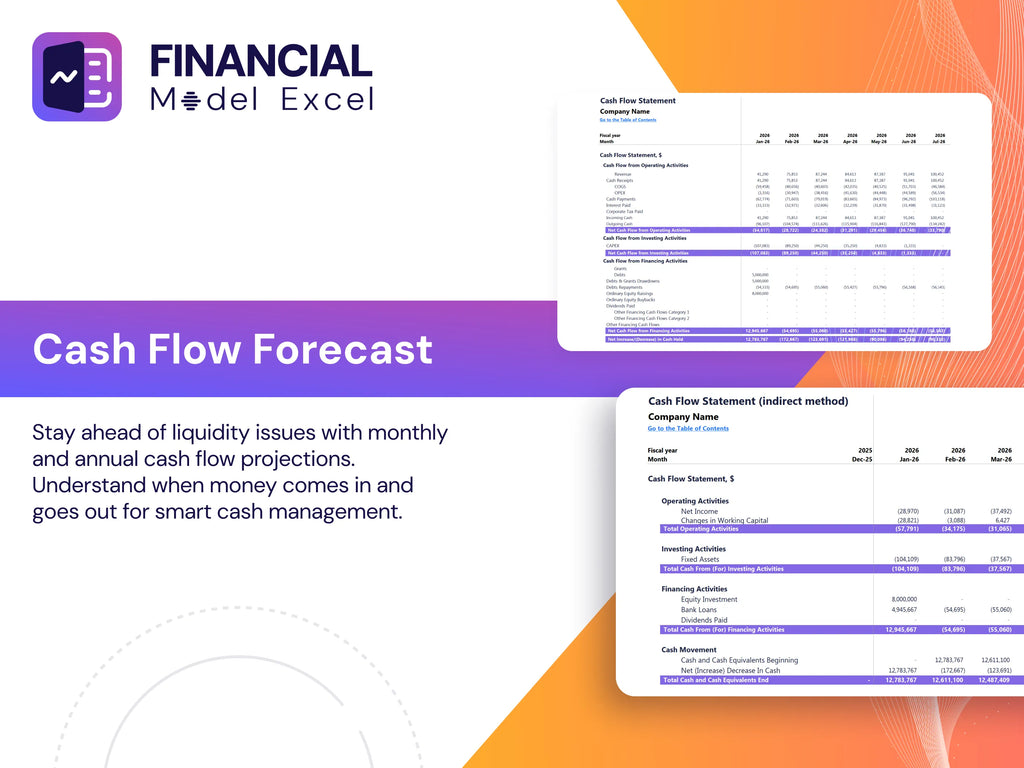

Cash Flow Forecast Excel

The cash flow statement is a critical component within robo advisor financial planning models, offering real-time insights into a company’s liquidity. By tracking the inflows and outflows of cash, this automated investment financial model helps identify potential shortfalls, ensuring businesses maintain positive cash flows essential for securing new financing. Integrating predictive analytics and machine learning financial models enhances the accuracy of cash flow forecasts, empowering firms to optimize their robo advisor asset allocation and investment management automation models with confidence.

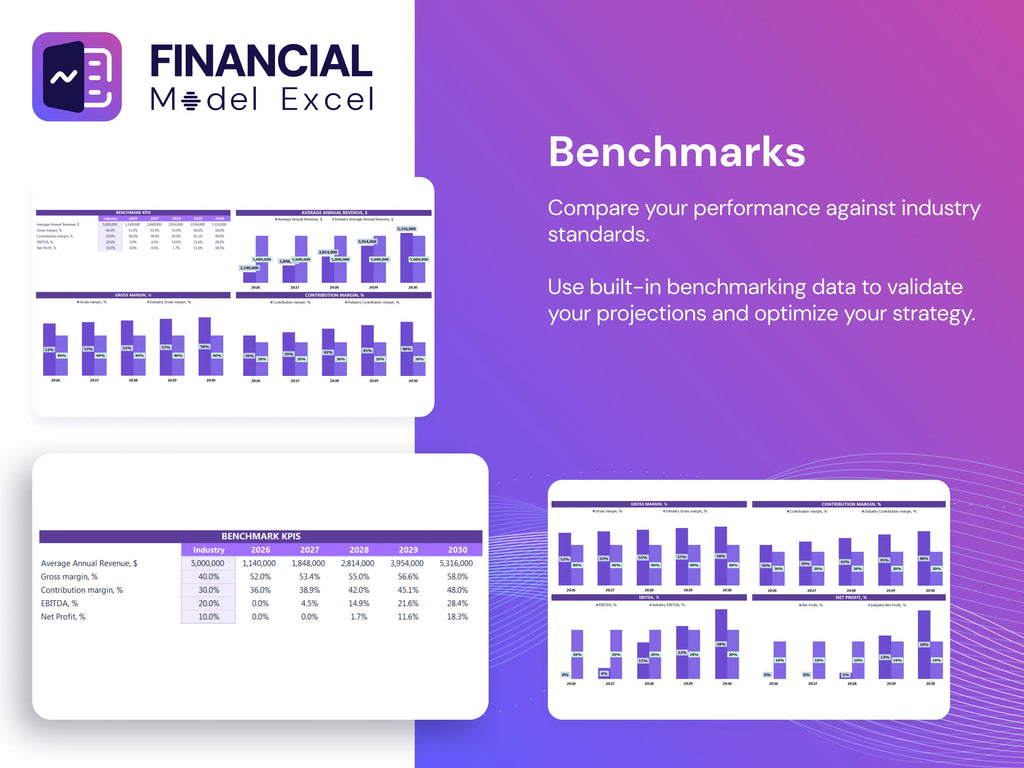

KPI Benchmarks

The feasibility study template’s benchmark tab leverages a robust robo advisor financial planning model to calculate and compare key performance metrics. By highlighting average values and conducting comparative analyses, it provides vital insights into effectiveness and strategic potential. These indicators are crucial for startups employing fintech robo advisor models, enabling informed decisions in automated investment strategy, risk assessment, and asset allocation. This data-driven approach supports optimal financial planning and strategic management, ensuring startups can confidently refine their algorithmic trading financial models and digital wealth management models to maximize success.

P&L Statement Excel

A pro forma profit and loss statement offers a clear view of an enterprise’s profitability by detailing key income streams and expenses. Integrated with a robo advisor financial planning model, it enhances forecasting accuracy, showcasing the company’s ability to generate sustainable revenue. Leveraging automated investment financial models and predictive analytics, this profit and loss projection empowers strategic decision-making, ensuring optimized asset allocation and robust cash flow management within digital wealth management frameworks.

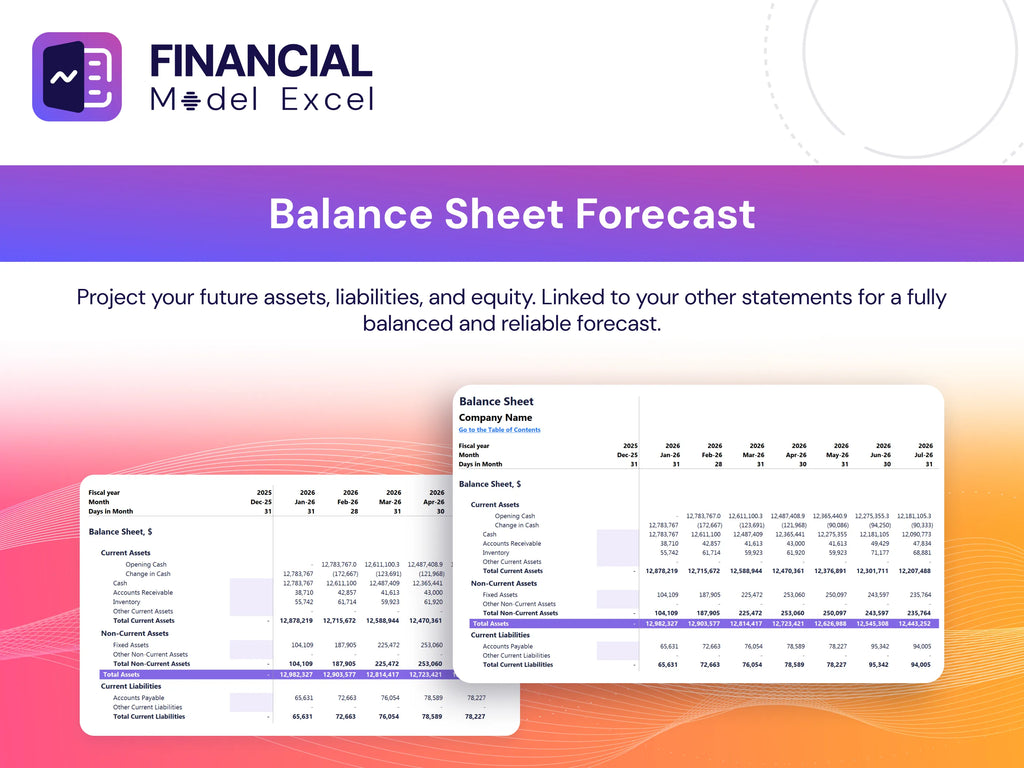

Pro Forma Balance Sheet Template Excel

Our projected balance sheet template delivers a clear snapshot of your business’s assets, liabilities, and shareholders’ equity at a specific point in time. Designed to seamlessly integrate with automated investment financial models and robo advisor portfolio models, it empowers users to accurately assess financial standing. This dynamic tool supports fintech robo advisor models and machine learning financial models by providing essential data for algorithmic trading and predictive analytics. Elevate your financial planning with our intuitive template, enabling precise investment management automation and optimized robo advisor asset allocation strategies.

ROBO ADVISOR FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

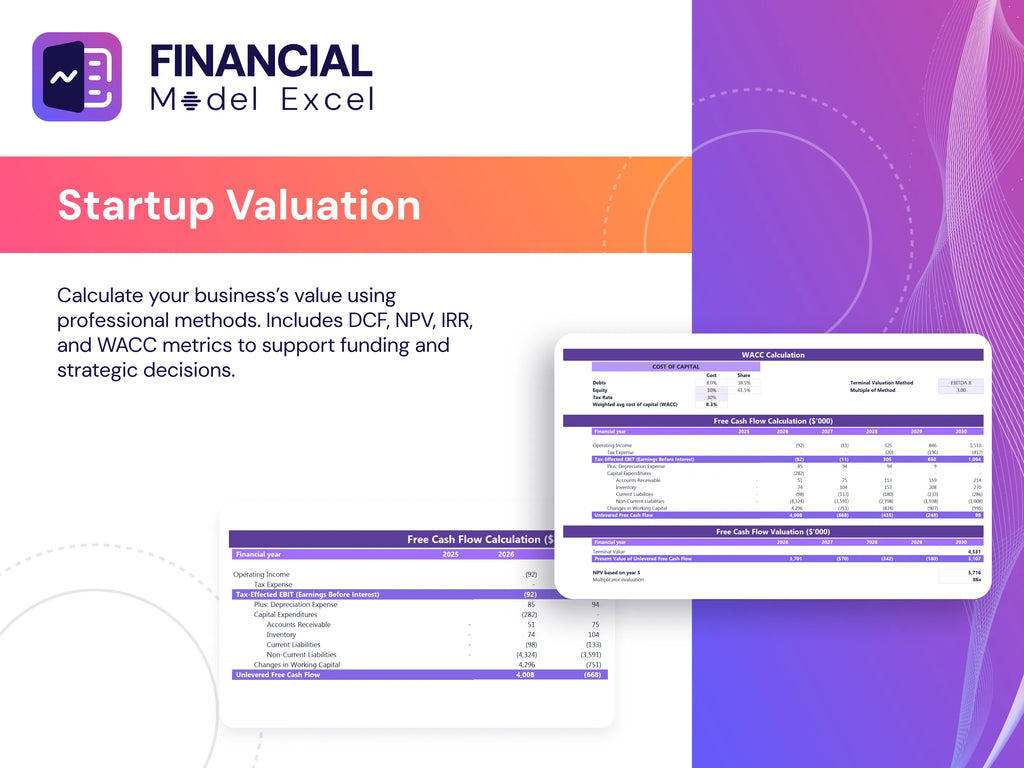

Startup Valuation Model

This fintech robo advisor financial model offers a comprehensive automated investment financial model optimized for valuation analysis using Discounted Cash Flow (DCF) methodology. Beyond DCF, it incorporates predictive analytics and algorithmic trading financial models to evaluate residual value, replacement costs, market comparables, and recent transaction comparables. Designed for digital wealth management and robo advisor portfolio models, this tool empowers startups with robust investment management automation, facilitating precise market analysis and informed decision-making. Enhance your robo advisor revenue model and client acquisition strategies with this advanced, data-driven financial planning model.

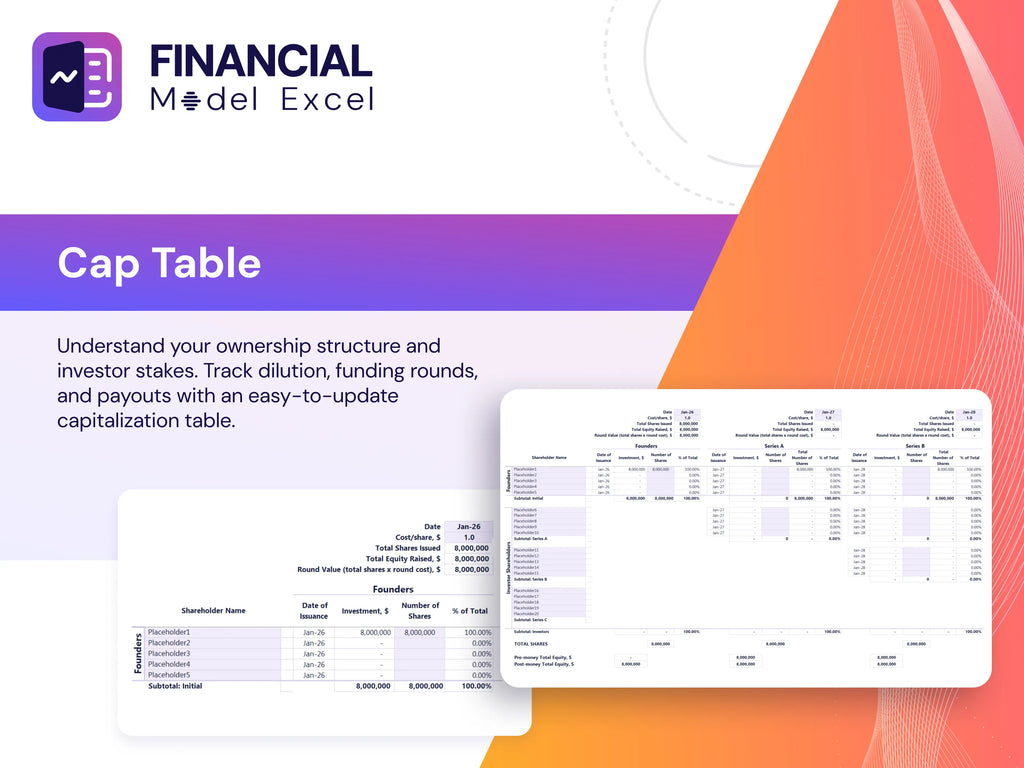

Cap Table

The fintech robo advisor model integrates automated investment strategies and advanced algorithmic trading financial models to optimize portfolio management. Leveraging machine learning financial models and predictive analytics, it enhances the robo advisor risk assessment model and asset allocation model for precise financial planning. Additionally, the robo advisor revenue model and fee structure model ensure transparent profitability, while the robo advisor client acquisition model drives sustainable growth. Together, these components create a comprehensive digital wealth management model that revolutionizes investment management automation and delivers exceptional value to both advisors and clients.

ROBO ADVISOR FIVE YEAR FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Make smarter hiring decisions with the robo advisor financial model’s data-driven, precise, and efficient business plan insights.

The robo advisor revenue model optimizes profit by accurately predicting break-even points and maximizing return on investment.

Assess your startup’s potential efficiently using the robo advisor financial model for precise, data-driven financial projections.

The robo advisor financial planning model streamlines projections, enhancing accuracy and efficiency in valuation analyses.

The robo advisor financial model enhances investment accuracy through automated, data-driven portfolio and risk management strategies.

ROBO ADVISOR THREE WAY FINANCIAL MODEL ADVANTAGES

The robo advisor portfolio model optimizes asset allocation for smarter, efficient, and personalized investment growth.

The robo advisor cash flow model enables proactive forecasting, preventing cash gaps and accelerating strategic business growth decisions.

The robo advisor risk assessment model swiftly detects payment issues, enhancing client trust and financial accuracy.

The robo advisor cash flow model accelerates collections by identifying unpaid invoices and optimizing timely payment strategies.

The robo advisor asset allocation model optimizes investments efficiently, maximizing returns with automated precision and reduced risk.

The robo advisor revenue model optimizes forecasts by easily adjusting inputs for agile and accurate financial planning.

The robo advisor financial planning model optimizes asset allocation, enhancing growth potential and ensuring smarter future investments.

The robo advisor cash flow model empowers precise growth planning by forecasting expenses and scaling strategies effortlessly.

Optimize returns and minimize risk with our advanced robo advisor asset allocation model for smarter financial planning.

Optimize success with a robo advisor financial planning model, ensuring precise investment strategies and smarter funding outcomes.