Small Restaurant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Small Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

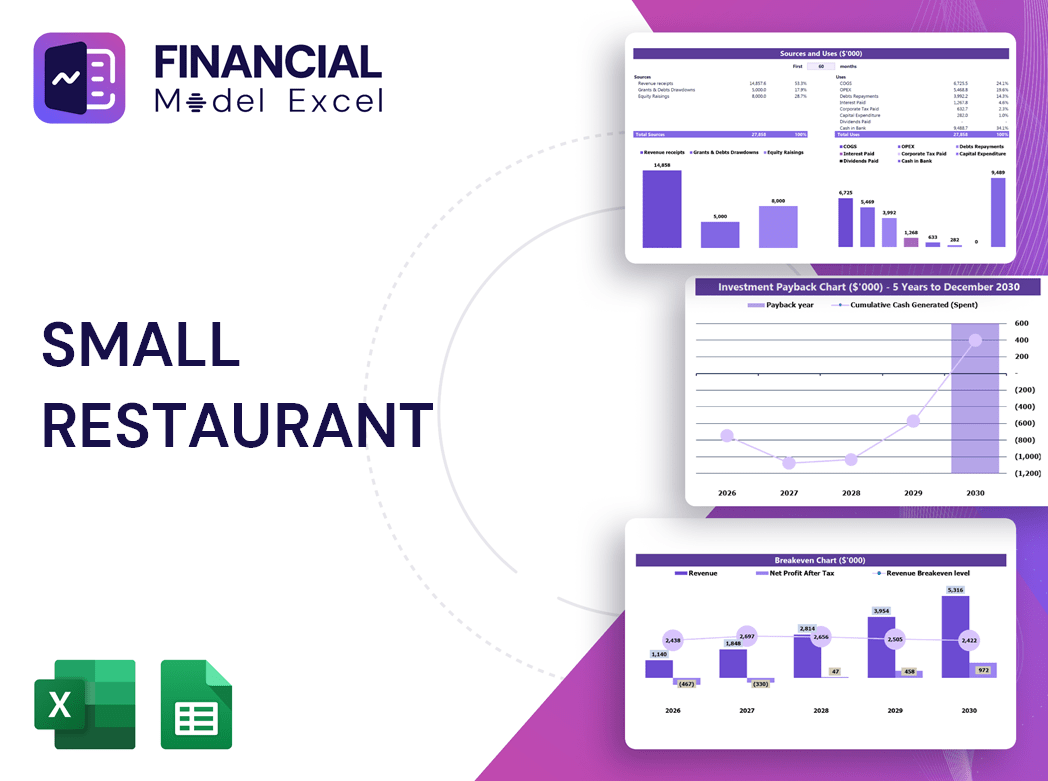

Small Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SMALL RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year small restaurant financial projection model template is essential for any eatery, regardless of its size or development stage. Designed for users with minimal financial planning experience and basic Excel skills, this comprehensive tool combines restaurant budgeting and forecasting tools with a restaurant income statement template, cash flow model for restaurants, and profit and loss model for small dining establishments. Ideal for startups, it supports financial scenario planning for restaurants and small restaurant investment analysis, enabling quick and reliable results to secure funding from banks or investors. Fully unlocked and editable, this small business restaurant financial template also integrates restaurant expense management tools and a financial dashboard for small restaurants to track key performance indicators with ease.

This ready-made small restaurant financial projection model Excel template addresses critical pain points by streamlining complex financial planning for small eateries through comprehensive restaurant budgeting and forecasting tools, including a detailed restaurant income statement template and cash flow model for restaurants. It simplifies restaurant expense management with an intuitive restaurant cost analysis spreadsheet and provides a robust profit and loss model for small dining businesses, enabling effective break-even analysis for restaurants and precise restaurant revenue forecasting methods. By integrating a restaurant capital budgeting model and financial scenario planning for restaurants, this template empowers owners to conduct small restaurant investment analysis and track restaurant financial KPIs via a user-friendly financial dashboard for small restaurants. Ultimately, it accelerates restaurant operational budget template creation and enhances decision-making, ensuring consistent profitability and sustainable growth for a small business restaurant financial template user.

Description

This small restaurant financial projection model offers comprehensive restaurant budgeting and forecasting tools that enable precise financial planning for small eateries. Featuring an integrated restaurant income statement template and a cash flow model for restaurants, it supports profit and loss model for small dining ventures and restaurant cost analysis spreadsheet functionalities. Tailored for both startups and established businesses, the model includes financial statement modeling for eateries, a restaurant startup financial plan, and break-even analysis for restaurants to evaluate financial viability. Additionally, it incorporates restaurant revenue forecasting model, restaurant expense management tools, and a small business restaurant financial template that facilitate restaurant capital budgeting model decisions and financial scenario planning for restaurants. With a financial dashboard for small restaurants and restaurant financial KPI tracking, this solution empowers small restaurant investment analysis, operational budgeting using a restaurant operational budget template, and employs advanced restaurant sales forecasting methods to optimize profitability and sustainability.

SMALL RESTAURANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive small restaurant financial projection model integrates the income statement, cash flow model, and balance sheet to provide a holistic view of your eatery’s financial health. Utilizing restaurant budgeting and forecasting tools, such as a financial dashboard for small restaurants or a profit and loss model for small dining, ensures accurate year-end financial planning. This disciplined approach, including break-even analysis for restaurants and restaurant cost analysis spreadsheets, equips every establishment—regardless of size—to manage expenses, forecast revenue, and optimize investment decisions effectively for sustained growth.

Dashboard

The restaurant startup financial plan is an essential tool for small eateries, offering comprehensive cash flow modeling and projected balance sheet forecasts. It supports detailed breakdowns for any period—monthly or yearly—enabling precise financial planning for small restaurants. The intuitive financial dashboard provides clear numerical data alongside dynamic charts, enhancing restaurant budgeting and forecasting insights. This powerful model streamlines restaurant expense management and revenue forecasting, empowering owners to optimize profitability and track key financial KPIs with confidence.

Business Financial Statements

Generate comprehensive business financial reports effortlessly using a flexible small restaurant financial projection model. By incorporating various assumptions, this restaurant income statement template and cash flow model for restaurants deliver clear, investor-ready statements. Ideal for financial planning for small eateries, it simplifies restaurant budgeting and forecasting tools, enabling accurate restaurant revenue forecasting and expense management. Whether you need a profit and loss model for small dining or break-even analysis for restaurants, this versatile financial dashboard for small restaurants ensures precise financial statement modeling for eateries, enhancing your small business restaurant financial template with clarity and professionalism.

Sources And Uses Statement

Our small restaurant financial projection model simplifies financial planning by clearly outlining sources and uses of funds. This transparent approach reassures lenders and investors of the restaurant’s funding needs and potential alternative sources, such as crowdfunding. Whether pursuing a restaurant startup financial plan or ongoing expense management, balancing these funding inflows and outflows is crucial. Integrating this with restaurant budgeting and forecasting tools or a financial dashboard for small restaurants ensures effective financial scenario planning and builds confidence among stakeholders through precise, balanced financial statements.

Break Even Point In Sales Dollars

The break-even analysis within our small restaurant financial projection model pinpoints the sales volume needed to cover all fixed and variable costs, ensuring zero profit or loss. Beyond this threshold, your profit margin grows. Utilizing our restaurant budgeting and forecasting tools, including an intuitive break-even sales calculator and financial dashboard for small restaurants, you can visualize and manage sales targets effectively. This empowers investors and owners with precise insights for financial planning, investment analysis, and operational budgeting—crucial for driving profitability and sustainable growth in the competitive foodservice industry.

Top Revenue

In small restaurant financial projection models, the top line represents gross revenue, while the bottom line indicates net profit—both crucial metrics in any restaurant income statement template. Investors and stakeholders closely monitor these figures through restaurant budgeting and forecasting tools, assessing revenue growth and operational efficiency. A well-constructed cash flow model for restaurants and profit and loss model for small dining help highlight top-line growth, signaling successful financial planning for small eateries. Utilizing restaurant expense management tools and financial KPI tracking ensures informed decision-making, driving sustainable profitability and long-term success in the competitive restaurant industry.

Business Top Expenses Spreadsheet

Our small restaurant financial projection model includes a comprehensive restaurant expense management tool that categorizes and tracks top expenses, simplifying cost analysis. By leveraging this restaurant cost analysis spreadsheet, owners can monitor trends, identify rising costs, and optimize spending effectively. Whether launching a startup or scaling operations, detailed financial planning for small eateries is essential. Utilize our restaurant budgeting and forecasting tools alongside the restaurant income statement template and cash flow model for restaurants to drive profitability and informed decision-making. Effective expense management is key to sustaining growth and maximizing returns in the competitive dining industry.

SMALL RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A small restaurant financial projection model is an essential tool for effective financial planning for small eateries. By leveraging restaurant budgeting and forecasting tools, you can create a comprehensive restaurant expense management strategy that pinpoints cost-saving opportunities and highlights areas for improvement. Integrating a restaurant cost analysis spreadsheet with a profit and loss model for small dining empowers you to optimize resources, enhance operational efficiency, and strengthen funding proposals. This financial blueprint not only supports loan applications but also drives informed decision-making, ensuring your restaurant’s sustainable growth and profitability.

CAPEX Spending

A small restaurant capital budgeting model outlines planned long-term asset investments, such as equipment, expected to add value beyond one year. These capital expenditures appear on the startup financial plan and pro forma balance sheet. Ongoing costs, like electricity, are reflected monthly in the restaurant income statement template under expenses. Depreciation expense, highlighted in the profit and loss model for small dining, gradually writes off asset value annually, reducing its balance sheet worth. Together with financial dashboard tools and cost analysis spreadsheets, this approach ensures comprehensive financial planning and transparency for small eateries’ investment and operational budgeting.

Loan Financing Calculator

Our small restaurant financial projection model includes an integrated loan amortization plan that accurately calculates both principal and interest. This restaurant budgeting and forecasting tool determines your monthly payments by factoring in the loan amount, interest rate, term, and payment schedule. Essential for financial planning for small eateries, it streamlines your cash flow model for restaurants and enhances your restaurant expense management tools. Use this restaurant startup financial plan feature to confidently manage your capital budgeting and maintain a clear, actionable restaurant income statement template. Maximize control over your financial health with our comprehensive small business restaurant financial template.

SMALL RESTAURANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical metric in restaurant financial planning, fundamental for small restaurant financial projection models. It measures profitability by comparing cash inflows to outflows stemming from investments. Calculated as net investment gains divided by total investment costs, ROI guides financial scenario planning for restaurants, enabling owners to assess the effectiveness of capital budgeting models and optimize resource allocation. Using robust restaurant budgeting and forecasting tools alongside ROI analysis ensures informed decision-making, driving sustainable growth and profitability in small eateries.

Cash Flow Forecast Excel

A comprehensive cash flow model for restaurants streamlines financial planning for small eateries by accurately forecasting cash inflows and outflows. Utilizing a reliable restaurant income statement template and expense management tools, this approach supports qualified management in budgeting, break-even analysis, and financial scenario planning. By integrating restaurant financial KPI tracking and revenue forecasting methods, owners gain clear insights into operational budgets and investment analysis. This financial dashboard for small restaurants enhances decision-making, ensuring sustainable growth through precise restaurant cost analysis spreadsheets and profit and loss models tailored for small dining establishments.

KPI Benchmarks

The small restaurant financial projection model includes a benchmark tab that calculates key financial and operational KPIs, comparing them against industry averages. This restaurant financial KPI tracking enables startups to perform effective financial benchmarking—a critical element of financial planning for small eateries. By analyzing experienced competitors, new restaurants can apply proven best practices to their restaurant budgeting and forecasting tools, refining their restaurant startup financial plan. This strategic financial scenario planning supports informed decision-making and drives improved profitability in the competitive restaurant landscape.

P&L Statement Excel

A small restaurant financial projection model is vital for startups to effectively plan and monitor performance. Utilizing a profit and loss model for small dining, combined with restaurant budgeting and forecasting tools, empowers owners to forecast income and expenses over five years. This approach supports financial planning for small eateries by providing actionable insights through a restaurant income statement template and cash flow model for restaurants. With accurate restaurant revenue forecasting models and expense management tools, businesses can develop strategic plans to optimize performance, enhance profitability, and ensure long-term growth in a competitive market.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is a crucial component of financial planning for small eateries, offering a snapshot of assets, liabilities, and equity over a specific period. Utilizing our restaurant startup financial plan with an integrated balance sheet forecast empowers owners to assess their establishment’s financial position accurately. Combined with restaurant budgeting and forecasting tools, this model aids in effective expense management and investment analysis, ensuring informed decision-making. Elevate your small restaurant’s financial strategy with our comprehensive financial dashboard, designed to streamline cash flow modeling and optimize profitability through precise financial statement modeling for eateries.

SMALL RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Elevate your small restaurant’s financial planning with our comprehensive financial projection model, designed to provide investors with clear valuation insights. Utilize advanced restaurant budgeting and forecasting tools, including a detailed cash flow model for restaurants and a profit and loss model for small dining. Understand your weighted average cost of capital (WACC)—the average cost from equity and debt—and apply discounted cash flow (DCF) methods to accurately estimate your eatery’s value based on future cash flows. Streamline your financial scenario planning and investor presentations with our restaurant income statement template and startup financial plan tools.

Cap Table

Our small restaurant financial projection model includes a comprehensive cap table template, essential for startup financial planning. This spreadsheet clearly outlines your eatery’s ownership structure, detailing shares, options, and investor contributions. By integrating this with our restaurant income statement template and cash flow model for restaurants, you can effortlessly track ownership percentages alongside financial KPIs. Ideal for small business restaurant financial templates, this tool supports effective restaurant budgeting and forecasting, ensuring precise investment analysis and operational budget management for your growing dining venture.

SMALL RESTAURANT BUSINESS PROJECTION TEMPLATE ADVANTAGES

Empower your growth with a flexible 5-year cash flow projection model designed for small restaurant financial planning.

Optimize cash flow timing efficiently using our small restaurant financial projection model for smarter payable and receivable management.

Accurately assess your small restaurant’s feasibility with our 5-year financial projection model for confident decision-making.

The small restaurant financial projection model minimizes risk by accurately identifying the most profitable growth opportunities.

Easily plot and manage startup loan repayments with our small restaurant financial model for precise cash flow forecasting.

SMALL RESTAURANT STARTUP FINANCIAL PROJECTIONS ADVANTAGES

Run different scenarios with our small restaurant financial projection model to optimize budgeting and boost profitability efficiently.

The small restaurant cash flow model enables dynamic scenario planning, optimizing financial decisions to ensure sustainable profitability.

Identify cash gaps and surpluses early using our small restaurant financial projection model for proactive financial management.

Our small restaurant cash flow model predicts deficits early, enabling proactive solutions and strategic reinvestment for growth.

Maximize profitability with our small restaurant financial projection model offering precise key metrics analysis for smart decision-making.

Streamline financial planning with our 5-year small restaurant model delivering dynamic GAAP/IFRS statements and revenue forecasts instantly.

Our small restaurant financial projection model ensures accurate forecasts, satisfying banks and guiding profitable decision-making.

A small restaurant financial projection model ensures accurate forecasting, satisfying bank loan requirements and optimizing financial planning.

Easily update your small restaurant financial projection model to optimize budgeting, forecasting, and profit planning anytime.

The restaurant startup financial plan enables dynamic input adjustments for precise, ongoing forecasting and strategic decision-making.