Bowling Center Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Bowling Center Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Bowling Center Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BOWLING CENTER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year bowling center financial planning model template is designed for startups and entrepreneurs seeking to impress investors and secure funding. It features detailed bowling center revenue projections, expense analysis, and cash flow financial models, alongside crucial elements like break-even analysis, capital expenditure tracking, and ROI forecast. With built-in financial charts, income statements, budgeting, and operational financial models, this template supports thorough investment analysis and sales forecasting, making it an essential tool for crafting a compelling bowling center business plan and ensuring robust profitability and fund allocation strategies. Fully unlocked and editable, it helps users get funded by banks, angels, grants, and VC funds.

The bowling center financial model Excel template alleviates the common pain points of complex financial planning by delivering an all-in-one tool that streamlines bowling center revenue projections, expense analysis, and cash flow management into a cohesive operational financial model. It addresses startup challenges by offering detailed bowling center startup costs financial model and break-even analysis, ensuring users can accurately forecast profits and cash budgets without guesswork. With integrated sales forecast, capital expenditure, and fund allocation models, it optimizes budgeting processes and investment analysis, empowering users to conduct thorough financial ratio and ROI forecasts. The dynamic visualization of income statements and profitability models simplifies decision-making, allowing business owners and investors to monitor key metrics effortlessly and confidently plan sustainable growth.

Description

The comprehensive bowling center financial model offers a robust 5-year cash flow projection template designed specifically for detailed bowling center financial planning, including startup costs, sales forecast, and expense analysis. This Excel-based tool features integrated sheets for projected profit and loss statements, balance sheets, break-even analysis, and equity valuation, enabling precise bowling alley profit forecast and investment analysis. With a focus on operational financial management, the model supports budgeting, fund allocation, capital expenditure planning, and in-depth financial ratio analysis to optimize profitability and ROI forecast. Crafted by experts, it provides clear, actionable insights into the bowling center’s cost structure and cash budget model, making it ideal for users to evaluate business viability, enhance financial health, and drive sound decision-making without needing advanced technical expertise.

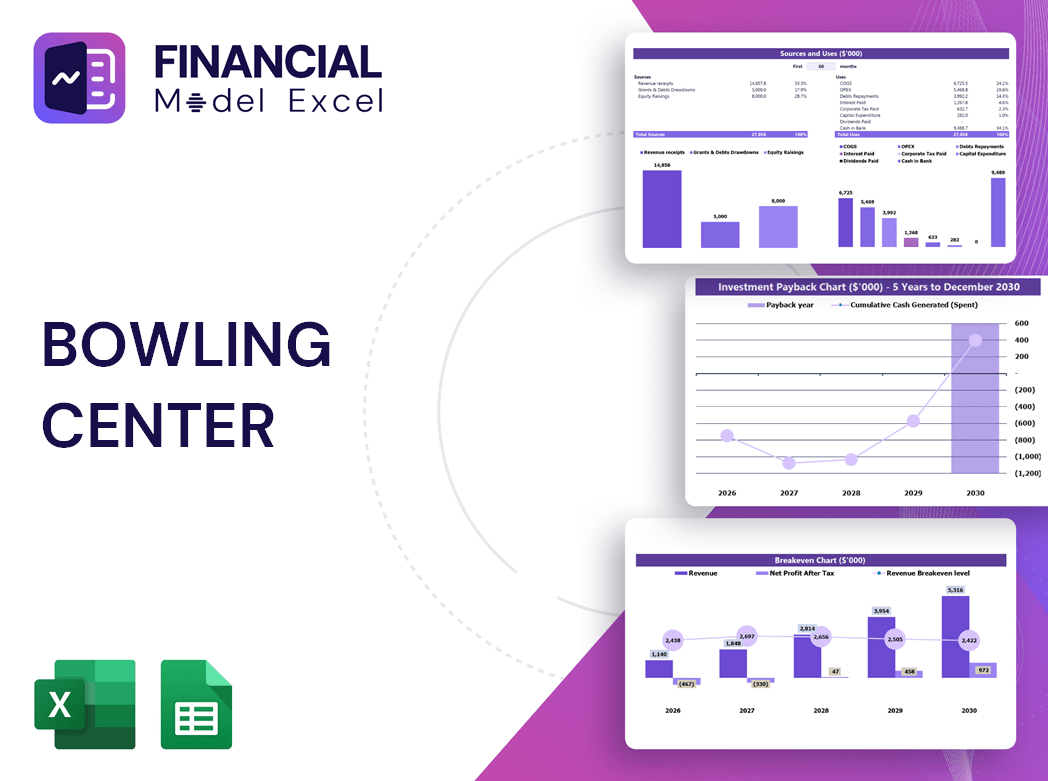

BOWLING CENTER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our customizable bowling center financial planning model lets you adjust key parameters including income statements, operating costs, hiring plans, startup valuation, cap table, and revenue multiples. Easily tailor projections for sales forecasts, expense analysis, cash flow, and break-even analysis to fit your unique business needs. Our flexible financial model allows you to add new assumptions and forecasting methods, edit every formula and cell, and create a comprehensive bowling alley profit forecast, budgeting, and ROI forecast. Build a precise, adaptable bowling center business plan financial model that drives informed decision-making and maximizes profitability.

Dashboard

The bowling center financial planning model offers a dynamic dashboard to streamline revenue projections, expense analysis, and cash flow management. It enables accurate, real-time insights into profitability, break-even points, and startup costs, essential for strategic decision-making. This comprehensive tool supports budgeting, investment analysis, and ROI forecasting, ensuring transparent financial reporting. By optimizing your bowling alley’s cost structure and sales forecasts, it empowers you to enhance operational efficiency and build trust with stakeholders through precise, transparent financial statements. Perfect for startups and growing centers, this model drives informed, confident business growth.

Business Financial Statements

Our bowling center financial planning model features a comprehensive integrated summary, consolidating key data from all supporting spreadsheets. This includes the projected balance sheet, pro forma profit and loss statement, and detailed cash flow forecast. Expertly formatted for investor presentations, this streamlined summary enhances your business plan financial model by providing clear bowling alley profit forecasts, expense analysis, and ROI projections—empowering you with a robust tool for precise revenue projections, capital expenditure planning, and break-even analysis. Elevate your pitch deck with a professionally crafted financial overview designed to showcase your bowling center’s profitability and growth potential.

Sources And Uses Statement

Our Bowling Center Financial Planning Model offers a comprehensive sources and uses of cash tool, ensuring transparent fund management. It clearly details funding origins and allocates expenditures, essential for accurate expense analysis and cash flow management. This model supports investment analysis, break-even calculations, and budgeting, empowering stakeholders with a clear view of financial health and strategic fund deployment. Ideal for optimizing your bowling center’s revenue projections and profitability forecasts.

Break Even Point In Sales Dollars

This bowling center break-even analysis financial model accurately determines when revenues surpass total costs, signaling the start of profitability. Identifying this critical point before launch is essential for investors and creditors assessing project viability. By analyzing the relationship between fixed and variable expenses and forecasting revenue, this model supports sound financial planning. Integrating bowling center revenue projections and expense analysis, it empowers stakeholders to make informed decisions, minimize risks, and optimize operational success.

Top Revenue

The Top Revenue tab in the bowling center financial model offers a clear summary of your company’s revenue, detailed by product line. This operational financial model delivers an annual breakdown of revenue streams, showcasing total revenue by segment alongside comprehensive revenue bridges. Such insights enhance your bowling alley profit forecast financial model and support precise revenue projections for strategic financial planning.

Business Top Expenses Spreadsheet

Our bowling center financial planning model features a dynamic top expenses tab, highlighting your four major cost areas for clear insights. Remaining expenses are efficiently grouped under ‘Other,’ ensuring comprehensive expense analysis. This operational financial model automatically adjusts expenses based on your assumptions, delivering an accurate bowling center expense analysis financial model and generating detailed reports instantly. Streamline your budgeting and enhance your business plan with precision and ease.

BOWLING CENTER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

This comprehensive bowling center financial planning model streamlines your startup process by delivering accurate revenue projections, expense analysis, and cash flow forecasts instantly. Featuring built-in formulas, it automates updates across bowling alley profit forecast, break-even analysis, and budgeting reports. Save time and enhance decision-making with this all-in-one bowling center business plan financial model—no manual updates required.

CAPEX Spending

Capital expenditure (CAPEX) is a critical component of any bowling center financial model, reflecting investments in property, plant, and equipment (PPE). Our bowling center capital expenditure financial model accurately forecasts startup costs by incorporating asset additions, disposals, and depreciation. It also accounts for fixed assets under financial leasing, ensuring a comprehensive expense analysis. Integrating CAPEX into your bowling center budgeting and cash flow financial models enables precise revenue projections, profitability forecasts, and break-even analysis—essential tools for sound financial planning and investment analysis in the bowling alley industry.

Loan Financing Calculator

Our bowling center financial planning model includes a dynamic loan amortization schedule with built-in formulas, detailing principal and interest payments across monthly, quarterly, or yearly intervals. This feature integrates seamlessly into your bowling alley profit forecast financial model, providing precise loan repayment tracking to optimize cash flow and expense analysis. Designed to support your bowling center startup costs financial model and capital expenditure financial model, the schedule enhances budgeting accuracy and financial ratio analysis, empowering informed decisions and strengthening your bowling center investment analysis financial model.

BOWLING CENTER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA on the bowling center income statement is a crucial indicator of operational success, reflecting earnings before interest, taxes, depreciation, and amortization. Integrating this metric into a comprehensive bowling center financial planning model enhances profit forecast accuracy and supports effective expense analysis. Leveraging EBITDA within your bowling alley profit forecast financial model allows stakeholders to assess true operational performance, optimize cash flow, and drive strategic investment decisions. This approach ensures a clear understanding of profitability, guiding actionable insights in budgeting, cost structure, and ROI forecasts for sustained business growth.

Cash Flow Forecast Excel

The bowling center cash flow financial model provides a clear analysis of operating cash flow, highlighting the cash generated exclusively from core business activities. By excluding secondary income sources such as interest or investments, this model delivers precise insights into operational liquidity. Utilizing this tool within your bowling alley financial planning model enhances decision-making, supports accurate budgeting, and strengthens revenue projections for sustained profitability and growth.

KPI Benchmarks

This bowling center financial planning model features a dedicated tab for a comprehensive financial benchmarking study. By analyzing key financial indicators and comparing your bowling alley’s performance against industry standards, this tool sharpens insights into competitiveness, efficiency, and productivity. Leveraging this benchmarking within your bowling center profit forecast financial model enables informed decision-making, optimized expense analysis, and strategic operational improvements to maximize revenue and profitability. Elevate your bowling center’s financial health with data-driven analysis tailored for success.

P&L Statement Excel

The bowling center financial model’s income statement is a vital tool for assessing revenue, expenses, and overall profitability. This detailed 5-year pro forma profit and loss forecast provides monthly and annual insights into sales, operating costs, margins, and net profit. With embedded graphs, financial ratios, and assumptions, it enables precise bowling center revenue projections, expense analysis, and profitability forecasting. Ideal for operational financial planning, budgeting, and investment analysis, this model offers a comprehensive view of your bowling alley’s financial health and income generation potential.

Pro Forma Balance Sheet Template Excel

The bowling center financial planning model includes a pro forma balance sheet, providing a clear snapshot of your business’s financial position at a specific point in time. This essential component outlines assets, liabilities, and net worth throughout the forecast horizon, supporting accurate bowling center revenue projections and expense analysis. Integrating this with your bowling alley profit forecast and cash flow financial model equips you to make informed decisions, optimize your cost structure, and confidently plan for long-term growth.

BOWLING CENTER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive 5-year bowling center financial planning model supports pre-revenue startups by enabling users to perform a Discounted Cash Flow (DCF) valuation effortlessly. With customizable inputs for Cost of Capital rates, it delivers precise bowling center cash flow financial analysis, facilitating accurate revenue projections, expense analysis, and ROI forecasts. Ideal for investment analysis and strategic budgeting, this model empowers stakeholders to confidently navigate startup costs, break-even points, and profitability forecasts, ensuring informed decision-making throughout the bowling alley’s growth trajectory.

Cap Table

A comprehensive bowling center financial planning model is essential for startups, integrating key elements like revenue projections, expense analysis, and cash flow. Just as a cap table excel provides detailed ownership distribution over time for startups, a well-structured bowling alley profit forecast financial model ensures precise tracking of investment, budgeting, and break-even analysis. This holistic approach supports informed decision-making, optimizes fund allocation, and drives sustainable profitability in a competitive market.

BOWLING CENTER PRO FORMA TEMPLATE EXCEL ADVANTAGES

The bowling center financial model ensures precise budgeting and maximizes profitability by tracking expenses and revenue seamlessly.

Bowling center financial models enhance profitability forecasts, attracting investors and top talent through precise financial planning.

Start a new business confidently with a bowling center financial model, ensuring accurate revenue projections and profit forecasting.

The bowling center financial model enhances revenue projections and optimizes budgeting for smarter business decisions.

Maximize profits and streamline decisions with our comprehensive bowling center financial model Excel template.

BOWLING CENTER PRO FORMA FINANCIAL STATEMENTS TEMPLATE EXCEL ADVANTAGES

Easily update your bowling center financial model anytime for accurate revenue projections and optimized profit forecasting.

Easily refine your bowling center financial model by adjusting inputs to optimize revenue and profitability projections continuously.

Our bowling center financial model delivers accurate profit forecasts and cash flow insights with print-ready, professional reports.

The bowling center financial model delivers print-ready reports for clear profit forecasts, cash flow, and comprehensive financial ratios.

Get a powerful bowling center financial model that optimizes revenue, controls expenses, and boosts profit forecasts effortlessly.

This robust bowling center financial model empowers precise planning, customization, and insightful profit and cash flow forecasting.

Easily update your bowling center financial model anytime for accurate revenue projections and optimized profit forecasting.

The bowling center financial model enables dynamic input adjustments for precise startup planning and ongoing revenue forecasting.

Optimize cash flow and profitability with our comprehensive bowling center financial model for effective accounts receivable management.

A bowling center cash flow financial model pinpoints late payments, optimizing cash flow and enhancing revenue predictability.