Software As A Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Software As A Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Software As A Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOFTWARE AS A SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year SaaS financial projections model designed for any business size or development stage, requiring minimal financial planning experience and basic Excel knowledge. This comprehensive cloud software financial planning tool enables accurate monthly recurring revenue calculation, subscription revenue model analysis, and SaaS cost structure analysis, providing quick and reliable estimates of startup costs and recurring revenue forecasts. Fully unlocked and customizable, it supports software subscription cash flow management, SaaS unit economics evaluation, and break-even analysis, making it an essential resource for tech startup financial modeling and software as a service budgeting.

This ready-made Excel template alleviates common SaaS financial planning challenges by providing a comprehensive SaaS business model analysis that integrates subscription revenue model dynamics, monthly recurring revenue calculation, and SaaS churn rate impact, enabling accurate software revenue growth modeling and recurring revenue forecast without requiring advanced Excel skills. Designed to simplify tech startup financial modeling, it incorporates essential SaaS financial metrics such as customer acquisition cost SaaS, annual contract value SaaS, and SaaS revenue retention rates, facilitating precise SaaS unit economics assessment and SaaS cost structure analysis. Its intuitive structure supports software subscription pricing model adjustments, SaaS break-even analysis, and software subscription cash flow management, empowering users to achieve reliable software as a service budgeting and software service profitability modeling efficiently.

Description

This SaaS financial model template offers comprehensive cloud software financial planning by integrating subscription revenue model analysis, monthly recurring revenue calculation, and recurring revenue forecast to provide accurate software revenue growth modeling and SaaS business model analysis. It enables detailed SaaS financial metrics tracking, including customer acquisition cost SaaS, SaaS churn rate impact, and SaaS revenue retention rates, ensuring a clear understanding of SaaS unit economics and software subscription cash flow. The model supports SaaS cost structure analysis and software subscription pricing model evaluation, facilitating precise software service profitability model assessments and SaaS break-even analysis over a 5-year horizon, ideal for tech startup financial modeling with realistic annual contract value SaaS projections and software as a service budgeting aligned with investors’ expectations and bank loan requirements.

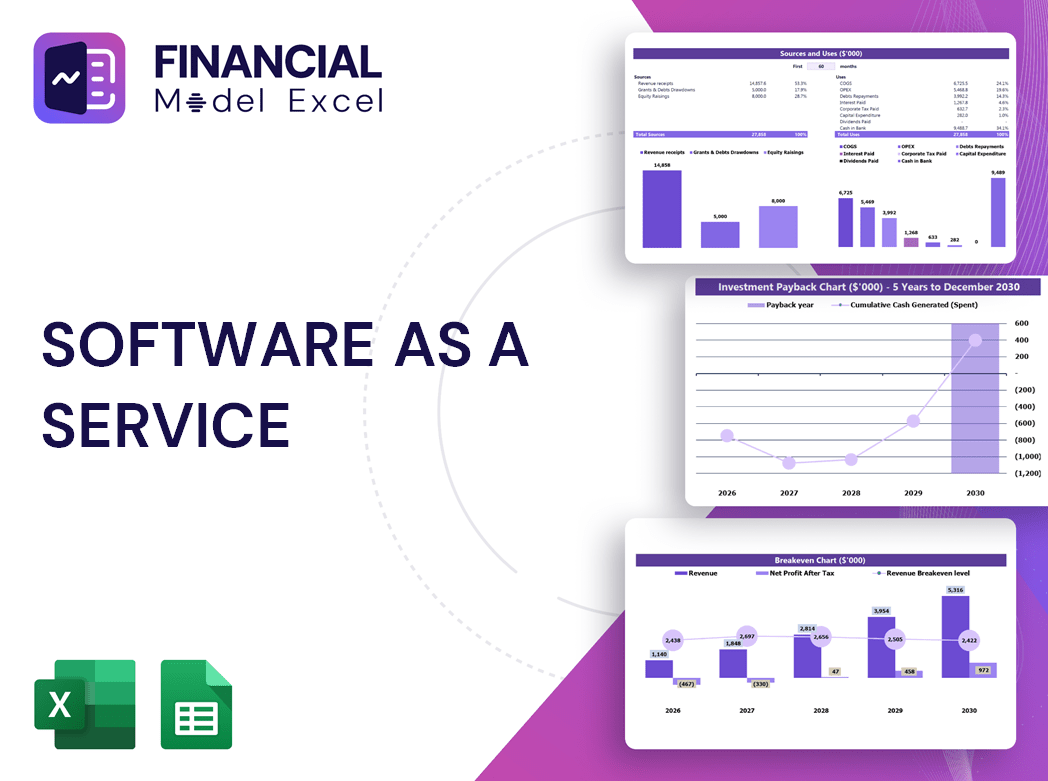

SOFTWARE AS A SERVICE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive SaaS financial projections template in Excel serves as a vital roadmap, enabling entrepreneurs to master their subscription revenue model and SaaS unit economics. Integrating monthly recurring revenue calculation, customer acquisition cost SaaS, and SaaS churn rate impact, it empowers precise cloud software financial planning. Monitoring software subscription cash flow and SaaS break-even analysis helps start-ups track cash burn rates and runway, ensuring informed decisions on software service profitability and SaaS revenue retention rates. This robust model drives strategic software revenue growth modeling and budgeting, guiding businesses to achieve key milestones efficiently and sustainably.

Dashboard

Our SaaS financial projections template features an intuitive dashboard that delivers comprehensive insights into your subscription revenue model and recurring revenue forecast from day one. Visualize key SaaS financial metrics—including cash flow projections, pro forma profit and loss statements, annual contract value analysis, and software subscription cash flow—through dynamic charts and graphs. Designed for tech startup financial modeling and SaaS business model analysis, this tool empowers informed decisions on SaaS unit economics, customer acquisition cost, and churn rate impact, streamlining your software as a service budgeting and revenue growth modeling efforts.

Business Financial Statements

Our feasibility study template Excel delivers a comprehensive SaaS financial projections report, seamlessly integrating key metrics like monthly recurring revenue calculation, SaaS churn rate impact, and customer acquisition cost. It consolidates data from essential spreadsheets—including projected balance sheets, profit and loss forecasts, and software subscription cash flow models—offering an expert-structured financial overview. Perfectly designed for your pitch deck, this tool supports precise SaaS business model analysis, subscription revenue modeling, and software revenue growth modeling to accelerate your cloud software financial planning and tech startup financial modeling efforts.

Sources And Uses Statement

In SaaS financial projections, the Sources and Uses section of your pro forma template details the company’s funding and spending strategies. The ‘Sources’ highlight capital inflows—ranging from investor funding to loans—supporting your subscription revenue model. Meanwhile, the ‘Uses’ outline cash deployment across key areas such as customer acquisition cost, infrastructure, or software development. This clarity aids in precise software subscription cash flow management and strengthens SaaS business model analysis, enabling robust recurring revenue forecasts and smart budget allocation aligned with your SaaS unit economics and revenue growth modeling.

Break Even Point In Sales Dollars

Curious about when your SaaS startup will turn profitable? Our break-even analysis tool provides precise insights into the sales volume or revenue needed to cover all operating costs. Ideal for SaaS financial projections and subscription revenue models, this template simplifies monthly recurring revenue calculation and software subscription cash flow management. Leverage this to optimize your SaaS unit economics, refine your customer acquisition cost metrics, and drive software revenue growth modeling. Make informed decisions with confidence—discover the exact milestone where your SaaS business model shifts from cost to profit.

Top Revenue

The Top Revenue tab in your 5-year SaaS financial projections offers a clear, concise overview of each product or service’s revenue streams. It provides an annual breakdown essential for subscription revenue model analysis, highlighting key SaaS financial metrics such as monthly recurring revenue calculation, revenue depth, and revenue bridge. This enables precise software revenue growth modeling and informs strategic decisions around customer acquisition cost SaaS, churn rate impact, and SaaS revenue retention rates—empowering data-driven planning for sustainable profitability and optimized cloud software financial planning.

Business Top Expenses Spreadsheet

Our SaaS financial projections template includes a Top Expenses tab designed for precise SaaS cost structure analysis and software subscription cash flow management. It generates detailed expense summaries by category, simplifying tax preparation and enhancing software as a service budgeting. By comparing actual costs against forecasts, business owners can optimize their subscription revenue model and improve SaaS unit economics. This robust recurring revenue forecast tool supports software revenue growth modeling and SaaS business model analysis, empowering startups to evaluate development scenarios and make data-driven decisions for sustainable profitability.

SOFTWARE AS A SERVICE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our SaaS financial projections template offers advanced cost structure analysis, enabling precise planning of operational expenses up to 60 months ahead. Designed for software subscription cash flow and SaaS business model analysis, it categorizes costs by COGS, variable, fixed, wages, and CAPEX. Integrated forecasting curves allow customizable expense growth rates—whether fixed, variable, or tied to revenue percentages—supporting accurate recurring revenue forecasts and monthly recurring revenue calculations. This user-friendly tool streamlines SaaS financial planning, enhancing software revenue growth modeling and ensuring reliable SaaS financial metrics for robust budgeting and profitability modeling.

CAPEX Spending

This dynamic cash flow statement template for SaaS empowers precise software subscription cash flow forecasting by automatically calculating required funding based on your recurring revenue forecast and funding sources. Designed for tech startup financial modeling, it integrates SaaS financial metrics like customer acquisition cost, churn rate impact, and monthly recurring revenue calculation to enhance your SaaS business model analysis. Streamline your cloud software financial planning and optimize your SaaS cost structure analysis with ease—driving smarter decisions for software revenue growth modeling and sustainable profitability.

Loan Financing Calculator

Our Excel-based financial model features a dynamic loan amortization schedule tailored for SaaS businesses. Equipped with pre-built formulas, it accurately breaks down each installment’s principal and interest repayment across monthly, quarterly, or annual terms. This tool seamlessly integrates with SaaS financial projections, supporting precise software subscription cash flow management and enhancing your SaaS business model analysis. Ideal for cloud software financial planning, it aids in evaluating subscription revenue models and refining SaaS unit economics, ensuring your tech startup’s financial forecasting and budgeting are both efficient and insightful.

SOFTWARE AS A SERVICE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a key SaaS financial metric essential for robust cloud software financial planning. Integrated within SaaS financial projections, ROI evaluates the ratio of cash inflows to outflows from investment activities, helping quantify software subscription cash flow efficiency. By dividing net gains from investments by total costs, ROI offers clear insight into software as a service budgeting and profitability models. Leveraging ROI analysis alongside SaaS unit economics and recurring revenue forecasts empowers tech startups to optimize their subscription revenue model and accelerate sustainable software revenue growth.

Cash Flow Forecast Excel

A comprehensive SaaS financial projections model focuses on precise cash flow forecasting, highlighting subscription revenue models and monthly recurring revenue calculations. Unlike profit and loss statements that include non-cash expenses, this pro forma cash flow forecast zeroes in on actual cash inflows and outflows, crucial for cloud software financial planning and SaaS business model analysis. Featuring fully integrated, customizable templates, it supports recurring revenue forecasts, SaaS churn rate impact assessments, and software subscription cash flow over monthly or annual periods—empowering startups with accurate SaaS financial metrics for optimal budgeting, break-even analysis, and revenue growth modeling.

KPI Benchmarks

A robust SaaS financial projections template benchmarks key metrics like monthly recurring revenue, churn rate impact, and customer acquisition cost SaaS to evaluate business effectiveness. Highlighting average values enables comparative SaaS business model analysis, essential for cloud software financial planning and subscription revenue model optimization. This data-driven approach supports strategic management by identifying growth opportunities and guiding software subscription pricing model adjustments. Accurate tracking of SaaS financial metrics empowers startups to enhance software revenue growth modeling and ensure sustainable profitability, making it indispensable for successful tech startup financial modeling and software as a service budgeting.

P&L Statement Excel

Stay ahead in your SaaS business with precise financial projections and comprehensive SaaS financial metrics. Utilizing advanced software subscription cash flow models and recurring revenue forecasts enables accurate monthly recurring revenue calculation and SaaS churn rate impact analysis. Leverage cloud software financial planning and SaaS business model analysis to optimize your subscription revenue model and improve customer acquisition cost SaaS insights. With a robust software revenue growth modeling approach and SaaS cost structure analysis, you can effectively manage software service profitability and conduct SaaS break-even analysis—ensuring your tech startup’s financial health and sustainable growth.

Pro Forma Balance Sheet Template Excel

A startup’s projected balance sheet offers a snapshot of total assets, liabilities, and equity, revealing its net worth and capital structure. While insightful alone, combining it with the profit and loss forecast—reflecting operational results over time—provides a comprehensive view essential for SaaS financial projections. Integrating these with subscription revenue models, SaaS churn rate impact, and monthly recurring revenue calculations empowers precise cloud software financial planning and tech startup financial modeling, driving informed decisions on SaaS unit economics, customer acquisition cost, and software service profitability.

SOFTWARE AS A SERVICE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our pre-revenue startup template delivers comprehensive SaaS financial projections and subscription revenue model insights essential for investor funding. It incorporates cloud software financial planning tools—including monthly recurring revenue calculation, SaaS churn rate impact, and SaaS cost structure analysis. The Weighted Average Cost of Capital (WACC) quantifies investment returns on operating capital, while free cash flow valuation highlights cash available to shareholders and creditors. Leveraging discounted cash flow methods, our model accurately forecasts future cash flows relative to today’s value, empowering precise SaaS business model analysis and software revenue growth modeling for confident financial decision-making.

Cap Table

Our startup financial model template includes a comprehensive cap table, essential for SaaS business model analysis. This spreadsheet details your company’s ownership structure, listing shares, options, and investor pricing. Leveraging this tool alongside SaaS financial projections and subscription revenue model insights enables precise recurring revenue forecasts and customer acquisition cost analysis. By integrating monthly recurring revenue calculations and SaaS unit economics, startups can optimize software subscription pricing models, enhance software revenue growth modeling, and confidently manage software subscription cash flow, ultimately driving scalable and profitable cloud software financial planning.

SOFTWARE AS A SERVICE FINANCIAL MODEL ADVANTAGES

Optimize cash flow and forecast growth confidently with our SaaS financial projections and subscription revenue model template.

Raise capital confidently using a SaaS financial model Excel template for precise revenue growth and profitability insights.

Create multiple scenarios in SaaS financial models to optimize subscription revenue and improve recurring revenue forecasts effectively.

See precisely where your SaaS cash flows enable smarter budgeting and accelerate profitable subscription revenue growth.

Optimize growth and profitability using the SaaS financial model Excel template for precise sales strategy development.

SOFTWARE AS A SERVICE FINANCIAL MODEL TEMPLATE FOR STARTUP ADVANTAGES

Our SaaS financial projections simplify budgeting, boosting accuracy in subscription revenue and profitability forecasts instantly.

Effortlessly forecast SaaS profitability and growth with our sophisticated yet user-friendly financial planning Excel model.

Accurate SaaS financial projections optimize subscription revenue models for sustained software revenue growth and profitability.

Clear, well-structured SaaS financial projections enable rapid hypothesis testing and enhance strategic decision-making efficiency.

Optimize SaaS financial projections to save time and money while enhancing subscription revenue and profitability insights.

Our SaaS financial projections simplify budgeting, saving you costs while empowering strategic growth and innovation effortlessly.

Optimize SaaS cash flow by accurately forecasting subscription revenue and identifying cash gaps before they impact your business.

SaaS financial projections empower proactive cash flow management, ensuring timely decisions to prevent deficits or maximize growth opportunities.

Our SaaS financial projections deliver great value by optimizing subscription revenue and boosting recurring revenue forecasts efficiently.

Leverage our proven 3-year SaaS financial model for precise, affordable projections—no hidden fees, just clear profitability insights.