Soybean Oil Production Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Soybean Oil Production Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Soybean Oil Production Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOYBEAN OIL PRODUCTION FINANCIAL MODEL FOR STARTUP INFO

Highlights

The soybean oil production cost analysis financial model and soybean oil profitability financial model are essential tools for startups and established companies aiming to secure funding from investors or financial institutions. By integrating soybean oil supply chain financial forecasting with soybean oil price trends financial models, businesses can develop comprehensive cash flow projections and production budgeting models. These integrated financial plans support the evaluation of startup ideas, planning of pre-launch expenses, and formulation of investment appraisal models, ultimately enhancing business plans and facilitating successful fundraising efforts through banks, angels, grants, and venture capital. The model is fully unlocked for editing, allowing customization to fit specific needs such as capacity expansion, sales and revenue projection, and product line financial forecasts within the agro-industrial sector.

This ready-made soybean oil financial model Excel template effectively addresses common pain points such as complex data integration and time-consuming manual calculations by offering a user-friendly yet comprehensive solution encompassing soybean oil production cost analysis, supply chain financial modeling, and profitability projections. It enables seamless scenario planning with embedded soybean oil market forecast and price trends financial models, facilitating accurate soybean oil extraction financial projections and manufacturing financial planning. Business owners and investors can effortlessly perform soybean oil investment appraisal, capacity expansion modeling, and sales and revenue forecasting, ensuring informed decision-making without requiring advanced Excel skills or extensive financial expertise.

Description

The comprehensive soybean oil production cost analysis financial model in Excel integrates detailed input tables, dynamic charts, and a 60-month forecast of the pro forma income statement and projected balance sheet, enabling precise soybean oil manufacturing financial planning and profitability assessment. Designed for ease of use, this soybean oil processing plant financial model supports supply chain financial modeling, investment appraisal, and capacity expansion analysis with clear equity valuation and breakeven graphs, all backed by 5-year financial projections for accurate soybean oil extraction financial projections and sales revenue forecasting. Whether evaluating vegetable oil production financial metrics or conducting soybean crushing financial modeling, this robust tool facilitates insightful decision-making for agro-industrial ventures, balancing liquidity, valuation, and growth strategies in the evolving soybean oil market forecast financial model environment.

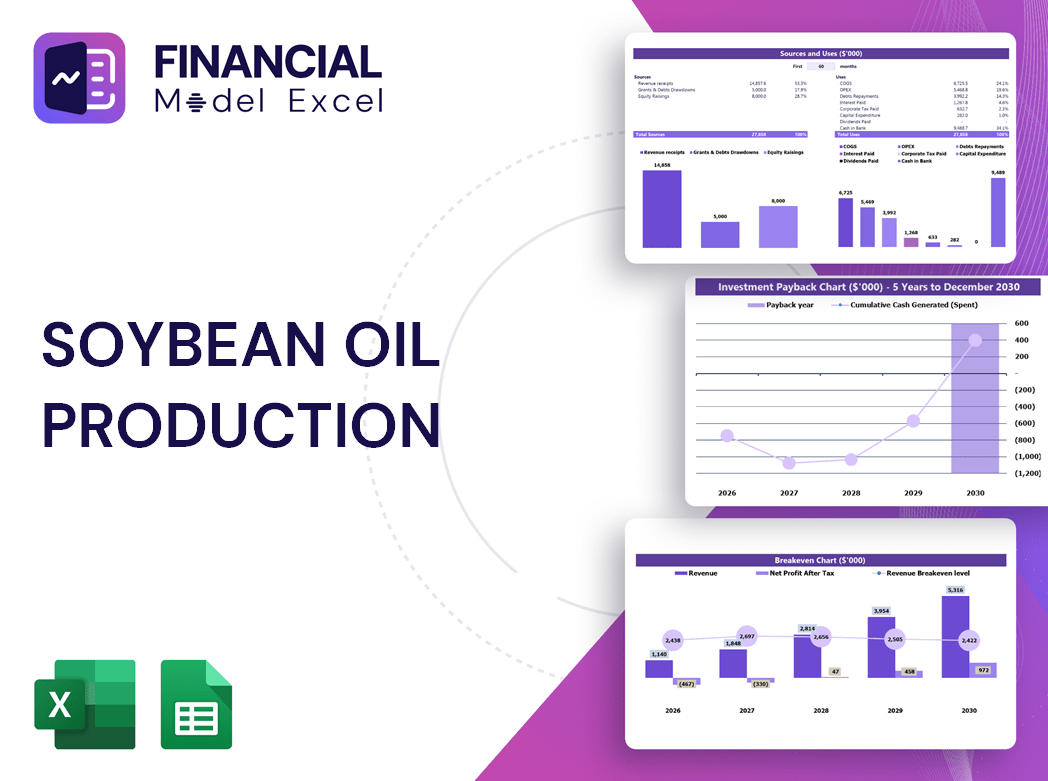

SOYBEAN OIL PRODUCTION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Leverage our soybean oil production cost analysis financial model to generate dynamic, scenario-driven reports tailored to your business needs. This robust and adaptable soybean oil manufacturing financial plan automatically adjusts to changing assumptions, eliminating manual recalculations. Designed for flexibility, it accommodates diverse operational scenarios, supporting scalability as your business expands. Whether refining cost structures or forecasting revenue, this proforma model empowers strategic decision-making with precision and efficiency. Elevate your soybean oil processing plant’s financial planning with a customizable, growth-oriented tool built for success.

Dashboard

Our comprehensive soybean oil financial model features a dynamic dashboard showcasing key financial indicators tailored to specific timeframes. It includes detailed cash flow statements, annual revenue breakdowns, and precise profit forecasts, empowering strategic decision-making. Designed for soybean oil production cost analysis and market forecast financial modeling, this tool supports supply chain optimization, processing plant budgeting, and profitability assessments. Whether refining your soybean oil business forecast or planning capacity expansion, this model provides clear insights into sales projections, extraction financial projections, and investment appraisal—ensuring confident, data-driven growth in the competitive edible oil sector.

Business Financial Statements

The soybean oil production cost analysis financial model offers a precise snapshot of your agro-industrial assets, liabilities, and equity at any reporting period’s end. This comprehensive financial plan enables users to input business data, generating detailed balance sheet forecasts and key financial reports automatically. Ideal for soybean oil processing plant startups, it supports budgeting, profitability analysis, and investment appraisal. Streamline your soybean oil refinery financial analysis with this dynamic Excel template, designed to enhance decision-making and optimize your production and sales forecasts efficiently.

Sources And Uses Statement

The Sources and Uses of Cash statement within the soybean oil financial model provides a clear summary of capital inflows (Sources) and expenditures (Uses). It ensures that total funding matches total allocation, offering precise insights for decision-making. This statement is essential for soybean oil production budgeting models, investment appraisals, and capacity expansion plans, especially during recapitalization, restructuring, or M&A activities. Leveraging this analysis enhances financial planning accuracy and supports strategic growth in the competitive soybean oil market.

Break Even Point In Sales Dollars

Curious about when your soybean oil venture will turn profitable? Our soybean oil profitability financial model pinpoints the exact sales volume or revenue needed to break even. This comprehensive tool integrates production costs, supply chain expenses, and market price trends to deliver precise break-even analysis. Ideal for soybean oil processing plants and manufacturers, it helps you confidently forecast sales, manage costs, and strategize growth. Unlock clear insights into your soybean oil business forecast and make informed decisions with our professional financial planning model.

Top Revenue

This comprehensive soybean oil business forecast financial model features a dedicated tab for in-depth revenue stream analysis. It meticulously breaks down revenue by product line and services, enabling precise profitability insights and informed decision-making. Ideal for refining your soybean oil production budgeting model and optimizing sales and revenue projections.

Business Top Expenses Spreadsheet

In our 5-year soybean oil production cost analysis financial model, top expenses are categorized into four key areas for clear budgeting. The “Other” section allows customization to capture all essential costs unique to your operation. Integrate this with the comprehensive 3-statement financial model template to monitor your soybean oil manufacturing financial plan and project profitability with precision. This streamlined approach ensures effective tracking and management of expenses, supporting accurate forecasting and strategic decision-making throughout your soybean oil processing plant’s growth.

SOYBEAN OIL PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive soybean oil production cost analysis financial model offers precise forecasting of expenditures and resource allocation, ensuring optimal budget management. Designed as a key component of your soybean oil processing plant financial plan, it highlights high-priority areas, enabling cost savings and efficient resource use. This robust soybean oil manufacturing financial model facilitates clear communication of financial insights to investors and lenders, supporting confident decision-making. Leverage this tool for accurate soybean oil market forecast and profitability analysis, driving your business toward sustainable growth and competitive advantage.

CAPEX Spending

Capital expenditures (CAPEX) are essential for driving rapid growth and innovation in the soybean oil industry. A comprehensive soybean oil production budgeting model ensures effective allocation of resources toward cutting-edge technologies and optimized product lines. By integrating CAPEX into soybean oil profitability financial models and production cost analysis, companies can strategically plan investments, control expenses, and enhance operational efficiency. Robust capital budgeting analysis empowers businesses to maintain financial stability, monitor market forecast trends, and seize growth opportunities within the soybean oil supply chain and refinery processes.

Loan Financing Calculator

Our comprehensive soybean oil financial model integrates an advanced loan amortization schedule designed to manage diverse loan types seamlessly. It meticulously tracks key loan details including principal amount, interest type, rate, term, and repayment timeline. This precise loan management tool enhances the accuracy of your soybean oil production cost analysis, profitability forecasting, and investment appraisal. Ideal for soybean oil processing plants and refinery financial analysis, our model supports robust financial planning, ensuring informed decisions for capacity expansion and market growth within the soybean oil supply chain.

SOYBEAN OIL PRODUCTION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Sales growth year-to-date is a crucial metric in any soybean oil business forecast financial model, enabling entrepreneurs to track revenue trends and drive growth. Utilizing a comprehensive soybean oil sales and revenue projection template, businesses can analyze sales performance across daily, weekly, monthly, or yearly intervals. This insight allows precise sales growth targeting and performance monitoring, especially when multiple sales teams operate. Integrating sales growth analysis within your soybean oil production budgeting model ensures data-driven decision-making for sustainable profitability and capacity expansion.

Cash Flow Forecast Excel

The monthly cash flow statement in Excel is an essential financial model for startups, especially in sectors like soybean oil production. It provides a clear snapshot of the company's liquidity, helping entrepreneurs monitor cash inflows and outflows closely. By integrating this with soybean oil profitability financial models or production budgeting tools, businesses can proactively identify cash shortages, ensuring they remain eligible for financing opportunities. This strategic insight supports sound decision-making, enhancing the financial health and growth potential of soybean oil ventures.

KPI Benchmarks

Benchmarking in soybean oil production leverages financial models—such as soybean oil production cost analysis and profitability financial models—to evaluate performance against industry leaders. These models enable clear comparison of key metrics like profit margins, cost per unit, and productivity ratios. Utilizing comprehensive templates for soybean oil processing plants and supply chain financial models, businesses can effectively chart their operations against best-in-class competitors. This streamlined approach supports strategic decisions, enhances operational efficiency, and drives competitive advantage within the soybean oil market forecast and investment appraisal frameworks.

P&L Statement Excel

For a profitable soybean oil production business, utilizing a comprehensive soybean oil profitability financial model is essential. This model offers detailed profit and loss forecasts, enabling accurate projections of revenues and expenses. Ideal for startups, it includes an annual report generated from your data, highlighting after-tax balances and net profits. Incorporating soybean oil production cost analysis and sales revenue projections, the model empowers strategic decision-making and ensures financial clarity throughout your soybean oil processing plant or refinery operations.

Pro Forma Balance Sheet Template Excel

A comprehensive soybean oil financial model, incorporating production cost analysis and market forecast, offers vital insights into your processing plant’s profitability and supply chain efficiency. By integrating pro forma balance sheets with profit and loss forecasts, this financial plan provides a clear snapshot of assets, liabilities, and equity over time. Such dynamic modeling enables precise investment appraisal, capacity expansion planning, and revenue projection, empowering stakeholders to make informed decisions and strategically prepare for future market trends and production scalability.

SOYBEAN OIL PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive soybean oil financial model offers a robust valuation report template, enabling users to conduct a precise Discounted Cash Flow (DCF) analysis with minimal input on the Cost of Capital. Ideal for soybean oil production cost analysis, profitability forecasting, and investment appraisal, this tool streamlines financial planning for processing plants, supply chains, and capacity expansions. Empower your soybean oil business forecast with accurate sales, revenue projections, and price trends—all integrated into a user-friendly, professional financial model designed for strategic decision-making and optimized financial performance.

Cap Table

The capitalization table is an essential tool for business owners to accurately assess shareholder ownership dilution. Our 5-year cash flow projection template in Excel includes a dynamic cap table featuring up to four funding rounds, allowing users to customize their financial models by applying one, two, or all rounds. This flexibility ensures precise integration with soybean oil production cost analysis financial models or soybean oil investment appraisal models, enabling informed decision-making and strategic planning tailored to your agro-industrial financial forecast needs.

SOYBEAN OIL PRODUCTION BUSINESS PLAN FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

Make informed hiring decisions efficiently using the comprehensive soybean oil production financial model Excel template.

The soybean oil financial model minimizes risk by accurately forecasting profitability and guiding smart investment decisions.

A dynamic soybean oil financial model ensures accurate forecasting, satisfying banks and empowering confident investment decisions.

Optimize capital demand accurately using the soybean oil production financial model with pro forma Excel templates.

Optimize startup loan repayments confidently using the comprehensive soybean oil production financial model template.

SOYBEAN OIL PRODUCTION FINANCIAL MODEL EXCEL ADVANTAGES

Streamline decisions with our all-in-one soybean oil financial model for accurate cost, forecast, and profitability analysis.

Comprehensive soybean oil financial models deliver precise forecasts, in-depth KPIs, and clear profitability insights for informed decision-making.

Unlock superior investment insights with our soybean oil profitability financial model driving strategic growth and maximum returns.

Unlock investor interest quickly with the soybean oil financial model’s precise forecasting and insightful profitability analysis.

Our soybean oil production cost analysis financial model delivers clear, actionable insights for maximizing profitability and efficiency.

Simplify soybean oil production cost analysis with our easy, accurate financial model, backed by expert support and tutorials.

Optimize profits and attract investors with our comprehensive soybean oil production cost analysis financial model.

Accurately forecast profits and cash flow with our comprehensive soybean oil financial model, featuring in-depth market and cost analysis.

Our soybean oil profitability financial model offers precise 5-year forecasts, optimizing investment and maximizing returns confidently.

Streamline decision-making with our automated, fully-integrated 5-year monthly soybean oil production financial model.