System Integration Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

System Integration Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

System Integration Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SYSTEM INTEGRATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year system integration financial model template in Excel features prebuilt three-statement financial modeling tools, including a consolidated P&L forecast, balance sheet, and pro forma cash flow statement. Designed specifically for system integration projects, it integrates key financial metrics, budget forecasting, and revenue projection models to support detailed financial planning and expense tracking. The template also includes financial risk assessment features, investment feasibility analysis, and an interactive financial dashboard model, making it an essential financial modeling tool for system integration cost analysis and profitability evaluation. Fully unlocked for customization, this financial model empowers users to accurately estimate startup costs and optimize system integration project financial performance.

This comprehensive system integration financial model template effectively addresses common pain points by streamlining financial planning system integration models and enhancing accuracy in budget forecasting and cost analysis. It empowers users with dynamic financial scenario modeling system integration capabilities, enabling detailed expense tracking and cash flow financial management to mitigate financial risk assessment system integration challenges. With integrated financial performance system integration models and investment financial models, decision-makers can confidently evaluate profitability and revenue projections, while the financial dashboard model provides clear visualization of crucial financial metrics for system integration projects. This ready-made excel tool drastically reduces the complexity of system integration project financial modeling, offering adaptable financial data modeling and statement models that save time and improve precision in financial feasibility studies.

Description

Our system integration financial model provides a comprehensive financial planning system integration model designed to facilitate accurate budget forecasting, cost analysis, and financial performance evaluation for system integration projects. This model encompasses a full set of financial statements—including cash flow financial model, profitability financial model, and investment financial model—spanning 5 years on monthly and yearly bases, allowing for detailed financial scenario modeling system integration and risk assessment. It integrates key financial metrics for system integration and includes tools for expense tracking, revenue projection, and debt service coverage analysis, while linking funding sources such as bank loans and equity to valuation calculations. This user-friendly system integration financial dashboard model offers diagnostics, KPIs, and financial ratios to support owners and investors in making well-informed business decisions and optimizing financial outcomes for small to medium-sized enterprises.

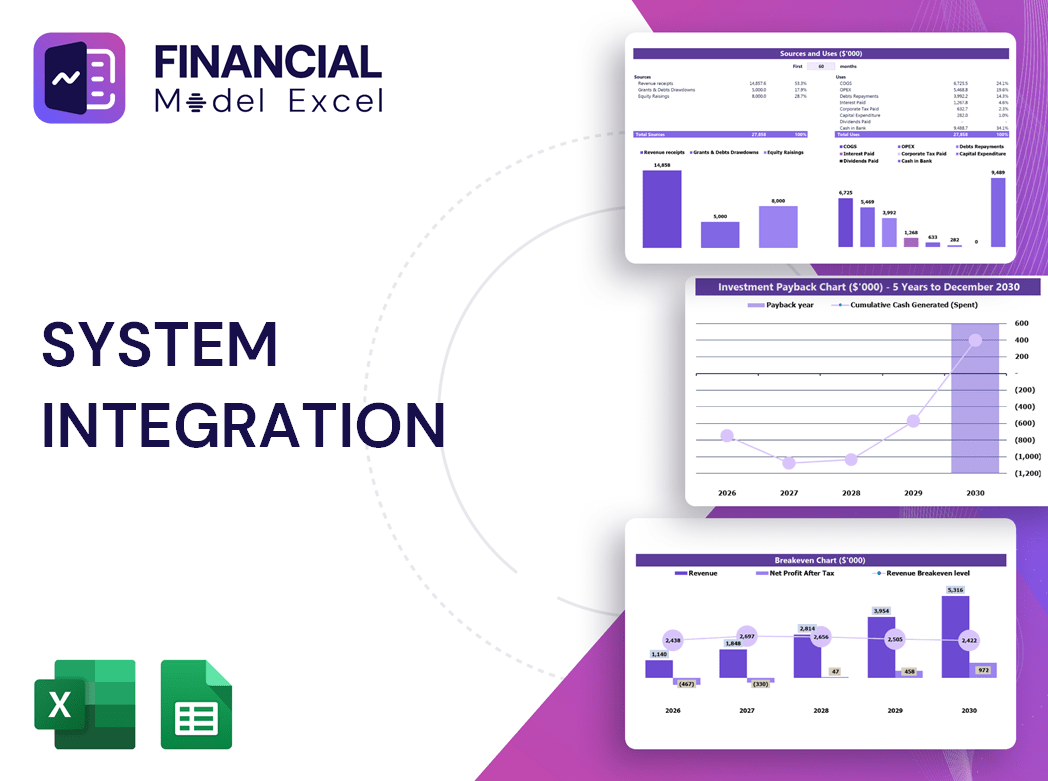

SYSTEM INTEGRATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive financial model for system integration projects combines income statements, cash flow, and balance sheets into a holistic 5-year projection. This financial planning system integration model captures all operational changes throughout the year, ensuring precise budget forecasting and expense tracking. Whether for investment analysis or financial risk assessment, every organization must develop a detailed system integration financial dashboard model annually. Utilizing robust system integration project financial modeling tools guarantees accurate financial feasibility and profitability insights, empowering better decision-making and sustainable growth.

Dashboard

Granting stakeholders access to your system integration financial dashboard model—featuring comprehensive cash flow and expense tracking—enhances transparency and collaboration. Utilizing advanced financial modeling tools for system integration projects strengthens budget forecasting and revenue projection accuracy. By integrating financial performance and risk assessment models, you empower your team to make informed decisions, optimizing profitability and investment outcomes. Expand your business capabilities with robust financial planning system integration models to drive efficiency and deliver compelling financial insights throughout your startup financial plan.

Business Financial Statements

Our comprehensive system integration financial modeling solution delivers a robust five-year financial projection model tailored for system integration projects. It streamlines financial planning, budget forecasting, cash flow analysis, and expense tracking, enabling precise financial performance and risk assessment. With automated financial statements, dashboards, and customizable visualizations, it empowers stakeholders to grasp key financial metrics effortlessly. Ideal for showcasing investment feasibility, profitability, and revenue projections, this tool elevates communication with investors through clear, data-driven presentations, ensuring confident decision-making and strategic growth in system integration ventures.

Sources And Uses Statement

Companies often leverage investor capital to accelerate profit growth effectively. Utilizing system integration financial modeling tools, such as a comprehensive system integration cash flow financial model and financial performance system integration model, enables owners to gain clear insights into financial metrics for system integration projects. Accurate financial planning system integration models ensure precise tracking of profits and losses, preventing deficits. By employing system integration budget forecasting and expense tracking financial models, businesses can make informed decisions that align with their strategic goals. These financial models are essential for startups aiming to optimize financial performance and safeguard long-term success.

Break Even Point In Sales Dollars

The break-even in dollars analysis is essential for system integration financial modeling, revealing the sales volume needed to cover fixed and variable costs. This critical financial planning system integration model aids stakeholders in assessing project feasibility and profitability. By accurately forecasting revenue and expenses, it empowers managers to set optimal pricing strategies, conduct financial risk assessments, and enhance budget forecasting. Leveraging system integration financial dashboard models ensures clear visibility into financial performance, guiding informed decisions to achieve sustainable profitability and successful project outcomes.

Top Revenue

Effective system integration financial modeling is crucial for sustainable business growth. Accurate revenue projection models directly impact the system integration profitability financial model and overall enterprise value. Management must leverage financial scenario modeling and budget forecasting models to ensure precise forecasts. Utilizing system integration financial data modeling tools and expense tracking financial models enables informed decision-making. Detailed assumptions, grounded in historical financial metrics for system integration, enhance the reliability of the system integration investment financial model. This strategic approach supports robust financial planning, risk assessment, and ultimately drives optimal performance in system integration projects.

Business Top Expenses Spreadsheet

Effective cost management is crucial in system integration financial modeling. Our 5-year system integration expense tracking financial model features a top expense report that highlights the four largest cost categories, grouping the rest as ‘other’ for clear visibility. This enables users to monitor expense trends, optimize costs, and enhance financial planning. For startups and established companies alike, leveraging this system integration budget forecasting model ensures accurate cost analysis, supports profitability, and strengthens financial performance, making it an essential tool for successful project financial modeling and ongoing expense optimization.

SYSTEM INTEGRATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective expense forecasting is vital for system integration financial planning. Our system integration budget forecasting model enables precise expense tracking and financial projections up to five years. Utilizing parameters like income percentages, payroll, recurring costs, and CAPEX schedules, the financial model for system integration projects allocates expenses into Fixed, Variable, COGS, and Wages categories. This robust system integration financial dashboard model delivers comprehensive cost analysis and enhances financial performance visibility. Designed for accuracy and adaptability, it’s an essential tool for optimizing system integration project financial modeling and informed decision-making.

CAPEX Spending

A robust system integration financial model is essential for accurately forecasting CAPEX impacts on the pro forma balance sheet and profit and loss statements. Integrating system integration budget forecasting models ensures precise cash flow projections, strengthening overall financial planning. Utilizing specialized system integration cost analysis and expense tracking financial models enhances investment decisions, supporting the company’s business financial model. Effective system integration financial dashboard models provide real-time insights, facilitating strategic capital expenditure management and driving profitability in today’s dynamic market environment.

Loan Financing Calculator

Our 5-year system integration financial model features an integrated loan amortization schedule, precisely calculating principal and interest. This dynamic financial planning system integration model enables accurate payment forecasting, factoring in loan amount, interest rate, duration, and payment frequency. Designed for seamless expense tracking and cash flow analysis, it empowers stakeholders with clear financial risk assessment and budget forecasting. Optimize your financial performance and investment decisions with this comprehensive tool tailored to system integration projects.

SYSTEM INTEGRATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The system integration financial modeling Excel template includes a vital payback period metric. This metric is calculated by dividing the customer acquisition cost by the profits generated from those customers. Utilizing this payback period within the system integration financial model allows for clear assessment of investment efficiency, enabling precise financial planning, budgeting, and profitability analysis. Incorporating this metric enhances your financial performance and risk assessment for system integration projects, supporting informed decision-making and optimized cash flow management.

Cash Flow Forecast Excel

This financial dashboard model features a dedicated sheet for comprehensive cash flow analysis, tracking your company’s cash-ins and outs with precision. Utilizing key inputs like annual revenue, working capital, long-term debt, and net cash, it generates an accurate system integration cash flow financial model. Designed for robust financial planning, this pro forma template supports a 5-year projection, enabling effective budget forecasting and cash position monitoring. Ideal for system integration projects, it empowers strategic decision-making through clear visibility into cash flow dynamics and financial performance.

KPI Benchmarks

This system integration financial model includes a dedicated tab for benchmarking analysis, comparing key financial metrics against industry peers. By leveraging this financial benchmarking study, users can evaluate their company’s competitiveness, operational efficiency, and productivity relative to similar organizations. This insight supports informed decision-making within system integration project financial modeling tools, enhancing financial planning, cost analysis, and profitability assessments. Ultimately, it empowers businesses to optimize performance and achieve sustainable growth within the system integration sector.

P&L Statement Excel

To make informed decisions in system integration projects, leveraging a comprehensive financial model is essential. A well-structured system integration financial dashboard model delivers accurate monthly profit and loss insights, covering revenue, expenses, and income. This enables rigorous financial planning, cost analysis, and profitability assessment, empowering you to identify strengths, mitigate risks, and optimize performance. Utilizing advanced system integration project financial modeling tools ensures your financial feasibility, budget forecasting, and cash flow management are precise and actionable, driving strategic success and sustainable growth.

Pro Forma Balance Sheet Template Excel

Leverage our system integration financial modeling tools, including a comprehensive projected balance sheet template in Excel, to visualize your company’s assets, liabilities, and equity over a 5-year horizon. This financial model for system integration projects enables precise financial planning, budget forecasting, and expense tracking, providing a clear snapshot of your organization’s financial position. Empower your decision-making with robust system integration cost analysis, financial performance metrics, and risk assessment integrated into a dynamic financial dashboard model. Assess your system integration project’s financial feasibility and profitability with accuracy and confidence.

SYSTEM INTEGRATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our system integration financial model includes advanced tools for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) analysis. WACC serves as a critical financial risk assessment metric, helping banks evaluate capital costs from debt and equity before loan approvals. The DCF component projects the present value of future cash flows, essential for investment decisions and financial planning. This comprehensive system integration financial dashboard model empowers businesses with accurate budget forecasting, profitability analysis, and scenario modeling, streamlining strategic decisions for sustained growth and optimized capital allocation.

Cap Table

A capitalization table is a vital financial modeling tool that offers comprehensive insights into investments, shareholders, and funding limits. In system integration projects, leveraging a financial model for system integration allows precise budget forecasting, expense tracking, and investment analysis. This empowers organizations to perform detailed financial feasibility assessments, revenue projections, and risk evaluations, ensuring robust financial planning and optimized profitability. Utilize advanced system integration financial dashboard models to monitor key financial metrics and improve decision-making throughout the project lifecycle.

SYSTEM INTEGRATION FINANCIAL PROJECTION EXCEL ADVANTAGES

The system integration financial model empowers precise forecasting, revealing strengths and optimizing project profitability efficiently.

Optimize surplus cash flow efficiently using the system integration financial model for precise financial planning.

Accelerate informed decisions and predict success with a comprehensive system integration financial model for startup projections.

Enhance decision-making with a precise financial summary tailored for your system integration financial model PitchDeck.

Optimize startup expenses accurately with our system integration financial model for confident, data-driven project planning.

SYSTEM INTEGRATION FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Our system integration financial model ensures accurate forecasting, maximizing profitability and minimizing investment risks for confident decision-making.

Accelerate funding and streamline negotiations using a precise 5-year system integration financial projection model with key metrics.

Optimize budgets and forecast profits effortlessly with our advanced system integration financial modeling tools—precision meets insight.

Streamline your system integration financial planning with effortless modeling—no formulas, formatting, or costly consultants needed.

Optimize spending and ensure budget control with a robust system integration expense tracking financial model.

The system integration cash flow financial model empowers precise future cash flow planning and budget comparison for informed decisions.

Optimize budgets and forecast profits effortlessly with our advanced system integration financial modeling tools—precision meets insight.

Streamline system integration planning effortlessly with our Excel financial model—no formulas, programming, or costly consultants needed.

Optimize system integration projects with financial models that enhance budget accuracy and maximize profitability forecasting.

A system integration cash flow financial model enables proactive forecasting to safeguard business growth and financial health.