Virtual Assistant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Virtual Assistant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Virtual Assistant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

VIRTUAL ASSISTANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year financial projection for virtual assistant startups, this comprehensive financial model for virtual assistant business incorporates essential tools such as virtual assistant revenue forecasting, expense tracking, and profitability analysis. Designed to support businesses at any size or development stage, it requires minimal prior financial planning experience and basic Excel knowledge, yet delivers quick and reliable results. The model includes a virtual assistant cost analysis model, cash flow model for virtual assistant business, and a customizable virtual assistant budgeting template, enabling entrepreneurs to evaluate startup costs, develop a robust virtual assistant pricing strategy model, and perform a thorough virtual assistant break-even analysis. Fully unlocked and editable, this financial dashboard for virtual assistant companies is the ideal template for virtual assistant business plan financials and financial statement preparation, ensuring comprehensive virtual assistant business valuation and financial risk assessment.

This ready-made virtual assistant financial modeling tool addresses critical pain points by providing a comprehensive financial projection for virtual assistant startups that seamlessly integrates budgeting templates, expense tracking models, and revenue forecasting features. By utilizing this virtual assistant business valuation model combined with cash flow models and break-even analysis, users can mitigate risks through thorough financial risk assessment and optimize profitability with clear financial metrics tailored specifically for virtual assistant firms. The inclusion of an intuitive financial dashboard and income statement templates simplifies virtual assistant financial statement preparation, enabling efficient financial planning and funding strategies, while the pricing strategy model and cost analysis ensure accurate expense control and competitive positioning, ultimately empowering business owners to make informed decisions and attract investors confidently.

Description

Our comprehensive virtual assistant financial modeling tools provide an integrated financial projection for virtual assistant startups, incorporating essential elements such as a virtual assistant revenue forecasting system, cost analysis model, and expense tracking model to enhance financial planning for virtual assistant services. This robust virtual assistant budgeting template enables accurate preparation of virtual assistant income statement templates and cash flow models for virtual assistant businesses, ensuring detailed virtual assistant profitability analysis and break-even analysis. Designed to support strategic decision-making, the model includes a financial dashboard for virtual assistant companies and a virtual assistant business valuation model, facilitating effective virtual assistant pricing strategy modeling, financial risk assessment, and funding model evaluation, all aimed at optimizing overall financial metrics for virtual assistant firms.

VIRTUAL ASSISTANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Effective management is key to success, and our virtual assistant financial modeling tools provide a clear roadmap for your startup’s growth. This financial projection for a virtual assistant startup streamlines cash flow modeling, expense tracking, and profitability analysis, empowering you to understand liquidity and cash burn rates. With tailored virtual assistant budgeting templates and revenue forecasting, you’ll confidently navigate financial planning, break-even analysis, and risk assessment. Optimize your virtual assistant business plan financials and secure funding with precision using our comprehensive financial dashboard and business valuation model.

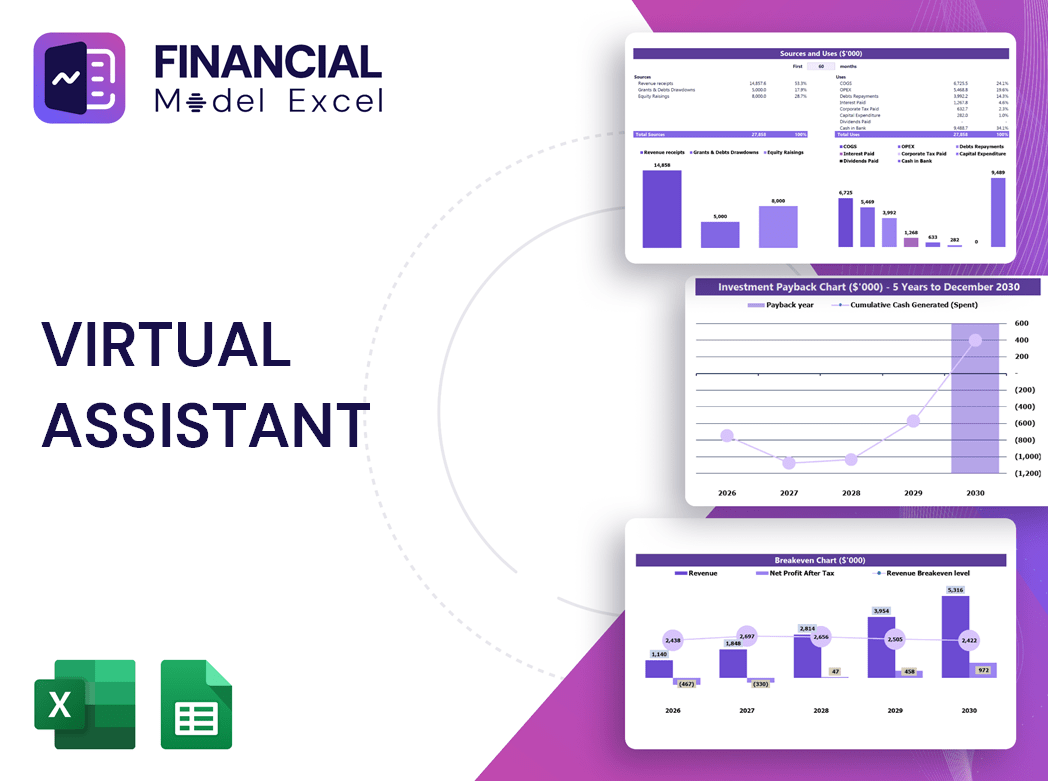

Dashboard

By inputting comprehensive data into our virtual assistant financial modeling tools, you will quickly develop a robust financial plan template tailored for your business. Utilizing the built-in analyses within our bottom-up financial model, including revenue forecasting, expense tracking, and profitability analysis, empowers you to make strategic decisions that enhance your virtual assistant business plan financials. The intuitive financial dashboard provides clear charts and graphs, simplifying complex data and driving impactful insights. Elevate your virtual assistant startup’s financial projection and planning with precision and confidence using this all-in-one solution.

Business Financial Statements

Our virtual assistant financial modeling tools include pre-built, consolidated pro forma profit and loss, balance sheet, and cash flow projections. These comprehensive financial statements can be generated monthly or annually, providing clear insights for your virtual assistant business planning. Easily integrate existing financial reports from QuickBooks, Xero, FreshBooks, and more to create dynamic rolling forecasts. Optimize your financial planning, budgeting, and revenue forecasting with our user-friendly virtual assistant business financials, designed to support profitability analysis, cash flow management, and strategic decision-making for your startup or established firm.

Sources And Uses Statement

The sources and uses of cash statement within this comprehensive 3-way financial model for virtual assistant businesses clearly illustrate the inflows and outflows of funds. This essential tool supports effective financial planning for virtual assistant services by highlighting revenue streams and expense allocations. Utilizing this model enables virtual assistant firms to optimize cash flow management, enhance budgeting accuracy, and strengthen profitability analysis. Incorporating these insights into your virtual assistant business plan financials ensures informed decision-making and sustainable growth.

Break Even Point In Sales Dollars

This virtual assistant break-even analysis outlines the annual revenue required to cover both fixed and variable costs, providing clear insight into your business’s financial health. It also highlights the precise number of months needed to reach profitability, empowering strategic decision-making. Utilize this essential financial model to optimize your budgeting, pricing strategy, and overall financial planning for virtual assistant services, ensuring sustainable growth and long-term success.

Top Revenue

Revenue drives every virtual assistant business’s success and is central to any financial model. An effective virtual assistant revenue forecasting tool captures multiple income streams and growth trends, ensuring accurate financial projections. Our virtual assistant financial modeling tools incorporate historical data and realistic assumptions to deliver precise revenue forecasts. Whether you’re using a virtual assistant cost analysis model or a financial dashboard for virtual assistant companies, our templates simplify crafting reliable revenue projections and enhance your financial planning for virtual assistant services. Elevate your startup’s financial strategy with our expert-designed financial projection and budgeting templates.

Business Top Expenses Spreadsheet

Our three-statement financial model template offers an efficient virtual assistant expense tracking model, dividing top expenses into four key sections plus an ‘Other’ category for customizable inputs. This financial tool enables comprehensive financial planning for virtual assistant services, providing clear insights into cost dynamics. Use this virtual assistant financial modeling tool to analyze past performance and project changes over the next five years. Empower your virtual assistant business with accurate virtual assistant revenue forecasting and budgeting templates to drive informed decisions and strategic growth.

VIRTUAL ASSISTANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The virtual assistant financial modeling tools are essential for precise financial planning and growth. Our comprehensive virtual assistant business plan financials offer robust cost analysis models, revenue forecasting, and profitability analysis. With intuitive expense tracking, budgeting templates, and cash flow models, you can confidently assess financial risks and opportunities. The financial dashboard for virtual assistant companies highlights key metrics, enabling timely decisions and optimized resource allocation. Whether preparing financial statements or conducting break-even and valuation analyses, these tools empower you to build a resilient, scalable virtual assistant startup with clear funding and pricing strategies.

CAPEX Spending

The CAPEX budget highlights your company’s asset investments that drive future value and growth. Utilizing a financial projection template tailored for virtual assistant businesses, including capital cost analysis tools, enables precise assessment of long-term development prospects. This empowers virtual assistant entrepreneurs to perform accurate cost analysis, expense tracking, and profitability analysis. Understanding CAPEX distinct from financial statements or depreciation is essential for effective financial planning, business valuation, and forecasting. Equip your virtual assistant startup with robust financial modeling tools to optimize budgeting, revenue forecasting, and strategic decision-making for sustainable success.

Loan Financing Calculator

Start-ups and growing virtual assistant businesses must diligently manage loan repayment schedules, detailing amounts, maturity, and terms. This critical component integrates with financial modeling tools to enhance cash flow models, ensuring accurate tracking of principal repayments and interest expenses. Interest costs directly influence virtual assistant cash flow projections, while closing debt balances update the balance sheet. Incorporating loan schedules into financial dashboards and expense tracking models empowers financial planning, enabling startups to optimize budgeting templates, conduct profitability analysis, and maintain precise financial statements—essential for sustainable growth and informed decision-making in virtual assistant services.

VIRTUAL ASSISTANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a key financial metric in a virtual assistant business’s cash flow model, reflecting how effectively your company turns total revenue into actual profit. It’s calculated by expressing net income—after all costs and expenses—as a percentage of gross sales. This metric provides crucial insight into your virtual assistant business’s profitability, guiding financial planning, revenue forecasting, and expense tracking. Monitoring net profit margin helps optimize your pricing strategy model and supports sustainable long-term growth by ensuring income consistently exceeds operating costs. Use it to drive informed decisions in your virtual assistant financial modeling tools.

Cash Flow Forecast Excel

The cash flow model for virtual assistant businesses is essential for projecting financial activities, particularly when planning financing strategies like loans or raising capital. Effective capital management is critical for startups, as success hinges on careful preparation to seize growth opportunities. Utilizing a robust financial planning tool ensures virtual assistant firms maintain liquidity, optimize budgeting, and support sustainable expansion. This proactive approach, supported by detailed financial projections and cash flow analysis, empowers virtual assistant startups to confidently navigate funding challenges and drive profitability.

KPI Benchmarks

Our virtual assistant financial modeling tools include an advanced benchmarking feature that compares your startup’s key financial metrics against industry averages. This virtual assistant business valuation model enables accurate financial planning and profitability analysis by highlighting relative strengths and weaknesses. Leveraging these insights, virtual assistant startups can refine their revenue forecasting, cost analysis, and budgeting templates to optimize performance. Benchmarking industry leaders is a strategic approach that drives smarter decision-making, strengthens financial projections, and supports sustainable growth for virtual assistant services. Elevate your financial dashboard with data-driven benchmarks to achieve competitive advantage and maximize profitability.

P&L Statement Excel

Our virtual assistant income statement template in Excel streamlines financial planning for your business. Designed for monthly or annual use, this tool simplifies the creation of comprehensive profit and loss statements, providing clear insights into your company’s income and expenses. Ideal for virtual assistant financial modeling tools, it supports accurate revenue forecasting, expense tracking, and profitability analysis. Elevate your virtual assistant business plan financials with this essential financial dashboard component, empowering you to make informed decisions and drive sustainable growth.

Pro Forma Balance Sheet Template Excel

Our virtual assistant financial modeling tools include a comprehensive balance sheet forecast within the feasibility study template. This financial statement provides a clear snapshot of the company’s assets, liabilities, and equity, offering vital insights into how operations impact financial health. Stakeholders can easily analyze the connection between income, expenses, and overall financial position. For instance, sales growth directly influences both the revenue forecast in the income statement template and the assets section of the balance sheet. This integrated approach enables accurate virtual assistant business valuation and supports strategic financial planning.

VIRTUAL ASSISTANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive virtual assistant business valuation model delivers essential financial insights investors demand. Featuring a weighted average cost of capital (WACC) to highlight the minimum return on invested funds, it ensures transparent stakeholder confidence. Integrated free cash flow valuation presents available cash flows to shareholders and creditors, while discounted cash flow analysis accurately values future earnings in today’s terms. This robust financial projection for virtual assistant startups empowers informed decision-making and strategic growth.

Cap Table

An equity cap table is essential for any virtual assistant business, providing clear insights into the company’s financial structure and capital allocation. It details all shares, options, and their origins, enabling precise calculation of each investor’s ownership percentage and invested capital. Integrating this with your virtual assistant financial planning tools ensures accurate financial projections, investor relations, and strategic decision-making. Use the cap table alongside models like virtual assistant business valuation and profitability analysis to optimize funding strategies and drive sustainable growth.

VIRTUAL ASSISTANT STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Virtual assistant financial modeling tools pinpoint strengths and weaknesses, empowering smarter decisions and maximizing business growth.

Calculate precise capital demand efficiently using the virtual assistant financial model’s comprehensive three-way financial forecasting capabilities.

Drive success confidently with the virtual assistant financial model, optimizing profitability and forecasting future growth accurately.

The virtual assistant cash flow model empowers confident financial planning and strategic growth for your business.

Accelerate growth confidently with a virtual assistant financial model offering precise revenue forecasting and profitability analysis.

VIRTUAL ASSISTANT 5 YEAR CASH FLOW PROJECTION TEMPLATE EXCEL ADVANTAGES

Leverage the virtual assistant financial model to confidently plan future growth with precise budgeting and revenue forecasting.

Virtual assistant cash flow models empower precise financial planning, ensuring sustainable growth and strategic business expansion.

Streamline your virtual assistant business growth with easy-to-use financial modeling tools for accurate forecasting and budgeting.

Clear, color-coded virtual assistant financial model ensures precise startup cost planning with easy input, calculation, and reporting.

Streamline your virtual assistant business growth with a simple, practical financial model for accurate revenue forecasting and cost analysis.

Simplify growth with our sophisticated virtual assistant financial model—expert planning made easy, accurate, and accessible for all.

Our financial model streamlines virtual assistant budgeting and forecasting, delivering all necessary reports for informed decisions.

Our virtual assistant financial model streamlines reporting, delivering lender-ready financials and precise calculations effortlessly.

Optimize growth with our virtual assistant financial modeling tools for accurate forecasting and strategic business planning.

Our financial model delivers comprehensive, print-ready reports optimized for precise virtual assistant business forecasting and planning.