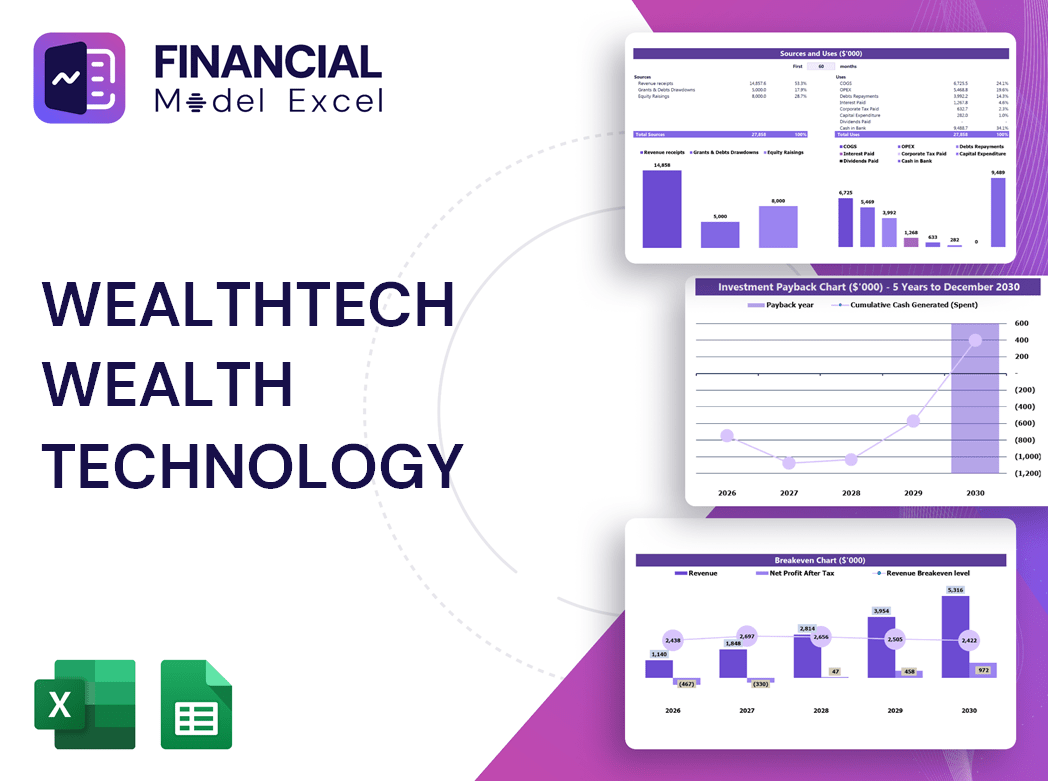

Wealthtech Wealth Technology Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Wealthtech Wealth Technology Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Wealthtech Wealth Technology Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

WEALTHTECH WEALTH TECHNOLOGY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year financial projection model is designed specifically for wealthtech startups, leveraging advanced wealth management technology and financial forecasting models to impress investors and facilitate capital raising. Utilizing state-of-the-art financial modeling techniques and investment management software, this customizable proforma business plan template integrates automated financial models and digital wealth platforms to streamline wealth management automation. Ideal for early-stage ventures, it incorporates predictive financial modeling and financial data analytics to provide a comprehensive overview of expected growth, making it an essential tool before purchasing any wealthtech business financial model.

This ready-made financial model Excel template for wealth management technology addresses common pain points by integrating advanced financial planning software features and automated financial models, enabling users to effortlessly handle complex financial forecasting models and financial risk modeling without needing extensive expertise. By leveraging financial data analytics and predictive financial modeling, the template offers dynamic input tables and visually intuitive charts that simplify monitoring cash flow, equity valuation, and profitability, aligning perfectly with current wealthtech trends. Designed with the latest financial technology innovations, including robo-advisors technology and digital investment tools, this model empowers wealthtech startups and established firms to streamline investment management software processes, enhance financial services technology workflows, and achieve precise, real-time financial insights critical for strategic decision-making and wealth management automation.

Description

Launching a wealthtech venture demands leveraging cutting-edge financial planning software and investment management software to create a robust and dynamic financial model that incorporates advanced financial forecasting models and predictive financial modeling techniques. Utilizing automated financial models and financial data analytics enables precise evaluation of initial capital investments, working capital requirements, and monthly sales forecasts, ensuring accurate projections within digital wealth platforms. Integrating artificial intelligence in wealthtech solutions and robo-advisors technology further enhances the analysis of financial risk modeling and cost-effectiveness, allowing stakeholders to simulate various scenarios and optimize decision-making based on comprehensive financial services technology. This approach not only aligns with current wealthtech trends but also empowers businesses with personalized finance technology and wealth management automation tailored to drive sustainable growth in the rapidly evolving landscape of financial technology innovations.

WEALTHTECH WEALTH TECHNOLOGY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This cutting-edge financial model leverages advanced wealth management technology and predictive financial modeling to provide startups with a comprehensive guide to their business performance. Integrating financial planning software and digital wealth platforms, it enables founders to optimize cash flow, forecast financial sustainability, and make informed decisions. By harnessing financial data analytics and automated financial models, this wealthtech solution empowers entrepreneurs to understand cash utilization rates and strategic milestones, ensuring long-term growth and success in today’s evolving financial services technology landscape.

Dashboard

Leverage cutting-edge wealth management technology and advanced financial modeling techniques to build a robust 5-year cash flow projection. By integrating financial data analytics within our proforma business plan template and applying predictive financial modeling, you can create dynamic, insightful forecasts. Our Dashboard features intuitive charts and graphs, powered by automated financial models, enabling strategic decision-making that enhances your business plan’s appeal to investors. Embrace the latest financial technology innovations and wealthtech solutions to optimize your financial planning software and drive success.

Business Financial Statements

Our advanced financial planning software leverages cutting-edge wealth management technology and financial data analytics to empower business owners. It streamlines the creation of comprehensive financial reports, forecasts, and calculations using predictive financial modeling and automated financial models. Additionally, the platform enhances stakeholder communication by generating dynamic presentations with insightful financial charts and graphs. These digital investment tools provide clear visual summaries of complex financial data, making it easier to engage potential investors and drive informed decision-making—reflecting the latest wealthtech trends and innovations in financial services technology.

Sources And Uses Statement

The sources and uses of cash statement within advanced financial modeling software offers a clear summary of capital inflows and outflows, ensuring total funds sourced match total expenditures. Essential in wealth management technology and digital investment tools, this statement supports crucial decisions during recapitalization, restructuring, or mergers & acquisitions. Leveraging predictive financial modeling and financial data analytics, wealthtech solutions provide accurate insights that empower firms to optimize capital allocation and mitigate risks effectively. Integrating these automated financial models with cutting-edge financial technology innovations drives smarter, data-driven strategies in today’s dynamic financial services landscape.

Break Even Point In Sales Dollars

Our free startup financial model template Excel features a detailed proforma, including a break-even sales calculator. Leveraging advanced financial forecasting models and predictive financial modeling, this tool empowers wealthtech startups and financial services technology firms to accurately determine pricing strategies. By integrating automated financial models and financial data analytics, companies can pinpoint the exact revenue needed to cover costs. This seamless blend of digital wealth platforms and investment management software enhances financial planning software capabilities, driving smarter, data-driven decisions in the evolving landscape of wealth management technology and financial technology innovations.

Top Revenue

Accurate revenue modeling is essential for robust wealth management technology and financial forecasting models. Advanced financial modeling techniques and investment management software enable analysts to capture multiple revenue streams within digital wealth platforms. Incorporating predictive financial modeling and financial data analytics, our 3-statement financial model template leverages historical growth rates and automated financial models to deliver precise revenue projections. Designed for wealthtech startups and financial services technology sectors, this dynamic tool empowers professionals to optimize financial planning software and stay ahead in evolving wealthtech trends. Elevate your revenue forecasting with cutting-edge digital investment tools and AI-driven wealth management automation.

Business Top Expenses Spreadsheet

Our feasibility study template excels at tracking company expenses efficiently, segmented into four main categories plus an “other” section for custom entries. Leveraging advanced financial planning software and digital wealth platforms, businesses can harness financial data analytics and predictive financial modeling to gain deeper insights into their activities. Integrating wealth management technology and automated financial models, including robo-advisors technology, empowers companies to forecast changes over the next five years with precision. Embrace cutting-edge wealthtech solutions and financial technology innovations to drive smarter investment management and seamless wealth management automation.

WEALTHTECH WEALTH TECHNOLOGY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our advanced wealth management technology leverages automated financial models and predictive financial modeling to accurately forecast expenditures and assess resource sufficiency. Utilizing cutting-edge digital wealth platforms and financial planning software, our solution highlights high-priority costs, enabling strategic savings. Ideal for wealthtech startups and professionals, this investment management software seamlessly integrates financial data analytics and robo-advisors technology, empowering you to communicate clear insights to investors and lenders. Embrace innovation with our wealthtech solutions to optimize budgeting and elevate your financial strategy.

CAPEX Spending

In wealth management technology, understanding key financial metrics is crucial. The "top line" represents total revenue, reflecting growth in digital wealth platforms or investment management software. Top-line growth signals increasing client assets and revenue streams. Conversely, the "bottom line" indicates net income, showcasing profitability after expenses—essential for assessing the impact of automated financial models and robo-advisors technology. Leveraging financial forecasting models and predictive financial modeling, wealthtech startups and firms optimize both metrics, driving innovation in personal finance technology and financial services technology. Monitoring these trends helps unlock sustainable success in wealthtech solutions.

Loan Financing Calculator

Effective loan payment planning is crucial for startups navigating complex financial landscapes. Leveraging advanced financial modeling techniques and wealth management technology, our Excel-based financial model template includes an intuitive loan amortization schedule and calculator. This wealthtech solution simplifies payment forecasting and enhances financial planning accuracy. By integrating automated financial models and digital investment tools, startups can optimize cash flow management and make informed decisions with ease, aligning with the latest wealthtech trends and financial services technology innovations.

WEALTHTECH WEALTH TECHNOLOGY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our wealth management technology solutions leverage advanced financial forecasting models and predictive financial modeling to deliver actionable KPIs tailored to your business. Whether you use digital wealth platforms or investment management software, selecting relevant metrics—such as customer lifetime value (LTV) and acquisition costs for SaaS or financial risk modeling for trading firms—is vital. By integrating AI-driven financial data analytics and automated financial models, wealthtech startups and enterprises can optimize performance, maximizing revenue growth, profitability, and operational efficiency through personalized financial planning software and wealth management automation. Stay ahead with innovative financial technology innovations designed for your unique needs.

Cash Flow Forecast Excel

Accurate cash flow projections are essential in any integrated financial modeling technique for startups. Leveraging advanced investment management software and financial forecasting models ensures that changes in cash flow statements seamlessly update projected balance sheets and income statements. Wealth management technology and automated financial models empower startups to generate precise pro forma financials. Incorporating financial data analytics and digital wealth platforms enhances the reliability of financial statements, making flawless cash flow projections indispensable for effective financial planning software and wealthtech solutions.

KPI Benchmarks

This pro forma Excel template, enhanced with advanced financial forecasting models and predictive financial modeling, empowers business owners to analyze industry benchmarks and financial data effectively. Leveraging wealth management technology and financial data analytics, users gain clear insights into their company’s performance relative to competitors. Integrating digital wealth platforms and automated financial models, the template highlights strategic opportunities and supports informed decision-making. Ideal for businesses seeking cutting-edge financial technology innovations, this tool streamlines wealth management automation and investment management software capabilities to optimize growth and competitive advantage.

P&L Statement Excel

For wealthtech startups, leveraging advanced financial modeling techniques and automated financial models is crucial to ensure profitability. Preparing a detailed projected profit and loss statement using cutting-edge investment management software and digital wealth platforms helps assess whether expected revenues cover expenses. This comprehensive approach, powered by financial data analytics and predictive financial modeling, delivers precise monthly and annual forecasts. Such wealthtech solutions provide clear insights into after-tax balances and net profits, empowering businesses to make informed decisions and stay ahead in the evolving landscape of wealth management technology and financial technology innovations.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet template in Excel provides a clear snapshot of your wealthtech startup’s key assets—such as buildings and equipment—alongside liabilities and equity at a specific date. Leveraging advanced financial modeling techniques and automated financial models, this critical digital investment tool demonstrates your business’s financial health. Banks especially focus on loan security within the assets section, making accurate financial forecasting models essential. Incorporating wealth management technology and financial data analytics into your pro forma enhances credibility, aligning with the latest wealthtech trends and ensuring effective wealth management automation.

WEALTHTECH WEALTH TECHNOLOGY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Discover the power of our cutting-edge wealthtech solution—an advanced financial modeling template designed for seamless valuation. Integrating automated financial models and financial forecasting techniques, this digital investment tool enables precise Discounted Cash Flow (DCF) analysis alongside residual value, replacement cost, and market comparables assessment. Ideal for wealth management technology professionals and wealthtech startups, it streamlines complex valuation processes, empowering smarter investment decisions through robust financial data analytics and financial risk modeling. Elevate your financial planning software toolkit with this comprehensive, easy-to-use platform that embodies the latest wealthtech trends and innovations.

Cap Table

Our Excel pro forma template features an advanced cap table model—an essential digital investment tool for startups. This wealth management technology solution clearly maps your company's ownership structure, detailing shares, options, and investor contributions. By integrating financial data analytics and automated financial models, it provides precise insights into each investor’s percentage ownership and investment pricing. Designed to align with cutting-edge wealthtech trends, this cap table model empowers founders with robust financial forecasting models and investment management software, streamlining equity management within modern financial services technology frameworks.

WEALTHTECH WEALTH TECHNOLOGY PRO FORMA TEMPLATE EXCEL ADVANTAGES

Enhance investor trust with wealthtech financial models, delivering accurate insights and transparent wealth management automation.

Automated financial models deliver precise, flexible 5-year projections, empowering smarter wealth management and strategic planning.

Advanced financial modeling techniques empower your brand with precise forecasting and strategic wealth management advantages.

Automated financial models enhance accuracy and efficiency, empowering smarter investment decisions within wealth management technology.

Automated financial models enhance wealth management by delivering precise predictions and optimizing investment strategies globally.

WEALTHTECH WEALTH TECHNOLOGY PROJECTED INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Automated financial models enhance accuracy and efficiency, transforming wealth management technology with predictive financial forecasting benefits.

Our automated financial model streamlines reporting by providing comprehensive, lender-ready reports and accurate calculations instantly.

Automated financial models optimize surplus cash management, boosting returns with precision and efficiency in wealthtech solutions.

Predictive financial modeling empowers managers to optimize surplus cash timing and maximize reinvestment opportunities with confidence.

Leverage predictive financial modeling to optimize investment strategies and secure confident, data-driven wealth management decisions.

Impress investors with automated financial models that drive accurate forecasting and optimize wealth management strategies seamlessly.

Automated financial models accelerate accurate forecasting, empowering smarter investment decisions and driving wealth management growth.

Predictive financial modeling empowers businesses to evaluate growth options and optimize cash flow for strategic success.

Automated financial models enable precise scenario analysis, enhancing predictive accuracy and optimizing investment decisions effortlessly.

Automated financial models enable dynamic cash flow forecasting by simulating variable impacts for smarter wealth management decisions.