AI Assisted Credit Score Improvement Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

AI Assisted Credit Score Improvement Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

AI Assisted Credit Score Improvement Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AI ASSISTED CREDIT SCORE IMPROVEMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly AI-driven credit score enhancement model designed for startups and existing businesses, featuring credit score optimization algorithms integrated within a profit and loss statement format, startup cash flow statement, and balance sheet with monthly and annual timelines. This AI-powered credit risk assessment tool leverages machine learning credit score prediction and predictive analytics for credit improvement, providing a comprehensive financial forecasting with AI and an automated credit score improvement system. Consider using this AI-based financial modeling tool and data-driven credit improvement model as part of your credit scoring AI integration strategy before investing in the AI-assisted credit score improvement financial model business. Fully unlocked for seamless editing and customization.

This AI-driven credit score enhancement model addresses key pain points by integrating machine learning credit score prediction and credit improvement predictive analytics to deliver precise financial forecasting with AI, simplifying complex data into actionable insights. Its automated credit score improvement system employs credit score optimization algorithms and AI-powered credit risk assessment to help users effectively manage and reduce financial risks without requiring technical expertise. The template’s AI credit bureau data analysis and credit risk management using AI capabilities provide a comprehensive, data-driven credit improvement model, supported by clear visualizations such as charts and graphs for easy interpretation. Additionally, the AI financial decision support system and predictive financial modeling AI components facilitate seamless financial planning and investor valuation, ensuring users can monitor and simulate credit score growth effortlessly through AI enhanced credit scoring techniques and AI credit score monitoring solutions. This ready-made Excel template thus transforms intricate credit scoring AI integration into an accessible, efficient tool for sustainable financial health and risk mitigation.

Description

Leveraging AI-driven credit score enhancement models and machine learning credit score prediction, this comprehensive financial model integrates advanced credit score optimization algorithms and predictive financial modeling AI to deliver robust financial forecasting with AI. It provides a detailed analysis of credit risk management using AI-powered credit risk assessment, incorporating credit improvement predictive analytics and AI credit bureau data analysis for precise credit scoring AI integration. Featuring an automated credit score improvement system and AI-enabled credit risk forecasting, this financial model supports dynamic decision-making through AI-based financial modeling tools, offering a financial model for credit score growth with data-driven credit improvement models and AI credit score monitoring solutions. By simulating credit score scenarios with AI-enhanced credit scoring techniques, the tool allows for thorough evaluation of operational and financial aspects, optimizing initial capital investment strategies and providing projections via profit and loss forecasts, cash flow models, and balance sheet templates, ensuring effective risk assessment and maximizing business outcomes.

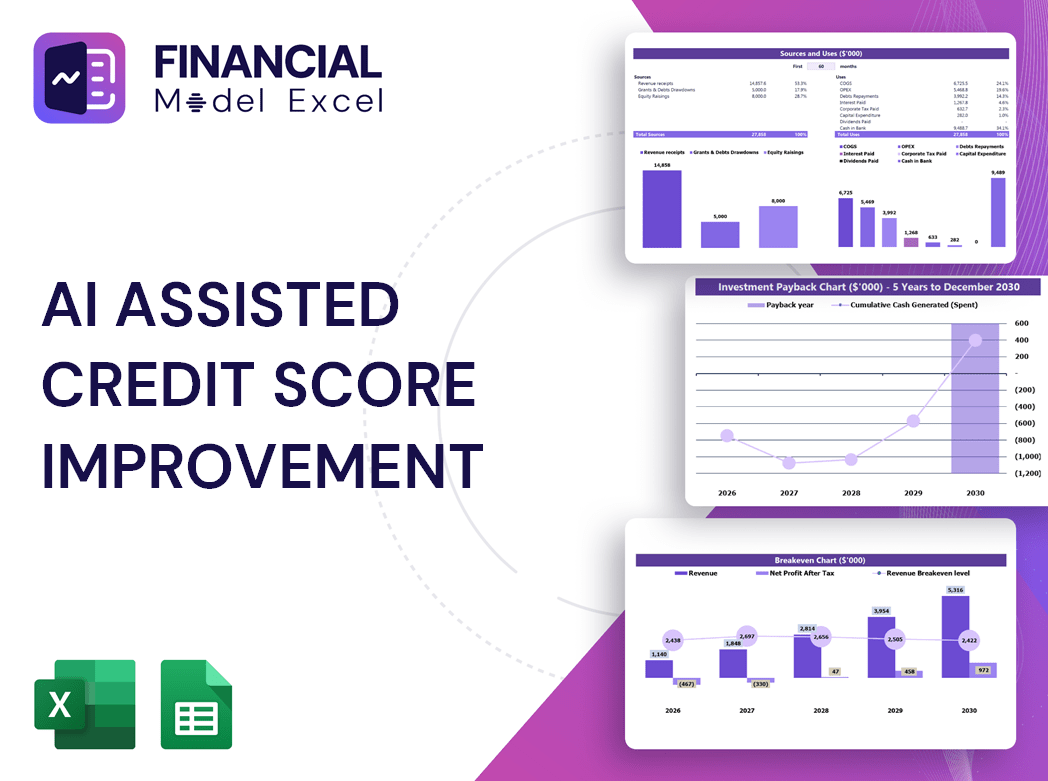

AI ASSISTED CREDIT SCORE IMPROVEMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This AI-driven credit score enhancement model offers an intuitive Excel template designed for seamless use. Featuring clearly defined financial assumptions consolidated on a single sheet, its advanced credit score optimization algorithms and predictive analytics automatically update across 15 interconnected sheets. Simply input your parameters in highlighted cells, and the AI-powered financial forecasting tool generates accurate, data-driven projections, including credit risk assessment and income forecasts. Elevate your credit improvement strategy with this cutting-edge AI credit scoring integration, delivering efficient, automated credit score simulation and optimization for smarter financial decision-making.

Dashboard

Access to an AI-driven credit score enhancement model integrated within an Excel dashboard empowers your business with real-time financial forecasting and credit risk assessment. Leveraging machine learning credit score prediction and credit score optimization algorithms, this automated credit score improvement system offers predictive analytics for credit improvement. Shareable insights from AI-powered credit risk management and data-driven credit improvement models enhance transparency and support informed decision-making among stakeholders, ensuring strategic growth through AI-enabled financial modeling tools and credit scoring AI integration.

Business Financial Statements

This AI-powered financial forecasting template offers seamless integration with QuickBooks, Xero, FreshBooks, and more. Featuring automated credit score improvement systems and advanced machine learning credit score prediction, it consolidates P&L statements, balance sheets, and cash flow forecasts into customizable monthly or annual views. Leverage AI-driven credit risk assessment and credit score optimization algorithms to enhance your financial decision-making. Ideal for startups, this data-driven credit improvement model combines predictive financial modeling AI and credit scoring AI integration, empowering accurate credit score simulation and AI-enabled credit risk forecasting—all within a user-friendly Excel environment.

Sources And Uses Statement

The Sources and Uses of Funds pro forma in this Excel template provides stakeholders with a clear, AI-enhanced financial model for credit score growth. Leveraging machine learning credit score prediction and credit score optimization algorithms, it transparently outlines where a company acquires funds and how those resources are allocated. This automated credit score improvement system integrates predictive financial modeling AI and credit risk management using AI, empowering informed decision-making and fostering financial forecasting with AI-driven insights for sustainable credit improvement and risk assessment.

Break Even Point In Sales Dollars

Incorporating AI-driven credit score enhancement models and predictive financial modeling AI, startups can optimize their financial forecasts with precision. Our 5-year cash flow projection integrates credit score optimization algorithms and AI-powered credit risk assessment to simulate profitability scenarios. The break-even analysis identifies the revenue threshold covering all costs, including taxes, signaling when investments begin generating profit. Leveraging AI credit bureau data analysis and automated credit score improvement systems, startups gain valuable insights for data-driven credit improvement and strategic decision-making, ensuring their business model is built for sustainable success.

Top Revenue

When developing a financial plan template, accurate revenue forecasting is paramount, as it drives key financial metrics and overall valuation. Leveraging AI-powered financial modeling tools—such as machine learning credit score prediction and credit improvement predictive analytics—enhances forecasting precision. Our model integrates data-driven credit improvement models with predictive financial modeling AI to provide robust revenue growth assumptions rooted in historical data. Users benefit from AI-enhanced credit scoring techniques and automated credit score improvement systems, delivering best-practice financial planning components essential for strategic decision-making and sustainable growth in startups and established firms alike.

Business Top Expenses Spreadsheet

The Top Expenses tab within our AI-driven credit score enhancement model offers a comprehensive view of your company’s annual expenditures. Leveraging predictive financial modeling AI, it categorizes costs into customer acquisition, COSS placeholders, wages & salaries, fixed and variable expenses, and more. This AI-powered financial forecasting tool enables precise credit risk management using AI, supporting strategic decision-making through data-driven credit improvement models and credit score optimization algorithms for sustainable financial growth.

AI ASSISTED CREDIT SCORE IMPROVEMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Leverage AI-powered financial forecasting with advanced credit score optimization algorithms to accurately predict and enhance your credit standing. Our machine learning credit score prediction and credit improvement predictive analytics enable dynamic cost management by providing clear insights into current and forecasted expenses. This data-driven credit improvement model supports strategic fund allocation, maximizing financial efficiency. Integrating AI enhanced credit scoring techniques with automated credit score improvement systems ensures reliable credit risk assessment and effective communication with investors and creditors. Elevate your financial planning with predictive financial modeling AI for optimized credit score growth and proactive risk management.

CAPEX Spending

Leverage AI-driven financial modeling tools in this business forecast template’s Top Revenue tab to prepare demand forecasts by product or service. Utilize predictive financial modeling AI and credit score simulation with AI to assess potential profitability and financial attractiveness across scenarios. Analyze revenue depth and revenue bridge alongside forecasted demand levels—such as weekdays versus weekends—to optimize resource scheduling, including manpower and inventory. This integrated approach, powered by credit improvement predictive analytics and automated credit score improvement systems, empowers data-driven decision-making and enhances overall credit risk management using AI.

Loan Financing Calculator

Leverage AI-driven credit score enhancement models and machine learning credit score prediction to optimize loan management. Our financial model template Excel features an automated credit score improvement system with credit score simulation and credit risk management using AI. The built-in amortization calculator details principal payments, periodic terms, and interest rates for precise loan tracking. Integrating AI-powered credit risk assessment and predictive analytics for credit improvement, this tool empowers companies to forecast liabilities, monitor credit growth, and strategize repayments effectively, ensuring data-driven financial decision support and credit scoring AI integration for robust financial planning.

AI ASSISTED CREDIT SCORE IMPROVEMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a key financial metric calculated using data from balance sheet forecasts and monthly profit and loss templates. It evaluates how effectively a company’s assets generate earnings, reflecting the efficiency of resource utilization. Leveraging AI-powered financial modeling tools and predictive financial modeling AI can further enhance ROA analysis through precise forecasting and optimization. Integrating AI-driven credit score optimization algorithms and credit risk management using AI enables more accurate financial decision support systems, driving improved asset performance and strategic growth.

Cash Flow Forecast Excel

Banks and stakeholders often request a startup pro forma template to verify your company’s capacity to repay loans. Integrating AI-driven credit score enhancement models and credit improvement predictive analytics into your financial forecasting with AI demonstrates robust cash flow management. Utilizing AI-powered credit risk assessment and credit score optimization algorithms ensures your pro forma reflects reliable, data-driven insights. This not only validates your financial stability but also showcases advanced credit scoring AI integration, offering confidence that your business can effectively manage cash and meet debt obligations.

KPI Benchmarks

This AI-powered financial modeling Excel template integrates advanced credit score optimization algorithms and machine learning credit score prediction to benchmark your company against industry peers. Leveraging data-driven credit improvement models and predictive financial modeling AI, it provides deep insights into operational and financial metrics. Quickly identify strengths and weaknesses with AI-enhanced credit scoring techniques and credit risk management using AI. Empower your financial forecasting with AI-driven credit risk assessment to optimize credit score growth and make informed decisions through our automated credit score improvement system and AI credit score monitoring solutions.

P&L Statement Excel

Our AI-driven credit score enhancement model features an advanced financial forecasting system, enabling users to generate precise, data-driven income statements effortlessly. Utilizing machine learning credit score prediction and credit score optimization algorithms, the model streamlines proforma income statement creation to assess key financial health indicators. This predictive financial modeling AI provides critical insights, translating projected profits and losses into actionable strategies for credit improvement. By integrating AI-powered credit risk assessment and credit scoring AI integration, the model supports robust financial decision-making, driving sustainable credit score growth through automated, AI-enhanced credit scoring techniques.

Pro Forma Balance Sheet Template Excel

Leverage our AI-driven financial modeling tools featuring machine learning credit score prediction and credit score optimization algorithms. Our projected 5-year balance sheet Excel template integrates seamlessly with AI-powered credit risk assessment and predictive financial modeling AI, delivering a comprehensive view of your organization’s assets, liabilities, and equity. This automated credit score improvement system supports data-driven credit improvement models and financial forecasting with AI, empowering precise credit risk management using AI and enhancing decision-making through AI-enabled financial decision support systems. Elevate your financial planning with credit scoring AI integration for dynamic, predictive insights.

AI ASSISTED CREDIT SCORE IMPROVEMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our AI-driven credit score enhancement model integrates advanced credit scoring AI techniques with robust financial forecasting. Featuring machine learning credit score prediction and credit score optimization algorithms, it utilizes discounted cash flow (DCF) and weighted average cost of capital (WACC) methods to deliver precise financial performance forecasts. This AI-powered credit risk assessment framework ensures data-driven credit improvement through predictive analytics, providing a comprehensive financial model for credit score growth. Ideal for business plans, it seamlessly combines AI-based financial modeling tools with automated credit score improvement systems for actionable insights and strategic decision support.

Cap Table

Our AI-driven credit score enhancement model empowers precise financial decision-making through advanced credit scoring AI integration and predictive analytics for credit improvement. Utilize machine learning credit score prediction and credit risk management using AI to evaluate market value and optimize investments confidently. Our comprehensive financial model for credit score growth includes proformas and automated credit score improvement systems, offering a robust AI-powered credit risk assessment platform. Access this data-driven credit improvement model now to elevate your financial forecasting with AI and unlock unparalleled insights for strategic investment and credit optimization.

AI ASSISTED CREDIT SCORE IMPROVEMENT BUSINESS PLAN FORECAST TEMPLATE ADVANTAGES

Our AI-driven credit score enhancement model delivers precise, data-driven improvements that optimize financial growth and credit reliability.

Take loans confidently with AI-driven credit score improvement and 5-year cash flow projection for precise financial planning.

AI-driven credit score enhancement models deliver precise, data-driven insights for optimized, faster financial growth and risk management.

Easily model AI-driven credit score improvement for accurate financial forecasting and optimized income statements and balance sheets.

Discover where AI-driven credit score optimization models precisely track your financial inflows and outflows for smarter decisions.

AI ASSISTED CREDIT SCORE IMPROVEMENT PROJECTED INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Our AI-driven credit score enhancement model delivers precise, data-driven insights for optimized financial decision-making and growth.

AI-powered financial modeling tools deliver accurate credit score optimization and dynamic cash flow forecasting for confident decision-making.

AI-driven credit score optimization algorithms enable proactive identification of cash shortfalls, enhancing financial stability and growth.

The AI-driven credit score enhancement model acts as an early warning system, optimizing financial forecasting and cash flow management.

Our AI-driven credit score enhancement model delivers precise, scalable financial forecasting for optimized credit growth and risk management.

Impress investors with an AI-driven credit score optimization model delivering strategic, data-driven financial forecasting and predictive analytics.

AI-driven credit score optimization algorithms deliver precise, data-driven growth predictions, maximizing investors’ financial returns confidently.

AI-driven credit score optimization algorithms empower startups with accurate, investor-ready financial models for confident decision-making.

Our AI-driven credit score enhancement model delivers precise, data-driven insights for optimized financial decision-making.

AI-driven 5-year credit score model delivers dynamic, accurate financial forecasts and actionable insights in GAAP or IFRS formats.