Airport Hotel Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Airport Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Airport Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AIRPORT HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly airport hotel financial projection model designed for startups or existing businesses, this comprehensive Excel template facilitates detailed profit and loss projections, cash flow forecasting, and balance sheet analysis on both monthly and annual timelines. Ideal for conducting an airport hotel financial feasibility study, it includes critical features such as an airport hotel revenue forecasting model, operating expense and cost structure models, as well as break-even and return on investment analysis tools. Before acquiring an airport hotel investment financial model, users can leverage this fully unlocked and editable airport hotel budgeting financial model to optimize capital expenditure planning, debt financing, and overall project finance management for maximum profitability and growth.

This ready-made airport hotel financial projection model in Excel expertly addresses common pain points by providing a fully-integrated solution that automates complex calculations across income statements, cash flow financial models, and balance sheet financial models, enabling seamless five-year revenue forecasting and budgeting. It eliminates manual data entry errors through dynamic linking within the airport hotel financial analysis template while incorporating airport hotel operating expense models, capital expenditure models, and debt financing models to capture every facet of the investment lifecycle. The built-in airport hotel break-even analysis model, return on investment model, and sensitivity analysis model empower users to evaluate profitability, occupancy rate impacts, and financial feasibility with precision, while the comprehensive project finance model and valuation model offer valuable insights for funding decisions and strategic planning. This all-in-one dashboard consolidates annual summaries into an intuitive financial summary report, dramatically reducing time spent on financial consolidation and enhancing decision-making confidence for investors and operators alike.

Description

This comprehensive airport hotel financial projection model is designed to facilitate precise revenue forecasting, expense budgeting, and cash flow analysis over a 60-month horizon, integrating all critical components including an income statement model, balance sheet financial model, and cash flow financial model. Tailored for both startups and established ventures, this airport hotel investment financial model incorporates break-even analysis, operating expense modeling, capital expenditure planning, and debt financing considerations to support robust financial feasibility studies and profitability modeling. Featuring intuitive sensitivity analysis tools and valuation capabilities, the model offers a user-friendly template that requires no advanced technical expertise, enabling stakeholders to conduct thorough financial analysis, optimize occupancy rate projections, evaluate return on investment, and make informed decisions backed by detailed project finance modeling and cost structure insights.

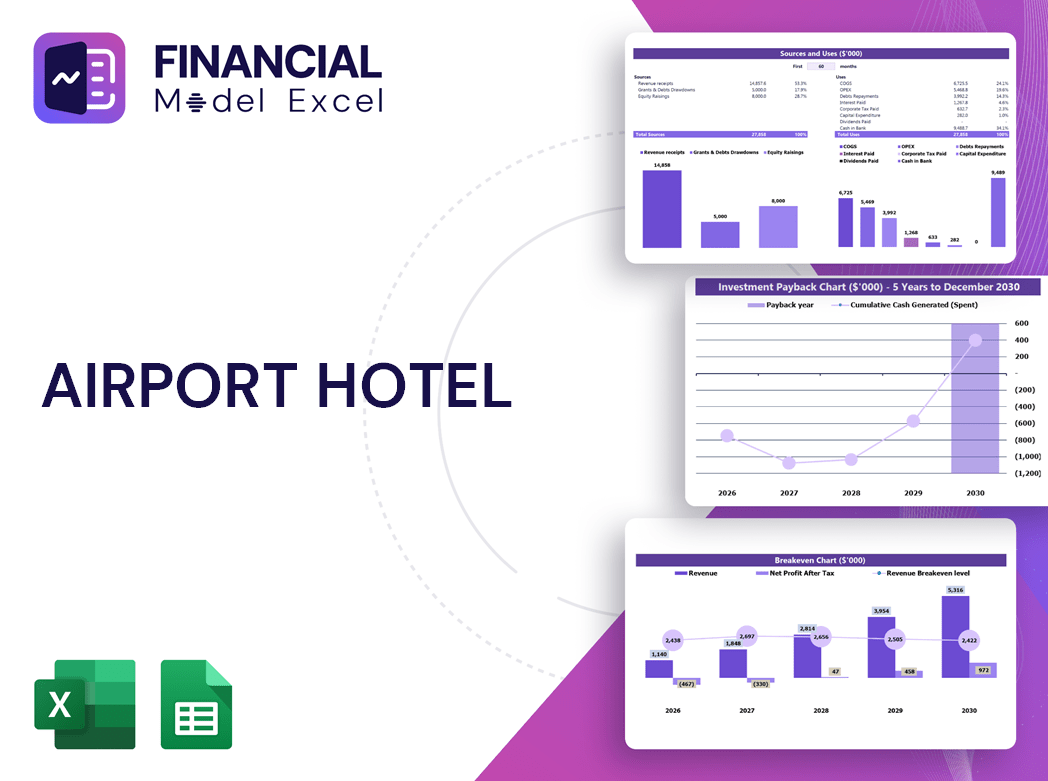

AIRPORT HOTEL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Every airport hotel investment demands a comprehensive financial projection model tailored to its unique dynamics. Our airport hotel financial feasibility study Excel template strikes the perfect balance between detailed analysis and flexible customization. Featuring a dynamic 3-statement financial model, it empowers users to build multiple scenarios, refine revenue forecasting, and optimize cash flow projections effortlessly. This expandable tool ensures precise budgeting, operating expense management, and profitability assessment, making it an indispensable asset for sound decision-making and maximizing return on investment. Elevate your airport hotel financial planning with a model designed for clarity, adaptability, and strategic insight.

Dashboard

The airport hotel financial projection model features a dynamic dashboard that streamlines financial analysis and reporting. This versatile tool accelerates accurate insights into key metrics such as occupancy rates, revenue forecasts, and operating expenses, essential for strategic decision-making. By integrating data across income statements, cash flow models, and capital expenditure plans, it ensures transparent, reliable financial feasibility studies. Optimizing budgeting and profitability, the model supports effective project finance and debt financing strategies, fostering stakeholder confidence through comprehensive, honest financial reporting. This empowers airport hotel investors and managers to drive sustainable growth and maximize return on investment.

Business Financial Statements

An airport hotel financial projection model integrates three key reports for comprehensive analysis: the income statement model tracks revenues, expenses, depreciation, taxes, and interest; the balance sheet financial model offers a real-time snapshot of assets, liabilities, and equity; while the cash flow financial model details cash inflows and outflows from operations, investments, and financing. Together, these components ensure accurate airport hotel revenue forecasting and cash flow management, essential for robust profitability modeling, budgeting, and investment decision-making. This holistic approach underpins airport hotel financial feasibility studies and capital expenditure planning with precision and clarity.

Sources And Uses Statement

The airport hotel financial projection model provides a comprehensive overview of capital sources and allocation, revealing income streams and expense distribution. This clarity is essential for accurate revenue forecasting, budgeting, and profitability analysis. Leveraging this financial analysis template ensures informed decision-making, optimized cost structures, and robust cash flow management. A deep understanding of these financial dynamics empowers airport hotel operators to enhance operational efficiency, drive sustainable growth, and maximize return on investment.

Break Even Point In Sales Dollars

Our airport hotel break-even analysis model empowers investors to pinpoint the exact revenue needed to cover fixed and variable costs, marking when profitability begins. This dynamic financial tool offers both graphical insights and precise calculations, enabling users to simulate various pricing and volume scenarios. By adjusting room rates and occupancy projections, the model delivers actionable forecasts, ensuring informed decisions on revenue targets and investment viability. Perfectly integrated within our comprehensive airport hotel financial projection and revenue forecasting models, it supports robust financial feasibility studies and maximizes return on investment.

Top Revenue

The Top Revenue tab in the airport hotel financial projection model offers a clear, detailed overview of your company’s revenue streams, segmented by service or product. This airport hotel revenue forecasting model delivers an annual breakdown of total revenue, supporting precise revenue bridges. Designed as part of a comprehensive airport hotel financial analysis template, it empowers investors and management to make informed decisions, optimize profitability, and drive sustainable growth.

Business Top Expenses Spreadsheet

In the Top Expenses section of our five-year airport hotel financial projection model, key cost categories are clearly outlined across four main points. The ‘Other’ category offers flexibility to include any additional critical expenses unique to your operation. Utilize our pro forma financial statements template in Excel to meticulously track and analyze your airport hotel’s financial performance over five years, ensuring effective budgeting, cash flow management, and strategic decision-making. This comprehensive airport hotel financial analysis template empowers investors and managers to optimize profitability and forecast growth with precision.

AIRPORT HOTEL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our airport hotel financial projection model empowers precise cost structure management and expense monitoring, ensuring proactive issue resolution and agile decision-making. This comprehensive 3-way financial model integrates income statement, cash flow, and balance sheet projections, essential for effective budgeting and profitability analysis. Perfect for aligning with your business plan or impressing investors, it supports detailed revenue forecasting, break-even analysis, and capital expenditure planning. Leverage this airport hotel financial analysis template to confidently navigate investment decisions and optimize your airport hotel’s financial performance.

CAPEX Spending

Initial startup costs are vital for strengthening an airport hotel’s financial position. Captured within the airport hotel capital expenditure model, these investments ensure strategic allocation of funds to cover essential needs. By channeling CAPEX into innovative business management practices and cutting-edge technology, airport hotel financial projection models enhance operational efficiency and long-term profitability. This disciplined approach supports robust airport hotel revenue forecasting and cash flow financial models, driving sustainable growth and maximizing return on investment.

Loan Financing Calculator

Accurately calculating loan or mortgage payments is critical for airport hotel start-ups to ensure financial stability. Our comprehensive airport hotel debt financing model includes a detailed loan amortization schedule and an intuitive amortization calculator, simplifying this complex task. This tool empowers investors and managers to forecast cash flows, plan capital expenditures, and manage debt obligations effectively—providing clarity and precision in your airport hotel financial projection model. Streamline your financial planning and confidently navigate your investment’s path to profitability with our expertly designed template.

AIRPORT HOTEL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Capital (ROC) evaluates an airport hotel’s efficiency in generating earnings from its combined equity and debt. This key metric is derived using data from the airport hotel investment financial model, specifically the pro forma balance sheet and income statement models. By integrating insights from the airport hotel profitability model and cash flow financial model, ROC offers a comprehensive view of capital effectiveness, empowering stakeholders to optimize financial performance and guide informed investment decisions.

Cash Flow Forecast Excel

The airport hotel cash flow financial model is essential for precise cash flow planning and forecasting in your investment. This comprehensive tool tracks inflows and outflows, enabling effective financial management and strategic decision-making. Leveraging the airport hotel revenue forecasting model and operating expense model allows you to optimize capital turnover and boost profitability. Ideal for investors and operators alike, employing these financial analysis templates ensures your airport hotel project’s financial feasibility and maximizes return on investment. Streamline your budgeting, enhance cash management, and elevate your airport hotel’s financial performance with an integrated financial projection model.

KPI Benchmarks

The Benchmark tab in our airport hotel financial analysis template enables precise comparative analysis of operating performance against industry peers. By leveraging this tool within your airport hotel revenue forecasting model, you can identify performance gaps, optimize your cost structure, and enhance profitability. Benchmarking empowers informed decision-making in your airport hotel financial feasibility study, driving improved occupancy rates and cash flow management. For startups and established investors alike, this essential analysis guides strategies to elevate financial success, ensuring your airport hotel investment financial model reflects real-world competitiveness and growth potential.

P&L Statement Excel

To ensure profitability in your airport hotel business, leveraging a comprehensive airport hotel financial projection model is essential. This dynamic profit and loss projection template accurately forecasts revenues and expenses, providing invaluable insights into future profitability. Utilizing a robust airport hotel income statement model combined with a 3-statement financial framework delivers detailed annual reports, capturing net profit and after-tax balance with precision. This approach empowers startups and investors alike to make informed decisions, optimize budgeting, and enhance financial feasibility for sustained growth and success.

Pro Forma Balance Sheet Template Excel

The airport hotel balance sheet financial model provides a clear snapshot of your assets, liabilities, and equity over a set period. This projected statement of financial position is essential for evaluating your hotel’s financial health and guiding strategic decisions. Utilize our pro forma balance sheet template within your airport hotel financial projection model to gain insightful analysis, optimize capital structure, and enhance your airport hotel investment financial model’s accuracy and reliability. Stay ahead by forecasting financial stability and strengthening your airport hotel profitability model with this vital financial tool.

AIRPORT HOTEL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive airport hotel valuation model to provide investors with critical insights, including weighted average cost of capital (WACC) to demonstrate minimum required returns on capital investments. Our airport hotel financial projection model integrates free cash flow analysis, highlighting available cash resources, while discounted cash flow valuation captures the present value of future cash streams. This robust airport hotel investment financial model ensures transparent, data-driven financial feasibility studies, empowering stakeholders with essential metrics for sound decision-making and maximizing return on investment.

Cap Table

Our equity cap table serves as a dynamic instrument for precise allocation of financial assets across periods, enhancing transparency and strategic planning. Integral to the airport hotel financial projection model, it offers investors clear insights into potential returns, aligning with comprehensive airport hotel investment financial models. This tool supports robust airport hotel cash flow financial modeling and profitability analysis, empowering stakeholders to make informed decisions based on accurate equity distribution and anticipated profits.

AIRPORT HOTEL FINANCIAL MODEL ADVANTAGES

Our airport hotel financial projection model empowers precise revenue forecasting and maximizes investment profitability confidently.

The airport hotel financial projection model ensures precise break-even analysis and maximizes your five-year return on investment.

Plan ahead confidently and optimize cash flow with the comprehensive airport hotel cash flow financial model.

Raise capital confidently using the airport hotel financial projection model with accurate income statement templates in Excel.

Maximize returns confidently using the airport hotel financial projection model for precise, data-driven investment decisions.

AIRPORT HOTEL BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Our airport hotel financial projection model empowers startups to optimize revenue and ensure profitable long-term growth confidently.

The airport hotel financial projection model delivers clear, concise summaries perfect for compelling pitch decks and investor confidence.

The airport hotel financial projection model ensures confident loan repayment through accurate revenue and cash flow forecasting.

Using an airport hotel cash flow financial model boosts lender confidence by clearly demonstrating your loan repayment plan.

Optimize airport hotel budgets effectively with our financial model, ensuring precise spending control and maximum profitability.

The airport hotel cash flow financial model enables precise future planning by forecasting inflows and outflows against budgets effortlessly.

Our airport hotel financial projection model delivers accurate key metrics analysis for informed, strategic investment decisions.

Generate accurate 5-year airport hotel financial projections instantly with customizable GAAP or IFRS-compliant templates and ratios.

Unlock strategic growth with the airport hotel investment financial model, optimizing profitability and maximizing return on investment.

The airport hotel cash flow financial model reveals optimal growth options and funding impacts for informed, strategic business decisions.