Boutique Fitness Studio Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Boutique Fitness Studio Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Boutique Fitness Studio Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive boutique fitness studio financial model is essential for startups and established companies aiming to secure funding from investors or bankers, as it enables accurate boutique fitness studio revenue projections, cash flow modeling, and fitness studio budgeting strategies. This financial planning tool supports financial forecasting for fitness businesses, allowing for detailed profit and loss analysis, expense management, and the development of a fitness studio cost structure model. By incorporating financial scenario modeling and boutique gym break-even analysis, businesses can evaluate boutique gym financial performance indicators effectively, optimize boutique fitness membership revenue models, and enhance overall boutique fitness startup financials to inform strategic decisions and funding strategies.

This ready-made financial model template addresses the common pain points faced by boutique fitness studio owners by streamlining complex financial planning through intuitive fitness studio budgeting strategies and a comprehensive fitness studio cash flow model, enabling accurate boutique fitness membership revenue modeling and thorough profit and loss analysis for fitness studios. It simplifies boutique gym expense management and offers detailed financial forecasting for fitness business growth, while incorporating vital financial metrics for boutique gyms and clear boutique gym break-even analysis to guide investment decisions. The model supports financial scenario modeling for fitness studios, allowing users to anticipate challenges and optimize their boutique fitness center profit analysis without needing advanced financial expertise, ultimately serving as a robust fitness studio investment model and boutique fitness startup financials toolkit that enhances financial planning for health clubs and helps craft effective boutique fitness studio funding strategies.

Description

Our boutique fitness studio financial model provides comprehensive financial forecasting for fitness business operations, integrating boutique gym financial planning with detailed fitness studio budgeting strategies to optimize revenue projections and expense management. This expertly designed financial model for fitness studios includes a robust fitness studio cash flow model, profit and loss for fitness studios, and break-even analysis, all supported by a 5-year boutique fitness center profit analysis and membership revenue model. It features key financial metrics for boutique gyms, financial performance indicators, and scenario modeling that streamline boutique gym expense management and investment decisions, ensuring accurate financial planning for health clubs and a clear boutique fitness startup financials overview. The dynamic and easy-to-use financial model automatically updates with input changes, helping studios maintain precise boutique gym funding strategy forecasts and reliable fitness business financial statements without requiring advanced financial expertise.

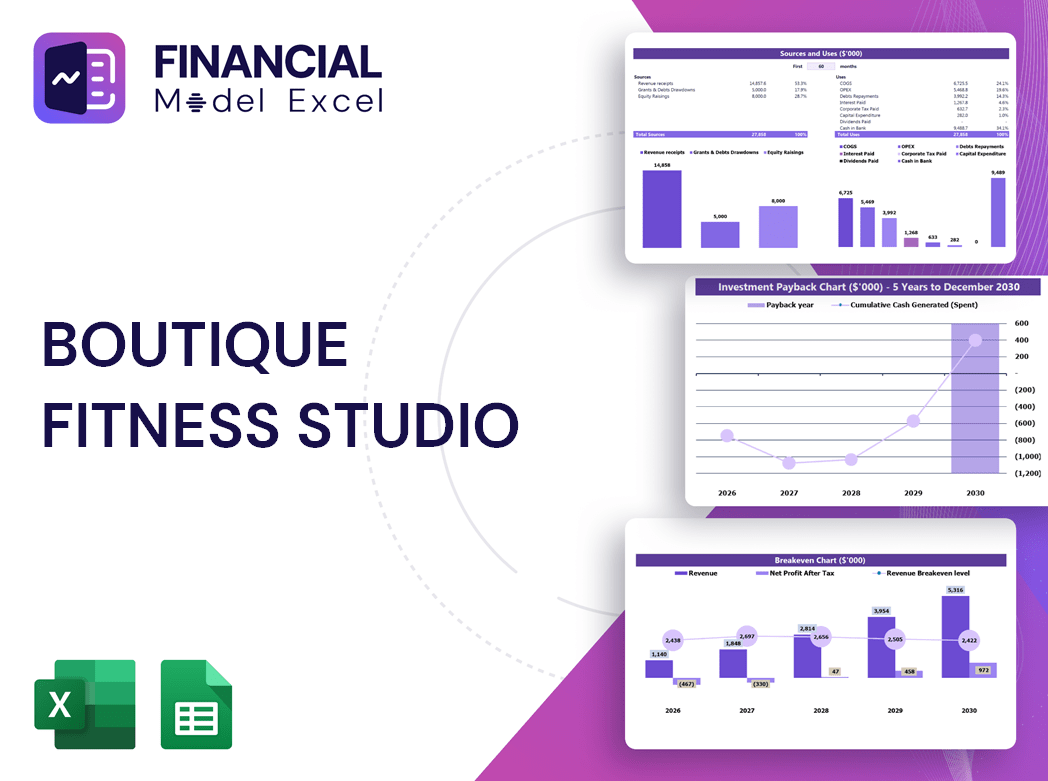

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This boutique fitness studio financial model offers entrepreneurs a comprehensive startup financial plan, providing clear insights into the business’s key components and their interconnections. Designed for precise financial forecasting, it enables effective fitness studio cash flow modeling and accurate cash burn rate analysis. These critical financial metrics help determine funding milestones and project how long capital will sustain operations. Ideal for boutique gym financial planning and budgeting strategies, this model supports informed decision-making, ensuring strategic growth and sustainable financial performance for your fitness business.

Dashboard

The Dashboard tab in our boutique fitness studio financial model delivers a comprehensive snapshot through dynamic graphs, charts, key financial metrics, and summary tables. Designed for seamless integration into your pitch deck, it streamlines boutique gym financial planning and enhances your fitness studio budgeting strategies. This tool supports precise financial forecasting for fitness businesses, empowering you to analyze profit and loss for fitness studios, optimize cash flow models, and confidently present boutique fitness center profit analysis. Elevate your fitness startup financials with clear, actionable insights tailored for effective boutique gym expense management and investment decisions.

Business Financial Statements

A comprehensive boutique fitness studio financial model includes a monthly profit and loss template, detailed financial statements, and a 5-year projected balance sheet. The P&L statement offers deep insights into revenue-generating operations, essential for accurate revenue projections and profit analysis. Meanwhile, the projected balance sheet and cash flow model focus on asset management and funding strategies, enabling effective expense management and capital allocation. Together, these tools form the foundation for boutique gym financial planning, empowering informed decision-making through robust budgeting strategies and financial forecasting for sustained growth.

Sources And Uses Statement

The “Sources and Uses of Cash” tab details the funding origins alongside planned expenditures within the boutique fitness studio financial model. This clear breakdown supports robust financial forecasting for fitness businesses, aiding in budgeting strategies and investment decisions. By outlining cash inflows and outflows, it enhances boutique gym expense management and improves the accuracy of profit and loss projections. This vital component empowers boutique fitness center profit analysis and strengthens boutique gym financial planning, ensuring a comprehensive view of financial metrics and supporting sound boutique fitness startup financials and funding strategies.

Break Even Point In Sales Dollars

A boutique gym break-even analysis is a crucial financial model that identifies the sales volume needed to cover both fixed and variable costs. This key metric enables fitness studio owners to evaluate the viability of their business and informs pricing strategies to ensure profitability. By integrating this into boutique fitness studio revenue projections and cash flow models, owners can make informed decisions on budgeting and expense management. Ultimately, this financial planning tool supports sustainable growth and effective financial forecasting for fitness businesses.

Top Revenue

In boutique fitness studio financial planning, understanding key metrics like the top line and bottom line is crucial. The top line represents total revenue, reflecting the success of your membership revenue model and overall sales growth. Bottom line, or net income, reveals true profitability after managing expenses through effective boutique gym expense management. Accurate financial forecasting for fitness businesses, including profit and loss for fitness studios and cash flow models, enables informed decision-making. Leveraging these insights supports robust boutique gym financial performance indicators, guiding revenue projections and investment models to drive sustainable growth and maximize profit in your boutique fitness center.

Business Top Expenses Spreadsheet

Accurate revenue projections are critical in boutique fitness studio financial planning, as they directly impact profit and loss statements and overall business valuation. Developing a detailed financial model for fitness studios, including scenario modeling and budgeting strategies, ensures reliable forecasting of membership revenue and cash flow. Utilizing proforma templates with growth rate assumptions based on historical data enhances financial forecasting for fitness businesses. Effective expense management and break-even analysis further optimize boutique gym financial performance indicators, supporting sustainable revenue growth and sound investment decisions within fitness studio startup financials and long-term financial planning.

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive boutique fitness studio financial model is essential for effective revenue projections and expense management. This tool streamlines budgeting strategies and cash flow modeling, enabling targeted financial forecasting for fitness businesses. Accurately outlining startup financials and cost structures helps identify weaknesses and informs actionable plans to boost profitability. Clear, detailed financial statements and profit and loss analyses are crucial when engaging investors or securing funding. Utilizing financial metrics and scenario modeling ensures a robust boutique gym investment model that supports sustainable growth and strategic decision-making.

CAPEX Spending

A comprehensive boutique fitness studio revenue projection begins with strategic capital expenditure planning. Utilizing straight-line or double-declining depreciation methods within your financial model for fitness studios enhances accuracy in boutique fitness startup financials. This approach ensures precise tracking and control of capital investments, ultimately improving your fitness studio cash flow model. Effective budgeting strategies rooted in well-defined capex planning empower boutique gyms to optimize expense management and strengthen financial forecasting for fitness business success.

Loan Financing Calculator

For boutique fitness studios, rigorous financial planning demands precise loan payback schedules detailing amounts, maturity, and terms. Integrating these schedules into cash flow models enhances accuracy in financial forecasting for fitness businesses. Interest expenses on debt influence cash flow projections, while principal repayments are reflected within financing activities. This comprehensive approach supports boutique gym financial performance indicators and improves budgeting strategies, ensuring clear insight into projected balance sheets and profit and loss statements. Effective debt management is essential for boutique gym expense management and strengthens overall boutique fitness startup financials and funding strategies.

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In a boutique fitness studio revenue projections and financial model, key performance indicators (KPIs) are essential for owners and investors alike. These financial metrics provide clear insights into your fitness studio’s cash flow model, cost structure, and overall profitability. By leveraging KPIs, you can effectively analyze your boutique gym’s financial performance indicators, supporting sound budgeting strategies and accurate financial forecasting. Staying focused on these metrics ensures your boutique fitness center profit analysis drives informed decisions, aligning your financial planning for health clubs with your growth goals and investment strategies.

Cash Flow Forecast Excel

A well-crafted fitness studio cash flow model is essential for accurate financial forecasting for fitness businesses. It ensures you can manage boutique gym expense management effectively and meet critical obligations like payroll and operating costs. Integrating this into your boutique fitness startup financials provides clarity on profit and loss for fitness studios, supporting sound boutique gym financial planning and investment decisions. Leveraging a comprehensive financial model for fitness studios enables strategic budgeting, strengthens financial performance indicators, and drives sustainable revenue growth for your boutique fitness center.

KPI Benchmarks

Accurate recording and monitoring of financial metrics in a boutique fitness studio financial model is essential for effective benchmarking. By tabulating key indicators, such as revenue projections and expense management, the model identifies average values, enabling comparative analysis. This insight empowers fitness studios—especially startups—to optimize budgeting strategies, refine profit and loss forecasts, and develop robust growth plans. Leveraging financial forecasting and scenario modeling ensures informed decision-making, driving sustainable revenue growth and strong financial performance. Investing time in this financial planning approach is vital for boutique gyms aiming to maximize profitability and scale successfully.

P&L Statement Excel

The profit and loss statement is essential in boutique fitness studio financial planning, enabling you to accurately model revenues and expenses as they arise. Unlike cash flow models that track actual cash movement, this financial forecasting tool captures non-cash items like depreciation, spreading costs over multiple years. Incorporating this into your boutique gym financial model enhances profitability analysis and budgeting strategies, ensuring a comprehensive view of your fitness studio’s financial performance. This approach supports informed decision-making and effective expense management for sustainable growth.

Pro Forma Balance Sheet Template Excel

Our projected balance sheet template in Excel is an essential tool for boutique fitness studio financial planning. It details current and long-term assets, liabilities, and equity—key components for accurate financial forecasting and profit analysis. This foundational document supports fitness studio budgeting strategies, cash flow modeling, and break-even analysis, enabling informed decisions on boutique gym expense management and funding strategies. By integrating this balance sheet into your fitness business financial statements, you gain critical insights into financial performance indicators and cost structure models, ensuring a robust financial model for your boutique fitness startup’s success.

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive boutique fitness studio financial model offers detailed startup financial projections, empowering you with accurate profit and loss statements, cash flow models, and expense management insights. Featuring discounted cash flow and free cash flow valuation, it highlights the true value of your fitness business to investors and lenders. Incorporating weighted average cost of capital (WACC), this financial forecasting tool ensures clear communication of minimum required returns, supporting effective boutique gym financial planning and funding strategies. Ideal for boutique fitness membership revenue modeling and financial scenario analysis, it’s your essential resource for confident investment and budgeting decisions.

Cap Table

An equity cap table is essential for boutique fitness studio financial planning, providing a clear breakdown of ownership stakes and investor shares. This tool offers a unified, comprehensive view of the studio’s capital structure, enabling precise financial forecasting for fitness businesses. Understanding each financial component through the cap table supports effective boutique gym financial performance analysis, investment modeling, and budgeting strategies. Leveraging this insight enhances fitness studio cash flow models and profit and loss management, driving informed decisions and maximizing revenue potential in the competitive boutique fitness market.

BOUTIQUE FITNESS STUDIO FINANCIAL PLAN FOR BUSINESS PLAN ADVANTAGES

A boutique fitness studio financial model accurately forecasts cash inflows and outflows, optimizing revenue and expense management.

A robust financial model empowers boutique fitness studios to anticipate challenges and optimize revenue for sustainable growth.

Build a boutique fitness studio financial model to secure funding with accurate revenue projections and expert feasibility analysis.

Our financial model empowers boutique gyms to optimize revenue and identify growth opportunities with precision and clarity.

Optimize capital demand confidently using a boutique fitness studio financial model with precise profit and loss projections.

BOUTIQUE FITNESS STUDIO FINANCIAL MODEL EXCEL TEMPLATE ADVANTAGES

Integrated financial models empower boutique fitness studios to attract investors through precise revenue and profit forecasting.

Our financial model integrates assumptions, calculations, and outputs into a clear, investor-ready format boosting funding success.

Our simple-to-use financial model enhances boutique fitness studio revenue projections and boosts strategic financial planning efficiency.

Our boutique fitness studio financial model delivers quick, reliable insights with minimal Excel skills for all business stages.

Optimize boutique gym revenue with precise financial forecasting and compelling profit analysis to attract savvy investors.

Secure investor meetings effortlessly with our Boutique Fitness Studio Financial Model, driving confident and strategic funding decisions.

Optimize boutique fitness studio revenue projections with a financial model designed to plan for future growth effectively.

A boutique fitness studio cash flow model empowers precise financial planning to drive sustainable growth and targeted profit goals.

Our financial model for fitness studios identifies customer payment issues, enhancing revenue accuracy and cash flow management.

A financial model empowers timely identification of unpaid invoices, optimizing cash flow and enhancing boutique gym profitability.