Business Broker Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Business Broker Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Business Broker Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUSINESS BROKER FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly business broker financial planning model template designed for comprehensive financial forecasting, including profit and loss projections, cash flow budgeting, and balance sheet analysis on a monthly and annual timeline. This financial modeling template for brokers works seamlessly for startups or established business broker operations, enabling detailed business valuation and financial due diligence. It supports business acquisition financial modeling and financial scenario analysis for brokers, helping to evaluate startup ideas, plan acquisition costs, and perform transaction financial modeling with fully unlocked and editable components.

The business broker financial modeling template addresses common pain points by offering a comprehensive financial planning model that streamlines business valuation and acquisition processes, enabling brokers to perform detailed financial due diligence with ease. Its built-in business broker cash flow model and expense forecasting tools simplify profit analysis and budgeting, while dynamic financial projections for business sales help forecast revenue and operating expenses accurately over a 5-year horizon. Designed for users with minimal financial expertise, this ready-made Excel model incorporates intuitive dashboards, scenario analysis capabilities, and transaction financial modeling to enhance decision-making, deal structuring, and investment assessment, ultimately reducing complexity and increasing the accuracy and reliability of your financial metrics and statements.

Description

The business broker financial model offers a comprehensive financial planning and forecasting framework tailored for business brokers, encompassing detailed financial projections for business sales through its integrated business broker cash flow model, profit analysis model, and expense forecasting tools. This financial modeling template for brokers features a robust financial forecast for business brokers, including a complete set of projected three financial statements—profit and loss, balance sheet, and cash flow forecast—while enabling critical financial due diligence model capabilities such as financial statement analysis for brokers and financial metrics for business brokers. By incorporating business acquisition financial model elements and business broker investment model features, it facilitates scenario analysis and deal structuring, ensuring precise budgeting and effective capital allocation, thus empowering brokers to evaluate initial capital requirements, free cash flows, and breakeven sales with clarity and confidence to optimize transaction financial models and business valuation financial models within a dynamic, decision-support environment.

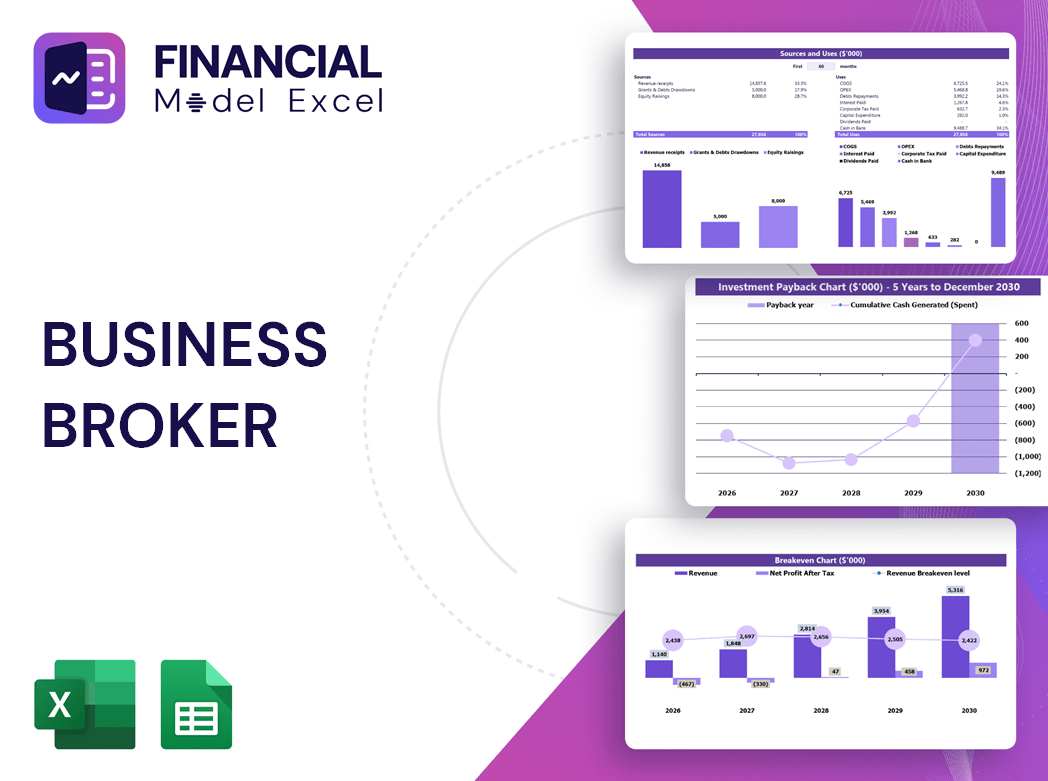

BUSINESS BROKER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive business broker financial modeling template is essential for startups seeking investment. Utilizing financial modeling for business brokers ensures accurate business valuation, cash flow projections, and profit analysis, providing investors with clear insight into potential returns. Robust financial forecasts and scenario analysis validate funding needs and expected ROI, demonstrating financial due diligence and professionalism. Investors demand detailed financial projections for business sale readiness—without them, startups risk losing credibility. Harnessing tailored financial models empowers brokers to structure deals confidently and secure successful business acquisitions with transparent, data-driven planning.

Dashboard

Our business broker financial modeling template features an intuitive, all-in-one dashboard designed for speedy, accurate financial planning and analysis. Tailored for brokers, it streamlines business valuation, cash flow modeling, expense forecasting, and profit analysis—empowering users to perform financial due diligence and scenario analysis effortlessly. Access comprehensive financial projections, transaction models, and key metrics at a glance, enabling smarter deal structuring and acquisition planning. This robust financial model accelerates decision-making, delivering transparent, actionable insights that drive business sales and acquisitions with confidence.

Business Financial Statements

Understanding the three core financial statements is essential for business brokers and stakeholders to assess a company’s health. Utilizing a business broker financial modeling template—such as a profit analysis model or cash flow model—delivers key financial metrics that illuminate operational performance and earnings generation. Meanwhile, financial projections for business sales and pro forma balance sheets emphasize capital management, asset structure, and liquidity. Integrating these models within financial due diligence and business acquisition financial planning ensures accurate forecasting, strategic deal structuring, and robust financial scenario analysis for successful transactions and sustained growth.

Sources And Uses Statement

This financial forecast for business brokers includes a detailed sources and uses of funds statement, providing a clear summary of funding origins supporting business activities. Designed as part of a comprehensive business broker financial planning model, this template enhances financial due diligence and investment analysis, empowering brokers to optimize cash flow, revenue, and profit through precise business valuation financial modeling. Ideal for deal structuring and transaction planning, it streamlines financial projections for business sales with a professional, insightful approach.

Break Even Point In Sales Dollars

The break-even analysis tab in this financial modeling template for business brokers provides a clear visualization of when your business acquisition or sale will start generating profit. This essential financial forecast for business brokers highlights the precise point where revenues surpass expenses, enabling informed decision-making. Utilizing this break-even Excel model enhances your financial planning and business valuation, ensuring accurate cash flow modeling and comprehensive profit analysis for successful deal structuring and transaction management.

Top Revenue

In business broker financial modeling, two critical metrics in the profit and loss forecast are the top line and bottom line. The business broker revenue model highlights sales growth, while the business broker profit analysis model focuses on net profit—both essential for investors and analysts. Consistent top-line growth signals increasing sales, directly influencing the business broker cash flow model and overall financial projections for business sale. Accurate financial forecasting for business brokers ensures informed decision-making and effective deal structuring, driving successful acquisitions and maximizing value in every transaction.

Business Top Expenses Spreadsheet

Achieving financial success requires precise expense tracking and control. Our 5-year financial forecast for business brokers includes a detailed expense forecasting model, categorizing costs into four key groups plus an ‘other’ category for additional inputs. Accurately estimating expenses is crucial for maintaining company health and identifying operational trends. Annual expense analysis within our business broker budgeting model provides valuable insights into efficiency, empowering brokers to optimize performance and make informed decisions for sustainable growth. Leverage our financial modeling template for brokers to drive effective cost management and enhance profitability.

BUSINESS BROKER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our business broker expense forecasting model offers a comprehensive financial planning tool, enabling precise cost budgeting and forecasting for up to 60 months. Utilizing pre-built expense forecasting curves, users can easily model expenses as a percentage of revenue, fixed or variable costs, recurring or fluctuating expenses, and CAPEX. The model automatically manages accounting treatments such as COGS, wages, and operational expenses, ensuring accuracy in financial projections for business sale and acquisition. Designed for business brokers, this financial modeling template simplifies expense allocation and supports informed decision-making through detailed financial due diligence and profit analysis.

CAPEX Spending

Our business broker financial planning model includes a dedicated CapEx calculation tab, enabling precise forecasting of capital expenditures related to property, plant, and equipment. This feature supports detailed financial projections for business sales and acquisitions by illustrating long-term investment impacts. Understanding CapEx alongside depreciation and financial statement analysis is crucial for accurate business valuation and effective cash flow modeling. Equip yourself with our financial modeling template for brokers to enhance expense forecasting, transaction financial modeling, and strategic decision-making in business acquisitions and growth planning.

Loan Financing Calculator

In financial modeling for business brokers, loan amortization plays a critical role in accurate financial projections for business sales. It involves systematically spreading loan repayments over multiple reporting periods through fixed payments—often monthly but sometimes quarterly or annually. Integrating a robust loan amortization schedule within a business acquisition financial model or business broker cash flow model ensures precise expense forecasting and supports comprehensive financial due diligence. This approach enhances financial planning for acquisitions and deal structuring, providing clear visibility into cash flow impacts and strengthening overall business valuation accuracy.

BUSINESS BROKER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our financial modeling template for business brokers automatically calculates the internal rate of return (IRR), a key metric in business valuation and financial forecasting. IRR represents the discount rate that equates the net present value of cash flows from business acquisitions, expenses, and investments to zero. This vital financial metric enables brokers and investors to assess the profitability and long-term return potential of business deals with precision. Leveraging this model enhances your financial due diligence and supports informed decision-making in business broker transactions.

Cash Flow Forecast Excel

The business broker cash flow model enables precise financial projections, essential for effective capital management and financing strategies, including loans and capital raising. Utilizing this financial modeling template for brokers ensures startups are well-prepared to seize growth opportunities. Robust financial planning for business acquisition and accurate financial forecast for business brokers are critical to drive success and optimize deal structuring. This disciplined approach empowers brokers to confidently navigate financial due diligence and make informed investment decisions, ultimately maximizing profitability and sustainable business growth.

KPI Benchmarks

Benchmarking is a crucial financial metric in business broker financial planning models, enabling comprehensive financial projections for business sales. By analyzing profit margins, cost efficiency, and productivity within business broker cash flow models, benchmarking compares a company’s performance against industry peers. This financial due diligence model supports accurate business valuation financial models and strategic financial planning for business acquisitions. Whether for startups or established firms, benchmarking provides essential insights for business broker deal structuring models, ensuring informed decision-making and optimized transaction outcomes in a competitive market landscape.

P&L Statement Excel

Financial forecasting is essential in any business broker financial planning model. Utilizing a detailed financial projections template, including pro forma income statements, enables precise analysis of net income and gross profit margins. This critical financial modeling for business brokers not only illuminates future profitability but also enhances deal structuring and acquisition strategies. By leveraging comprehensive financial due diligence models and cash flow forecasts, brokers gain confidence in their business valuation and investment decisions, ultimately strengthening their market position and driving successful transactions.

Pro Forma Balance Sheet Template Excel

The 5-year projected balance sheet in Excel is a vital component of your business broker financial model, detailing assets, liabilities, and equity at a specific date. It includes cash, equipment, and property, providing a clear snapshot of your financial position. Essential for financial due diligence and business acquisition planning, this statement is crucial when securing financing. Lenders rely on this pro forma balance sheet to assess risk and inform lending decisions, making it a key tool in your financial planning and forecasting for business brokers.

BUSINESS BROKER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This business broker financial model features a comprehensive valuation analysis template enabling precise Discounted Cash Flow (DCF) evaluations. It supports in-depth financial projections for business sale by incorporating key metrics like residual value, replacement costs, market comparables, and recent transaction comparables. Designed for financial due diligence and business acquisition planning, this model empowers brokers to conduct thorough profit analysis, cash flow forecasting, and deal structuring with confidence and accuracy.

Cap Table

In financial modeling for business brokers, a cap table template is essential, detailing the distribution of a company’s securities among investors. This table provides a clear breakdown of common and preferred shares, ownership percentages, and security prices. By integrating this data into a business broker financial model or acquisition financial model, brokers gain comprehensive insights crucial for transaction financial analysis, deal structuring, and investment evaluation. The cap table serves as a reliable foundation for accurate financial projections, profit analysis, and due diligence, ensuring informed decisions throughout the business sale or acquisition process.

BUSINESS BROKER STARTUP FINANCIAL MODEL TEMPLATE ADVANTAGES

Our business broker financial model ensures accurate forecasts, optimizing deal structuring and maximizing transaction profitability.

Easily streamline business broker financial modeling to enhance accurate income statements and balance sheets for smarter decisions.

The 5-year financial model empowers business brokers to optimize expenses and maximize profitability through data-driven projections.

The business broker cash flow model proactively identifies cash gaps and surpluses, optimizing financial planning accuracy.

The business broker financial model empowers precise valuation and optimizes acquisition decisions with clear financial insights.

BUSINESS BROKER 5 YEAR PROJECTION TEMPLATE ADVANTAGES

Financial modeling for business brokers identifies potential cash shortfalls early, ensuring proactive financial management and stability.

The business broker financial model enables proactive cash flow management, serving as an essential early warning system for brokers.

Unlock accurate business valuations and confident decisions with our comprehensive financial modeling template for brokers.

Our business broker financial model streamlines cash flow projections and reporting, perfectly aligning with lender requirements.

Streamline deal decisions with our dynamic financial modeling template for brokers, enhancing accuracy and profitability instantly.

Easily adjust inputs anytime to refine your business broker financial model for accurate 5-year projection planning.

Optimize deal success with our business broker financial model, preventing cash flow shortfalls and enhancing financial planning.

A business broker cash flow model spotlights pro forma shortfalls early, enabling proactive financial planning and risk reduction.

Optimize deals confidently with a business broker financial model that enhances accuracy and maximizes profit potential.

A business broker cash flow model enables proactive cash gap detection, optimizing growth and financial decision-making.