Civil Engineering Consulting Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Civil Engineering Consulting Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Civil Engineering Consulting Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CIVIL ENGINEERING CONSULTING SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly civil engineering consulting services financial model designed for comprehensive budget forecasting and financial projection, including templates for projected income statements, cash flow modeling, and balance sheets with monthly and annual timelines. Ideal for startups or established firms, this model supports detailed financial feasibility studies, cost estimation in civil engineering consulting, and investment appraisal, enabling firms to perform thorough economic evaluations and profitability analysis before selling or expanding their business. Fully unlocked for editing, it provides robust tools for capital expenditure planning, risk assessment in civil engineering finance, and strategic financial resource allocation, enhancing the overall financial performance metrics and reporting capabilities for consulting firms.

This ready-made financial model excel template specifically addresses the common pain points faced by civil engineering firms in financial planning, offering a comprehensive solution for cost estimation in civil engineering consulting and cash flow modeling for civil engineering projects. By integrating detailed financial budgeting civil engineering consulting and budget forecasting for civil engineering services, it eliminates the complexity of financial modeling for civil engineering firms, enabling users with no prior expertise to perform robust financial analysis for infrastructure projects and investment appraisal in civil engineering with ease. The template incorporates key consulting services financial performance metrics and profitability analysis civil engineering consulting, facilitating risk assessment in civil engineering finance and capital expenditure planning civil engineering. Its all-in-one design featuring a 3-way financial model with balance sheet, income and expenditure, startup cost plan, and break-even analysis streamlines financial resource allocation civil engineering and financial feasibility study civil engineering, making it an indispensable tool for startups and established consultancies aiming for precise financial projection models civil engineering and economic evaluation of civil engineering projects without the need for time-consuming edits or customization.

Description

This comprehensive financial model for civil engineering consulting firms is designed to support strategic financial planning and investment appraisal by incorporating advanced cash flow modeling for civil engineering projects, cost estimation in civil engineering consulting, and profitability analysis civil engineering consulting. The model offers robust financial projection models civil engineering tailored for startups and existing firms, enabling dynamic budget forecasting for civil engineering services and financial resource allocation civil engineering, while also integrating risk assessment in civil engineering finance and economic evaluation of civil engineering projects to ensure accurate consulting services financial performance metrics over a five-year horizon with adaptable scenarios to reflect real-world variations.

CIVIL ENGINEERING CONSULTING SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A robust financial modeling approach for civil engineering firms integrates profit and loss forecasts, balance sheet projections, and cash flow modeling into a cohesive financial projection model. Unlike basic templates that focus solely on income statements, dynamic financial models enable detailed budget forecasting, risk assessment, and scenario analysis. This comprehensive method enhances investment appraisal and cost estimation accuracy, ensuring a precise financial feasibility study for infrastructure projects. By leveraging advanced financial projection models, civil engineering consultants can optimize resource allocation, improve financial performance metrics, and strategically plan capital expenditures to drive sustainable profitability and growth.

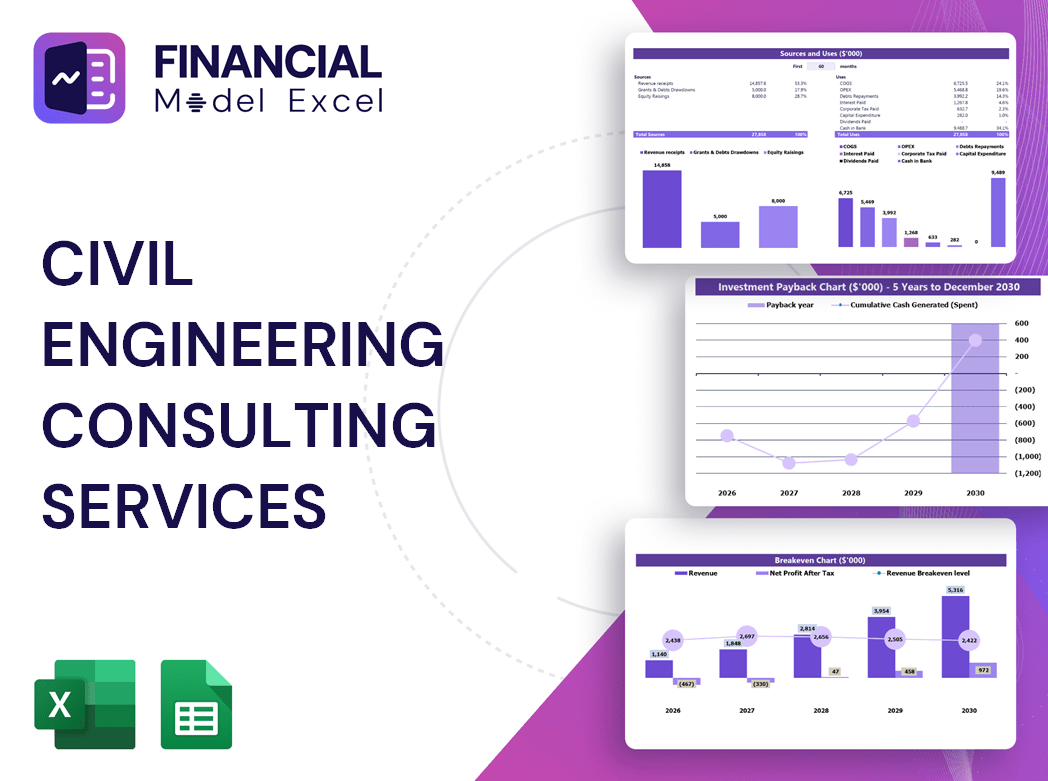

Dashboard

The Dashboard tab delivers comprehensive financial indicators—including graphs, ratios, charts, and formatted financial statements—designed for immediate application in civil engineering project financial planning. These insights support advanced financial modeling for civil engineering firms, enabling precise cost estimation, budget forecasting, and cash flow modeling. By integrating profitability analysis and risk assessment, the dashboard empowers consulting services to optimize financial performance metrics and capital expenditure planning, ensuring robust financial feasibility studies and investment appraisals for infrastructure projects.

Business Financial Statements

This advanced financial modeling Excel template seamlessly integrates three essential financial statements: Profit & Loss, projected balance sheet, and cash flow projections tailored for civil engineering projects. Designed specifically for civil engineering consulting firms, it connects all data inputs across spreadsheets, facilitating accurate cost estimation, budget forecasting, and financial feasibility studies. Ideal for financial planning, investment appraisal, and cash flow modeling, this tool enhances financial analysis and reporting, empowering firms with actionable insights to optimize capital expenditure planning and improve profitability analysis in infrastructure projects.

Sources And Uses Statement

To professionalize and streamline financial planning for civil engineering projects, our model incorporates a dedicated Sources and Uses of Funds statement template. This tab clearly outlines funding origins alongside their targeted allocations, enhancing transparency in budget forecasting and capital expenditure planning. By integrating precise cost estimation and financial modeling for civil engineering firms, this tool supports robust financial analysis, investment appraisal, and risk assessment, ensuring informed decision-making and optimized resource allocation throughout project lifecycles.

Break Even Point In Sales Dollars

Unlock profitability milestones with precise financial modeling for civil engineering firms. Our break-even analysis tool offers clear insights into the exact sales volume or revenue level required to cover all operating costs, ensuring informed financial planning and budget forecasting. Ideal for civil engineering consulting, this template supports cost estimation, cash flow modeling, and investment appraisal, empowering your firm to optimize financial performance metrics and enhance economic evaluations. Leverage advanced financial projection models to strategically navigate risk assessment and capital expenditure planning, driving sustainable growth and profitability in your infrastructure projects.

Top Revenue

The Top Revenue section in a financial projection model for civil engineering firms delivers comprehensive insight into your service or product income streams. It offers a detailed annual breakdown, highlighting revenue depth and bridging factors critical for accurate financial planning. Leveraging these financial projection models enhances budget forecasting, investment appraisal, and profitability analysis in civil engineering consulting, empowering firms to optimize financial performance metrics and drive sustainable growth in infrastructure projects.

Business Top Expenses Spreadsheet

Maximize profitability by leveraging expert financial analysis for civil engineering consulting. Our five-year financial projection model includes a detailed top expense tab, highlighting the four largest costs and grouping others for clear visibility. This essential tool supports accurate cost estimation and budget forecasting, enabling firms to implement strategic cost optimization annually. Whether you’re a startup or an established engineering consultancy, proactive financial resource allocation and cost-benefit analysis ensure robust profitability and sustainable growth in civil engineering projects.

CIVIL ENGINEERING CONSULTING SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a critical element in financial modeling for civil engineering firms, impacting cash flow modeling and budget forecasting from the outset. Effective cost estimation and financial resource allocation ensure these initial expenses do not jeopardize project viability or firm profitability. Our comprehensive financial projection models for civil engineering consulting integrate detailed expense tracking and capital expenditure planning, supported by robust financial analysis and risk assessment. This enables accurate financial feasibility studies and investment appraisals, empowering firms to optimize financial performance metrics and execute strategic financial budgeting with confidence.

CAPEX Spending

Capital expenditure planning is a crucial component in financial projection models for civil engineering projects. It enables precise start-up cost estimation and informs investment appraisal decisions. Accurately forecasting capital expenditures supports robust cash flow modeling and strengthens budgeting strategies essential for financial feasibility studies. Integrating capital expenditure forecasts into financial analysis enhances risk assessment and optimizes resource allocation, ultimately driving improved profitability and sustainable growth within engineering consultancy financial strategies. Effective management of these metrics ensures transparent financial reporting and empowers firms to make informed decisions in infrastructure project financing.

Loan Financing Calculator

Our financial forecasting template integrates a precise loan amortization schedule, detailing principal, interest rates, loan duration, and payment frequency. Designed specifically for civil engineering consulting, this tool enhances capital expenditure planning and cash flow modeling, enabling accurate budget forecasting and financial projection models. Empower your firm with comprehensive financial analysis for infrastructure projects, optimizing resource allocation and supporting robust investment appraisal. Streamline your financial reporting and elevate the profitability analysis within your civil engineering services with this essential financial modeling solution.

CIVIL ENGINEERING CONSULTING SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a key financial metric in civil engineering consulting, derived from pro forma balance sheets and P&L templates. It measures a firm’s efficiency by dividing net earnings by total assets, highlighting how effectively assets generate profits. In financial modeling for civil engineering firms, a higher ROA indicates superior asset utilization, essential for investment appraisal, budget forecasting, and capital expenditure planning. Utilizing ROA within financial analysis for infrastructure projects enables consulting services to optimize resource allocation and enhance overall financial performance.

Cash Flow Forecast Excel

Effective cash flow modeling is essential in civil engineering project financial planning. Utilizing Excel-based cash flow projection models, firms gain clear insight into cash inflows and outflows, enabling precise financial budgeting and risk assessment. Alongside financial feasibility studies and cost estimation in civil engineering consulting, cash flow analysis supports informed decision-making, investment appraisal, and capital expenditure planning. By monitoring cash flow dynamics, engineering consultancies enhance financial performance metrics, optimize resource allocation, and ensure robust economic evaluation of infrastructure projects. Embrace cash flow modeling to strengthen your firm’s financial strategy and drive sustainable profitability.

KPI Benchmarks

A financial forecast template benchmark tab plays a crucial role in evaluating key financial performance metrics for civil engineering firms. By analyzing and comparing average values, it supports effective financial modeling and budget forecasting for civil engineering consulting projects. This comparative analysis guides strategic decision-making, optimizing financial resource allocation and improving profitability. Especially for startups, conducting comprehensive financial feasibility studies and risk assessments early ensures a solid foundation. Implementing robust financial planning and projection models is essential for driving sustainable growth and success in infrastructure projects and engineering consultancy services.

P&L Statement Excel

In civil engineering consulting, precise financial planning is essential for profitability. Leveraging zero-based budgeting within financial projection models ensures accurate cost estimation and capital expenditure planning. Without meticulous budgeting and integrated financial reporting, firms cannot reliably assess profitability—regardless of revenue size. Comprehensive financial analysis and cash flow modeling enable firms to consolidate all data, empowering confident investment appraisal and risk assessment. Ultimately, success in engineering consultancy depends on robust financial performance metrics and strategic resource allocation that drive positive bottom-line results.

Pro Forma Balance Sheet Template Excel

Accurate financial modeling for civil engineering firms is crucial, integrating balance sheet forecasts with income statements and cash flow projections. Though less headline-grabbing, balance sheet forecasting plays a vital role in budget forecasting and cash flow modeling for civil engineering projects. It enables investor confidence by providing transparency into profitability analysis and financial feasibility studies. Moreover, these forecasts support risk assessment and investment appraisal, ensuring realistic net income projections and optimizing financial resource allocation. Effective financial planning and reporting empower engineering consultancies to enhance their economic evaluation and capital expenditure planning for sustainable growth.

CIVIL ENGINEERING CONSULTING SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive financial model template for civil engineering projects provides investors with all essential data for precise financial planning and investment appraisal. Featuring advanced cash flow modeling and discounted cash flow analysis, it captures the true economic value and profitability potential. The Weighted Average Cost of Capital (WACC) quantifies required returns on operating capital, while free cash flow valuation highlights cash available to shareholders and creditors. This robust financial projection model ensures accurate budget forecasting, risk assessment, and capital expenditure planning—empowering civil engineering firms to optimize financial performance and confidently pursue infrastructure development opportunities.

Cap Table

The financial projection Excel template, combined with a comprehensive cap table, offers startups a clear overview of investor details, equity distribution, and capital contributions. For civil engineering firms, integrating such tools enhances financial modeling accuracy, supports capital expenditure planning, and streamlines investment appraisal. Leveraging these models ensures precise cash flow forecasting and robust financial analysis, essential for successful project financial planning and consulting services.

CIVIL ENGINEERING CONSULTING SERVICES STARTUP COSTS TEMPLATE ADVANTAGES

Optimize project success by forecasting all three financial statements using a 5-year civil engineering financial model template.

Leverage our civil engineering financial model to optimize asset acquisition and maximize project profitability efficiently.

Financial modeling for civil engineering projects ensures accurate loan repayment forecasts, enhancing funding approval confidence.

Financial modeling for civil engineering firms enables proactive problem identification, ensuring timely solutions and optimized project outcomes.

Financial modeling for civil engineering projects enables precise cash flow projection, ensuring informed financial planning and risk management.

CIVIL ENGINEERING CONSULTING SERVICES 3 STATEMENT FINANCIAL MODEL EXCEL TEMPLATE ADVANTAGES

Accurate financial modeling for civil engineering firms drives informed investment decisions and maximizes project profitability.

Optimize civil engineering project success with our financial modeling, featuring comprehensive forecasts and clear profitability insights.

Financial modeling for civil engineering firms simplifies budgeting and boosts project profitability with clear, actionable financial insights.

Enhance accuracy and transparency with our color-coded civil engineering financial model featuring detailed pro forma income statements.

Financial modeling for civil engineering firms enables early identification of cash shortfalls, optimizing project financial planning.

Financial modeling for civil engineering firms provides an early-warning system, optimizing cash flow and enhancing project profitability.

Accurate financial modeling for civil engineering firms empowers investors with confident, data-driven project investment decisions.

Accelerate funding and boost investor confidence with precise financial modeling tailored for civil engineering project success.

Optimize civil engineering project outcomes with our convenient all-in-one dashboard for advanced financial modeling and planning.

Financial modeling for civil engineering firms ensures precise forecasting, enhancing profitability through detailed cash flow and performance analysis.