Coal Mining Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Coal Mining Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Coal Mining Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COAL MINING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly coal mining financial model template designed for comprehensive financial planning in the coal mining industry, including detailed coal mining revenue forecasts, cash flow models, and income statement projections with both monthly and annual timelines. Ideal for startups or established businesses, this financial model facilitates thorough coal mining investment analysis and coal mining project valuation, incorporating coal mine cost estimation and operational costs models. Perfect for conducting financial feasibility studies, cost-benefit analyses, and financial risk assessments, this unlocked template allows full customization to accurately assess coal mining profit margin analysis and overall financial performance metrics before launching or selling a coal mining business.

The ready-made financial model for coal mining projects offers comprehensive coal mining investment analysis by automating coal mine cost estimation models, coal mining revenue forecasts, and coal mining expense forecasting, significantly reducing manual errors and saving time. Its integrated coal mining cash flow model and coal mining capital expenditure model enable precise financial planning for the coal mining industry, while built-in coal mining profit margin analysis and coal mining financial risk assessment tools provide critical insights for evaluating financial feasibility coal mining initiatives. Additionally, the template’s coal mining project valuation and coal mining operational costs model streamline budgeting and expense tracking with a user-friendly coal mine budgeting template, ensuring buyers can confidently generate accurate coal mining income statement projections, balance sheets, and other coal mining financial statement models with adherence to GAAP/IFRS formats.

Description

This comprehensive coal mining financial model is expertly crafted to support detailed coal mining investment analysis and facilitate robust financial planning in the coal mining industry. It integrates a coal mining cash flow model, coal mine cost estimation model, and a coal mining revenue forecast, enabling precise coal mining expense forecasting and capital expenditure modeling over a 5-year horizon. The model encompasses a full suite of financial statement projections—including income statement, balance sheet, and cash flow statement projections—designed to assess financial feasibility coal mining initiatives through profit margin analysis, cost-benefit analysis, and financial risk assessment. Equipped with a coal mining project valuation framework and operational costs model, along with budgeting templates and performance metrics, this tool empowers stakeholders to conduct thorough coal mining financial statement modeling and strategic decision-making for both startup and existing coal mining ventures.

COAL MINING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Achieving a comprehensive view of your coal mining project requires integrating key financial models: income statement projections, pro forma balance sheets, and cash flow forecasts. Our financial model for coal mining projects delivers precise five-year coal mining revenue forecasts and expense forecasting, enabling accurate coal mining investment analysis and financial feasibility assessments. With our coal mining cash flow model and cost estimation tools, you can confidently evaluate operational costs, profit margin analysis, and capital expenditure. This holistic economic model empowers optimal scenario planning and risk assessment to maximize your coal mining project's financial performance and long-term success.

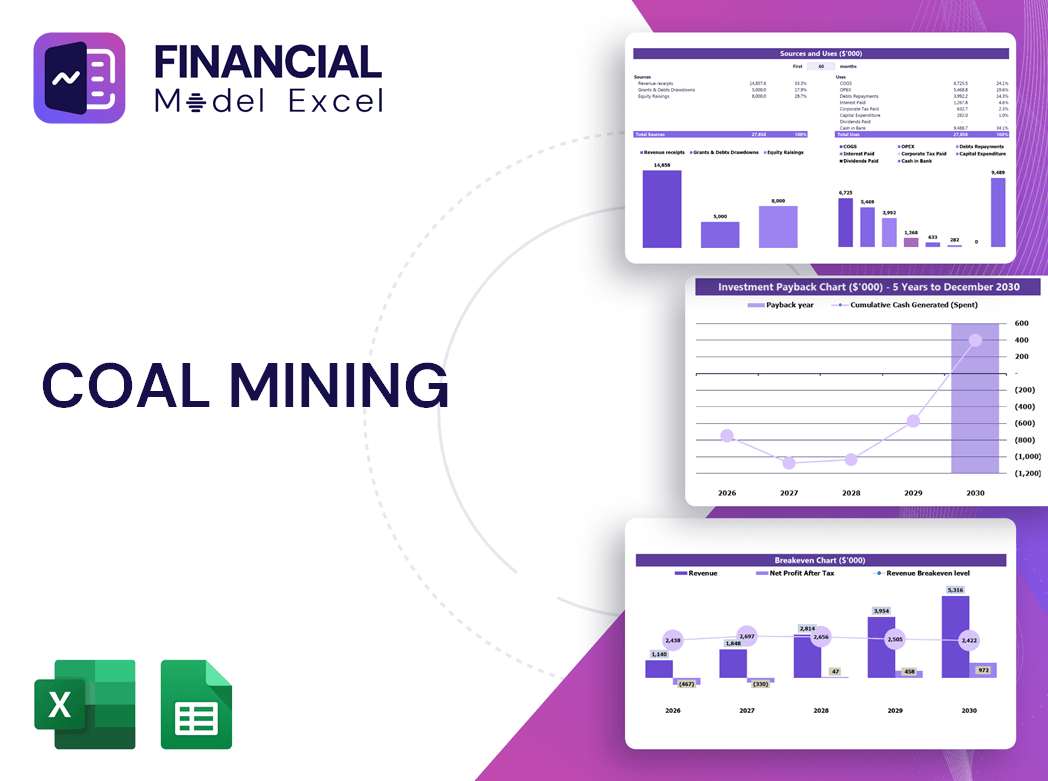

Dashboard

This comprehensive coal mining financial model offers an all-in-one dashboard providing a clear snapshot of your project's key financial metrics. Easily track coal mining revenue forecasts, cash flow projections, profit margin analysis, and operational cost estimations. Visual charts and graphs enable effective coal mining investment analysis and financial feasibility assessment, empowering informed decision-making for your coal mining project's budgeting, capital expenditure, and overall valuation. Optimize your coal mining financial planning with this dynamic and professional financial statement model.

Business Financial Statements

Our coal mining financial model offers a comprehensive balance sheet projection, capturing your project's financial position at period-end. This dynamic template enables seamless input of operational data to generate detailed pro forma financial statements, including income statement projections and cash flow models. Designed for coal mining investment analysis and financial feasibility assessments, it supports accurate coal mine cost estimation, revenue forecasting, and profit margin analysis. Streamline your coal mining financial planning with our robust budgeting and expense forecasting tools to enhance project valuation and risk assessment efficiently.

Sources And Uses Statement

The sources and uses of capital tab within a coal mining financial model for project valuation is essential for effective financial planning. It clearly outlines coal mining investment analysis by detailing funding sources and capital allocation, enabling precise coal mine cost estimation and operational costs modeling. This vital component supports financial feasibility coal mining assessments and enhances coal mining cash flow model accuracy, ensuring comprehensive coal mining profit margin analysis and expense forecasting for start-ups and established ventures alike.

Break Even Point In Sales Dollars

Our coal mining financial model includes an integrated break-even analysis template, enabling precise coal mining project valuation. This powerful tool helps management determine the exact timeline and unit sales required to achieve profitability. Automatically generating break-even timing, break-even units, and break-even points, it supports comprehensive coal mining investment analysis and financial feasibility assessments. Optimize your coal mining cash flow model and enhance financial planning within the coal mining industry with accurate cost estimations, expense forecasting, and profit margin analysis—all designed to drive informed, strategic decision-making.

Top Revenue

The Top Revenue tab in this coal mining financial model enables comprehensive revenue forecasting by product or service. It supports coal mining revenue forecast and profit margin analysis, allowing users to simulate potential profitability across various scenarios. With detailed demand projections—such as weekday versus weekend variations—users can optimize resource allocation, including manpower and inventory. This feature enhances coal mining investment analysis and financial planning within the coal mining industry, driving informed decision-making for operational efficiency and maximizing financial performance metrics.

Business Top Expenses Spreadsheet

In the Top Expenses section of our coal mining financial projection model, key cost categories are clearly outlined and divided into four main groups. The “Other” category offers flexibility to include any additional expenses vital to your operation. Utilize our 5-year coal mining cash flow model template to systematically track and analyze your company’s financial performance, ensuring accurate coal mining expense forecasting and supporting strategic financial planning within the coal mining industry. This approach enhances your coal mining investment analysis and strengthens your project valuation.

COAL MINING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A financial model for coal mining projects is an essential tool to accurately estimate operational costs and forecast revenue streams. By utilizing a comprehensive coal mine cost estimation model and a 5-year financial projection template, companies can optimize budgeting, enhance coal mining investment analysis, and identify potential risks early. This strategic financial planning in the coal mining industry supports effective capital allocation, strengthens coal mining project valuation, and builds investor confidence for funding or loans. Ultimately, a robust coal mining cash flow model drives informed decision-making and maximizes profit margins.

CAPEX Spending

Capital expenditure (CapEx) is a critical component in coal mining financial projections, representing investments in property, plant, and equipment (PPE). Our financial model for coal mining projects integrates CapEx by accounting for depreciation, asset additions, disposals, and leased fixed assets. This comprehensive coal mining capital expenditure model supports precise cost estimation, enhances cash flow forecasting, and strengthens coal mining investment analysis. Utilizing this approach within our coal mine budgeting template ensures robust financial planning and accurate coal mining project valuation, enabling stakeholders to assess financial feasibility and optimize profit margin analysis effectively.

Loan Financing Calculator

Our comprehensive financial model for coal mining projects includes an advanced loan amortization schedule designed to manage all loan types effectively. This template records critical loan details such as principal amount, interest type and rate, loan duration, and repayment schedules. Integrated into a robust coal mining cash flow model, it supports precise coal mine cost estimation and financial feasibility analysis, enhancing your coal mining investment analysis and project valuation for optimal financial planning in the coal mining industry.

COAL MINING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross profit margin, a key metric in coal mining financial projections, reveals the difference between revenues and cost of sales. An improving margin indicates enhanced operational efficiency, with rising revenues or reduced expenses in your coal mining project’s income statement projection. Utilizing a robust coal mining financial model or cash flow model helps track this essential profit margin analysis, enabling accurate coal mine cost estimation and expense forecasting. This metric is crucial for effective financial planning in the coal mining industry, driving stronger coal mining investment analysis and ensuring the financial feasibility of your project.

Cash Flow Forecast Excel

A robust coal mining cash flow model is crucial for startups, enabling precise financial planning and enhanced profitability. Accurate cash flow forecasting supports strategic decision-making, ensuring efficient operational and capital expenditure management. Additionally, a detailed coal mining financial projection is essential for securing bank loans and attracting investors, clearly demonstrating your project’s repayment capacity and overall financial viability. Leveraging a comprehensive financial model for coal mining projects empowers stakeholders with insights into revenue forecasts, cost estimations, and risk assessments—driving informed investment analysis and sustainable growth in the competitive coal mining industry.

KPI Benchmarks

Our coal mining financial model offers a comprehensive benchmarking tool for investment analysis, enabling companies to compare operational costs, profit margins, and cash flow models within the industry. This coal mining financial projection supports informed decision-making by highlighting key financial performance metrics and expense forecasting. By leveraging this economic model for coal mining, stakeholders can conduct thorough cost-benefit and financial risk assessments, optimizing budgeting and capital expenditure planning. Accurate coal mining revenue forecasts and project valuation empower businesses to enhance financial feasibility and drive sustainable growth in a competitive market.

P&L Statement Excel

A robust financial model for coal mining projects is essential for accurate profit margin analysis and financial feasibility assessment. Utilizing a detailed coal mining income statement projection enables precise forecasting of revenues, operational costs, and after-tax net profit. This coal mining financial statement model supports comprehensive cash flow management and expense forecasting, empowering startups to make informed investment decisions and maximize profitability. With a reliable coal mining financial projection, stakeholders gain critical insights into capital expenditure, cost-benefit analysis, and overall project valuation to drive sustainable growth and financial performance in the coal mining industry.

Pro Forma Balance Sheet Template Excel

A comprehensive coal mining financial model integrates key elements like project valuation, cost estimation, and cash flow forecasting. Utilizing a coal mining income statement projection alongside a balance sheet template, it provides a clear snapshot of assets, liabilities, and equity at a specific point. This framework enables accurate coal mining investment analysis and profit margin assessment, highlighting liquidity and solvency through critical financial performance metrics. Effective financial planning in the coal mining industry demands this robust model to support capital expenditure decisions, operational cost management, and long-term revenue forecasts, ensuring informed, strategic growth and risk mitigation.

COAL MINING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive coal mining financial model offers a robust seed-stage project valuation, delivering critical insights investors prioritize. Featuring weighted average cost of capital (WACC) analysis, it assures stakeholders of minimum expected returns. The integrated free cash flow valuation clearly outlines cash availability for shareholders and creditors, while the discounted cash flow method accurately calculates the present value of all future cash flows. This financial planning tool supports precise coal mining investment analysis, enhancing your project’s financial feasibility and accelerating confident decision-making.

Cap Table

A comprehensive coal mining financial model, including a detailed cap table, is essential for accurate coal mining investment analysis. This spreadsheet delineates share ownership, investor pricing, and equity dilution, providing clarity on ownership percentages. Integrating the cap table within the coal mining financial projection enhances financial planning, supports coal mine cost estimation models, and strengthens coal mining project valuation. It is a vital tool for assessing financial feasibility, forecasting revenue, and conducting coal mining profit margin analysis, ensuring informed decision-making and optimized capital expenditure in the coal mining industry.

COAL MINING FINANCIAL PROJECTIONS SPREADSHEET ADVANTAGES

Boost profits confidently using our precise coal mining financial model for accurate investment analysis and revenue forecasting.

A financial model for coal mining projects enables precise revenue forecasts, optimizing investment decisions and boosting profitability analysis.

Optimize budgeting and operational costs with a comprehensive coal mining financial model for accurate investment analysis.

The coal mining financial model ensures accurate cost control, boosting investment confidence and maximizing project profitability.

The coal mining financial model in Excel proactively identifies cash shortfalls, enhancing strategic planning and investment security.

COAL MINING EXCEL FINANCIAL MODEL TEMPLATE ADVANTAGES

The coal mining financial model identifies cash gaps and surpluses early, optimizing investment and operational decisions.

A coal mining cash flow model enables proactive financial planning to prevent deficits and maximize profitable reinvestment opportunities.

Our coal mining financial model ensures confident investment decisions through accurate revenue forecasts and risk assessments.

Our coal mining financial model optimizes planning, risk management, and cash flow forecasting for five-year investment success.

Our coal mining financial model ensures accurate investment analysis, maximizing profit margin and mitigating financial risks effectively.

Enhance investor confidence and secure funding faster with an accurate coal mining financial model delivering key performance insights.

Our financial model for coal mining projects ensures accurate revenue forecasts and optimizes investment analysis for maximum profitability.

Easily refine your coal mining financial model with adjustable inputs for accurate projections and strategic decision-making.

Unlock profits with our coal mining financial model, optimizing investment analysis and boosting project valuation confidence.

The coal mining financial model ensures accurate projections, boosting investor confidence and securing essential funding quickly.