Cold Chain Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Cold Chain Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Cold Chain Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COLD CHAIN FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year cold chain startup financial model is an essential tool for fundraising and strategic business planning tailored specifically for entrepreneurs and new ventures in the cold chain industry. Featuring integrated cold chain revenue projection, cost analysis, and cash flow financial models, it offers detailed financial forecasting and expense tracking to accurately evaluate startup costs and operational performance. Designed with built-in cold chain market analysis and pricing strategy models, this editable template empowers users to optimize investment decisions, manage assets efficiently, and anticipate financial risks, making it ideal for cold chain logistics financial planning and distribution management.

This cold chain financial forecasting model addresses critical pain points by providing a comprehensive, ready-made Excel template that seamlessly integrates cold chain cost analysis, revenue projection, and expense tracking models, enabling precise cold chain budgeting and logistics financial planning. Buyers benefit from industry benchmark KPIs tailored for 5-year monthly projections, ensuring accurate cold chain profit and loss modeling alongside robust cash flow forecasts. The model simplifies complex cold chain asset management and distribution financial processes with automated annual summaries, supporting investment decisions through cold chain startup financial and market analysis financial models while mitigating financial risks with an embedded cold chain financial risk model. This all-in-one solution empowers users to optimize cold chain operations, management, and pricing strategies with real-time financial performance insights and streamlined cold chain warehouse and supply chain financial models.

Description

This comprehensive cold chain financial forecasting model is expertly designed to facilitate detailed cold chain investment financial planning by integrating cold chain cost analysis, revenue projection, and cash flow financial models into one seamless tool. It supports cold chain logistics financial planning with precise cold chain budgeting and expense tracking models that empower users to predict operational costs and manage distribution and warehouse financial elements effectively. With the inclusion of cold chain asset management and financial risk models, this cold chain business financial model delivers robust cold chain market analysis alongside pricing strategy insights to optimize profit and loss outcomes. Ideal for startups, this cold chain startup financial model features a 60-month cold chain supply chain financial model enabling calculation of key indicators such as IRR, NPV, and free cash flow, ensuring reliable cold chain financial performance modeling for informed decision-making and strategic growth.

COLD CHAIN FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our cold chain financial forecasting model empowers informed decision-making by projecting the future impact of your choices today. This comprehensive cold chain startup financial model delivers detailed financial statements, including profit and loss, balance sheet, and cash flow projections—all within an intuitive Excel template. It also calculates key startup KPIs based on your assumptions, providing a clear view of your cold chain business financial performance. With a sleek, interactive dashboard, you can effortlessly track expenses, revenue, and operational metrics—ensuring strategic financial planning and effective cold chain logistics management.

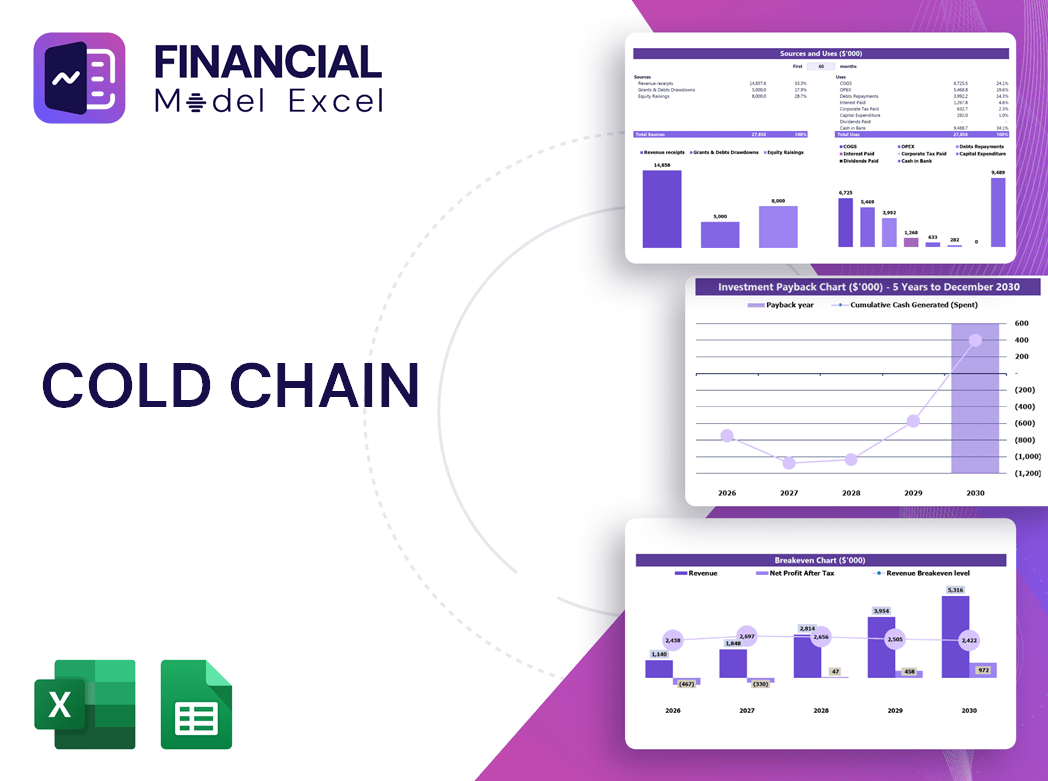

Dashboard

This cold chain startup financial model features an all-in-one dashboard providing a comprehensive snapshot of your business’s key metrics. Instantly access core startup financials, detailed revenue projections, cash flow forecasts, and profitability outlooks—all visualized through intuitive charts and graphs. Designed for precise cold chain financial planning and investment analysis, this dashboard empowers informed decision-making to optimize your cold chain business performance from day one.

Business Financial Statements

When developing a cold chain financial forecasting model, clarity and completeness are essential. Your Excel-based cold chain business financial model must include all crucial components—from revenue projections to expense tracking—while remaining intuitive and easy to navigate. Whether it’s a cold chain startup financial model or a comprehensive cold chain logistics financial planning tool, an accessible layout enhances stakeholder evaluation. Prioritize a streamlined cold chain financial performance model to effectively communicate your financial strategy with confidence and precision.

Sources And Uses Statement

This cold chain financial model features a comprehensive Sources and Uses tab, detailing the firm’s capital structure alongside precise tracking of fund allocation. Whether for cold chain investment financial modeling, budgeting, or operational planning, this section ensures transparent insights into how resources are sourced and deployed. It is essential for effective cold chain cost analysis, cash flow forecasting, and financial risk assessment, empowering stakeholders with clarity to optimize financial performance and drive strategic growth within cold chain logistics and supply chain operations.

Break Even Point In Sales Dollars

The cold chain financial forecasting model includes an essential break-even analysis to identify the exact sales volume or revenue needed to cover fixed and variable costs. At this break-even point, profits are zero; beyond it, your cold chain business financial model begins generating profit. Our customizable break-even chart empowers precise cold chain budgeting and financial planning, enabling stakeholders to visualize minimum sales targets. This calculation is vital for investors assessing profitability and estimating ROI timelines, strengthening confidence in cold chain investment financial models and strategic decision-making.

Top Revenue

The Top Revenue tab enables you to generate detailed demand reports within your cold chain financial forecasting model, showcasing the profitability and financial appeal of various scenarios to inform strategic decisions. Meanwhile, the 5-year revenue projection template lets you build a comprehensive revenue bridge, analyzing key drivers like product volume and pricing. This insight supports accurate demand forecasting across different periods, optimizing sales resource allocation. Together, these tools enhance your cold chain revenue projection model and cold chain financial planning for sustained growth and operational efficiency.

Business Top Expenses Spreadsheet

Accurate cold chain revenue projection models are vital for sustainable business growth. Effective cold chain financial forecasting models help management confidently predict future revenues, a primary driver of enterprise value within integrated financial statements. Leveraging detailed assumptions and historical data, cold chain business financial models enable precise budgeting, cost analysis, and cash flow projections. This meticulous financial planning ensures informed investment decisions and strengthens operational strategies, minimizing risks and maximizing profitability in the cold chain logistics sector.

COLD CHAIN FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our cold chain startup financial model is an essential tool for accurate financial forecasting and expense tracking. It enables precise cold chain cost analysis and budgeting, ensuring you identify high-priority areas and optimize resource allocation. With comprehensive cold chain investment financial planning, this model supports detailed revenue projections and cash flow management. Ideal for communicating financial insights, it empowers you to present a robust cold chain business financial model to investors and lenders, facilitating informed decision-making and driving sustainable growth.

CAPEX Spending

The CAPEX cost represents the total investment required to enhance and sustain a cold chain business’s competitive edge, excluding staff salaries and operating expenses. Utilizing a comprehensive cold chain financial forecasting model, this analysis helps identify the most lucrative investment areas, guiding strategic capital allocation. Given the significant variability of capital expenditures across different cold chain business models, integrating this CAPEX evaluation into your cold chain investment financial model is essential for precise financial planning and informed decision-making.

Loan Financing Calculator

Our cold chain financial forecasting model integrates a dynamic loan amortization schedule with embedded formulas, enabling precise tracking of principal and interest payments. This feature streamlines cold chain investment financial planning by instantly calculating repayment amounts, including principal, interest, payment frequency, and duration. Optimize your cold chain business financial model with accurate cash flow insights and enhance budgeting, expense tracking, and profit and loss projections for smarter decision-making and sustained growth in cold chain logistics.

COLD CHAIN FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The cold chain profit and loss model emphasizes gross profit margin, a vital financial ratio indicating business health. This margin reveals the difference between revenue and cost of sales within cold chain logistics financial planning. An improving gross profit margin signals reduced operational expenses or increased sales revenue, highlighting more efficient cost management. Presented as a percentage, this metric is essential in cold chain business financial models for evaluating profitability and guiding strategic financial forecasting. Understanding and optimizing your cold chain profit and loss model ensures robust financial performance and sustainable growth.

Cash Flow Forecast Excel

Maximize your cold chain business’s financial health with our comprehensive cold chain cash flow financial model. Designed to track liquidity and ensure smooth operations, this model integrates key inputs like payable and receivable days, working capital, and long-term debt. It provides precise cash flow projections, beginning and ending cash balances, and helps avoid unnecessary financing. Ideal for cold chain logistics financial planning, this template supports effective decision-making, ensuring your cold chain supply chain remains liquid and financially stable. Gain full visibility into your cash position and secure your company’s operational success with this essential financial tool.

KPI Benchmarks

This cold chain financial performance model features a dedicated comparative analysis tab, enabling side-by-side evaluation of key financial metrics across industry peers. By benchmarking results within the cold chain logistics sector, this tool delivers clients deep insights into their company’s financial health and competitive positioning. It empowers strategic decision-making through precise financial forecasting, cost analysis, and revenue projection—ensuring a comprehensive understanding of operational efficiency and market standing in the cold chain supply chain ecosystem.

P&L Statement Excel

Our comprehensive cold chain financial forecasting model is expertly crafted for users of all experience levels—from beginners to seasoned analysts. This cold chain profit and loss model offers a clear, step-by-step walkthrough of income and expenses, forming the foundation of your cold chain business financial planning. Designed to enhance accuracy in revenue projection and cost analysis, it supports sound decision-making and strategic growth in cold chain logistics and supply chain financial management.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is a vital component of the cold chain startup financial model, providing a comprehensive view of current and long-term assets, liabilities, and equity. This essential report empowers stakeholders with critical data for accurate cold chain financial forecasting, cost analysis, and performance evaluation. By integrating this balance sheet within the cold chain business financial model, users can efficiently calculate key financial ratios and metrics, enhancing strategic decision-making and financial planning across the cold chain supply chain ecosystem.

COLD CHAIN FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our cold chain financial model expertly combines two robust valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). This integrated approach delivers precise revenue projection, cash flow analysis, and profit and loss forecasting, enabling informed cold chain investment financial planning. By accurately representing expected financial performance, it supports effective budgeting, expense tracking, and comprehensive cold chain business financial modeling to optimize operational and supply chain decisions.

Cap Table

The pro forma projection and capitalization table (Cap table) provide a clear overview of your cold chain startup financial model by detailing investor information, equity shares, and investment amounts. This essential component of your cold chain business financial model empowers strategic cold chain financial forecasting and investment planning, ensuring transparent cold chain asset management and facilitating informed decision-making for sustainable growth.

COLD CHAIN PROJECTED INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Accelerate startup success by forecasting all three financial statements with a comprehensive cold chain financial model.

Optimize global cold chain investments effortlessly with our financial model supporting 161 currencies for precise projections.

The cold chain financial model ensures accurate 5-year projections, optimizing tax planning and maximizing investment returns.

The cold chain market analysis financial model empowers precise competitive insights for strategic, data-driven decision-making and growth.

The cold chain startup financial model proves your loan repayment ability, boosting investor confidence and securing funding.

COLD CHAIN FINANCIAL MODEL BUSINESS PLAN ADVANTAGES

Optimize profits and minimize risks with our comprehensive cold chain financial forecasting model—get it right the first time.

Optimize funding success with a cold chain financial forecasting model that ensures clear, confident investment decisions.

The cold chain financial forecasting model delivers accurate insights through a convenient all-in-one dashboard for strategic planning.

The cold chain financial forecasting model delivers comprehensive reports, assumptions, KPIs, and visual insights for strategic decision-making.

The cold chain financial forecasting model enables better decision making through precise revenue projection and expense tracking.

Leverage the cold chain cash flow financial model to confidently forecast scenarios and optimize operational investment decisions.

The cold chain financial forecasting model saves you time by streamlining budgeting and improving accuracy for smarter decisions.

The cold chain cash flow financial model streamlines budgeting, letting you focus on growth, products, and customer success.

The cold chain financial forecasting model saves time and money by optimizing budgeting and boosting profit accuracy.

The cold chain startup financial model simplifies projections, enabling effortless growth planning without complex formulas or costly consultants.