Commercial Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Commercial Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Commercial Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COMMERCIAL BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

This sophisticated 5-year commercial bank financial model template is designed for startups at any size or stage, providing comprehensive commercial bank financial projections and financial forecasting for commercial banks with minimal prior financial planning experience or advanced Excel skills required. Featuring a robust commercial bank valuation model along with bank financial statement analysis and commercial bank revenue model capabilities, it enables users to conduct detailed commercial bank profitability analysis, bank cash flow modeling, and bank capital adequacy modeling. Fully unlocked and customizable, this commercial banking sector financial model supports bank asset and liability management, bank loan portfolio modeling, and commercial bank expense forecasting, making it an essential tool to get funded by banks or investors efficiently.

The commercial bank financial model template effectively alleviates common pain points faced by financial analysts and investors by offering a comprehensive, ready-made Excel framework that integrates detailed commercial bank financial projections with robust bank asset and liability management model features. It simplifies the complexity of bank financial statement analysis and enhances accuracy in financial forecasting for commercial banks by incorporating a bank cash flow model, bank loan portfolio modeling, and a commercial bank revenue model, ensuring dynamic, scenario-based profitability and expense forecasting. Additionally, this template addresses critical risk assessment needs through a commercial bank risk assessment model and bank credit risk financial model, while supporting strategic decisions with bank capital adequacy modeling and bank interest income projection models, ultimately delivering an all-encompassing tool for commercial bank budgeting, performance analysis, and valuation modeling.

Description

This comprehensive commercial bank financial model template is designed to provide detailed financial projections, including a 5-year forecast that integrates bank financial statement analysis, bank loan portfolio modeling, and commercial bank revenue model components. It offers robust bank cash flow models and expense forecasting tools, along with bank asset and liability management models, enabling users to perform commercial bank profitability analysis and commercial bank risk assessment model evaluations effectively. The template supports financial modeling for banks by automating updates across all key metrics such as bank interest income projection models, bank capital adequacy modeling, and bank credit risk financial models once inputs are adjusted, making it an essential tool for financial forecasting for commercial banks and comprehensive bank financial performance model development.

COMMERCIAL BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our commercial bank financial model template offers a comprehensive roadmap for your institution’s success. Designed for financial modeling for banks, it enables in-depth commercial bank financial projections, profitability analysis, and bank asset and liability management modeling. This powerful tool highlights how long your capital will sustain operations while identifying key milestones achievable within that period. With capabilities spanning bank financial statement analysis, commercial bank revenue model, and bank credit risk financial model, it empowers strategic decision-making and robust financial forecasting for commercial banks, ensuring your bank’s sustainable growth and optimized performance.

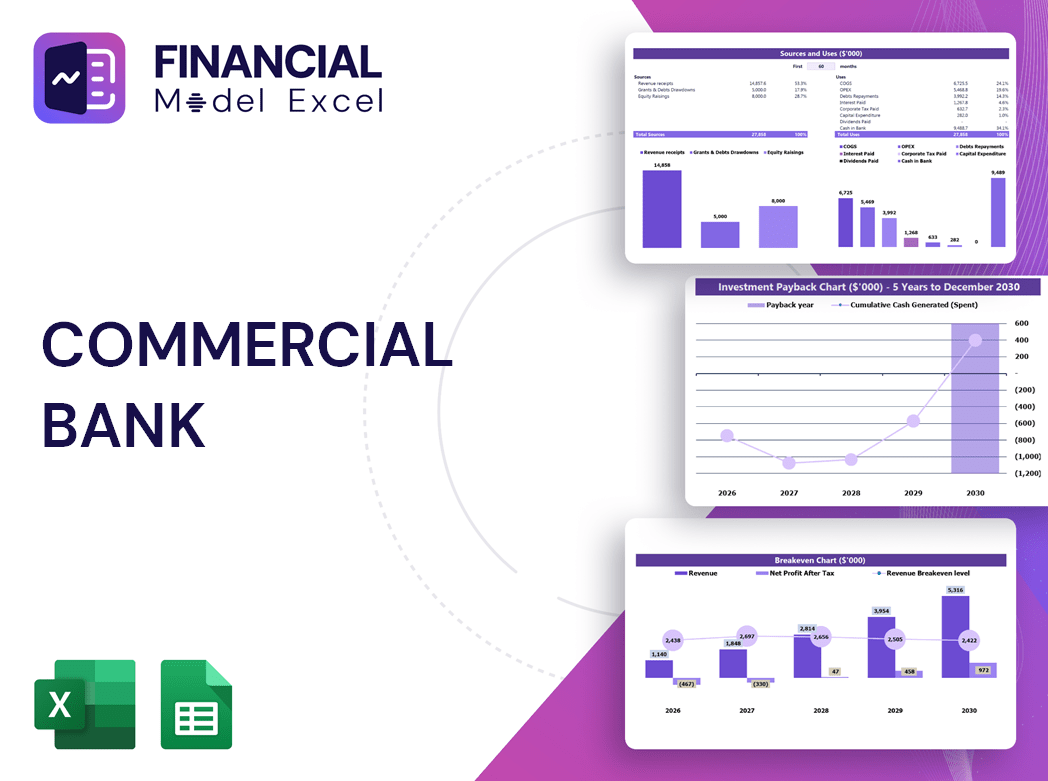

Dashboard

Our commercial bank financial model template features an all-in-one dashboard designed for fast, reliable, and transparent financial forecasting. Ideal for financial modeling for banks, it streamlines bank financial statement analysis, commercial bank revenue model evaluation, and bank loan portfolio modeling. This powerful tool enables efficient bank financial performance model reviews, bank cash flow modeling, and bank capital adequacy modeling—all vital for effective commercial bank profitability analysis and risk assessment. Empower your decision-making with instant access to key financial projections, KPIs, and detailed insights, ensuring strategic financial management and enhanced stakeholder communication.

Business Financial Statements

All three financial statements are essential for comprehensive commercial bank financial modeling. The income statement offers detailed insight into core revenue and expense drivers, aiding commercial bank profitability analysis and bank interest income projection modeling. Meanwhile, the projected balance sheet template supports effective bank asset and liability management and capital adequacy modeling. Complemented by a robust bank cash flow model, these tools enable precise financial forecasting for commercial banks and enhance bank financial statement analysis, ultimately driving informed decision-making within the commercial banking sector financial model.

Sources And Uses Statement

This commercial bank financial model template offers a comprehensive view of cash flow sources and their allocation within the institution. By integrating bank financial statement analysis and commercial bank revenue model insights, it enables structured financial forecasting for commercial banks and streamlined reporting. Detailed bank cash flow modeling and bank interest income projection models ensure accurate income tracking, supporting effective bank profitability analysis and expense forecasting. Ideal for financial modeling for banks, this tool empowers precise financial planning, risk assessment, and asset-liability management—making it essential for strategic decision-making and sustainable growth in the commercial banking sector.

Break Even Point In Sales Dollars

This commercial bank financial model template integrates break-even analysis to identify the sales volume required to cover fixed and variable costs, guiding profitability timelines. Leveraging financial forecasting for commercial banks, it enables management to adjust pricing, optimize expense forecasting, and refine revenue models for improved outcomes. By combining bank financial statement analysis with a bank cash flow model, this tool supports strategic decisions on loan portfolios and asset-liability management. Ultimately, the model provides a comprehensive commercial bank financial projection framework, helping stakeholders assess investment returns and enhance overall bank profitability analysis.

Top Revenue

The Top Revenue tab in our commercial bank financial model template presents a detailed breakdown of your revenue streams. This powerful tool enables precise financial forecasting for commercial banks, offering annual insights into revenue depth and revenue bridges across your banking products. Leverage this feature to enhance your commercial bank revenue model, optimize profitability analysis, and support strategic decision-making with accurate bank financial projections.

Business Top Expenses Spreadsheet

Effective cost control is vital for maximizing profitability in commercial banking. Utilizing a comprehensive commercial bank financial model template allows precise categorization and analysis of expenses, including an 'other' category for thorough oversight. This approach supports accurate commercial bank expense forecasting and financial projections, enabling informed decision-making. By leveraging bank financial statement analysis and financial forecasting for commercial banks, institutions can manage costs efficiently, enhance profitability, and drive sustainable growth. Robust financial modeling for banks is essential to optimize capital adequacy, asset-liability management, and overall financial performance.

COMMERCIAL BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective expense forecasting is vital in commercial bank financial modeling. Our 5-year commercial bank financial projections template enables precise budgeting and expense tracking over extended periods. It incorporates key parameters such as income percentages, payroll, recurring costs, and capital expenses, categorizing them as variable or fixed, COGS, wages, and capital budgets. This comprehensive commercial bank financial model template supports bank expense forecasting, profitability analysis, and financial statement analysis—empowering financial professionals with a robust tool for accurate financial forecasting and strategic decision-making in the commercial banking sector.

CAPEX Spending

CapEx, or capital expenditure, represents a company’s investments in acquiring or building long-term assets. These significant expenditures enhance the company’s value over multiple periods. In financial modeling for banks, accurate CapEx forecasting is essential for preparing commercial bank financial projections and bank financial statement analysis. Rather than expensing the full cost immediately, CapEx is capitalized and reflected on the pro forma balance sheet template. This approach ensures precise commercial bank financial performance modeling, supporting robust bank asset and liability management models and enhancing commercial bank profitability analysis.

Loan Financing Calculator

Our commercial bank financial model template features an integrated loan amortization plan that accurately calculates principal and interest payments. Utilizing this bank loan portfolio modeling tool, you can generate precise monthly payment schedules based on loan amount, interest rate, term, and payment frequency. This essential component enhances your commercial bank financial projections, supporting effective bank asset and liability management and improving overall financial forecasting for commercial banks.

COMMERCIAL BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT (Earnings Before Interest and Taxes) is a critical metric included in commercial bank financial projections and valuation models. It represents the bank’s core operating performance by excluding non-operational income and expenses, offering clear insight into earning potential. Integrating EBIT within financial forecasting for commercial banks and bank financial statement analysis enables more accurate commercial bank profitability analysis. This focus helps stakeholders, including investors and management, evaluate sustainable earnings and supports robust bank financial performance models essential for strategic decision-making.

Cash Flow Forecast Excel

Your startup's pro forma template, integrated with a robust bank cash flow model, demonstrates the ability to manage cash flows effectively and generate sufficient liquidity to meet liabilities. Financial forecasting for commercial banks emphasizes the importance of reliable five-year financial projections to assure lenders of your repayment capacity. Utilizing a commercial bank financial model template enhances transparency in bank financial statement analysis and commercial bank profitability analysis, increasing confidence in your loan portfolio modeling and overall financial performance model. This strategic approach strengthens your position during bank credit risk evaluation and capital adequacy modeling.

KPI Benchmarks

The Profit and Loss Projection Benchmark tab evaluates a commercial bank’s key financial and business performance metrics, comparing them against industry-wide averages. Utilizing these benchmarks enhances financial modeling for banks by estimating relative value and identifying best practices in the commercial banking sector. Such benchmarking is essential for accurate commercial bank financial projections, profitability analysis, and risk assessment modeling. It empowers banks to align strategies with industry standards, optimize bank financial statement analysis, and improve expense forecasting, ultimately supporting robust financial forecasting and strategic decision-making in banking operations.

P&L Statement Excel

The Monthly Income Statement in this commercial bank financial model template offers detailed, timely reporting ideal for ongoing financial monitoring. It integrates all revenue streams, linking gross and net earnings with comprehensive revenue analysis for precise insights. The Yearly Pro Forma Income Statement provides a clear overview of revenue alongside general and administrative expenses. Enhanced with graphs, key ratios, margins, net profit, and expense breakdowns, it supports thorough commercial bank profitability analysis and financial forecasting. This model is essential for robust financial modeling for banks, ensuring accurate, data-driven decision-making.

Pro Forma Balance Sheet Template Excel

This commercial bank financial model template integrates monthly and annual pro forma balance sheets with detailed cash flow forecasting, profit & loss projections, and comprehensive bank financial statement analysis. Designed for financial modeling for banks, it offers a complete view of assets, liabilities, and equity aligned with the commercial bank revenue model and expense forecasting. This holistic commercial banking sector financial model enables precise financial forecasting for commercial banks, supporting effective bank asset and liability management, capital adequacy modeling, and profitability analysis—empowering users with robust insights for strategic decision-making.

COMMERCIAL BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our commercial bank financial model template integrates two robust valuation methods: Discounted Cash Flow (DCF) and Weighted Average Cost of Capital (WACC). This comprehensive approach enables precise financial forecasting for commercial banks, enhancing bank financial statement analysis and profitability analysis. By combining these techniques, the model delivers accurate projections of bank cash flow and capital adequacy, supporting strategic decision-making in bank asset and liability management. Ideal for financial modeling for banks, this tool drives insightful commercial bank revenue modeling and risk assessment, empowering institutions to optimize financial performance and growth.

Cap Table

Our commercial bank financial model template seamlessly integrates the capitalization table into cash flow projections, linking funding rounds to financial instruments like equity and convertible notes. This approach enhances bank financial projections by clearly illustrating the impact of strategic decisions on share ownership and dilution. Designed for precise bank financial statement analysis and commercial bank profitability analysis, this model supports robust financial forecasting for commercial banks and aids in capital adequacy modeling and revenue optimization. Experience comprehensive financial modeling for banks that drives informed decision-making and strengthens overall commercial banking sector financial performance.

COMMERCIAL BANK STARTUP COSTS TEMPLATE ADVANTAGES

Make confident hiring decisions using the commercial bank financial model template for accurate, data-driven financial planning.

The commercial bank financial projection model enhances accuracy, preventing overdue payments and optimizing cash flow management effectively.

Optimize cash flow timing confidently using our commercial bank cash flow model for accurate accounts payable and receivable projections.

The commercial bank financial model template forecasts cash flow precisely, enabling proactive management of shortages and surpluses.

The commercial bank financial model template enables precise forecasting, enhancing startup readiness for upcoming financial changes.

COMMERCIAL BANK BUDGET FINANCIAL MODEL ADVANTAGES

Unlock precise insights and drive profitability with our comprehensive commercial bank financial model template and print-ready reports.

Enhance decision-making with a comprehensive commercial bank financial model offering print-ready reports and detailed financial projections.

Leverage our commercial bank financial model template to accurately plan for future growth and enhance strategic decision-making.

A commercial bank financial projections model empowers accurate growth planning and strategic decision-making with effortless forecasting.

Accelerate decision-making with our commercial bank financial model template—update anytime for precise, real-time insights.

The commercial bank financial model template enables dynamic forecasting and precise adjustments for accurate, ongoing financial projections.

Save time and money with our commercial bank financial projections for accurate, efficient, and insightful decision-making.

Our commercial bank financial model template delivers expert projections effortlessly, saving costs and freeing you to focus on strategic growth.

Our commercial bank financial model template ensures accurate, timely forecasts for informed decisions and confident external stakeholder reporting.

A commercial bank financial model enhances accurate forecasting, improving loan approvals and optimizing bank financial performance effectively.