Concrete And Masonry Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Concrete And Masonry Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Concrete And Masonry Company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONCRETE AND MASONRY COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly financial modeling template designed specifically for concrete and masonry companies, this comprehensive tool includes a masonry business budget template, profit and loss statement for construction company, and a detailed cash flow forecast for masonry firms. Ideal for both startups and established businesses, it supports construction company financial planning by offering projected financial statements, balance sheet setup for construction companies, and revenue forecasting for masonry contractors over a 5-year period. This unlocked model facilitates thorough financial analysis for concrete contractors, cost estimation modeling for concrete projects, and break-even analysis for concrete company operations—enabling efficient working capital management, capital expenditure planning, and financial risk assessment for masonry businesses.

Our ready-made financial model Excel template addresses critical pain points faced by concrete and masonry business owners by providing a comprehensive financial planning tool that includes detailed cash flow forecasts for masonry firms and profit and loss statements for construction companies. It simplifies complex financial analysis for concrete contractors through automated balance sheet setup and financial statement modeling tailored specifically for masonry businesses, enabling accurate revenue forecasting and cost estimation models for concrete projects. This template incorporates key financial metrics for masonry businesses, supports capital expenditure planning for construction firms, and facilitates working capital management to optimize operating expense budgets. Moreover, users benefit from a built-in break-even analysis for concrete companies and investment appraisal for masonry services, reducing financial risks with clear financial dashboards and allowing for efficient project financial projections over a five-year horizon.

Description

This comprehensive financial model for a concrete and masonry company integrates detailed financial analysis for concrete contractors with construction company financial planning tools, including revenue forecasting for masonry contractors and a masonry business budget template. It features projected financial statements concrete company owners can rely on, encompassing a profit and loss statement for construction companies, balance sheet setup for construction companies, and cash flow forecast for masonry firms. The model also supports financial modeling for construction companies by incorporating essential financial metrics for masonry business, break-even analysis for concrete company operations, and cost estimation models for concrete projects. Additionally, it addresses capital expenditure planning for construction firms, working capital management construction, and includes investment appraisal for masonry services, all within an easy-to-use financial dashboard for masonry contractors to ensure effective operating expense budget construction company management and comprehensive financial risk assessment masonry business.

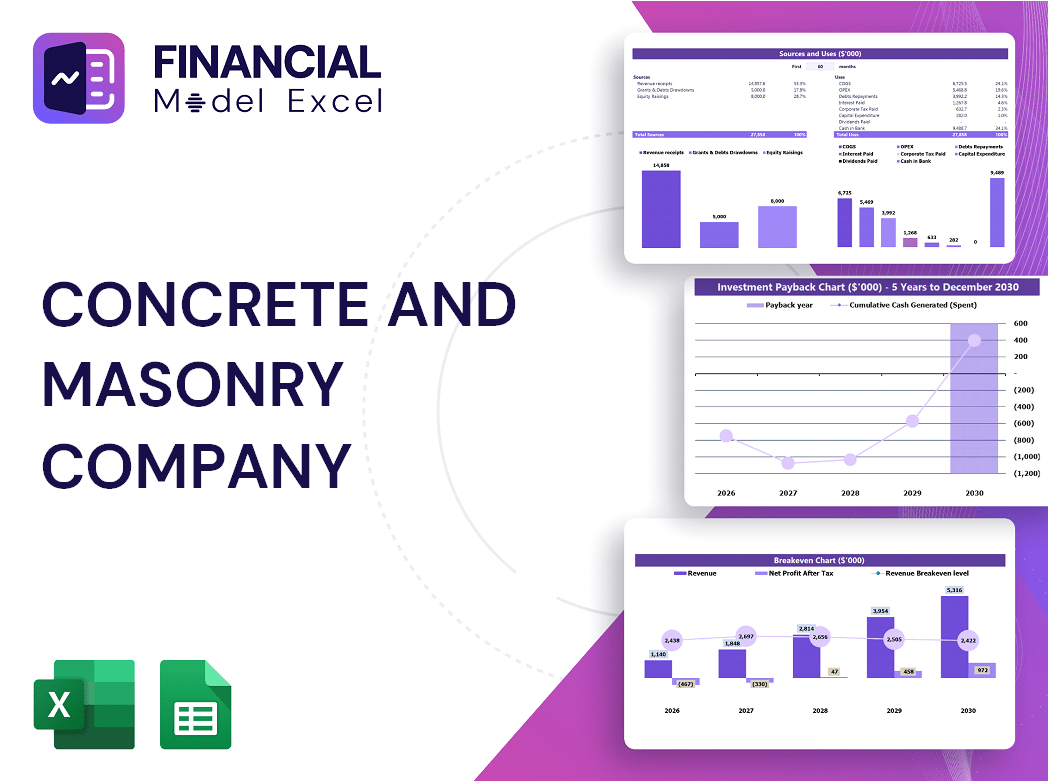

CONCRETE AND MASONRY COMPANY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive concrete and masonry company financial projections deliver an all-in-one solution featuring profit and loss statements, cash flow forecasts, and balance sheet setups. Designed for construction company financial planning, this three-way financial model integrates detailed financial analysis for concrete contractors and masonry firms. Benefit from insightful revenue forecasting, break-even analysis, and operating expense budgets, alongside monthly and annual performance reviews. Perfect for startups and established businesses seeking robust financial modeling, working capital management, and capital expenditure planning tailored specifically to the masonry and concrete industry. Elevate your financial strategy with our expert financial dashboard and projected financial statements.

Dashboard

Sharing access to your company’s pro forma cash flow forecast through a centralized financial dashboard empowers all stakeholders with real-time insights. Enhancing transparency and collaboration not only sharpens your financial modeling for construction companies but also optimizes working capital management and revenue forecasting for masonry contractors. Leveraging these tools elevates your construction company financial planning, making your concrete and masonry company financial projections more accurate, dynamic, and actionable—driving smarter decisions and sustainable growth.

Business Financial Statements

Startup financial statements for concrete and masonry companies include three key reports: the Profit and Loss Statement, detailing revenues, expenses, depreciation, taxes, and interest; the Balance Sheet, presenting assets, liabilities, and shareholders’ equity to ensure financial balance; and the Cash Flow Statement, tracking cash inflows and outflows to assess actual liquidity. These foundational financial statements support robust financial modeling, cash flow forecasting, and construction company financial planning, empowering masonry firms with accurate financial analysis, risk assessment, and strategic budgeting for sustainable growth.

Sources And Uses Statement

This 5-year financial projection template offers concrete and masonry companies a clear view of cash flow sources and their distribution, enabling precise financial planning. Designed for construction company financial planning, it streamlines reporting by analyzing all income streams in detail. Ideal for financial modeling for construction companies, this pro forma income statement template simplifies budgeting and enhances financial analysis for concrete contractors and masonry firms. Empower your masonry business with accurate revenue forecasting, cost estimation, and working capital management using this reliable and professional tool.

Break Even Point In Sales Dollars

A break-even analysis for concrete and masonry companies identifies the sales volume needed to cover fixed and variable costs, crucial for accurate financial projections. Using a profit and loss statement for construction companies, managers can pinpoint when profitability begins and estimate the time to return investments. This financial modeling empowers stakeholders to assess business viability, optimize pricing strategies, and adjust assumptions in the masonry business budget template. By leveraging these insights, concrete contractors improve cash flow forecasts and enhance overall financial planning for sustained growth and risk management.

Top Revenue

The top line and bottom line are crucial in construction company financial planning, especially in concrete and masonry business budgets. The top line, representing revenue in profit and loss statements, signals growth when increasing, directly influencing cash flow forecasts and profitability. Investors closely analyze these financial metrics for masonry contractors, using financial modeling and projected financial statements to assess performance. Understanding top-line growth through revenue forecasting and bottom-line results via profit analysis enables effective operating expense budgeting and working capital management in construction firms, driving informed decisions and sustainable success in the masonry and concrete industry.

Business Top Expenses Spreadsheet

Our Excel financial model for concrete and masonry companies features a streamlined top expenses tab, highlighting your four largest costs while consolidating all remaining expenses under ‘Other.’ This dynamic model leverages your input assumptions to automatically calculate and update expenses, delivering an insightful snapshot for efficient financial analysis. Ideal for construction company financial planning, this tool supports accurate cost estimation, cash flow forecasting, and operating expense budgeting—empowering masonry contractors to confidently manage their financial metrics and drive profitability.

CONCRETE AND MASONRY COMPANY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Every concrete and masonry company’s financial projections must accurately capture startup costs, incurred before completing strategic milestones. Effective financial planning for construction companies ensures these expenses don’t cause significant losses or cash flow issues. Utilizing a profit and loss statement for construction companies, alongside a masonry business budget template, helps create comprehensive operating expense budgets. Leveraging financial modeling for construction companies allows for precise cost estimation and cash flow forecasts, safeguarding working capital management and supporting sustainable growth through informed capital expenditure planning and financial risk assessment.

CAPEX Spending

A capital expenditure budget is integral to financial modeling for construction companies, closely tied to Excel-based financial models. It plays a crucial role in accurately estimating capex, ensuring effective monitoring and evaluation of capital spending. This planned expenditure provides key insights into asset growth, essential for projection and startup cost analysis. By integrating capital expenditure planning with your masonry business budget template and cash flow forecast, you can enhance financial analysis for concrete contractors and improve overall working capital management in your construction company.

Loan Financing Calculator

Our financial modeling template for concrete and masonry companies features an integrated loan amortization schedule, enabling precise differentiation between principal and interest payments. Effortlessly track repayment amounts, payment frequency, and loan duration, ensuring accurate cash flow forecasts and streamlined working capital management. This tool supports comprehensive financial planning, enhancing your construction company’s budgeting, investment appraisal, and risk assessment processes with clarity and accuracy.

CONCRETE AND MASONRY COMPANY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Internal Rate of Return (IRR) is a crucial metric in financial modeling for construction companies, especially within profit and loss statements and masonry business budget templates. IRR estimates the profitability of potential investments by identifying the discount rate that sets the net present value (NPV) of all cash flows to zero. Presented as a percentage, IRR guides investors, analysts, and contractors in financial planning and risk assessment for concrete and masonry firms, ensuring informed decisions in capital expenditure planning and cash flow forecasting. Integrating IRR enhances the accuracy of project financial projections and investment appraisals.

Cash Flow Forecast Excel

A cash flow forecast is essential for construction company financial planning, providing clear visibility into money inflows and outflows. Utilizing a pro forma cash flow statement template enables concrete and masonry companies to efficiently manage working capital, optimize operating expenses, and support revenue forecasting for masonry contractors. This financial modeling tool helps track capital turnover and improve profitability, serving as a foundation for break-even analysis and investment appraisal. For business owners, adopting a cash flow Excel spreadsheet enhances financial analysis for concrete contractors, ensuring informed decision-making and sustainable growth in project execution and overall masonry business success.

KPI Benchmarks

This comprehensive financial template features a dedicated tab for financial benchmarking research, enabling detailed financial analysis for concrete and masonry companies. Users can compare key financial metrics—such as cash flow forecasts, profit and loss statements, and balance sheet setups—against industry standards. This empowers masonry contractors to evaluate their competitiveness, operational efficiency, and productivity effectively. Leveraging this benchmarking study supports informed construction company financial planning and enhances strategic decision-making for sustainable growth.

P&L Statement Excel

To safeguard your concrete and masonry company’s financial future, leveraging a detailed profit and loss statement for construction companies is essential. Utilizing a masonry business budget template and projected financial statements enables accurate revenue forecasting and cash flow forecasting for masonry firms. Our financial modeling for construction companies delivers annual reports that guide strategic decisions, reflecting past performance and future projections. This approach supports effective working capital management, cost estimation models, and break-even analysis—crucial tools for startups and growing businesses aiming to optimize profitability and sustain long-term growth.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet template for concrete and masonry companies offers a detailed financial modeling tool, highlighting key assets—from cash and inventory to fixed assets and equipment—alongside current and non-current liabilities and equity. This essential financial statement supports construction company financial planning by providing a clear snapshot of financial health at a given time. For startups, a projected balance sheet is vital when seeking financing, giving creditors insight into asset allocation, liabilities, and ownership structure, thereby strengthening loan applications and enabling informed investment appraisal for masonry services.

CONCRETE AND MASONRY COMPANY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive startup financial plan template includes a robust valuation analysis tool designed for concrete and masonry companies. It facilitates discounted cash flow (DCF) valuation while seamlessly integrating key financial metrics such as residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for financial modeling and investment appraisal, this template empowers construction firms to perform precise financial analysis, enhance financial planning, and strengthen project evaluations. Elevate your masonry business budget template with this essential tool for accurate revenue forecasting, cash flow forecasting, and informed capital expenditure planning.

Cap Table

The startup financial model template in Excel, including a cap table, is vital for construction companies’ financial planning. It clearly outlines ownership structure, equity distribution, and stakeholder valuations, crucial for effective financial modeling for construction companies and masonry business budget templates. This tool supports investment appraisal for masonry services and enables accurate financial analysis for concrete contractors. Integrating this cap table with projected financial statements for concrete companies and cash flow forecasts for masonry firms ensures comprehensive financial risk assessment and working capital management construction businesses need to drive sustainable growth.

CONCRETE AND MASONRY COMPANY FINANCIAL PLANNING MODEL ADVANTAGES

Financial modeling for construction companies enables precise budgeting, boosting profitability and strategic financial planning efficiency.

Gain precise control and boost profitability with our concrete and masonry company financial projections spreadsheet.

Accurately estimating expenses with our financial model empowers concrete and masonry companies to optimize budgets and maximize profits.

Our 5-year financial model accurately forecasts break-even points and maximizes ROI for masonry and concrete companies.

Secure lender confidence and timely repayments with precise financial modeling tailored for concrete and masonry companies.

CONCRETE AND MASONRY COMPANY STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Optimize cash flow and ensure budget control with our precise financial modeling for concrete and masonry companies.

Accurate cash flow forecasts empower masonry firms to proactively manage finances and optimize future profitability.

Our financial modeling for construction companies simplifies budgeting, boosting accuracy and driving smarter masonry business decisions.

Streamlined, color-coded financial modeling empowers concrete and masonry firms with clear, actionable insights for confident decision-making.

Optimize growth with our 5-year financial modeling for construction companies, ensuring strategic planning and profitability.

Streamline 5-year masonry financial planning with automated, fully integrated monthly projections and annual summary aggregation.

Accurate financial modeling ensures your concrete company confidently demonstrates loan repayment ability to secure funding.

Financial modeling for construction companies boosts loan approval by clearly demonstrating reliable cash flow and repayment plans.

Simple-to-use financial modeling empowers masonry companies with accurate cash flow forecasts and profitable project insights.

Our concrete and masonry financial model delivers quick, reliable insights with minimal experience, accelerating your business growth confidently.