Cooking School Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Cooking School Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Cooking School Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COOKING SCHOOL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The cooking school financial planning model and financial projection for cooking school in Excel template provide an essential tool for startups or established culinary academies to develop a comprehensive financial strategy for cooking academy operations. This culinary business budgeting model enables precise cooking class income forecasts, detailed profit and loss forecast cooking school reports, and a robust cooking school cash flow model to manage expenses efficiently. Designed to support fundraising efforts, the cooking school funding model calculates funding requirements and performs cooking school break-even analysis, ensuring financial sustainability for culinary education ventures. Its versatile financial budgeting for culinary school features allow businesses to enhance their business plan, evaluate investment potential, and optimize their cooking school expense management model—making it an indispensable resource for financial analysis for cooking classes and culinary training center financial forecasts.

This comprehensive cooking school financial planning model Excel template alleviates the complexities of managing your culinary school's financial sustainability by offering a detailed culinary school revenue model and cooking class income forecast that accurately project your business’s cash flow and profitability over a 5-year period. With integrated profit and loss forecast cooking school statements and a precise cooking school expense management model, it helps you pinpoint cost structures for cooking classes and optimize your culinary business budgeting model to enhance financial strategy for your cooking academy. The built-in cooking school break-even analysis and cooking academy investment plan empower you to make informed decisions, while the financial budgeting for culinary school and culinary education financial model components enable clear visibility into funding needs and financial planning for cooking school business growth, ensuring a robust financial analysis for cooking classes and long-term success.

Description

This comprehensive culinary education financial model serves as an essential tool for analyzing the financial sustainability of your cooking academy by providing detailed financial projections including a cooking class income forecast, profit and loss forecast for cooking school operations, and a precise cooking school break-even analysis. It incorporates a culinary school revenue model and culinary business budgeting model to accurately forecast cash flow and manage expenses using a cooking school expense management model, while also supporting strategic financial planning through a financial strategy for cooking academy and an investment plan tailored to culinary training centers. Designed to support both startups and established cooking schools, this financial plan for cooking school business ensures precise financial budgeting for culinary school projects, offers a thorough financial analysis for cooking classes, and facilitates an effective cooking school funding model, making it easier to make informed business decisions and maintain robust profitability over a 60-month period.

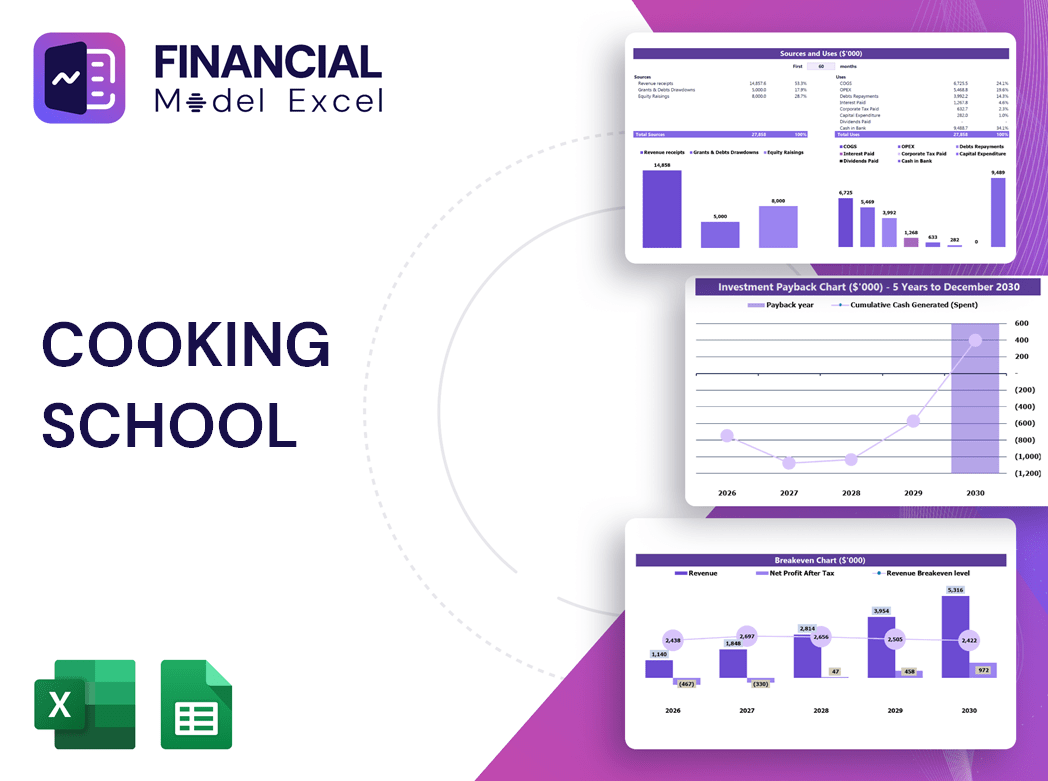

COOKING SCHOOL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Investors demand a robust financial plan for cooking school businesses. Our comprehensive cooking school financial model and financial projection excel template are essential tools to attract funding. This culinary school revenue model clearly outlines start-up capital needs, detailed cost structure for cooking classes, and a precise profit and loss forecast. With built-in cooking school break-even analysis and cash flow modeling, it ensures financial sustainability and confidence in your cooking academy investment plan. Use our financial budgeting for culinary school to validate returns and secure investor trust effectively.

Dashboard

By inputting detailed data into our cooking school financial planning model, you’ll quickly develop a robust three-way financial projection for your culinary academy. Utilize the built-in financial analysis for cooking classes within our Excel template to evaluate your profit and loss forecast and cash flow model. Strategic adjustments based on these insights will enhance your cooking school’s financial sustainability and investment appeal. The Dashboard tab offers clear graphs and charts, empowering you to optimize your culinary business budgeting model and secure a prosperous future for your cooking school startup.

Business Financial Statements

A comprehensive financial planning model for a cooking school integrates the profit and loss forecast, balance sheet, and cash flow model to deliver a full-spectrum analysis. The pro forma income statement reveals key culinary class income forecasts and expense management, spotlighting operational profitability. Meanwhile, the startup financial model, coupled with cash flow projections, illuminates asset management and capital structure. This multifaceted financial strategy for cooking academies ensures sustainable growth, effective budgeting, and informed investment planning within the culinary education financial framework.

Sources And Uses Statement

The sources and uses of funds statement within a cooking school startup financial model is a crucial tool for pinpointing funding origins and detecting cash flow inefficiencies. This financial analysis for cooking classes ensures precise expense management and supports a robust culinary school revenue model. By integrating this approach into your culinary education financial model, you can enhance financial sustainability, optimize budgeting, and drive strategic investment plans, ultimately securing the long-term success of your cooking academy.

Break Even Point In Sales Dollars

This comprehensive cooking school financial planning model features a dynamic break-even sales calculator for up to five years. It delivers precise break-even analysis in both numeric and chart formats, empowering culinary academies with clear insights into revenue thresholds. Ideal for financial budgeting, expense management, and profit forecasting, this tool supports sustainable growth and strategic decision-making for cooking class income forecasts and culinary school financial sustainability.

Top Revenue

In any culinary school financial planning model, the top line represents gross revenue, while the bottom line reflects net profit—both critical in the profit and loss forecast for cooking schools. Investors and stakeholders closely monitor these figures through financial projections to assess growth and sustainability. Top-line growth signals successful revenue strategies within the culinary school revenue model, positively affecting financial sustainability and cash flow. Effective expense management and budgeting models ensure the cooking academy’s financial health, making the financial strategy for cooking schools essential for long-term profitability and attracting investment.

Business Top Expenses Spreadsheet

Accurate financial projection for cooking schools is essential for sustainable growth. Developing a robust cooking school startup financial model ensures reliable culinary school revenue models and precise cooking class income forecasts. Management must focus on detailed financial analysis and effective expense management models to optimize profitability. Utilizing proforma templates and culinary education financial models helps forecast future revenues, supporting sound financial planning for cooking academies. A well-structured financial strategy, including break-even analysis and cash flow modeling, drives the cooking school's long-term financial sustainability and successful investment planning.

COOKING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive cooking school financial planning model offers a robust expense management framework, enabling precise cost structure forecasting up to five years. This culinary school budgeting model captures all expense categories—including COGS, fixed, variable costs, wages, and CAPEX—allowing dynamic adjustment based on revenue percentages and growth rates. Designed for culinary academies, it supports accurate financial projections, facilitating effective profit and loss forecasts and ensuring financial sustainability. Empower your cooking class income forecast and cash flow management with this specialized financial strategy tool tailored for culinary education businesses.

CAPEX Spending

The capital expenditure forecast in a cooking school financial planning model outlines essential investments to enhance the culinary school’s growth and performance. Unlike operating costs, CAPEX excludes salaries and daily expenses, focusing solely on long-term asset development. This financial strategy for cooking academies highlights where to allocate resources effectively, ensuring financial sustainability and optimized growth. Since capital expenditure varies across culinary training centers, incorporating detailed CAPEX reports within the cooking school financial model is crucial for accurate financial projections, expense management, and informed decision-making in your culinary business budgeting model.

Loan Financing Calculator

Start-ups and early-stage cooking schools must carefully manage their loan repayment schedules as part of a comprehensive financial strategy. A detailed loan breakdown, including amounts and maturity terms, is essential for accurate culinary school cash flow modeling and financial sustainability. Principal repayments appear under financing activities in cash flow forecasts, while interest expenses directly impact the profit and loss forecast for cooking schools. Effective integration of these elements ensures precise financial projections and supports robust expense management models, enabling cooking academies to maintain strong financial health and achieve long-term growth.

COOKING SCHOOL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA—the earnings before interest, tax, depreciation, and amortization—is a key metric within the cooking school financial planning model. It serves as the primary indicator of operating performance in culinary school revenue models and financial projections for cooking schools. Incorporating EBITDA into your culinary academy’s financial strategy enables precise profit and loss forecasting, enhances expense management, and supports effective budgeting. This metric is essential for developing a robust cooking school startup financial model and ensuring financial sustainability in culinary education ventures.

Cash Flow Forecast Excel

A robust culinary school cash flow model is essential for projecting your cooking academy’s financial health, especially when seeking funding or loans. By accurately forecasting cash inflows and outflows, you ensure financial sustainability and avoid liquidity pitfalls. Integrating this financial strategy for cooking academies within your overall financial planning model enables precise revenue and expense management, strengthening your cooking school’s startup financial model. This proactive financial analysis not only supports successful budget planning but also boosts investor confidence through clear profit and loss forecasts and break-even analysis.

KPI Benchmarks

Leverage our intuitive cooking school financial planning model with built-in benchmarking tools to effortlessly conduct comparative industry analysis. This culinary school revenue model empowers you to evaluate your financial position, expense management, and profitability against peers. Gain critical insights into your cooking class income forecast, cost structure, and cash flow model, identifying gaps and opportunities for growth. Especially vital for startups, this financial strategy for cooking academies refines investment plans and enhances financial sustainability, ensuring your culinary training center thrives in a competitive market. Benchmark with confidence and drive your cooking school’s success.

P&L Statement Excel

For precise financial projections in your cooking school, an Excel-based profit and loss forecast is essential. This culinary school revenue model supports monthly and long-term forecasts up to five years, enhancing your financial strategy for cooking academy success. It not only predicts profits and losses but also tracks cash flow and expense management. Using this culinary education financial model enables accurate analysis of sales and cost structure for cooking classes, ensuring financial sustainability and informed decision-making. Streamline your cooking school startup financial model with this comprehensive tool for effective budgeting and forecasting.

Pro Forma Balance Sheet Template Excel

A comprehensive 5-year projected balance sheet in Excel is essential for any cooking school’s financial planning model. It details current and long-term assets, liabilities, and equity, forming the foundation for accurate culinary school revenue models and cash flow forecasts. This critical financial tool supports informed decisions through financial analysis for cooking classes and delivers key insights for profit and loss forecasts. By leveraging this data, cooking academies can optimize expense management models, perform break-even analysis, and strengthen their financial strategy for sustainable growth and investment planning.

COOKING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive cooking school startup financial model offers an essential financial planning framework that investors demand. Featuring a detailed profit and loss forecast and cash flow model, it demonstrates the cooking academy’s financial sustainability. The weighted average cost of capital (WACC) assures stakeholders of a minimum return on invested funds. Free cash flow valuation underlines the actual cash available to investors, while discounted cash flow analysis presents the present value of future earnings. This culinary school financial strategy and investment plan empower founders with clarity and confidence for successful growth and funding.

Cap Table

Our 3-year financial projection template Excel, paired with the cooking school cap table model, offers a comprehensive overview of your culinary academy’s investment plan. It details investor information, share distribution, and capital contributions, supporting your financial strategy for cooking academy success. This essential tool enhances your culinary school revenue model and financial sustainability by enabling precise cooking class income forecasts and effective expense management. Optimize your financial planning for cooking school startups and ensure robust financial analysis for cooking classes with this integrated budgeting and funding model.

COOKING SCHOOL FINANCIAL PLAN TEMPLATE EXCEL ADVANTAGES

Set clear objectives to optimize your cooking school's financial model for sustainable growth and accurate revenue forecasting.

The cooking school financial model ensures accurate 5-year cash flow projections, optimizing budgeting and boosting profitability.

Optimize cash flow and boost profitability with a cooking school financial model using pro forma Excel templates.

The 3-way financial model empowers precise forecasting, enhancing financial sustainability and profitability for cooking schools.

Unlock business growth and secure investment with a comprehensive cooking school financial model and strategic planning tool.

COOKING SCHOOL FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Our cooking school financial model ensures accurate 5-year forecasts, optimizing profitability and strategic growth with expert financial planning.

Our 5-year cooking school financial model ensures precise monthly forecasts with automated annual summaries for strategic planning.

Our cooking school financial model ensures accurate projections, boosting profitability and sustainability for startups.

Our cooking school financial model ensures precise budgeting and boosts investor confidence for a successful startup launch.

Optimize profitability and ensure sustainability with a comprehensive financial model tailored for cooking schools.

A comprehensive cooking school financial model ensures strategic funding success by accurately forecasting revenue and managing expenses effectively.

Optimize funding success with a comprehensive cooking school financial model that ensures clear projections and sustainable growth.

Impress investors confidently with our strategic 5-year cooking school financial model and comprehensive projection template.

Our cooking school financial model ensures precise cost control and maximizes profitability for sustainable culinary business growth.

Our cooking school financial planning model ensures precise budgeting and maximizes profitability for sustainable culinary education growth.