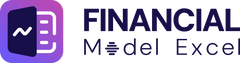

Credit Risk Evaluation Platform Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Credit Risk Evaluation Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Credit Risk Evaluation Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CREDIT RISK EVALUATION PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This advanced 5-year credit risk management solution and financial forecasting model is tailored for businesses of any size and development stage, requiring minimal financial planning experience and basic Excel skills. It serves as a comprehensive credit risk assessment tool and loan risk evaluation model, enabling quick, reliable results through integrated risk prediction algorithms and creditworthiness evaluation tools. Utilize this financial risk modeling software and credit risk prediction engine before acquiring credit portfolio analytics, ensuring confidence to secure funding from banks or investors. Fully unlocked and editable, it empowers users with a robust credit risk monitoring platform and financial risk quantification software for effective risk mitigation and strategic planning.

This credit risk management solution addresses critical pain points faced by financial professionals by integrating a robust credit risk assessment tool and loan risk evaluation model directly within an accessible Excel template. It simplifies complex financial forecasting models and credit portfolio analytics by automating the generation of comprehensive financial statements on both monthly and annual bases, reducing the time and expertise needed to perform in-depth risk analysis. By incorporating risk prediction algorithms and a credit scoring system, users can efficiently evaluate creditworthiness and monitor loan default risk, while diagnostic tools and feasibility matrices enhance the accuracy of financial risk quantification. Additionally, the model’s credit risk monitoring platform and financing options analysis provide actionable insights for risk mitigation and capital allocation, ultimately delivering a powerful financial risk assessment framework that supports early identification of potential debt risks and strategic decision-making.

Description

The credit risk assessment tool integrates a robust financial risk modeling software designed to deliver an all-encompassing credit scoring system and credit portfolio analytics, enabling precise loan risk evaluation models and loan default risk models. This risk analysis platform leverages advanced risk prediction algorithms within a financial risk assessment framework to provide detailed financial forecasting models and credit risk data platforms, supporting comprehensive credit risk management solutions. Users benefit from real-time credit risk monitoring platforms and financial credit scoring models that calculate accurate creditworthiness evaluation, while the debt risk analysis system and credit risk rating model ensure effective risk mitigation financial models. This credit risk prediction engine empowers businesses to generate detailed pro forma financial statements including profit and loss forecasts, cash flow forecasting tools, discounted cash flow (DCF) calculations, and five-year financial projections, streamlining credit risk quantification software to facilitate operational focus and strategic growth management.

CREDIT RISK EVALUATION PLATFORM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive credit risk assessment tool offers entrepreneurs an insightful financial forecasting model, combining income and cost assumptions to build accurate business scenarios. Leveraging advanced risk prediction algorithms within a credit risk management solution, users can evaluate creditworthiness and anticipate potential loan defaults effectively. This credit scoring system, integrated with a robust credit portfolio analytics platform, empowers strategic decision-making and optimizes financial outcomes.

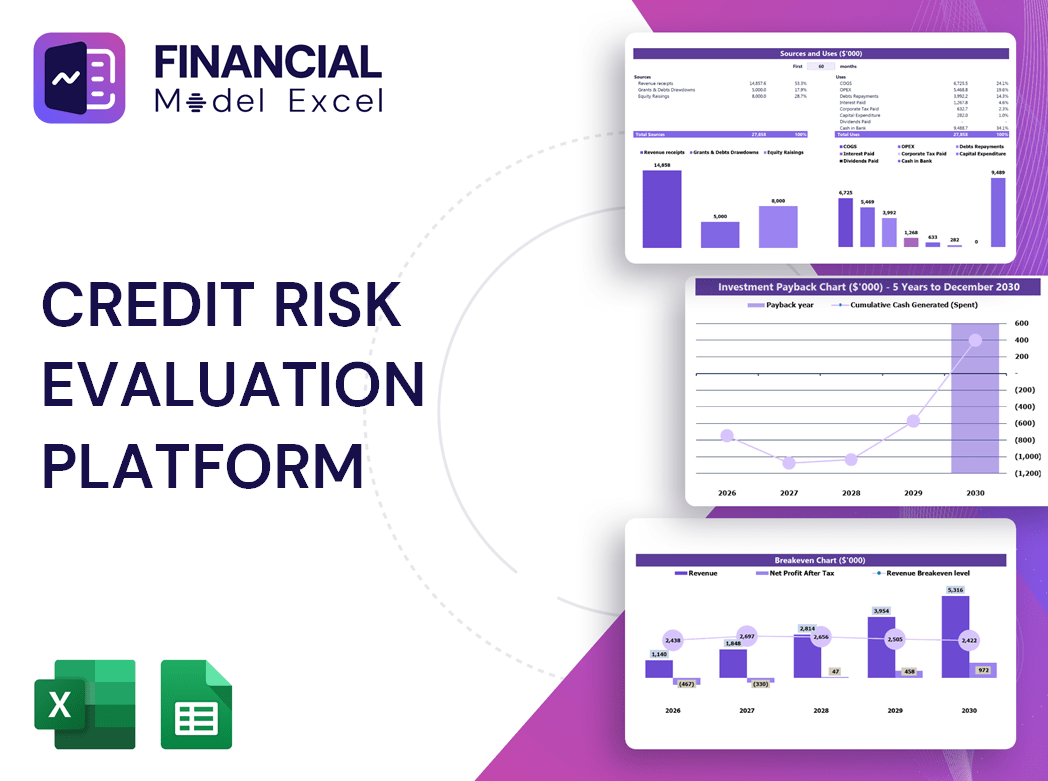

Dashboard

Leverage a robust credit risk management solution featuring an intuitive dashboard for comprehensive financial forecasting models and risk analysis platforms. Access to a dynamic credit risk data platform enables seamless sharing of your company’s financial insights with stakeholders. Integrating advanced risk prediction algorithms within your credit scoring system enhances transparency and supports informed decision-making. Elevate your financial reporting by combining loan risk evaluation models and credit portfolio analytics, ensuring a proactive approach to creditworthiness evaluation and debt risk analysis. Empower your team with a cutting-edge credit risk monitoring platform to optimize risk mitigation strategies and foster confidence among investors and partners.

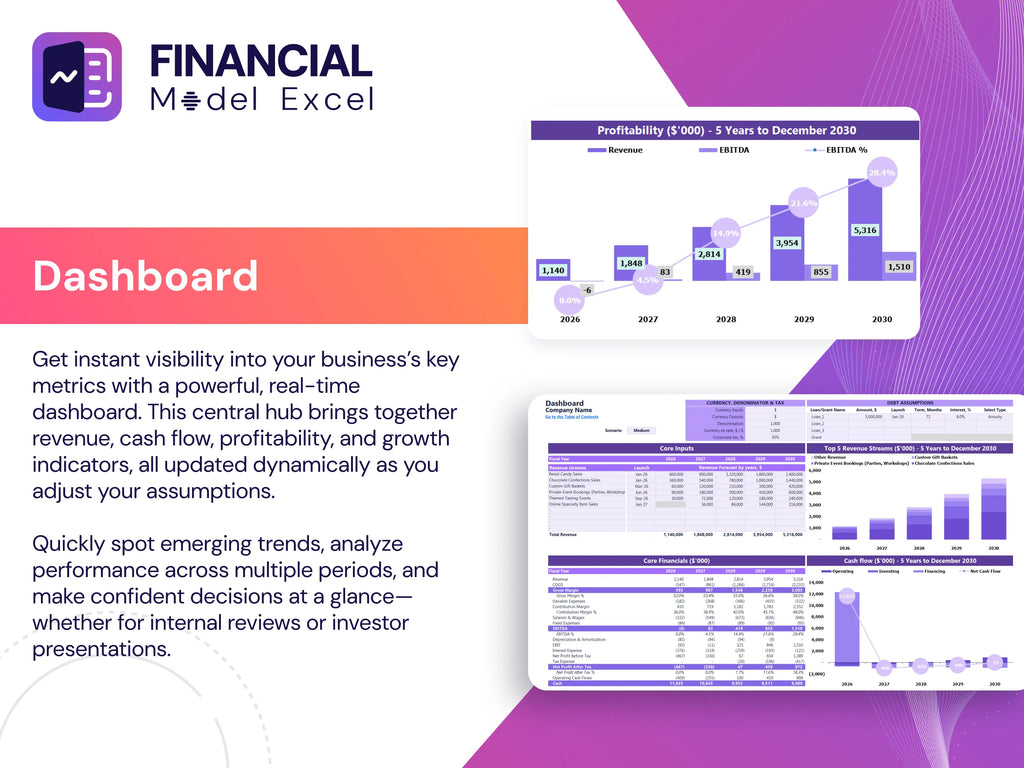

Business Financial Statements

Our business plan Excel template features a pre-built financial summary powered by an advanced financial forecasting model. It seamlessly consolidates data from pro forma balance sheets, profit and loss statements, and cash flow projections. Leveraging robust credit risk assessment tools and financial risk modeling software, this integrated summary offers precise credit portfolio analytics and loan risk evaluation insights. Expertly formatted for your pitch deck, it ensures a compelling presentation supported by sophisticated credit risk management solutions and risk prediction algorithms, empowering confident financial decision-making and strategic planning.

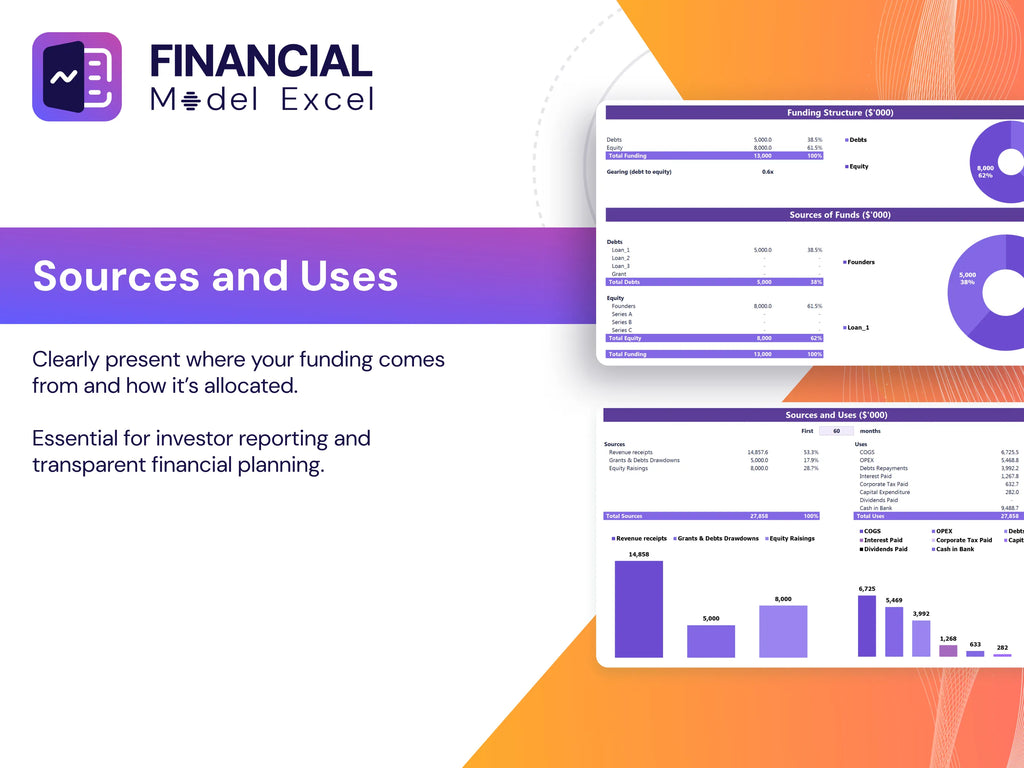

Sources And Uses Statement

Companies rely on advanced credit risk management solutions, such as credit risk assessment tools and financial risk modeling software, to gain clear insights into funding sources and cash flow directions. Utilizing credit portfolio analytics and loan risk evaluation models, these platforms enhance transparency and support informed decision-making. Integrating risk prediction algorithms within a comprehensive credit risk monitoring platform empowers businesses to optimize their financial risk assessment framework, ensuring efficient allocation of resources and proactive risk mitigation strategies.

Break Even Point In Sales Dollars

Our financial forecasting model integrates a break-even revenue calculator, vital for startups evaluating business viability. This credit risk assessment tool pinpoints the precise revenue threshold covering all expenses, including taxes. By leveraging this credit risk management solution, entrepreneurs can determine when their investments begin generating profit. Utilizing advanced risk prediction algorithms, the platform ensures smart financial decisions, fostering confident growth.

Top Revenue

In financial risk management, understanding key metrics like the top line (total revenue) and bottom line (net income) is crucial. Utilizing advanced credit risk assessment tools and financial risk modeling software, analysts can enhance their credit scoring systems and loan risk evaluation models. These risk analysis platforms leverage credit risk prediction engines and risk mitigation financial models to monitor credit portfolios and accurately forecast financial outcomes. By integrating a robust credit risk management solution with credit portfolio analytics, businesses gain deeper insights into profitability trends, enabling more precise financial forecasting and informed decision-making.

Business Top Expenses Spreadsheet

The Top Expenses tab in the startup pro forma template provides a comprehensive financial risk assessment framework by categorizing costs into four key segments. Featuring an integrated annual expense chart, it highlights essential expenditures for client base expansion and payroll. This dynamic credit risk management solution incorporates both fixed and variable costs, enabling precise financial forecasting models and loan risk evaluation models. Ideal for entrepreneurs seeking a robust credit scoring system combined with effective credit portfolio analytics, this tool supports informed decisions through advanced risk prediction algorithms and comprehensive debt risk analysis systems.

CREDIT RISK EVALUATION PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

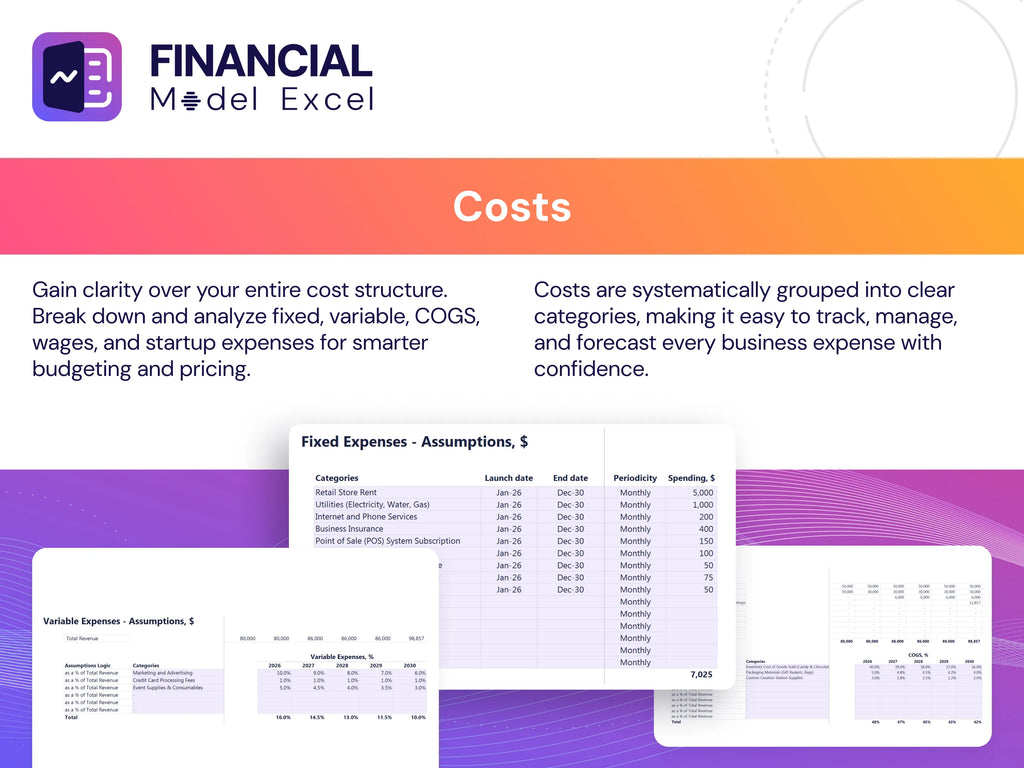

Costs

Enhance your cost budgeting with a robust financial forecasting model tailored for startups. Our comprehensive credit risk management solution integrates a financial credit scoring model and credit portfolio analytics, enabling precise cost projections and insightful loan risk evaluation. This risk analysis platform ensures clear visibility into your financial operations, identifying potential shortfalls and optimizing risk mitigation strategies. Utilize our startup financial model template to craft accurate budgets and confidently present your financial outlook to investors and creditors, backed by advanced credit risk assessment tools and risk prediction algorithms. Elevate your financial planning with precision and professionalism.

CAPEX Spending

Leverage our financial forecasting model combined with an advanced credit risk assessment tool to generate precise demand forecasts by product or service. This credit risk management solution enables you to simulate profitability scenarios, analyze revenue depth, and identify revenue bridges with clarity. Integrated with a risk prediction algorithm, it allows for optimized resource scheduling—manpower, inventory, and more—based on forecasted demand patterns. Empower your financial planning with this comprehensive loan risk evaluation model and credit portfolio analytics, enhancing decision-making and driving sustainable growth.

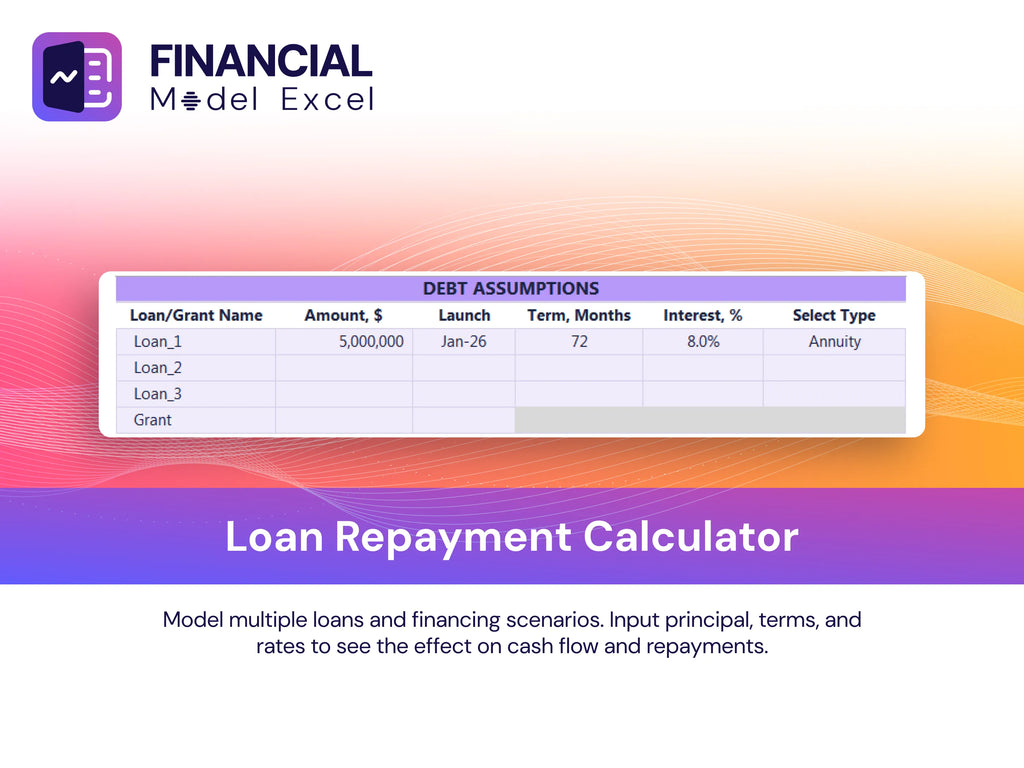

Loan Financing Calculator

Our financial plan integrates a sophisticated loan risk evaluation model featuring a dynamic loan amortization schedule. This credit risk management solution precisely calculates payment amounts by analyzing the principal, interest rate, loan term, and payment frequency. Leveraging advanced financial forecasting models and risk prediction algorithms, it ensures accurate creditworthiness evaluation and supports effective credit portfolio analytics. This comprehensive credit risk assessment tool empowers businesses to optimize loan repayment strategies while enhancing overall financial risk quantification and mitigation.

CREDIT RISK EVALUATION PLATFORM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our credit risk management solution integrates a robust financial forecasting model with customizable credit risk data platform features. It includes pre-built proformas for profit and loss forecasts, balance sheets, and cash flow projections, supporting both strategic planning and investor presentations. This credit scoring system enables comprehensive monitoring of cash flows, revenues, costs, and profitability margins. Leveraging advanced risk prediction algorithms, the platform provides detailed liquidity analysis, KPIs, and profitability ratios, empowering you to make informed decisions and optimize credit portfolio analytics effectively.

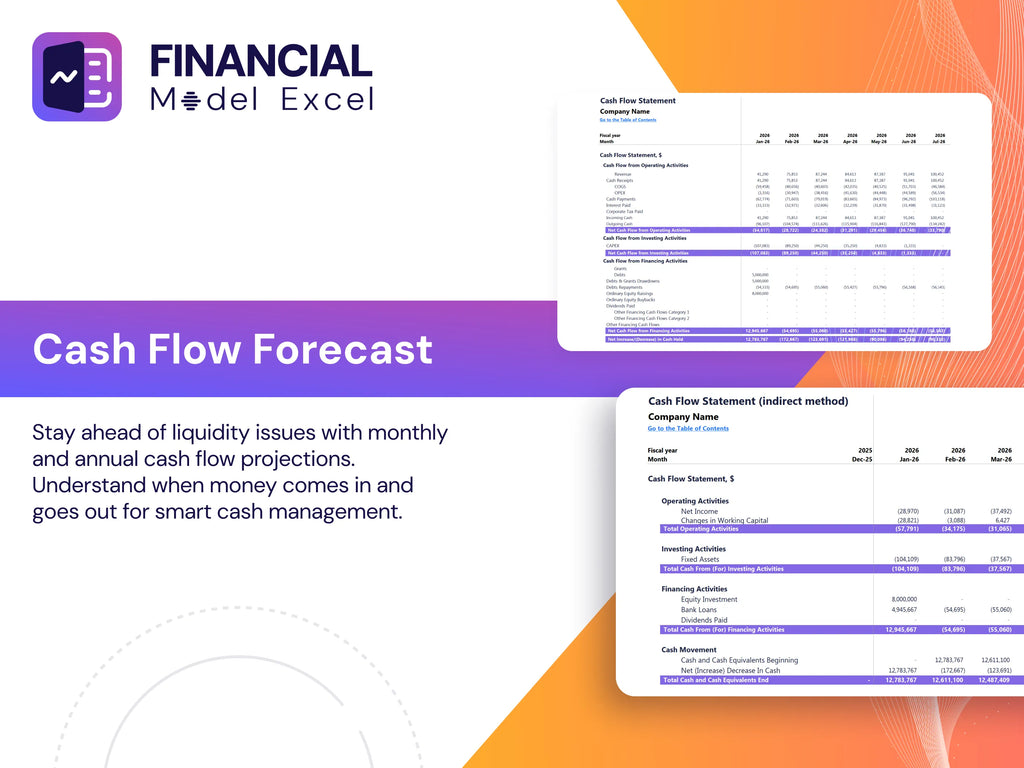

Cash Flow Forecast Excel

A robust financial forecasting model is crucial for startups, providing clear insights into cash flow and ensuring operational stability. Leveraging a credit risk assessment tool or creditworthiness evaluation tool helps accurately predict loan default risks and manage financial obligations efficiently. Integrating a credit risk management solution with your financial risk quantification software enables seamless monitoring and mitigation of potential risks, empowering businesses to confidently meet payroll and vendor payments while optimizing credit portfolio analytics for sustainable growth.

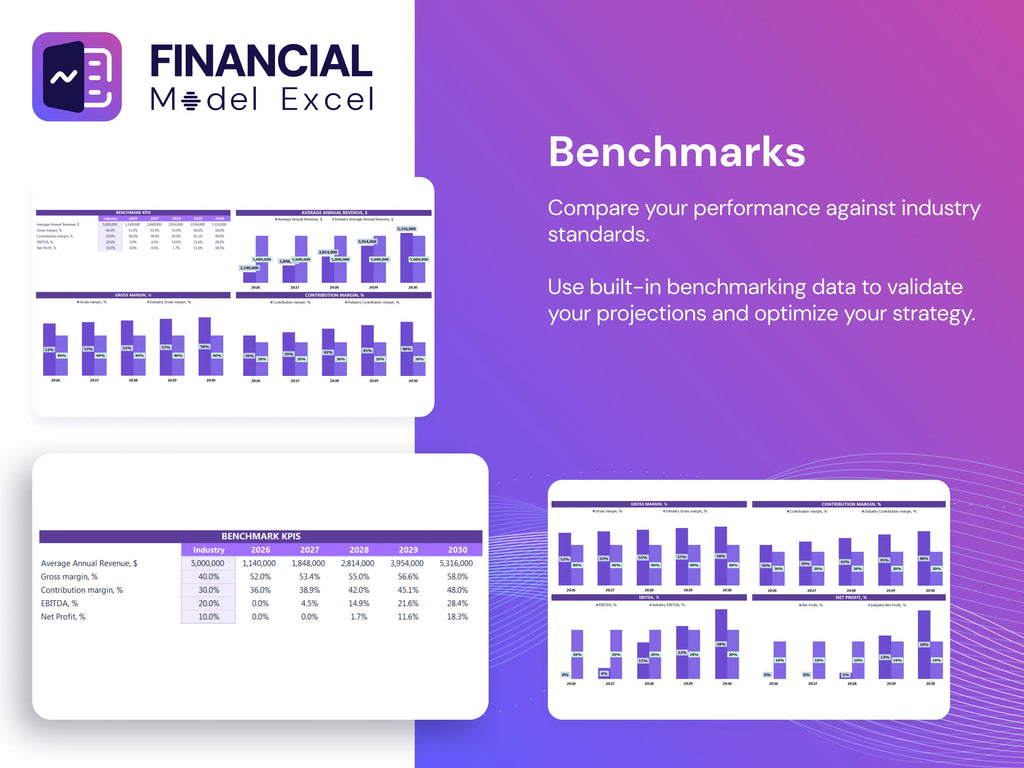

KPI Benchmarks

The benchmarking tab in our financial risk assessment framework offers vital industry and financial benchmarks, enabling precise credit risk evaluation. By integrating advanced credit risk prediction engines and credit portfolio analytics, it highlights top-performing companies and benchmarks your credit scoring system against industry standards. This risk analysis platform empowers users to identify areas needing improvement, enhancing loan risk evaluation models and overall credit risk management solutions. Elevate your financial forecasting model accuracy and leverage risk mitigation financial models with insightful benchmark indicators designed for effective credit risk monitoring and management.

P&L Statement Excel

Optimize your startup’s financial success with our advanced credit risk assessment tool and financial forecasting model. Designed for precision, this credit risk evaluation platform leverages robust risk prediction algorithms and a financial credit scoring model to deliver accurate profit and loss projections. Tailored for startups aiming for profitability, our loan risk evaluation model integrates seamlessly with your assumptions, ensuring comprehensive annual forecasts. Gain clear insights into net profits post-tax and confidently manage credit portfolio analytics with our cutting-edge credit risk management solution. Elevate your financial planning and secure your future with this indispensable risk analysis platform.

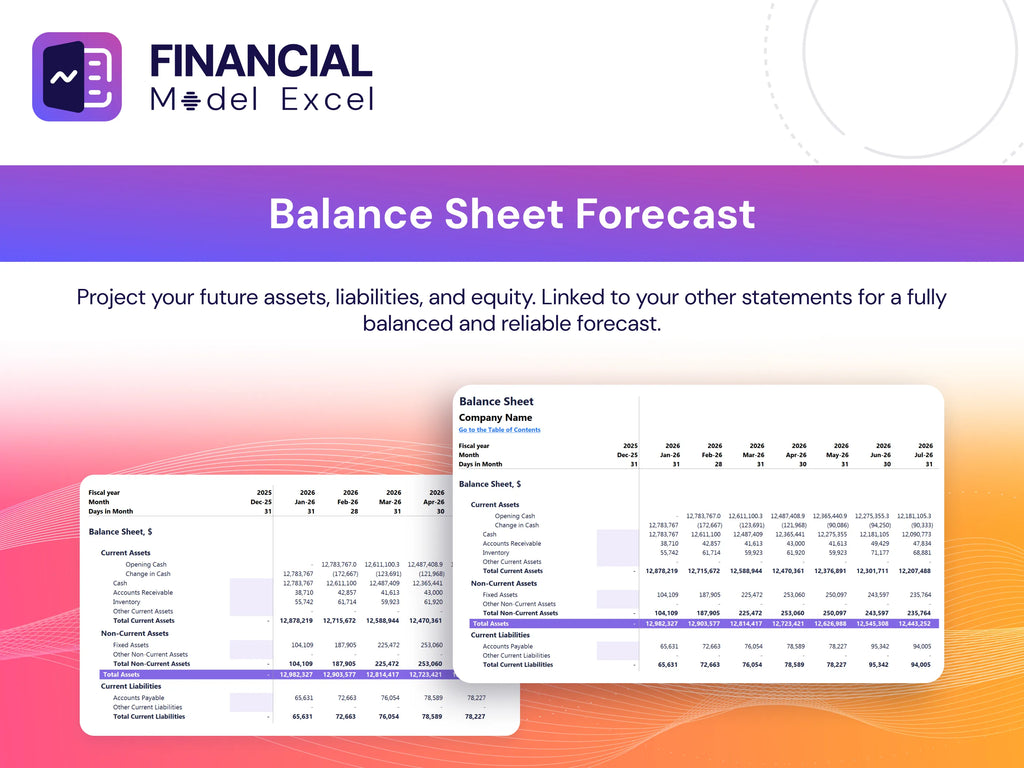

Pro Forma Balance Sheet Template Excel

The projected balance sheet, integral to any business revenue model, offers vital insight into a startup’s assets, liabilities, and equity. Utilizing a financial risk assessment framework, this pro forma balance sheet template in Excel empowers users to perform credit risk analysis and financial forecasting with precision. By integrating with credit risk management solutions and credit scoring systems, it enables accurate calculation of key financial ratios essential for loan risk evaluation models and risk mitigation financial models. This comprehensive approach supports informed decision-making through robust credit portfolio analytics and risk prediction algorithms.

CREDIT RISK EVALUATION PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

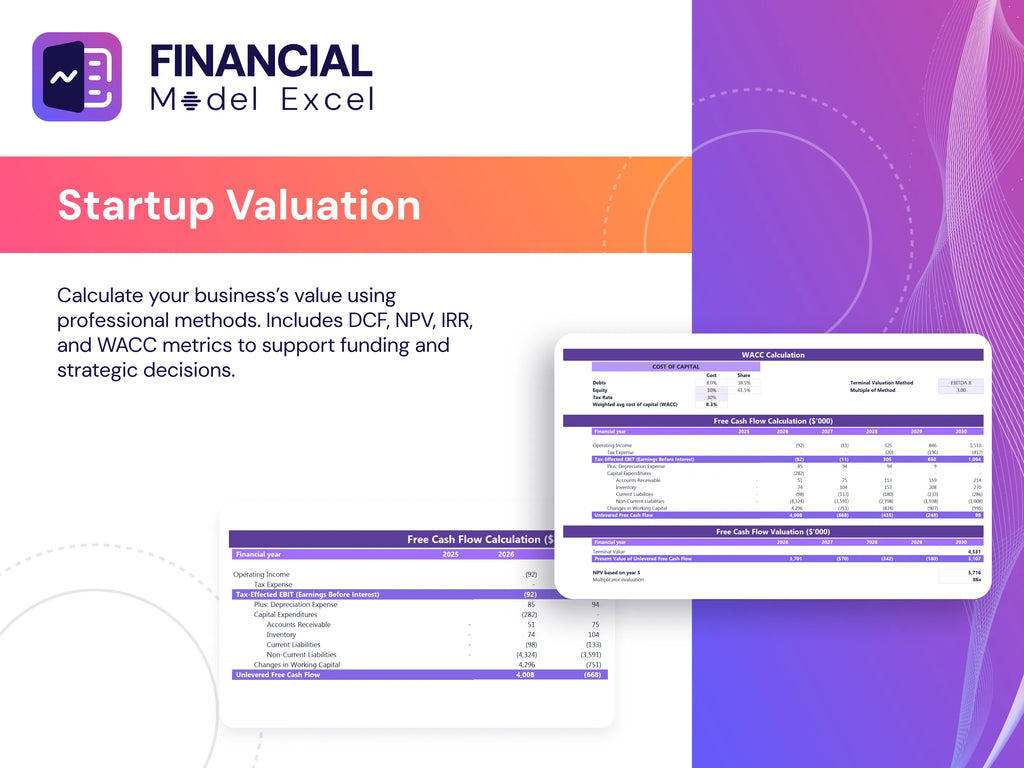

Startup Valuation Model

Our cutting-edge financial risk modeling software integrates a comprehensive financial forecasting model, including Investment Required, Equity Raised, Future Values, Net Income, Total Investment, WACC, EBITDA, and Growth Rate. Powered by advanced risk prediction algorithms, this credit risk assessment tool delivers precise net present value (NPV) calculations—discounting all future cash flows to present value. Ideal for credit risk management solutions and loan risk evaluation models, it enhances decision-making by providing robust credit portfolio analytics within a dynamic credit risk data platform. Optimize your investment strategies with our sophisticated financial risk quantification software and credit risk monitoring platform.

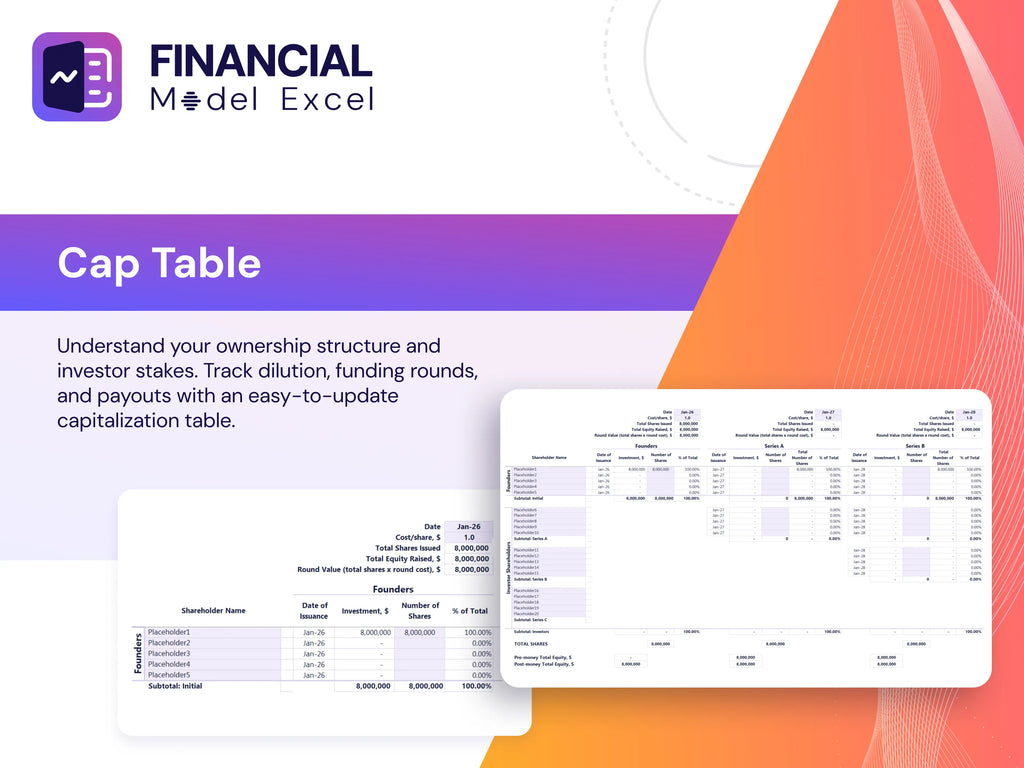

Cap Table

Leveraging a cutting-edge credit risk assessment tool enhances a company’s financial oversight by accurately tracking securities, including common and preferred stock, warrants, and options. Coupled with a sophisticated credit portfolio analytics platform, businesses gain real-time insights into investor holdings and capital allocation. This comprehensive credit risk management solution empowers informed decision-making, ensuring clear visibility into where funds are directed—an essential factor in driving sustainable business success and mitigating financial risks effectively.

CREDIT RISK EVALUATION PLATFORM BUDGET FINANCIAL MODEL ADVANTAGES

This credit risk prediction engine proactively prevents overdue payments, enhancing financial stability and optimizing loan portfolios.

Our credit risk assessment tool enhances accuracy, ensuring confident, data-driven financial decisions and effective risk management.

Plan upcoming cash gaps confidently using our credit risk evaluation platform with advanced financial forecasting models.

Boost stakeholder confidence using our advanced financial forecasting model for accurate, reliable credit risk assessment.

Leverage our credit risk prediction engine to enhance accuracy and secure funding with a robust financial model.

CREDIT RISK EVALUATION PLATFORM BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Our credit risk assessment tool enhances precision, reducing loan defaults and optimizing your financial portfolio’s performance effectively.

Optimize decisions with a credit risk assessment tool that ensures accurate, customizable currency and denomination settings.

Our credit risk prediction engine delivers precise insights, enhancing investment decisions and minimizing financial risks effectively.

Our financial forecasting model integrates data seamlessly to deliver investor-ready insights and boost funding success.

Our credit risk assessment tool saves you time by delivering fast, accurate loan risk evaluations for confident decision-making.

The credit risk prediction engine streamlines analysis, letting you focus more on growth and customer success.

Our credit risk management solution offers intuitive graphical visualization on a convenient all-in-one dashboard for effortless insights.

The credit risk management solution's dashboard consolidates all essential reports, enabling immediate, streamlined data comparison without switching sheets.

Our credit risk assessment tool enhances accuracy and streamlines loan decisions with advanced risk prediction algorithms.

Experience unparalleled clarity with our transparent credit risk evaluation platform featuring a detailed, color-coded three-statement financial model.