Cultural Heritage Hotel Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Cultural Heritage Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Cultural Heritage Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CULTURAL HERITAGE HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial model for a cultural heritage hotel offers an in-depth hotel financial feasibility study, including cash flow forecasting, profit and loss forecasts, and capital expenditure planning tailored for startups and entrepreneurs. Designed to support heritage hotel investment analysis and cultural tourism hotel budgeting, the model features key financial metrics, revenue projections, and break-even analysis to effectively assess heritage property financial forecasting and operational costs. With built-in financial statement modeling and hotel asset management financials, this editable Excel template is ideal for presenting a compelling heritage hotel investment returns case to investors and securing funding.

The ready-made financial model for heritage hotel investment analysis effectively addresses common challenges faced by cultural heritage hotel owners and investors by offering a comprehensive heritage hotel cash flow model integrated with a 3-statement format, enabling accurate heritage property financial forecasting and cultural hotel revenue projections over a 5-year horizon. This template simplifies hotel financial feasibility studies by including dynamic tools for assessing heritage accommodation financial metrics such as occupancy rate financial models, operational costs, and capital expenditure planning, which collectively support hotel profit and loss forecasts and break-even analysis. By incorporating financial statement modeling tailored for boutique and cultural hotels, it empowers users with actionable hotel cost management strategies, enhances hotel asset management financials, and provides clear insights into cultural heritage property valuation, ultimately improving decision-making about cultural tourism hotel budgeting and enhancing potential cultural hotel investment returns.

Description

This comprehensive financial model for a cultural heritage hotel integrates detailed heritage hotel investment analysis, cultural tourism hotel budgeting, and heritage property financial forecasting to provide a robust 5-year hotel profit and loss forecast and cash flow model. It incorporates hotel occupancy rate financial models and heritage hotel break-even analysis to optimize hotel asset management financials and cost management strategies, ensuring accurate cultural hotel revenue projections. Additionally, the model supports hotel capital expenditure planning, heritage hotel operational costs evaluation, and financial statement modeling, enabling precise financial feasibility studies that drive sustainable cultural heritage property valuation and enhance heritage accommodation financial metrics for improved investment returns.

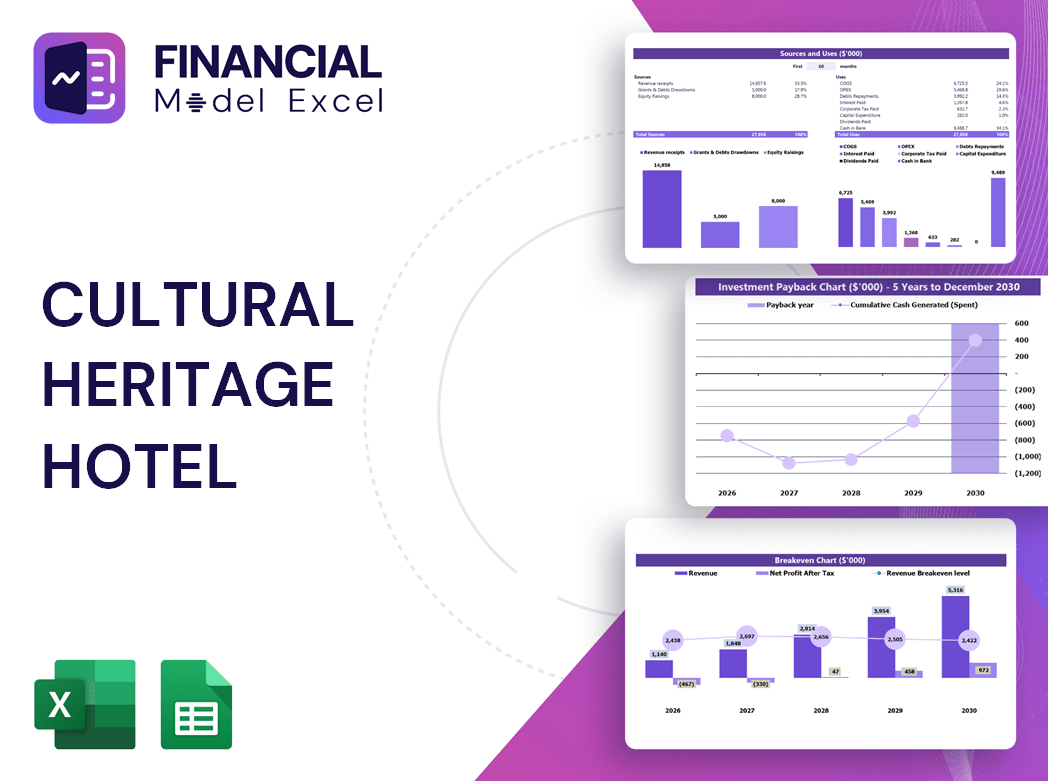

CULTURAL HERITAGE HOTEL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking investors for your cultural heritage hotel? A comprehensive financial model for heritage hotel investment analysis is essential. Utilizing an Excel-based hotel financial feasibility study helps accurately project revenue, operational costs, and cash flow, providing clear insights into capital requirements and anticipated returns. Investors demand a detailed heritage hotel cash flow model and profit and loss forecast to confidently evaluate risk and potential. Ensure your cultural tourism hotel budgeting and financial forecasting demonstrate strong hotel occupancy rate financial models and break-even analysis. Secure funding by presenting robust financial statement modeling tailored for boutique heritage accommodation, positioning your investment opportunity for success.

Dashboard

A comprehensive dashboard featuring essential financial metrics is vital for accurate heritage hotel financial forecasting. Integrating detailed financial statements with hotel revenue projections and operational costs, it enables precise heritage hotel investment analysis. Users can customize timelines to examine hotel occupancy rate financial models, capital expenditure planning, and profitability forecasts. Leveraging these key performance indicators facilitates in-depth break-even analysis and cash flow modeling, empowering strategic decision-making to optimize cultural tourism hotel budgeting and maximize investment returns. This dynamic tool is indispensable for effective hotel asset management and sustainable growth within the cultural heritage hospitality sector.

Business Financial Statements

A comprehensive heritage hotel financial model integrates three core financial statements—historical and projected—crucial for a robust 5-year financial feasibility study. Embedding key metrics into dynamic financial charts enhances visual analysis, an effective tool for cultural heritage hotel investment presentations. Our Excel template streamlines heritage property financial forecasting by automatically generating detailed startup cost charts, supporting strategic hotel capital expenditure planning and revenue projections. This approach empowers investors with clear insights into hotel profit and loss forecasts, cash flow models, and operational costs, ensuring informed decision-making in cultural tourism hotel budgeting and asset management.

Sources And Uses Statement

Our financial model for heritage hotels offers a comprehensive sources and uses statement, essential for effective heritage hotel financial forecasting and investment analysis. This tool delivers clear insights on required capital, fund allocation, and operational costs. It supports cultural heritage hotel budgeting, enhances cash flow management, and strengthens profit and loss forecasts. Ideal for both experienced professionals and newcomers, it simplifies complex financial metrics, ensuring accurate revenue projections and optimized hotel asset management. With this model, investors and operators can confidently evaluate hotel financial feasibility, drive cultural tourism hotel budgeting, and maximize heritage accommodation financial returns.

Break Even Point In Sales Dollars

This heritage hotel financial model integrates a comprehensive break-even analysis, pinpointing the exact sales volume needed to cover all fixed and variable costs. Essential for heritage hotel investment analysis, this tool enhances financial forecasting by allowing precise adjustments to operational costs and revenue projections. Our user-friendly proforma enables strategic cultural heritage hotel budgeting, empowering investors to refine assumptions and optimize profitability. With this financial feasibility study framework, you can confidently manage capital expenditure planning, hotel occupancy rate financial models, and cash flow projections, ensuring robust heritage property financial metrics and sustainable cultural tourism hotel growth.

Top Revenue

This pro forma financial statements Excel template offers a dedicated tab for in-depth analysis of revenue streams by product or service category. Ideal for heritage hotel investment analysis and cultural heritage hotel financial planning, it empowers users to create accurate cultural hotel revenue projections and heritage hotel cash flow models. Utilize this tool for comprehensive hotel financial feasibility studies, detailed operational cost tracking, and precise hotel profit and loss forecasts—enhancing your financial modeling for boutique hotels and heritage properties with clarity and confidence.

Business Top Expenses Spreadsheet

The Top Expenses tab in this heritage hotel financial model provides a comprehensive breakdown of annual costs, categorized into four key groups. This detailed expense analysis is essential for accurate heritage hotel financial forecasting and cash flow modeling. By distinguishing between fixed expenses and operational costs—such as customer acquisition and heritage hotel operational costs—investors gain clarity on spending origins. Leveraging this insight supports effective hotel cost management strategies and enhances overall financial planning for boutique or cultural heritage hotels, ensuring sound financial feasibility and optimized hotel profit and loss forecasts.

CULTURAL HERITAGE HOTEL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our financial Excel template offers a seamless, intuitive experience tailored for cultural heritage hotel financial planning. Featuring automated, end-to-end formulas, it eliminates manual updates, enabling precise and efficient heritage hotel cash flow modeling. Ideal for heritage hotel investment analysis, revenue projections, and operational cost forecasting, this tool streamlines your hotel financial feasibility study and capital expenditure planning. Enhance your boutique or cultural heritage property valuation with accurate profit and loss forecasts and break-even analysis, empowering smarter financial decisions and robust hotel asset management financials. Maximize your cultural tourism hotel budgeting with confidence and ease.

CAPEX Spending

For any cultural heritage hotel startup, strategic capital expenditure (CAPEX) planning is essential to drive sustainable growth and maximize investment returns. Incorporating detailed financial modeling, including heritage hotel cash flow models and profit and loss forecasts, enables precise heritage hotel financial forecasting. By managing CAPEX within a comprehensive hotel financial feasibility study, owners can introduce innovative technologies while controlling operational costs. Effective financial statement modeling supports accurate heritage hotel investment analysis and cultural hotel revenue projections, ensuring a balanced startup cash flow and a robust capital expenditure plan that aligns with long-term asset management and profitability goals.

Loan Financing Calculator

Our 5-year heritage hotel cash flow model features an integrated loan amortization schedule, precisely calculating principal and interest payments. This comprehensive financial tool supports accurate financial forecasting for heritage property investments, incorporating loan amount, interest rates, loan tenure, and payment frequency. Designed for cultural heritage hotel financial planning, it enhances financial feasibility studies and capital expenditure planning, ensuring precise management of operational costs and optimized hotel profit and loss forecasts. Elevate your boutique hotel investment analysis with this essential financial modeling solution tailored for cultural tourism and heritage accommodation financial metrics.

CULTURAL HERITAGE HOTEL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The cultural heritage hotel financial model features a comprehensive revenue breakdown proforma, visually presented through dynamic charts. This financial planning tool accurately projects monthly revenue streams from five core products, enabling precise heritage hotel investment analysis. Users can seamlessly customize the number of revenue sources or adjust the analysis period to enhance cultural hotel revenue projections. Ideal for heritage property financial forecasting and hotel financial feasibility studies, this model supports informed decision-making and optimized hotel capital expenditure planning.

Cash Flow Forecast Excel

A comprehensive 5-year heritage hotel cash flow model is vital for tracking all cash inflows and outflows, ensuring your cultural heritage hotel maintains sufficient liquidity to meet obligations. This financial forecasting tool is essential in heritage hotel investment analysis and capital expenditure planning, providing banks and investors with a clear view of your hotel's cash position and its ability to service debt. Accurate heritage hotel financial modeling enhances loan approval prospects, supports operational cost management, and strengthens cultural hotel revenue projections, making it a cornerstone of successful hotel financial feasibility studies and asset management strategies.

KPI Benchmarks

The benchmark tab in a heritage hotel financial model delivers vital industry-average KPIs, enabling precise heritage hotel investment analysis and cultural hotel revenue projections. By comparing your hotel's financial metrics against top-performing cultural heritage hotels, you gain critical insights for heritage property financial forecasting and operational cost management. This benchmarking is essential for heritage hotel financial feasibility studies, break-even analysis, and capital expenditure planning. Ultimately, it empowers informed decision-making, ensuring optimized hotel profit and loss forecasts and enhanced cultural tourism hotel budgeting for sustained investment returns and asset management.

P&L Statement Excel

In any cultural heritage hotel financial model, all financial metrics are seamlessly integrated, ensuring the projected profit and loss statement captures every business activity. This comprehensive financial forecasting template offers detailed insights into net profit margin ratios and gross profit margin analysis. Leveraging these projections enables precise heritage hotel investment analysis and effective financial planning. With accurate revenue projections and operational cost tracking, you can confidently assess your hotel’s profitability, optimize budgeting, and strategically target expected returns in the dynamic cultural tourism market.

Pro Forma Balance Sheet Template Excel

Accurate heritage hotel financial forecasting is vital for seamless integration of the pro forma balance sheet with profit and loss forecasts and cash flow models. While less eye-catching than income statements, projected balance sheets play a crucial role in heritage hotel investment analysis and cultural hotel revenue projections. They enable precise assessment of hotel occupancy rate financial models and profitability metrics like return on equity and return on invested capital. This comprehensive financial modeling for boutique hotels ensures investors gain clear insights into operational costs, cash flow viability, and hotel capital expenditure planning—key factors driving confident cultural heritage hotel investment decisions.

CULTURAL HERITAGE HOTEL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive financial model for heritage hotels integrates key valuation techniques, including discounted cash flow (DCF) and weighted average cost of capital (WACC). Designed to enhance cultural heritage hotel financial planning, this model delivers accurate revenue projections and detailed cash flow analysis. It empowers investors with precise heritage hotel investment analysis, supporting robust hotel financial feasibility studies and capital expenditure planning. Elevate your boutique hotel’s financial forecasting and asset management with our tailored financial statement modeling, ensuring informed decisions for sustainable profitability and optimized hotel operational costs.

Cap Table

A comprehensive financial model for heritage hotels is essential for effective financial planning and investment analysis. It provides detailed insights into cultural heritage hotel revenue projections, operational costs, and capital expenditure planning. Utilizing tools like hotel financial feasibility studies and cash flow models enables accurate heritage property financial forecasting and break-even analysis. Integrating hotel profit and loss forecasts with cost management strategies ensures optimized asset management financials. This approach empowers stakeholders to evaluate cultural hotel investment returns confidently while aligning with the unique financial metrics and valuation needs of boutique heritage accommodations.

CULTURAL HERITAGE HOTEL FINANCIAL MODEL EXCEL ADVANTAGES

Make informed hiring decisions with a cultural heritage hotel financial model, optimizing investment and operational strategies effectively.

Enhance profitability and reduce risks with our precise, customizable cultural heritage hotel financial model in Excel.

Avoid cash flow shortfalls with our cultural heritage hotel financial model, ensuring precise forecasting and optimized profitability.

Optimize loan repayments effortlessly using our cultural heritage hotel financial model for precise, strategic financial planning.

Easily optimize profits and manage costs using a cultural heritage hotel financial model for accurate investment analysis.

CULTURAL HERITAGE HOTEL FINANCIAL FORECASTING MODEL ADVANTAGES

Our heritage hotel financial model optimizes investment returns through precise revenue projections and cost management strategies.

Financial modeling for heritage hotels enables dynamic forecast adjustments, optimizing financial planning and maximizing investment returns.

Run different scenarios with our heritage hotel financial model to optimize investment returns and ensure profitability.

Financial modeling for heritage hotels enables dynamic cash flow forecasting to optimize costs and maximize investment returns.

Optimize heritage hotel investments with precise financial models delivering clear, print-ready reports for confident decision-making.

Optimize heritage hotel investments with our financial model’s comprehensive reports for precise profit, cash flow, and ratio analysis.

The financial model for heritage hotels identifies potential cash shortfalls early, ensuring proactive financial planning and stability.

The heritage hotel financial model provides early warnings, ensuring precise cash flow forecasting and proactive financial management.

Maximize heritage hotel returns with precise financial models delivering great value through informed budgeting and investment analysis.

Optimize heritage hotel profits with our proven, affordable financial model—no hidden fees, one-time payment only.