Deli Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

ALL IN ONE MEGA PACK - CONSIST OF:

Deli Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DELI FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive deli financial planning model offers a detailed 5-year deli business financial forecast template, including a projected income statement template in Excel, deli financial statement model, and key financial ratios prepared in GAAP or IFRS formats. Designed to assist in deli revenue forecast modeling, deli expense budgeting, and deli cash flow financial analysis, it provides an all-in-one deli startup financial model to evaluate deli financial performance and business valuation effectively. Fully unlocked and editable, this deli financial model template is ideal for conducting deli break-even analysis, margin analysis, and overall deli cost analysis financial modeling before making strategic investment or selling decisions.

The deli financial planning model provides a comprehensive solution to common pain points faced by deli business owners by offering an easy-to-use financial projection for deli operations that includes a detailed deli revenue forecast model and deli expense budgeting model, ensuring accurate tracking of both income and costs. It features a deli profit and loss model and deli cash flow financial model that simplify understanding of the business’s financial health and liquidity, while the deli break-even analysis model helps identify critical sales targets for profitability. By integrating deli cost analysis financial model elements and deli margin analysis model insights, users can optimize pricing and operational efficiency. This deli startup financial model also includes a deli budgeting and forecasting model with customizable assumptions, enabling precise planning and a financial statement model that facilitates clear communication with investors through the deli investment financial model and deli business valuation model. Overall, the financial model template for deli consolidates all essential reporting—ranging from deli income statement model to performance KPIs—within a structured format to alleviate forecasting complexity and enhance confident decision-making.

Description

The deli financial planning model provides a comprehensive deli business financial model that integrates a deli profit and loss model, deli cash flow financial model, and deli income statement model to offer a detailed financial projection for deli operations. This deli expense budgeting model, combined with the deli revenue forecast model and deli margin analysis model, enables precise deli cost analysis financial model capabilities and supports effective deli budgeting and forecasting model processes. Featuring a deli break-even analysis model and deli sales forecast financial model, the tool helps evaluate deli operational cost model dynamics while facilitating investment decisions through the deli investment financial model and deli business valuation model. Its dynamic structure ensures that any adjustments in key assumptions automatically update all deli financial statement model components, making it an essential deli startup financial model and financial model template for deli entrepreneurs seeking real-time scenario planning and robust financial performance model insights.

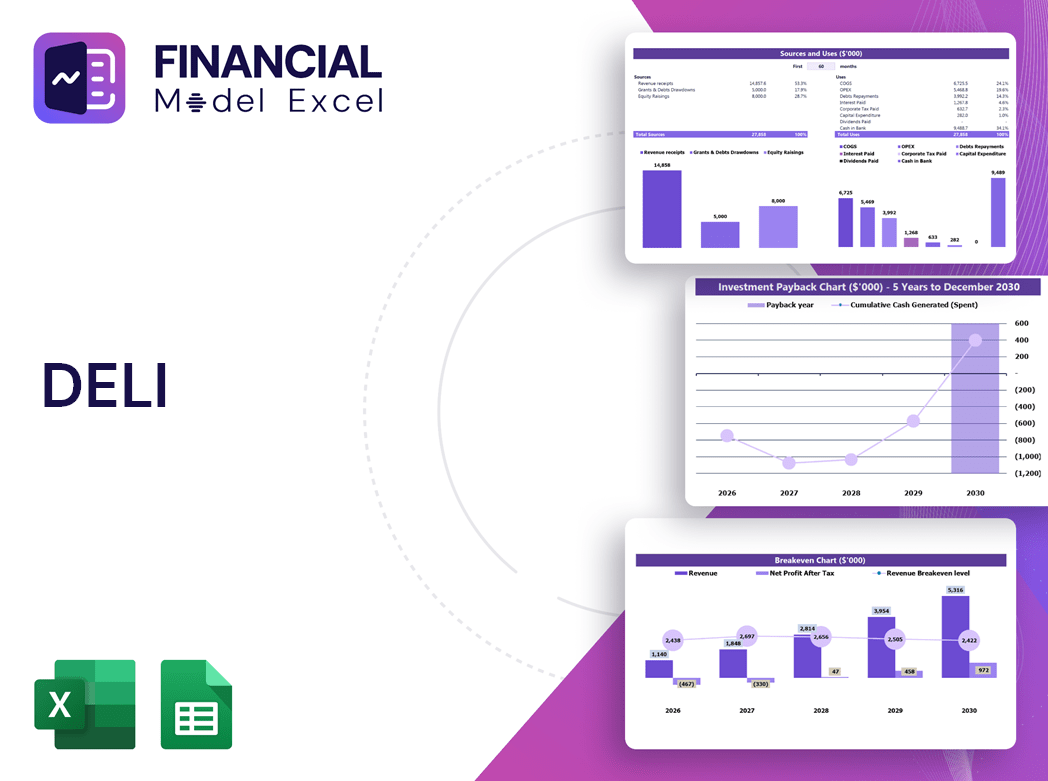

DELI FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our deli financial planning model is fully customizable, allowing you to adjust key parameters such as startup financial statements, operating costs, hiring plans, and revenue forecasts. This deli business financial model enables precise deli expense budgeting, break-even analysis, and cash flow projections tailored to your needs. Easily add new assumptions and forecasting methods within the flexible deli startup financial model template. Every cell and formula is editable, empowering you to create an accurate deli profit and loss model and deli financial statement model that drives informed decisions and supports your deli’s growth.

Dashboard

Leverage our deli financial planning model with a comprehensive 5-year financial projection template in Excel. This intuitive financial dashboard tracks essential KPIs, ensuring precise cash flow management and detailed oversight of expenses, sales, and profits. Empower your deli’s financial management with robust deli revenue forecast, expense budgeting, and profit and loss models—all designed to optimize performance and exceed your business goals. Share this deli startup financial model seamlessly with stakeholders for transparent, data-driven decision-making and sustained growth.

Business Financial Statements

Our deli startup financial model template offers a comprehensive 3-year financial projection with dynamic graphs and charts. Easily generate detailed deli revenue forecast models, cash flow financial models, and profit and loss statements. This deli financial planning model includes pre-built proformas for revenue breakdown, operating cash flow, EBITDA, and EBIT, empowering you to create accurate deli expense budgeting models and deli sales forecast financial models. Perfect for strategic deli business financial planning, it supports up to five-year projections, enhancing your deli financial performance model and investment financial model capabilities.

Sources And Uses Statement

The deli business financial model is an essential tool for accurate financial projection and performance evaluation. Ideal for startups and investors, this deli profit and loss model forecasts revenue, expenses, and cash flow, providing clear insights into profitability and growth potential. With regular data input, the deli expense budgeting model delivers timely, objective reports that build confidence and guide strategic decisions. From break-even analysis to margin and cost assessments, this comprehensive deli financial planning model ensures precise, real-time insights, helping you optimize investment and confidently plan your deli’s successful future.

Break Even Point In Sales Dollars

A deli break-even analysis model pinpoints when total revenue equals total costs, marking the shift from loss to profit. Utilizing this deli financial planning model helps you identify the exact sales volume or revenue needed to cover fixed and variable expenses. Integrating a deli profit and loss model with a deli expense budgeting model provides a comprehensive financial projection for deli success. This approach also refines sales pricing to boost contribution margin—the key driver of profitability—ensuring your deli’s operations remain financially healthy and growth-oriented.

Top Revenue

Using the deli financial planning model’s Top Revenue tab, you can generate a detailed demand report for your products and services, highlighting profitability across scenarios to guide strategic decisions. The financial model template for deli business plans enables you to build a revenue bridge, illustrating key revenue drivers like sales volume and pricing over time. This powerful deli sales forecast financial model helps predict demand fluctuations by period, optimizing resource allocation for your sales team and enhancing overall financial performance. Leverage these insights to drive growth with precision and confidence.

Business Top Expenses Spreadsheet

The deli expense budgeting model within our financial projection for deli offers a clear overview of your top expenses, highlighting the four largest cost drivers for quick insight. This deli cost analysis financial model delivers in-depth evaluations, including customer acquisition and fixed costs, empowering you to identify spending patterns. Utilizing this deli financial planning model enables precise expense management, enhancing profitability and supporting smarter financial decisions tailored to your deli business.

DELI FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Initial costs are critical in launching a successful deli, and our deli startup financial model precisely captures these expenses to ensure balanced budgeting. This deli expense budgeting model helps prevent underfunding and financial losses by providing clear insights into early-stage costs. Our comprehensive deli financial planning model offers detailed cost and funding projections, empowering you to manage expenses effectively. Designed for strategic expense management and planning, this financial model template for deli supports informed decision-making and sustainable growth from day one.

CAPEX Spending

Capital expenditure (CAPEX) is a crucial component of a deli startup financial model. It enables precise tracking of investments in fixed assets, such as property, plant, and equipment (PPE), while accounting for depreciation, additions, and disposals. Integrating CAPEX within your deli financial planning model ensures accurate financial projections, supporting effective deli expense budgeting and deli cash flow financial models. Additionally, it includes additions of leased assets, providing a comprehensive deli investment financial model that enhances operational cost management and drives sustainable growth.

Loan Financing Calculator

Effective loan repayment schedules are crucial in a deli startup financial model, providing detailed insights into principal amounts, terms, maturity periods, and interest rates. These schedules directly impact the deli cash flow financial model, influencing cash flow projections and operational cost planning. Integrating loan repayments within the deli expense budgeting model ensures accurate financial projections and supports robust deli profit and loss modeling. Monitoring repayments is essential for maintaining balanced cash flow and reflecting debt accurately on the deli financial statement model, ultimately enhancing the deli business financial model’s reliability and aiding strategic financial decision-making.

DELI FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) serves as a vital indicator within a deli business financial model, highlighting true operating performance. Incorporating EBITDA into your deli financial planning model ensures accurate financial projections, enabling precise deli revenue forecast models and effective deli expense budgeting models. By focusing on EBITDA, deli operators can optimize cash flow financial models and refine profit and loss models, driving informed decisions and maximizing profitability. Use this metric alongside deli break-even analysis and margin analysis models for comprehensive insights into your deli’s financial health and growth potential.

Cash Flow Forecast Excel

The deli cash flow financial model is an essential tool for precise financial management. Utilizing an Excel-based cash flow projection empowers deli owners to accurately track and optimize money inflows and outflows. This model integrates seamlessly with deli expense budgeting and revenue forecast models, ensuring informed decision-making and stronger financial performance. Harnessing a comprehensive deli financial planning model enhances operational efficiency and supports sustainable growth.

KPI Benchmarks

Benchmarking is a crucial component of a deli financial planning model, enabling precise evaluation of your deli’s performance through key metrics like profit margins, cost analysis, and productivity ratios. By integrating benchmarking within a deli business financial model or deli revenue forecast model, managers can effectively compare operational efficiency against industry peers. This insight is invaluable for both startups and established delis, informing decisions in budgeting, expense management, and break-even analysis. Leveraging benchmarking within your deli financial projection ensures informed strategies that drive profitability and sustainable growth.

P&L Statement Excel

To ensure profitability in your deli business, leveraging a comprehensive deli profit and loss model is essential. This financial model accurately forecasts all revenues and expenses, providing clear insights into potential profits and losses. Ideal for startups aiming for sustainable growth, the deli financial statement model generates detailed annual reports, capturing every critical detail. It delivers accurate after-tax balances and net profit projections, empowering informed decision-making and strategic planning. Utilizing a deli business financial model elevates your financial planning, giving you a competitive edge for future success.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is a vital deli financial statement model that outlines your startup’s assets, liabilities, and equity over a specific period. This deli business financial model offers a clear snapshot of what your deli owns and owes, empowering informed decision-making. Utilize our 5-year projected balance sheet template to strengthen your deli financial planning model, enhance your deli budgeting and forecasting model, and confidently assess your deli’s financial stance for sustained growth and profitability.

DELI FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our deli financial planning model offers a comprehensive financial projection for your investment’s worth. It meticulously incorporates all revenue streams, expense budgeting, and the precise timing of cash flows. Designed to provide clear insights, this deli cash flow financial model ensures accurate deli profit and loss forecasting, enabling you to optimize operational costs and maximize returns. Tailored for deli startups and established businesses alike, it’s the ideal financial model template to support strategic decision-making and confident growth.

Cap Table

The deli financial planning model offers a comprehensive cap table template, designed to track and analyze four rounds of financing. This deli investment financial model clearly illustrates how investor equity impacts the company’s earnings after each funding stage. By integrating the deli profit and loss model and deli cash flow financial model, it provides a dynamic view of ownership changes and their financial effects, empowering deli businesses with precise financial projection and strategic growth insights.

DELI FINANCIAL MODEL BUSINESS PLAN ADVANTAGES

The deli cash flow financial model accurately projects future cash, empowering smarter business decisions and growth planning.

The deli financial planning model empowers precise expense control to maximize profits and sustain business growth.

The deli startup financial model simplifies tax planning, ensuring accurate projections and optimized financial performance.

The deli startup financial model clearly proves your ability to repay loans, boosting investor confidence and securing funding.

The deli financial planning model accurately calculates break-even points and maximizes return on investment for your startup.

DELI FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

The deli financial planning model offers precise five-year forecasts to optimize profits and streamline expenses efficiently.

Generate a fully-integrated 5-year deli financial model with automated monthly-to-annual summary aggregation for precise forecasting.

The deli financial planning model enables accurate forecasting, optimizing profits and streamlining expense management effortlessly.

Easily refine your deli financial planning model by adjusting inputs for accurate, dynamic business projections and growth insights.

Our deli financial model ensures accurate projections, optimizing profits and streamlining your business planning effortlessly.

Deli financial planning models simplify budgeting and forecasting, eliminating programming for faster, accurate, consultant-free business insights.

The deli cash flow financial model enables early identification of cash shortfalls, ensuring proactive financial management.

The deli financial planning model acts as an early warning system, ensuring accurate cash flow and profitable growth.

The deli financial planning model streamlines key metrics analysis for smarter, data-driven business decisions and growth.

Generates accurate 5-year deli financial projections and statements effortlessly, ensuring compliant GAAP or IFRS reporting.