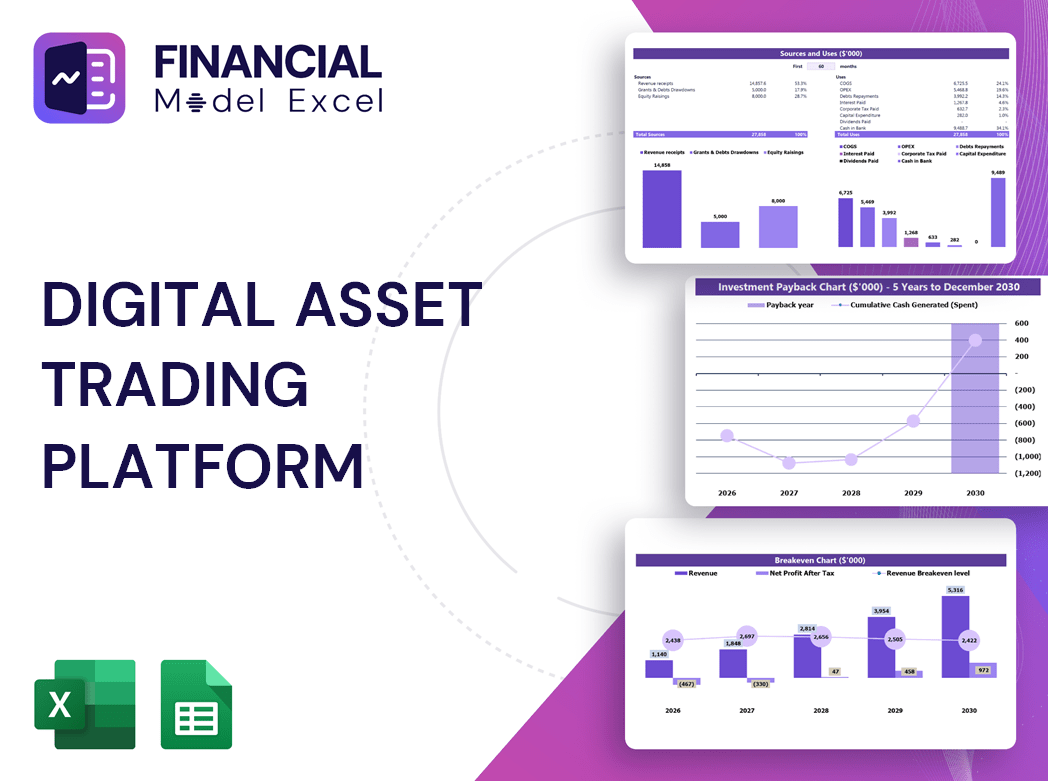

Digital Asset Trading Platform Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Digital Asset Trading Platform Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Digital Asset Trading Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL ASSET TRADING PLATFORM FINANCIAL MODEL FOR STARTUP INFO

Highlights

A digital asset trading platform financial model is an essential tool for startups or established companies aiming to develop a comprehensive business plan and refine their financial projections for asset trading. This financial model template supports accurate cash flow modeling, profit and loss analysis, and budget forecasting for digital trading platforms, facilitating financial forecasting and investment analysis. By leveraging a digital asset trading platform valuation model and financial scenario analysis, businesses can better understand their cost structure and growth projections, ultimately enhancing their ability to secure funding from banks or investors. This unlocked, fully editable model also serves as a powerful financial dashboard for trading platforms, enabling effective financial risk modeling and strategic planning in the evolving crypto asset trading landscape.

The digital asset trading platform excel model effectively addresses common pain points by offering a comprehensive and user-friendly financial forecasting tool designed specifically for crypto and digital asset exchanges. It integrates a detailed profit and loss model for trading platforms, a cash flow model, and a robust digital asset trading platform valuation model, enabling accurate financial projections for asset trading and investment analysis. With built-in financial scenario analysis and risk modeling capabilities, users can simulate various market conditions to optimize their digital trading platform budget model and growth projections. The ready-made template simplifies complex financial modeling for blockchain platforms, reducing manual workload and errors, while the financial dashboard for trading platforms consolidates key metrics for quick decision-making. By providing a clear picture of the cost structure and revenue model, this all-in-one financial plan ensures precise and efficient strategic planning, making it an indispensable tool for startups and established digital asset trading platforms alike.

Description

This comprehensive digital asset trading platform excel model serves as a robust financial blueprint, incorporating a detailed digital asset trading platform revenue model and a profit and loss model for trading platforms to facilitate precise financial forecasting for trading platforms over a 5-year horizon. Equipped with a digital asset trading platform cash flow model and a digital asset exchange financial template, it enables thorough financial projections for asset trading and investment analysis, while the digital asset trading platform valuation model leverages discounted cash flow calculations to ascertain startup valuation. The financial dashboard for trading platforms provides actionable insights through KPIs and financial performance ratios, supporting financial risk modeling for trading platforms and financial scenario analysis. This digital asset trading startup financial model further includes a cost structure outline and budget model, aiding in strategic decision-making and growth projections, ultimately fostering informed financial planning and scalability within the crypto asset trading financial plan landscape.

DIGITAL ASSET TRADING PLATFORM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive digital asset trading platform business plan with an integrated financial model tailored for crypto trading startups. This excel-based template automates profit and loss, balance sheet, and cash flow forecasts, enabling precise financial projections for asset trading. Leverage robust financial scenario analysis and risk modeling to evaluate growth projections and cost structure effectively. The dynamic financial dashboard consolidates key performance indicators, supporting strategic investment analysis and revenue modeling. Empower your decision-making with a professional financial forecasting tool designed specifically for blockchain and digital trading platforms.

Dashboard

Our digital asset trading platform Excel model features a dynamic financial dashboard designed for precise financial forecasting and investment analysis. This tool empowers startups to conduct accurate profit and loss modeling, cash flow projections, and risk assessments essential for strategic decision-making. By integrating comprehensive financial scenario analysis and valuation metrics, it ensures transparent reporting that builds stakeholder confidence. Ideal for crypto trading platforms, this sophisticated financial model streamlines budgeting and growth projections, driving informed strategies that enhance resource allocation and maximize company value.

Business Financial Statements

A comprehensive digital asset trading platform financial model integrates three essential statements: the Income Statement, detailing revenues, expenses, depreciation, taxes, and interest; the Balance Sheet, presenting assets, liabilities, and shareholders’ equity to maintain equilibrium; and the Cash Flow Statement, tracking cash inflows and outflows to assess liquidity and profitability. These components form the foundation for robust financial forecasting, investment analysis, and scenario planning within crypto trading platforms, enabling accurate valuation, budgeting, and growth projections tailored to the dynamic digital asset exchange landscape.

Sources And Uses Statement

The Sources and Uses of Funds tab in a digital asset trading platform financial model provides a clear overview of capital inflows and outflows. It highlights primary funding sources accessible to the company alongside detailed expenditure tracking. This financial template is essential for startups, offering crucial insights into cash flow management, cost structure, and investment allocation. Accurate financial forecasting and scenario analysis rely on this statement, empowering stakeholders to make informed decisions and optimize growth projections within the dynamic crypto trading environment.

Break Even Point In Sales Dollars

The break-even point represents when a digital asset trading platform’s revenue fully covers its fixed and variable costs, signaling no profit or loss. This critical metric, integral to financial forecasting for trading platforms, helps assess cost structures and revenue models within financial projections for asset trading. Platforms with lower fixed costs typically achieve break-even faster, supporting stronger growth projections and investment analysis. Incorporating break-even calculations into your digital asset trading platform business plan or financial model ensures informed decision-making, optimizing profitability and cash flow management in a competitive crypto trading environment.

Top Revenue

In a digital asset trading platform financial model, revenue forecasting is paramount, driving key metrics and overall valuation. Accurate revenue projections rely on well-founded growth assumptions rooted in historical data. Our comprehensive financial forecasting template for crypto trading platforms incorporates best-in-class practices, ensuring robust financial projections, cash flow models, and detailed cost structures. Analysts benefit from integrated scenario analysis and investment insights, making our digital asset trading platform business plan and valuation model essential tools for strategic financial planning and sustainable growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in the five-year digital asset trading platform financial model provides a comprehensive breakdown of annual costs, categorized into four key groups. This detailed expense analysis—covering customer acquisition, fixed costs, and more—enables precise financial forecasting for trading platforms. By understanding your digital asset trading platform cost structure, you gain essential insights to control spending effectively, optimize your profit and loss model, and drive sustainable growth projections. Harness this financial dashboard for trading platforms to manage resources wisely and enhance your platform’s investment analysis and valuation model with confidence.

DIGITAL ASSET TRADING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A digital asset trading platform financial model is essential for accurate expense tracking and forecasting. This pro forma template provides clear projections of your cost structure, enabling early identification of cash flow challenges. Incorporating expense forecasts into your business plan strengthens investment analysis by delivering transparent financial projections. Investors rely on comprehensive digital asset trading platform revenue and cash flow models to evaluate growth potential and profitability. Utilize this financial dashboard and budget model to build confidence, secure funding, and drive sustainable success in your digital trading platform venture.

CAPEX Spending

Capital Expenditure (CapEx) is a critical component of any digital asset trading platform financial model. Accurate CapEx forecasting enables precise financial projections for asset trading, reflecting investments in fixed assets such as property, plant, and equipment (PPE). This process accounts for depreciation, asset additions, and disposals, ensuring the digital asset trading platform cost structure is well-managed. Integrating CapEx into your digital asset trading platform business plan or valuation model strengthens financial scenario analysis and investment analysis, ultimately supporting robust financial forecasting and growth projections for your crypto trading platform.

Loan Financing Calculator

Our digital asset trading platform financial model features an integrated loan amortization schedule, offering precise repayment forecasts. This financial forecasting tool outlines each installment’s principal and interest components on a monthly, quarterly, or annual basis. Designed to enhance investment analysis and cash flow management, the built-in amortization template supports robust financial projections and risk modeling, empowering stakeholders with clear insights into the company’s repayment structure within the broader digital asset trading platform business plan.

DIGITAL ASSET TRADING PLATFORM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our digital asset trading platform financial model Excel template offers comprehensive KPIs critical for both firm and industry analysis. It features profitability, cash flow, liquidity, and other essential metrics tailored to crypto asset trading financial plans. Designed to support investment analysis, the model includes robust financial forecasting and scenario analysis, empowering stakeholders with clear insights into the platform’s growth projections and cost structure. This sophisticated digital asset trading platform valuation model is invaluable for creating precise profit and loss models and cash flow projections, enhancing investment confidence and strategic decision-making.

Cash Flow Forecast Excel

A digital asset trading platform cash flow model provides a clear forecast of cash movements across operating, investing, and financing activities. Like an advanced Excel budget model, it maps inflows and outflows over a defined period, offering precise financial projections for asset trading. Integrated within a comprehensive digital asset trading platform business plan, this financial tool supports investment analysis, growth projections, and effective financial risk modeling—empowering stakeholders to make informed decisions and optimize capital management in a rapidly evolving crypto trading environment.

KPI Benchmarks

Our digital asset trading platform financial model includes a robust benchmarking study to empower comparative performance analysis. By evaluating key financial indicators—such as losses and revenue metrics—against industry peers, businesses gain actionable insights to optimize operations. This financial forecasting tool guides investors and startup founders in refining their digital trading platform’s cost structure, growth projections, and cash flow model. Leveraging benchmarking in your crypto asset trading financial plan ensures informed decision-making, driving sustainable profitability and positioning your platform for scalable success within the competitive blockchain trading landscape.

P&L Statement Excel

Financial forecasting is essential for any digital asset trading platform financial model. Our comprehensive profit and loss model provides detailed insights into net income and gross profit margins, enabling precise financial projections. This digital asset trading platform cash flow model empowers you to evaluate business prospects confidently, supporting robust investment analysis and growth projections. By leveraging this financial dashboard for trading platforms, you can optimize your cost structure and strengthen your company’s position, ensuring informed decision-making and maximizing profitability in the competitive crypto asset trading landscape.

Pro Forma Balance Sheet Template Excel

A precise digital asset trading platform financial model hinges on an accurate pro forma balance sheet, reflecting assets, liabilities, and equity. Integrating historical data alongside your forecast income statement ensures reliable financial projections for asset trading. Assumptions for working capital and capital expenditure closely align with your platform’s revenue model, allowing seamless linkage across profit and loss, cash flow, and valuation models. This interconnected financial forecasting for trading platforms empowers investors and stakeholders to confidently analyze growth projections, risk, and cash flow outcomes, driving informed decision-making in your digital asset trading startup business plan.

DIGITAL ASSET TRADING PLATFORM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive digital asset trading platform valuation model integrated within a bottom-up financial forecasting framework to provide investors with crucial data and insights. Utilizing Weighted Average Cost of Capital (WACC), we capture your firm's blended cost of equity and debt, while our Discounted Cash Flow (DCF) method accurately projects the intrinsic value based on expected future cash flows. This financial modeling approach ensures precise investment analysis and robust financial projections for your crypto trading platform, empowering strategic decision-making and confident stakeholder engagement.

Cap Table

The Pro Forma Cap Table is an essential component of a digital asset trading platform’s financial model, detailing all company shares, ownership distribution, and investor pricing. Integrated within the bottom-up financial forecasting for trading platforms, this cap table tab clearly outlines each investor’s ownership percentage and dilution impact. It is vital for investment analysis and supports accurate financial projections, valuation modeling, and growth planning—ensuring transparency and strategic insight within the digital asset trading platform’s financial dashboard.

DIGITAL ASSET TRADING PLATFORM STARTUP COSTS TEMPLATE ADVANTAGES

Avoid cash flow shortfalls with a digital asset trading platform financial model that ensures accurate projections and strategic growth.

A digital asset trading platform financial model empowers startups with precise forecasts, boosting preparedness and strategic decision-making.

Optimize surplus cash efficiently with our comprehensive digital asset trading platform financial model in Excel.

The 5-year cash flow model empowers accurate financial forecasting, optimizing growth and investment strategies for digital asset trading platforms.

A digital asset trading platform financial model empowers precise growth projections and strategic investment analysis for optimal success.

DIGITAL ASSET TRADING PLATFORM 3 STATEMENT FINANCIAL MODEL EXCEL TEMPLATE ADVANTAGES

Optimize profits and growth with our dynamic digital asset trading platform financial model—update anytime for precise forecasting.

Easily adjust inputs anytime to optimize your digital asset trading platform financial model for accurate growth and profitability projections.

Optimize surplus cash management with our comprehensive digital asset trading platform financial model for informed decision-making.

A digital asset trading platform cash flow model empowers managers to forecast surplus cash for strategic reinvestment and debt management.

Optimize digital asset trading platform growth projections with a comprehensive financial model that prevents cash flow shortfalls.

A digital asset trading platform cash flow model proactively forecasts and visualizes cash flow to prevent costly business shortfalls.

The financial model for digital asset trading platforms ensures accurate forecasting, investment analysis, and optimized revenue growth strategies.

A well-structured digital asset trading platform financial model ensures efficient hypothesis testing and strategic decision-making.

Get a robust digital asset trading platform financial model that boosts growth projections and ensures accurate investment analysis.

This robust digital asset trading platform financial model empowers precise projections and customizable insights for strategic growth planning.