Digital Lending Marketplaces Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Digital Lending Marketplaces Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Digital Lending Marketplaces Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly digital lending marketplaces financial model in Excel offers a comprehensive tool for preparing detailed financial projections for lending marketplaces, including a P&L statement, cash flow model, and balance sheet with monthly and annual timelines. Designed to support both startups and established platforms, this digital lending startup financial model enables thorough financial forecasting for digital lenders, helping you evaluate your startup idea, plan operational cost models, and analyze loan marketplace profitability models. Fully unlocked and editable, it serves as an essential business plan model for assessing revenue streams, expense models, and risk assessment frameworks within peer-to-peer lending and online lending marketplace valuation contexts.

This ready-made digital lending marketplaces financial model Excel template serves as a comprehensive pain reliever by addressing critical challenges in financial forecasting for digital lenders, enabling seamless integration of the loan marketplace profitability model with precise financial projections for lending marketplaces, including profit and loss statements, cash flow models, and balance sheet projections over five years. Its automated aggregation feature eliminates the manual burden of consolidating monthly and annual financial summaries, streamlining the digital lending platform expense model and enhancing accuracy in financial assumptions for lending platforms. Additionally, it incorporates essential components such as digital lending risk assessment models and loan marketplace operational cost models, facilitating robust financial analysis and valuation for online lending marketplaces, which ultimately supports investor confidence and optimizes the digital lending investment model.

Description

Our digital lending marketplaces financial model Excel template integrates a comprehensive three-statement structure designed to support both operational management and investors with precise financial analysis. By utilizing this model, users can develop accurate financial projections for lending marketplaces, including revenue streams, expense models, and loan marketplace profitability frameworks, enabling detailed financial forecasting for digital lenders over a 60-month horizon. The model facilitates in-depth cash flow modeling, risk assessment, and loan default analysis, allowing startups and established platforms alike to blueprint capital investment needs and operational costs effectively. With adjustable financial assumptions tailored for digital lending platforms, this tool automates complex calculations, offering a robust peer-to-peer lending financial model alongside essential KPIs, valuation metrics, and investment scenario testing—all within an accessible, user-friendly interface that requires no prior financial expertise.

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive digital lending marketplace financial model integrates pro forma income statements, balance sheets, and cash flow forecasts into a dynamic, unified framework. Unlike simplified models relying solely on income statements, this approach delivers a complete financial analysis—enabling precise financial projections for lending marketplaces. It empowers stakeholders to perform scenario planning, assess loan marketplace profitability models, and understand the impact of business model adjustments on revenue streams, operational costs, and cash flow. This robust financial forecasting is essential for driving growth, managing digital lending risk assessment, and optimizing investment strategies in peer-to-peer and online lending platforms.

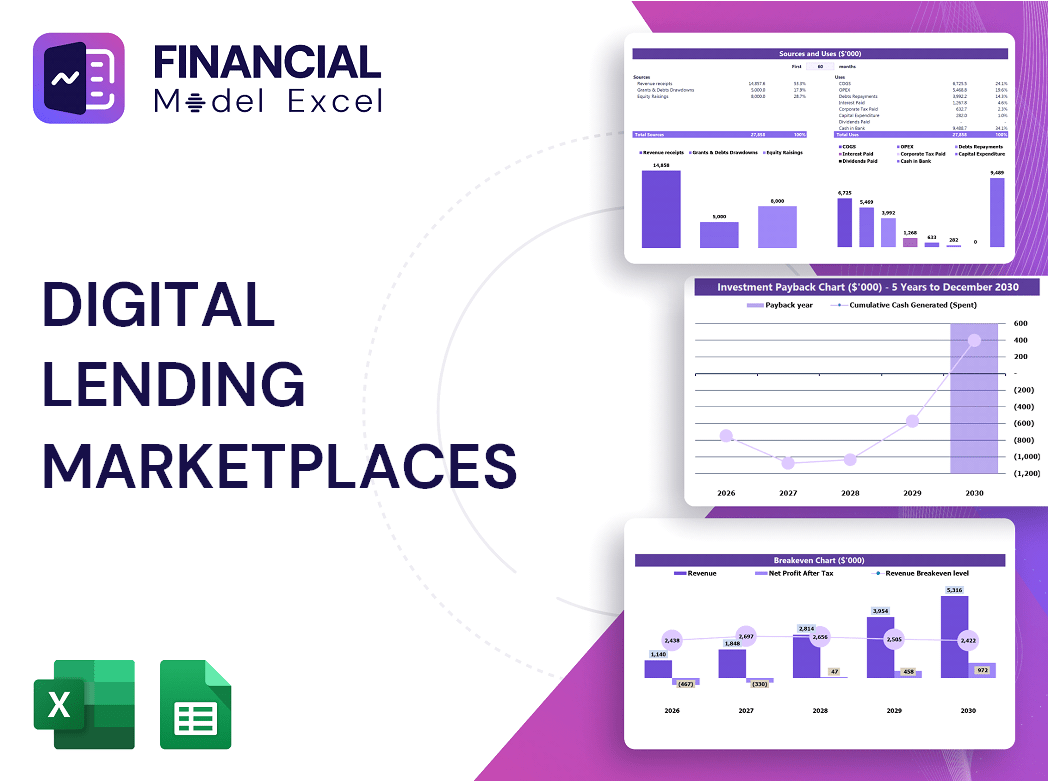

Dashboard

Elevate your financial projections for lending marketplaces with our intuitive Excel template. Simply input your data, and watch your digital lending platforms’ revenue model and loan marketplace profitability model come to life. Instantly generate professional, visually compelling outputs that seamlessly integrate into your presentation decks—whether you’re showcasing a digital lending startup financial model or conducting a detailed digital lending risk assessment model. Make your peer-to-peer lending financial model and online lending marketplace valuation clear, precise, and impactful with ease.

Business Financial Statements

A comprehensive digital lending marketplace financial model integrates projected income statements, balance sheet forecasts, and cash flow projections to deliver in-depth financial analysis. The profit and loss forecast highlights key revenue streams and operational activities driving growth, while balance sheet and cash flow forecasts focus on asset management and funding structure. This holistic approach supports accurate financial assumptions, risk assessment models, and capital management, essential for optimizing loan marketplace profitability and informing strategic investment decisions within digital lending platforms.

Sources And Uses Statement

A comprehensive digital lending startup financial model—including detailed sources and uses—provides critical insights into revenue streams and expense structures. By integrating financial assumptions for lending platforms, loan marketplace profitability models, and digital lending risk assessment frameworks, these templates enable accurate financial forecasting for digital lenders. This holistic approach supports strategic decisions by revealing how revenue models and operational cost models impact overall loan marketplace profitability and growth potential.

Break Even Point In Sales Dollars

The break-even graph is essential in any digital lending marketplaces financial model, pinpointing the sales volume needed to cover fixed and variable costs. Once revenue surpasses this break-even point, your digital lending platform shifts into profitability, crucial for financial forecasting and investment decisions. Our five-year financial projections template helps you visualize the minimum service sales required to cover operational costs, aiding in robust revenue modeling. By understanding the break-even point in dollars, investors can accurately assess the sales targets and timelines essential for a solid return on investment within digital lending marketplaces.

Top Revenue

When developing a digital lending marketplaces business model, revenue forecasting is paramount. Revenue drives overall enterprise value within financial projections for lending marketplaces. Financial analysts must employ robust digital lending platform expense and revenue stream models to accurately project future cash flows. Incorporating growth assumptions based on historical data strengthens financial forecasting for digital lenders. Our comprehensive digital lending startup financial model offers all essential components, enabling insightful peer-to-peer lending financial model analysis and optimized digital loan marketplace revenue models for sustainable profitability and informed decision-making.

Business Top Expenses Spreadsheet

In the Top Expenses section of our digital lending startup financial model, you can efficiently track key operational costs across four main categories, with flexibility to customize or add more as needed. This loan marketplace expense model allows you to incorporate historical data or develop comprehensive five-year financial projections. Tailored for digital lending platforms, it supports robust financial forecasting for lending marketplaces, enhancing your financial assumptions and risk assessment models to optimize revenue streams and ensure sustainable growth.

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive costing template meticulously tracks all full-time and part-time salaries, ensuring precise financial assumptions for lending platforms. This data seamlessly integrates across key sections in your digital lending startup financial model, enhancing accuracy in financial projections for lending marketplaces. By automating salary expenses within the loan marketplace operational cost model, you gain clear insights into your platform’s cash flow and profitability, supporting informed decisions aligned with your digital lending marketplace growth model.

CAPEX Spending

CAPEX start-up expenses represent significant investments in assets essential for scaling a digital lending marketplace. These costs, crucial for enhancing technology and operational efficiency, directly impact financial projections for lending marketplaces. Accurately reflecting CAPEX in the balance sheet and P&L templates ensures precise lending platform cash flow modeling and informed digital lending investment models. Proper allocation of these expenses supports sustainable growth, optimizes the digital lending startup financial model, and strengthens the loan marketplace profitability model through improved operational capacity.

Loan Financing Calculator

The loan amortization schedule within this digital lending platform cash flow model outlines the structured repayment timeline, detailing periodic installments that combine principal and interest components. This comprehensive schedule supports precise financial forecasting for digital lenders by illustrating payments until the loan is fully settled. Incorporating such detailed loan marketplace profitability models enables accurate financial projections for lending marketplaces, ensuring effective digital lending risk assessment and enhancing overall loan marketplace operational cost management. This empowers stakeholders to optimize revenue streams and maintain robust financial health within digital lending marketplaces.

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Internal Rate of Return (IRR) is a key metric embedded within financial projections for lending marketplaces. It represents the discount rate at which the net present value of all cash flows equals zero, providing a clear measure of investment efficiency. In digital lending platforms’ financial analysis and peer-to-peer lending profitability models, a higher IRR indicates stronger potential returns, making the business more attractive to investors. Incorporating IRR in digital lending startup financial models and loan marketplace profitability models helps stakeholders assess growth prospects and make informed decisions grounded in robust financial forecasting.

Cash Flow Forecast Excel

Effective financial forecasting is essential for digital lending startups and marketplaces. Utilizing a lending platform cash flow model enables precise tracking of funds inflow and outflow, supporting smart capital management and operational optimization. Incorporating this into your digital lending marketplace business model enhances financial projections, drives revenue growth, and mitigates risks. Whether analyzing digital lending platform expense models or loan marketplace profitability models, strategic cash flow planning is critical for sustainable success. Embrace these financial forecasting tools to boost capital turnover, streamline operations, and maximize your lending marketplace’s revenue streams and overall valuation.

KPI Benchmarks

The benchmark tab in digital lending startup financial models provides key industry-average metrics for robust financial forecasting and performance comparison. Utilizing these benchmarks enables digital lending marketplaces to evaluate revenue models, expense structures, and risk assessment frameworks against best-in-class peers. This financial benchmarking is critical for peer-to-peer lending profitability analysis and loan marketplace operational cost modeling. By aligning with industry standards, lenders can optimize their financial projections and strategic decisions to enhance growth and profitability. Ultimately, benchmarking serves as an essential tool for informed management and investment strategies within digital lending platforms.

P&L Statement Excel

The Profit and Loss Statement offers a clear view of your digital lending marketplace’s revenue streams and key expense categories. This essential financial analysis highlights profitability, income structure, and loan repayment capacity, providing stakeholders with critical insights. Leveraging this template’s forecasting capabilities, you can project monthly profitability and cash flows, enhancing financial forecasting for digital lenders. Whether refining your digital lending investment model or optimizing your loan marketplace profitability model, this tool supports robust financial projections and growth planning for your lending platform.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is a crucial component of a digital lending startup financial model, detailing current and long-term assets, liabilities, and equity. It forms the foundation for financial forecasting for digital lenders and supports accurate financial assumptions for lending platforms. By analyzing this statement, businesses can evaluate key financial ratios vital for refining their loan marketplace profitability model and optimizing operational cost structures. This insight drives informed decision-making to enhance the digital lending marketplace growth model and ensures sustainable revenue streams in competitive online lending marketplaces.

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Impress investors with our comprehensive digital lending marketplaces financial model, designed to streamline your startup costs and valuation process. Leverage built-in templates to generate key metrics like WACC, free cash flow, and discounted cash flow, providing transparent insights into loan marketplace profitability and cash flow models. This tool supports precise financial forecasting for digital lenders, enabling clear demonstration of enterprise value, risk assessment, and revenue streams. Perfect for crafting compelling business plans and investment presentations, it equips you to showcase robust financial assumptions and marketplace growth models with confidence and professionalism.

Cap Table

Our digital lending startup financial model includes a detailed pro forma cap table, presented in a separate Excel sheet. This table clearly outlines the ownership breakdown across various stages, providing transparency into equity distribution. For investors, it serves as a crucial tool to understand potential returns and exit valuation within the digital lending marketplace revenue model. Integrating this with financial projections for lending marketplaces ensures strategic planning and builds investor confidence in your loan marketplace profitability model.

DIGITAL LENDING MARKETPLACES FINANCIAL MODEL XLS ADVANTAGES

Optimize lending success with a digital lending platform cash flow model delivering precise 5-year financial projections.

Optimize capital demand accurately using the digital lending marketplaces financial model for precise startup financial projections.

The financial model enhances revenue by accurately forecasting cash flows and minimizing loan default risks in digital lending marketplaces.

Optimize growth and profitability with digital lending marketplaces financial models for strategic, data-driven decision making.

A robust financial model ensures transparent, updated forecasts, boosting stakeholder confidence and fueling digital lending marketplace growth.

DIGITAL LENDING MARKETPLACES STARTUP FINANCIAL PROJECTIONS ADVANTAGES

The digital lending marketplace revenue model simplifies growth forecasting, driving smarter investments and maximizing profitability effectively.

Our digital lending marketplace financial model delivers fast, accurate insights with minimal Excel skill, empowering strategic growth confidently.

The digital lending marketplace growth model drives scalable revenue while optimizing operational costs for sustained profitability.

Empower strategic growth with a dynamic 5-year digital lending marketplace financial model delivering real-time GAAP/IFRS insights.

The digital lending marketplace revenue model boosts profitability by optimizing diverse income streams and reducing operational costs.

Easily refine your digital lending startup financial model to optimize revenue and drive sustainable marketplace growth.

Optimize growth and profitability with a precise digital lending marketplace financial model that ensures informed, data-driven decisions.

A robust digital lending marketplaces financial model ensures confident funding decisions by forecasting growth and minimizing investor risk.

The digital lending marketplace revenue model unlocks scalable growth and maximizes profitability through strategic financial forecasting.

A digital lending platform cash flow model reveals optimal growth options by analyzing funding impacts and financial scenario outcomes.