Engineering Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Engineering Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Engineering Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ENGINEERING FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly engineering firm financial planning financial model designed for comprehensive budgeting plans and cash flow projections, enabling the preparation of detailed pro forma income statements, balance sheet projections, and expense analysis with monthly and annual timelines. Ideal for startups or established firms, this engineering firm financial model supports revenue forecasts, investment analysis, and break-even analysis, helping secure funding from banks, angels, grants, and VC funds. Fully unlocked and customizable, it serves as a robust tool for capital budgeting, working capital management, and scenario analysis to optimize profit margins and manage financial risk effectively.

The engineering firm budgeting plan financial model addresses common pain points by providing a comprehensive and customizable Excel template that simplifies complex financial processes such as cash flow projection, revenue forecast, and expense analysis, enabling firms to accurately estimate costs and manage working capital efficiently. This ready-made financial model includes built-in features for profit margin tracking, investment analysis, and capital budgeting, which significantly reduce the time and effort required for scenario analysis and financial risk assessment. Additionally, users benefit from an integrated balance sheet projection and income statement financial model, along with budget variance and financial ratio analysis, empowering engineering firms to make data-driven decisions, optimize project valuation, and ensure sustainable growth with minimal manual input.

Description

This engineering firm financial model offers a comprehensive budgeting plan and expense analysis financial model tailored to evaluate profitability and optimize resource allocation. Featuring a detailed cash flow projection and revenue forecast financial model, it assists in anticipating seasonal fluctuations and adjusting pricing or marketing strategies accordingly. The integrated income statement financial model and balance sheet projection financial model provide a clear view of the firm’s financial health across a 5-year horizon, while the engineering firm break-even analysis financial model pinpoints critical sales thresholds. Additionally, the model includes advanced scenario analysis and financial risk assessment financial models to help stakeholders make informed investment decisions, supported by robust profit margin financial model, working capital financial model, and capital budgeting financial model components, all designed for easy customization and automated updates.

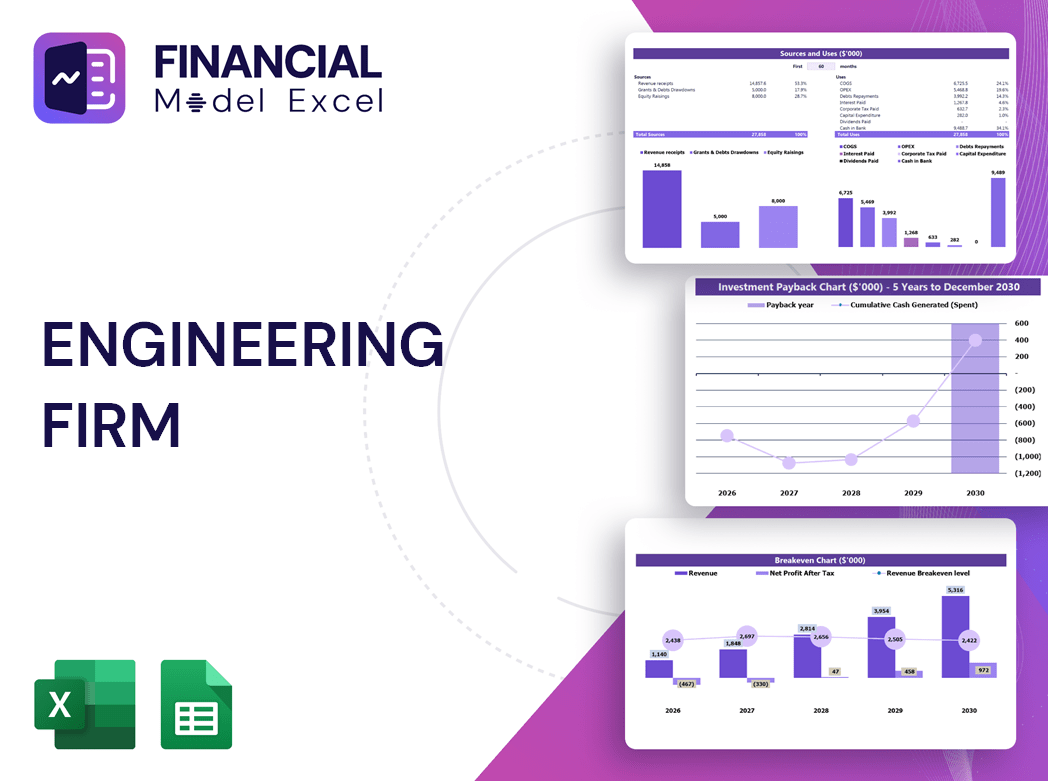

ENGINEERING FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive engineering firm financial model integrates the income statement, cash flow projection, and balance sheet forecast, offering a holistic view of the company's financial health. Typically updated monthly, this financial planning model ensures accurate budgeting, expense analysis, and profit margin assessment. At year-end, a detailed startup financial model or capital budgeting plan captures all annual changes, enabling precise break-even analysis and investment evaluation. Regardless of size, every engineering firm benefits from preparing a robust financial statement model annually to drive informed decision-making and sustainable growth.

Dashboard

Our engineering firm financial model offers a dynamic dashboard that streamlines budgeting plans, cash flow projections, revenue forecasts, and expense analyses. It delivers precise, real-time data essential for sound financial planning and investment analysis. By integrating break-even analysis, profit margin insights, and working capital projections, it provides a comprehensive view of your company’s financial health. This tool supports transparent financial reporting, fostering trust with stakeholders and enabling strategic decisions. Optimize your capital budgeting, risk assessment, and scenario analysis with a reliable model designed to drive growth and ensure long-term success.

Business Financial Statements

Our expertly crafted engineering firm financial model integrates key components—projected balance sheet, income statement, and cash flow projections—into a seamless three-statement framework. Designed with pre-built formulas, this budgeting and financial planning tool delivers an accurate financial summary to support your pitch deck without requiring Excel expertise. Whether you need revenue forecasts, expense analysis, or profit margin insights, our model simplifies complex financial data, enabling strategic investment analysis and confident decision-making for your engineering firm’s growth.

Sources And Uses Statement

The Sources and Uses Chart is a vital component of our engineering firm financial model, providing clear visibility into the origin of funds and their allocation. This statement empowers stakeholders with a transparent overview of how capital is sourced and strategically utilized within budgeting plans, cash flow projections, and investment analyses. By integrating this chart into your engineering firm’s financial planning, you enhance accuracy in expense analysis, project valuation, and capital budgeting—ensuring informed decisions that drive sustainable growth and optimize profit margins.

Break Even Point In Sales Dollars

Break-even analysis is a critical component of an engineering firm’s financial model, pinpointing when revenue fully covers all fixed and variable costs. At this juncture, the firm neither profits nor incurs losses, providing clear insight into operational sustainability. Integrating break-even analysis within your engineering firm financial planning model enhances decision-making by revealing the impact of cost structures on profitability. Firms with lower fixed costs typically achieve break-even faster, highlighting the importance of precise cost estimation and expense analysis in optimizing the engineering firm’s budget and revenue forecast financial models.

Top Revenue

The Top Revenue tab in this engineering firm startup financial model delivers a detailed annual breakdown of your revenue streams. It highlights key metrics such as revenue depth and revenue bridge, empowering you to make data-driven decisions. This comprehensive revenue forecast financial model enables precise financial planning and supports strategic growth by clearly mapping your firm’s income sources over a 5-year horizon.

Business Top Expenses Spreadsheet

Our startup financial model offers an efficient engineering firm expense analysis, categorizing top expenses into four main sections plus an 'other' category for additional inputs. This comprehensive approach enables precise tracking and forecasting of company costs. For insights into your firm’s financial evolution over the next five years, leverage our engineering firm startup financial model. It supports data-driven budgeting, cost estimation, and strategic planning to drive sustainable growth and optimize resource allocation.

ENGINEERING FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

An engineering firm financial model, including income statement and cash flow projection templates in Excel, is a vital tool for effective financial planning and budgeting. This advanced financial model enables precise cost estimation, expense analysis, and revenue forecasting, empowering management to make informed decisions. By integrating break-even analysis, profit margin evaluation, and budget variance tracking, the model highlights potential financial risks and optimizes working capital. These pro forma financial statements enhance transparency, supporting investment analysis, loan applications, and strategic growth initiatives, ultimately driving sustainable profitability and operational excellence.

CAPEX Spending

A capital budgeting financial model evaluates an engineering firm’s long-term asset investments, reflecting expenditures expected to generate value beyond one year. For instance, purchasing equipment appears as capital expenditure on the pro forma balance sheet projection, while ongoing costs like electricity are operating expenses in the income statement forecast. Depreciation expenses, shown in the projected income statement, systematically reduce asset value annually, providing stakeholders with a clear view of asset utilization and financial health. This integrated approach enhances budgeting, investment analysis, and financial planning, ensuring accurate portrayal of both CAPEX and ongoing expenses in the firm’s financial model.

Loan Financing Calculator

Start-ups and growing engineering firms often require loans to scale operations. Integrating loan commitments into your engineering firm financial planning financial model ensures accurate tracking of repayment schedules, including interest and maturity terms. This detailed loan repayment schedule feeds directly into cash flow projections and influences the revenue forecast, balance sheet projection, and financial ratio analysis. By linking these elements in a comprehensive financial model, firms gain clear visibility on budget variance and profitability, enabling strategic decisions rooted in timely, data-driven insights for sustainable growth.

ENGINEERING FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA is a key financial metric that evaluates an engineering firm’s operating performance by focusing on core profitability. Calculated from the pro forma income statement, EBITDA equals Revenue minus Expenses—excluding interest, taxes, depreciation, and amortization. Integrating this metric within an engineering firm’s financial model, such as revenue forecast or expense analysis, enhances budgeting plans and cash flow projections, providing clearer insights into profit margins and financial health. This approach supports strategic financial planning, investment analysis, and project valuation, empowering engineering firms to optimize operational efficiency and drive sustainable growth.

Cash Flow Forecast Excel

An engineering firm cash flow projection financial model is essential for effective financial planning in startups and established companies alike. It reveals precise inflows and outflows, enabling strategic budgeting and cash management. Utilizing this model supports informed decision-making, enhances capital turnover, and boosts revenue growth. Ideal for large engineering firms, it streamlines financial operations, mitigates risks, and drives profitability. Implementing a robust cash flow forecasting model empowers business owners to optimize resources and seize growth opportunities with confidence.

KPI Benchmarks

This engineering firm financial model includes a dedicated tab for financial benchmarking analysis, enabling a comprehensive comparison of your company’s key financial indicators against industry peers. By leveraging this tool, users can evaluate operational efficiency, competitiveness, and productivity with precision. Integrating benchmarking into your financial planning empowers informed decision-making, enhances performance assessment, and drives strategic growth within your engineering firm.

P&L Statement Excel

This engineering firm startup financial model generates a detailed projected income statement based on your input assumptions. Utilizing this pro forma profit and loss statement empowers you to conduct comprehensive financial planning, enabling accurate revenue forecasts, expense analysis, and profit margin evaluation. With these insights, you can strategically identify strengths and weaknesses within your engineering firm’s financial activities, supporting informed decision-making to optimize future performance and drive sustainable growth.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet is essential for any engineering firm startup, offering a comprehensive view of financial health and capital requirements. A 5-year projected balance sheet in Excel enables precise engineering firm financial planning financial model, revealing the funds needed to achieve projected profit margins. This forecast is a key element in the engineering firm budgeting plan financial model, providing strategic insights into future financial position and supporting informed decision-making for sustainable growth.

ENGINEERING FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This engineering firm income statement financial model features an integrated project valuation financial model, enabling precise Discounted Cash Flow (DCF) analysis. It empowers users to conduct comprehensive financial planning by assessing key metrics including residual value, replacement costs, market comparables, and recent transaction comparables. Designed to support strategic investment analysis and enhance budgeting plans, this model delivers critical insights for informed decision-making and maximizing profit margins within your engineering firm.

Cap Table

A comprehensive engineering firm financial model integrates essential tools like budgeting plans, revenue forecasts, and expense analysis to optimize profitability. Incorporating a detailed cap table within the startup financial model ensures clear visibility of equity distribution, investor ownership percentages, and dilution impacts. This holistic approach enhances financial planning, supports accurate income statement projections, and strengthens investment analysis—empowering engineering firms to make informed decisions and drive sustainable growth.

ENGINEERING FIRM P&L TEMPLATE EXCEL ADVANTAGES

Engineering firm financial models enhance accuracy, boosting credibility and confidence with investors and stakeholders.

The engineering firm startup financial model streamlines assumptions, enhancing accuracy and accelerating strategic decision-making.

Our engineering firm revenue forecast financial model empowers precise projections, optimizing growth and strategic decision-making.

Engineering firm financial model enhances cash flow projection, preventing overdue payments and ensuring timely financial decisions.

Engineering firm cash flow projection financial model ensures accurate budgeting to pay suppliers and employees on time.

ENGINEERING FIRM PROJECTED INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Our engineering firm budgeting plan financial model ensures precise forecasts to optimize profits and avoid costly financial setbacks.

An engineering firm cash flow projection financial model enables proactive decisions by forecasting cash gaps and ensuring sustainable growth.

Save time and money with an engineering firm cash flow projection financial model for precise budgeting and forecasting.

Engineering firm financial model simplifies planning with no formulas or consultants, maximizing growth and minimizing hassle.

Our engineering firm financial planning model optimizes budgeting accuracy and enhances strategic decision-making for sustainable growth.

Clear, consistent tabs in the engineering firm financial model enable efficient hypothesis testing and informed decision-making.

Engineering firm financial models offer clear, graphical dashboard visualizations for streamlined budgeting, forecasting, and risk assessment.

The engineering firm financial model dashboard streamlines all reports and calculations, enabling immediate, comprehensive data visibility without switching sheets.

Engineering firm cash flow projection financial model saves you time by streamlining accurate, efficient financial planning and analysis.

Streamline your engineering firm’s cash flow projection, freeing time to focus on innovation, clients, and business growth.