Farm Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Farm Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Farm Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FARM BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly agricultural bank financial model designed for comprehensive farm bank income analysis, including profit and loss projections, cash flow forecasts, and balance sheet preparation with monthly and annual timelines. Ideal for startups or existing farm lending financial strategy businesses, this farm financial statement model serves as an essential farm banking profitability model and farm bank budgeting tool. Utilize this farm loan financial forecast and farm investment financial plan to optimize agriculture financial projection efforts and secure funding from banks or investors. Fully unlocked and editable for customized farm bank risk assessment model and farm bank cost analysis.

This farm bank financial model Excel template addresses critical pain points faced by agricultural lenders by providing a comprehensive farm bank income analysis and farm lending financial strategy to enhance decision-making. With its robust farm finance cash flow model and detailed farm loan financial forecast, users can effectively manage liquidity risks and optimize the farm bank budgeting tool for better cost control. The integrated farm credit financial model and farm debt financial model allow for precise farm bank risk assessment and farm financial performance modeling, reducing uncertainty in investment decisions. Additionally, the agro bank financial dashboard consolidates key metrics in an easy-to-interpret format, streamlining agricultural bank financial modeling processes and supporting sustainable growth by providing actionable insights into farm banking profitability and rural bank financial template needs.

Description

Our comprehensive farm bank financial model integrates an agricultural bank financial model with a detailed farm financial statement model, enabling precise farm loan financial forecasts and agriculture financial projections tailored to both startup and established operations. This robust farm credit financial model incorporates a farm banking revenue model and farm bank income analysis, supported by a farm finance cash flow model and rural bank financial template for up to 60 months of accurate forecasting. Users can leverage the farm bank budgeting tool, crop loan financial simulation, and farm lending financial strategy features to assess profitability and manage risks using a farm bank risk assessment model, while benefiting from an agro bank financial dashboard that presents clear insights into farm financial performance, cost analysis, and debt structure within an integrated farm investment financial plan.

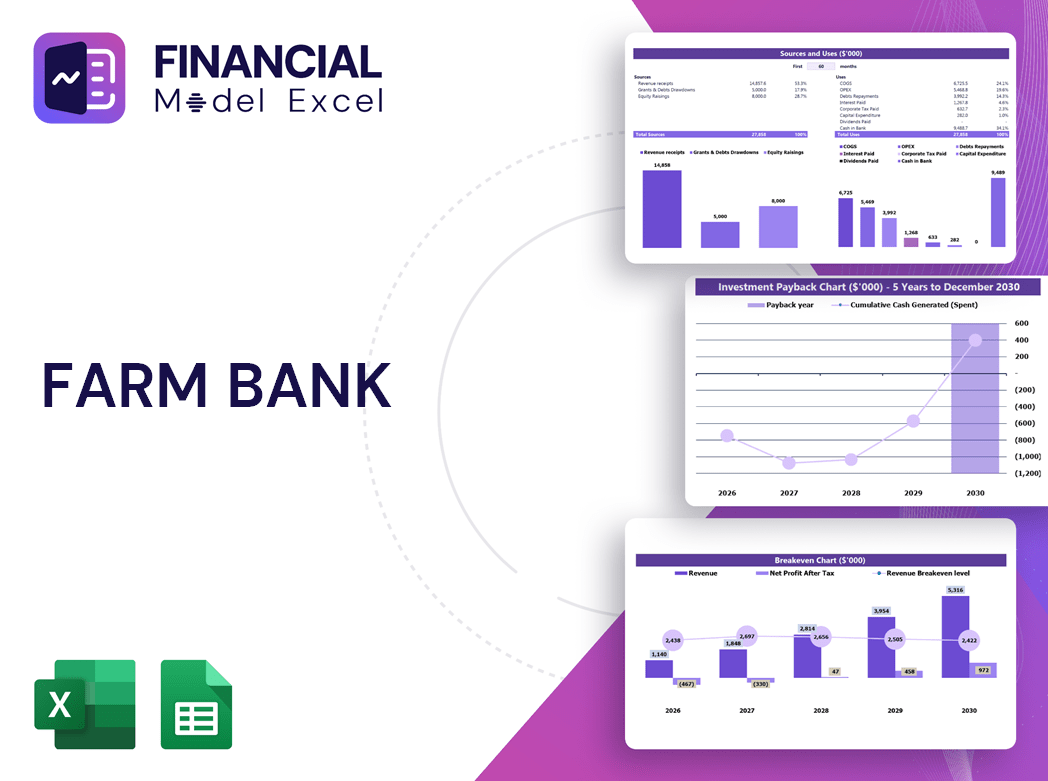

FARM BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive 5-year agricultural bank financial model includes all essential components for investor meetings: detailed financial assumptions, farm financial statement models, cash flow projections, and robust farm bank income analysis. Designed with an investor-friendly interface, this farm bank budgeting tool ensures clear presentation of your farm lending financial strategy and profitability model. Streamline your farm loan financial forecast and agriculture financial projection with ease, enhancing decision-making and stakeholder confidence.

Dashboard

The agro bank financial dashboard is an essential component of the farm bank financial planning toolkit. It consolidates key financial indicators, including farm financial statement models, farm loan financial forecasts, and crop loan financial simulations. By inputting data for specific periods, users gain insightful farm bank income analysis and can perform advanced farm banking profitability modeling. This robust rural bank financial template enhances farm investment financial plans through precise forecasting and risk assessment, empowering stakeholders with actionable insights for optimal farm lending financial strategies and sustainable growth.

Business Financial Statements

Our comprehensive five-year agriculture financial projection template empowers farm owners with precise farm financial statement models, farm loan financial forecasts, and farm banking revenue models. Designed for clarity and effectiveness, it streamlines farm bank income analysis and farm finance cash flow modeling, enabling transparent communication of operational results to stakeholders. This dynamic farm bank budgeting tool automatically generates insightful financial graphs and charts, presenting key data in a professional, investor-ready format. Optimize your farm lending financial strategy and boost profitability with this robust agricultural bank financial model tailored for confident decision-making and strategic growth.

Sources And Uses Statement

The sources and uses of funds statement template offers a clear overview of capital inflows and outflows, ensuring total sources equal total uses. This essential farm financial statement model supports agricultural banks and farm lenders in precise financial planning, budget allocation, and risk assessment. It is invaluable for farm loan financial forecasts, farm banking profitability models, and farm investment financial plans, especially during recapitalization, restructuring, or M&A processes. Utilizing this template enhances farm bank income analysis and strengthens farm lending financial strategies for sustainable growth and profitability.

Break Even Point In Sales Dollars

This farm bank financial planning template features an integrated farm banking profitability model, including break-even analysis to pinpoint when revenue surpasses total costs. Accurately forecasting this critical point empowers stakeholders with vital insights into project viability, enhancing farm loan financial forecasts and investment decisions. By analyzing the interplay between fixed and variable costs through a robust farm finance cash flow model, agricultural banks and lenders can confidently evaluate risk and profitability. This comprehensive agriculture financial projection tool is essential for developing a sound farm lending financial strategy and optimizing long-term financial performance.

Top Revenue

In farm banking financial planning, the topline—representing revenues or gross sales—and the bottom line—profit or EBITDA—are pivotal metrics within a farm financial statement model. Investors and stakeholders closely analyze these figures through farm bank income analysis and agricultural bank financial models, tracking quarterly and annual trends. Top-line growth in farm lending or crop loan financial simulations signals increased revenues, driving enhanced farm banking profitability models and strengthening the overall farm investment financial plan. Monitoring these key indicators ensures informed decision-making and robust agriculture financial projections for sustained growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in the 5-year farm financial projection provides a detailed breakdown of annual costs, segmented into four key categories. Utilizing this farm bank budgeting tool enables precise analysis of both fixed expenses and variable costs like customer acquisition. By leveraging this agricultural bank financial model, farmers gain clear insights into spending patterns, enhancing their farm financial performance model. This strategic approach supports effective farm loan financial forecasting and strengthens overall farm banking profitability, ensuring sound financial planning and efficient resource management.

FARM BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive farm financial statement model includes a detailed salary costs list, enabling precise tracking of both full-time and part-time employees. This integrated data seamlessly updates across all relevant sections, enhancing accuracy in your farm bank budgeting tool and agricultural bank financial model. Streamline your farm loan financial forecast and boost efficiency with automated insights tailored for your farm banking revenue model and farm finance cash flow model. Optimize your agricultural financial projection with this essential feature designed to support informed decision-making and sustainable farm lending financial strategy.

CAPEX Spending

The planned capital expenditure outlines the total investment allocated to defend, develop, and enhance the farm’s competitive position. Excluding staff salaries and operating costs, this farm financial statement model empowers stakeholders to identify the most advantageous investment areas. Given the variability of capital expenditures across agricultural bank financial models, integrating this analysis within your farm bank financial planning ensures a comprehensive farm investment financial plan and supports informed decision-making in farm banking profitability and risk assessment.

Loan Financing Calculator

Our farm loan financial forecast features an integrated amortization schedule with embedded formulas, offering a clear, time-based breakdown of principal and interest repayments. Designed for agricultural banks and farm credit services, this farm banking revenue model efficiently outlines monthly, quarterly, or yearly installments. This robust tool supports precise farm bank income analysis and enhances farm lending financial strategies by providing transparent, actionable insights into debt management and repayment timelines. Ideal for rural bank financial templates and farm investment financial plans, it streamlines budgeting and risk assessment, ensuring optimal farm financial performance and profitability.

FARM BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

For agricultural banks, accurately projecting customer acquisition costs is vital in a robust farm bank financial planning process. Incorporating this metric into your 3-year agricultural bank financial model ensures precise farm loan financial forecasts. By dividing total marketing expenses by new clients gained annually, the farm bank income analysis reveals the true cost of acquiring customers. Utilizing a comprehensive farm banking revenue model and rural bank financial template helps startups optimize their farm lending financial strategy, driving profitability and sustainable growth through informed farm financial performance models and cost analysis.

Cash Flow Forecast Excel

An effective farm bank financial planning model demonstrates your ability to manage cash flow and meet liabilities promptly. Utilizing a farm finance cash flow model and farm loan financial forecast ensures your agricultural bank financial projection aligns with repayment requirements. Lenders rely on a robust farm banking revenue model and farm bank budgeting tool to verify your capacity to service debt. Integrating a farm bank income analysis and farm bank risk assessment model enhances credibility, giving banks confidence in your farm lending financial strategy and securing essential financing for sustainable growth.

KPI Benchmarks

The benchmark tab in the farm bank financial model provides key performance indicators based on industry-wide agricultural bank financial projections. By comparing your farm’s financial statements and farm loan financial forecasts to top-performing peers, you gain critical insights into farm banking profitability and risk assessment. This financial benchmarking is essential for strategic farm investment financial plans and enhances decision-making in farm lending financial strategy. Utilizing this agriculture financial projection tool ensures precise farm bank income analysis, driving effective budget planning and optimizing farm finance cash flow models for sustainable growth.

P&L Statement Excel

This farm financial statement model is designed for both seasoned professionals and newcomers in agricultural banking. It delivers a comprehensive pro forma profit and loss forecast, offering clear insights into income and expenses. This detailed agriculture financial projection is essential for crafting an effective farm investment financial plan, enhancing farm banking profitability and supporting strategic farm lending financial decisions.

Pro Forma Balance Sheet Template Excel

A comprehensive farm bank financial model includes a 5-year projected balance sheet, integral to agricultural bank financial planning. Alongside pro forma profit and loss and cash flow models, this forecast supports accurate farm finance cash flow analysis. While less prominent than income statements, the farm financial statement model is vital for assessing farm lending financial strategy and profitability. Investors rely on these projections to evaluate farm bank income analysis and return metrics like ROE, ensuring realistic farm banking revenue models and robust agriculture financial projections. This holistic approach strengthens farm bank budgeting tools and risk assessment models for sustainable growth.

FARM BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The integrated farm bank financial model enables precise calculation of Return on Investment, Investor’s Future Equity Share, and Cash Burn Rate. This comprehensive farm financial performance model streamlines agricultural bank financial planning and enhances farm lending financial strategy by delivering clear insights. Utilizing this farm bank income analysis tool helps identify growth opportunities, optimize farm bank budgeting, and attract potential investors with confidence, ensuring robust farm investment financial plans and sustainable profitability.

Cap Table

The five-year agriculture financial projection serves as a powerful farm bank financial planning tool, enabling precise estimation of key indicators like sales and revenue. Integrated with a cap table Excel template, it enhances farm lending financial strategy by providing structured calculations and clear segmentation. This comprehensive farm bank budgeting tool empowers users to analyze farm banking profitability models and conduct thorough farm bank income analysis with accuracy and ease.

FARM BANK FIVE YEAR FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Maximize profits confidently using the farm bank financial model for precise business projections and strategic asset acquisition.

The farm bank financial model streamlines precise planning, boosting profitability and easing collaboration with financial experts.

Establish clear milestones and optimize growth using the farm bank financial model business projection template’s precision and insight.

The farm financial model streamlines assumptions input, enhancing accuracy and efficiency for strategic rural bank planning.

The farm bank financial model optimizes tax planning, enhancing profitability and strategic financial decision-making for startups.

FARM BANK FINANCIAL MODEL STARTUP ADVANTAGES

Optimize profits confidently with our farm banking profitability model—accurate, data-driven financial planning made effortless.

Streamline farm financial planning effortlessly with our model—no formulas, formatting, or costly consultants needed.

Optimize surplus cash efficiently with our farm bank financial model for strategic agricultural growth and profitability.

The farm finance cash flow model empowers managers to strategically reinvest surplus cash and optimize debt repayments efficiently.

Optimize profits and avoid cash flow shortfalls with our precise farm banking profitability model and risk assessment tool.

Optimize farm financial performance with a reliable farm finance cash flow model that anticipates and prevents cash shortfalls.

Optimize farm banking revenue with our financial model for better decision making and strategic growth.

Optimize farm banking decisions confidently using our dynamic farm finance cash flow model with scenario forecasting.

Our advanced farm banking profitability model empowers investors and lenders with precise financial forecasting for confident decision-making.

Accelerate funding with our farm financial projection model, delivering precise metrics to impress investors and streamline negotiations.